When lenders or investors assess a business, they don’t just look at revenue or assets; they also review liabilities. That includes what the company owes, when payments are due, and how manageable the debt is.

As an accounting or bookkeeping firm, understanding liabilities inside and out helps you guide clients to make smart borrowing choices, plan ahead, and keep their reports accurate.

In this guide, we’ll cover exactly what liabilities are, how to classify them, how they show up on the balance sheet, and how to manage them at scale across your client base.

What Are Liabilities in Accounting?

In accounting, liabilities are the amounts a business owes to other people or organizations. This could include loans from a bank, unpaid bills to suppliers, wages owed to employees, or taxes that haven’t been paid yet.

These are considered legal or financial obligations, and the business is expected to settle them over time, usually by paying cash, delivering goods, or providing services. You can think of liabilities as the part of a business’s assets that still “belongs” to someone else.

For example, if a business owns $500,000 worth of assets and owes $300,000 in liabilities, only $200,000 truly belongs to the owner. The rest is owed to others.

Tracking liabilities is just as important as tracking assets because they affect key parts of a business’s financial health, like cash flow, creditworthiness, debt levels and risk, etc.

Liabilities, expenses, and equity often get mixed up, but it’s important to understand the difference. Confusing them can lead to incorrect financial statements and the wrong conclusions during analysis.

- Liabilities are what the business owes to others (like loans or unpaid bills), and they go on the balance sheet.

- Expenses are the costs of running the business (like rent or payroll), and they go on the income statement. Still seem tricky? We cover Expenses in accounting in detail here.

- Equity is what’s left for the owner after subtracting liabilities from assets, and it also goes on the balance sheet. Learn more about Equity in Accounting.

Types of Liabilities

In accounting, liabilities are grouped based on when they’re due and how certain they are. The main types you’ll come across are: current liabilities, non-current (or long-term) liabilities, and contingent liabilities. Here’s a breakdown of each one with examples to make them easier to understand.

Current Liabilities

Current liabilities are debts or obligations a business needs to pay within 12 months (or within the normal business cycle, whichever is longer). These are the short-term items that come up in day-to-day operations.

Common examples include:

- Accounts payable – unpaid bills from suppliers or vendors

- Accrued expenses – things like wages, utilities, or interest that have been incurred but not yet paid

- Short-term loans – loans or credit lines due within a year

- Taxes payable – unpaid sales tax, income tax, or payroll tax

- Unearned revenue – money received in advance for work or products not yet delivered (like customer deposits)

You’ll look at these often when checking a client’s short-term financial health or planning for cash flow.

Non-Current (Long-Term) Liabilities

Non-current liabilities are debts that don’t need to be paid off right away. These are usually due more than a year from now, but they still need to be tracked so clients can plan ahead.

Examples include:

- Long-term loans – like a business loan or mortgage that’s paid off over several years

- Bonds payable – debt issued by the business to raise capital, typically repaid over a fixed period

- Deferred tax liabilities – taxes that are owed later because of timing differences between accounting and tax requirements

- Lease obligations – payments owed under long-term lease agreements

These types of liabilities are helpful for understanding how much long-term debt a business has and how it might affect future planning.

Contingent Liabilities

Contingent liabilities are a bit different. They’re possible obligations, i.e., things a business might have to pay, depending on what happens in the future. They’re not guaranteed, but you still need to track them as they could become real.

Examples include:

- A pending lawsuit that could result in damages

- A loan guarantee that might be called in if someone else defaults

- Fines or penalties that could come from unresolved legal or compliance issues

These types of liabilities usually don’t appear on the balance sheet unless there’s a high chance they’ll happen and the amount can be reasonably estimated. Otherwise, they’re just disclosed in the financial statement notes.

How are Liabilities Calculated in Accounting (Formula)?

To understand liabilities, it helps to start with the basic accounting equation:

Assets = Liabilities + Equity

This formula shows how a business is financed. Everything a company owns (its assets) is funded either by money it owes to others (liabilities) or by the owner’s investment (equity).

If you already know the value of a business’s assets and equity, you can rearrange the equation to figure out its total liabilities:

Liabilities = Assets – Equity

For example, let’s say a client has $400,000 in total assets and $150,000 in equity. Using the formula:

Liabilities = $400,000 – $150,000 = $250,000

That means the business owes $250,000, whether it’s in the form of unpaid bills, loans, taxes, or other obligations.

Liabilities are part of every transaction recorded through double-entry accounting. In this system, every financial event affects at least two accounts.

