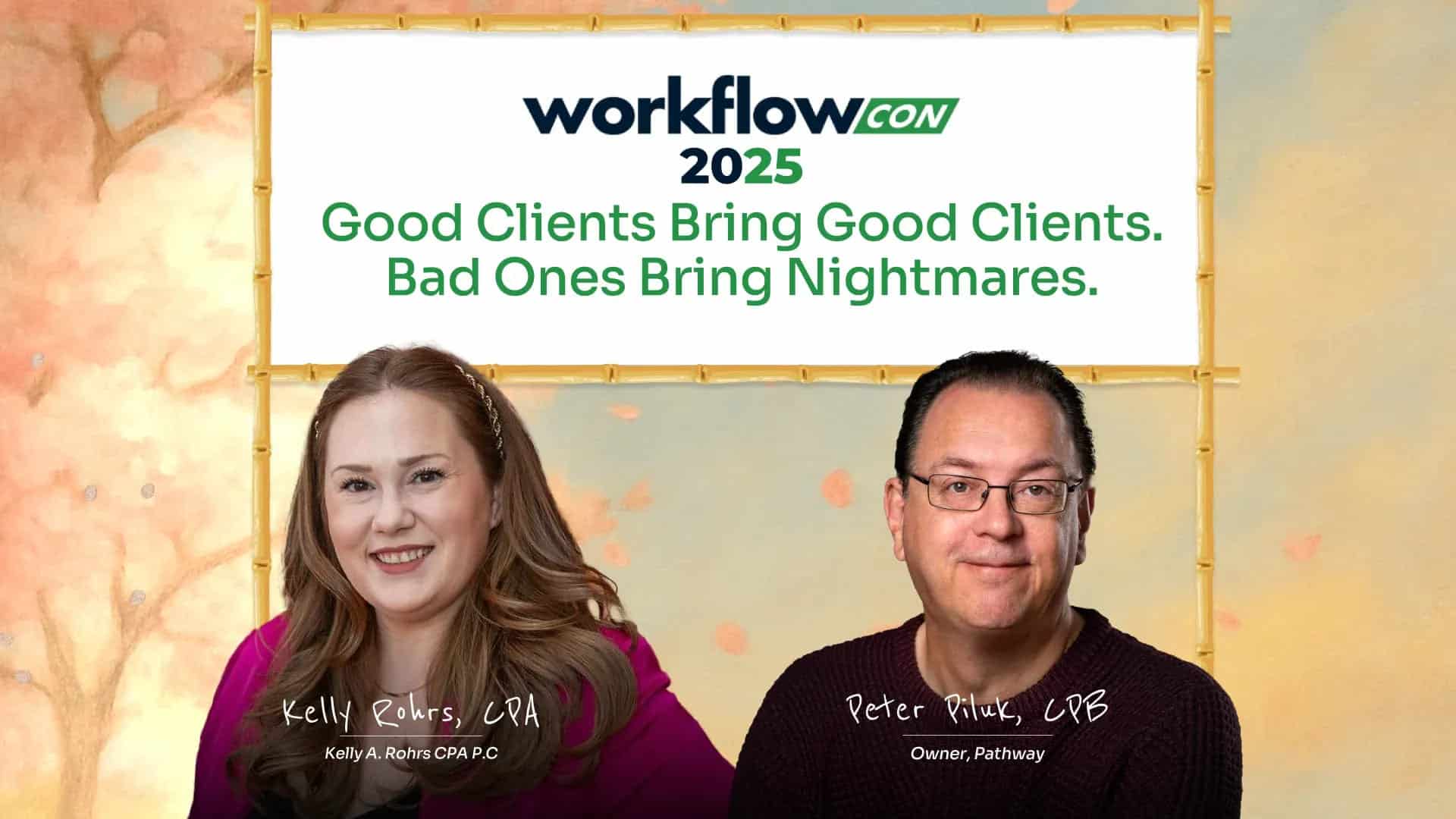

Building Strong Client Relationships in Accounting: Turning Clients into Advocates

Clients who advocate for your services are worth more than any marketing campaign or paid lead service.

Kelly Rohrs, CPA, and Peter Piluk emphasized that referrals have been the backbone of their firms’ growth, often accounting for the majority of new business each year. As Rohrs explained, a true client advocate is a current client who raves about you and refers people, but also a great referral source even if they are not a client anymore.”

Advocates are the clients who speak highly of your firm at networking events, who introduce you to their colleagues and friends, and who are proud to explain how your team has solved a challenge for them. Piluk described how in-person networking creates a unique opportunity for advocates to share their enthusiasm: “My favorite thing is when a client latches on to you at an event and starts introducing you to everyone they know.”

These advocates help bring in clients who are more likely to share your firm’s values, pay on time, and become referral sources themselves. Over time, the positive cycle they create can sustain a firm’s growth and help weather market downturns or changes in marketing channels.

