We all know the famous expression, “Time is money.” This is doubly true for accountants and bookkeepers.

Every minute spent manually resolving uncategorized transactions is a minute taken away from other high-value tasks that could be done.

The challenge of uncategorized transactions is real, and the time they steal can add up quickly.

In this article, you’ll find five practical tips for managing uncategorized transactions and streamlining your workflow. By implementing these tips, you can free up valuable hours and focus on what matters most—serving your clients strategically and growing your firm.

What Are Uncategorized Transactions?

As the name implies, uncategorized transactions are transactions without specific categories within your accounting software. They’re floating entries without a specific label, such as “rent,” “travel expenses,” or “salaries.” This lack of categorization makes it difficult to accurately track your clients’ income and expenses or reconcile their accounts.

Uncategorized transactions happen because of various reasons, including:

- New vendors or unfamiliar transactions: When a client uses a new vendor for a purchase, you may need to manually categorize the transaction so your accounting software recognizes it in the future.

- Unclear descriptions of bank statements: Bank statements often use vague terms or limited characters, making it difficult to understand the purpose of a transaction. This lack of detail makes it difficult to distinguish between business expenses and personal spending, leading to a backlog of uncategorized transactions for accountant professionals to sort through.

- Manual data entry errors: Typos or inconsistencies during manual data entry can lead to uncategorized transactions.

- Client-provided receipts: If a client provides a physical receipt that needs to be manually entered, it might be left uncategorized until you review it.

- Clients not providing receipts: Compliance requires receipts, particularly for large purchases, and sometimes, it can be difficult to gather these source documents from clients, leaving a transaction in limbo while waiting on the receipts.

Uncategorized transactions can steal valuable time from you and affect your firm in other ways, as you’ll see below.

Effects of Uncategorized Transactions

-

Inaccurate financial reporting

Uncategorized transactions can skew financial statements, making it difficult to generate accurate reports. Because these statements (including the balance sheet and income statement) are inaccurate, they can mislead clients about their profitability, solvency, and overall financial position. It can also make it difficult for you to complete specific tasks.

Imagine creating a budget for a client when a significant portion of their income and expenses remain uncategorized. It will neither be easy nor accurate.

-

Missed tax deductions:

Uncategorized transactions, particularly those related to business expenses, can easily slip through the cracks come tax season. This can lead to clients missing out on legitimate tax deductions, resulting in them overpaying taxes.

For instance, you might overlook an uncategorized office supply purchase during tax preparation. This oversight could cost the client valuable deductions that could have lowered their tax liability.

-

Decision-making challenges

To make informed financial decisions, you need financial data. Unfortunately, uncategorized transactions compromise this data. As a result, clients need a clearer understanding of their spending habits and financial standing.

This can lead to poor investment choices and missed growth opportunities.

For example, say your client recently experienced a surge in sales, leading to a high volume of transactions. You left out many transactions due to some online payment descriptions’ sheer volume and complexity.

Now, these uncategorized transactions distorted the company’s financial statements, making it difficult to assess profitability and track key metrics like cost of goods sold. Clear financial data could have helped the company’s ability to identify areas for cost optimization and make informed decisions about future investments.

-

Client dissatisfaction

These kinds of transactions can cause your clients to feel dissatisfied and affect your relationships. They might feel you’re not managing their finances well or not providing them with the level of service they expect.

Also, the back-and-forth communication required to clarify categorizations can be time-consuming and create friction in the client relationship.

Consider a situation where a bookkeeping error caused by uncategorized transactions results in a client missing a critical funding deadline. Or they incur tax penalties due to missed deductions. The client will certainly be unhappy with you and might even leave your firm.

In essence, you can’t afford to treat uncategorized transactions with levity. They are a serious issue requiring you to be proactive. Here’s how.

Managing Uncategorized Transactions: 5 Time-Saving Tips

Here are five effective tips to manage uncategorized transactions and save precious time.

Ditch Manual Processes Like Spreadsheets

Traditionally, accountants and bookkeepers have relied on spreadsheets to categorize transactions.

While spreadsheets can be effective for simple tasks, they become clunky and time-consuming when dealing with large volumes of work. Sorting through line items manually is a recipe for wasted time and errors. Spreadsheets also require constant maintenance to remain current and get the best results.

That’s why we recommend transitioning to a system that allows quick categorization and easy filtering of uncategorized transactions. One such system is ReCats by Financial Cents.

