The Ultimate Bookkeeping Checklist to Streamline Your Firm (+Free Templates)

Author: Financial Cents

Reviewed by: Kellie Parks, CPB

In this article

Many accounting firms offer bookkeeping services to their clients because it plays a critical role in financial management and decision-making for businesses of all sizes. Accurate bookkeeping is essential for tracking income and expenses, preparing financial statements, and complying with tax regulations.

The bookkeeping process includes processing accounts payable and expense transactions, accounts receivable and sales transactions, reconciling key balance sheet accounts, and maintaining detailed financial records. To execute these tasks efficiently, you must have a streamlined bookkeeping process, which a well-structured bookkeeping checklist helps with.

Kellie Parks, a seasoned bookkeeper, said,

Think of it [a checklist] as milestones. Your base checklists are the milestones of workflow steps that need to be done. Then you add the subtasks, descriptions, and best practices."

It ensures you stay organized, complete tasks on time, have accurate financial reports, and can effectively manage your clients’ finances. You can also use this checklist to train new staff to promote consistency and quality in your bookkeeping services.

Below, you’ll see the components of different checklists, plus links to download them for free.

The Ultimate Bookkeeping Tasks Checklist for Firms

Depending on the size and needs of a business, you typically do bookkeeping for them daily, weekly, monthly, quarterly or yearly. Here are different checklists containing the tasks and steps involved for each bookkeeping frequency.

Daily Bookkeeping Checklist

Tasks included in a daily bookkeeping checklist are:

- Record daily transactions: Document all the company’s daily financial transactions, as this real-time recording helps maintain accurate financial records.

- Update cash flow (inflows and outflows): Track daily cash flow movements, including money coming in and going out of the business. This detailed record helps monitor the company’s financial health and promptly identify irregularities.

- Deposit checks and cash: Handle, record, and deposit incoming payments into the company’s accounts. This helps you maintain proper cash flow management, prevent loss or misplacement of funds, and provides an accurate record of all transactions.

Weekly Bookkeeping Checklist

For this type of bookkeeping, you should:

- Pay bills: Prompt payment of invoices ensures good relationships with suppliers and maintains a positive cash flow for the business. You can also avoid unnecessary late fees or disruptions of goods and services.

- Publish all receipts: Collect, organize, verify, and store all receipts related to business expenses and income. That way, the business has a comprehensive record of financial transactions for audits, tax purposes, or financial analysis.

- Review Accounts Payable: This involves verifying and managing the money the business owes to its suppliers or vendors. It provides an accurate picture of the business’s financial obligations.

- Reconcile POS system: Analyze the company’s internal financial records against the POS system data to discover discrepancies. This practice ensures all sales transactions are accurately recorded and accounted for.

- Reconcile merchant accounts such as Stripe and Paypal (if applicable): If the business uses Stripe, check its internal statements with the Stripe platform data to see if there is a mismatch.

Download our free weekly bookkeeping checklist template

Monthly Bookkeeping Checklist

Here are the tasks included in a monthly checklist:

- Review bank, credit card, and loan statements: Gather the bank, credit card, and loan statements for the previous month and examine them for errors.

- Prepare accounts payable: Compile, organize, and resolve all outstanding payments to suppliers and vendors by doing the following:

- Publish all receipts from the receipt app: Use a receipt app or digital receipt management system to capture, categorize, and store receipts electronically. Then, during the review of bills and expenses for accounts payable, refer to the app’s receipts to confirm the charges’ accuracy.

- Review accounts payable report & pay bills: Generate an accounts payable report from your accounting system and execute payments according to the report. Once done, record the payment details in your client’s accounting system, linking the payment to the respective bill or invoice. This ensures accurate tracking of payments made and future reference for financial reporting.

- Reconcile accounts payable against supplier statements.

- Review accounts receivable: The reverse of accounts payable, it involves examining outstanding invoices and payments due from clients or customers. The purpose is to collect timely payments, detect overdue ones, and keep a healthy cash flow.

- Categorize uncategorized expenses: Assign proper categories to expenses that were not initially classified. This will show where the business allocates funds to support budgeting decisions, financial analysis, and tax reporting. It is crucial for accurate financial reporting and decision-making.

- Reconcile bank accounts: This task guarantees the accuracy of all financial transactions and contributes to the business’s financial integrity.

