When Accounting Workflow Meets Document Management

Author: Financial Cents

In this article

Digital transformation is critical for accounting professionals, but knowing when and how to reduce the number of applications your firm uses is just as important.

Not Striking the right balance will have you spend more time coordinating software solutions instead of doing the client’s work.

However, with software integration, several tech tools can be used without getting distracted with admin work. These integrations enable you to scale back on the number of apps you need to open individually.

Take Workflow and Document Management for example. At every point of the day, your team members need client documents to get work done in your accounting workflow software. Connecting both apps means they can access your document management system (DMS) from your workflow software.

This helps your employees’ attention to focus on one tool. The time your team gets back and improvement in work quality is better experienced than explained.

These are only possible when your workflow tool integrates with your document management system.

In this article, we explore what it means for the average accounting firm to enjoy the features of its DMS from its workflow software.

Understanding the Landscape

Accounting Workflow: An accounting workflow is the series of steps that an accounting team follows to complete a project. Accounting workflow software helps accounting firms manage the series of steps (tasks) by tracking the status of work, who is assigned what project, and which team member is overworking.

Accounting Document Management is the system accountants use to collect, store, and retrieve documents when needed. An accounting Document Management System (DMS) is a software that enables an accounting firm to collect and store electronic documents for client projects.

When integrated with your workflow tool, you wouldn’t need to open it several times a day (or search through your client database each time you need it) to retrieve client documents.

Challenges of Using Unsynchronized Workflow Software and Document Management System

1. Workflow Disruptions

It’s not enough to have great individual software solutions that don’t sync with each other. It creates more administrative work for your team members to manage your processes separately in each app.

Each administrative work your team does disrupts your workflow. Too many of these threaten your firm’s ability to fulfill its potential.

You may have a great system and process, but if it's not integrated, you'll do much more administrative, non-billable work."

Dawn Brolin CPA CFE (CEO of Powerful Accounting) who uses Financial Cents and SmartVault to manage workflow and documents2. Delay in Data Retrieval and Storage

When your clients are few and deadlines are far apart, an extra click (or two) does not hurt. But when you are a tax accountant on a tight deadline (like during tax season), any click of the mouse has to be necessary. Else, it will be a source of delay and frustration.

If your workflow and document management tools do not integrate, you may have to log out several times to log into your document management tool to fetch clients’ documents.

It gets worse when either of the applications doesn’t load quickly enough, which slows down the pace of the work.

If both apps like Financial Cents and SmartVault are integrated, you wouldn’t have to log out of your workflow tool (Financial Cents) to access the client’s documents in your DMS (SmartVault).

3. Inability to Leverage Automation

A part of automation in practice management is the ability to organize the documents you get from your clients.

For example, Financial Cents enables its users to automate the collection of additional documents from clients. Thanks to its integration with SmartVault, the client’s documents automatically get added to their folder in SmartVault when the client uploads them.

The inability to integrate accounting workflow software with accounting document management software informed Dawn Brolin’s decision to change her workflow management tool earlier in 2023.

I had a different workflow product just about eight months ago. We were looking for another one because we had to do many more manual processes and workarounds to connect SmartVault with our workflow tool. One of the key reasons that we switched to Financial Cents was because of the connection with SmartVault.”"

Dawn Brolin CPA CFE (CEO of Powerful Accounting)4. Limited Visibility

You’d want to ensure your staff knows where client work stands and where to get client documents.

With an integrated system, they will have everything at their fingertips without needing to close the workflow tool or open the document management software many times (which would have caused a blindspot in the process).

This visibility helps you and your team find client information and make necessary decisions faster.

Benefits of Integrating Your Accounting Workflow with a Document Management System

a. Time and Cost Savings

Workflow management software reduces the time your team spends updating work status and helps you know who is responsible for what task and how much time your team spends on manual work.

Meanwhile, document management software reduces the time your team spends on document processing.

Together, they make it easier for your team to retrieve client documents when working.

With the Financial Cents and SmartVault integration, you can access specific client’s profiles in SmartVault directly from Financial Cents. That saves you the stress of scrolling through a long list of client profiles for client information they need.

