Financial Cents provides an easy-to-use solution that helps accounting firms manage client work, collaborate with staff, and hit their deadlines.

Rated 5 stars on Capterra, Software Advice, and GettApp

Based on reviews from

Automate your workflows

Automate client data collection, create checklist templates to streamline your process, and automate recurring work

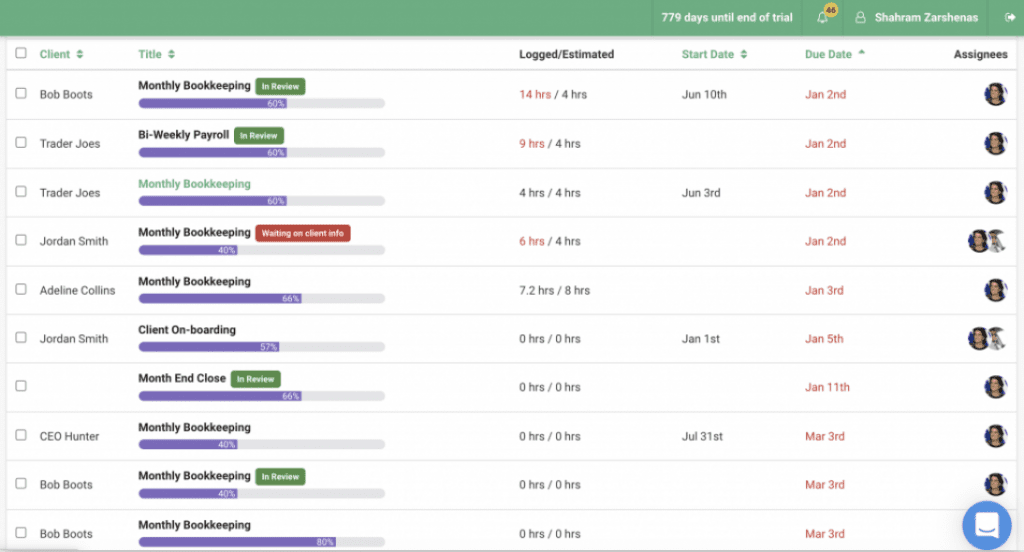

Know where everything stands

See whos working on what, know the status of client work, and track every deadline to ensure nothing slips through the cracks

Collaborate with your team

Easily collaborate on client work in real-time and have automated notifications to keep everyone in the loop

Stay organized

Store all your client work, documents, notes, emails, and more in one place so it’s always easy for your team to find.

Boost your profitability

Track team performance, identify over budget work, and see which clients are killing your firm’s profitability

Firms using Financial Cents save around $9,000 per employee, annually

100% of users said Financial Cents has helped them track and hit their deadlines

95% of firms said Financial Cents gave them visibility across their client work

9 out of 10 customers recommend Financial Cents to other accounting firms

Canopy Tax does doesn’t give you the tools you need to collaborate with your team and efficiently track your deadlines. Financial Cents has a focus on project management. We built a robust workflow tool that can scale to a firm of any size to ensure nothing falls through the cracks.

