Tax practice management software built to help you scale your firm.

30 Second Overview

Rated 5 Stars on

You struggle to know where everything stands with your tax clients. You don’t know who is working on what. And everything feels disorganized with your staff.

Managing your tax firm on spreadsheets, paper checklists, and sticky notes – DOESN’T WORK ANYMORE

Confidently scale your tax firm with ease

You can scale your firm with ease!

30 Second Overview

Workflow

Time Tracking

Client CRM

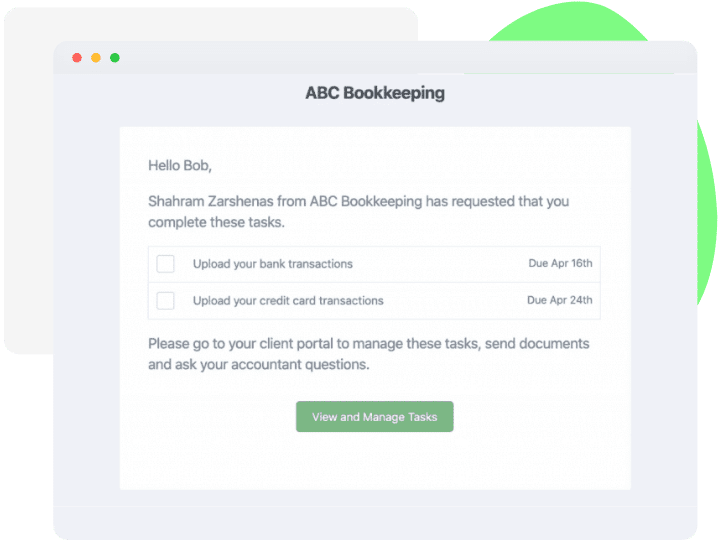

Client Requests

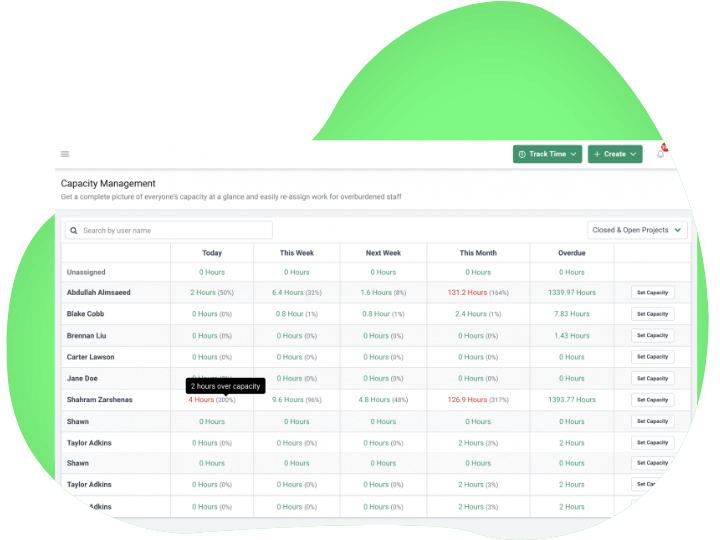

Capacity Management

Reporting

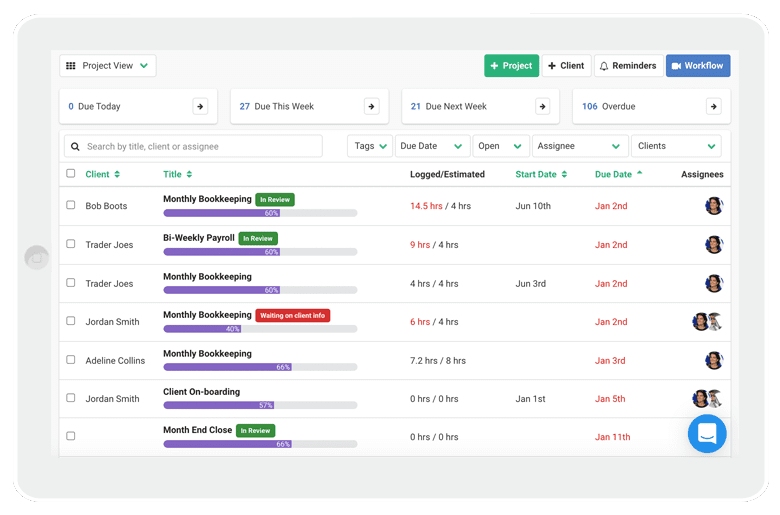

Delegate work, monitor your staff’s progress and track due dates in one simple view. Have all your communication and documents stored in one place for your staff to access and get their work done

Automate client data collection, create checklist templates, send automated reminders to your team, and automate recurring work

Identify bottlenecks and over budget work, easily manage firm capacity, and identify the clients killing your firm’s profitability

See how over 1,000 tax accountants have used Financial Cents to scale their firm

Is your tax firm finding it difficult to track the status of client work and hit deadlines as your business grows?

