How to optimize your Accounts Payable Workflow: A Step-by-Step Guide

Author: Financial Cents

Reviewed by: Kellie Parks, CPB

In this article

The accounting professional’s job is to protect clients from fraud, theft, and financial abuse.

With Accounts Payable transactions, accounting firms leverage bill matching and approval workflows to protect their clients’ businesses from overpayment, duplicate, and late payment—which might attract penalties or compromise relationships.

The accuracy of the Accounts Payable process rests on your team’s ability to go from one stage to another without missing even the smallest of details.

For example, if multiple vendors bill your client for the same transaction (or a supplier inflates the prices in their invoice), an accurate AP process ensures that no such error or fraud goes undetected.

But if the approval and matching process overwhelms your team, their ability to spot these errors reduces significantly. Your client could suffer losses—overpayment or duplicate payments.

An optimized Accounts Payable workflow streamlines the flow of work and boosts their ability to accurately cross-reference large amounts of supplier invoices with their Purchase Orders and receipt notes.

What is Accounts Payable Workflow?

Accounts payable workflow is the series of steps a firm takes to pay the money it owes to its vendors for availing their goods or services. involves bill (supplier invoice) coding, approval, cross-referencing (with Purchase Orders and goods receipt notes), posting for payments, payment approval, and reconciling accounts. It is a type of workflow for accounting.

Key Stages of the Accounts Payable Workflow

Pre-approval Stage:

-

Vendor Onboarding and Contract Negotiation

This step covers vendor selection and agreements around prices, delivery schedules, and payment terms.

It can also include agreements on payment methods and set up for seamless payment as and when due.

-

Purchase Order Creation and Management

When a company needs a product, the first step is often creating a Purchase Order. It’s similar to placing an order for goods or services. The agreed quantity and prices of the items are stated in the Purchase Order.

-

Receiving and Inspecting Goods

Here, the buyer takes delivery of the goods or services and inspects them to be sure they meet the requirements in the Purchase Order.

-

Matching POs with Bills (Supplier Invoices)

This is where the information on the bill is compared with the information on the Purchase Order and goods receipt note.

Any inconsistency in any of the documents has to be resolved before the bill can be processed further.

Approval Stage

-

Bills (Supplier Invoice) Data Entry and Coding

Coding bills (suppliers’ invoices) requires your team to enter the necessary information into the ERP platform. The key information includes the amount, payment term, payment information, due date, and relevant general ledger account. A mistake in any of this can result in late payment or overpayment.

-

Multi-Level Approval Routing Based On Amount or Type

This is where the relevant persons of your client’s organization will sign off on the AP process. – this is where the Internal Accounting Controls are mapped.It’s best to set up the approval level in multiple tiers. For example, the bill approver should be different from the payment approver.

If an error escapes the approver, it will not escape the payment approver. This gives an additional layer of protection for your client’s business. This is also the best way to mitigate corporate fraud.

You should also have a policy where payments above a certain amount go through multiple approvers.

-

Managing Discrepancies and Exceptions

When there is an inconsistency in the billing information and the Purchase Order or goods receipt note, the documents are reviewed manually according to your approval workflow.

Payment Stage

-

Select a Payment Method (e.g., check, ACH, electronic payment)

Payments can be made through one of many payment systems. Whether you send them a check, make an electronic payment, or use an automatic clearing house (ACH) depends on your arrangement with your supplier.

-

Schedule and Execute Payments Based on Due Dates and Discounts

This is where you start making payments that are currently due while scheduling future payments.

-

Reconcile Accounts and Record Transactions

Here, you reconcile accounts by comparing the Vendors’ Accounts Payable statements with your clients’ Accounts Payable aging reports. This helps you understand your client’s expenditures, confirm accuracy and where they could reduce spending. Solid Internal Accounting Controls would include a different person reconciling the payment accounts (bank, credit card or payment platform) then the one who approves the payments.

Post-payment Stage:

Archiving Bills and Related Documents

This is where your bills and other supporting documents in the Accounts Payable process are archived according to relevant regulatory requirements.

Some regulations require organizations to store documents for at least seven years, so advise your client to be careful of deleting documents too soon.

Recommended Resource:

The Best Accounting Document Management Options for Accounting Firms

Common Issues that Occur During Accounts Payable Workflow Process

a. Late Payments

Late payment is a challenge for business. 87% of companies don’t get paid until after their invoices are due. Late payment poses a cash flow problem for suppliers and can rupture your client’s relationship with their suppliers.

Late payment mostly results from:

- Routing bills to the wrong approver; holding up the payment process.

- The overwhelming task of manually coding, approving, and matching bills delays the AP process is a cause of delays.

- Payments made by check through the postal service can be unpredictable. There’s no telling how long it will take to get to the supplier.

Automating Accounts Payable tasks and choosing an efficient payment channel can give you more control over the timing of your clients’ payments.

b. Manual Data Entry Errors

Manual data entry is prone to errors primarily because the human brain is not designed to code billing information for hours without losing focus.

