Accounts receivable (AR) represents the money owed to a business by its customers for goods or services delivered but not yet paid for. It appears as a current asset on the balance sheet because it’s expected to be converted into cash within a short period, typically 30 to 90 days, depending on payment terms.

Managing accounts receivable effectively ensures a business maintains healthy cash flow, minimizes bad debts, and strengthens financial stability. It involves issuing invoices promptly, tracking outstanding payments, and following up on overdue accounts.

Why Accounts Receivable Management Is Crucial

Effective AR management goes beyond collecting payments. It provides several significant benefits:

- Enhancing Cash Flow: Prompt collections boost liquidity, ensuring funds are available to cover operating expenses and invest in growth opportunities.

- Reducing Bad Debts: Timely follow-ups prevent accounts from becoming delinquent, minimizing losses.

- Improving Customer Relationships: Clear communication around payment expectations builds trust and reduces disputes.

- Ensuring Financial Accuracy: A well-managed AR system improves the accuracy of financial statements by reflecting actual revenue and cash availability.

Key Metrics for Accounts Receivable Performance

To effectively manage accounts receivable (AR), businesses must track key performance indicators that provide insight into cash flow health, collection efficiency, and customer payment behaviors.

1. Days Sales Outstanding (DSO)

DSO measures the average number of days a business takes to collect payment after a sale. A lower DSO indicates that invoices are being paid promptly, contributing to a healthier cash flow. A high DSO, on the other hand, may signal inefficiencies in collections, lenient credit policies, or financial struggles among customers. Businesses should compare their DSO to industry benchmarks and implement strategies to optimize collections if needed.

2. Aging Report

An AR aging report categorizes outstanding invoices based on the length of time they have been unpaid—typically divided into 30-day intervals (0–30 days, 31–60 days, etc.). This report helps identify overdue accounts and prioritize collection efforts. Monitoring aging trends enables businesses to take proactive steps, such as adjusting credit policies or sending follow-up reminders, to prevent late payments from becoming bad debts.

3. Collection Effectiveness Index (CEI)

The CEI measures how effectively a business collects receivables within a given period. A higher CEI percentage indicates strong collection efforts and efficient AR management, while a lower percentage may highlight issues such as poor follow-up, ineffective credit policies, or economic downturns affecting customers’ ability to pay. CEI is calculated using the formula:

CEI =1 – Ending AR Balance−Beginning AR BalanceTotal Credit Sales 100

Tracking CEI over time helps businesses refine their AR strategies for improved financial performance.

By closely monitoring these metrics, businesses can optimize their AR processes, reduce payment delays, and maintain a steady cash flow.

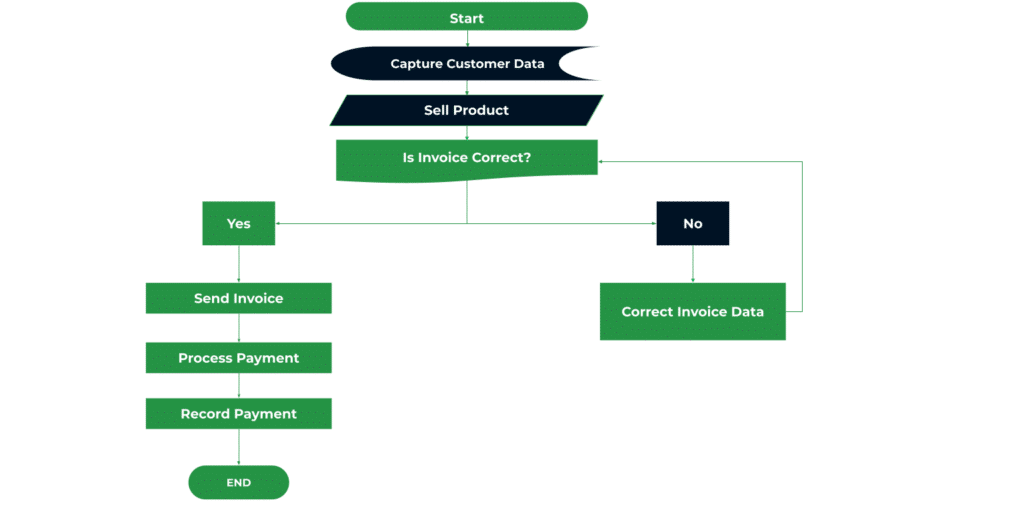

Flowchart diagram of a typical accounts receivable process.

Key Components of an Accounts Receivable System

A well-structured AR system ensures that invoices are issued correctly, payments are collected on time, and financial records remain accurate.

1. Invoice Generation

Invoice generation and issuance flowchart

Generating and delivering detailed, error-free invoices promptly after goods or services are provided is essential. Clear invoices should include payment terms, due dates, itemized charges, and accepted payment methods to minimize disputes and delays.

2. Payment Tracking

Effective AR management requires tracking outstanding balances, due dates, and partial payments in real-time. Using accounting software with dashboard insights can help businesses monitor customer payment behaviors and address late payments before they become problematic.

3. Credit Policies

Establishing clear credit policies helps businesses assess which customers qualify for credit terms and under what conditions. These policies should define credit limits, payment windows (e.g., Net 30, Net 60), and procedures for handling delinquent accounts.