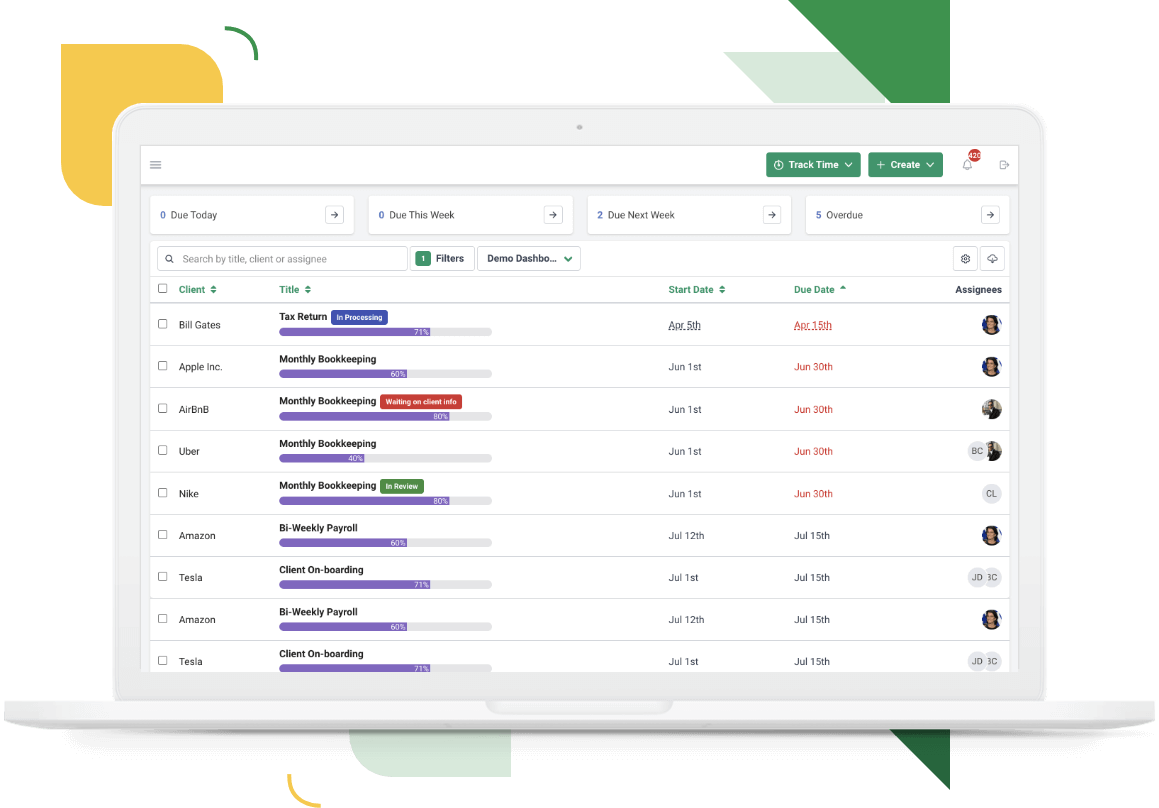

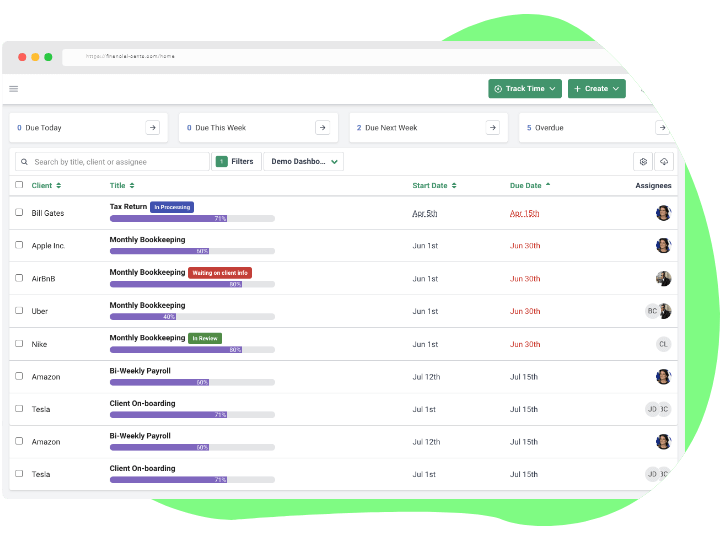

Our tax practice software gives you the visibility you need to scale your firm with ease!

With Financial Cents tax firm management software, you can get the automation, insights, and features you need to take your firm to the next level.

Yes, you will have access to all the features and features that Financial Cents has to offer during your free trial. Also, you will be able to invite your entire firm to use the solution.

Adding your clients is as easy as 1, 2, 3. You can import all your clients and their data within 30 seconds with our QBO integration. If you don’t use QBO then you can export your client list (via CSV) from your current software and import it into our system in just a few steps.

Offering best-in-class customer support is the core of our business. We understand that you are busy and don’t have time to wait for someone to get back to you after a few hours. That is why we promise quick and responsive support with responses within 15 minutes. We offer live chat support directly inside the app so our team can. If we can’t solve your issue via chat, we will jump on the phone or zoom to quickly resolve your issues.

We offer very robust tax practice management software full of all of the features your firm needs to grow with ease.

However, if there is something we don’t offer you can recommend it to our team! We release new features every week and constantly ask our users what we need to build next so we can drive more value for their accounting firm.

So yes, if you have new feature ideas and requests, we will add them to our roadmap and work with you on the best way to develop them.

We offer several reports that give you insights that help you identify bottlenecks in your process, drive efficiencies, and boost your firm’s profitability. Some of those reports include capacity management, measuring your effective hourly rate, and time tracking reports.

Yes, we offer unlimited storage for client and firm files. You can easily store all your documents in Financial Cents to keep your firm organized as it grows.

At Financial Cents, we know you want to run a tax management firm that can confidently scale and grow.

In order to do that, you need management software for tax firms that allows you to streamline your processes, track the status of client work, and help ease your project management so you can consistently hit client deliverable deadlines.

