The State of Accounting

Workflow and Automation

Your roadmap to a more efficient, profitable accounting firm in 2025

We went full detective mode—surveyed 800+ firm owners, grilled 9 industry experts, and

uncovered the 9 biggest workflow nightmares haunting the accounting world.

The defining moments that led firms to

automate workflows

Moment #1 – Work Falling Through the Cracks

Many firms realized they were missing

deadlines, losing track of tasks, and struggling with visibility into ongoing work. As workload grew, important client tasks were overlooked, leading to

inefficiencies and frustration.

55.5% of firm owners still experience workflow inefficiencies.

The survey highlights the primary challenges impacting firms.

“It is super important to automate everything you possibly can EARLY in the game. Setting up standardized processes (SOPs) and setting boundaries with clients can prevent workflow inefficiencies as your firm grows.”

– KELLY ROHRS, CPA

Owner, K. Rohrs, CPA, P.C.

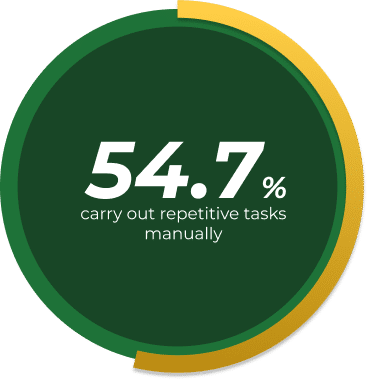

Moment #2 –

Increased Client Volume Made

Manual Tracking Impossible

Firms that started small were able to manage workflows manually. But, as client

numbers grew, spreadsheets and manual tracking became unsustainable. The

need for scalability and efficient task delegation became apparent.

– KELLIE PARKS, CPB,

Founder, Calmwaters Cloud Accounting.

You need to automate everything, even if you and a couple of part-timers already know how to do everything. Skipping this step and relying on memory or scattered notes only slows you down..”

Moment #3 –

Increased Client Volume Made

Manual Tracking Impossible

Firms that started small were able to manage workflows manually. But, as client

numbers grew, spreadsheets and manual tracking became unsustainable. The

need for scalability and efficient task delegation became apparent.

46.6%

Ineficient

32.1%

Just there

6.2%

Smooth

46.7% described client & Staff onboarding inefficient.

“Scaling isn’t easy, and it’s definitely not for everyone. The real key is to make sure your foundation is solid before you try to grow. That means having the right practice management software, clear internal processes, and a team that’s already working efficiently and effectively.”

– Mike Sylvester, CPA,

Managing Partner, SBS

CPA Group Inc.

Client demands are growing, staffing challenges persist, and manual processes

are no longer sustainable

Firms that improve their processes and embrace automation gain efficiency and work-life balance. This report shows you how.