The longer an employee has to repeat a data entry task consecutively, the higher the chances of mixing things up, which can lead to payment errors.

c. Lack of Visibility

The manual Accounts Payable process is not only slow, it’s also disorganized. You can’t monitor the steps of the process in one place, and you can hardly tell which stage in the process the bill is in and where the AP work stands in general. This leaves you with unreliable information, which hinders making well informed decisions.

With automated Accounts Payable software, you can view the history and status of Accounts Payable processes at a glance. This helps you understand important metrics like average bill processing time and number of bills per supplier.

d. Bills Approval Bottlenecks

Account payable professionals spend a day out of their week chasing their colleagues to approve bills.

It is stressful, time-consuming, and an inefficient use of Accounts Payable resources.

These bottlenecks are caused by:

- Paper bills: they get lost in the heap of other paper documents easily.

- Billing-related emails: it’s easy to lose track of emails or delete them accidentally.

- Manual approval system: the approver may be away from the office for a period that crosses over then they need to make approvals..

- Poor communication: it prevents employees from sharing timely information about a bill, causing a delay in the approval process.

Invoice routing software helps with all of these. It ensures that documents get to the right approver and makes approval easier with an e-signature process..

e. Missing or Lost Bills

Supplier bills get lost when:

- They are sent by traditional mail to the wrong address.

- They are attached to emails that were not opened or mistakenly deleted.

- Paper bills get mixed up with other documents on the approver’s desk.

Whatever the cause, missing or lost bills can result in late payments. Receiving bills electronically helps to ensure they get to where they are sent. Arrange with your suppliers to send invoices via invoice routing software to keep them from slipping through the cracks.

f. Inefficient Matching Processes

The matching process is the verification of the billing information. Two-way matching verifies the information on the bills from suppliers against the corresponding Purchase Order. Three-way matching verifies the information against the Purchase Order and the Goods Receipt Note (GRN) information.

If your team finds discrepancies between both documents, it could set the process back with a manual review that takes a long time to complete.

Best Practices for Streamlining Accounts Payable Workflow

a. Implement 3-way Matching

Businesses receive large amounts of bills based on purchased goods and services. Three-way match enables you to cross-reference a bill with the corresponding Purchase Order and Goods Receipt Note (GRN).

The process ensures that the information (quantity, quality, and payment due) is consistent across both documents.

If the three documents match, the bill progresses to the payment stage. If the information doesn’t, your client will pay more or less than they should unless the discrepancy is rectified.

b. Use AP Automation Software to Manage Repetitive Tasks

AP automation technology helps you manage your Accounts Payable tasks, from receiving, coding, and routing bills to AP reconciliation with little to no human input.

It enables you to use:

- Optical character recognition technology: to capture and code bills.

- Artificial intelligence: to match bills with PO and GRN by comparing the information in both documents. It flags all discrepancies for manual review and resolution.

- Routing software: to route matched bills for approval or payment.

This automates your manual processes and improves the timeliness of payments, which enhances your clients’ relationship with their suppliers.

c. Document Your Accounts Payable Process

Creating Standard Operating Procedures (SOPs) for your Accounts Payable projects helps your team understand how to handle each AP task.

A documented AP process outlines every step your team members should take to go from point A to Z when doing a client’s AP work.

A document AP process should cover:

- The internal rules your client’s employees need to follow to order for goods and services from suppliers.

- What authorizes Purchase Orders?

- Who signs the bills, and what amount can they sign single-handedly?

- Who approves payments?

- Etc.

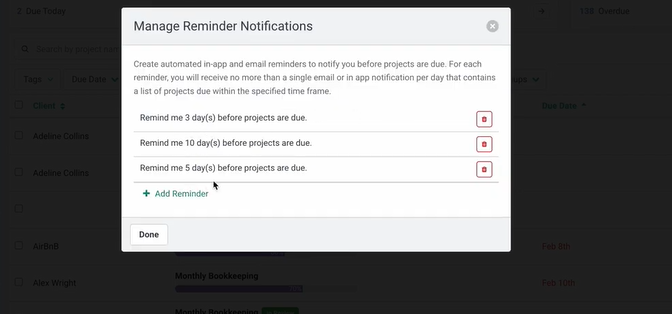

d. Setup Payment Reminders

Most Accounts Payable work usually comes at the same time of the month for a business owner. But with multiple business owners to help with Accounts Payable projects, you need a system to remind you of due payments so they don’t slip through the cracks.

The top accounting workflow management software options have due date reminders, which notify you about all client work approaching their due dates, depending on your predefined reminder frequency.