Using those Integrated Systems to streamline your processes will help you serve your clients better and make your team more productive and more profitable as we think about the ultimate way to supercharge your workflow ahead of tax season."

Dawn Brolin CPA CFE (CEO of Powerful Accounting)b. Enhanced Accuracy:

Accounting professionals deal with so many documents and repetitive tasks that it becomes so easy to mix things up, especially during tax season when pressure is highest and mistakes are more likely.

Unintegrated workflow and document management systems means creating and managing separate client information in the different apps. This increases the chances of having different versions of documents to work with.

Your employees could mistakenly use the wrong version of documents for a client’s tax return and produce inaccurate results.

With an integrated workflow and document management system, your staff members will access up-to-date client information. It improves their chances of doing quality work. And they wouldn’t need to second-guess the accuracy of the documents they have.

c. Improved Collaboration:

An integrated workflow and document management synchronizes client information across the board. It aids collaboration by giving team members sufficient clarity on work and client information.

With workflow tools like Financial Cents, you can share information with your team inside the client’s project using the comments and @mentions features. With DMS like SmartVault, you can collaborate in real-time on client documents while working on the client’s projects.

d. Data Security

Your client’s data is only as secure as the weakest tool in your tech stack. If either your workflow or document management system is not secure, it becomes the weak link by which fraudsters can access your client’s information.

You need to ensure your workflow and document management software are equally secure.

By integrating a workflow tool like Financial Cents and a DMS like SmartVault that are bank-level secure, your client data is safe from unauthorized access during transfer, processing, and storage.

Both tools give you access and control capability, which enables you to restrict access to documents and track the activities of your team members on client information.

Three (3) Reasons to Use Financial Cents Accounting Workflow Software and SmartVault Document Management System Integration

The Financial Cents and SmartVault integration enables your clients to synchronize their data on both platforms in real-time. Here’s what the integration enables you to do:

1. To Easily Link or Import Clients From Financial Cents to SmartVault

Financial Cents and SmartVault teams will help you integrate and import or link your clients between both apps in a direct integration.

Click this link to schedule a call with the Financial Cents team.

