Setting Up and Using Month End Close Reports in Financial Cents

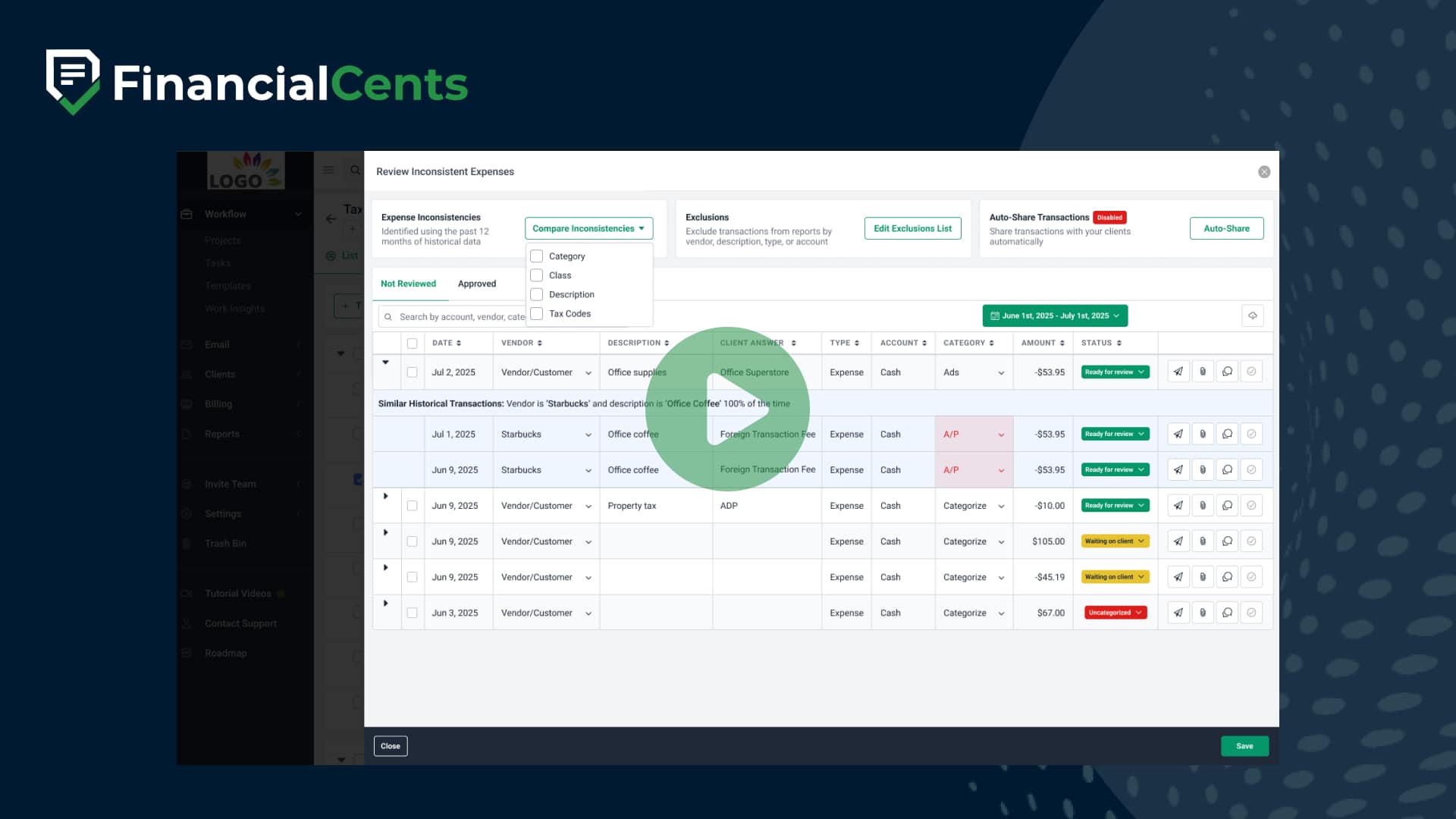

In this video, I’m gonna go over how to set up and use the month and close reports. Essentially, the big value add of these reports is they help your firm to quickly identify transactions which might need additional review. When you first integrate, you’ll essentially see two sides of the screen. On the left hand side of your screen, you’ll see all the reports that are available for use today. We do have several that are coming soon, so stay tuned. Whereas on the right hand side, you’ll see the settings available for the reports. First thing you might wanna do is on the left hand side, if you see any reports that are not relevant to this particular client, let’s say, for example, I don’t use class or location for this client, then you can just toggle off the reports so that they don’t appear later on when we set them up in projects. Once you determine which reports you’d like to use, you can further customize what shows up in each individual report. To do so, click on the report name, and then in the top right hand corner, you’ll see some additional configuration options. Do note some options are available on all reports. For example, every single report has this edit exclusions list where you can decide to exclude specific vendor slash customers, transaction types, or accounts. Other configurations, however, like this select amount here are report specific. So for example, this is a large transactions report. You can decide, you know, what should be the threshold, I’ll say, like, five thousand as an example, of the transaction in order for it to appear on this report itself. Another configuration option you have on each report is the ability to customize the columns that display. So if you click this customized columns, you can see all the information that is available for you available to you for each transaction. You can then click to toggle on additional columns, toggle off, you know, columns that you don’t need. You can also click to move around the ordering of the columns so that you can specify, you know, how you want this data to appear so that you can be most efficient. Once you’ve customized the report to display as you’d like, you can also then modify any information you need about each individual transaction. So for example, with this first transaction here, I can, select a vendor. I can change the status. I can change the category, etcetera, in order to get this transaction where it needs to be. You also have actions available on each transaction. For example, you have the ability to open up this transaction in QuickBooks Online so that if you need to modify anything directly in QuickBooks, you have the ability to do so. You can share the transaction to the client portal, so that if you have additional questions about the transaction or need additional information from your client, you can share it with them on their portal directly. You can attach documents to the transaction, and you can also chat with your client about this transaction. Now once the transaction has been reviewed, updated as you need, you can then click this approve button. What this will do is take the updated information on the transaction, push it back into QuickBooks online, and then move the transaction over into the approved tab. Lastly, if you make some changes here and you need to repull that information from QuickBooks, you can click this refresh data button, and that will repull the information from QuickBooks Online. Now once you’ve configured your