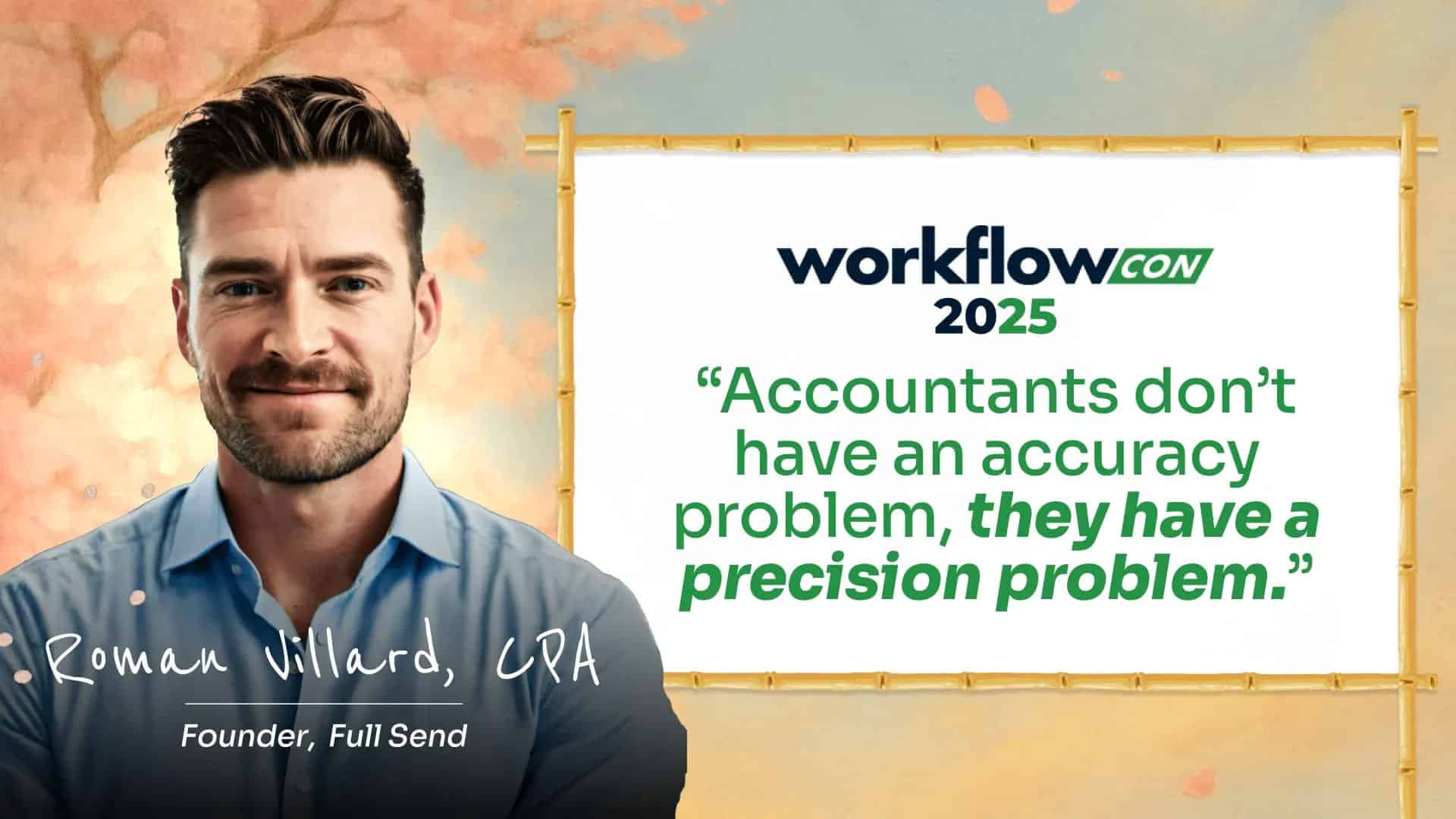

When Accuracy Is Enough: Roman Villard CPA’s Blueprint for Modern Accounting Firms

For generations, accountants have been taught to chase absolute perfection; a habit that often manifests as endless reconciliations, late nights, and an unspoken fear of even the smallest uncategorized transaction.

Roman Villard, CPA, founder of Full Send Finance, described the cost of this habit with surgical precision: “Accountants don’t have an accuracy problem. They have a precision problem. I’ve seen month-end closes drag on for days because someone found a $47 discrepancy in petty cash on a million-dollar revenue recognition.

