As remote work continues to be a norm and global opportunities for collaboration open up, offshore accounting has become a pivotal strategy for many accounting firms. It offers a way to access cost-effective services, boost efficiency, and scale operations without the geographical limitations of hiring locally. 52% of top performing CPA firms in a survey by AICPA plan to use offshore workers.

But what exactly is offshore accounting, and how can it benefit your practice? By understanding its advantages, challenges, and best practices, you can make informed decisions about leveraging offshoring to grow your firm.

What Is Offshore Accounting?

Offshore accounting refers to the practice of outsourcing accounting tasks or entire processes to firms or professionals located in other countries. Typically, these countries offer lower labor costs, making it a cost-efficient option for accounting practices seeking to optimize operations. Tasks that are often outsourced include bookkeeping, payroll management, tax preparation, and financial analysis. Some of the popular countries firms offshore work to include Philippines, India, Vietnam etc.

You maintain control over the work while delegating tasks to specialized offshore teams. This approach helps you reduce overhead costs, enhance service delivery, and expand your firm’s capacity to serve clients without compromising on quality.

Offshoring your accounting services is different from outsourced accounting, which involves outsourcing work domestically.

Why You Should Consider Offshore Accounting for Your Firm

Cost Savings

Labor costs in countries with a strong offshore industry are significantly lower than domestic rates, allowing you to reduce expenses without sacrificing quality. This cost reduction enables firms to reallocate funds to growth initiatives, technology investments, or employee development.

Access to Global Talent

You get access to a diverse pool of skilled professionals, bringing fresh perspectives and specialized expertise. Many offshore accountants have experience with international tax laws, financial reporting standards, and accounting software, adding value to your practice.

Scalability

Need more hands during tax season? Offshore services allow you to scale up your resources quickly and efficiently. This flexibility ensures that firms can manage workload fluctuations without long-term hiring commitments.

Focus on Core Activities

Freeing up in-house staff from routine tasks enables them to concentrate on high-value, client-facing services. This shift enhances client relationships and allows firms to provide more strategic accounting advisory services or CAS accounting.

24/7 Productivity

Time zone differences can work to your advantage, with offshore teams continuing work while your local team rests. This around-the-clock productivity speeds up turnaround times and ensures that deadlines are consistently met.

Core Offshore Accounting Services

Bookkeeping

Offshore professionals manage daily financial transactions, accounts payable, accounts receivable, and general ledger maintenance, ensuring accurate and up-to-date records for clients.

Tax Preparation

Offshore accountants handle everything from gathering documentation to filing tax returns, ensuring compliance with tax regulations while saving firms time and resources.

Payroll Processing

Dedicated offshore payroll experts oversee salary calculations, tax deductions, and benefits administration, helping firms ensure error-free and timely payments for employees.

Financial Reporting

Offshore teams prepare detailed financial statements, balance sheets, profit and loss statements, and cash flow reports to provide clients with clear financial insights.

Reconciliation

Offshore professionals manage bank reconciliations, credit card reconciliations, and intercompany reconciliations to ensure the accuracy of financial records and prevent discrepancies.

Benefits of Offshoring Your Accounting

- Increased Profit Margins: Reduced labor costs translate directly into higher profitability, allowing firms to reinvest in business expansion or client service enhancements.

- Enhanced Operational Flexibility: Offshoring allows you to quickly adapt to changing business demands, ensuring that firms remain agile and responsive to fluctuations in workload and client requirements.

- Access to Specialized Expertise: Many offshore professionals possess certifications, training, and experience in industry-specific accounting practices, enabling firms to offer expert services without extensive internal training.

- Reduction in Administrative Burdens: With offshore teams handling repetitive accounting tasks, in-house staff can focus on more strategic roles, reducing workload stress and enhancing job satisfaction.

- Improved Client Service: Offshoring frees up local teams to dedicate more time to client interaction, relationship management, and advisory services, enhancing overall client experience.

Some of the Drawbacks

- Data Security Concerns: Protecting sensitive financial data is a top priority. The risk of data breaches increases when working with offshore teams that may not be under the same data protection regulations.

- Quality Control: Maintaining the quality of outsourced work can be challenging, as different teams may have varying levels of expertise and standards of accuracy.

- Communication Barriers: Language differences, varying work schedules, and time zone gaps may hinder smooth communication, leading to misunderstandings and delays.

- Cultural Differences: Differences in business practices, regulatory requirements, and work ethics can cause workflow inefficiencies and potential client service discrepancies.

- Compliance Issues: Offshore teams may not always be familiar with domestic tax laws, accounting regulations, or reporting standards, which can lead to compliance risks.

Solutions

- Implement Robust Security Measures: Ensure compliance with data protection regulations by using secure communication tools, encryption, and access controls to safeguard sensitive financial data.

- Set Clear Expectations and Performance Metrics: Establish detailed guidelines, conduct regular quality checks, and provide ongoing training to offshore teams to ensure consistent performance.

- Use Effective Communication Strategies: Leverage collaboration platforms, video conferencing, and scheduled check-ins to maintain seamless coordination between onshore and offshore teams.

