Accounting Billing Software

Save time & money with FC billing & payments

Get paid faster with automated invoicing, billing, and payments in one easy-to-use practice management solution.

Jenny Rost

Construct Bookkeeping, LLC

Bill and Get Paid Faster by Clients

Make billing seamless, from time tracking to payment.

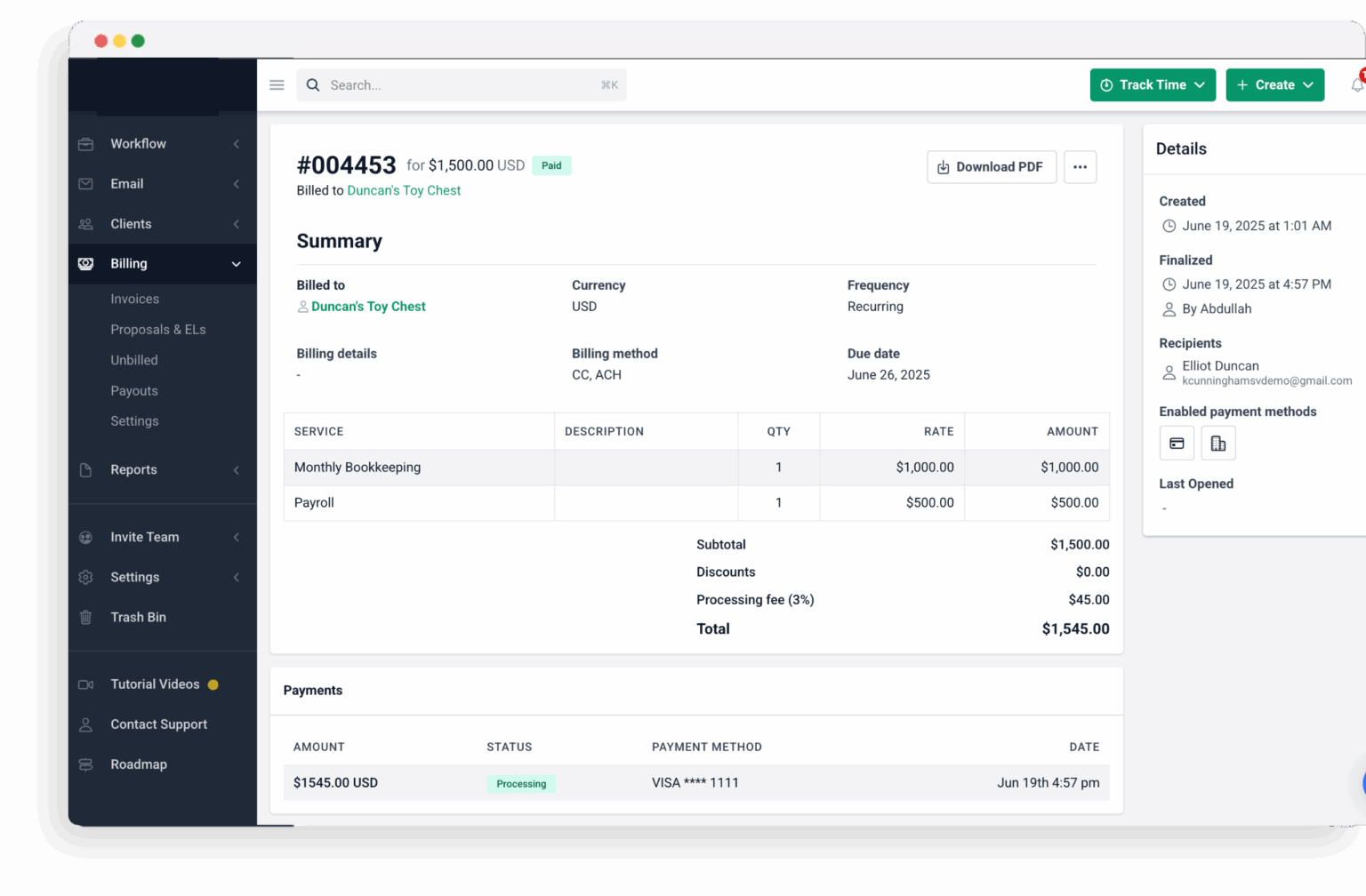

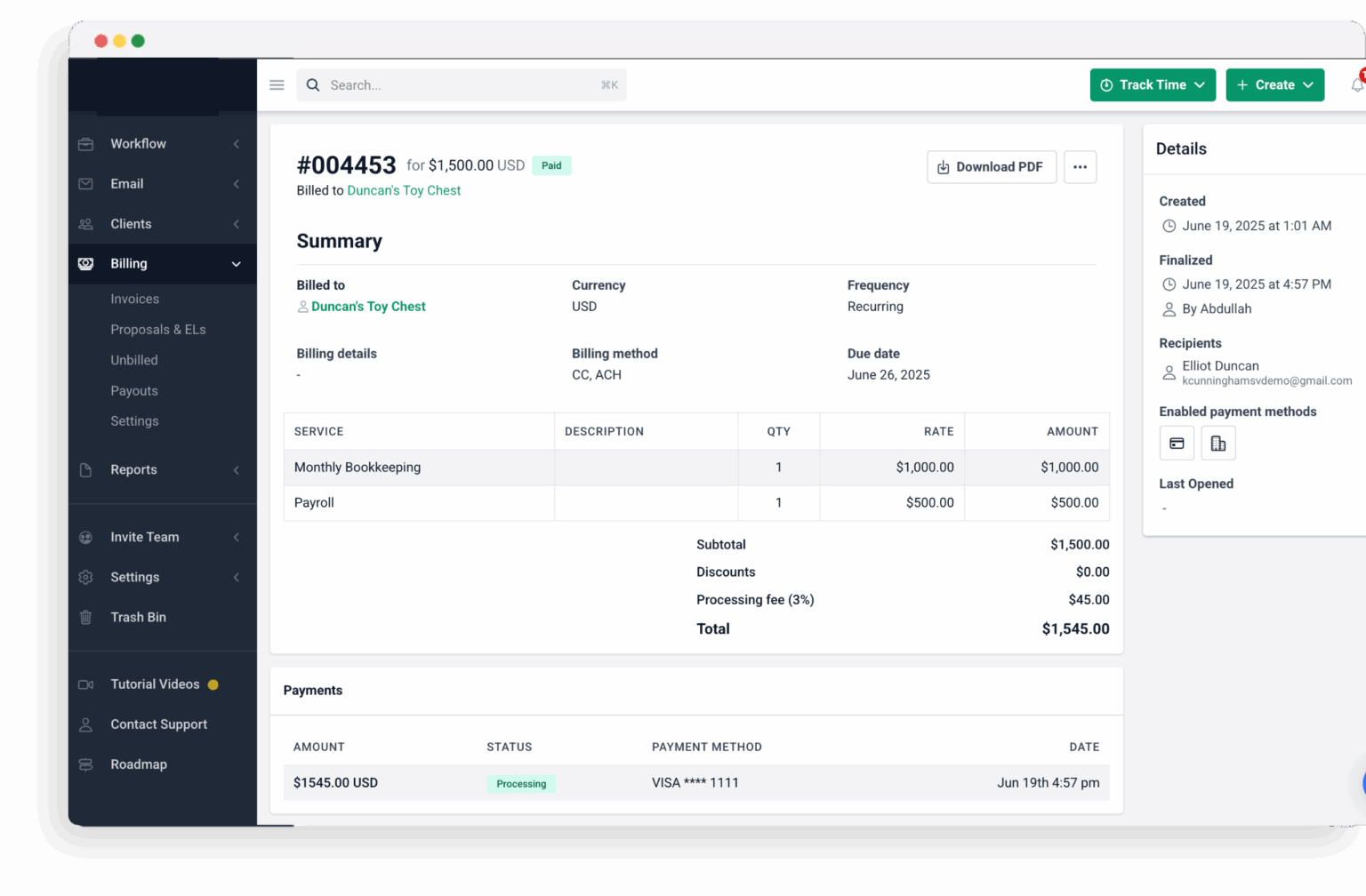

Financial Cents makes it easy to generate and send invoices directly from your workspace. Whether you’re billing for tracked time or flat-fee services, you can turn work into revenue in just a few clicks.

