Managing your invoices effectively is essential for maintaining healthy cash flow and accurate financial records. For your accounting firm, robust invoice management can mean the difference between streamlined operations and financial chaos. This guide explores what invoice management entails, its significance, and how you can optimize your invoicing process.

What Is Invoice Management?

Invoice management is the process of handling invoices from creation to payment, ensuring accuracy, timely submission, and proper record-keeping. It encompasses everything from generating and sending invoices to tracking payments and reconciling accounts, ensuring that your clients are billed correctly and that payments are received without delays.

For modern accounting practices, relying on manual invoice management is quickly becoming outdated. Automated systems significantly reduce the likelihood of human errors, improve processing times, and provide better visibility into your firm’s cash flow. By leveraging technology, you can ensure seamless financial operations while freeing up time to focus on other high-value tasks.

Why it Matters

Effective invoice management offers several key benefits that impact the financial stability and efficiency of your firm:

- Improved Cash Flow: Prompt and accurate invoicing ensures that you receive payments on time, maintaining liquidity and reducing financial stress. When invoices are sent without delay and followed up on consistently, your firm can maintain a steady cash flow that supports operational stability.

- Enhanced Client Relations: Clear, error-free invoices help build trust with your clients by minimizing billing disputes and confusion. When clients receive well-documented invoices with transparent payment terms, they are more likely to pay on time and continue doing business with you.

- Reduced Errors: Manual data entry can lead to mistakes, such as incorrect amounts, duplicate invoices, or missing details. Automation helps eliminate these common errors, reducing the risk of payment delays or rejected invoices due to inaccuracies and saving you money.

- Better Financial Oversight: With a structured invoice management system, you gain valuable insights into outstanding payments, overdue accounts, and your firm’s overall financial health. This allows you to make informed decisions about cash flow management and financial planning.

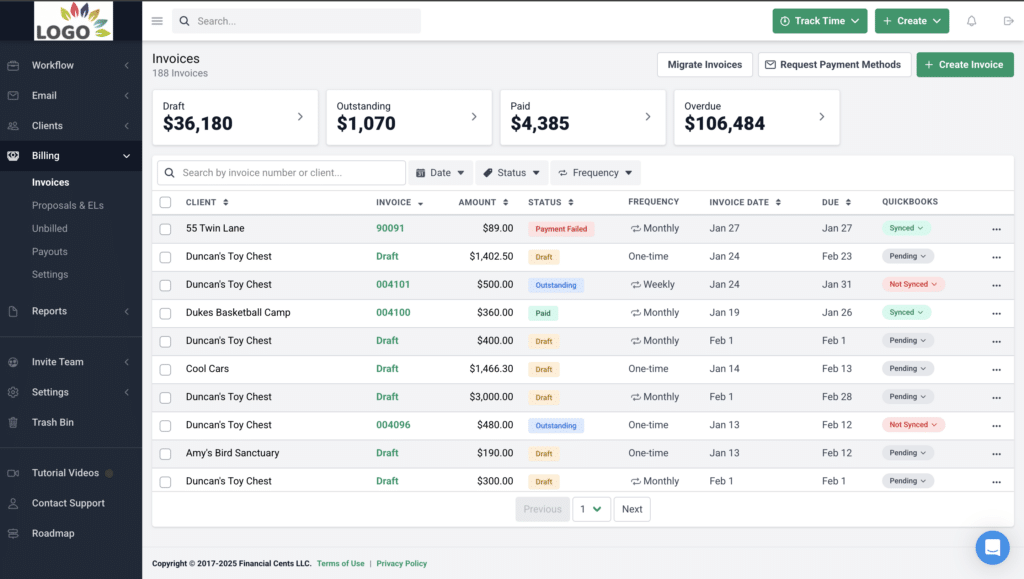

Financial Cents billing feature for accounting and bookkeeping firms provides you with an invoice management dashboard that provides you with the real-time status of your invoices.

In the competitive landscape of public accounting, efficient invoice management is not just an operational necessity—it’s a strategic advantage that enhances your firm’s professionalism and financial stability.

Key Elements for Managing Invoices

To successfully manage invoices, you need a structured approach that covers all aspects of the invoicing cycle:

- Invoice Generation: Creating detailed, professional invoices that include essential information such as the client’s name, service descriptions, applicable rates, payment terms, and due dates. Standardizing this process ensures consistency and reduces errors.