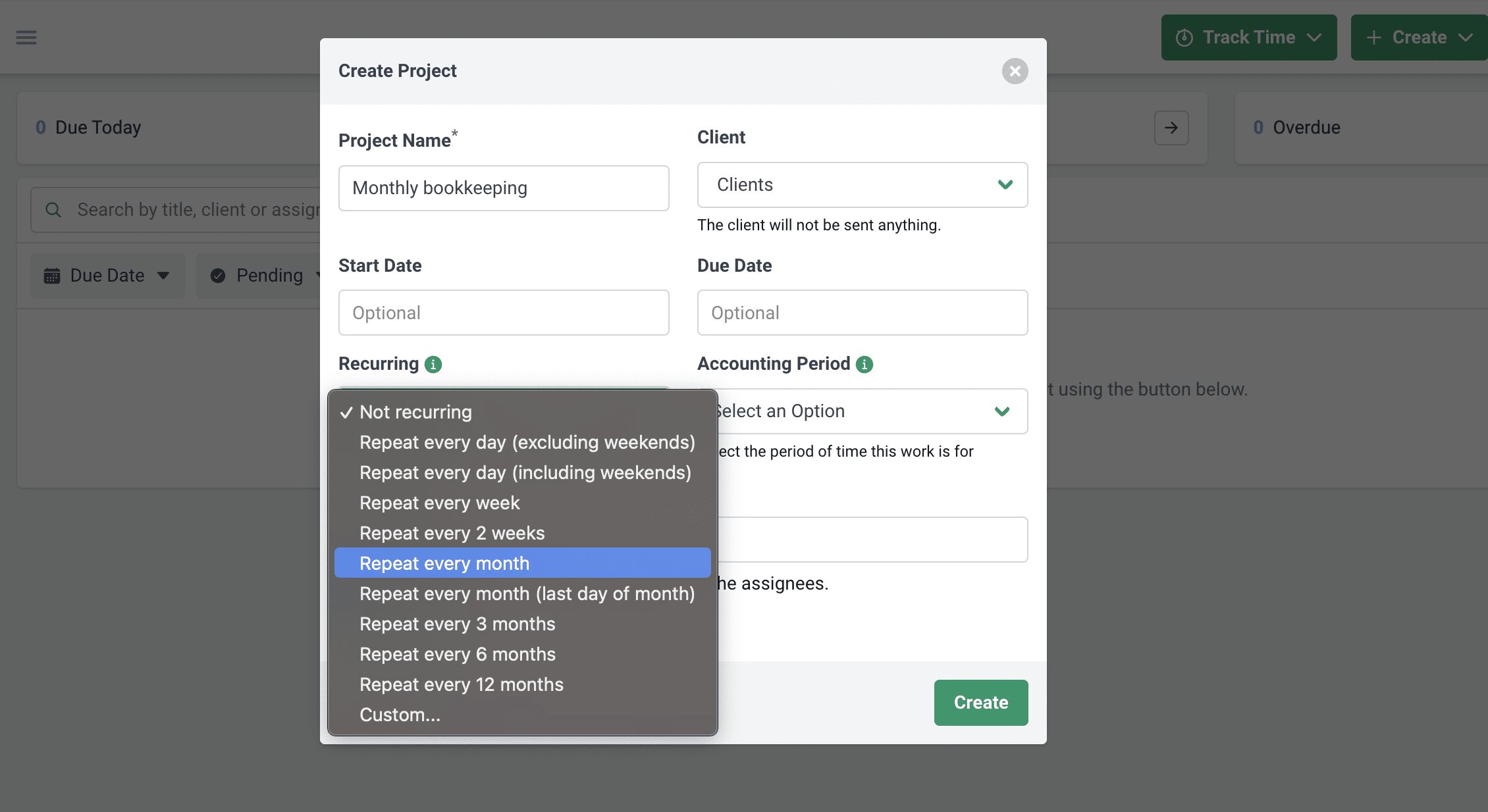

If you use Financial Cents to manage your workflows, you can also use the recurring work to make your Accounts Payable work recur. It saves you the stress of remembering or recreating your AP work from scratch. You will see the project on your dashboard each time you need to complete it.

e. Establish Clear Approval Workflows

A clear approval workflow not only helps your team know what to do at each stage of bill payment but also helps them know what to do when a bill cannot progress beyond each stage.

Establishing your approval procedures entails:

- Document Accounts Payable approval procedures.

- Defining the approvers at each stage of the process.

- Adding a timeline for the primary, back-up, and second-level approvals.

Using an Accounting Workflow Software to Manage Your AP Process

Like every other accounting process, success in Accounts Payable projects requires the ability to:

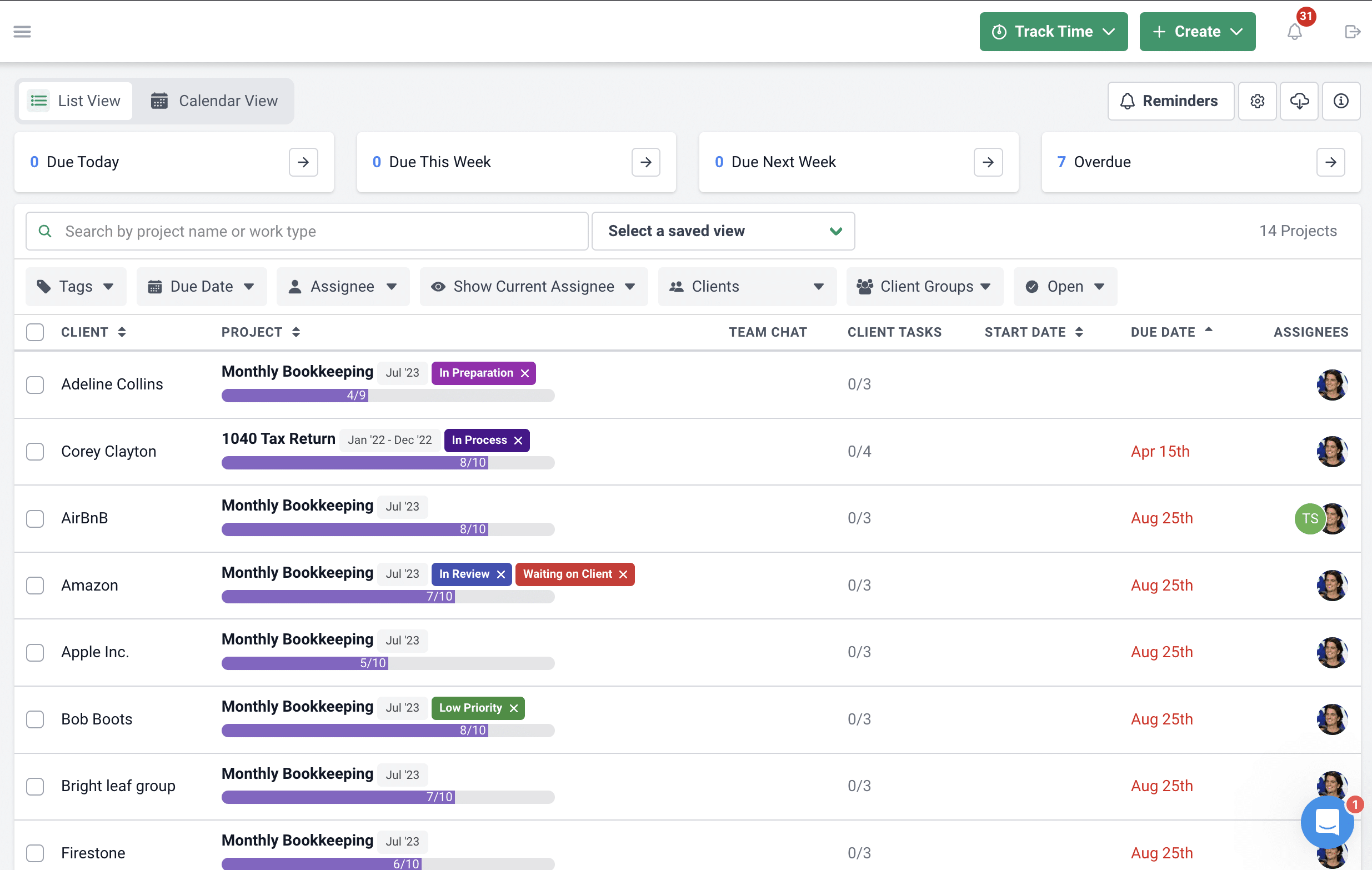

a. Gain Visibility into the Status of Tasks with the Workflow Dashboard

You can’t improve a process that you can’t see. AP workflow visibility gives you insights into the tasks delaying the process.

In Financial Cents, the workflow dashboard shows you your clients’ Accounts Payable work as they go through the stages.

Each AP work on your dashboard shows the client’s name, the due date, status, and progress bar. This gives you the information you need to make decisions that help you meet your client’s AP deliverables.

The Filter feature in Financial Cents workflow dashboard allows you to select all or specific AP work. This makes finding granular information easier. That way, you can ensure that nothing slips through the cracks.