- Reconcile credit card transactions: Compare the company’s internal financial records with credit card statements to identify irregularities.

- Reconcile POS systems: Analyze the company’s internal financial records against the POS system data to discover discrepancies. This practice ensures all sales transactions are accurately recorded and accounted for.

- Reconcile merchant accounts such as Stripe and Paypal (if applicable): If the business uses payment platforms, check the platform’s reports against the accounting program balances to verify accuracy.. These payment gateways should be reconciled like bank accounts to confirm the data is correct. Just like bank accounts, the ending balances may not be zero at the end of the month, so getting the reports from the payment platform is critical.

- Reconcile other key Balance Sheet accounts: Your clients may have loans, government liabilities, shareholder loans, and the like, and reconciling them will ensure the accuracy of these accounts.

- Balance the General Ledger against the reconciliation end balances and the sub-ledger reports: Occasionally, the General Ledger balances may not correspond to the sub-ledger accounts on the Balance Sheet and P&L. Verifying end balances match the Trial Balance is a critical step in ensuring the reliability and integrity of financial information. Verifying monthly will make it much quicker to spot irregularities than waiting until the year-end when much more data and possible hiccups have piled up.

- Create and compile financial reports: Run reports and review all financial data, including (but not limited to) Profit & Loss statements, Balance Sheet reports, and Cash Flow statements. This lets you gain valuable insights into the business’s financial performance and help your clients make informed decisions. These reports provide a snapshot of the company’s financial health, aiding in compliance, strategic planning, budgeting, and overall financial management.

- Share reports and insights with clients and file them for future reference: Ensure that reports and analyses are shared with your clients and that they have a copy of the reports under their custody. For data location redundancy and E&O purposes, ensure you also have control of copies of the reports. Name them consistently, report to report, and client to client to make retrieving them a breeze.

- Close books with a password: Don’t let all your great work be unwittingly undone! Closing the books with a password ensures that there is a warning to someone changing transactions in a past period. In the event that they override the close, there will be an Exceptions to Closed Period report.

Download our free monthly bookkeeping checklist template.

Yearly Bookkeeping Checklist

For the yearly checklist,

- Review year-end bank and credit card statements: At the end of the year, conduct a thorough review of bank and credit card statements to identify issues or areas of improvement. This practice helps with decision-making for the future and facilitates year-end reporting.

- Ensure monthly bookkeeping is complete: Verify that all monthly bookkeeping tasks like account reconciliation, payables, and receivables have been successfully completed throughout the year. This is essential for maintaining financial health and managing your client’s business effectively.

- Update the bookkeeping (if needed): Make any necessary adjustments or corrections to the financial records to reflect the most recent transactions and balances.

- Adjust entries: Correct any errors or omissions in the bookkeeping so the financial data is precise and up-to-date.

- Run & match reconciliation reports with statement balances: This is a crucial step in verifying financial records’ accuracy. It involves comparing the reconciled accounts to the statement balances to discover inconsistencies.

- Balance the General Ledger against the reconciliation end balances and the sub-ledger reports: This should be verified at year-end even if it has been done monthly.

- Create and compile draft financial reports: Generate reports consisting of a summary of financial data to present the business’s financial status and performance accurately.

- Process year-end data: Compile and review all financial information from the entire year for accuracy to assess financial performance and plan for the upcoming year. It involves two steps:

- Verify prior year financials match the prior year’s tax return: Make sure there is an alignment with data from the previous year and its tax return to ensure consistency and accuracy between financial reporting and tax obligations. This helps maintain compliance with tax regulations, minimizes the risk of penalties or audits, and provides a reliable financial foundation for future planning.

- Ensure all the W9s are in for the 1099’s to be done: Confirm that all W9 forms are submitted to complete the 1099 process efficiently, which is essential for tax reporting purposes. This step streamlines the tax preparation process, supports financial transparency, and aligns with regulatory requirements for reporting income and payments made during the year.

- Prepare and share year-end financial summary: Compile a comprehensive overview of the business’s financial performance and position throughout the year. Summarize key financial data and insights and share them with your client so they can understand their business’s financial performance, position, and future prospects. In turn, they can share this report with relevant stakeholders, promoting transparency and building trust.

- Complete year-end meeting with client: After sharing the summary, meet with the client to discuss the report, address any concerns, and plan for the upcoming year. This lets both of you align on strategies for continued success.