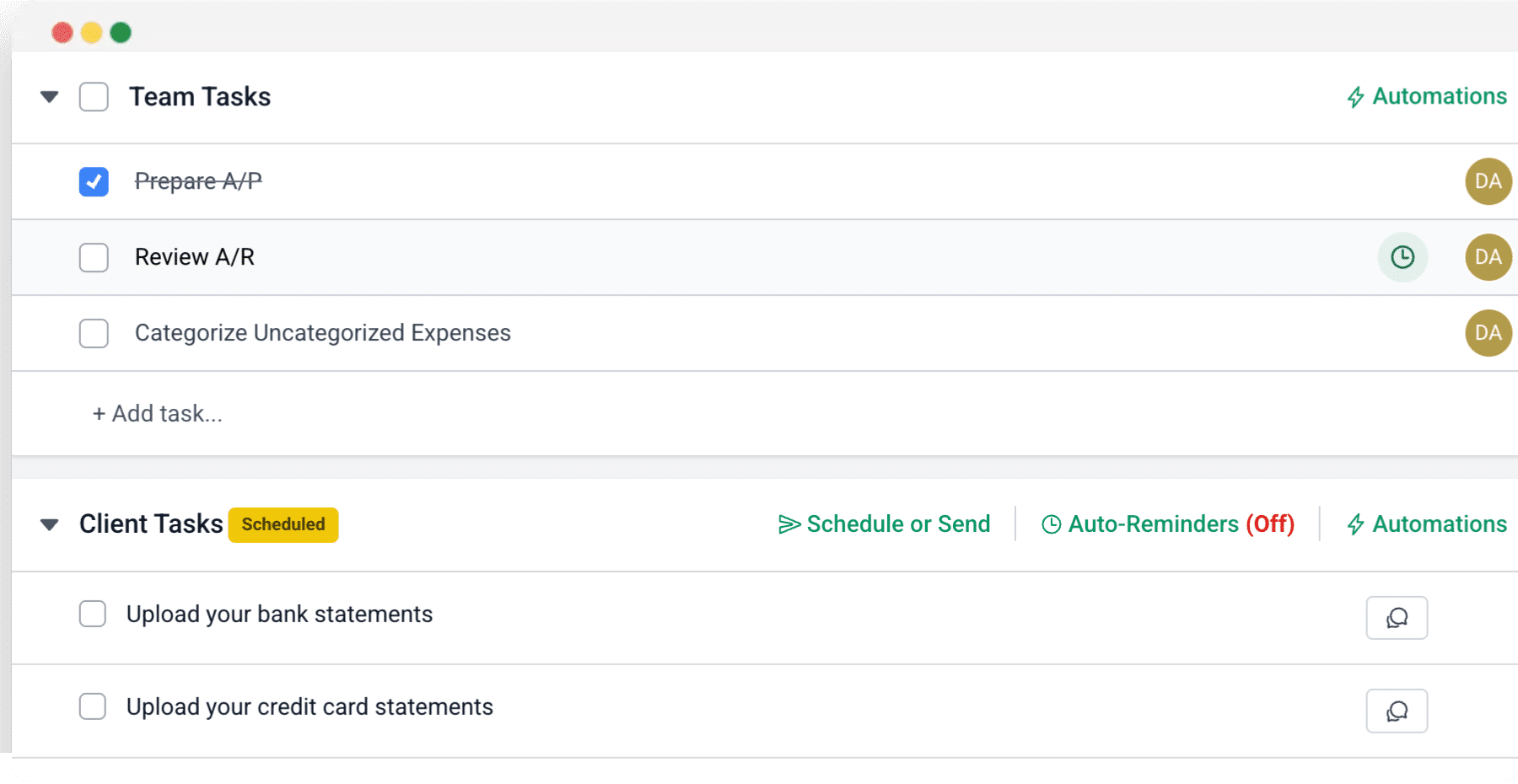

Get the ReportMoment #4 – Lack of Visibility and Disorganized Workflows

Firms struggled with tracking project statuses, work distribution, and collaboration among team members. Remote and hybrid work environments exacerbated visibility issues, making real-time

updates crucial.

73.9%

of firm owners in 2024 considered a centralized dashboard the most sought-after workflow software feature.

Other features considered:

Client tasks and reminders

69.3%

Client Portal

60.6%

Email integration

53.3%

Recurring Projects

50.7%

“I have a visual dashboard that shows where I’m at with all clients at any given moment. It helps me take quick stock of where I stand, which then allows me to plan my weeks better. This was a game-changer for me.

