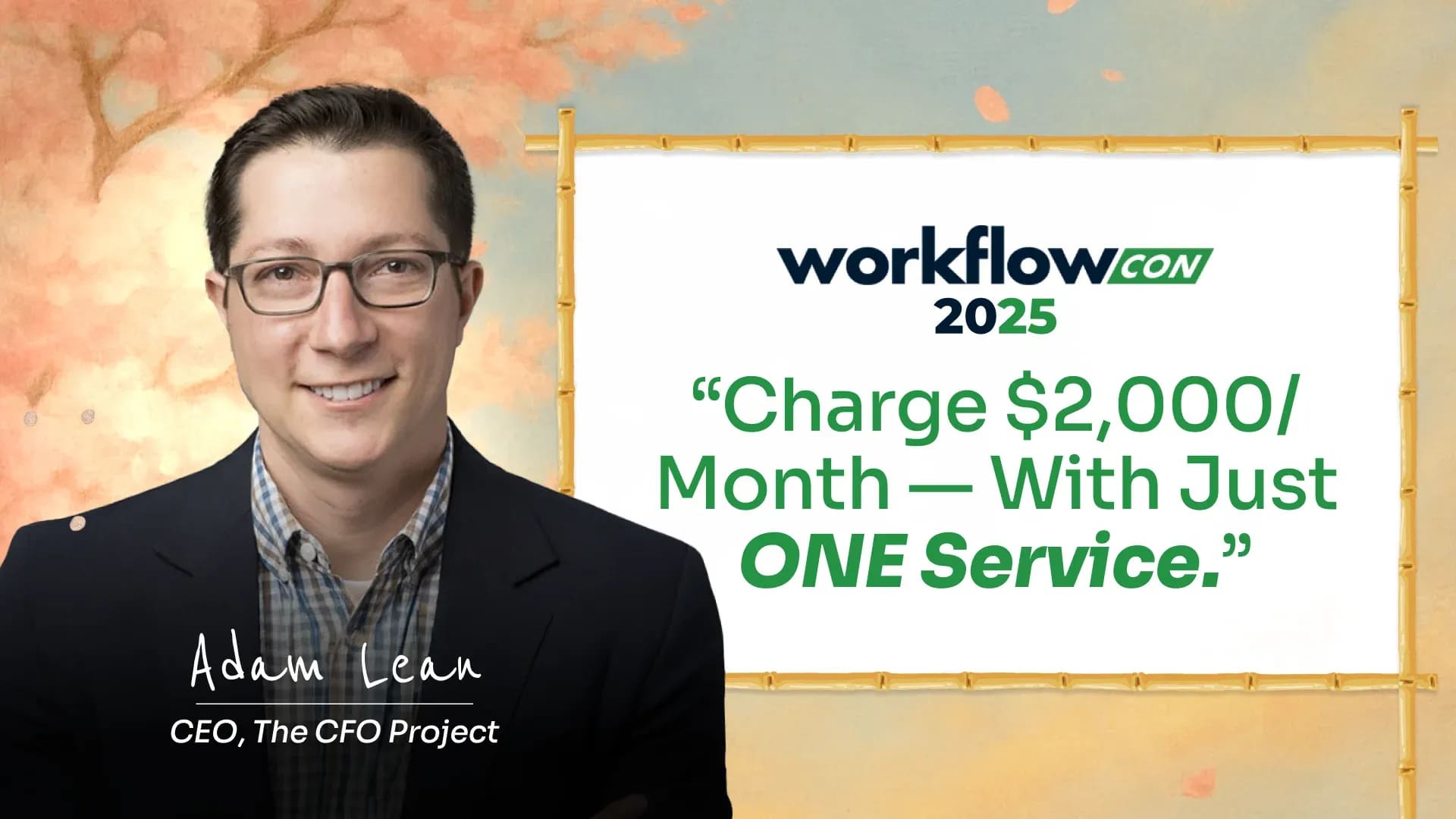

How to Build a Profitable CFO Advisory Service That Clients Value w/Adam Lean

It’s no secret that many accountants and bookkeepers feel boxed in by compliance work. You start your firm to make a difference, but end up stuck in a cycle of tax deadlines, low-margin bookkeeping, and endless price competition. At WorkflowCon 2025,

Adam Lean, founder of The CFO Project, pulled back the curtain on what it actually takes to break out of this trap. His session was packed with practical advice and candid stories that resonated with every practitioner who’s ever wondered how to make their work more impactful, and more profitable.

Adam didn’t just talk theory. He shared how, after growing and selling his own accounting firm, he realized that most business owners desperately want someone to help them build a better business. As he put it, “What they really want is someone to show them how to get what they want out of their business, and they’ll pay for it if you give them real value.”

Why Staying in Compliance Work Keeps Firms Trapped in Low-Value Service

One of the first challenges Adam addressed was the “commodity trap.” He pointed out that most business owners see tax and bookkeeping as boxes to check, not services that help them grow. “Clients need tax returns and books, but almost nobody wants them,” Adam said. “If all you do is compliance, you’re stuck competing on price.” The reality is, price wars and overwork are inevitable if you can only sell what clients already expect.

Adam challenged accountants to ask themselves if they want to keep running faster on the hamster wheel, or if they want to be the kind of advisor who actually moves the needle for their clients. If your only growth option is to take on more clients or work longer hours, you’re building a business that will eventually exhaust you.

The session also struck a chord when Adam described what business owners crave most: someone who can translate financial data into clear, actionable steps. “Most owners don’t understand their numbers, let alone know what to do next,” Adam explained. “What they want is someone to sit down with them, review the numbers, and tell them what to change, so they can make more money, have more time, or actually enjoy their business again.”

