Free & Comprehensive Accounts Payable Excel Template (+Google Sheets)

Author: Financial Cents

Reviewed for accuracy by: Kellie Parks, CPB

In this article

Cash flow is the lifeblood of any business. It dictates your ability to meet financial obligations, invest in growth, and maintain smooth operations.

Managing your client’s cash flow is part of your duties as an accountant or bookkeeper. In this case, it involves managing their Accounts Payable (AP).

You need to have a process to ensure they make timely payments for the goods and services received. Without a proper system for tracking AP, it’s easy to lose sight of upcoming due dates, miss early payment discounts, and incur late fees. This can strain your cash flow and damage relationships with vendors.

What’s the solution? Use an AP template. It provides a centralized and organized system for tracking invoices, managing payments, and maintaining a clear picture of outstanding liabilities.

We’ve created a free Accounts Payable Excel template (also available for Google Sheets) to simplify your AP tasks, and we’ll share it below.

Things to Include in Your Accounts Payable Template

Every AP template requires certain elements to keep invoice processing smooth and efficient. Here’s a breakdown of the essential elements it should have:

a. Vendor Information

i. Vendor Name: This is the primary identifier for the company your clients owe money to. Having it readily available simplifies tasks like searching for specific invoices or contacting vendors for clarification.

ii. Vendor Contact Information: Clear communication is key in any business relationship. You need easy access to the vendor’s email and phone number to ensure you have their details handy for processing bills, order confirmations, or any questions that may arise.

iii. Vendor Address (Optional): While not always necessary in the digital age, having a physical address on file can be helpful for sending paper checks or other physical correspondence.

b. Invoice Details

i. Bill Number: This unique identifier the vendor assigns allows you to reference a specific invoice whenever needed easily.

ii. Bill Date: The date the vendor issued the bill. This date helps track the length of time a bill has been outstanding.

iii. Due Date: This is the critical deadline for making payment to avoid late fees and penalties. So, keep a close eye on this date so you don’t miss it.

iv. Bill Amount: The total sum owed to the vendor for the goods or services provided.

v. Payment Terms: Clearly outlines the payment conditions, such as “net 30 days” or “2% discount if paid within 10 days.” Understanding these terms is essential for making timely payments while taking advantage of discounts.

vi. Balance Due: This dynamic field reflects the remaining amount owed to the vendor after factoring in any partial payments made.

vii. Status: Tracks the bill’s lifecycle. Common status options include “Open” (awaiting payment), “Paid,” or “Overdue.” This provides a quick visual cue on each bill’s payment status.

c. Payment Information

i. Payment Date: Records the date you settled the bill, providing a clear audit trail for your financial records.

ii. Payment Amount: The specific sum paid towards the bill. This can help reconcile payments with your bank statements.

iii. Payment Method (Optional): Specifies how you made the payment (check, ACH transfer, etc.) for easy reference and categorization.

iv. Transaction Reference Number (Optional): This is a unique number your bank assigns you during an electronic payment. It allows you to match the transaction with the corresponding invoice easily.

Optional Components

i. Category: This column allows you to categorize bills by expense type (e.g., rent, office supplies, marketing). Categorization simplifies expense reporting and helps identify areas for potential cost savings.

ii. Project: This column lets you assign bills to specific projects if you manage multiple projects. It enables you to track project-related expenses and ensure accurate budgeting.

Our AP template has all the above elements, allowing you to manage your cash flow effectively, pay vendors on time, and maintain strong relationships with them.