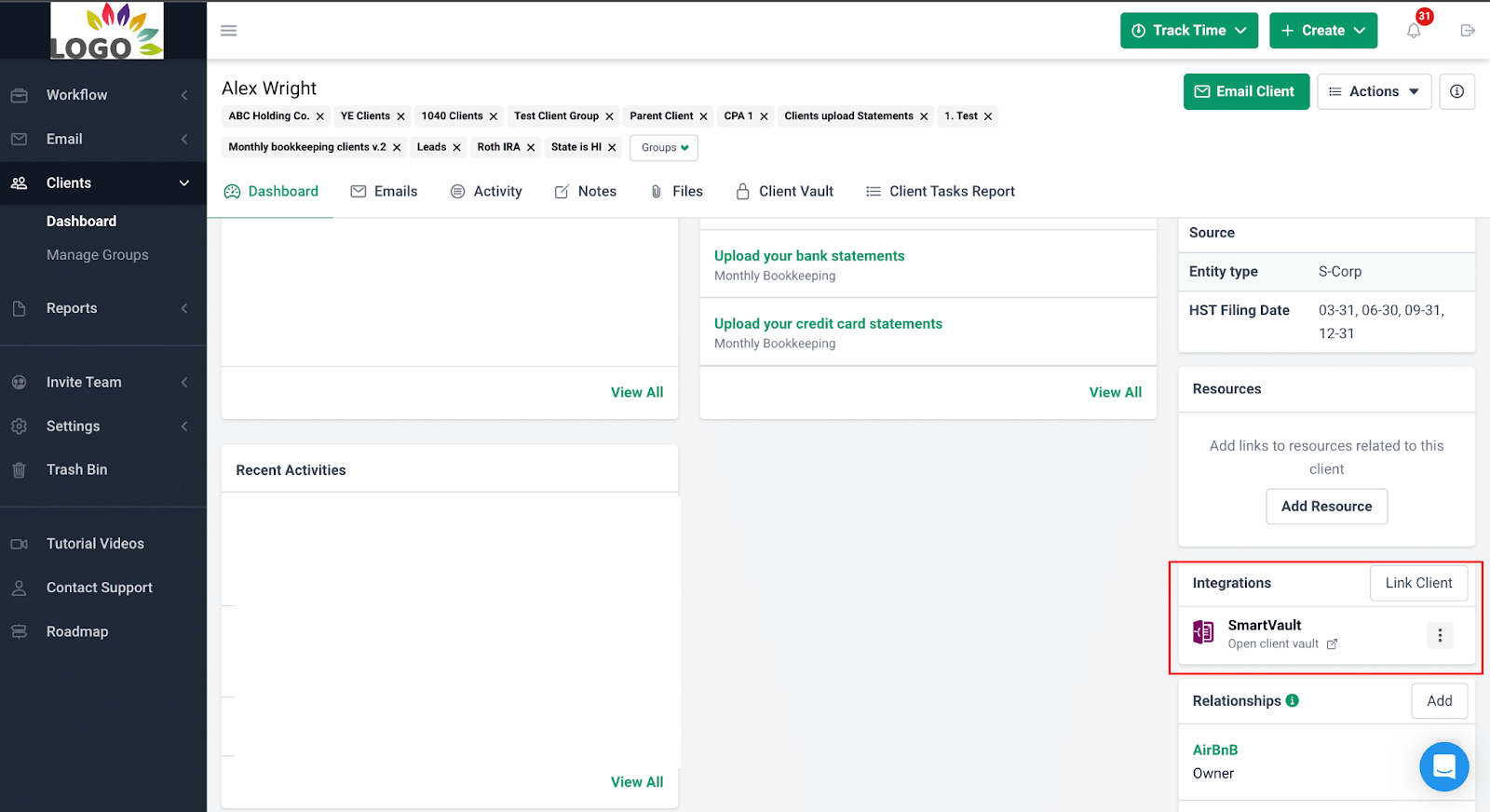

2. To Access SmartVault From Financial Cents

This integration enables you to access SmartVault from Financial Cents. You can access SmartVault from Financial Cents in any of three ways:

