Accounts payable (AP) refers to the money a business owes its suppliers and vendors for goods or services received but not yet paid for. It represents a critical component of short-term liabilities on the balance sheet. Managing accounts payable effectively ensures an organization maintains good supplier relationships, avoids late payment penalties, and optimizes cash flow.

AP processes range from simple invoice payments to more complex strategies involving credit terms and cash flow forecasting. Businesses use accounts payable systems to track outstanding obligations, streamline payment cycles, and improve financial accuracy.

Unlike long-term debt or accrued expenses, accounts payable represent obligations due within a short period, typically within one fiscal year. It can encompass anything from utility bills to supplier credit for inventory purchases.

Why Effective Accounts Payable Management Matters

Strong accounts payable management goes beyond merely paying bills. It provides several strategic advantages:

- Improved Cash Flow Management: Businesses can optimize cash reserves while maintaining liquidity by carefully scheduling payments and leveraging early-payment discounts.

- Better Supplier Relationships: Timely payments build trust, enhance partnerships with key suppliers, and may lead to improved credit terms.

- Reduced Errors and Fraud Risks: A robust AP system with checks and balances minimizes the chances of payment errors and fraudulent activities.

- Regulatory Compliance: Proper documentation, audit trails, and timely reporting ensure tax and financial regulations adherence.

Consider a small business managing its vendor payments manually. Late payments result in interest fees and strained relationships, while inaccurate tracking causes discrepancies in financial statements. Conversely, an automated and strategic AP process prevents these issues, making it a pillar of sound financial health.

Key Elements of an Accounts Payable System

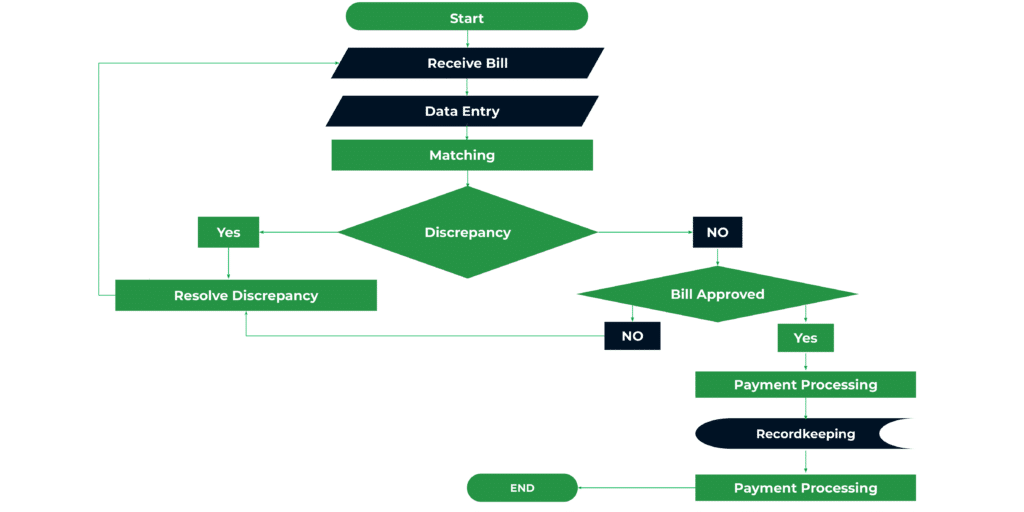

A basic accounts payable flowchart

1. Invoice Processing

Invoice processing is the first step in managing accounts payable. It involves:

- Receiving invoices from vendors for goods or services.

- Recording the invoices in the accounting system.

- Validating invoices by checking that the amounts, dates, and vendor details are correct.

- Getting approvals from relevant departments before processing payments.

This step ensures that all payments are backed by proper documentation and prevents unauthorized or incorrect payments.

Here’s an Invoice/Bill Processing

2. Payment Scheduling

Not all invoices need to be paid immediately. A smart payment scheduling system helps businesses:

- Prioritize payments based on due dates to avoid late fees.

- Take advantage of discounts offered for early payments.

- Optimize cash flow by balancing outgoing payments with incoming revenue.

Businesses can save money and maintain good relationships with suppliers by planning payments efficiently.

3. Vendor Management

A business often works with multiple vendors, making it essential to keep accurate records and maintain strong relationships. Vendor management includes:

- Maintaining up-to-date vendor records, including contact details and payment preferences.

- Evaluating vendor performance, such as timely deliveries and service quality.

- Negotiating better payment terms to reduce costs and improve cash flow.

Good vendor management ensures a smooth supply chain and builds trust between the business and its suppliers.

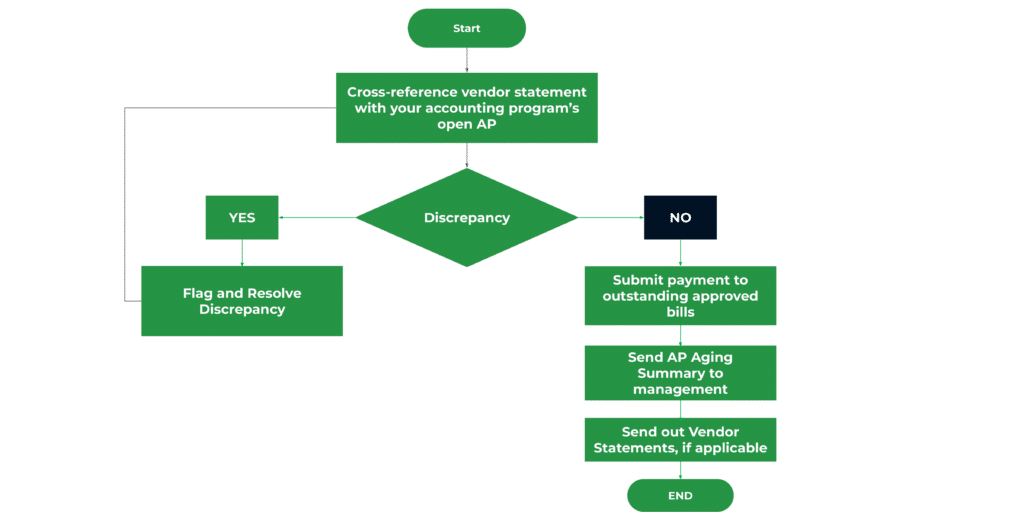

4. Reconciliation

Before making payments, businesses must verify that they are paying for what they actually received. This is done by:

