Accounts Payable Process Flowchart Guide (+ Diagrams & Templates)

Author: Financial Cents

Reviewed by: Kellie Parks, CPB

In this article

Like all accounting processes, the complications of the Accounts Payable (AP) process lie in the sheer volume of AP work an accounting firm may have to do for its clients.

Accounting firms often handle hundreds (or more) of accounts payable transactions for clients in a month. This can overwhelm even the most experienced accounting professionals.

The higher the number of AP work an accounting firm does, the higher the chances of error, especially when delegated to new staff.

Meanwhile, a single error in Accounts Payable work can cost your client money and valuable supplier relationships.

This is where Accounts Payable flowcharts come in handy. Flowcharts enable you to present the procedure for completing your Accounts Payable work in a diagram. This makes it easier for new staff members to understand how the tasks in the process fit together.

This article shows how you can create your Accounts Payable flowcharts (with examples to inspire you). Once you’re done creating your flowcharts, you can add the images to your projects in Financial Cents to help your staff complete the process faster and more efficiently.

Benefits of the Accounts Payable Process Flowchart

a. Provides Clarity and Understanding

The human mind processes visual information better than tabular or textual information.

By representing your workflow steps in a visual form, your staff members will find your standard operating procedures easy to follow. Ultimately, it empowers them to do their best work.

b. Simplifies Complex Process

Accounts Payable flowcharts help you bypass the need to explain complex workflows with many words.

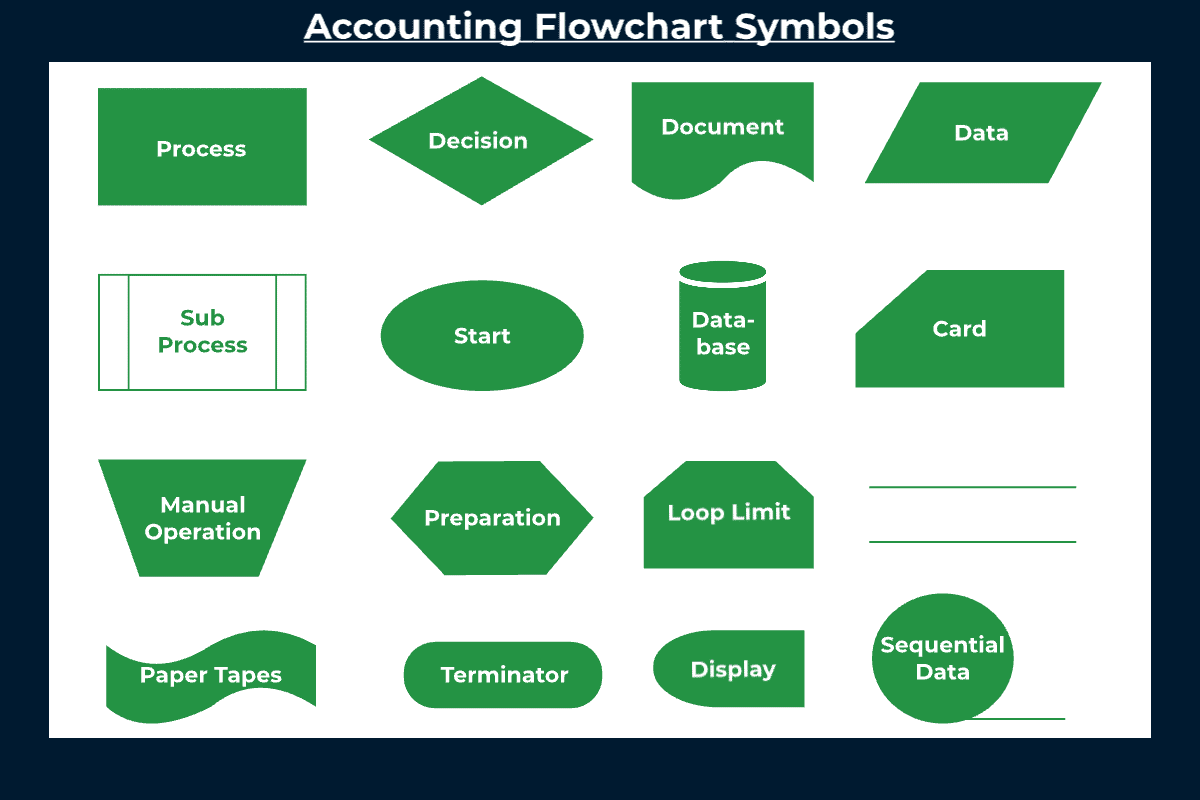

Flowcharts use conventional symbols (like rectangles, arrows, and diamond shapes) to provide context and direction to your workflow steps.

