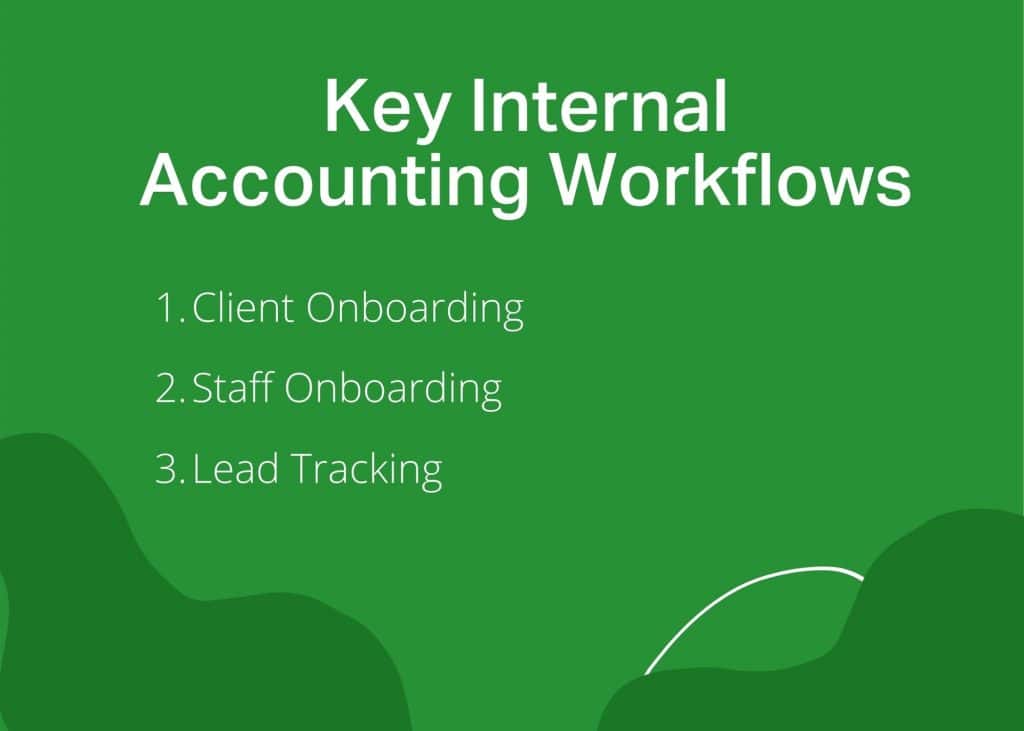

3 Internal Workflows Every Accounting Firm Needs to Streamline & Scale their Firm

Author: Financial Cents

In this article

4 – Do they have all the tools they need to succeed?

Nothing is more frustrating to a new employee than not having access to information or tools they need!

This can make an employee feel incompetent, which in turn can lead to discouragement and isolation. They may even decide to leave the company, which is terrible for your company’s long-term health.

5 – Are they receiving training in company software?

Your onboarding process should include giving your employee basic training in QuickBooks, Financial Cents, or whatever other software you use. Remember, even if it seems intuitive to you, your employee won’t automatically know everything.

It’s better to give everyone a run-through of the system at the beginning to eliminate confusion and mistakes later.

This also indicates to your employee that they’re not expected to know everything and it’s okay to ask for help if they need it.

6 – Do they have access to your firm’s SOPs and workflow templates?

Once you’ve onboarded new staff, they can start taking a load off your shoulders by helping with various tasks. You can do this by giving them access to your company’s workflow templates or standard operating procedures.

Good news—here at Financial Cents, we help you out by offering free accounting workflow templates and templates!

With the click of a button, you can assign tasks to employees, and you can always see who is working on what and where they are at in the process.

Meanwhile, your employees will have a clear guide on how to complete client work so they can confidently deliver consistent client deliverables that meet your firm’s standards.

You can even use the software to streamline your staff onboarding process. You will be able to create a clear process checklist for onboarding to ensure every new hire gets onboarded quickly and properly trained.

Are you looking for a great staff onboarding checklist to get started? We’ve made one just for you, and it’s free!

3 – Always show your lead a clear next step

Streamlining your lead tracking process is good for your company’s efficiency, but there’s more to it! It’s also good for your leads, and makes it easier for them to sign on with your firm.

What do we mean?

A streamlined system takes out the guesswork. You should end your interactions and follow-ups with your lead by providing a clear call to action so they always know what the next step is in the process of signing up for your company.

With Financial Cents, you can streamline your lead tracking process by creating checklists that help you keep track of leads.

Learn more about how you can track leads in Financial Cents here.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

The Seven (7) Best Accounting Client Onboarding Software That Delivers Results

Here are seven of the best accounting client onboarding software for simplifying, automating, and making client onboarding more seamless for you and…

Apr 23, 2024

The 7 Best Karbon Alternatives to Consider in 2024

There is a suitable practice management tool for every accounting firm. When it is the right firm, Karbon provides most of the…

Apr 16, 2024