How to Set Expectations and Boundaries For a Strong Client Relationship

Successful client relationships are built on a foundation of clear expectations and healthy boundaries. The panelists explained that onboarding is more than a paperwork exercise. It is a conversation about what is included in the service, how and when clients can reach out, and what happens if needs change or boundaries are crossed.

Rohrs said, “I set boundaries at the very beginning, when I have the initial consult and present the proposal. I explain, ‘This includes quarterly calls. We are available for questions between, but if it becomes excessive, then we will talk about a scope change and a change in the fee.”

This up-front clarity prevents confusion about what is or isn’t covered and keeps both sides aligned. Piluk added that scheduled meetings and published response times are essential to managing both the client’s expectations and the team’s capacity. This approach gives clients the reassurance that you are there for them, while also protecting your time from unnecessary interruptions or scope creep.

Designing Effective Pricing Packages and Service Tiers for Client Clarity and Value

Transparent, structured pricing is key to building trust and managing expectations. Both Rohrs and Piluk have moved away from ad-hoc billing or “one size fits all” pricing. Instead, they use clear packages or custom proposals that outline exactly what is included and what is not.

Rohrs described how her firm customizes every engagement but still provides base pricing, requires tax returns from every new client, and communicates the specific deliverables each package includes. “I don’t meet with people unless they provide tax returns before our call,” she shared. This ensures her team can make informed proposals and helps clients feel confident about the scope and price from day one.

Piluk’s firm uses formal service tiers, so clients know what they are entitled to, such as the number of meetings, the frequency of responses, and the amount of advisory provided. “When you are designing your packages, if you are communicating well with your client, you will hit the number they are comfortable with, and that number is often higher than you expect,” Piluk explained. These models prevent misunderstandings, limit over-servicing, and allow firms to deliver a higher level of service to their best clients.

Furthermore, strong client relationships are sustained by consistent, proactive touchpoints throughout the year, not just at tax time. The panelists recommend setting up a cadence of regular meetings, whether quarterly or monthly, to keep clients engaged and to address issues before they escalate.

Rohrs shared that she uses calendar links and automated reminders to schedule meetings in advance, ensuring clients never feel neglected. Even when most of the work is done remotely, these meetings create opportunities for deeper conversations and personal connection. “Forcing people to get a little uncomfortable and ask questions sometimes gets that relationship much deeper,” she noted.

Piluk’s firm leverages tools like Financial Cents to automate invitations and track client meeting history. He stressed the importance of tailoring reminders and touchpoints to each client’s personality, noting, “Some clients book meetings as soon as the link goes out, others need reminders, but the important part is that everyone feels seen and supported throughout the year”.

How to Deal with Difficult Clients and Enforce Boundaries Professionally

Every accounting firm will encounter clients who miss deadlines, ignore processes, or push past boundaries. Rohrs advised being quick to recognize when a client is not a good fit and not being afraid to let them go. She shared a recent example of firing a client after multiple years of red flags, missed communications, and disrespectful behavior. “You have to be quick to pull the trigger when you know it’s not a good fit,” she said, stressing that the cost of keeping a bad client goes far beyond lost revenue; it affects morale and the ability to serve better clients.

Piluk added that non-paying clients are a red flag that should be addressed quickly. “If the client’s not paying you, the business is probably not going well. You may have to sit them down and have the hard conversation about winding up their business,” he explained. The panelists both agreed that clear payment policies, upfront retainers, and clear disengagement processes protect the firm and ensure energy is spent on clients who value and respect the relationship.

Strong Relationships Are Built on Clarity, Consistency, and Respect

This WorkflowCon 2025 panel demonstrated that the foundation of client advocacy and loyalty in accounting is built on clear expectations, consistent touchpoints, and a willingness to enforce boundaries. By combining transparent pricing, routine communication, and a commitment to both efficiency and human connection, firm owners can create experiences that naturally lead to referrals and long-term growth.

Every step of the client journey is a chance to reinforce trust, deliver value, and create advocates who help your firm thrive.

Summary:

Kenji Kuramoto, founder of Acuity, shares his journey of scaling an accounting firm from startup chaos to structured clarity. He recounts three critical phases: aggressive growth that led to unsustainable churn and layoffs, misguided scaling attempts that copied tech company processes without considering firm culture, and finally achieving clarity through systems that aligned with their values.

Nancy McClelland’s session, ‘Building a Five-Star Culture,’ offered a deep dive on intentionally crafting trust and connection in remote teams. She highlighted the role of clear expectations, accountability, and deliberate rituals—including their firm’s creative approach to boosting morale and community.

WorkflowCon 2026 Waitlist is open!

Now we are already building the next chapter.

The Practice Management Hub

Get Started Today