This enables you to communicate complex processes more simply.

c. Improves Efficiency and Optimization

When your AP staff can see the flow of work effortlessly, they won’t waste time figuring out what to do next.

That way, they can focus on completing the process efficiently.

d. Enhances Communication and Collaboration

Accounts Payable flowchart enhances communication and collaboration by helping team members share ideas that enable them to overcome challenges in their AP process.

Flowchart software makes collaboration even better. They allow you to invite your team members to share their thoughts on your AP workflow process.

e. Supports Continuous Improvement

With flowcharts, it is easier to spot the cause of bottlenecks in your Accounts Payable process (like a step that delays the process, a step that can be left out). This makes improving the process much easier.

Breakdown of the Accounts Payable Process Flow

i. Receive Supplier Bill

Your AP work starts when the supplier bills you for the goods or services they delivered to you.

The supplier bill contains information about the transaction: quantity delivered, the amount owed, and payment information, among others.

ii. Data Entry

After receiving the supplier’s bill, it’s time to enter the information into the financial system. You’d want to be careful here; even a small error can affect the outcome of the process.

For example, entering the wrong bank details may result in the wrong supplier being paid.

Interestingly, errors are more likely at this stage due to manual data entry systems. If your AP team enters invoice data manually, someone will lose concentration and enter the wrong information sooner rather than later.

With an accuracy of up to 99%, automated data extraction tools will significantly reduce human errors in your Accounts Payable process.

iii. Matching

This is where you verify the accuracy of the information in the bill by cross-referencing it with the purchase order and the goods or services delivered.

When done well, this task saves your client the error of over or underpayment. Once the information matches, the bill can be sent to the relevant persons for approval.

iv. Discrepancy Resolution

Sometimes, the information on the purchase order and bill and the goods delivered do not match.

Imagine this scenario: your client receives a bill for five desktop computers. Upon delivery, one unit was found to be below standard. So, your client rejected it. However, the supplier is under the impression that five items were delivered.

In such an instance, your client has to resolve the difference in the quantity and amount of products received. That’s what this step helps with.

Once the discrepancy has been resolved, the supplier will issue a fresh bill matching the delivered products.

v. Approval Workflow

When bills have been verified and all errors resolved, they are sent for approval. Depending on a firm and client’s approval workflow, it can be sent to the person or department that received the goods or services.

Some organizations send payments above a certain amount to multiple persons for approval.

A common challenge here is sending the bill to the wrong person or department for approval, causing delays and possible late payments.

vi. Payment Processing

At this point, the supplier and the business (your client) agree on the amount to be paid and the preferred payment system.

Once the payment is due, your client is expected to send the money to the supplier through whatever payment system they agree to use. The most common payment methods are check, ACH, credit card, and electronic payment.

vii. Record keeping

Keeping up-to-date records is good for your client’s operation and regulatory compliance. In the United States, for example, businesses are required to keep transactions like Accounts Payable on file for a minimum of seven (7) years.

On the business side, up-to-date records of Accounts Payable transactions help your client manage their cash flow and payment obligations. This is important for accurate financial statements and possible Internal Revenue Service (IRS) audits.

viii. Reconciliation

This is where you reconcile your client’s accounts to ensure that their outstanding bills and the vendor statements match the Accounts Payable balance in their accounting ledger.