For instance, when a client takes out a loan, their cash (an asset) increases, and so does their loan balance (a liability). If they receive payment in advance for services, their cash increases, but so does unearned revenue, which is also recorded as a liability until the work is done.

This approach keeps the books balanced and ensures the accounting equation always holds true.

Liabilities on the Balance Sheet

Liabilities are a key part of the balance sheet, which follows the Assets = Liabilities + Equity formula. Depending on the format, liabilities are usually listed either on the right side (in a side-by-side layout) or below the assets (in a top-to-bottom layout).

When you’re putting together or reviewing a balance sheet, liabilities usually appear in this order:

- Current liabilities – like accounts payable, accrued expenses, taxes owed, or short-term loans

- Non-current liabilities – like long-term debt, lease obligations, or bonds payable

Each section is totaled separately, and then both are added together to show the total liabilities. This helps anyone reviewing the balance sheet to quickly see how much the business owes now versus later.

Let’s bring all this closer to home with a sample balance sheet scenario:

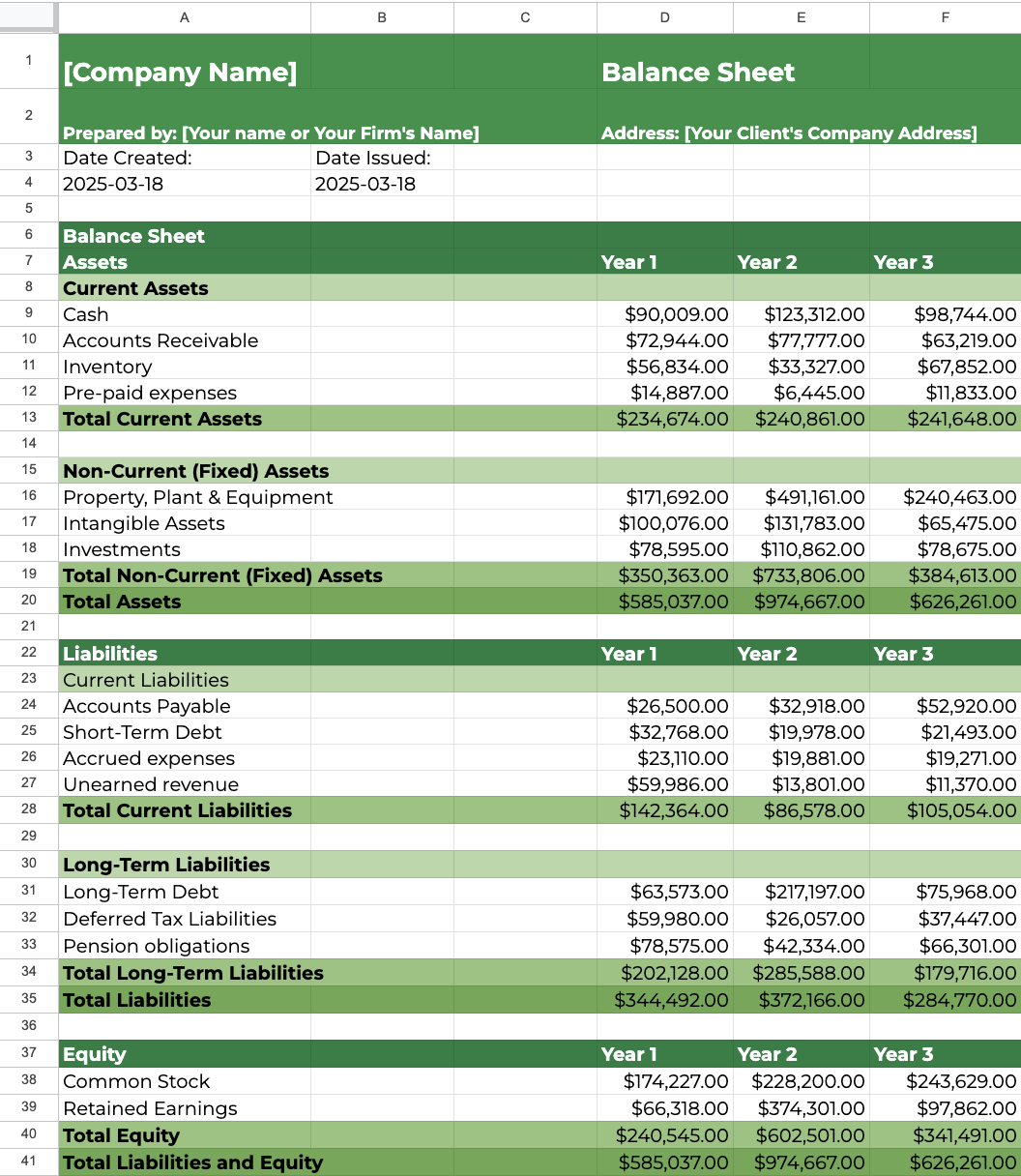

In Year 1, the business had $585,037 in total assets, made up of $234,674 in current assets and $350,363 in non-current (fixed) assets. These represent everything the company owns or controls.

