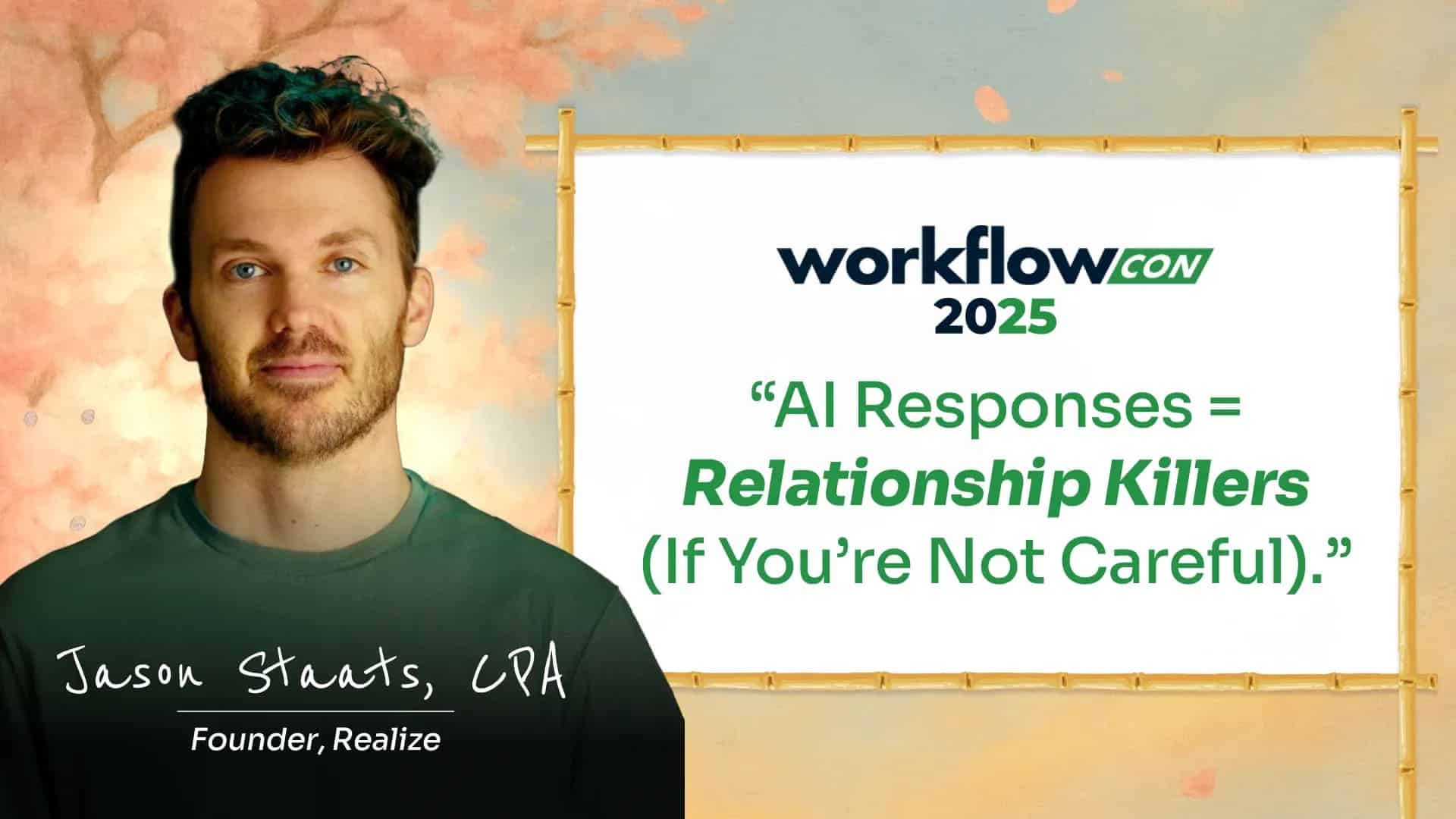

How Accounting Firms Can Transform Client Communication and Workflows with AI w/Jason Staats, CPA

One of the persistent challenges in accounting and bookkeeping is getting information from clients quickly and efficiently. Jason Staats, CPA, founder of Realize community, did not sugarcoat the pain: “Tracking down clients is still the biggest one. The solution’s probably a combination of just good product with maybe a little bit of AI.”

Firms still lose valuable time to follow-ups, clarifications, and the “hokey pokey” of exchanging documents and emails.

AI-powered tools can help solve these issues by automating reminders, categorizing and extracting client data from emails and uploads, and maintaining real-time records of all client touchpoints. Staats made it clear, however, that not every communication pain point needs a full AI solution. Sometimes the best approach is using strong client portals and proven practice management software, then layering in AI where it can truly add speed and intelligence to workflows.

Using AI to Train Junior Staff and Capture Institutional Knowledge

One of the most overlooked opportunities for AI inside accounting firms is its ability to accelerate training and preserve institutional knowledge. Jason Staats made the case that firms are already generating massive amounts of valuable expertise every week through meetings, advisory calls, client conversations, and internal problem-solving. The problem is that this knowledge disappears as soon as the meeting ends or the Slack message scrolls out of view.

Junior staff often struggle not because they lack ability, but because they lack context. They do not know how a decision was made, why a certain judgment call was taken, or how a partner typically approaches a specific situation. Traditionally, this knowledge lives in the heads of senior team members, which creates bottlenecks, interruptions, and inconsistent outcomes.

AI changes that dynamic by turning everyday work into a searchable, reusable training asset.