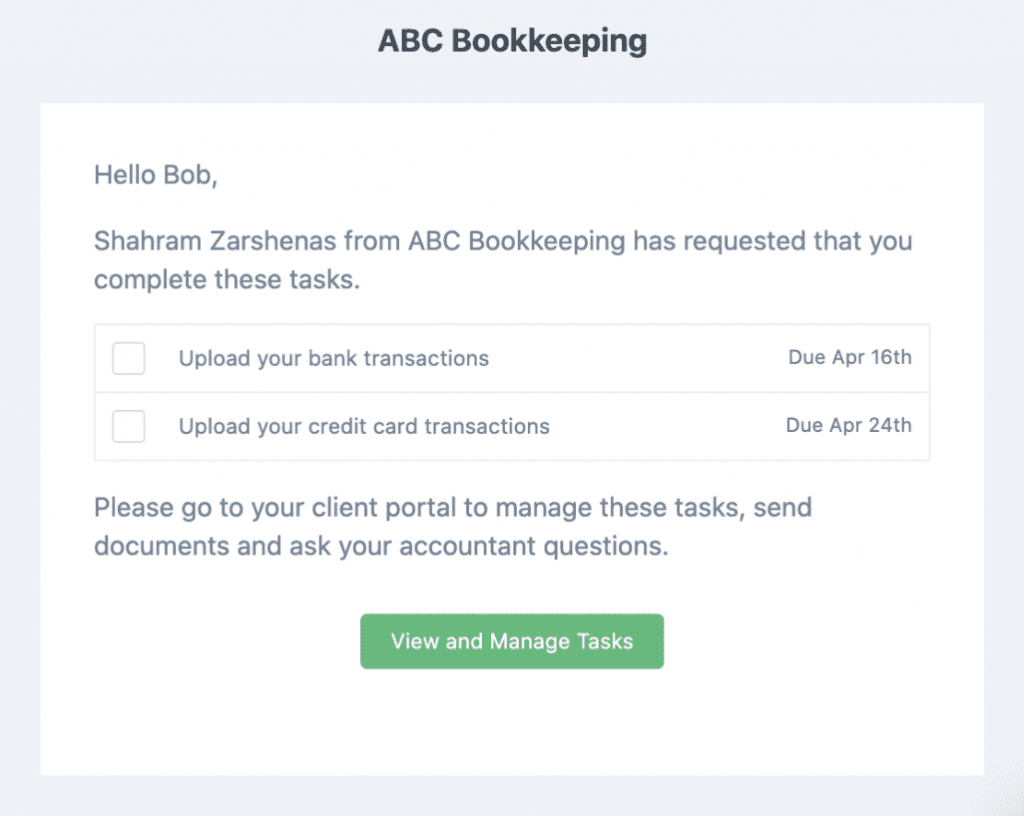

In Financial Cents you automatically send clients recurring data request lists and FC will follow follow up with them until they complete the request. So you never have to waste time chasing down client info again.

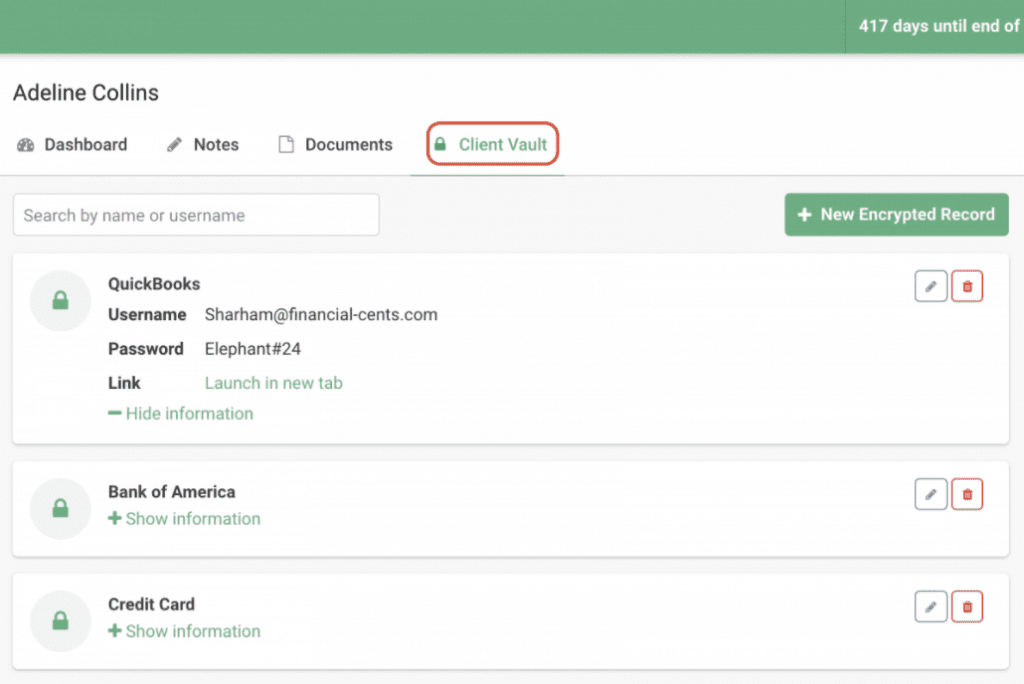

Store all your clients’ sensitive information can be tough and sharing it with your team in a secure way can be even tougher. Easily store your client passwords, bank information, and more in one secure location so your team has everything they need to get their work done.