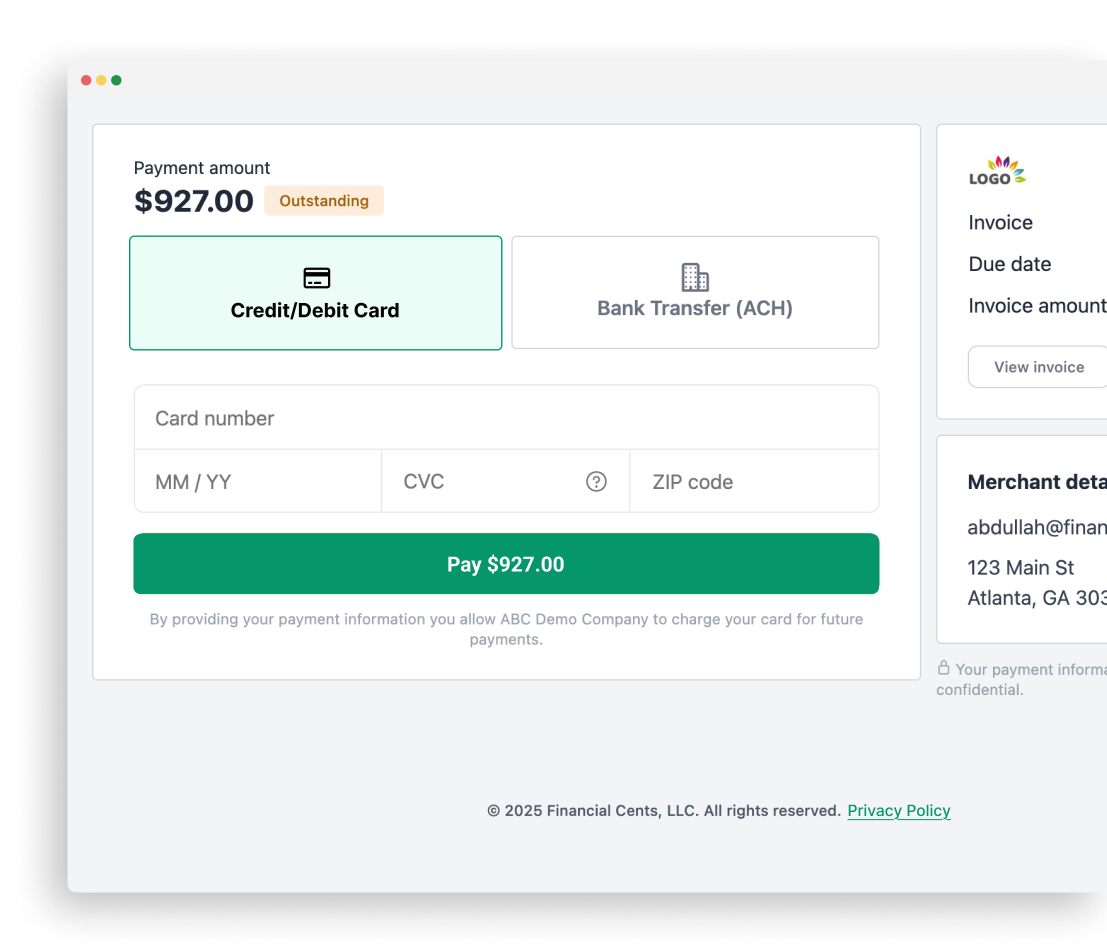

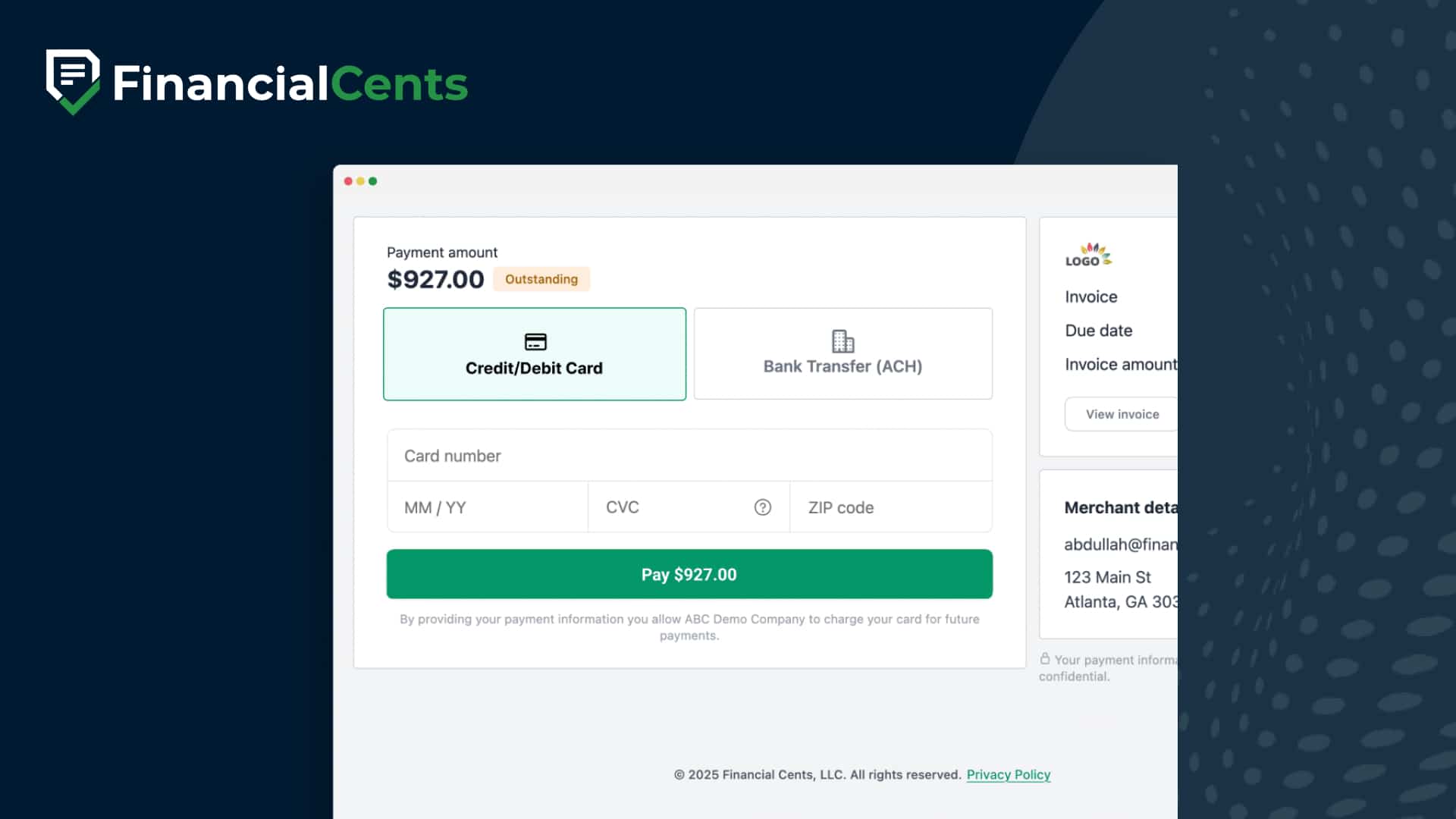

You can create invoices in seconds using time entries you’ve already tracked, or manually for fixed-fee services. If your team uses our built-in time tracker, it’s simple to bill directly off that tracked time, no extra steps or tools required. Plus, clients can pay however they prefer, thanks to our flexible payment options, including card and ACH payments.

“A complement to Quickbooks Online to help organize our tasks by the due date, track time which integrates with QBO & allows us to communicate with our clients.”

Veronica G.

(Accounting Firm Owner)

Automate Payment Collection

Set it, forget it, and get paid on time.