When firms record and transcribe client meetings, internal reviews, and advisory calls, those transcripts can be organized and indexed by AI tools. Over time, this creates a living knowledge base that junior staff can access on demand. Instead of asking a manager the same question repeatedly, a junior accountant can search prior discussions, review similar client scenarios, and see how decisions were framed in real situations.

Staats emphasized that this is not about replacing mentorship. It is about removing friction from learning so that mentorship becomes more strategic and less repetitive. Junior staff can arrive at conversations already informed, ask better questions, and apply consistent logic across their work.

AI-powered knowledge systems also dramatically improve onboarding. New hires no longer need to rely solely on static training manuals or outdated SOPs. They can review real examples of how the firm communicates with clients, handles objections, explains financial concepts, and resolves edge cases. This shortens the learning curve and increases confidence much faster than traditional shadowing alone.

Practical Applications of AI Agents for Spreadsheet Automation and Data Entry

Spreadsheet work and data entry remain some of the most time-consuming and repetitive tasks in accounting firms. Many teams still rely on manual copy-paste routines, endless reconciliations, and hand-built templates that are prone to human error. Jason Staats’ WorkflowCon session revealed how AI agents are now redefining what is possible for these everyday workflows, saving time, improving accuracy, and freeing up staff for higher-value work.

AI agents, especially those integrated with platforms like ChatGPT for Business, can handle complex spreadsheet tasks with remarkable speed and precision. Rather than replacing accountants, these tools act as powerful assistants that can execute detailed instructions, understand context, and even automate multi-step processes that used to take hours.

A standout example from Staats’ session was the allocation of a payroll journal across departments for a client with thirty employees. Traditionally, this would involve tedious manual entry, calculating percentages, distributing costs, and double-checking formulas across dozens or even hundreds of rows. Instead, Staats showed how an AI agent, when given a sample spreadsheet and clear instructions, was able to enter over a thousand payroll allocation values in just four minutes, achieving perfect accuracy

Beyond payroll, practical use cases for AI-powered spreadsheet automation include:

- Reconciling bank statements by matching transactions from client-provided CSVs against general ledger entries, flagging discrepancies, and highlighting missing documentation.

- Converting and cleaning client data received in messy or inconsistent formats, such as extracting key values from scanned documents, PDFs, or email attachments and formatting them into ready-to-use spreadsheets.

- Generating monthly, quarterly, or year-end financial reports by automating the collation of data from multiple sources, applying firm-specific formatting and formulas, and producing deliverables that are ready for review or client presentation.

- Analyzing trends and variances by instructing the AI to identify outliers, summarize large datasets, and even write plain-English commentary on financial performance.

- Populating tax workpapers and engagement checklists based on data pulled from portals, client uploads, or prior-year files, minimizing the risk of missed steps or incorrect inputs.

Staats emphasized that the most effective approach is to start with existing templates and established processes. Rather than expecting AI to build spreadsheets from scratch, accountants should provide a sample file and clear instructions about what needs to be done. This not only ensures more accurate results but also helps staff see immediate benefits from AI integration.

Security and Privacy Considerations When Integrating AI into Accounting Workflows

As accounting firms bring AI into more of their operations, security and privacy remain front and center. Jason Staats did not shy away from the tough questions, emphasizing that every decision about AI must begin with a clear-eyed look at how data is handled, stored, and protected.

Staats reassured the audience that business-focused AI platforms are built with privacy in mind. He explained, “If you’re using a tool like ChatGPT for Business, nothing you input is ever trained into the public models unless you specifically opt in. This was a really important reason why we chose the paid version.”

For accounting teams, this means that client information remains private and is not included in a broader AI dataset.

Still, Jason cautioned against using free or consumer-grade AI tools with client data, noting, “There’s a reason the free stuff is free. When you’re not paying, you’re the product, and your data is being used to train the next version of the tool.”

Accounting firms should only trust platforms that clearly spell out where data is stored, who has access, and how information is processed. Before rolling out a new AI tool, teams need to review privacy policies and ensure that everything aligns with both internal security standards and client expectations.

Another best practice is to start every new integration with read-only access. As Jason shared, “Never let a tool write back to your records unless you have tested it and know exactly what it is doing.” By keeping access limited, firms can safely experiment with automation and data extraction while minimizing risk. Over time, as comfort and confidence grow, more advanced integrations can be added under strict controls.

Staats also stressed the importance of ongoing staff education. Every team member should know what types of information can and cannot be shared with AI, and who to ask when in doubt. A clear internal policy, reviewed as new tools are added, will help keep privacy top of mind for everyone.

AI is an Advantage for Accounting Firms Ready to Lead

Adopting AI is about creating space for your team to do their best work. Jason Staats encouraged firms to see AI as a springboard for new ideas, faster problem-solving, and more meaningful relationships with clients. With secure practices and a willingness to experiment, accounting firms can use AI to move past old bottlenecks and discover new possibilities for growth and client value. The firms that lean in now will be the ones shaping what modern accounting looks like tomorrow.

Summary:

Kenji Kuramoto, founder of Acuity, shares his journey of scaling an accounting firm from startup chaos to structured clarity. He recounts three critical phases: aggressive growth that led to unsustainable churn and layoffs, misguided scaling attempts that copied tech company processes without considering firm culture, and finally achieving clarity through systems that aligned with their values.

Jason Staats’ session outlined how AI can revolutionize accounting firm operations. Key takeaways included using AI to fix client communication bottlenecks, build a searchable knowledge base for staff training from internal expertise, and implement AI agents for fast, accurate spreadsheet automation, with a deep dive into security and privacy.

WorkflowCon 2026 Waitlist is open!

Now we are already building the next chapter.

The Practice Management Hub

Get Started Today