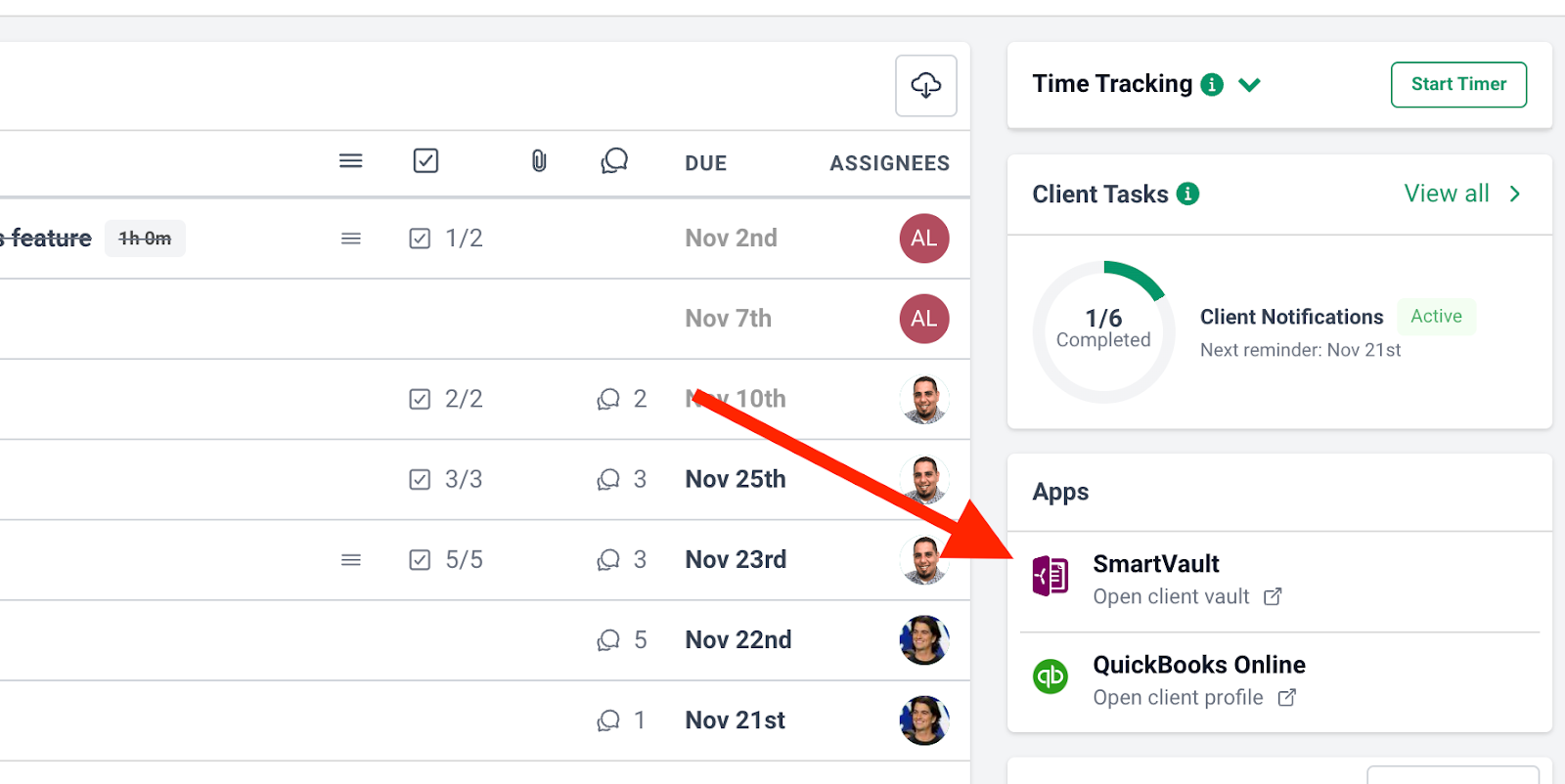

From the client Integrations section:

- Clicking Client

- Selecting the client’s profile from the database

- Clicking the SmartVault link on the right side of your screen

From The Client Files Section by:

- Clicking Client

- Selecting the client from your client database

- Click the Files tab

- Click the SmartVault tab on the left side of your screen

From the client’s projects:

- Opening the project

- Clicking the smartVault link to go directly to their SmartVault folder.

With this integration, you no longer need to open SmartVault whenever you need to use a client’s information for work, which can be cumbersome.

That way, you can always go into the client’s profiles to see what they have uploaded.

Additionally, the files your clients upload to your client portal in Financial Cents are added to your SmartVault folder automatically.

3. To Automatically Create Clients in SmartVault After Creating Them in Financial Cents

The integration creates an automatic client profile in SmartVault when you create a client in Financial Cents. This eliminates the need to create the client profile afresh.

Here’s how:

- Integrate Financial Cents with SmartVault and enable auto client sync.

- Click the green Create button

- Select Client

- Select Manually Enter Information.