- Get final client sign-off on reports: Have your clients sign the final reports and tuck them away, one copy for them to have and one for your firm.

- Close the books with a password: If these are annual engagements, and you are not closing the books with a password monthly, ensure you do it at year-end.

Manage Your Bookkeeping Checklist Effectively with Workflow Automation

In addition to the checklists we provided, you need to use workflow automation software for the best results. An accounting workflow management software is a specialized software solution designed to automate repetitive and time-consuming accounting processes and tasks. This increases efficiency, accuracy, and productivity. An example of such software is Financial Cents, and it has the following features:

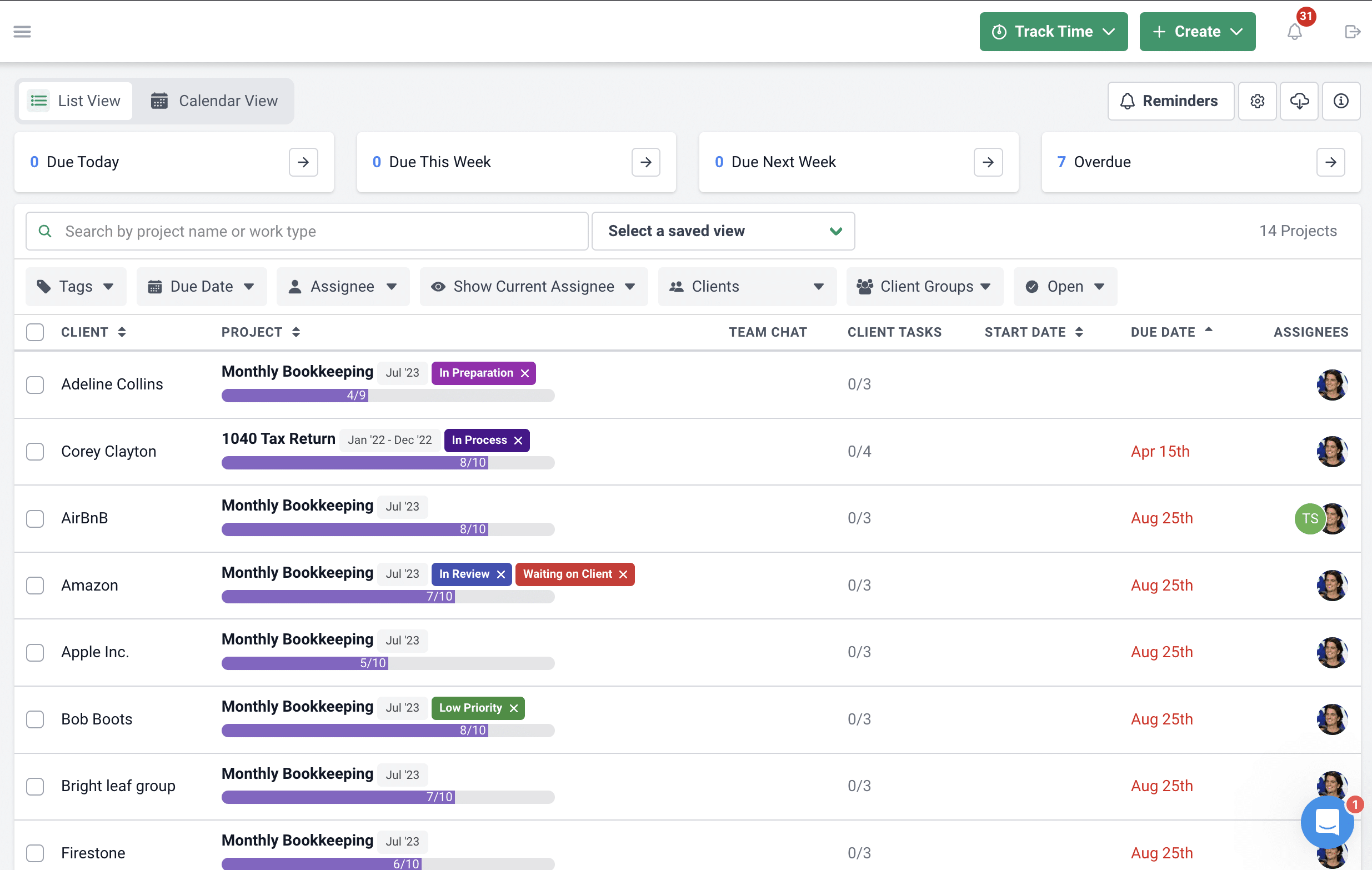

Workflow Dashboard

A centralized hub where users can view and manage all tasks, deadlines, and progress. You can see what is ‘Due Today,’ ‘Due This Week,’ ‘Due Next Week,’ and ‘Overdue’ so you don’t miss deadlines.

