#1 Accounting Practice Management Software for Teams of 5 or more

Financial Cents enables you to track client work, get client responses faster, and meet deadlines with our easy-to-use practice management software that your team will love.

Firms using Financial Cents save an average of $19,200 per employee each year.

An easy-to-use accounting practice management software

Project

Management

Workflow Automation

Email Management

Client Database

Client Portal

Document Management

Time Tracking & Billing

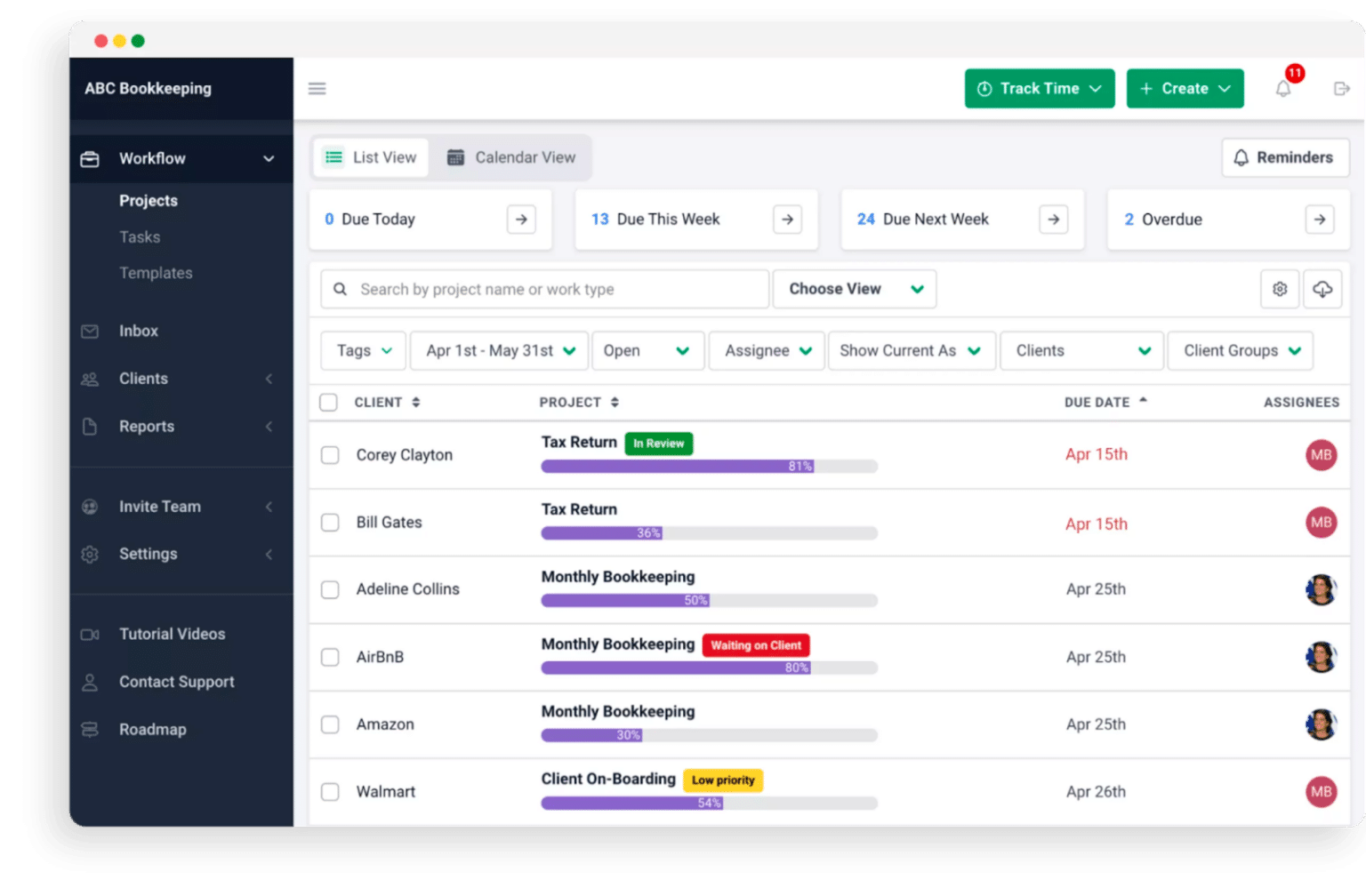

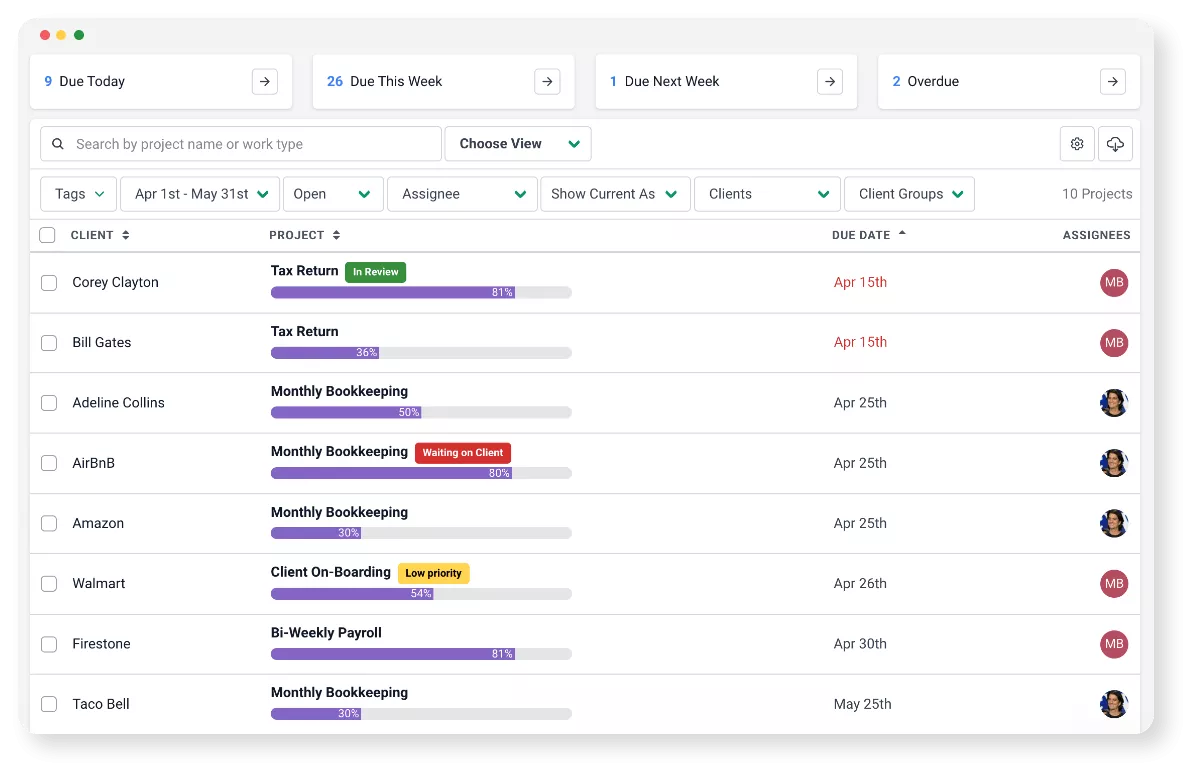

Know where everything stands

Keep things from slipping through the cracks by easily tracking the status of client work, who’s working on what, and all your deadlines in one simple view.

“The business problem we are solving with Financial Cents is two fold. First, we are improving our internal communications. Second, we are ensuring that no project falls through the cracks.”