At Financial Cents, we believe every tax professional deserves management software that makes it easy for your team to work together, gather client data, and help you easily track projects and due dates.

We understand how stressful it is when you don’t have a clear vision of where your projects are. That’s why our tax software allows you to easily…

Work with Financial Cents and experience confidence in working with your tax clients!

Wondering how Financial Cents changed the way other tax agencies manage their work? Read a few user reviews below, or click here for more reviews.

Aaron Reid:

“I’m quite happy with Financial Cents. I started out with Client Track years ago and then went to Jetpack Workflow and we made the switch to Financial Cents this summer. They are very receptive to feedback.”

Susan Bart:

“I’m 4 days into Financial Cents trial and really liking it. Very easy to set up, user-friendly, and it does what I need it to do. Really like the effective hourly rate too. I asked a question in their app chat and had a response within 30 minutes. I’m sold!”

Michelle Duford:

“I was using Financial Cents. It is really good for managing a team. It does do the client notifications and reminders. IMO, FC is more appropriate to use than Clickup because it does have a CRM portion for clients.”

Financial Cents exists to serve a variety of financial institutions, including:

You can also view our collection of FREE bookkeeping & accounting templates:

Why is efficient management software important for tax firms?

Having proper management software allows firms to automate large portions of their client tracking work. It also allows firms to utilize one central location for inbound requests, data collection, and in-depth business analysis – such as profitability or time management.

This greatly benefits tax professionals if they can leverage software and technology to do a lot of the hidden back-end tracking for their firm. No matter what the workflow required, having the right software can make or break a firm.

Although software varies between providers, tax practice management technology typically needs to address the following:

With Financial Cents, your tax firm will properly handle these and many more requirements!

Get Set Up in Minutes. No Training or Implementation Needed!

Read our free eBook to learn 4 signs that show you are ready for a more robust system to manage your firm!

A cloud-based solution that makes it easy for accounting firms to manage client work, collaborate with staff, and hit their deadlines

Register to start a 14-day trial