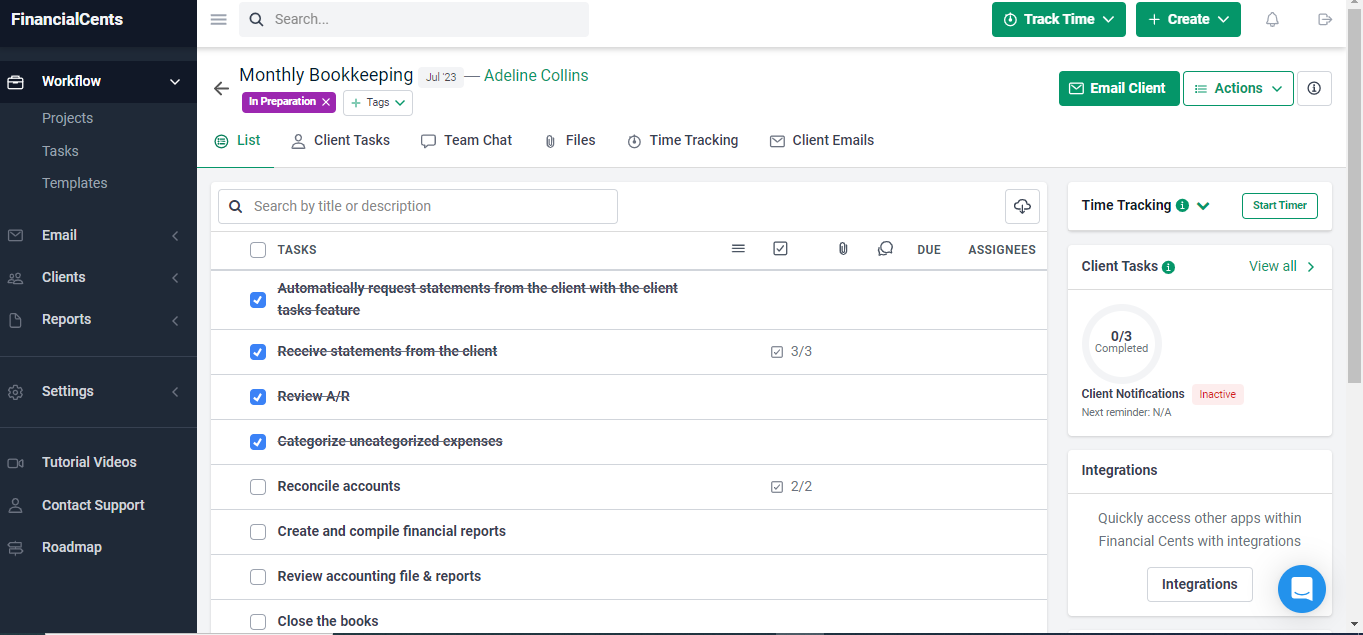

b. Standardize your Accounts Payable Process Using Workflow Templates

There are several steps between creating a Purchase Order and reconciling accounts. This can overwhelm even seasoned AP specialists when the workload is heavy.

In those moments, the AP workflow template reduces stress by outlining the step-by-step procedure to get work done. It also helps new hires complete work to your firm’s standard.

A documented workflow template improves your confidence in delegating work to your team.

Financial Cents’ workflow templates feature enables you to outline your preferred procedure for getting AP work done.

With its ChatGPT integration, you can use AI to generate an Accounts Payable template that you can customize as you like.

c. Automate Manual Tasks

The primary goal of accounting workflow software like Financial Cents is automating repetitive tasks.