Adam’s advice is simple: stop leading with jargon, service menus, or titles like “fractional CFO.” Instead, start the conversation with outcomes.

He encouraged practitioners to say, “I’ll look at your numbers each month, and then meet with you to tell you what’s working, what’s not, and exactly what to do next.” This language immediately resonates with owners who feel lost or stressed, and it sets you apart from firms offering generic financial reports.

The Blueprint for Launching a Scalable, Fulfilling CFO Advisory Practice

Adam Lean made it clear that launching a profitable CFO advisory service is not about reinventing the wheel for every client or building a practice that depends entirely on your own time and expertise. Instead, he encourages accountants to develop a clear, step-by-step system, one that is easy to follow, simple to explain, and designed to scale as your client base grows.

Step 1: Define Your Service and Deliverables

Start by deciding exactly what your CFO advisory service includes. Adam advised practitioners to strip away the complexity and focus on a core monthly rhythm: a regular financial check-in, a concise “scoreboard” report, and a specific action plan for the business owner. He said, “Don’t make it complicated. Every client gets the same deliverables each month, a scoreboard showing what’s working, a conversation about the numbers, and clear steps for what to do next.” This makes your offering easy to communicate, repeat, and price.

Step 2: Productize Your Process

Rather than building new tools or reinventing reports for each engagement, Adam recommends productizing your advisory service. This means creating templates for onboarding, meeting agendas, scoreboards, check-in emails, and action plans. He emphasized, “When you have systems, you can bring in team members, delegate, and actually take a vacation without everything falling apart.” Productizing also makes it easier to sell your service, clients know exactly what to expect, and you avoid scope creep.

Step 3: Systematize Client Onboarding and Prep

A scalable advisory practice starts with a repeatable client onboarding process. Adam suggests creating a checklist that covers everything from the initial discovery call and document collection to setting up the first meeting and delivering the first scoreboard. Prep work, such as gathering monthly numbers or prepping questions for your client, should be systematized so it takes less time each month and can be handled by a team member. Adam said, “You want to spend your time in the meeting, not prepping for it. The magic happens when you talk to the owner, not when you’re stuck in spreadsheets.”

Step 4: Focus on Ideal Clients and Value-Based Pricing

Scalability comes from working with clients who see the value in what you offer and are willing to pay for it. Adam is adamant: “Don’t sell this to everyone. Target businesses doing $500,000 to $5 million in revenue, owners who want your help and can afford your fee.” Pricing should reflect the outcomes you deliver, not the hours you spend. For most firms, Adam suggests $2,000 per month as a starting point, adjusted for market and client size.

Step 5: Develop Your Delivery Cadence and Delegate

Set a consistent meeting cadence, usually monthly, with a tight agenda focused on reviewing the scoreboard and setting action items. Adam’s system allows practitioners to deliver value in four hours per client per month, including prep, meeting, and follow-up. Much of the prep and communication can be handled by staff, freeing you up for the conversations and decision-making that drive real client results.

Step 6: Build for Consistency and Growth, Not Just Customization

The true power of Adam’s blueprint is that it lets you add clients without burning out. Because the process, tools, and expectations are the same for every client, you can scale without working more hours. It is also easier to train team members, maintain quality, and even sell the business one day.

Step 7: Invest in Relationships and Results

Adam reminded attendees that a scalable CFO advisory practice still depends on building relationships. “Your clients aren’t looking for a spreadsheet. They’re looking for someone to listen, give honest feedback, and hold them accountable.” By systematizing the routine work, you have more time to be present for your clients and actually help them reach their goals.

The Right Tools and Rituals Keep Remote Teams Aligned

Effective communication is the backbone of every remote or hybrid firm. The panelists made it clear: you can’t rely on scattered emails or ad-hoc meetings. You need a deliberate system that makes information transparent, breaks down silos, and keeps everyone on track.

Katie Helle described her workflow: “Financial Cents is our command center, then we use Google Chat and Loom for asynchronous updates and training videos. With a global team, you have to build the process into your tools so nobody gets stuck waiting for a meeting.” Greg Scholten explained how every client and internal note is logged directly into Financial Cents, making it possible for new hires to “get up to speed quickly” without confusion.

For most firms, regular meetings aren’t enough. Rituals like biweekly team check-ins, shared chats about life outside work, and documented training help remote employees feel connected and ensure accountability for results. The key is consistency and visibility: the more work and communication happen “in the open,” the easier it is for everyone to perform at a high level.

Wrapping Up

In the end, the path to building a rewarding CFO advisory practice is marked by clarity and intention. Advisory work at this level asks accountants to lead with a willingness to invest in each client’s journey. When a practice is built on repeatable processes, meaningful communication, both the client and the advisor win.

As Lean demonstrated, the opportunity before the profession is to shape practices that deliver lasting value; practices that reflect both professional standards and the evolving aspirations of those who choose to serve as true financial partners.

Summary:

Kenji Kuramoto, founder of Acuity, shares his journey of scaling an accounting firm from startup chaos to structured clarity. He recounts three critical phases: aggressive growth that led to unsustainable churn and layoffs, misguided scaling attempts that copied tech company processes without considering firm culture, and finally achieving clarity through systems that aligned with their values.

Adam Lean, founder of The CFO Project, presented a step-by-step blueprint for accountants and bookkeepers to transition from low-margin compliance to a highly profitable and scalable CFO advisory service. The session focused on overcoming the ‘commodity trap’ by productizing the advisory process, setting value-based pricing, and delivering clear, actionable client outcomes through a simple, consistent monthly cadence.

WorkflowCon 2026 Waitlist is open!

Now we are already building the next chapter.

The Practice Management Hub

Get Started Today