- Delivery and Tracking: Ensuring invoices are delivered to the right recipients promptly and tracking their status to confirm receipt. By monitoring when an invoice has been viewed or paid, you can avoid miscommunications and proactively address delays.

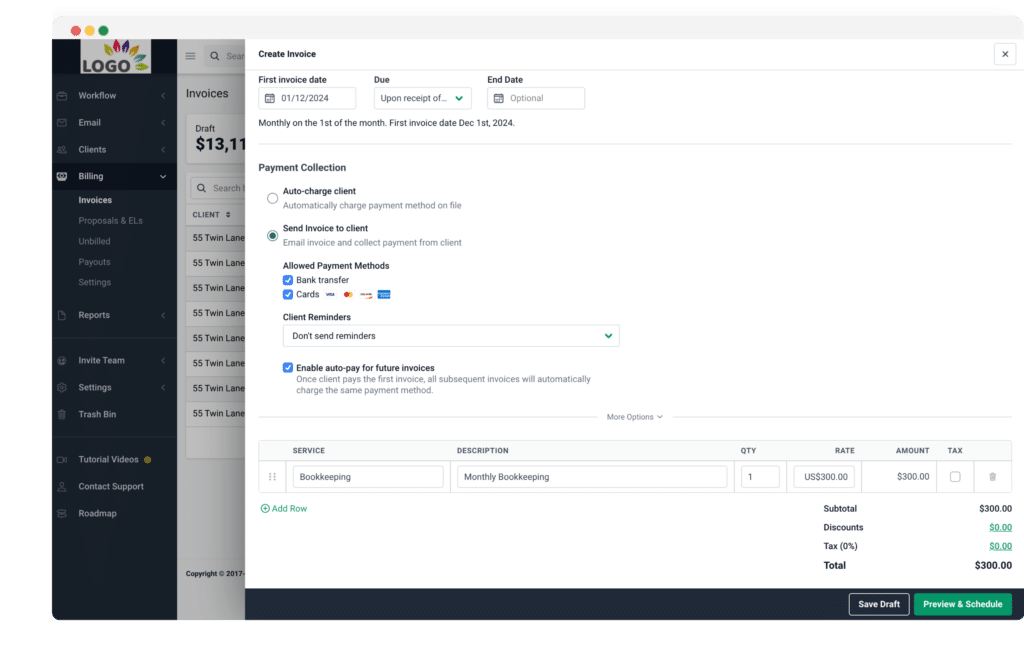

- Payment Processing: Managing multiple payment methods, including credit cards, bank transfers, and digital payment platforms, to make it easier for clients to pay on time. Efficient reconciliation of payments with invoices ensures that financial records remain accurate.

- Follow-Up and Reminders: Automating reminders for overdue payments helps reduce collection times and keeps cash flow steady. A structured follow-up system prevents outstanding invoices from becoming bad debts.

- Record Keeping: Storing invoices in an organized system for easy access during audits, financial reviews, or tax filing. Maintaining accurate and well-documented records improves compliance and supports better financial decision-making.

With Financial Cents billing feature you get access to all these features as well as the ability to mark offline payments such as cheques paid.

Types of Invoice Management Software

Modern invoice management tools cater to different needs, helping you choose the best fit for your firm:

- Cloud-Based Solutions: These enable remote access, allowing your team to manage invoices from anywhere. This flexibility is especially beneficial for growing firms that require collaboration across multiple locations.

- Integrated Accounting Platforms: These combine invoicing with other core financial functions like bookkeeping, payroll, and project management. By consolidating your financial processes into one platform, you reduce manual data entry and streamline workflows. Cloud based integrated accounting practice management systems like Financial Cents combine project management, capacity management, client relationship management and invoicing.

- Specialized Billing Software: Some industries, such as law firms or consulting businesses, require tailored invoicing solutions. Specialized software ensures that unique billing structures, such as milestone-based payments or retainer billing, are properly managed.

Bottlenecks You May Face

- Manual Errors: Data entry mistakes, such as incorrect amounts, missing invoice numbers, or mismatched client details, can lead to disputes and delays. A single miscalculation can disrupt cash flow and create additional administrative work to correct errors.

- Late Payments: Some clients may miss payment deadlines due to forgetfulness, financial difficulties, or unclear payment terms. This can create a domino effect, delaying your ability to pay vendors or manage business expenses efficiently.