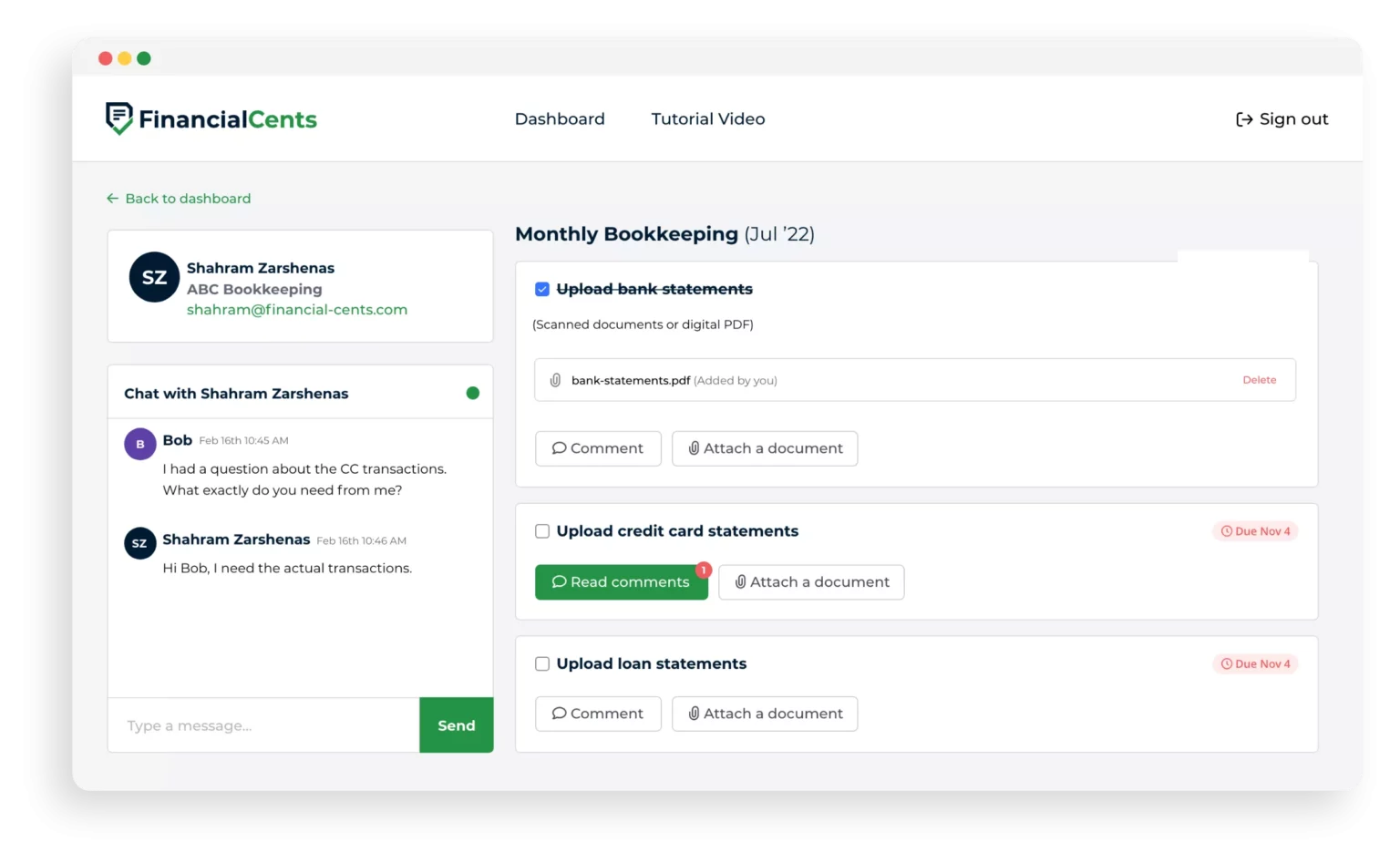

For example, the client task feature in Financial Cents allows you to request documents from clients by setting tasks up for them in the client portal. It also follows up with your clients automatically. This frees your employees to focus on core AP work.

With the E-signature feature, signing off on documents in real-time is easy. Your clients will no longer need to print and scan bills to approve documents.

d. Set AP Tasks to Recur Automatically

Knowing the Accounts Payable transactions your client repeatedly needs to make, you can set them up for the current and future dates.

For example, if your client pays a supplier every quarter, you can create a recurring project for the client in your accounting workflow software. If you do, you won’t have to create the project again when you need to do it in the next three or six months.

You won’t have to struggle with forgetting to do the work because it’ll be set up in your dashboard whenever it is due. This also saves you the time you’ll have used to create the project in three or six months.

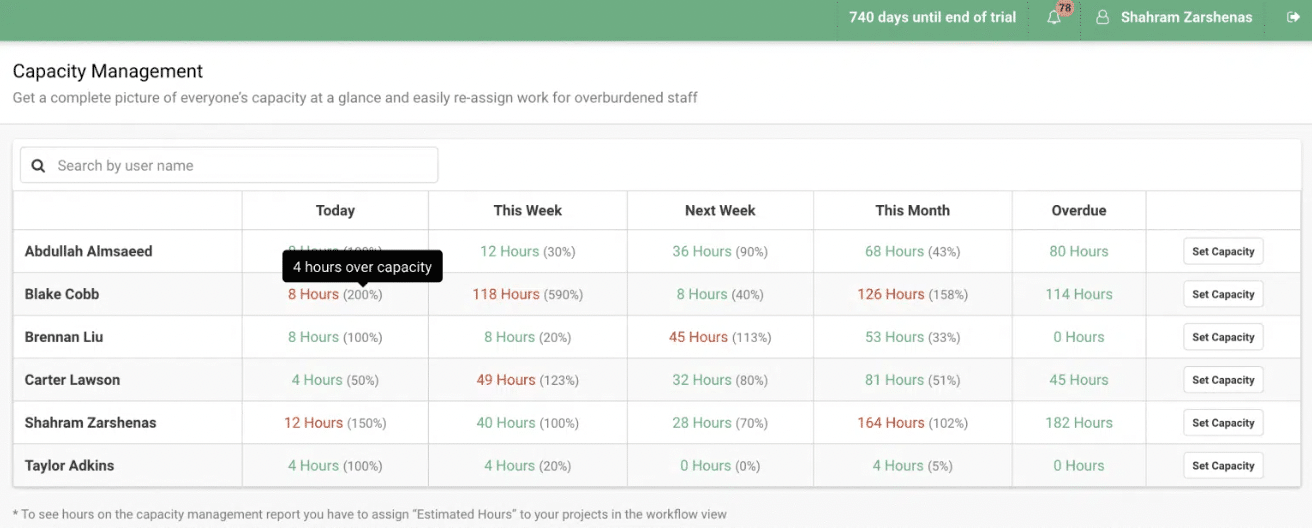

e. Assign and Delegate Tasks Effectively

Accounting workflow software enables you to assign work to your team members in a central place where you can track them as they do the work.

The capacity management feature in Financial Cents makes this even better. It shows you how much work each employee has on their plate. This helps you make sure that you are not overworking your staff members.

f. Automate Dependencies

The dependencies feature in the top accounting software takes the confusion out of AP workflows that involve multiple persons.

It helps each person know when they are due to complete their task in an AP project by sending them a notification. That way, it ensures that no AP work slips through the cracks.