Accounts Payable Process Flowchart Diagrams and Templates

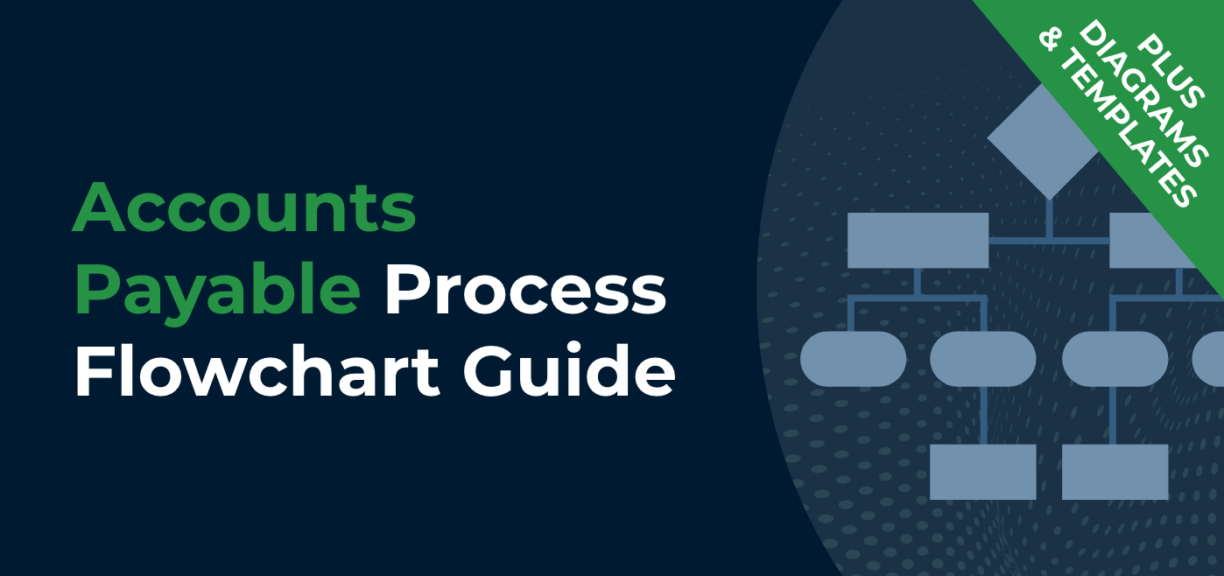

1. Accounts Payable Process Flowchart

Download the editable version here

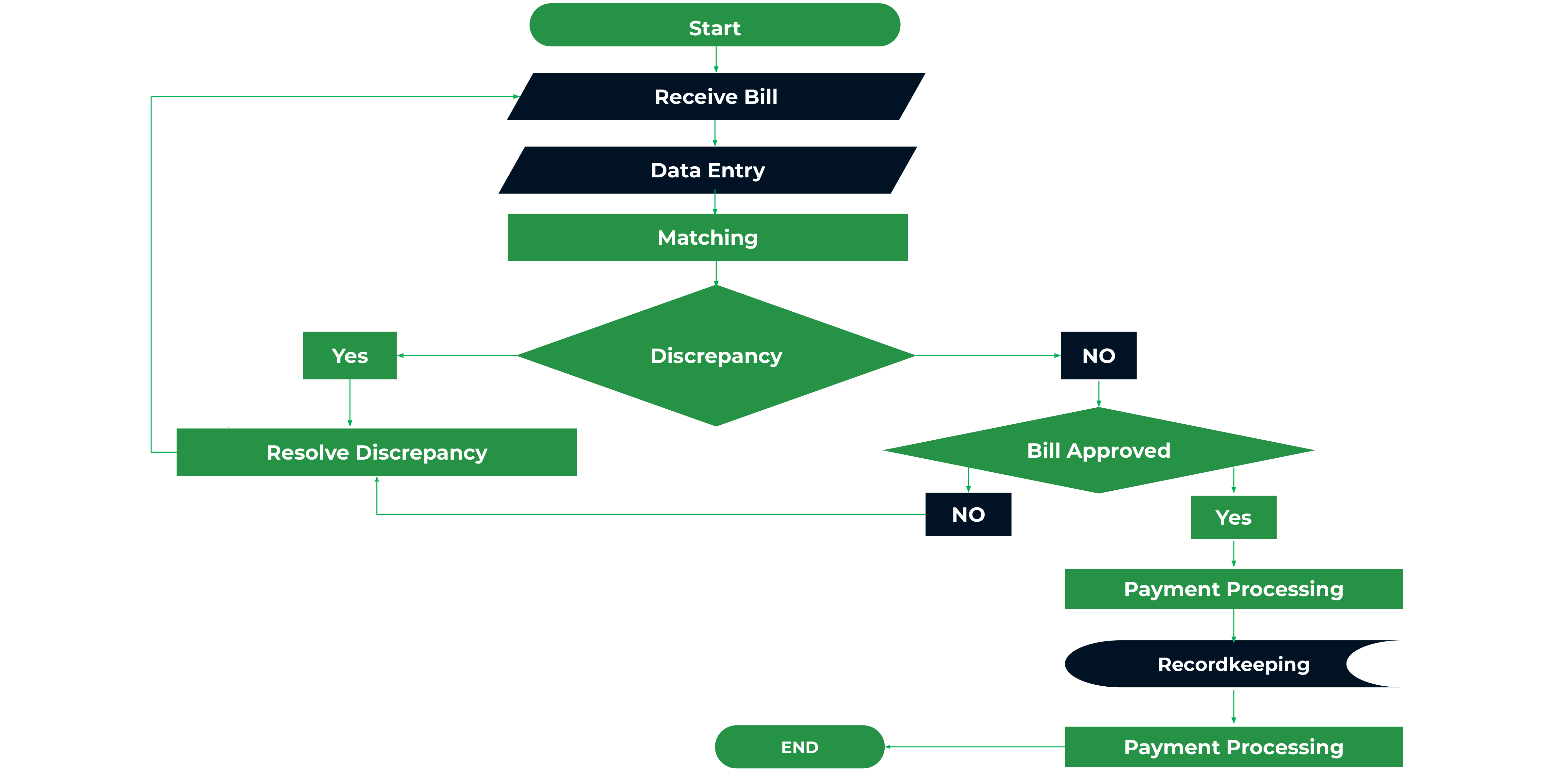

2. Bill Processing Flowchart

Download the editable version here

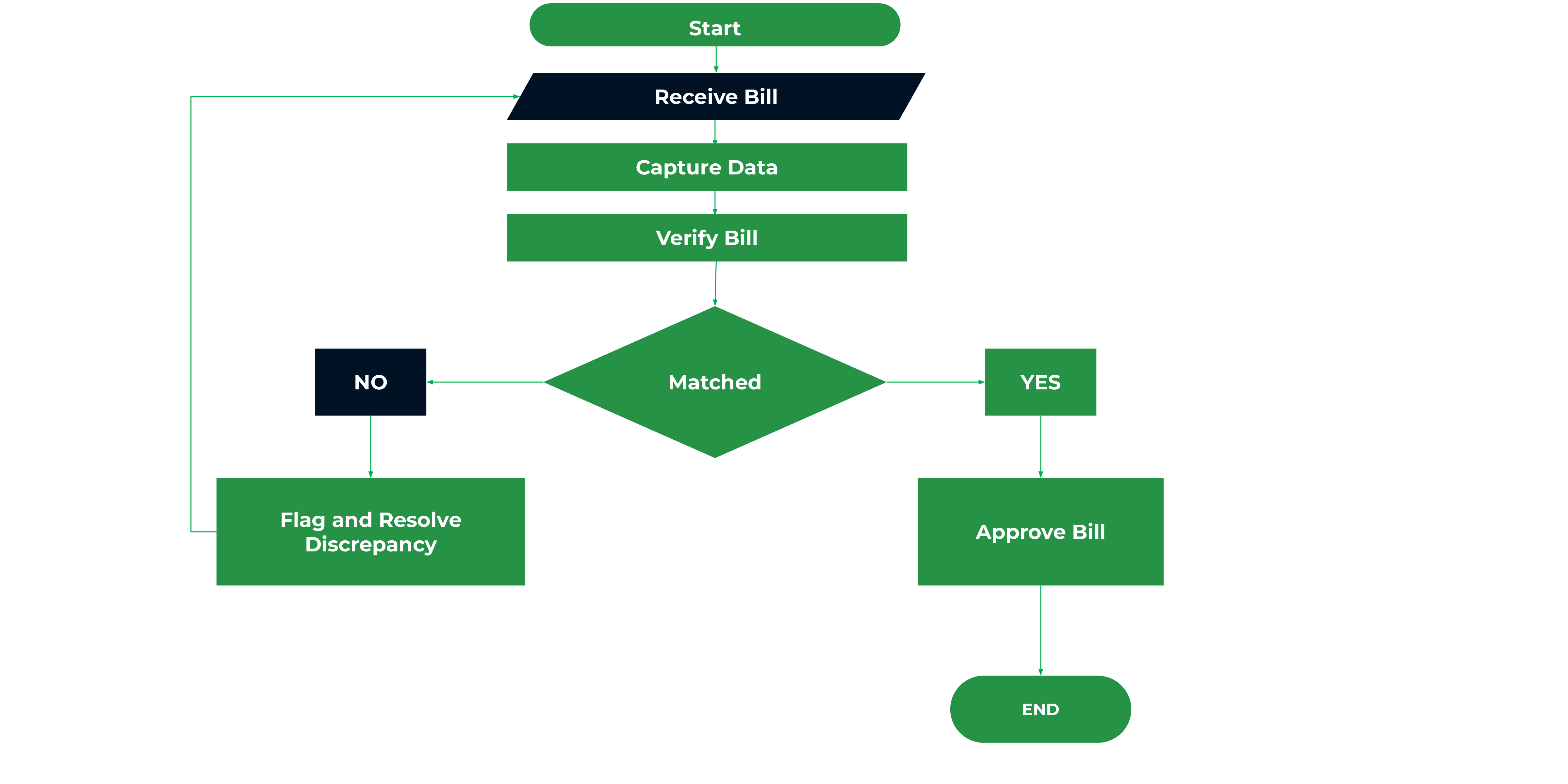

3. Accounts Payable Reconciliation Template

Download the editable version for free here or use our Free Accounts Payable Reconciliation Checklist Template

Here’s what each symbol in an accounting flowchart means so you understand how to use them:

We cover this in more detail in this blog – accounting process flowcharts and diagrams.

How to Create Your Accounts Payable Flowchart

1. Define Your Purpose and Scope

Creating your Accounts Payable flowcharts begins with defining the purpose and scope.

A defined purpose helps you clarify why the flowcharts are necessary in the first place. It also helps your team members value it as much as you do.

You also need to understand and communicate the scope of your flowcharts. The scope will guide you in providing sufficient details while keeping it simple enough to avoid overwhelming your staff members.

2. Map Out the Core Processes

This is where you list all the tasks in your Accounts Payable workflow in their order of performance.

Doing this will keep you from missing important steps.

3. Choose Your Tools – Pen and Paper or Tools such as PowerPoint, Flowchart Software, Etc.