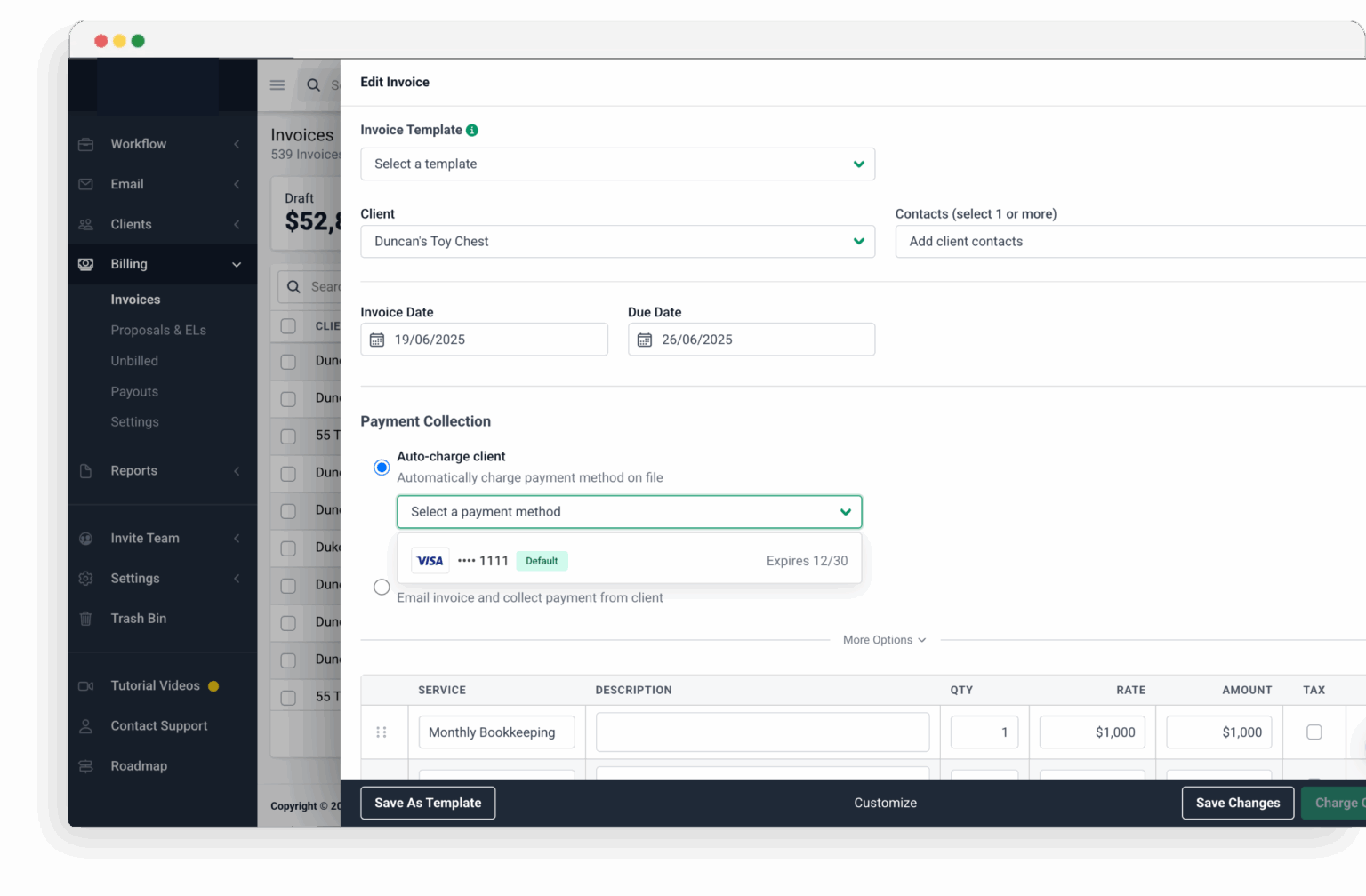

Our billing system takes the headache out of payment collection for your firm. You can collect and securely save your clients’ preferred payment methods upfront, making it easy to automatically bill them when invoices are due.

For ongoing work, you can schedule recurring invoices so payments go out and come in without any manual effort. And with automated payment reminders, your clients will get notified about upcoming or overdue payments—helping you stay on top of collections without constantly following up.

“It didn’t take me long to get started using it once my templates were configured. It’s very easy to customize each project for my needs and set it to recur automatically.”

Jessica F.

