How to Quickly Create Your Accounting Workflow Checklists

Author: Financial Cents

In this article

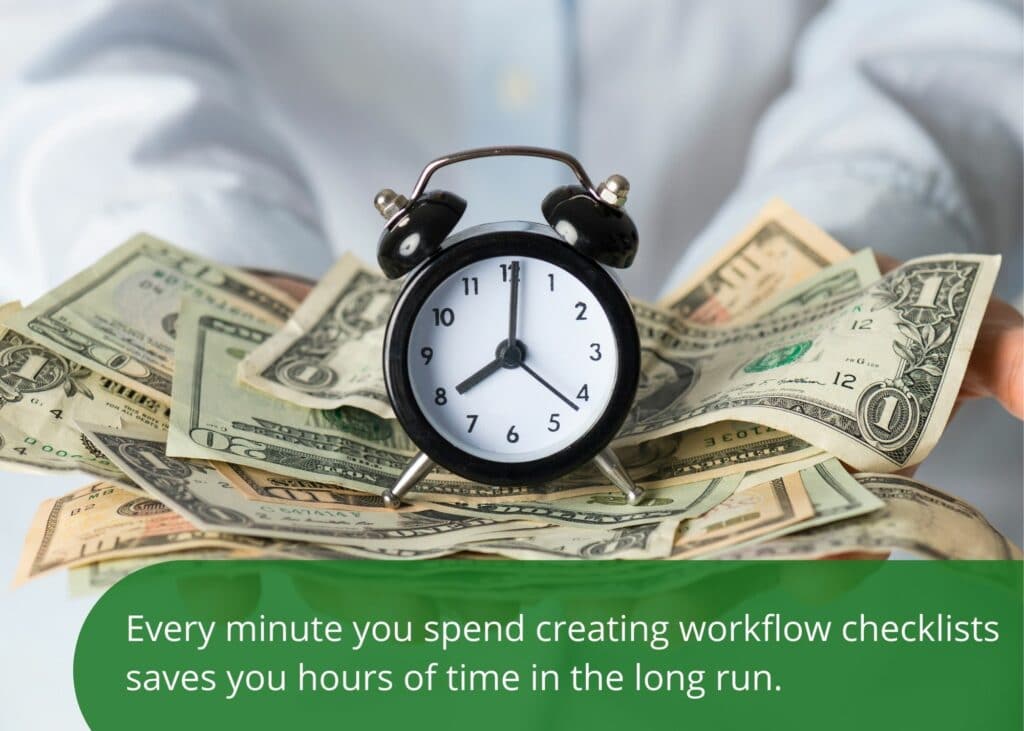

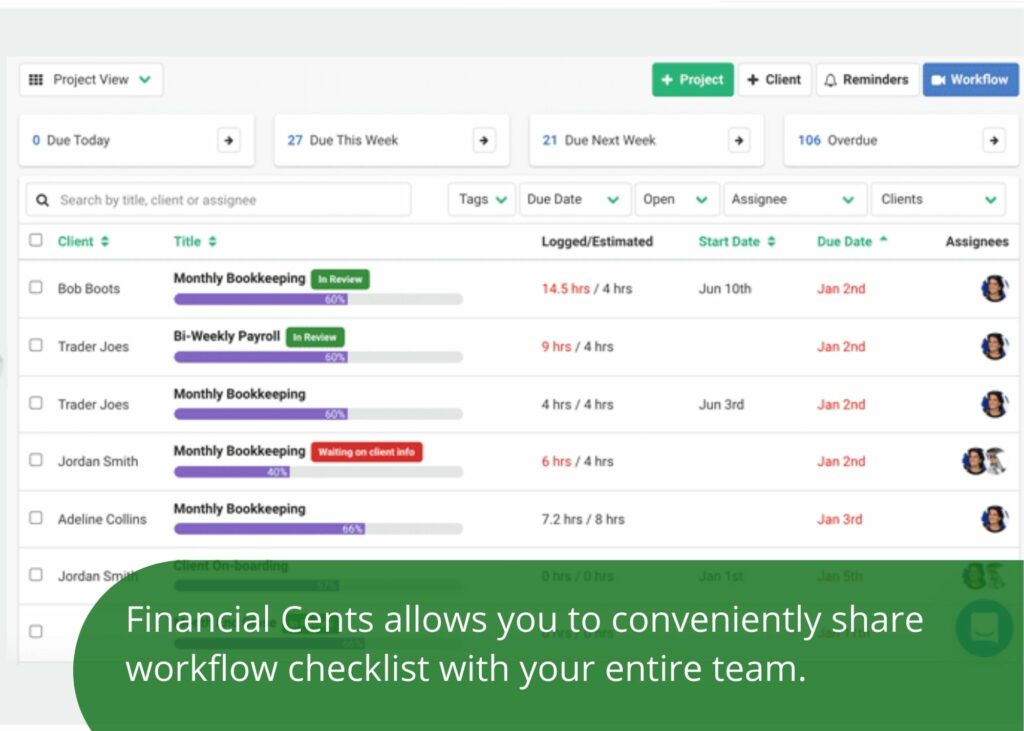

Benefit 3: Attain freedom and flexibility

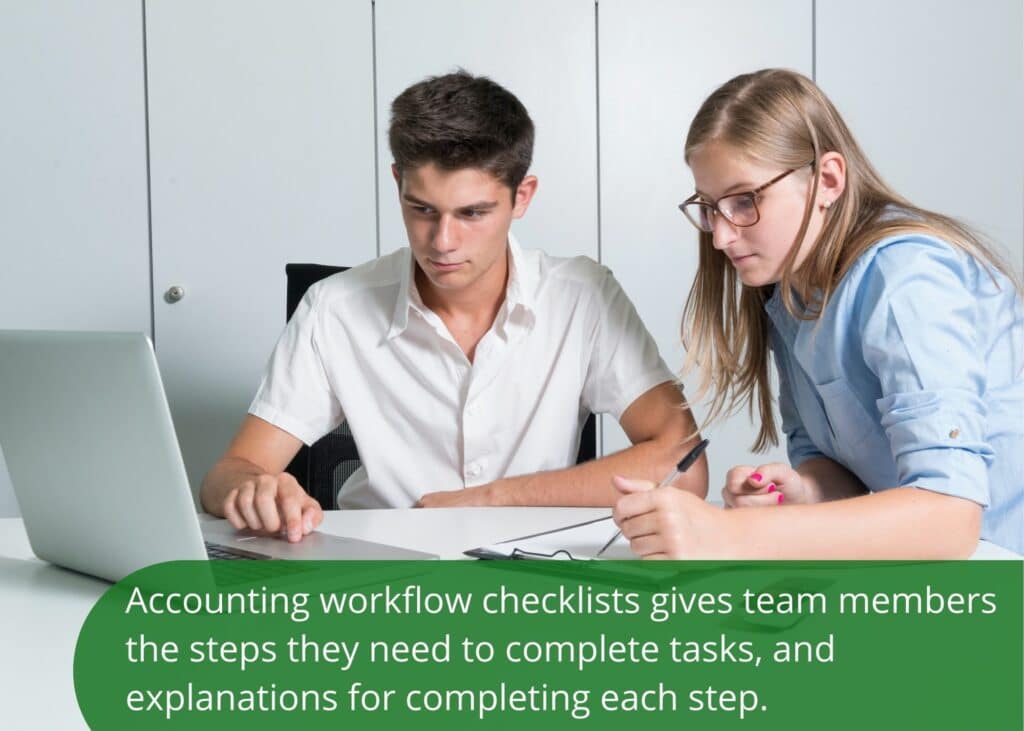

From the outside, being an entrepreneur and starting an accounting firm seems brave and exciting. But when it’s your firm, you know the truth: It can be stressful and even depressing. To ensure that your business is successful, you have to wear a lot of different hats, take on financial risk, and work long hours. While you may be able to sustain this lifestyle for a time, if you let it go on too long you will burn out. On the other hand, if you successfully hire new employees, train them to do the tasks competently, and streamline your firm, you’ll end up with the freedom and flexibility that inspired you to own your own firm in the first place. Of course, you’ll need to pull yourself out of the day-to-day process in order to do this. And how will you do that? With workflow checklists. When you create workflow checklists, you provide your team with everything they need to complete tasks without you. They won’t need to ask you questions, nor will they need you to get involved in the process because they’ll have everything they need right within these checklists. When you remove yourself from the day-to-day processes, you will have the freedom and flexibility to focus on working on the business instead of in the business, growing your firm instead of wasting time on menial tasks. Not only that, but since your business can now run without you, you can slow down a bit and focus on staying healthy and not burning out. There’s no need to work seven days a week anymore. And you can finally take that vacation you’ve needed for three years!

