The A-Z Staff Onboarding Guide for Accounting Firms + Free Template

Author: Financial Cents

Reviewed by: Alexis Sadler

In this article

The difference between a good and bad staff onboarding program lies in the value a firm places on it.

Most firms think of staff onboarding merely in terms of the tasks and paperwork a new staff has to do. But it is much more than that.

Take the case of these two firms for example (Let’s call them “Firm A” and “Firm B”):

For every new hire, Firm-A:

- Stays in touch after sending the welcome email. In this period, they collaborate with the new employee to set them up in the firm’s systems.

- Days before the new staff member starts work, they are told what is expected of them during their first week.

The firm understands that any helpful information it gives at this stage demonstrates its thoughtfulness and value for its workers.

Even a piece of information as to where they should park their car (if they are driving to a physical office) is significant.

- When they come for their first meeting they get introduced to the team.

They also help the new employee learn about the firm’s history, structure, mission, workflows, etc.

- Next, they clarify the performance expectations for the role while encouraging the new staff to share any concerns they might have.

- The hiring manager checks on them after the first week, month, and quarter to see how well they are settling into the team.

The new staff member comes out of the onboarding program excited and motivated to contribute to your firm’s growth. That is why organizations with good onboarding processes are 82% more likely to retain their new hire.

At Firm-B, they treat staff onboarding like merely completing a checklist.

- Everyone is busy trying to get work done. So, new hires wait for onboarding information, which takes a long time.

- New team members are not properly introduced to their other team members, so they don’t know who to meet for help on a project or how.

- Weeks have passed, but new hires still do not understand the firm’s processes. They are even wondering whether they made the right decision to join the firm.

Benefits of a Good Accounting Staff Onboarding Process

-

Faster Integration into Ongoing Projects and Clients

New hires usually need time to get the hang of things. A poor onboarding process prolongs that time, while effective onboarding helps you get your new staff up to speed.

It builds clarity regarding procedures for getting work done, lines of communication, and where to find work resources. This gives them the confidence they need to take on ongoing projects.

-

Reduction in Employee Turnover

We all know how time consuming and expensive it is to hire and onboard a new staff member. Relying on a good onboarding process ensures their competence and gives them a better chance of remaining and growing with your firm. Setting them up for success and ensuring your employee turnover is limited.

Plus, the lower the turnover rate, the better the rest of the workforce can focus on their work instead of trying to do the work of vacant positions.

-

Increased Employee Productivity & Satisfaction

When new hires understand their roles, have the resources they need to get work done, and know who to go to when they run into a challenge, your new staff will less likely waste time completing their tasks.

New hires feel more confident and fulfilled when they can complete their tasks to your firm’s standard.

New hires cannot do work that meets your standards without role-based onboarding.

-

High Employee Engagement

Your new staff is likely nervous about joining your firm. A smooth onboarding process integrates them into your team more easily.

This sets them up to get work done and connect with their new team members.

This gives them a sense of belonging and sets them up for an engaging work experience.

-

Talent Attraction

An effective staff onboarding system shows the value you place on your employees and your commitment to helping them succeed. Employee referrals are one of the most reliable sources of accounting talent.

Your staff have a way of reaching the accounting talents you will need to fill your future vacancies. They share the same conference spaces and online communities.

Plus, they want the best talents on their team because they value their own professional growth and development. An effective onboarding program demonstrates your firm’s commitment to helping potential staff grow, and they will be more eager to join your firm.

-

Faster Adoption of Company Culture

Staff onboarding is a time to showcase your firm’s culture because new staff are most open to learning at this point.

This helps your new hire incorporate into your firm’s culture and operations on an emotional level.

Accounting Staff Onboarding: The A-Z Guide

The first onboarding tip will enable you to incorporate new staff into your firm’s processes. The rest will make new staff buy into your vision and team culture more quickly.

1. Have an Accounting Staff Onboarding Checklist

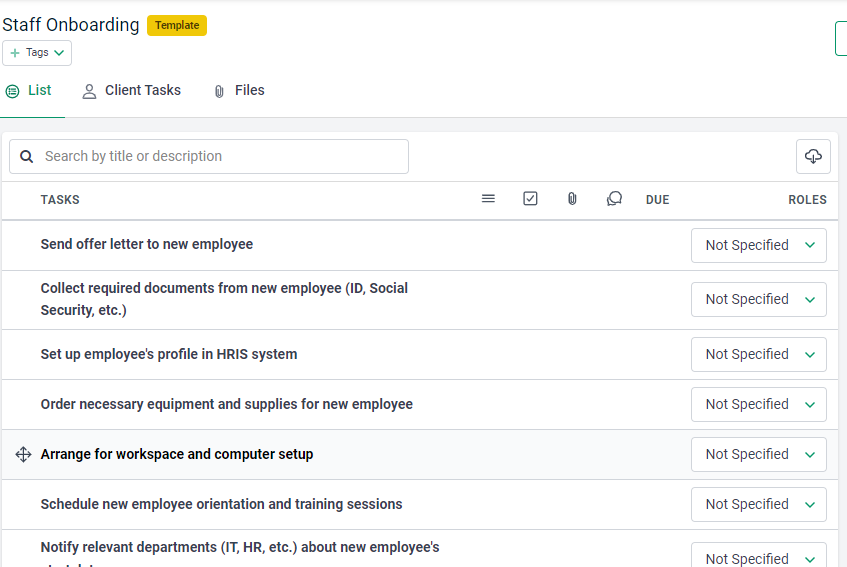

This step addresses the traditional onboarding requirements. The onboarding checklist ensures that you send the offer letter at the right time. Collect all relevant documents, create employee profiles in HRIS systems, etc. You can find the complete steps of a standard accounting staff onboarding process for your clients here.

