Time Tracking for Accountants: How to Improve Client Billing and Revenue Management

Author: Financial Cents

In this article

When the essence of time tracking for accountants is clear, tracking time suddenly stops feeling time-consuming (and less complicated).

The point of time tracking is to make data available for you to get more value for your time. To achieve that, you need to be sure of the tasks or clients taking your team’s time—whether you charge a fixed fee or not.

At the end of this article, you will be clear on what time tracking is and how it can help you earn more and pay your team better without overworking. You’ll also understand why manually tracking your time for one more day can cost you revenue and growth opportunities.

For example, Jonathan Burns knew the value of time tracking and billing, but it wasn’t until he left the “unwieldy” Google spreadsheets for time-tracking software that he began to substantially improve the firm’s unbilled time and profitability.

We used to manage it (time tracking and billing) with Google spreadsheets, but the problem was as we grew, we started having to track different types of hours like out-of-scope or catch-up hours, and then the spreadsheet became too unwieldy across multiple bookkeepers. Like most things, the spreadsheet was an okay way to handle it when things were simple, but we quickly outgrew it,"

Jonathan Burns, Founder, Back Office StarsTime Tracking for Accountants: How to Improve Client Billing and Revenue

Since more time equals more work and revenue, here’s how you can leverage your time to make more money from your clients.

-

Stop Tracking Time Manually and Start Using a Time-tracking Software

There’s a myth that paper timesheets and Excel are as good as time-tracking software. That couldn’t be more wrong. Time-tracking software solutions provide visibility, ease of use, and reports that Excel and paper timesheets don’t. Besides, employees can easily manipulate Excel and paper timesheets.

In January 2023, a Canadian accountant was found to have increased the work hours on her timesheet by as much as 50.76 hours. But thanks to her firm’s time tracking software, the accountant was found out and her employer was compensated for it.

Financial Cents’ automatic time tracking gives you the features to understand what tasks and clients your employees spend their time on.

- A start/stop timer that you can access from any part of the app to prevent your team from forgetting to track time, which could lead to revenue leakage.

- Admin permissions that limit editing: your employees can only edit their time entries if you permit them to do so. This reduces the chances of staff falsifying their time data.