- Provide Cross-Cultural Training: Educate both offshore and onshore teams on cultural nuances, business practices, and expectations to foster smoother collaboration and understanding.

- Conduct Regular Compliance Audits: Ensure offshore teams adhere to domestic accounting regulations by implementing regular compliance checks and maintaining updated documentation.

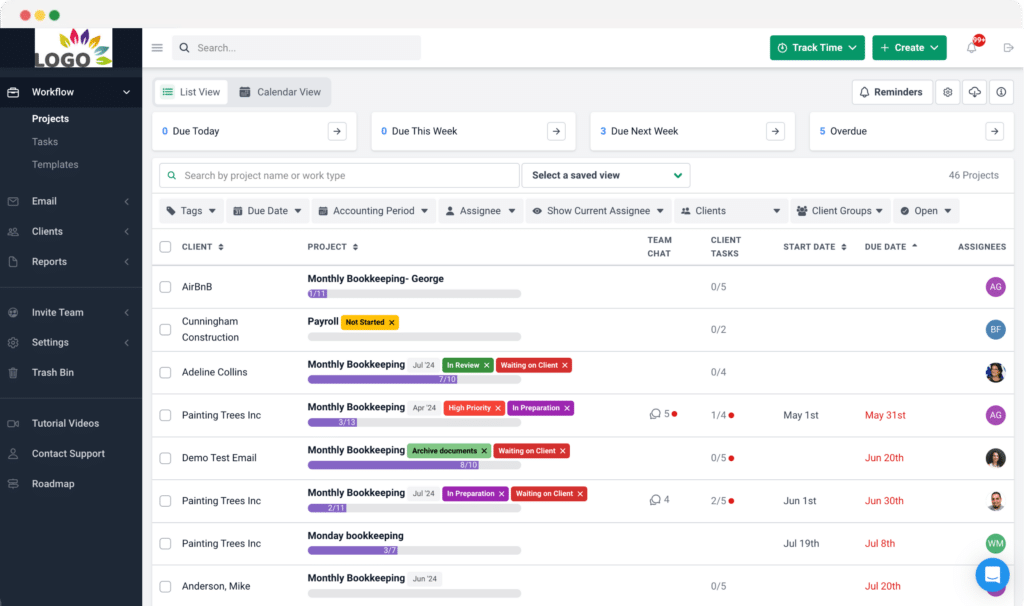

Standardizing and Improving the Quality of Work with Practice Management Software

A well-implemented practice management software can help streamline offshore accounting operations, ensuring consistent quality and efficiency.

- Workflow Templates for Standardization: Predefined workflow templates ensure that every task follows a standardized process, reducing inconsistencies and maintaining a high level of service quality no matter who’s handling the task.

- Tracking the Status of Work: With real-time task tracking, you can monitor the progress of offshore assignments, identify bottlenecks, and ensure deadlines are met.

- Fostering Collaboration: Built-in communication tools allow seamless interaction between onshore and offshore teams, reducing miscommunication and improving response times.

- Task Assignment and Accountability: Assigning work through a centralized platform ensures that responsibilities are clear, preventing confusion and duplication of efforts.

- Setting Deadlines and Due Dates: Automated reminders and deadline tracking ensure timely completion of tasks, improving overall workflow efficiency.

Financial Cents practice management software provides you with tools and features you need to effectively manage your offshore and onshore team.

Best Practices

- Choose the Right Partner: Conduct extensive research before selecting an offshore provider. Evaluate their expertise, industry reputation, client testimonials, and data security protocols to ensure they align with your firm’s standards. A well-vetted partner will contribute to seamless integration and long-term success.

- Start Small: Begin by outsourcing non-critical or low-risk tasks before scaling up to more complex processes. This gradual approach allows you to test workflows, assess efficiency, and make necessary adjustments without disrupting essential operations.

- Maintain Clear Communication: Establish structured communication channels such as regular video calls, shared dashboards, and collaboration tools. Define reporting structures and escalation processes to ensure alignment and address concerns promptly, fostering transparency and accountability.

- Prioritize Data Security: Implement stringent data protection policies, access controls, and encryption measures to safeguard sensitive client information. Partner with offshore teams that comply with international data privacy regulations, such as GDPR or SOC 2, to minimize risks.

- Set KPIs and Track Progress: Define key performance indicators (KPIs) such as accuracy rates, turnaround times, and error reduction metrics. Regularly review these metrics using project management and monitoring tools to ensure that offshore operations align with firm objectives and continuously improve efficiency.

Is Offshoring Your Accounting Services Right for Your Firm?

If you’re looking to reduce costs, scale operations, and enhance flexibility, offshore accounting could be a game-changer for your practice. However, it’s vital to weigh the pros and cons carefully, ensure compliance with regulations, and partner with reputable providers to maximize benefits.

Conclusion

Offshore accounting represents a powerful opportunity to grow your firm in a competitive, globalized marketplace. By leveraging the right strategies and partnerships, you can reduce costs, increase efficiency, and enhance your service offerings. Embrace offshoring thoughtfully, and it will position your firm for long-term success and scalability.

With Financial Cents you can standardize work, collaborate with your team and manage your clients effectively.