– Erica Goode, CPA

Owner, Erica Goode CPA

PLLC

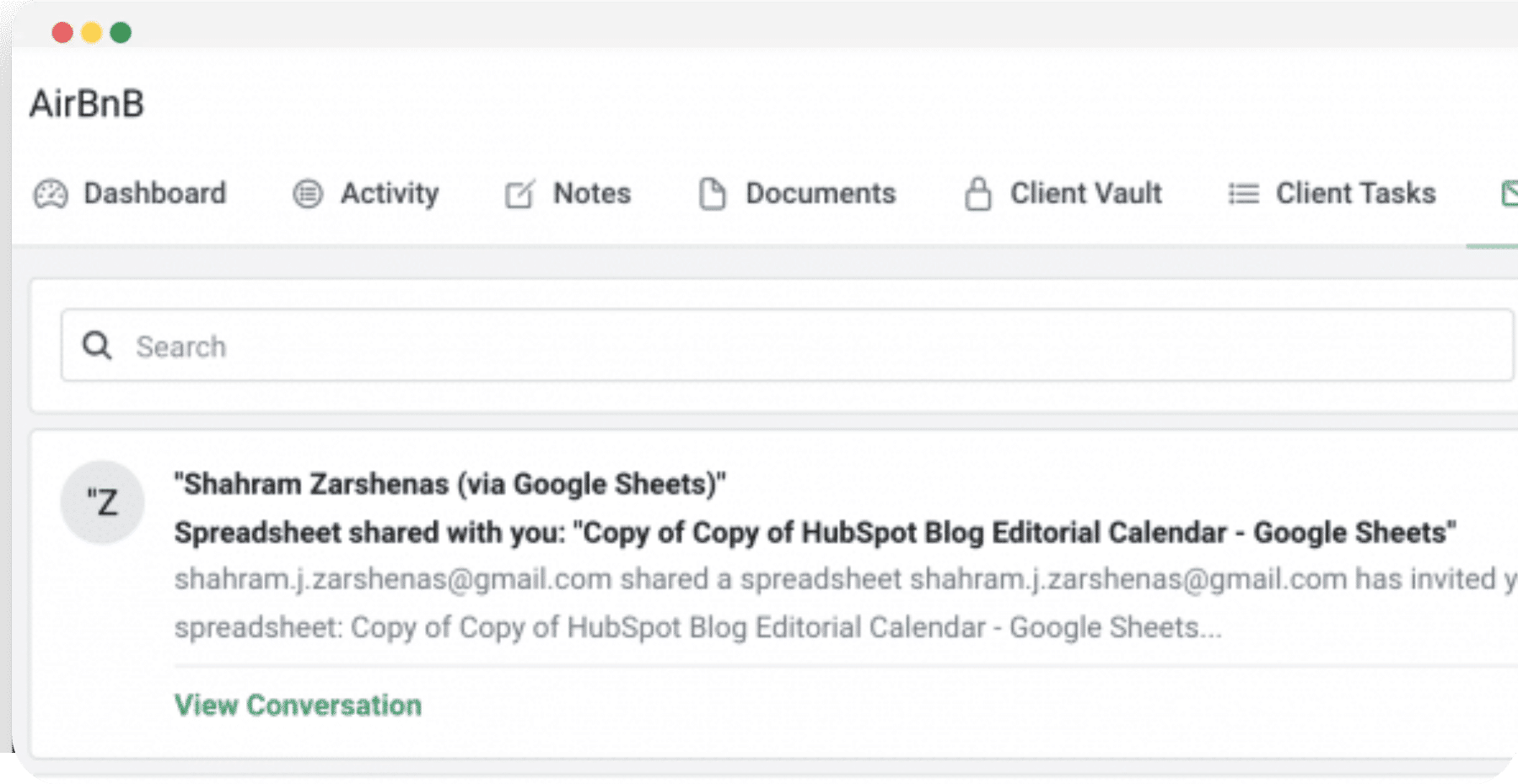

Moment #5 – Client Communication and Document

Collection Bottlenecks

Many firms struggled with clients sending documents in multiple formats, forgetting to send

key information, or responding only after multiple follow-ups. The lack of a centralized,

automated request system led to delays and inefficiencies.

The average time for clients to submit requested documents is 5 days across

firms on the scale plan in Financial Cents.

95%

Under 10 days

38%

Under 3 days

20%

Under 24 hours

– Logan Graf, CPA

Owner, The Graf Tax Co

“Schedule out information deadlines for each client instead of having a broad deadline for all clients. This helps spread the workout and sets clear expectations.”

See how firms like yours eliminate manual bottlenecks,

improve collaboration, and

regain work-life balance.

Get the Report

Moment #6 – Stress, Burnout, and Work-Life

Balance Struggles

Many respondents cited stress, burnout, and an unsustainable work-life balance as major

triggers for automation. The inability to delegate effectively or manage workload efficiently

led to frustration and exhaustion.

57.5%

experienced poor work-life balance

Missed Deadlines

37%

Saw impact on revenue

28.1%

Errors and poor work quality

26.2%

Poor work distribution.

25.1%

“One of the biggest mistakes firms make is not having a standardized onboarding process. Early on, we had no structured way to track new clients, leading to inefficiencies, confusion, and a lack of guidance for both the firm and the client.

Now, we have refined our process to ensure every client has a seamless experience while maintaining efficiency for our team. Automation should remove unnecessary manual tasks, but the but the human touch should remain in areas that build relationships and trust.“

– Nick Boscia,

Owner, Boscia & Boscia P.C.

Moment #7 – Learning from Other Firms and

Industry Leaders

Some respondents realized they needed automation after learning from more successful firms

or attending industry webinars. Seeing how other firms leveraged workflow automation

provided the push they needed.

Top areas of impact:

28.7%

Better standardized systems and processes

22.3%

Getting work done faster

11%

Improved team collaboration

10%

Faster document collection

“When I think about AI-driven automation, I’m picturing a system that kicks off processes like interpreting data or classifying information. But proper checks and balances are key. The safest approach is to build in a “human in the loop” function to ensure you’re not relying blindly on the tech.”

– Chad Davis, CPA,

Co-Founder of LiveCA LLP

& AutomationTown.io

Get access to

100+ free workflow templates from our community library.