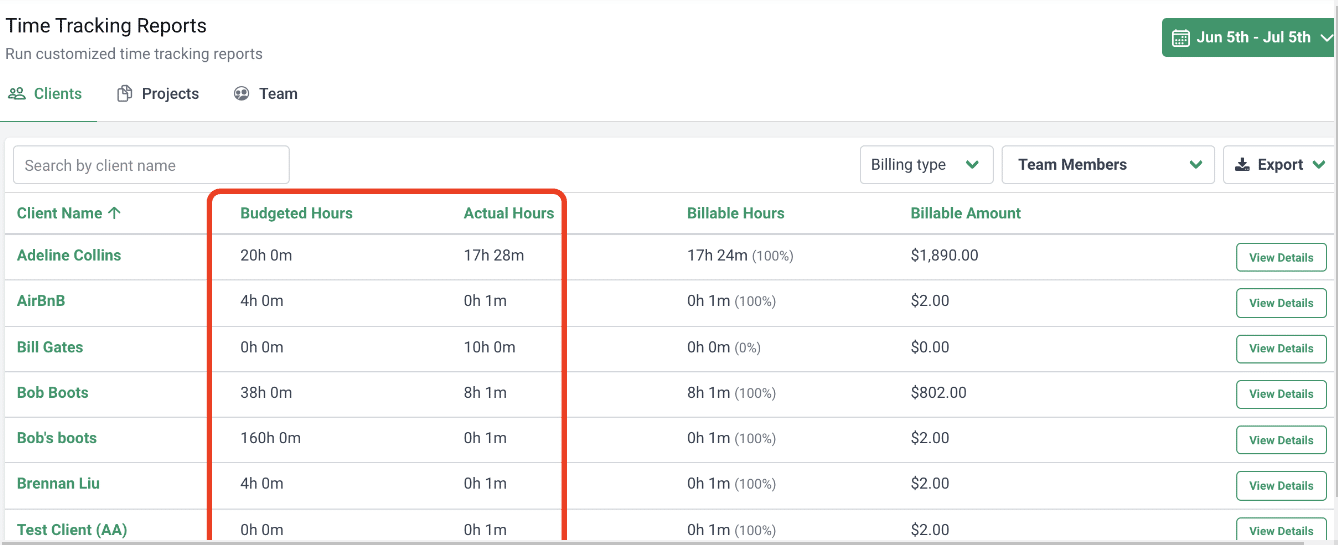

- Time Tracking Reports that you can look into to understand where your firm is wasting time so that you can make more meaningful decisions.

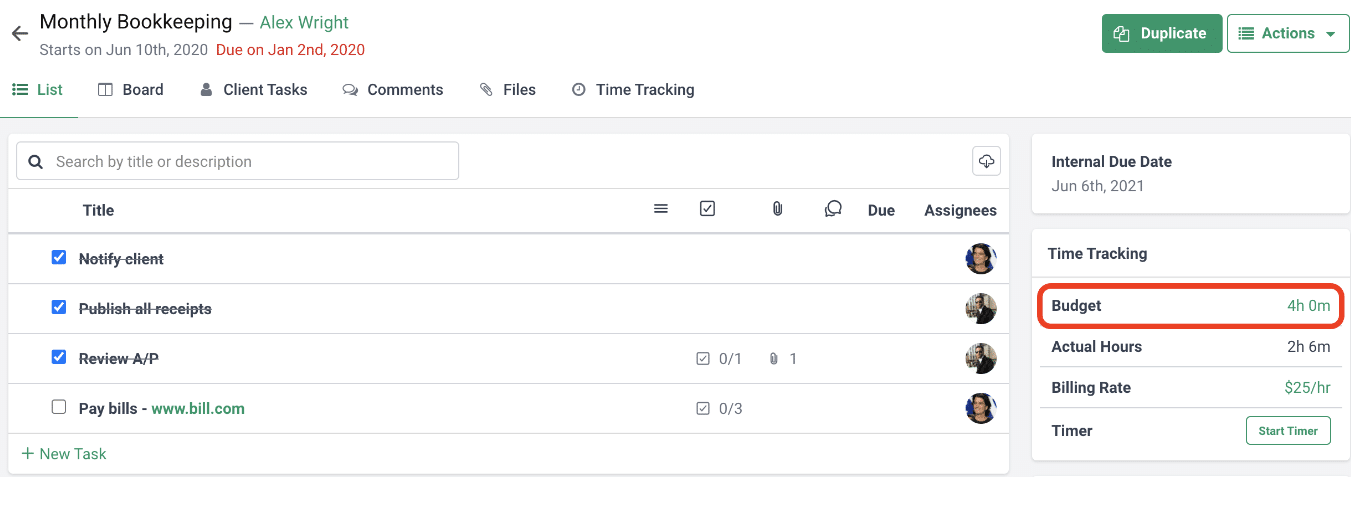

Time Budget helps you know when your team is wasting time on a client’s work.

What I needed was a simple way to see when projects for clients were over their estimated time. In Financial Cents, this is built right into the main dashboard, and when a project goes over, its hours go red. So simple, but exactly what I needed!"

Jonathan Burns, Founder, Back Office Stars-

Identify Profitable and Unprofitable Clients

Scope creep is a major source of revenue leakage because it keeps your team working extra hours for free.

At the end of the day, you’ll struggle to remember what you achieved with your time. But if you use the time tracking feature in Financial Cents, your time tracking reports will show you what you did with the time. This comes in handy when you need to present proof of service to get paid.

Financial Cents’ Time Budget feature makes receiving additional payments even easier. It allows you to budget your time for projects and tasks. If a client’s work exceeds the time you budgeted for it, you can quickly see it in red ink in your Financial Cents dashboard and discuss fee increases.