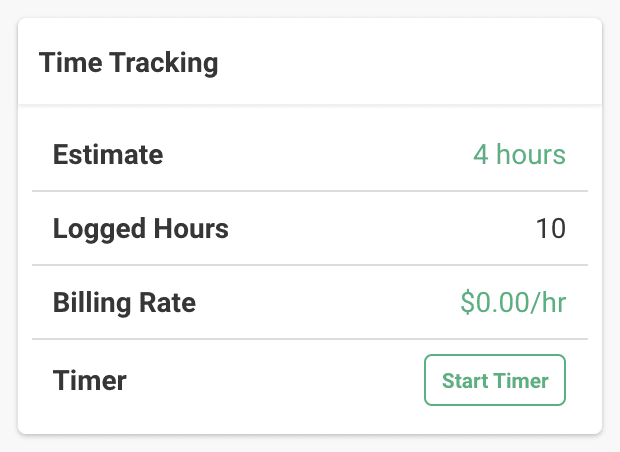

Quickly identify which clients are taking more work than you originally estimated so you can adjust your rates and boost your bottom line.

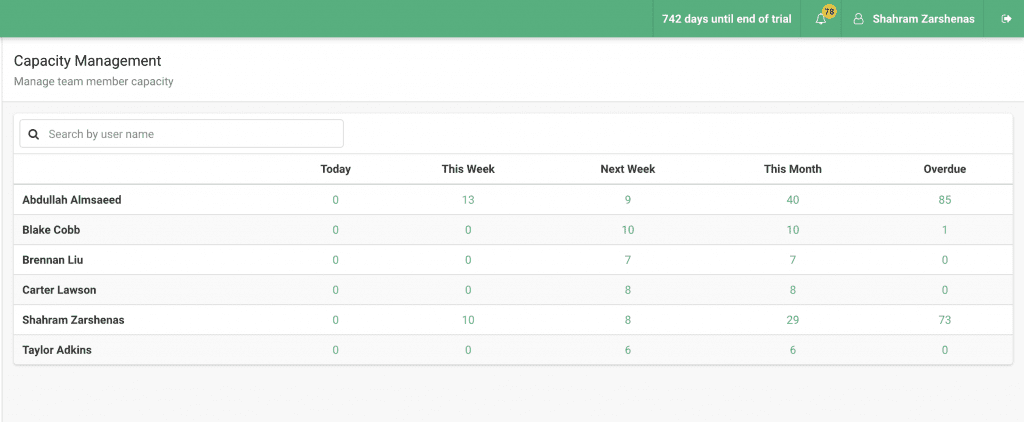

Get a quick overview of your team’s workload capacity, so you can manage resources more effectively, quickly reassign tasks, and ensure you deliver client work on time and on budget.

Use the Promo Code: switch

What Is TPS?

TPS is an accounting management software designed for small to medium sized firms. Since 1999, TPS has served over 3,000 firms across Canada and the USA.

TPS offers both an on-premise solution, and a cloud-based solution for those working remotely. Other features and benefits of the program include:

Key Differences Between TPS And Financial Cents

TPS offers two solutions, one for those working on premise, and one for those working remote. These two plans are priced differently.

FC does not offer a solution specifically for those working on premise, only a cloud based solution suitable for anyone to work with.

Both TPS and FC are user friendly and easy to learn. Plus, both offer free resources to help you learn to use the programs.

FC offers live training, client import, and a dedicated success manager, all free of charge with the program.

The resources TPS offers include a large library of instructional videos that go over how to use all the features in the program. You can find the videos on their website.

Financial Cents and TPS offer different payment plans. With FC, you pay per team member per month. You can choose between two different plans:

With this you will get access to all the FC training resources to help you learn how to maximize the program.

TPS offers two different programs: on premise and cloud based. For the cloud based program, which is similar to FC, they offer three different pricing plans based on business size:

A cloud-based solution that makes it easy for accounting firms to manage client work, collaborate with staff, and hit their deadlines

Register to start a 14-day trial