reports to be as you need them, the other thing you’ll probably want to configure is the report settings. So first setting you have is client reminders. This will determine how frequently we email your client that they have transactions that they need to review from you. So if you click auto reminders, you can determine what that cadence should be for the notification frequency. You can send the notification now, and you can also view when the last reminder was set to your client. You can also choose which client contacts should be getting these notification emails. So I might wanna turn off these notifications for Susan as an example. You can also determine which team members should get notifications whenever clients respond to your transactions, or take them off if you need. And then your last two options, you can reimport all of the transactions if needed or disconnect the integration altogether. Now that everything is configured, set up, and ready to use, the last piece I wanna show you is how to add these reports into your project. The value of this is that instead of, you know, having your project in Financial Cents related to month end close and then having to come to this month end close tab to do your work, you can instead have an integrated experience where everything occurs in the project itself. So to do that, I’m gonna go to create projects. I’ll just do mine from scratch. Month close. I’m going to set the accounting period for monthly for last month, and then click create. Now with month enclosed, if I click this team task button, I have two options to create either create a custom task or a month enclosed, section. If you click custom task, that will just be your, typical, you know, blank section that you can then add tasks as needed. If instead you click this month enclosed section, that’s going to prepopulate all the reports that you had enabled for this client with this new view report button on each task. Now what this allows you to do is if you click view report, that will then slide out this slider with that specific report directly into your project. Like I said, this makes it a lot easier to keep everything all in one place and to do all your work in one place versus having to bounce between several screens. Now this first option with the, team tasks, one thing I do wanna note is that this is a quick add option. If you instead have existing tasks so let me say something like, review all transactions greater than five thousand. Let’s say I already had a task set up. You can also add a report directly on the task itself. To do so, you’ll click on the task, scroll down to month and close, click add report, select the report that you want to add, and then click save. Notice that the accounting period prepopulated based off the accounting period of the project, but you do have the option to change this if you’d like. And it’s on there. Lastly, do wanna emphasize that these are just regular old tasks. So if I wanted to click and drag this into a different section or if I wanted to add any sort of automation, or if I wanted to add a dependency, reminders, budgeted time, etcetera, you still have all the features and functionalities available to you from tasks on these tasks as well because because they’re just tasks. You they they’re tasks that now have the the reports directly on them so that, you know, you can work on them within the project. But, yeah, that’s how you set up and use the month enclosed feature.

Learn more about the Month End Close feature here.

Ready to Upgrade Your Month-End Close?

Book a demoGet Started Today