You go back to a client after three months and tell them that they agreed to pay for 5 hours of work a month, but we have been doing 8 hours for the past few months. Could you pay us the difference? The longer that time goes by, the lower the chances of getting paid.” Jonathan added that “Financial Cents’ Time Budget feature has helped us nip in the bud unprofitable changes in client scope needs sooner, and match billings to actuals with a faster reaction time. Instead of identifying unprofitable clients in 3 – 4 months, we can now do it in say, 3 weeks."

Jonathan Burns, Founder, Back Office Stars-

Set a profitable pricing strategy for your firm

Pricing strategy could make the only difference between a profitable 80-client firm and a firm with 200 clients that is unprofitable. Mark Wickersham, FCA, would know better having grown his firm to 200 clients and nine staff in two-and-half years. He had all the trappings of success, but he alone knew how many long hours he needed to work just to make payroll. By the end of 1998, Mark and his firm were in a mess.

Everything turned around in 1999 when he learned the pricing strategy that enabled him to 3X his rates and change his firm’s fortunes.

In this episode of Financial Cents’ Grow and Scale series, Mark explains why value-based pricing is the most profitable pricing strategy:

In hourly pricing, you’re billing according to the time you spent on a client’s work. As you gain more experience and streamline your processes, your team will grow their expertise to do more in less time, which could make you earn less.

Mark points out that this could also hurt the relationship because “clients want to know exactly what they’ll be paying up front.”

Fixed Pricing is similar. Your income still depends on how fast you can work rather than the value your work brings to the customer.

Value Pricing, on the other hand, is about pricing your services based on your understanding of the value your work brings to the client and how much they are willing to pay for it. This strategy helps you separate the cost of providing a service from the amount you charge. This will allow you to charge more (for your expertise) by providing more services for a potentially smaller number of clients in fewer hours.

Imagine if you could charge three times what you charge now for a tax return, even for ten percent of your customers. That'll make a big difference to your bottom line. So you’re leaving a lot of money on the table."

Blake Oliver, CPAHow do you get as much as three times the price of your current services?

It requires adopting what Mark calls the menu pricing strategy, which entails packaging your services into three different modules: bronze, silver, and gold.

It's basically coming out with different options. So, you do not offer one tax return. You offer different choices of tax returns. It gives customers a choice. Customers like to be able to choose."

Mark Wickersham, FCAThis optionality gives your clients the power to choose their preferred package based on how much they are willing to pay, which will then determine how much time you can devote to them.

By giving them these different options, you can budget time for them accordingly. But it all begins with tracking time to:

- Analyze and validate your value rates

- Know the level of experience a client’s work deserves

- Gauge how much time and human resources you’d need to complete the work

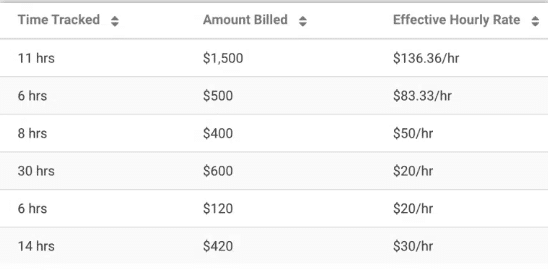

Regardless of the pricing method you’re using, Financial Cents’ Effective Hourly Rates let you see how much revenue you’re generating from each client over time. At the very least, it helps you to set a profitable fixed rate for your services, which will serve as a benchmark for your value pricing strategy.

-

Track revenue and have fee-increase conversations with clients

Communicating price increases, especially to existing clients, is easier said than done. That is why most accounting firm owners carry on struggling to make ends meet while sacrificing personal and family time.

Loren Fogelman has been there. She once worked too many extra hours and sacrificed family time just to earn enough money to keep her firm afloat.

When she realized that she could raise her rates to earn more and stop depriving her family of the level of attention she wanted to give, finding a way to communicate the price increase without losing clients became a huge challenge.