Before their task is due, the feature also declutters the assignees’ dashboard so they can focus on the work at hand.

This feature saves you the stress of coordinating AP workflows manually.

g. Use Due Dates

Due dates remind you when your Accounts Payable work is due, so you don’t forget to complete them.

Your projects in Financial Cents are organized in their order of urgency. This lets you see which Accounts Payable work is nearest its due data at a glance.

Plus, Financial Cents’ Due Date Reminders feature lets you set up in-app and email reminders. You can choose when the reminders should be sent (by selecting how many days before the deadline you want to be reminded). Financial Cents will send you notifications about your due Accounts Payable projects.

This keeps you from forgetting the most urgent projects.

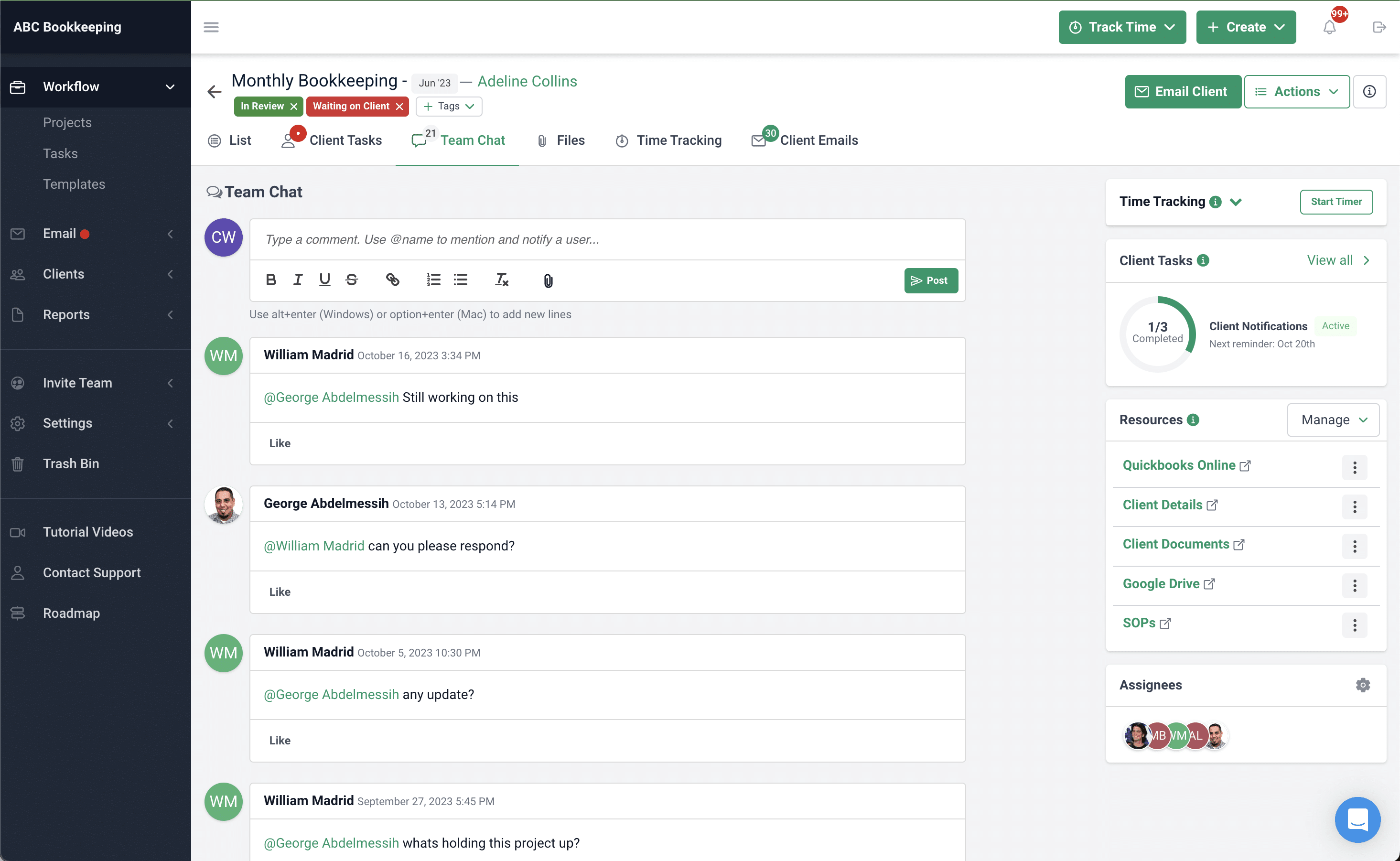

h. Communicate with Team Members

Sharing timely information with your team prevents bottlenecks, puts everyone on the same page, and makes the Accounts Payable workflow more seamless.

In Financial Cents, team communication comes in many forms. You can share information with your team where the Accounts Payable work is getting done.

The Comments feature allows you to ask or answer questions and hold work-related conversations with your team members on the Accounts Payable project.

