Template Bundles For Tax Firms

Standardized Tax Templates to Run a More Organized, Scalable Tax Practice

The Tax Firm Templates Bundle is a curated collection of ready-to-use templates designed to help tax firms standardize their tax preparation workflows, reduce bottlenecks during busy seasons, and deliver a consistent client experience year after year.

This free bundle includes templates for client intake and tax organizers, 1040, 1120, 1041, and 990 preparation, due diligence, proposals, client communication, and staff onboarding, so your firm isn’t rebuilding systems every tax season.

Financial Cents Hub » Firm Template Bundles » Templates Bundles For Tax Firms

Who This Template Bundle Is For

This bundle is built for tax firms that:

Prepare individual and business tax returns under tight seasonal deadlines

Manage a growing client base with limited staff and time

Rely on repeatable processes to get through tax season efficiently

Hire seasonal or junior staff who need clear guidance

For tax firms and tax preparers, consistency is the difference between a manageable tax season and a stressful one. These templates help you replace ad-hoc processes and last-minute fixes with documented workflows your entire team can follow, so nothing critical is missed when volume increases.

What’s Included in the Tax Firm Templates Bundle

The Tax Firm Templates Bundle covers the full tax engagement lifecycle—from intake to filing to post-season follow-up.

- Individual and business tax organizers

- Tax client intake forms and onboarding checklists

- Tax preparer checklists for clients

- Client transition and welcome letters

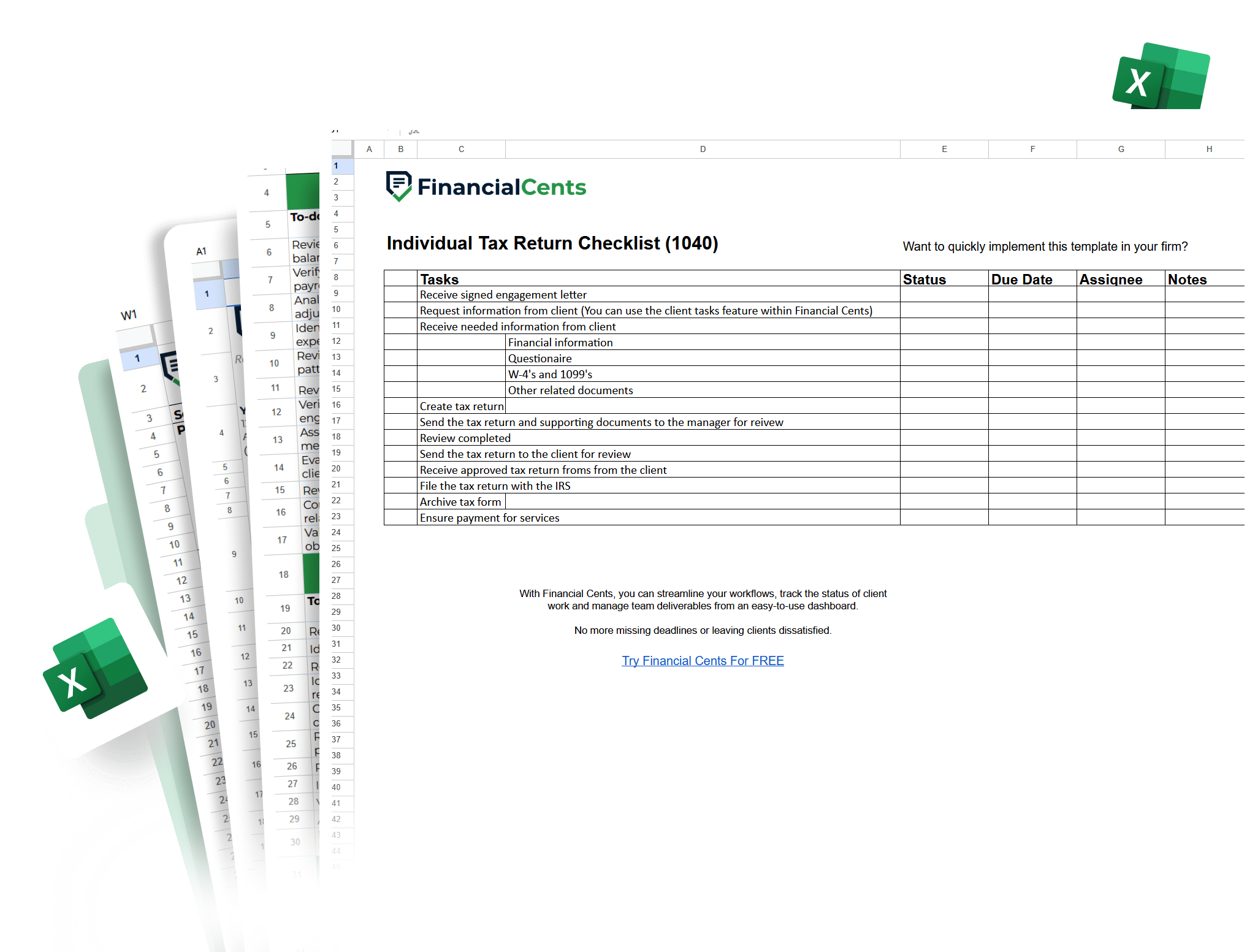

- 1040 preparation checklists

- 1120 business return checklists

- 1041 fiduciary return checklists

- 990 nonprofit return checklists

- General tax return procedures

- Due diligence notes for tax preparers

- CPA tax return review checklists

- Firm acquisition and merger due diligence checklists

- Estimated tax payment planning checklists

- Tax engagement letters and service proposals

- Tax return transmittal letters

- Tax invoices and billing templates

- Tax-exempt and tax memo templates

- Staff onboarding and training

- Tax preparation business planning

- Company formation checklists

- Internal workflow documentation These templates are especially helpful for firms onboarding seasonal staff or scaling their tax practice.

Why Tax Firm Use These Templates

Tax firms don’t struggle because they lack technical knowledge—they struggle because tax season magnifies every process gap.

This bundle helps you:

- Reduce prep-review-file bottlenecks

- Minimize last-minute errors and rework

- Train staff faster with documented workflows

- Deliver a consistent client experience year after year

- Approach tax season with more control and confidence

Instead of reinventing your process each season, your firm runs on repeatable systems.

How Tax Firms Use the Templates

Firms use these templates to:

- Prepare for tax season before volume spikes

- Standardize tax prep across staff and return types

- Improve turnaround times without sacrificing accuracy

- Reduce reliance on memory and informal checklists

- Create a single source of truth for tax workflows

Download once, customize for your firm, and reuse them every tax year.

Built for Tax Firms

Financial Cents works with thousands of accounting, bookkeeping, and tax firms to help them streamline workflows, improve accountability, and manage work more effectively—especially during peak seasons.

These templates are based on real-world tax firm processes, not generic examples.

FAQS

The bundle includes templates for 1040, 1120, 1041, and 990 returns, along with general tax return procedures and preparation checklists.

Yes. These templates are designed to reduce bottlenecks, improve handoffs, and standardize prep-review-file workflows during high-volume periods.

Yes. The bundle includes individual and business tax organizers, and onboarding checklists to improve information collection.

Absolutely. Clear checklists and documented procedures make it easier to onboard seasonal staff and maintain consistency.

Yes. The bundle includes due diligence checklists for acquisitions, mergers, and firm transitions.