Here are the steps she now teaches firm owners to effectively communicate price increases:

Choose a medium of communication:

The most common way is email. Make sure to make the conversation about them and how these new changes will enable you to serve them better.

Don’t make it about increased costs of running your business because they have their fair share of it. That would make you sound like you’re passing your costs down to them.

Schedule a Conversation:

Reach out to them to know when you can have a conversation about it.

Have a Value Conversation:

Your clients need to find you valuable if you will succeed at raising your rates. Here, you need to understand where they are now, where they want to be, why that is important to them, and how you can help them get there.

Ask them what matters, what is it that they want to achieve in about 12 months, why it matters to them, the metrics that might help them to make better decisions to that effect, any reasons they fear they might not reach that goal and how different things will look if they did reach that goal."

Loren FogelmanHere’s a bonus resource to price your bookkeeping and accounting services more profitably.

The more you know about your client’s business, the better you will be at understanding their challenges and where you can provide value to them.

PRO TIP: In helping them figure things out, you want to be an advisor, not just a client, and that means that if you have bundled your services into different tiers (as Loren recommends you should), you can help them pick the pricing tier that will best serve their needs and not just what makes you the most money. The genuine concern for their growth alone demonstrates value in and of itself.

Prepare for Objections

Think about the reasons they may object to your new prices and prepare answers for them.

-

Make Time Tracking a Standard in Your Firm to help you keep track of profitability

If you’re struggling to implement time tracking in your firm for whatever reason, remember that it is a win-win for everyone involved.

- It helps productive employees get recognized.

- It gives the client confidence in what they are paying for.

- It provides you with the data you need to bill adequately and improve their processes.

-

Bill clients on time by integrating with billing software

In between meeting client deliverables, getting new clients, and making strategic decisions, you can easily push invoicing to the back burner. Meanwhile, dishonest clients can use delayed invoices as an excuse to pay late, and that will hurt your cash flow.

Billing software solutions like Bill.com, Anchor, and Practice Ignition can make billing and payments one less thing to worry about in your practice.

For example, you can easily set up your Anchor account, and your clients can fill in their information and pay you on time.

It gets even better; you don’t need to use these apps separately. You can easily link to them from your client’s profile in Financial Cents.

Benefits of Financial Cents Time Tracking Software for Accountants:

Here are the ways Financial Cents’ Time Tracking feature can bring you closer to your revenue goals:

-

Bill Clients Accurately

Billing errors are often a result of manual billing and time-tracking processes. You’re more likely to bill accurately when you use a workflow tool that has a time-tracking feature. That is because tracking time in and out of different apps increases your risk of errors.

As a part of your admin work, time tracking needs streamlining to keep your team efficient. Else, they’ll be overwhelmed and prone to billing errors.

Financial Cents time tracker is inbuilt and enables your team to track time and manage projects from the same place. This reduces the chances of error significantly.

-

Filter-out Unprofitable Clients

Financial Cents’ Effective Hourly Rate lets you separate profitable clients from the unprofitable by showing you which clients are costing your firm more time than their fees command.

With the Effective Hourly Rate report, Financial Cents divides the time you have tracked for a client’s work by the amount you bill them each month.

That way, you can see if you’re getting a good return on the time you’re investing in a client. If you’re not earning enough from them, you can approach the client to review the rates.

-

See When You Work Overtime

As long as you’re trying to earn more only by serving more clients, you’ll always work long hours without commensurate fees. But you can serve fewer clients, work fewer hours and earn more if you use Financial Cents’ time budgets to set time estimates for your projects.

Time estimates work because you most likely allocate time to your clients according to their rates. So, when a client’s work is taking longer than it should, you will use that data to make a decision that serves your firm’s revenue and growth goals.