- Enter client information

- Click Save to create the client in Financial Cents

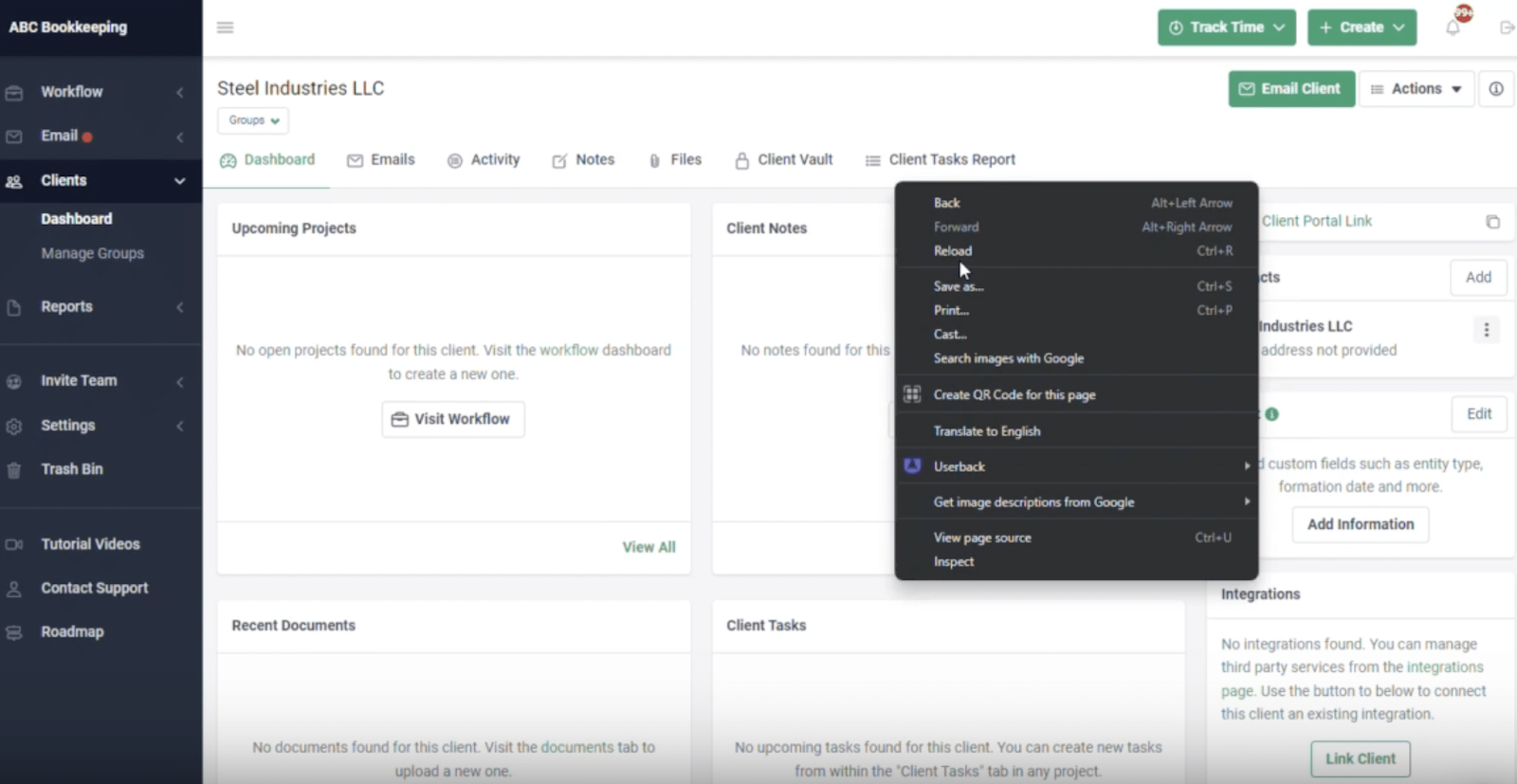

- Right-click in the profile and select Reload

The link to the client’s SmartVault folder will appear on your screen. You can click the link anytime to access the client profile in SmartVault.

Start Using Financial Cents to Manage Your Firm to Enjoy This (and Similar) Integrations

As your firm grows, you’re only going to get busier.

Today is a good day to integrate your tech stack and start doing as much work as possible without jumping between many apps.

You can start by connecting your workflow and document management software to save your team unnecessary workarounds while doing client work.

You can do workarounds, but if you leverage an integrated system, you can manage everything in one place. Tasks in Financial Cents and Documents in SmartVault.

If your clients are not used to SmartVault, you can send them a client request from Financial Cents to obtain documents. It goes into their SmartVault folders as well."

Start Using Financial Cents and SmartVault integration to manage documents better.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features Your Accounting Client Portal Must Have

By utilizing a client portal, you can eliminate the inefficiencies of manual methods and create a smoother workflow for both you and…

May 15, 2024

The 5 Best Avii Workspace Alternatives for Modern Firms

If, for whatever reason, Avii does not meet your long-term workflow needs, this review of the best Avii workspace alternatives should help…

May 08, 2024