With the @mention feature, you can tag specific team members in your comments so that the system pulls them directly into the conversation.

The Client Notes feature allows you to share updates relating to your AP clients on the client’s profile.

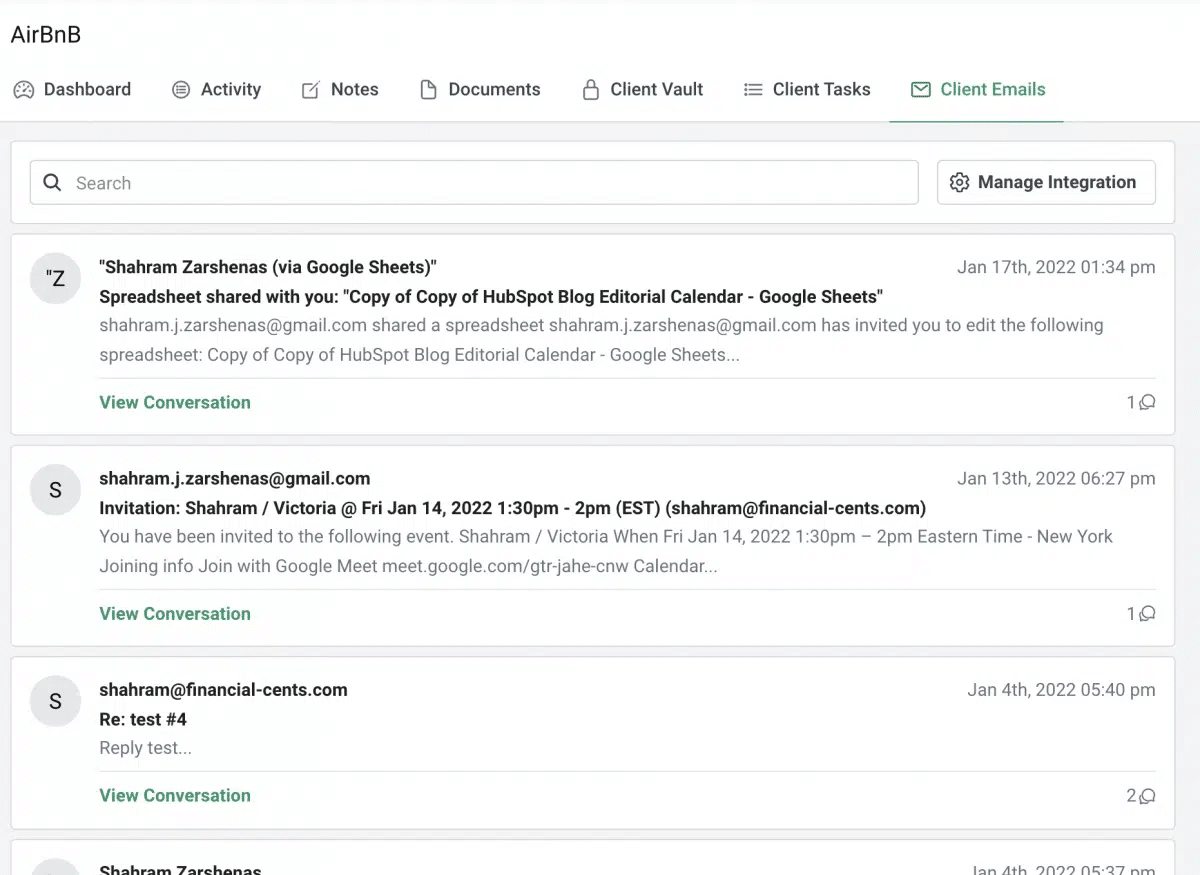

The Email Integration feature brings all your emails from clients into your Financial Cents workspace. This allows you to track all client emails from the same place you are doing their work, keeping things from slipping through the cracks.

Start Using Financial Cents for Your Accounts Payable Workflow Needs

Validating and paying a client’s short-term debts to their suppliers is stressful enough. Doing it month-in and month-out for multiple clients is much more stressful, especially with a manual process.

Unfortunately, AP workflows are messy without a system to coordinate them through the stages. This results in lousy Internal Accounting Controls, overpayment, duplicate payment, and late payment—the problems you are supposed to protect your clients from.

Fortunately, accounting workflow software helps accounting firms—regardless of the number of AP clients you have—to streamline their Accounts Payable workflow and focus on what matters most. This improves their clarity of vision to spot fraudulent and erroneous AP transactions.

Use Financial Cents for your accounting firm’s workflow needs.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Accounts Receivable Workflow Process: An Easy Step-by-Step Guide

This guide shows how you can continuously improve your Accounts Receivable process so that your clients’ day sales outstanding (DSO) will reduce…

Mar 14, 2024

Accounts Receivable Process Flowchart Guide (+ Diagrams & Templates)

AR teams need Accounts Receivable process flowcharts to visualize and standardize the collection of your clients’ accounts receivable. This keeps your team…

Mar 14, 2024