4. Collections Management

A structured collections process ensures timely follow-ups on overdue accounts. Businesses should implement escalation protocols, starting with friendly payment reminders and progressing to more formal collection actions if necessary. Some companies may also employ third-party collection agencies for severely overdue invoices.

5. Reconciliation

Payment Recording and Reconciliation

Matching incoming payments with outstanding invoices ensures financial records remain accurate and up to date. Automated reconciliation tools can help detect discrepancies, prevent revenue leakage, and maintain compliance with accounting standards.

Check out our accounts receivable checklist template.

Types of Accounts Receivable Automation

Automation enhances AR processes by reducing manual work, minimizing errors, and accelerating payments.

1. Invoice Automation

Automated invoicing generates and sends invoices based on predefined triggers, such as order fulfillment or service completion. This ensures invoices are issued promptly and contain accurate details, reducing disputes and delays.

2. Payment Reminder Automation

Automated payment reminders notify customers of upcoming or overdue payments through email, SMS, or customer portals. These reminders help businesses collect payments faster while reducing the need for manual follow-ups.

3. Customer Portals

A self-service customer portal allows clients to view invoices, track payment history, and submit payments online. This improves the payment experience, reduces administrative work, and accelerates cash inflows.

4. Reconciliation Tools

Automated reconciliation tools match incoming payments to corresponding invoices, flagging discrepancies and reducing manual bookkeeping errors. This helps businesses maintain accurate financial records with minimal effort.

5. Accounting Workflow Automation

Integrating AR tasks into broader accounting workflows ensures seamless financial operations. Automated data syncing between AR software and accounting platforms eliminates redundant entries, enhances reporting accuracy, and streamlines financial analysis.

Common Accounts Receivable Challenges

Despite automation and best practices, businesses often face challenges in managing AR efficiently.

1. Late Payments

Delayed customer payments can disrupt cash flow and make it difficult to meet operational expenses. Businesses must implement proactive collection strategies to minimize payment delays.

2. Invoice Disputes

Errors, missing details, or unclear terms on invoices can lead to disputes, which delay payments. Ensuring invoice accuracy and providing clear documentation helps prevent disputes before they arise.

3. High Days Sales Outstanding (DSO)

A prolonged collection cycle means businesses wait longer to receive revenue, potentially affecting financial stability. Monitoring DSO and enforcing stricter payment policies can improve cash flow.

4. Bad Debt Risks

Some overdue accounts may never be collected, leading to financial losses. Businesses should conduct regular credit evaluations and establish a structured collections process to mitigate bad debt risks.

5. Manual Processes

Relying on manual invoicing, AR excel templates, payment tracking, and reconciliation increases inefficiencies and the likelihood of errors. Automating AR tasks can significantly enhance accuracy and speed.

Strategies for Overcoming AR Challenges

Implementing the right strategies can help businesses maintain a steady cash flow and reduce AR-related risks.

1. Set Clear Payment Terms

Clearly define payment timelines, due dates, penalties for late payments, and incentives for early payments upfront. This ensures customers understand their obligations from the start.

2. Automate Invoicing and Reminders

Using automation tools for invoicing and payment reminders reduces manual work, accelerates collections, and minimizes human errors in billing.

3. Perform Regular Credit Checks

Assessing customers’ creditworthiness before extending payment terms helps prevent late payments and bad debts. Businesses should establish risk-based credit policies to protect their cash flow.

4. Establish a Collections Process

A structured collections strategy—including friendly reminders, formal demand letters, and escalation steps—ensures overdue invoices are addressed promptly.

5. Offer Multiple Payment Options

Providing diverse payment methods, such as credit card payments, ACH transfers, and online payment portals, makes it easier for customers to pay on time.

By adopting these best practices, businesses can improve their AR performance, reduce outstanding receivables, and maintain a healthy financial position.

Best Practices for Proactive Accounts Receivable Management

To further optimize AR processes:

- Offer Early Payment Discounts: Encourage faster payments by providing small incentives for early remittances.

- Personalize Follow-up Communications: Tailor payment reminders and follow-ups to each customer’s history.

- Maintain Transparent Invoicing: Ensure invoices are clear, detailed, and free from errors to reduce disputes.

- Leverage Data Analytics: Use insights to predict payment behavior and refine collection strategies.

Accounts Receivable vs. Accounts Payable

While accounts payable represent money a business owes, accounts receivable reflect money owed to a business. Balancing both is critical for optimal cash flow management. AR management focuses on collections, while AP management emphasizes timely supplier payments.

Final Thoughts: Turning Receivables into Revenue

Managing accounts receivable effectively is not just about collecting money—it’s about creating efficient systems that drive cash flow, minimize risks, and enhance customer relationships. By leveraging automation, clear policies, and proactive follow-ups, businesses can unlock the full potential of their receivables, fueling sustainable financial growth.

Managing multiple AR and bookkeeping tasks can be challenging when you don’t have the right processes in place. Use Financial Cents to create a streamlined workflow for managing tasks, keeping track of work, client communications and so much more.

Start a Free Trial or Book a Demo to explore Financial Cents.