- Matching invoices with purchase orders and receipts to ensure accuracy.

- Identifying discrepancies, such as overcharges or missing items.

- Resolving issues with vendors before payments are made.

Regular reconciliation prevents financial losses due to errors or fraud and keeps accounting records accurate.

Snag this accounts payable reconciliation checklist to help you streamline the process.

An Accounts Payable reconciliation flowchart.

5. Compliance Monitoring

An accounts payable system must follow financial and tax regulations to avoid penalties. Compliance monitoring includes:

- Keeping detailed records for audits and financial reviews.

- Ensuring tax compliance, such as proper withholding and reporting.

- Following company policies to prevent fraud and unauthorized transactions.

By staying compliant, businesses reduce risks and ensure smooth financial operations.

Why Automation Transforms Accounts Payable

Automation tools have revolutionized how companies handle accounts payable. Key benefits include:

- Increased Efficiency: Automated systems reduce manual data entry such as using AP excel templates, significantly cutting processing times and improving turnaround.

- Enhanced Accuracy: Optical Character Recognition (OCR) and AI technologies help to extract data from invoices with minimal errors.

- Fraud Prevention: Automated approval workflows enforce dual approvals, access controls, and notifications for anomalies.

- Streamlined Record-Keeping: Digital archives store documents for faster retrieval during audits and tax filings.

Types of Accounts Payable Automation

1. Invoice Automation

Invoice automation streamlines the invoicing process by automatically capturing, verifying, and processing incoming invoices. Optical Character Recognition (OCR) technology extracts key invoice details, such as vendor name, invoice number, and payment terms, minimizing data entry errors. The system cross-checks invoices against purchase orders (POs) and receipts, flagging discrepancies for review. This reduces manual intervention, speeds up invoice processing, and enhances data accuracy, ensuring timely and error-free financial records.

2. Payment Automation

Payment automation simplifies and secures outgoing payments by scheduling them according to vendor terms and preferences. Businesses can set up electronic fund transfers (EFTs), Automated Clearing House (ACH) payments, or virtual credit card payments, reducing reliance on paper checks. Automated reminders prevent missed due dates, helping firms avoid late fees while optimizing cash flow. Additionally, payment automation enhances security by reducing fraud risks and ensuring compliance with internal controls.

3. Approval Workflow Automation

Approval workflow automation accelerates invoice approvals by routing them to the appropriate stakeholders based on predefined rules. Instead of chasing down signatures via email or paper trails, invoices are automatically sent to managers or department heads for digital approval. Configurable approval hierarchies ensure that high-value invoices receive additional scrutiny while lower-value invoices move through the process faster. This results in fewer bottlenecks, improved transparency, and enhanced compliance with financial policies.

4. Accounting Workflow Automation

Accounting workflow automation integrates accounts payable with the broader financial ecosystem, ensuring seamless data flow between AP software, enterprise resource planning (ERP) systems, and accounting platforms. This connectivity eliminates the need for redundant data entry, reduces reconciliation errors, and provides real-time visibility into payables. Automation also facilitates financial reporting by generating accurate AP reports, tracking spending trends, and supporting budgeting efforts. By automating repetitive tasks, accounting teams can focus on strategic financial planning rather than manual administrative work.

Common Accounts Payable Challenges

- Manual Data Entry Errors: Keying in invoice details by hand leads to frequent mistakes and inefficiencies.

- Fraudulent Invoices: Scams exploit weak AP controls, leading to unauthorized payments.

- Late Payments: Missed deadlines result in penalties and damaged vendor relationships.

- Lost Documents: Paper-based systems increase the risk of losing critical payment records, delaying reconciliations and audits.

- Inefficient Approval Workflows: Complex or unclear approval processes slow down invoice processing, leading to delays.

Strategies for Overcoming AP Challenges

- Adopt Automation Tools: Use specialized AP software to minimize manual tasks, enhance accuracy, and speed up processing times.

- Establish Clear Approval Policies: Define roles and ensure dual-authority rules for approving large or unusual payments.

- Negotiate Vendor Terms: Secure favorable payment terms and leverage early payment discounts for savings.

- Conduct Regular Reconciliations: Cross-check AP records frequently to detect and correct discrepancies.

- Centralize Documentation: Store all invoices and payment records digitally to improve organization and ensure compliance.

Final Thoughts

Accounts payable may seem straightforward at first glance, but managing it effectively requires strategy, technology, and proactive oversight. From automating routine tasks to implementing strong approval workflows, businesses can significantly enhance their financial stability, reduce costs, and strengthen vendor relationships by prioritizing sound AP workflow management.

Using a tool like Financial Cents to streamline your workflow for accounts payable, manual tasks automation and client management makes it easy to keep track of work and meet deadlines.

Start a 14 Days Free Trial.