The result? Time and effort are poured into “solving” minute issues that have no bearing on the business owner’s strategy or confidence in their financials. Instead of delivering insight, accountants too often deliver immaculate but irrelevant ledgers.

The Great Wall of China: A Metaphor for Misplaced Effort in Accounting

To illustrate the futility of excessive precision, Villard drew a parallel to one of history’s largest engineering projects: “The Great Wall of China is a fascinating study to me because it took over 2,300 years to build, spanned over 13,000 miles, and cost hundreds of billions of dollars, yet it didn’t really work actually, to fortify the northern frontier.”

The wall was an impressive monument, but invaders simply went around or through it. In much the same way, accounting teams may build elaborate controls and chase minor variances, but ultimately fail to provide business owners with what they truly need: actionable guidance.

This “Great Wall” mindset leads to a disproportionate level of effort for minimal return. “We spend so much of our time trying to build this wall, trying to reconcile these accounts to the penny, when in reality, our clients don’t really care a whole lot about that.”

Villard encouraged accountants to shift from work that is psychologically satisfying, tidy reconciliations, perfect ledgers, and detailed categorizations, to work that is strategically valuable.

What Business Owners Actually Care About: The Three Real Value Drivers

Despite the profession’s historical focus on flawless reconciliations, Roman Villard insisted that this pursuit is not only disconnected from client needs but it also often blinds accountants to the very things business owners need most. Instead, he mapped out three foundational drivers that consistently define real value in every client relationship.

1. Cash Flow Visibility

Cash flow is not an abstract accounting concept for business owners, but the oxygen that keeps their company alive. Owners are rarely interested in the technicalities of cash flow statements, but they are deeply invested in their ability to answer critical questions confidently: Will we make payroll next month? Can we fund this growth initiative? Are we in danger of coming up short?

Villard made this point with characteristic clarity:

“Owners care about how can I make payroll and also fund growth and not feel the financial stress of not having cash on hand. They care about making sure they’re getting paid by their customers on a regular basis and paying vendors on time.”

He urged accountants to get out of the weeds of indirect cash flow statements and instead focus on tools that bring the reality of cash management front and center. His top recommendation:

- Build a rolling thirteen-week cash flow forecast.

Unlike a static report, this tool is updated weekly. It serves as a real-time dashboard, empowering owners to anticipate cash gaps, plan major expenditures, and even negotiate more favorable terms with vendors or lenders.

Practical advisory for cash management also means helping clients set up efficient billing and collection systems, automate reminders, and regularly analyze payment terms to keep working capital healthy. The accountant’s advisory role, Villard argued, is not just to “report” on cash, but to help owners control it.

2. Profitability Analysis

While most firms dutifully deliver monthly P&Ls, business owners are far less interested in abstract net income than in understanding exactly where profit is being generated, or lost.

Villard put it bluntly:

“Owners really want to focus on what the profitability of this specific product, of this service, of this particular customer or project. What channels are actually making money for me so I can reinvest in growth?”

Modern advisory accounting means helping clients see past the summary. Villard offered several practical approaches:

- Segmented Margin Reporting: Use classes, locations, departments, or product lines to track gross and net margin at a granular level. For example, a restaurant chain needs to know which locations are profitable and which are dragging down the group.

- Customer and Project Profitability: Break down revenue and costs by client or job. Which customers are high-maintenance and low-margin? Which projects run consistently over budget? This insight can drive better pricing, smarter resource allocation, and even client selection.

- Pricing Strategy: Help clients understand the real cost to serve, beyond materials, including labor, time, and overhead. Use this analysis to inform pricing decisions, discounts, and sales focus.

Villard’s takeaway: The most valuable accountants are not just delivering the “scorecard”, they are providing the playbook for owners to optimize profit, cut losses, and grow strategically.

3. Growth Strategies: Moving Beyond Simple Trends to Meaningful Advisory

Growth is the goal of nearly every entrepreneur, but few want to “grow” for its own sake. Owners seek purposeful, sustainable expansion, whether that means top-line sales, headcount, market reach, or even social impact.

Villard challenged accountants to stop relying on canned month-over-month change reports:

“A lot of systems that we use for reporting tend to start with this month-over-month change report. That doesn’t provide a whole lot of advisory to the clients. Owners are trying to figure out: What is helping us move forward sustainably?”

Instead, he outlined a more consultative approach:

- Pipeline to Revenue Conversion: Analyze the sales funnel to help clients understand how many leads, proposals, or prospects are needed to hit revenue targets. Advisory here might mean building basic CRM dashboards, or simply interpreting pipeline metrics and conversion rates.