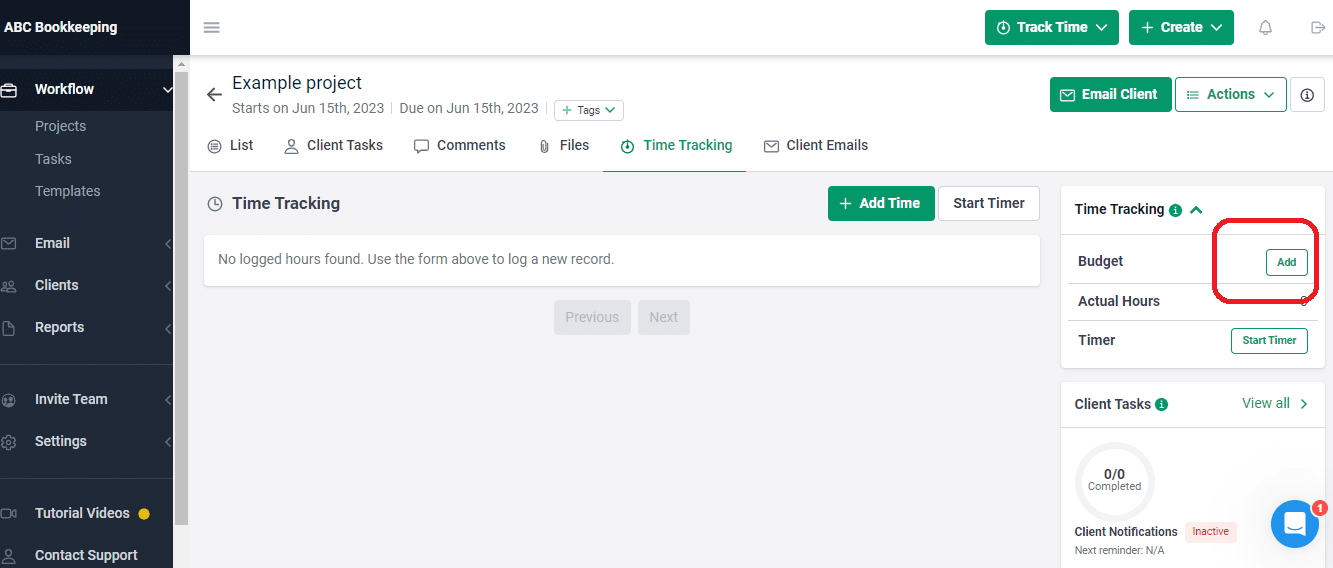

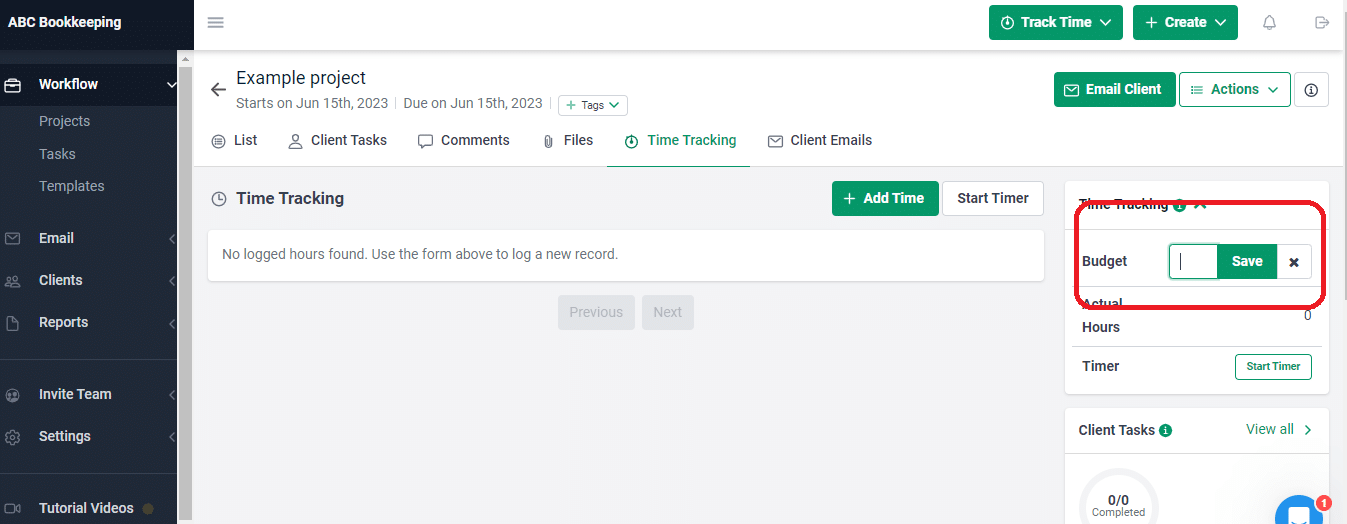

You can set time budgets in Financial Cents after creating the project by

- Clicking the Time Tracking button on the right.

- Clicking Add by the Budget tab.

Enter the number of hours in the field and click Save

At the end of the project or task, you can measure the time you budgeted by the time you tracked for it (actual time)

-

Transparent Billing and Invoicing

Accurate billing is an opportunity to improve your relationship with your clients, but erroneous billing can harm customer trust and undermine your reputation.