Accounting Professional

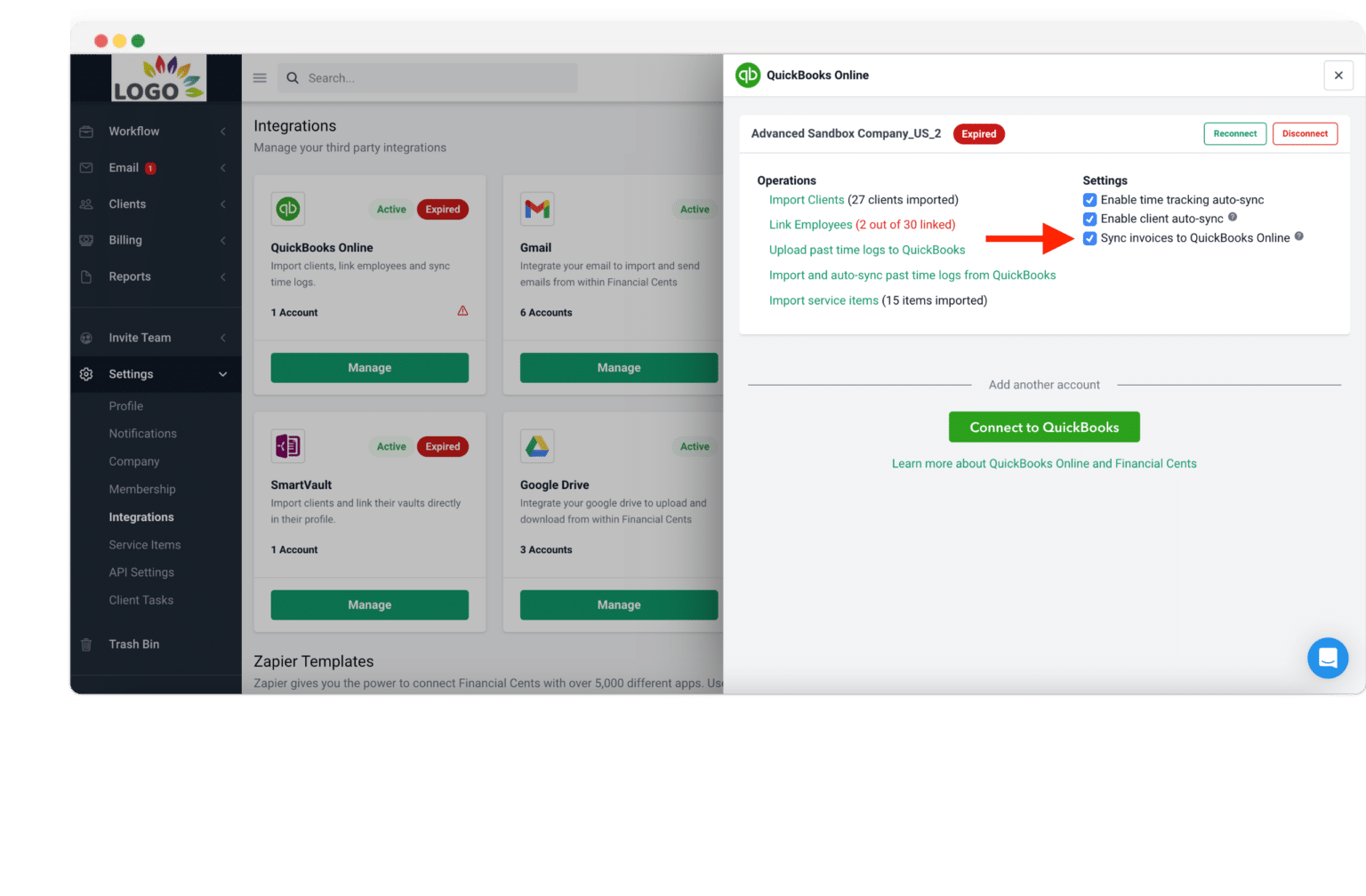

Two-Way QuickBooks Online (QBO) Sync

Stay in sync without lifting a finger.

Our two-way QuickBooks Online sync keeps your accounting data up to date by ensuring that client records, invoice statuses, and payment details are automatically reflected in both systems. This eliminates duplicate data entry, reduces errors, and saves your team hours of manual work each month.

“A complement to Quickbooks Online to help organize our tasks by the due date, track time which integrates with QBO & allows us to communicate with our clients.”

Veronica G.

Accounting Firm Owner

Proposals & Engagement Letters

Send polished proposals, scope your services clearly, and get paid faster—all in one place.

With Financial Cents, you can send professional-looking proposals and engagement letters that reflect your brand. Each proposal allows you to clearly outline the services you’re offering, along with the associated scope and fees.

Clients can submit their payment information directly through the proposal, so you’re ready to bill from day one. Once everything looks good, clients can electronically sign and agree to your terms, and no printing or scanning is required. Invoicing can be automatically generated and activated as soon as the engagement is signed to keep your billing process moving forward.

“It didn’t take me long to get started using it once my templates were configured. It’s very easy to customize each project for my needs and set it to recur automatically.”

Jessica F.