- Scenario Planning and Forecasting: Develop models that allow clients to see the impact of “what if” scenarios, such as hiring, equipment purchases, or new product launches, on cash flow, profit, and KPIs. This is where accountants add value as true business partners, not just historians.

- Headcount and Capacity Planning: Many owners underestimate the financial impact of hiring (or failing to hire) at the right time. Advisory accountants can help model labor costs, productivity assumptions, and break-even points, guiding growth that is realistic and sustainable.

- Benchmarking and Goal Setting: Use industry data to help clients assess their progress relative to peers. Where are they excelling? Where are the vulnerabilities?

In sum, Villard’s approach to growth advisory is about facilitating forward-looking decisions, not just documenting the past. When accountants focus on these drivers, owners become more confident, proactive, and resilient, no longer overwhelmed by data, but empowered by insight.

Materiality: The Secret Weapon for CAS Teams

With the foundation set, Villard delivered his practical playbook for moving teams beyond perfectionism: materiality. This foundational audit concept, he argued, belongs in every advisory and CAS firm.

What Is Materiality? Defining the Thresholds That Matter

Villard explained: “Overall materiality is the amount that actually matters to a broader client’s financial picture on an annualized basis, a single threshold calculated from a financial driver, such as revenue or assets.” Tolerable misstatement is then set as a fraction of overall materiality—typically 10–25%—to guide daily work.

Example: For a $1 million business, an overall materiality threshold might be $5,000–$10,000. The day-to-day tolerable misstatement for team judgment is then $500–$1,250. Anything below this is not escalated, freeing up attention for what actually moves the needle.

How to Calculate and Use Materiality in Your Advisory Practice

Villard’s process:

- Set overall materiality based on the client’s industry, risk, and financial drivers.

- Determine tolerable misstatement for routine tasks—using 10% for higher-risk or more complex businesses, and up to 25% for routine environments.

- Apply materiality standards by account, if needed, and document every decision to provide defensibility and consistency.

He stressed, “Materiality is an internal calculation. This is not something you share with the client. Rather, use it to elevate your team’s thinking.”

Materiality is not a license to ignore the details, but a disciplined way to focus on what truly matters, while recognizing when judgment should override mindless precision.

Judgment, Communication, and Team Behavior: How to Make Materiality Work

Materiality is only practical if accompanied by strong team judgment and clear client communication. Villard advocated for a two-pronged approach:

- Educate and Empower Your Team

Train staff to distinguish between items that merit escalation and those that can be resolved with professional judgment. Reward team members for clarity, speed, and responsiveness—not just for ticking every reconciliation box.

“We want to replace perfection. Accountants historically equate their ability to be accurate with the value they provide. But our job isn’t necessarily to fix everything, but to get to a point where we can focus on what matters and drives value to the client.” - Ask Clients What Matters Most

During onboarding, ask directly: “Which financial items do you care about every month? Where do your eyes linger on the statements?” This focuses advisory on their real priorities and shapes materiality thresholds by client, not by generic rules.

Elevate Your Advisory Service by Letting Go of Perfection

Roman Villard’s session challenged one of the accounting profession’s most deeply rooted habits: the relentless pursuit of precision, often at the expense of real impact. For too long, accountants have measured their worth by their ability to reconcile every dollar, chase every unexplained transaction, and produce financials that impress their peers but leave clients underwhelmed and underserved.

Villard’s message was a call to elevate the work of accountants by changing what “good” looks like. Instead of chasing technical perfection, he urged practitioners to adopt a discipline of relevance, to understand and align with what clients truly value: clear cash flow, actionable profitability insights, and strategies for sustainable growth.

Summary:

Kenji Kuramoto, founder of Acuity, shares his journey of scaling an accounting firm from startup chaos to structured clarity. He recounts three critical phases: aggressive growth that led to unsustainable churn and layoffs, misguided scaling attempts that copied tech company processes without considering firm culture, and finally achieving clarity through systems that aligned with their values.

Roman Villard, CPA, challenges the accounting industry’s pursuit of perfection. He introduces a blueprint to shift focus from endless reconciliation to delivering true client value through three drivers: Cash Flow Visibility, Profitability Analysis, and Growth Strategies. Learn how to use the materiality concept to empower your CAS team and elevate advisory service.

WorkflowCon 2026 Waitlist is open!

Now we are already building the next chapter.

The Practice Management Hub

Get Started Today