Financial Cents integration with QuickBooks Online empowers you to present your billing and invoicing information transparently so that your clients know what they are paying for. This will save you from loss of client confidence.

Financial Cents’ inbuilt time tracker enables you to track time for each project or task where you’re doing their work. Its integration with QuickBooks Online allows you to automatically sync your time log for invoicing.

Since the process doesn’t need manual input, you can rest assured that the billing information is accurate.

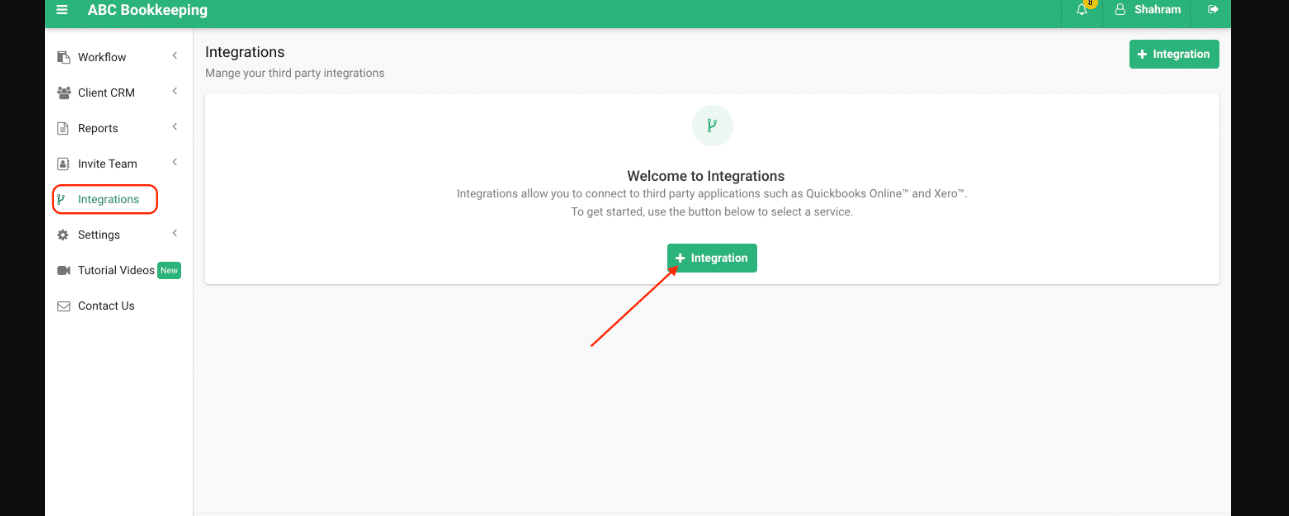

Automatically sync your Financial Cents’ time entries with QBO in three steps:

1. Add Clients

- By selecting the “Integrations” tab.