This is where you determine your tool of choice for the flowcharts. You can use the good old pen and paper, but being a manual system, it requires a lot of time and effort to create flowcharts at scale.

You could also use the SmartArt or the Shape Library in MS PowerPoint. However, these methods are limited and lack the flexibility to create quick and accurate flowcharts.

Flowchart software makes the process of creating flowcharts easier in many ways.

- First, they provide templates you can customize to suit your workflow needs in a few clicks. That means you wouldn’t bother about arranging the shapes.

- They enable you to share feedback on the flowchart you have created with team members.

- You can share flowcharts in documents via email or in shared cloud drives with your team members.

4. Format Tasks by Type and Correspond Them with the Correct Symbol.

Attach shapes to the steps you mapped out in the second step. For example, all action steps should be represented by a rectangle shape.

5. Build Your Flowchart

If you prefer to use pencil and paper, go ahead and draw the corresponding shapes and connect them with flows (lines or arrows).

If you’re using flowchart software, go to the flowchart library to drag and drop the shapes for the tasks (like process, oval, decision, and document shapes) in the process.

Once you’ve added them, arrange them in chronological order. Connect the shapes with the directional lines or arrows.

6. Review and Update Periodically

This is where you check your workflow flowchart for missing or redundant steps. You can do this periodically as the passage of time gives you a better perspective on the process.

If you use flowchart software, you can invite others to help you review the process for efficiency and accuracy.

Manage Your Accounts Payable Flowcharts Alongside Your Accounts Payable Projects in Financial Cents

Accounting project management is most effective when the accounting teams can access most, if not all, of the resources they need to manage client work from start to finish.

With the number of productivity tools coming into the market every month, the ability to use as many tools as possible from one place will determine how efficient your firm becomes.

For example, Financial Cents project management features enable you to add the Accounts Payable flowcharts you’ve created elsewhere to your projects.

You can add the images to the Financial Cents projects, link the shared cloud drives in the resources, and/or add them to the files sections.

This saves your team the stress of jumping between multiple apps to access the resources they need to get work done.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Accounts Receivable Workflow Process: An Easy Step-by-Step Guide

This guide shows how you can continuously improve your Accounts Receivable process so that your clients’ day sales outstanding (DSO) will reduce…

Mar 14, 2024

Project Management for Accountants: A Definitive Guide

Project management is about getting things done efficiently. To succeed at it, the project manager needs to understand what needs to get…

Mar 03, 2023 | 10 Mins read