Accounting Professional

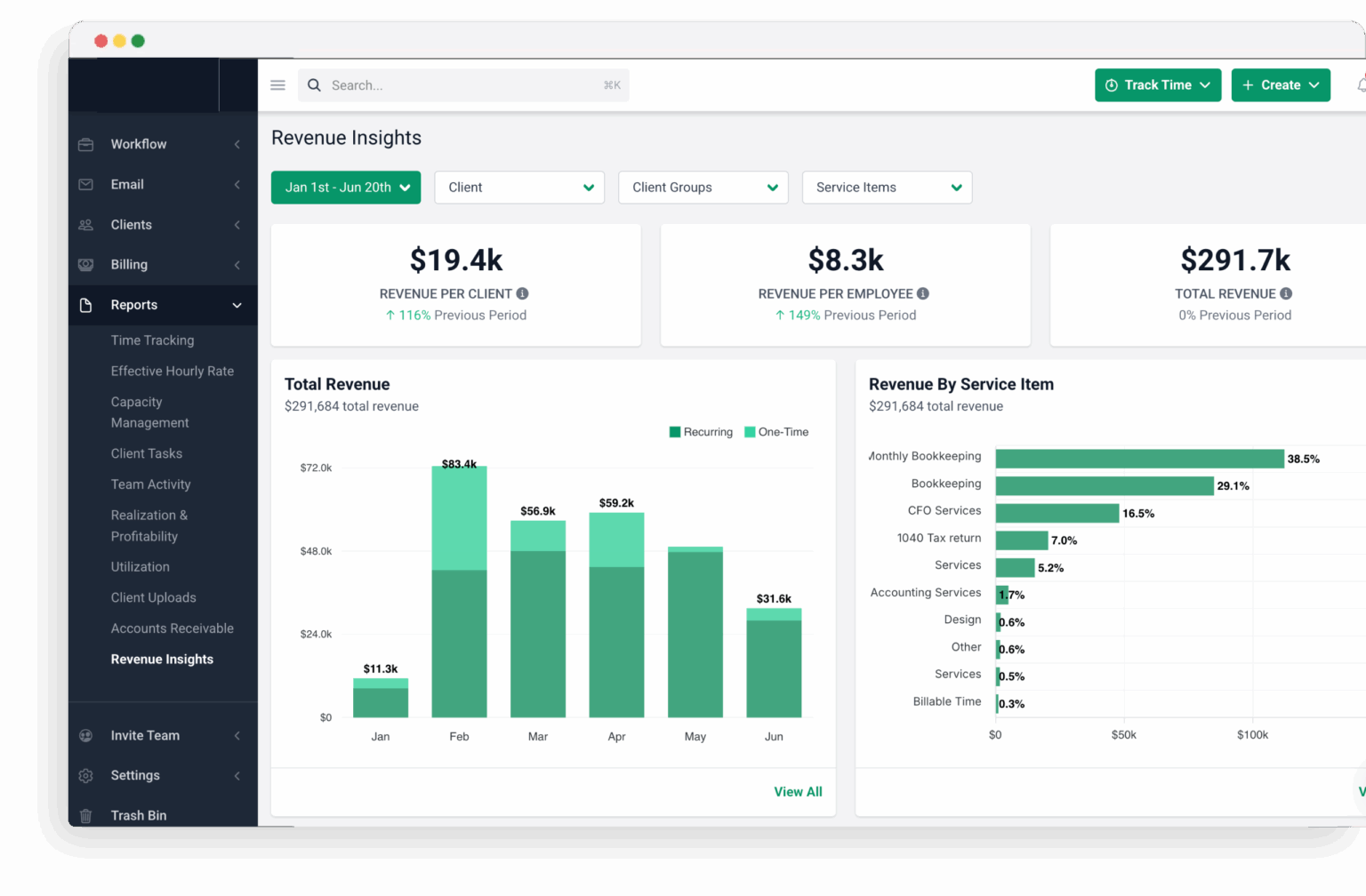

Billing Reports That Power Growth

Track performance and cash flow with financial clarity. Financial Cents gives you the reporting tools you need to understand how your billing efforts are performing.

The Accounts Receivable Aging Report shows you which clients have outstanding invoices and how long they’ve been overdue. This helps you follow up efficiently and reduce cash flow delays.

Realization reports help you track how much of your team’s billable time is being invoiced so that you can identify and fix revenue leaks. You’ll also gain insight into profitability by tracking which clients and services contribute most to your bottom line.

“Love how easy it is to setup and begin using.”

