Financial Cents vs TaxDome

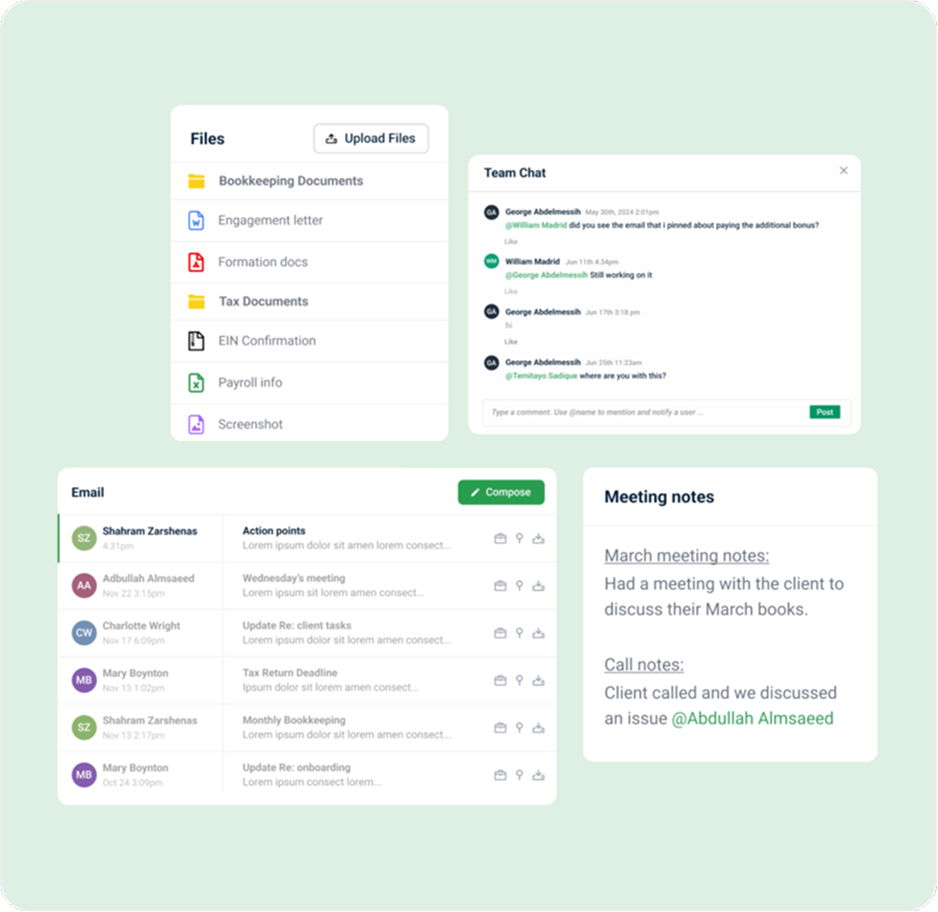

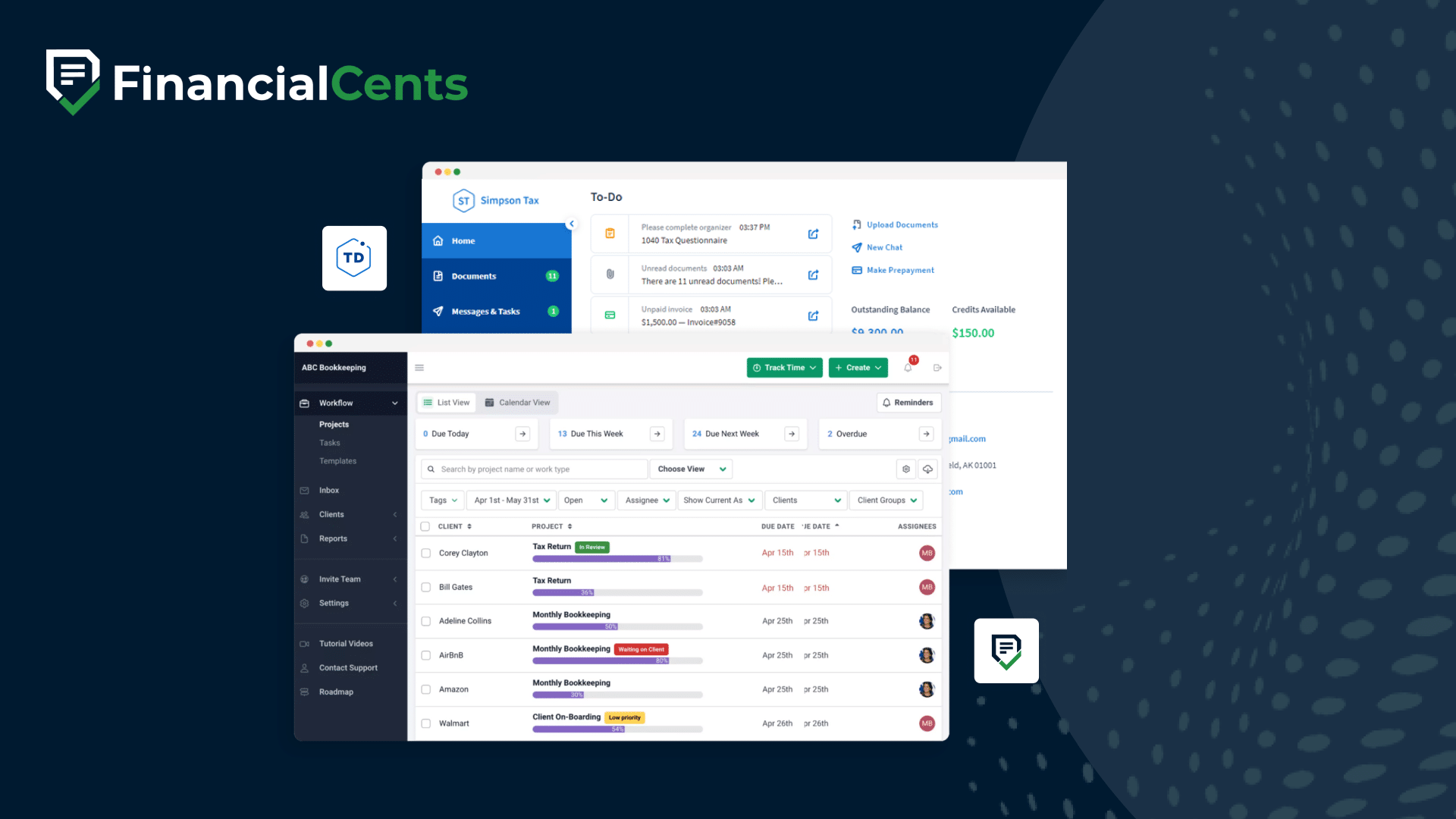

Financial Cents is an easy-to-use accounting practice management software that provides accounting and bookkeeping firms with all they need to grow, from workflow automation and team collaboration to seamless client management, task management, and automated client request features that enhance the client experience.

Nat Valentin Heaney

Valentin Accounting & Tax

Financial Cents vs TaxDome features compared

Financial Cents

TaxDome

Features

| Workflow Automation | ||

| Document Management | ||

| Billing & Invoicing | ||

| Proposals & Engagement Letters | ||

| Client Portal | ||

| Firm-branded client portal | ||

| E-signature | ||

| Manage uncategorized transactions | ||

| Zapier integration | ||

| Automated client reminders | ||

| Integrated email | ||

| QuickBooks integration | ||

| SmartVault Integration | ||

| Google Drive Integration | ||

| OneDrive Integration | ||

| Capacity Planning | ||

| Open API | ||

| Robust reporting | ||

| Workflow Templates | ||

| Community template library | ||

| Workflow templates AI | ||

| Email templates AI | ||

| Team Chats | ||

| Comments and @mentions on tasks and projects | ||

| CRM | ||

| Secure file storage | ||

| Time Tracking | ||

| Time Tracking reports & budgeting |

Why users love us ❤️

Built for accounting, bookkeeping & tax firms

Unlike Taxdome, which is primarily built for tax firms, Financial Cents is a comprehensive practice management designed specifically for the diverse needs of accounting, bookkeeping, and tax firms. Regardless of your firm’s specialty or needs, you can streamline workflows on Financial Cents to manage all your client’s tasks.