- Complex Invoice Approval Workflows: In firms with multiple stakeholders, invoices often require several levels of approval before they can be sent out. If approval processes are not well-structured, invoices may get stuck in review cycles, causing unnecessary delays in receiving payments.

Effectively addressing these challenges requires both strategic process improvements and the implementation of modern invoice management tools.

How to Solve Them

- Implement Automation: Adopting invoicing software can help eliminate human errors, automatically generate invoices, and track payments in real time. This reduces administrative work and ensures invoices are always accurate.

- Set Clear Payment Terms: Clearly outlining payment expectations, such as net-30 or net-15 terms, late fees, and early payment discounts, helps manage client expectations and reduces delays. Ensuring clients agree to these terms before work begins creates transparency.

- Use Automated Reminder Systems: Sending automatic payment reminders via email or SMS can significantly reduce late payments. These reminders can be set at different intervals, such as before the due date and after a missed payment, ensuring consistent follow-ups.

- Simplify Approvals: Using software that streamlines invoice approvals allows accounting firms to set predefined workflows, ensuring invoices move quickly through the approval process without unnecessary hold-ups.

Best Practices for a Smooth Invoicing Process

For a seamless invoicing process, follow these key best practices:

- Standardize Invoice Templates: Creating a structured invoice template with all necessary details, including payment methods and tax information, ensures that each invoice is clear and professional. Customizing templates for different client types can also improve efficiency.

- Track Aging Invoices: Regularly reviewing outstanding invoices helps identify clients who frequently pay late and allows firms to take preemptive action. Setting up an accounts receivable aging report helps prioritize follow-ups.

- Leverage Reporting Tools: Using analytical tools to monitor payment trends and client behaviors can help identify potential cash flow issues before they become major problems. Insights from these reports can guide decisions on whether to adjust payment policies or offer flexible payment plans.

- Integrate with Accounting Software: Linking invoice management with accounting software like QuickBooks streamlines financial tracking by automatically updating records, reducing the risk of duplicate entries, and ensuring that invoices and payments align with financial reports. Financial Cents auto-syncs your invoice with QuickBooks.

How Technology is Improving Invoice Management

Technology has transformed the way invoices are managed, making the process faster, more accurate, and more efficient. Key advancements include:

- Automating Workflows: Modern invoice management tools can automate repetitive tasks like invoice creation, sending reminders, and reconciling payments, reducing manual effort and improving efficiency.

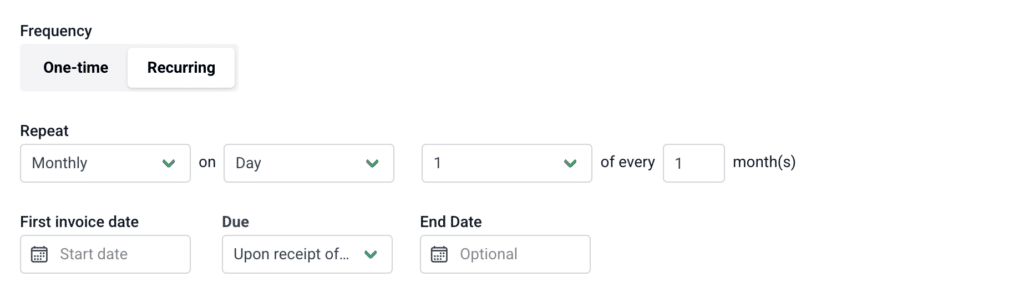

- Recurring Billing Features: If your firm provides ongoing services, recurring invoicing ensures that invoices are sent out at set intervals, minimizing the risk of forgotten or delayed payments. This is especially useful for subscription-based services. In Financial Cents you can set your invoice to automatically recur.

- Payment Integration: Integrating invoicing software with digital payment platforms allows clients to pay invoices instantly via credit cards, ACH transfers, or digital wallets. This speeds up collections and provides greater convenience for clients.

By leveraging technology, you can optimize your invoice management system, reducing administrative burdens and ensuring timely, accurate billing for your clients.

Conclusion

Invoice management is critical to your firm’s financial health. By implementing structured processes, leveraging automation, and adopting best practices, you can improve cash flow, enhance client relations, and maintain accurate financial records. Efficient invoice management isn’t just about issuing bills—it’s about sustaining growth and stability in a competitive financial landscape.

Explore how Financial Cents can help you streamline your invoice management and manage work in your firm.