Step 1: Keep it simple

Does the idea of creating accounting workflow checklists seem overwhelming to you?

If so, you’re not alone. Many firms never get around to creating workflow checklists because they find the idea daunting. It seems like a large undertaking, that takes too much time and energy. You simply don’t have hours and hours to dedicate to checklist creation.

That’s why it’s best to start by keeping it simple.

After all, a simple checklist is better than nothing at all. And “nothing at all” is what you’ll get if you try to do everything perfectly, get frustrated, and spend hours on the task before giving up without finishing.

Don’t overthink it! If you overthink it, you’ll end up with analysis paralysis.

Instead, tell yourself that you’re just going to start with something simple and basic. You can always optimize it later, but for now, simple is best.

Free Accounting Workflow Checklist Templates

Maybe the brain dump method isn’t your cup of tea. Maybe you’d rather find a checklist that’s already been created, and simply tweak it to fit your specific process.

After all, accounting processes are fairly straightforward and should be similar across firms.

If that’s you, you’re in luck!

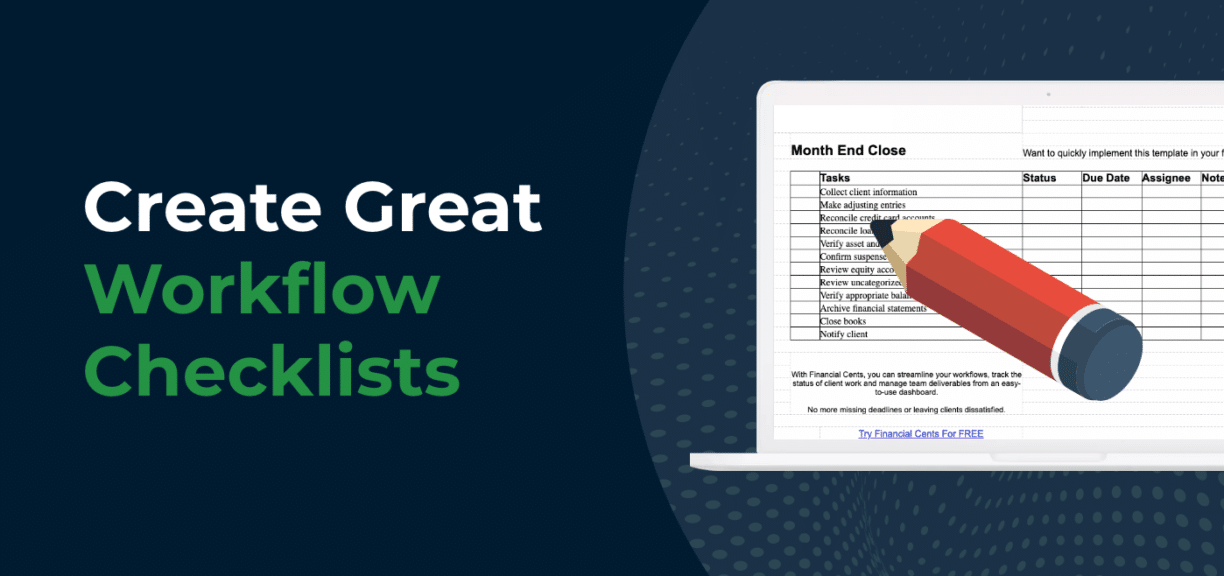

At Financial Cents, we offer a variety of free accounting workflow checklist templates, including a weekly bookkeeping checklist template, a payroll checklist template, an individual tax return checklist template, business tax return checklist templates, a client onboarding checklist template, and more!

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

The 7 Best Karbon Alternatives to Consider in 2024

There is a suitable practice management tool for every accounting firm. When it is the right firm, Karbon provides most of the…

Apr 16, 2024

The Top 8 TaxDome Alternatives for Your Accounting Firm

Practice management software, like TaxDome, should help firm owners manage their projects, clients, and staff to improve client service and stay profitable.…

Apr 08, 2024