Use this Free Accounts Payable Excel Template (Also available in Google Sheets)

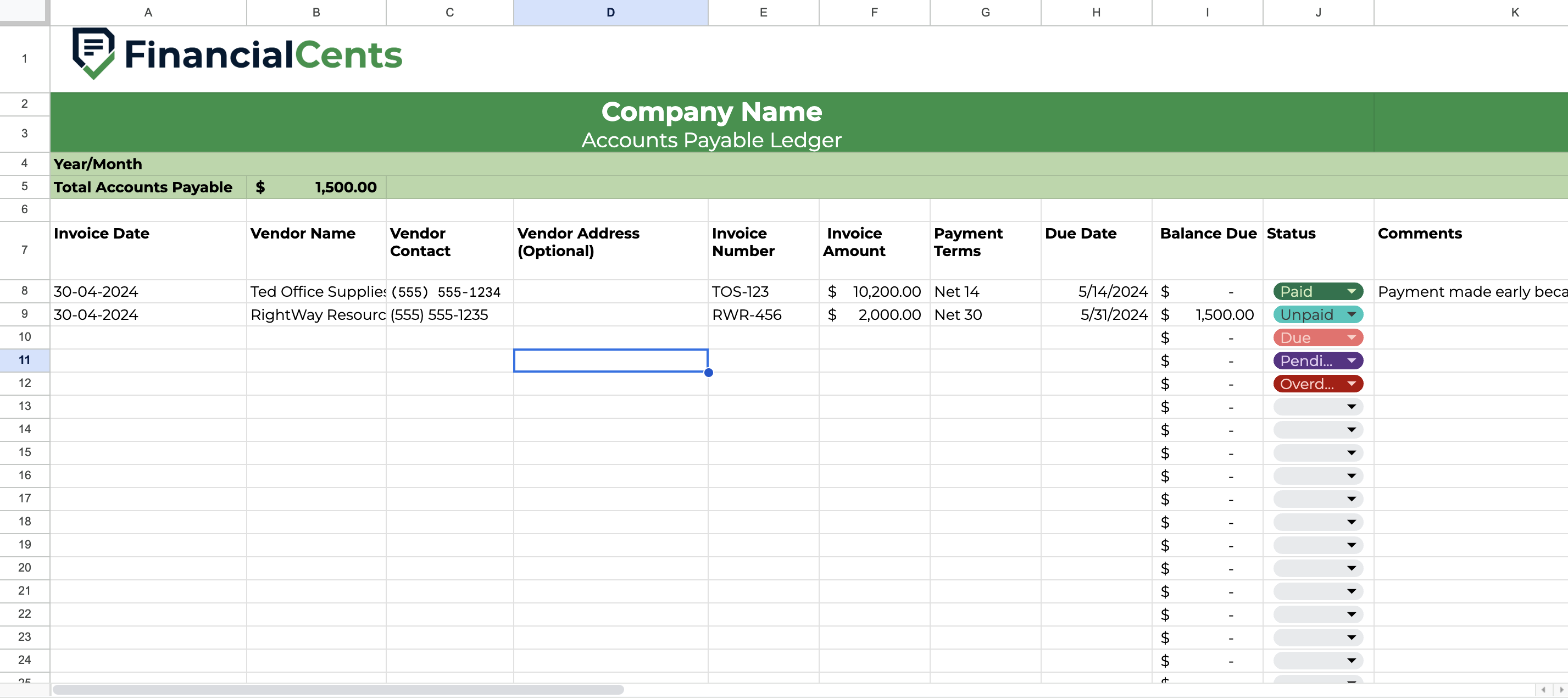

Here’s what our AP template looks like:

As you can see from the image above, it contains the essential components we’ve discussed, like bill date, vendor name, vendor contact, vendor address, invoice number, invoice amount, payment terms, due date, balance due, status, and comments.

In addition, it’s embedded with formulas to automate calculations, saving you valuable time and minimizing errors. For instance, as you enter bill data and record payments, the template automatically updates the following:

- Balance Due: This column automatically reflects the remaining amount owed to the vendor after considering any partial payments made.

- Total Accounts Payable: The template calculates the sum of all outstanding invoice balances, providing a real-time snapshot of your total AP liability.

Free Accounts Payable Excel Template

Benefits of Using the AP Excel Template

Imagine managing your AP with scattered receipts, emails, and handwritten notes. Sounds chaotic, right? An AP template eliminates this clutter, making your AP process efficient and error-free.