Additionally, Financial Cents offers the scalability and flexibility to adapt and grow with your firm, eliminating the need to switch software as your service offerings expand.

“Streamlining Bookkeeping to leave room for more Advisory

I don’t have to chase clients nearly as much with their to-do lists and client portals set up. They can ask questions, and I can add accountability tasks for clients for them to be reminded automatically, and everything is pretty customizable – including the reminder emails.”

Danielle M

A more robust workflow

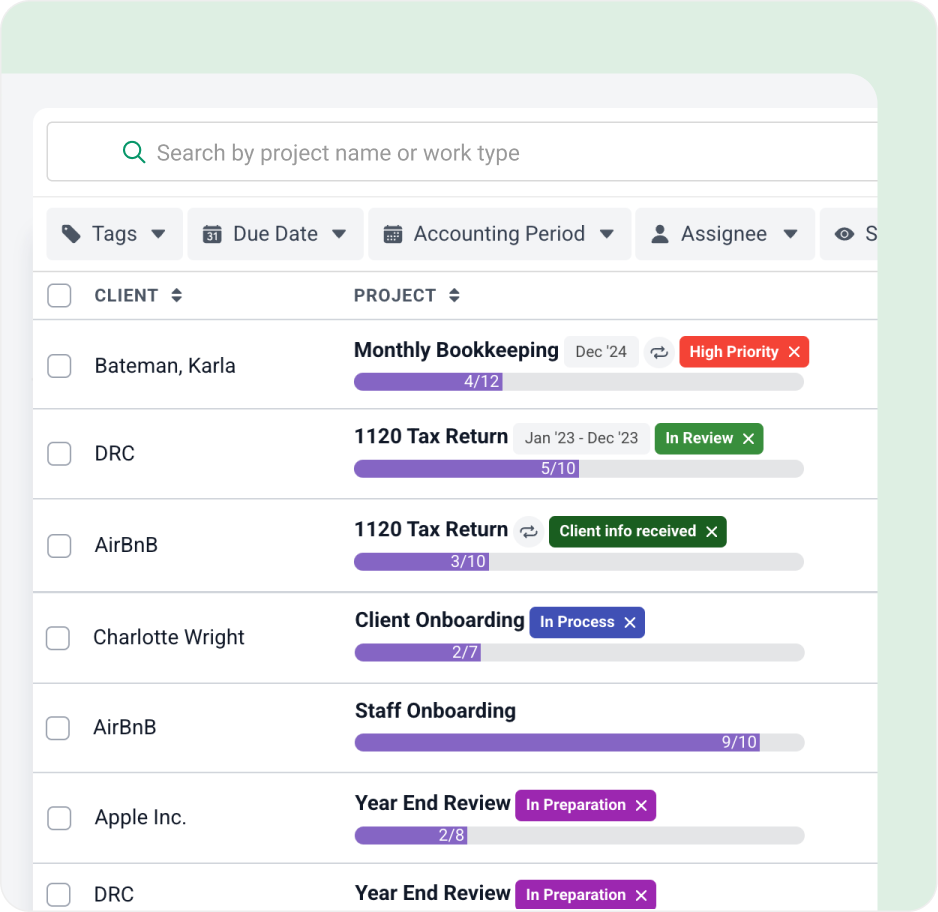

Taxdome does a little bit of everything making its accounting workflow and automation features limited. Financial Cents on the other hand offers a more robust workflow and features to help you get work done for clients more efficiently and right on time.