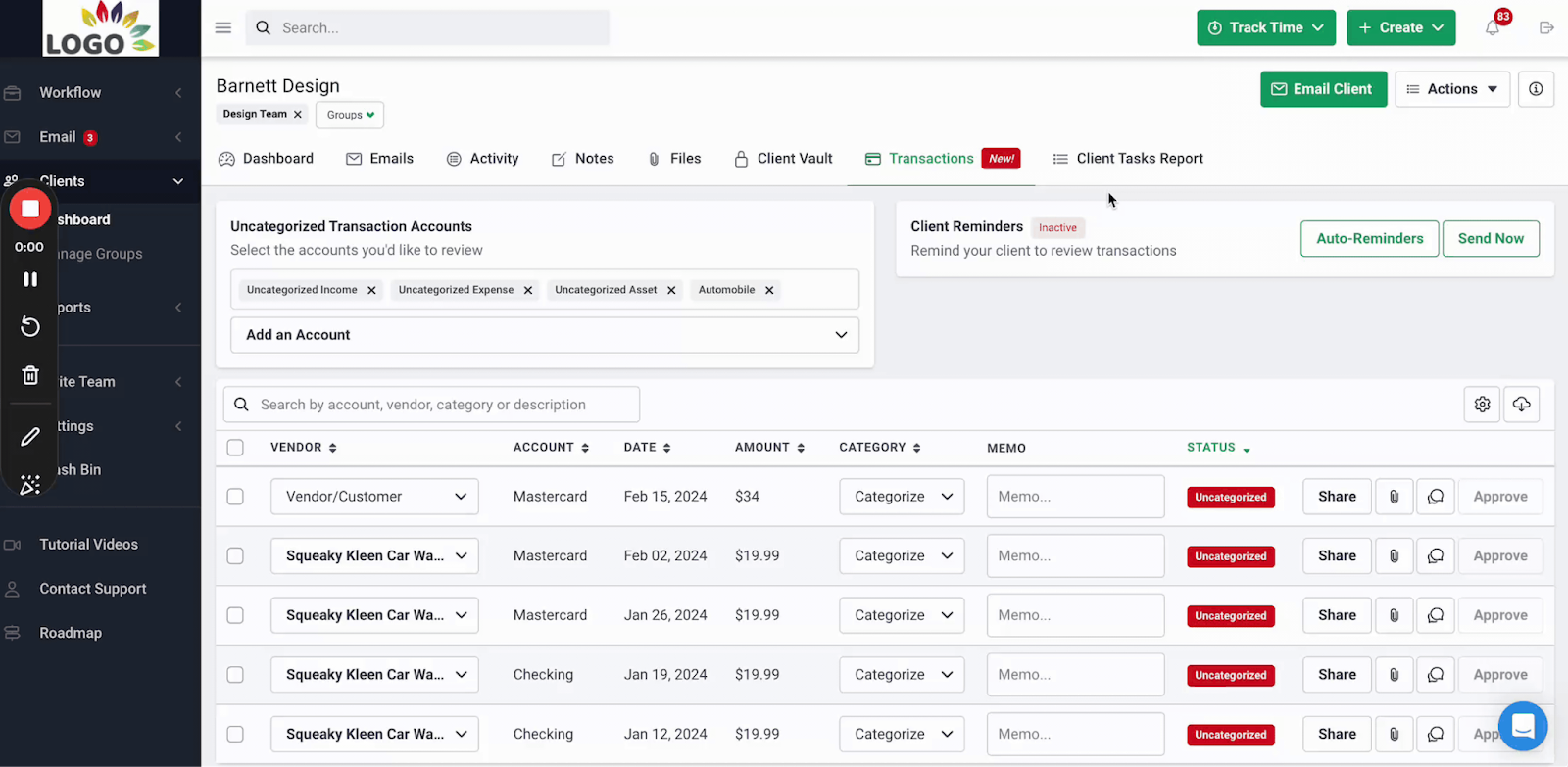

It lets you automatically retrieve uncategorized transactions from your client’s QuickBooks Online account, eliminating the need to create spreadsheets whenever you access their files manually. This ensures you and your clients have the most current data, saving time and improving efficiency.

Use an Uncategorized Transactions Management System

Consider using an uncategorized transactions management system (UTMS) to manage these transactions. These systems have features that simplify the identification and categorization of transactions, reducing the time and effort of the process.

ReCats comes into play here again. We designed it specifically for accountants and bookkeepers to simplify the categorization process. With ReCats, you can categorize transactions in seconds and free up valuable time for more strategic tasks.

Some of the features of ReCats include:

- Effortless categorization: Its intuitive interface makes it easy to categorize transactions.

- Seamless integration with Quickbooks: ReCats integrates with Quickbooks so you can keep a central record of all your client’s transactions, notes, and documents.

- Client collaboration: It facilitates collaboration between you and your clients by allowing you to send them requests about certain uncategorized transactions and allowing them to respond to those requests, all within the platform. They can upload necessary documents or files that provide more context to help you with the categorization.

Batch-Categorize Transactions

Instead of categorizing transactions individually, group similar transactions together and categorize them in batches. This approach can significantly improve efficiency, especially for recurring expenses like utility bills or subscriptions.

ReCats allows you to batch-categorize transactions. Simply select all the transactions without categories and send them to your client. That way, they can simultaneously provide all the information you need, thus saving time.

Set up Auto Reminders for Clients

Sometimes, clients need to be reminded to respond to your requests, but you may need more time to send them reminders. This can cause delays and disrupt your workflow.

To resolve this, use Financial Cents’ auto reminders feature. It lets you send follow-up messages to your clients at set intervals:

These gentle nudges can significantly improve client response rates and keep the categorization process moving forward.

Schedule Regular Review Sessions

Dedicate specific times within your week or month to reviewing and categorizing uncategorized transactions. Depending on the volume of transactions you handle, this could be a daily or weekly task. Stick to the schedule you choose, as consistency is very important.

Doing this regular review prevents transactions from piling up and creating a backlog. Instead, you’ll be able to stay on top of these tasks and help your clients maintain accurate financial records.

Use Financial Cents To Manage Your Workflow and Uncategorized Transactions

Uncategorized transactions can drain your time and resources, hindering your ability to deliver exceptional service to your clients. But there’s a solution:

Financial Cents is an accounting practice management software with additional features that help simplify the transaction categorization process. How? It makes it easy to ask clients to clarify transactions, automate manual processes, and allows you to batch-categorize transactions.

Furthermore, Financial Cents helps you manage your workflow and make your firm more efficient with its templates, customer relationship management (CRM) features, and automation abilities.

Excellent article!