- Clicking the “+” Integration” button.

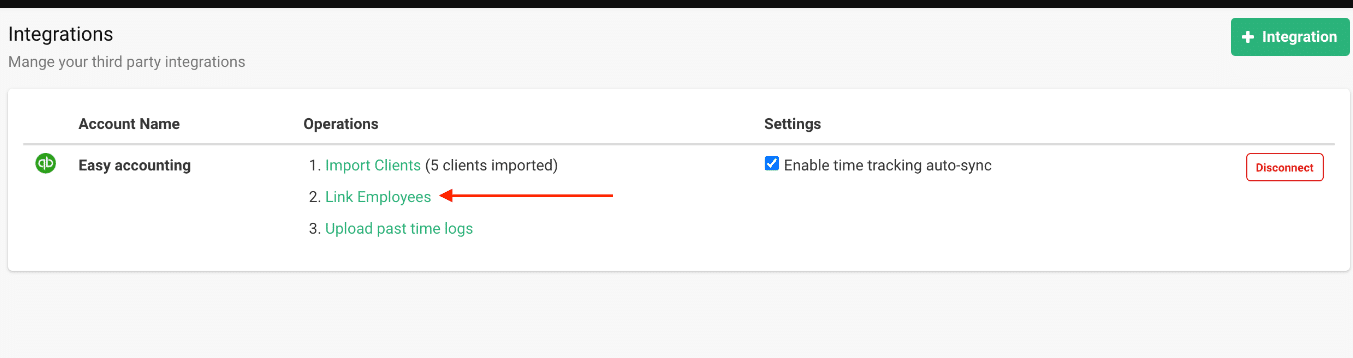

2. Link Employees

- Link your staff in QBO to Financial Cents to allow QBO to recognize those that are tracking time.

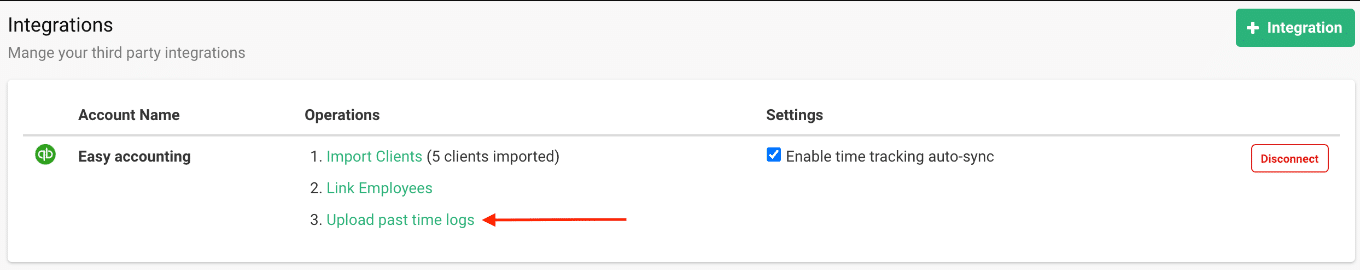

3. Upload Past Time Logs

Click Upload Past Time Logs to manually bring your past time logs into QBO. You wouldn’t need to do this again after the first time.

-

Enables You to Set Realistic Timelines

Financial Cents time tracking enables you to understand how much time certain projects usually take to complete.

This enables you to set realistic deadlines for your team to complete those tasks. Else, they will constantly feel frustrated and unsatisfied by their inability to meet deadlines that are not realistic in the first place.

-

It Helps You Reward and Recognize Your Best Employee

Financial Cents time tracking gives you the information to know who is working on what and when. This information is useful for identifying which employee is getting more work done, contributing the most to your firm, and will be more deserving of a promotion.

Start using Financial Cents to accurately track time spent on clients work and improve your billing and revenue management. Try for Free.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to our newsletter for an awesome dose of firm growth tips.

Subscribe to our newsletter for an awesome dose of firm growth tips.