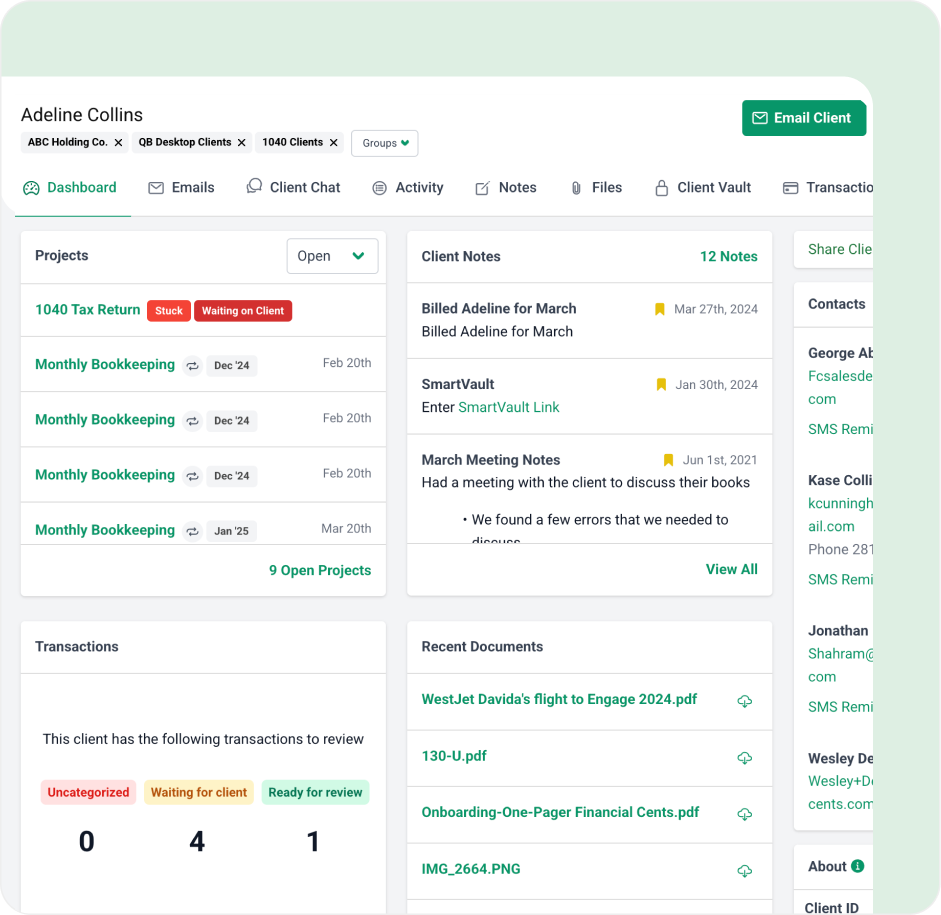

Our workflow management features include a workflow dashboard that gives you visibility to track work done in your firm; workflow automation to help you automate manual tasks and recurring tasks; automated client requests to help you receive information from clients faster; an easy-to-use client portal and more.

“The business problem we are solving with Financial Cents is twofold. First, we are improving our internal communications. Second, we are ensuring that no project falls through the cracks.”