Michael McMullin | Managing Partner, Jack Trent & Co

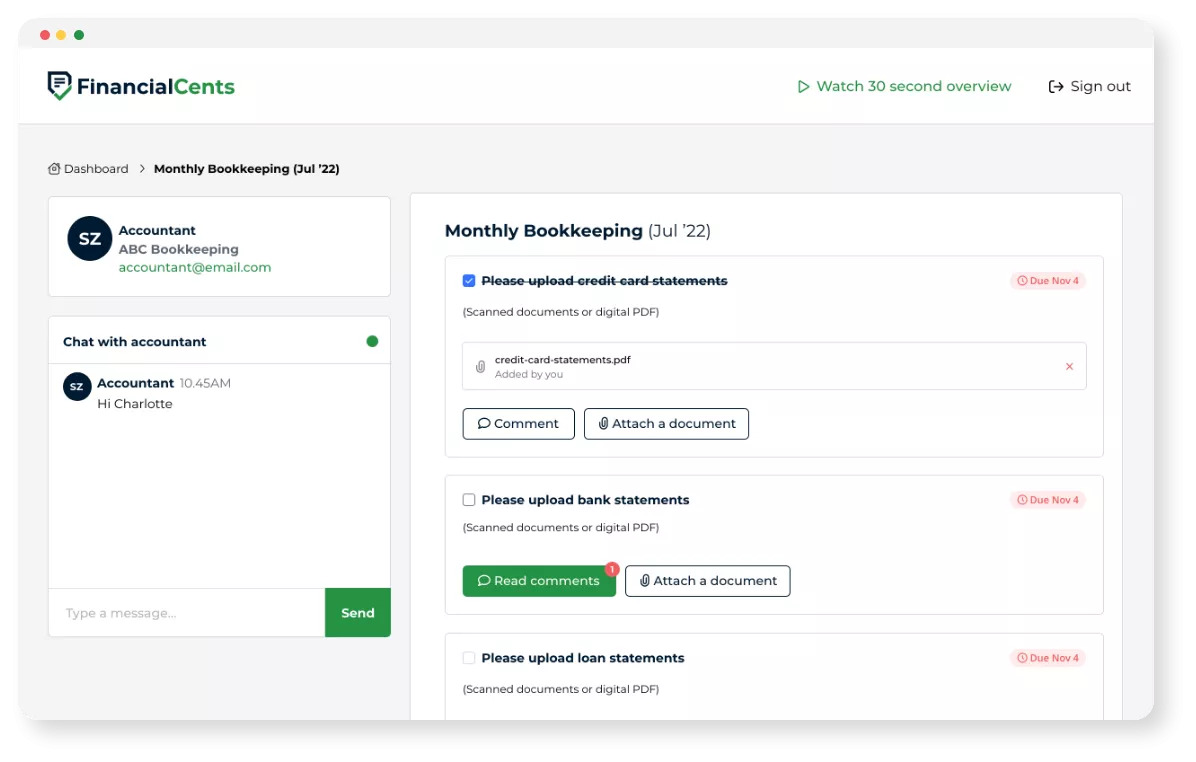

Get client responses faster

Make it easy for your clients to work with you with our secure passwordless portal and automated reminders. Request documents, ask about uncategorized transactions, and share folders.

“Clients can get reminded for task they need to complete and they can upload right into the software without setting up a login for themselves.”

Krista Sievers | Owner, Advanced Plus Bookkeeping

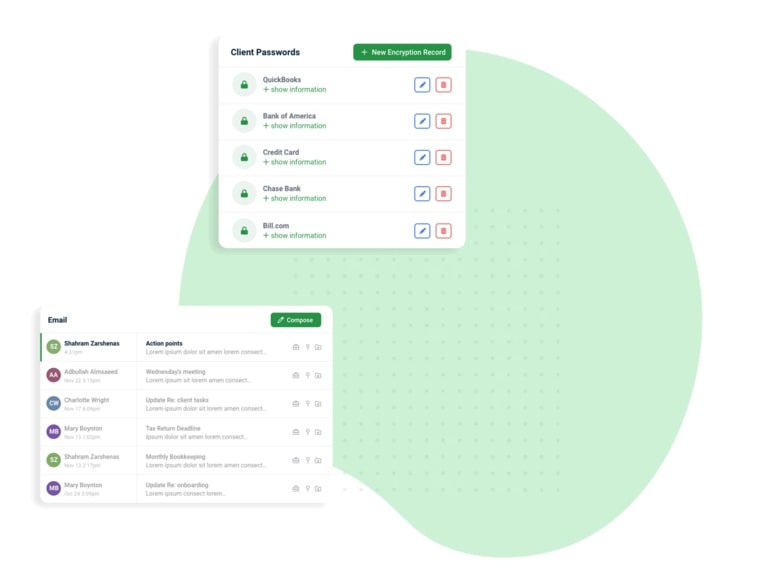

Centralize everything in one place

Keep all communication, documents, notes, email and client info stored in one place so your team can access it and get their work done.

“This program is such a benefit to our accounting practice that we did not want knowledge of it to leak out to other accounting practices.”

John Griffing | Managing Partner, Intelesoft Financials

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!