On average, the onboarding process goes through different stages across several days or weeks. It gets overwhelming when you have to remember what to do and which staff member should do it each time someone joins your firm.

Using the staff onboarding checklist is a great way to know what to do ahead of time, track what has been done, and what is left to make it a memorable process.

Checklists also keep you from overloading your new staff with information and help them get the information they need at the right time to settle into their role seamlessly.

Financial Cents staff onboarding checklist has everything you need to do to get your new hire from point A to Z.

2. Establish Clear Communications Channels for Your Remote Staff

Clear communication is critical to ensuring your new staff understands your procedures, especially when working remotely.

Clear communication is the difference between two scenarios where:

A team member is confused and navigating through their tasks without understanding.

A team member is empowered and working with clarity and assurance.

In the second scenario, the team member is very clear about their role, responsibilities, and the processes to follow, which enhances their confidence and helps to reduce errors."

Since remote work lacks some of the perks of an in-office environment, you have to be intentional about establishing communication systems that keep your team engaged.

You may be interested in:

Nayo recommends creating an effective communication system for your team (and new staff) by:

- Establishing a comprehensive documentation system that provides clear guidance (to your new staff) on your processes and workflows.

- Instituting consistent and regular check-in meetings to catch up with your new staff and clarify any doubts.

- Creating a central hub for team collaboration so that information, updates, and conversations are accessible to everyone.

3. Know What Your New Staff Cares About and Use it to Promote Team Connections

Take advantage of people’s desire for human connection to integrate your new staff members into your team.

Alisa McCabe has used this beautifully. She makes her staff submit their favorite charity or passion projects and figure out how everyone on the team can support the course together.

For example, one staff member submitted a project for children who are homeless or in the foster care system. The team decided to provide blankets for the kids.

We bought kits for hand-making blankets for everybody on the team. We got together on a Zoom call and made the blankets together. We took pictures and shared them. Doing that to support someone on the team created the next level of connectedness"

Alisa McCabe, Owner, First Step FinancialsPractices like this have improved employee retention at the firm. Alisa has ten staff, two of whom have been at the firm for ten years. The newest employee has worked there for five years.

4. Define and Align Your New Staff Around your Firm’s Goals

Defining your goals is necessary because it helps your new staff understand where the firm is going. Otherwise, everyone will be chasing their individual goals.

It is easier to sell your goals to your new employees when you are clear about your firm’s future.

You need to know where the business is going as the firm owner. Is it scaling? Is it team-oriented? If you don't start to state those goals, your new staff will make up a reason that does not align with yours because they don't know why we're doing the work. we."

Kellie Parks, Founder of CalmWaters Cloud Accounting5. Document Your SOPs to Get Your New Employee Embedded into Them

Kellie Parks recommends using well-documented standard operating procedures (SOPs) to enable your team to deliver consistent work quality.

A well-documented workflow process guides your new staff to achieve the results you want to see. As a Financial Cents user, you can create a list of the steps (tasks) a project requires from beginning to end. You can break those tasks into subtasks and describe them in a way that helps your new (and existing) staff know what to do at each point.

When documenting the steps in your bookkeeping process, for example, the initial tasks could look like this (according to Kellie Parks):

- STEP 1: Tell the client the documents you need from them. Don’t just say, ‘Hey, send me your bank statement.’ Say, ‘We need your bank statements by X date.’

As a Financial Cents user, your new staff wouldn’t need to worry about this language. The client task feature enables them to request the documents ahead of time and choose a date that the task is due.

- STEP 2: When the client has sent all the documents you need, you can clear the document app (like Dext, which collects all the bank statements) and push that over to QBO.

- STEP 3: Clear the bank feed. This task requires subtasks

- You should state how many banks they should clear and whether they’ll clear any payroll account.

- Other tasks in the monthly bookkeeping can follow in that order.

If you document your SOPs well enough, your new staff will get work done faster and will not have to second-guess themselves.

BONUS: Use Video Walkthrough for Better Results

Documenting your SOPs is many times more effective with video. Walkthrough videos enable you to record your screen (with apps like Loom) as you complete the process for a client. It doesn’t require you to set time aside to create it for your staff.

Once you have completed the final subtask in the project, you can end the video and attach it to the tasks you want to assign your new employees in Financial Cents. That way, you are showing—not just telling—them how the process is done.

Onboard Your New Staff and Manage Their Capacity with Financial Cents

Managing your team is easier when you onboard new staff members with the same software you use to track their performance and the client projects they are working on.

Onboard Your Staff and Manage Your Team with Financial Cents.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features Your Accounting Client Portal Must Have

By utilizing a client portal, you can eliminate the inefficiencies of manual methods and create a smoother workflow for both you and…

May 15, 2024

The 5 Best Avii Workspace Alternatives for Modern Firms

If, for whatever reason, Avii does not meet your long-term workflow needs, this review of the best Avii workspace alternatives should help…

May 08, 2024