Let’s explore the key advantages you’ll gain by incorporating this template into your financial workflow.

a. Improved Organization and Record-Keeping for Accounts Payable

No more scrambling through emails or paper files to find specific invoices. This template centralizes all your AP data in one convenient location, making it easy to access and manage your vendor bills.

b. Efficient Tracking of Invoices and Payments

Gain real-time visibility into your outstanding invoices and payments. With all the details conveniently located in one spreadsheet, you can effortlessly monitor upcoming due dates, identify overdue payments, and ensure timely settlements.

c. Timely Bill Payments To Avoid Late Fees and Penalties

Late fees and penalties can eat into your client’s profits. But by using this template, you’ll be able to stay on top of due dates with clear visual cues, reminding you to prioritize payments before they become overdue. This saves your clients money and strengthens their relationships with vendors.

d. Simplified Financial Reporting and Analysis

Financial reporting becomes a breeze when you have accurate and organized data. The template lets you easily generate reports that provide valuable insights into your spending patterns, vendor trends, and overall AP performance. This information helps clients make informed financial decisions and optimize cash flow management.

Streamlining Your Accounts Payable Process

Our free AP template is a powerful tool, but it’s the first step toward achieving a truly streamlined AP process. Here are some additional strategies to consider for even greater efficiency:

Consider Using AP Automation Software for Manual Tracking

As your client’s business grows and invoice volume increases, manually tracking AP can become cumbersome and time-consuming. Fortunately, various AP automation software solutions are available. These software programs offer a range of features designed to streamline the AP process, including:

- Automated Bill Processing: Say goodbye to manual data entry. AP automation software can automatically capture bill data from emails or portals, reducing errors and saving valuable time.

- Approval Workflows: Establish automated workflows to route bills for approval by designated personnel, ensuring proper oversight and adherence to spending limits.

- Online Payments: Simplify bill payments by electronically sending payments directly to vendors through the software platform.

Some popular AP automation software options include Dext, QuickBooks and FreshBooks.

Document Your Process

A clear understanding of your current AP workflow is essential for identifying areas for improvement. It serves as a roadmap for your team, ensuring everyone understands their roles and responsibilities within the accounts payable workflow.

A helpful tool for documenting your process is an Accounts Payable flowchart. This visual diagram maps out the steps in handling bills, from receiving and approval to payment processing and record-keeping. By creating a flowchart, you can identify potential bottlenecks and areas for improvement.

Optimize Your AP Processes and Workflow

The business world constantly evolves, and your AP processes should keep pace. Don’t settle for a static system. Regularly review and update your AP workflow to ensure it remains efficient and adapts to your changing business needs. Here are some areas to consider for optimization:

- Leverage technology: Explore new technologies and automation tools that can further streamline your AP tasks.

- Negotiate payment terms: Negotiate extended payment terms with vendors whenever possible to improve your cash flow.

- Standardize procedures: Establish clear and consistent invoice handling and approval procedures to minimize errors and delays.

- Early payment discounts: Take advantage of vendor discounts offered for early payments. This can generate significant savings.

Final Thoughts

Effective cash flow management is important to any business, and an effective AP system is the key to achieving it.

We shared our free AP template to organize your clients’ vendor information, track bills and payments, and automatically calculate key metrics. The results? Improved organization, efficient tracking, timely bill payments, and simplified financial reporting for your clients.

You can use Financial Cents to assign and delegate AP tasks to other team members, track their work status, automate certain tasks, and manage the entire project.

There are also over 50 workflow templates available you can use to streamline your workflow and become more efficient. If you need a particular template we don’t have available, use our chat GPT integration to create them. For instance, if you want specific elements included in your AP template, you can instruct AI to create it for you, and it’ll do so in seconds.

Use Financial Cents for your workflow management.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Dive Deeper

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Comprehensive Guide to Accounting Policies and Procedures (+Free Template)

Don’t have an accounting policies and procedures manual for your firm? Learn how to create one using our free template.

Jun 10, 2024

Accounting Lead Generation: A Comprehensive Guide for Accounting Firms

Accounting lead generation is unique in the sense that there is no shortage of accounting leads (because every business needs accounting services).…

Jun 04, 2024