Christopher N. CPA

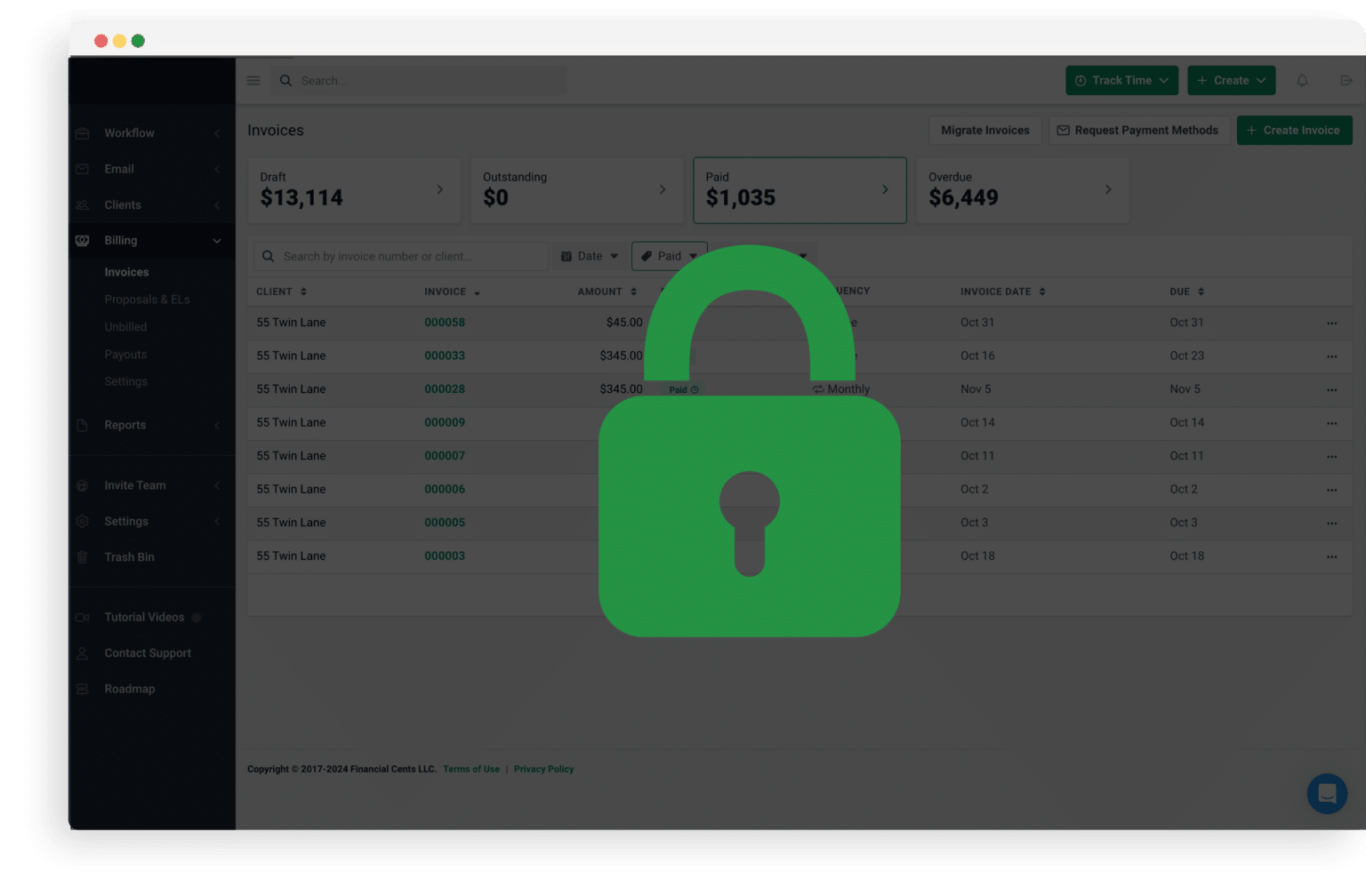

Advanced Permissions for Secure Access

Financial Cents understands the importance of maintaining control over sensitive billing data. With our permissions feature, you can easily manage who on your team has access to the billing system.

“Everything under one roof! Accounting firms often use several tools to operate their practice. Financial Cents speaks to that pain point with project management, email integration, client requests, time and capacity management, and password management.”

Crystal M

Bookkeeper

Got 5 minutes?

Step inside the Billing feature to see how Financial Cents helps you streamline invoicing and get paid faster.

Take a Tour

Accounting billing & payments features

Recurring & one time invoices

Easily create one time or recurring invoices to reduce admin work.

QuickBooks Online sync

Automatically sync all invoices and payments to QuickBooks Online.

Proposals & EL’s

Drive more revenue with modern proposals that clients can easily sign

Profitability reports

Identify which clients and services are driving firm profitability.

Pass card fees to clients

Pass card processing fees onto clients to instantly boost your bottom line

Automated payments

Automatically collect and charge payment methods to save time and get paid faster.

Automated client reminders

Automatically remind clients to pay unpaid invoices so your team never have to chase them down.

Realization reports

Track how effective you are at billing your clients for billable work

Loved by over 10,000 accountants, bookkeepers and CPAs

Billing Software for Accounting Firms FAQs

Yes. You can create recurring or one-time invoices and set up automatic payment collection via card or ACH. Once set up, Financial Cents will bill clients and collect payments without manual follow-up.

Financial Cents links time tracking to billing, allowing you to generate invoices directly from tracked billable hours. This eliminates the need for separate time and billing tools.

Absolutely. You can schedule recurring invoices for ongoing services like monthly bookkeeping, so you never have to recreate them manually each billing cycle.

Yes. Financial Cents offers online payment options, including credit card and ACH, so clients can pay securely and conveniently, helping you get paid faster.

Financial Cents automatically sends email reminders for upcoming or overdue invoices, helping reduce accounts receivable and freeing your team from chasing payments.

Yes. Financial Cents offers two-way sync with QuickBooks Online, ensuring your client data, invoice status, and payment records are always up to date in both systems.

No. You can use Financial Cents’ billing and payments feature independently of QuickBooks Online. However, if you do use QuickBooks Online, Financial Cents offers a two-way sync to keep your invoices and payment records updated automatically.

Yes. Once you collect and securely store client payment details, Financial Cents can automatically charge them when invoices are due, ideal for retainer or subscription-based services.

You can send branded proposals and engagement letters through Financial Cents. Once signed, billing and invoicing can be triggered automatically, streamlining the entire client onboarding and payment process.

Yes. Use the Accounts Receivable Aging Report to view outstanding invoices and their aging status, so you can follow up on overdue payments efficiently.

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!