Michael McMullin | Managing Partner, Jack Trent & Co

Streamline your work and client communication with AI assisted processes

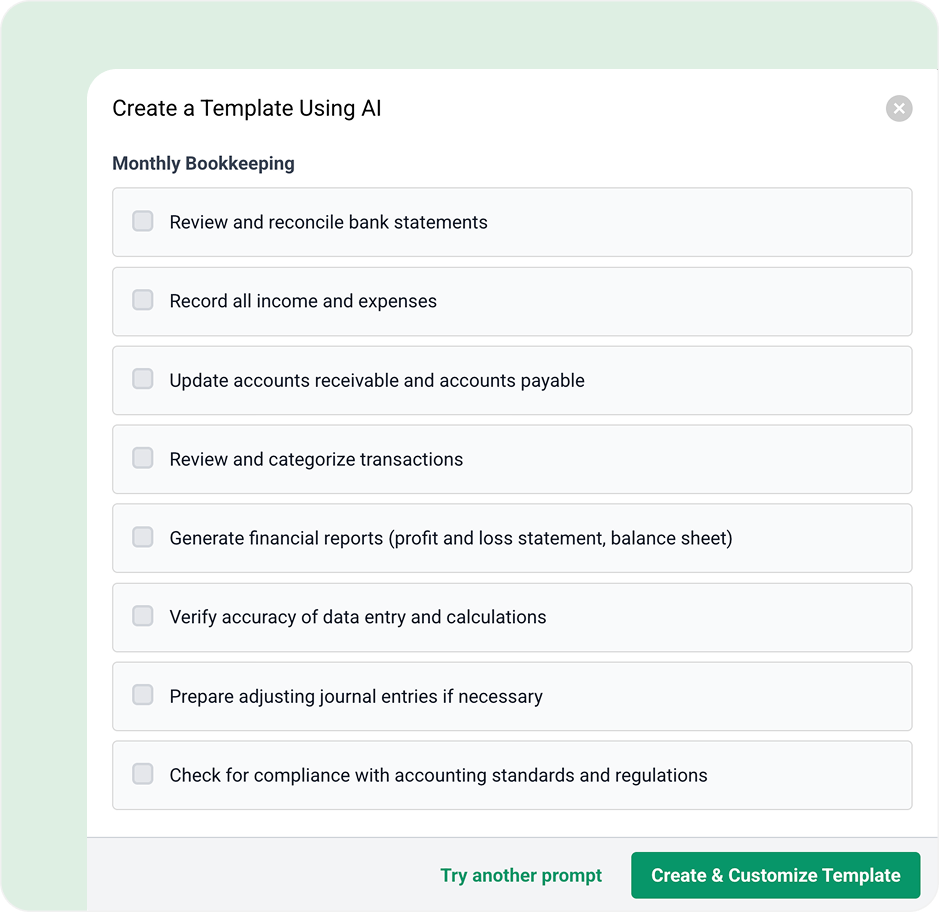

Our AI integration helps you create workflow templates within seconds for any client tasks or project you may have, even if they seem out of scope, making work easier for you. You can tweak and save the email for future use within your firm.

You don’t have to spend minutes or hours when you want to send emails to clients or respond to their emails. Using AI inside Financial Cents, you can create client emails on the go. The best part? You can save the email generated as a template inside Financial Cents, so you don’t have to generate them each time. Your team members can also have access to them and use them for client emails whenever they need to.

Taxdome’s AI features are limited to document management and reporting.

“Can’t say enough good things about it!

We are thrilled with the streamlined workflow Financial Cents brings to our firm! After much trial and error, with other products/companies over-promising and under-delivering, the cloud-based accessibility, affordability, intuitive interface, and INCREDIBLE customer support have made this an easy decision for us. Financial Cents is my top choice for efficient and effective financial management – 10/10 highly recommended!”

Michelle A.

Easy to set up

One of the reasons clients love Financial Cents is its ease of use, which makes it easy to set up and start implementing. Financial Cents workflow dashboard is intuitive, simple to understand and get around at first try. We designed our interface with a users first approach and we constantly request feedback to ensure users do not encounter roadblocks while using our software.

We also provide a library of tutorial videos to help you start automating processes and workflows in your firm in no time.

Financial Cents is rated 4.9/5.0 for ease of use on Capterra, while Taxdome is rated 4.5/5.0.

“I love that it took little to no effort to understand, all of the intro videos were so helpful. They got me started on the right path. I love that it is like taking my brain and putting it into order. It helps me get/stay organized.”

Jill B

Financial Cents vs TaxDome Pricing

Financial Cents has four plans – Solo plan, Team plan, Scale plan and the Enterprise plan.