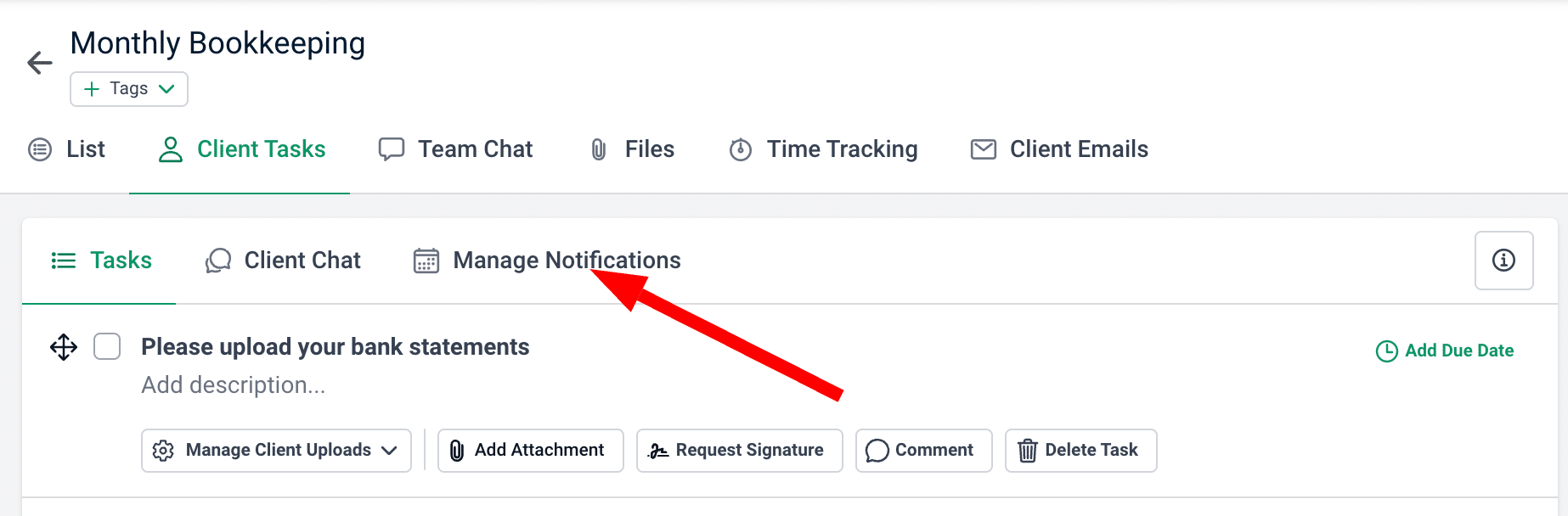

Workflow Automation

Automates tasks like following up with clients and reminding them to upload the information you need with the client task feature, saving you time and effort.

There are also automated reminders about upcoming due dates so you can stay on top of things.

Recurring Projects (such as weekly and monthly bookkeeping)

Users can set up recurring tasks for weekly, monthly, or quarterly bookkeeping activities instead of creating new projects from scratch every time. This eliminates repetitive tasks and saves time.

Due Date Tracking

Enables users to assign deadlines to tasks and track their progress towards completion. This feature helps prioritize activities, avoid delays, and ensure you complete all bookkeeping tasks on time.