On the liabilities side (which is listed below the assets in this example), the business owes a total of $344,492. This includes $142,364 in current liabilities (like accounts payable, short-term debt, accrued expenses, and unearned revenue) and $202,128 in long-term liabilities (such as long-term debt, deferred tax liabilities, and pension obligations). Together, these show what the business needs to pay in the near term and further down the line.

Equity, which reflects the owner’s share in the business, totals $240,545, made up of $174,227 in common stock and $66,318 in retained earnings.

If we apply the accounting equation:

Assets = Liabilities + Equity

$585,037 = $344,492 + $240,545

Everything balances, just as it should. This structure stays consistent across Year 2 and Year 3, making it easy to track how the business changes over time.

Why Liabilities Matter in Accounting

Here’s why liabilities matter and how they impact the day-to-day and long-term outlook of any business.

For Assessing Financial Risk and Leverage

Liabilities help you see how much of a business is funded by borrowing. If the business owes a lot compared to what the owners have invested (equity), it may be considered risky. Lenders, investors, and auditors pay attention to this when deciding whether to trust the business with more money.

For Helping Businesses Make Informed Borrowing Decisions

If a client is thinking about taking a loan or bringing in outside funding, knowing their current liabilities helps you check if they can handle more debt. It also helps you spot any red flags, like low cash flow or already high short-term obligations.

For Evaluating a Company’s Ability To Meet Its Obligations

By looking at current liabilities alongside current assets, you can determine whether a business can cover what’s due in the short term. Metrics like the current ratio and quick ratio give insights into liquidity, helping you advise clients on how to stay financially stable and avoid cash crunches.

For Meeting Compliance and Reporting for Stakeholders

Tracking liabilities accurately is key for things like tax reporting, loan agreements, and financial audits. If a business forgets to record something it owes, it could face penalties or have to correct its financial statements later.

For Managing Cash Flow

Liabilities tell you when money needs to go out, whether it’s paying off a loan, settling invoices, or refunding unearned revenue. Managing this well helps your clients avoid missed payments, late fees, and cash shortages.

How to Track and Manage Liabilities

Here are two key ways to stay on top of liabilities:

Use a General Ledger With the Right Liability Accounts

Every time a business takes on a new obligation, like a bill, a loan, or a customer prepayment, record it in the general ledger using the correct account. Most accounting software already includes common liability accounts like accounts payable, wages payable, and taxes payable. But you can also create custom liability accounts based on your client’s needs. For example, separating a short-term loan from a long-term one, or tracking unearned revenue separately from regular payables. Keeping these accounts organized makes financial reports more accurate and easier to explain

Perform Regular Liability Reviews and Reconciliations

Set time aside (monthly accounting or quarterly) to review all liability balances. This helps you make sure everything is up to date. During your review, look for:

- Bills that were paid but not marked as paid

- Accrued expenses that need to be adjusted

- Loan balances that have changed (interest or principal)

- Deferred revenue that needs to be recognized

You should also reconcile each liability account by comparing the balance in your system with source documents like loan statements, payroll reports, or tax filings. This helps catch mistakes early and keeps your clients’ books clean.

Financial Cents Helps You Manage Liability Tasks Across Clients

Liabilities show what a business owes and when those payments are due. They’re a key part of the balance sheet and help complete the financial picture. By tracking different types of liabilities, you can spot cash flow issues early, understand financial risk, and guide clients on borrowing or investing wisely.

If you manage books for several clients, keeping up with recurring liability tasks like loan payments, tax deadlines, or deferred revenue can quickly become overwhelming. But with Financial Cents accounting practice management tool, you can build step-by-step workflows, set automatic reminders, and keep every liability account up to date. This standardizes your processes across all client accounts and helps you avoid missed deadlines.

Try Financial Cents free today and see how it can help your team stay organized.

Very educative and informative.I got all the information I needed.Thank you so much

You are welcome, Michael.

Glad you found it helpful.