The Solo Plan is perfect for solo accountants and bookkeepers who want a simple way to stay organized, manage client work, and never miss a deadline. It includes features like workflow management, time tracking, invoicing & billing, client portal & client tasks. It costs $19/month – billed annually.

The Team plan includes all you need to hit your client deadlines with more visibility, collaboration and organization. It costs $49/month per user – billed annually and $69/month per user month – billed monthly.

The Scale plan has more advanced features such as the branded client portal, auto-follow ups for client tasks and more. It costs $69/month per user – billed annually and $89/month per user month – billed monthly.

The Enterprise Plan provides advanced support, security, and customization for large firms. It includes everything in the Scale Plan, plus enhanced security, custom permissions, webhooks, priority support, premium training, and a dedicated success manager. Contact sales for custom pricing.

Learn more about our pricing plans

Taxdome has three (3) pricing plans:

Essentials Plan (for solo users) – $700 per year/per user for a 3 year plan, $750 per year/per user for a 2 year plan or $800 per year/per user for a 1 year plan

Pro Plan – $900 per year/per user for a 3 year plan, $950 per year/per user for a 2 year plan or $1,000 per year/per user for a 1 year plan

Business plan – $1,100 per year/per user for a 3 year plan, $1,150 per year/per user for a 2 year plan or $1,200 per year/per user for a 1 year plan

Loved by over 10,000 accountants, bookkeepers and CPAs

Frequently asked questions

No. Unlike TaxDome, which is primarily built for tax firms (it’s in the name), Financial Cents is designed for accounting, bookkeeping, and tax firms. This makes it an even better fit if your firm offers a wider range of services.

TaxDome’s workflow tools are geared mostly toward tax-related tasks. Financial Cents on the other hand provides a more robust workflow system with features like a workflow automation, dashboard, client requests, and recurring task management, helping firms ensure no client work slips through the cracks.

Financial Cents is consistently rated easier to use. On Capterra, Financial Cents scores 4.9/5.0 for ease of use, compared to TaxDome’s 4.5/5.0. Many firms highlight that they can set up Financial Cents quickly and begin streamlining workflows without a steep learning curve.

Financial Cents starts at $19/month for the Solo Plan and $49/month per user for team plans, with no client limits and flexible monthly or annual billing without long-term lock-ins.

TaxDome, on the other hand, charges per user, per year, and requires multi-year commitments for discounts. Taxdome 3 year solo plan starts from $700/year (3 year commitment) and their team plan starts from $900/user per year with limited functionality.

TaxDome’s AI is focused mainly for simple document management and reporting. Financial Cents offers AI workflow template creation and AI email generation, which helps firms save significant time when setting up processes and communicating with clients.

No. TaxDome doesn’t include functionality for managing uncategorized transactions. Financial Cents has a dedicated feature, Month-End close, to track, review, and assign uncategorized transactions so nothing slips through the cracks, making month-end and year-end close faster and more accurate.

Both Financial Cents and TaxDome prioritize data security with bank-level encryption and secure client portals. Financial Cents offers role-based permissions, encrypted file storage, and enterprise-grade security controls to keep sensitive financial data safe.

Financial Cents is rated 4.8/5 on Capterra and G2 and is praised for its intuitive design, quick setup, and excellent customer support. Taxdome is rated 4.7/5 on Capterra and G2 with some users finding its interface harder to navigate.

Both Financial Cents and TaxDome offer unlimited document storage. However, Financial Cents takes it a step further by offering advanced document management through integrations with SmartVault, Google Drive, and OneDrive, allowing firms to organize, share, and collaborate on files using their preferred tools. TaxDome’s does not offer these third-party integrations, which can limit flexibility for firms already using external storage solutions.

Many firms switch to Financial Cents because it offers a cleaner workflow, better automation, easier setup, and more integrations. Additionally, Financial Cents provides unlimited scalability without forcing firms into complex pricing structures.

Get Started Today

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!