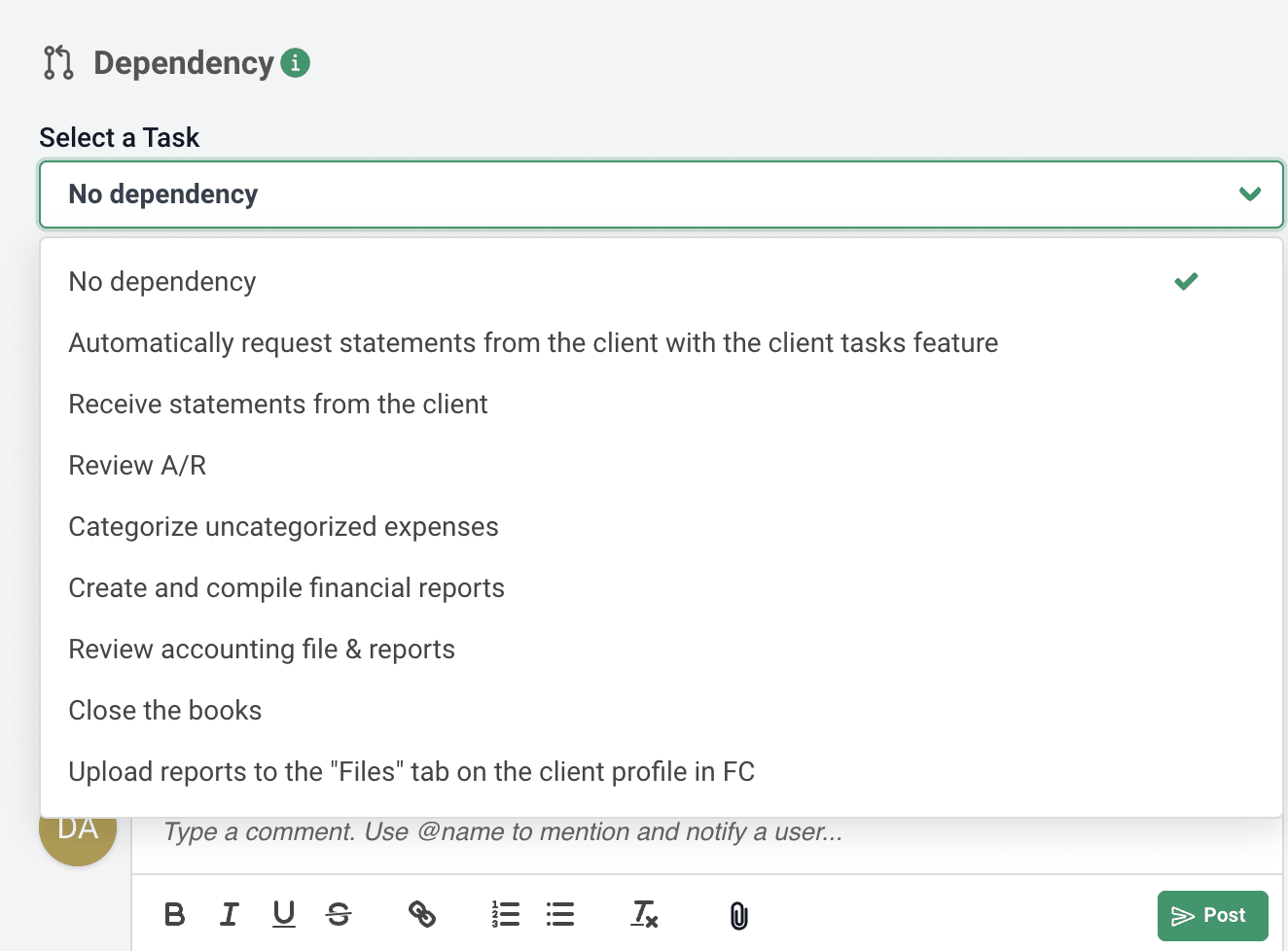

Task Dependencies

Establishes relationships between tasks to ensure that involved parties complete them in the correct sequence. Task dependencies help maintain the flow of the bookkeeping process and prevent bottlenecks caused by incomplete or out-of-order tasks.

Use Financial Cents To Manage Your Firm’s Bookkeeping Workflow

Financial Cents offers a user-friendly interface for efficiently managing your firm’s bookkeeping workflow. With features like workflow automation, due date tracking, and task dependencies, you can streamline your accounting processes, save time, and ensure timely completion of tasks.

We also have free template checklists to make bookkeeping easier and maintain consistency and accuracy in financial reporting.

Claim your free trial today and experience the benefits of automated bookkeeping processes.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features of a Great Accounting Document Management System

Here’s all you need to know about an accounting document management system and how it can make you more organized and save…

Apr 26, 2024

5 Simple Time-Saving Tips for Managing Uncategorized Transactions

Manually resolving multiple uncategorized transactions steals valuable time from accountants and bookkeepers. But there’s a solution. Here are five simple, time-saving tips…

Apr 24, 2024