Who Should Read this Report?

Independent Accountant Strategists

Solo Practitioners

If you’re wearing all the hats — client work, admin, marketing — this report helps you cut admin work and focus on your clients.

(2-5 Staff)

Small Firm Owners

Gain insights into how other small firms streamline work without adding overhead cost so you can stay lean and profitable.

(6-20+ Staff)

Growing Firms

Learn how automation helps you onboard new clients and staff faster, ensuring processes scale with your firm.

Remote & Hybrid Firms

See how firms working across different locations use automation to maintain visibility, collaboration, and client communication.

Firm Admins & Managers

Find strategies to reduce bottlenecks, track work more efficiently, and improve communication between teams and clients.

Cut hours off your week with

15+ automation ideas in the

Workflow Automation Ideas Library

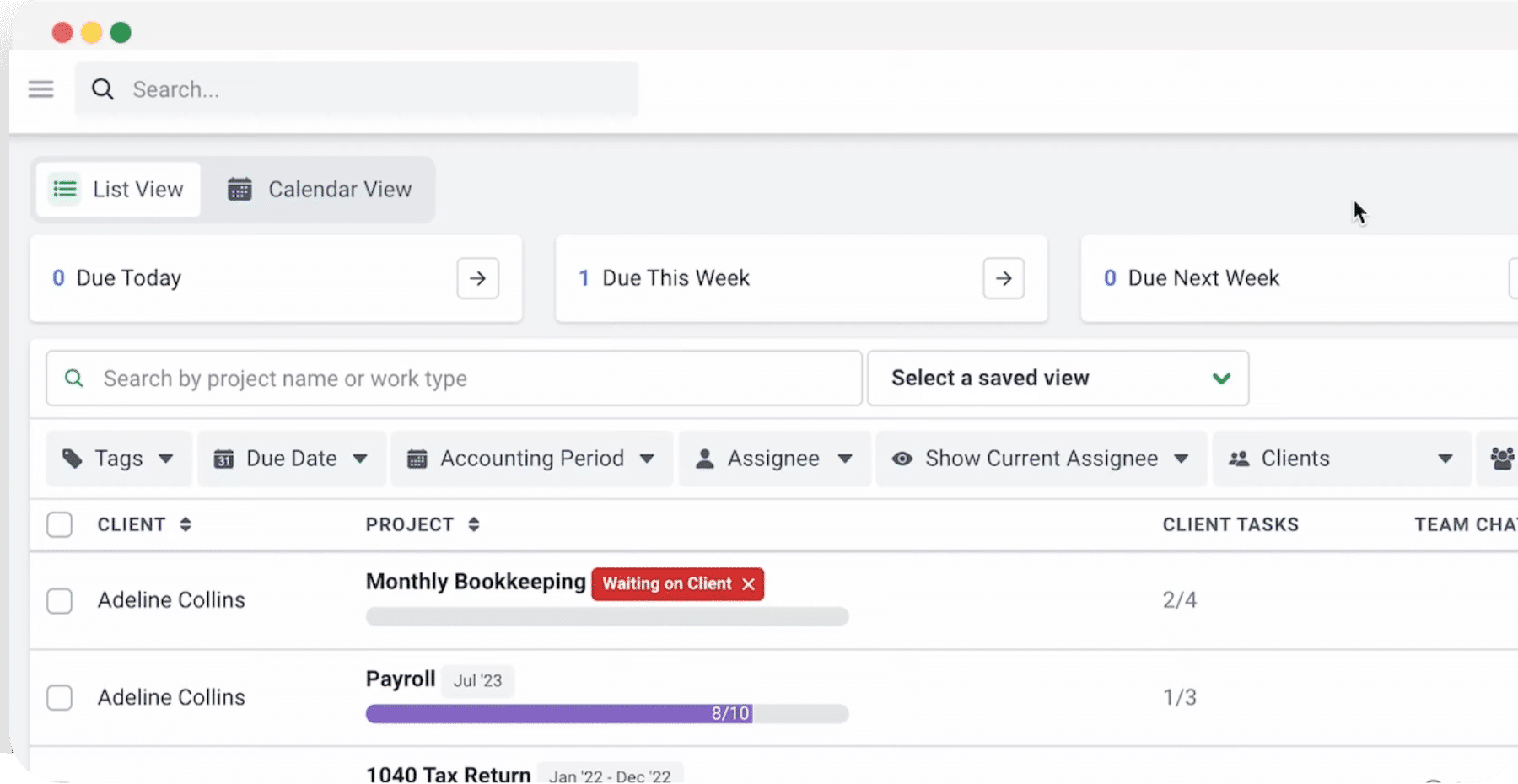

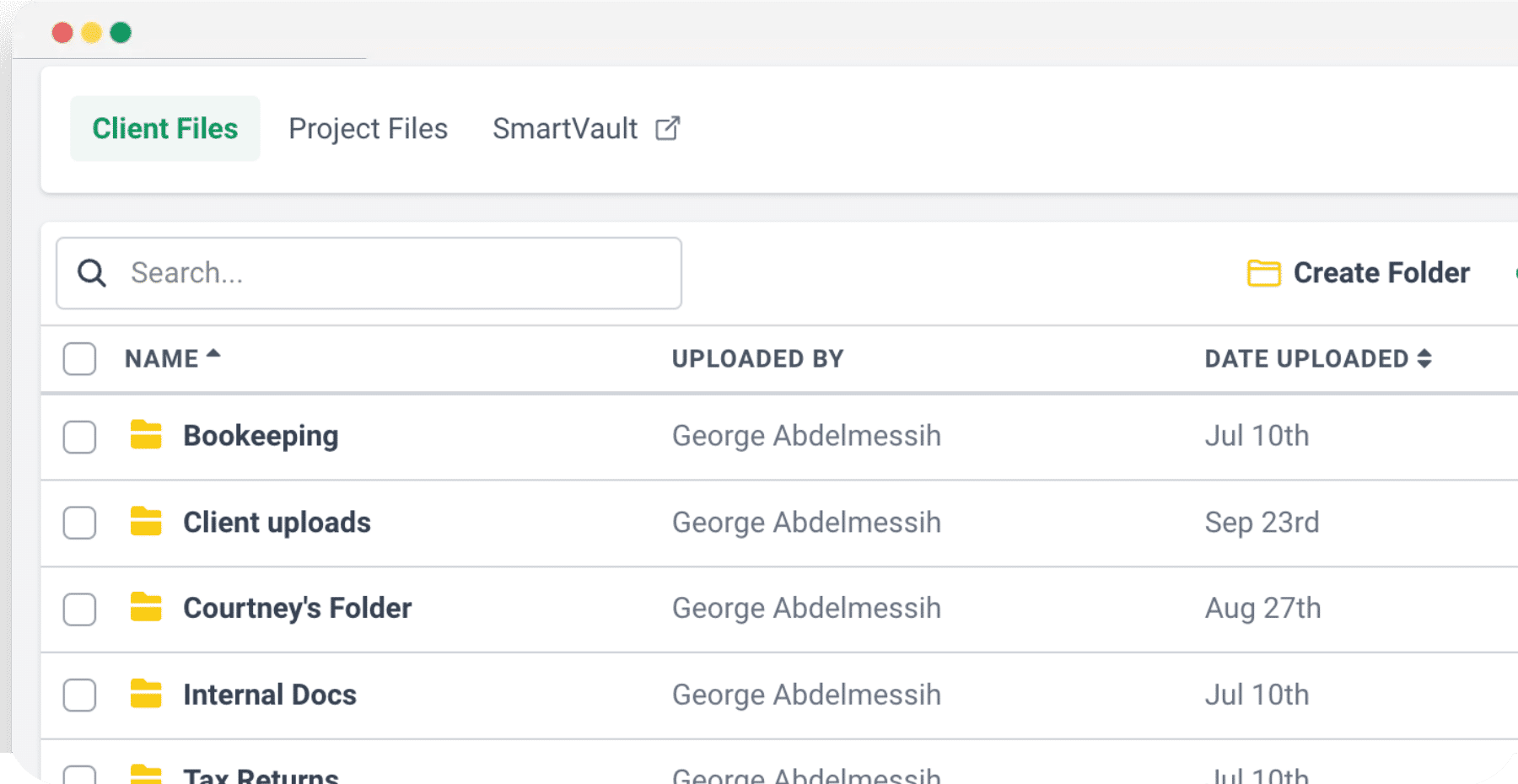

The 2025 State of Accounting Workflow & Automation Report is brought to you by Financial Cents.

Financial Cents is the #1 Accounting Practice Management software that helps firms to track client work, get client responses faster, and organize everything with one easy-to-use practice management software that your team will love.

Used by over 2,500 accounting, bookkeeping, and CPA firms.

See for YourselfHere’s how Financial Cents helped accounting firms get work done in 2024

102k

tasks completed

400m+

client emails sent

1.6m

projects wrapped up

538k

documents uploaded

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!