Financial Cents vs Canopy

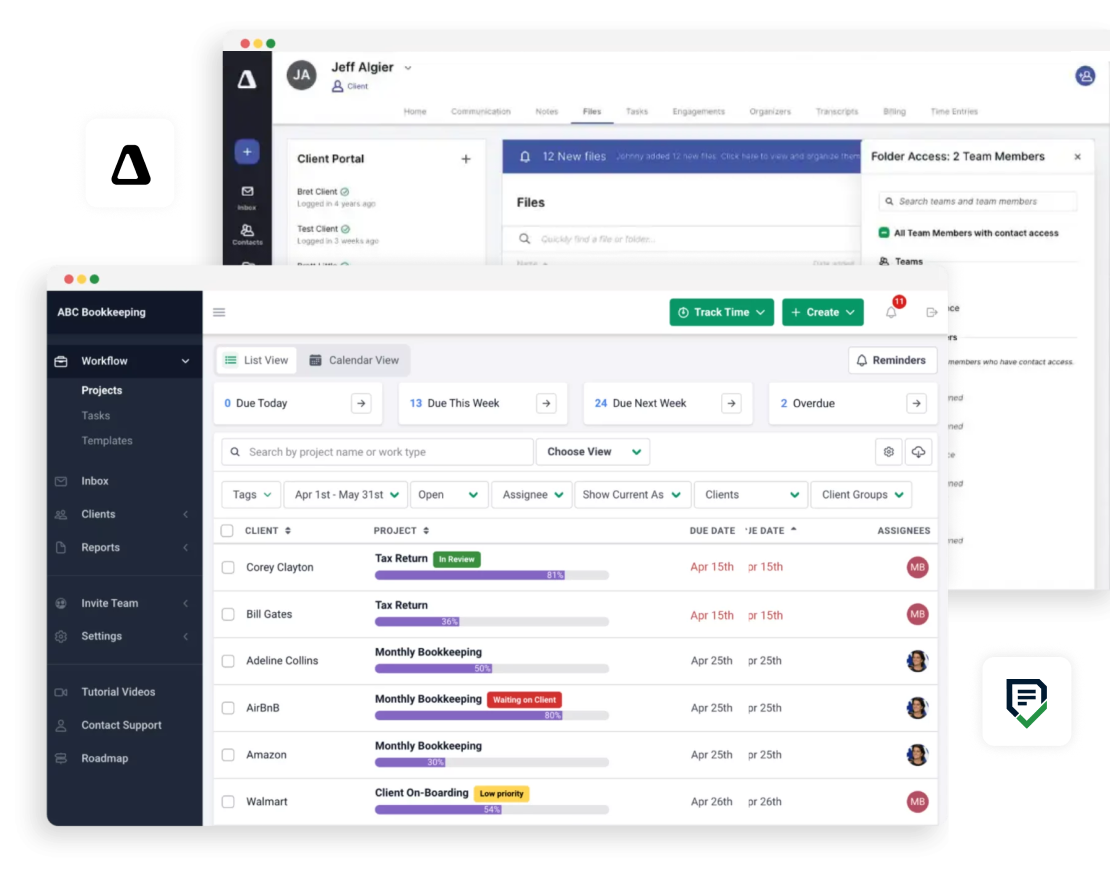

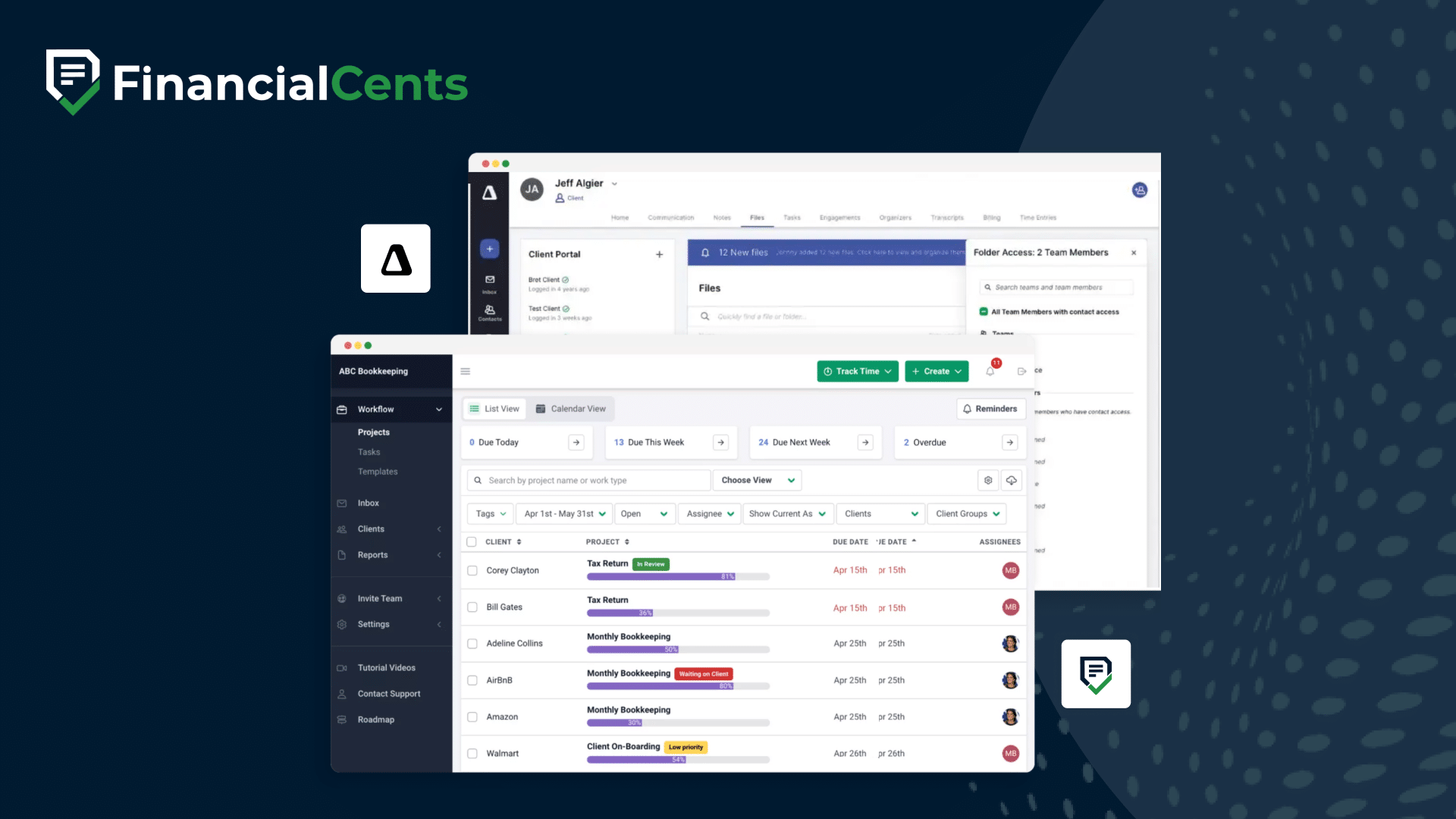

Financial Cents is an easy-to-use practice management software for accounting, tax and bookkeeping firms that provides you with all you need to gain visibility into your firm, automate your workflows, track and manage tasks, communicate and collaborate with your team, manage clients and hit your deadlines with ease.

Nat Valentin Heaney

Valentin Accounting & Tax

Financial Cents vs Canopy features compared

Financial Cents

Canopy

Features

| Workflow Automation | Limited | |

| Document Management | ||

| Billing & Invoicing | ||

| Proposals & Engagement Letters | ||

| Client Portal | ||

| Firm-branded client portal with custom URL | ||

| E-signature | ||

| Manage uncategorized transactions | ||

| Zapier integration | ||

| Automated client requests & reminders | ||

| Integrated email (Gmail & Outlook) | ||

| QuickBooks integration | ||

| SmartVault Integration | ||

| Google Drive Integration | ||

| OneDrive Integration | ||

| Capacity Planning | ||

| Open API | ||

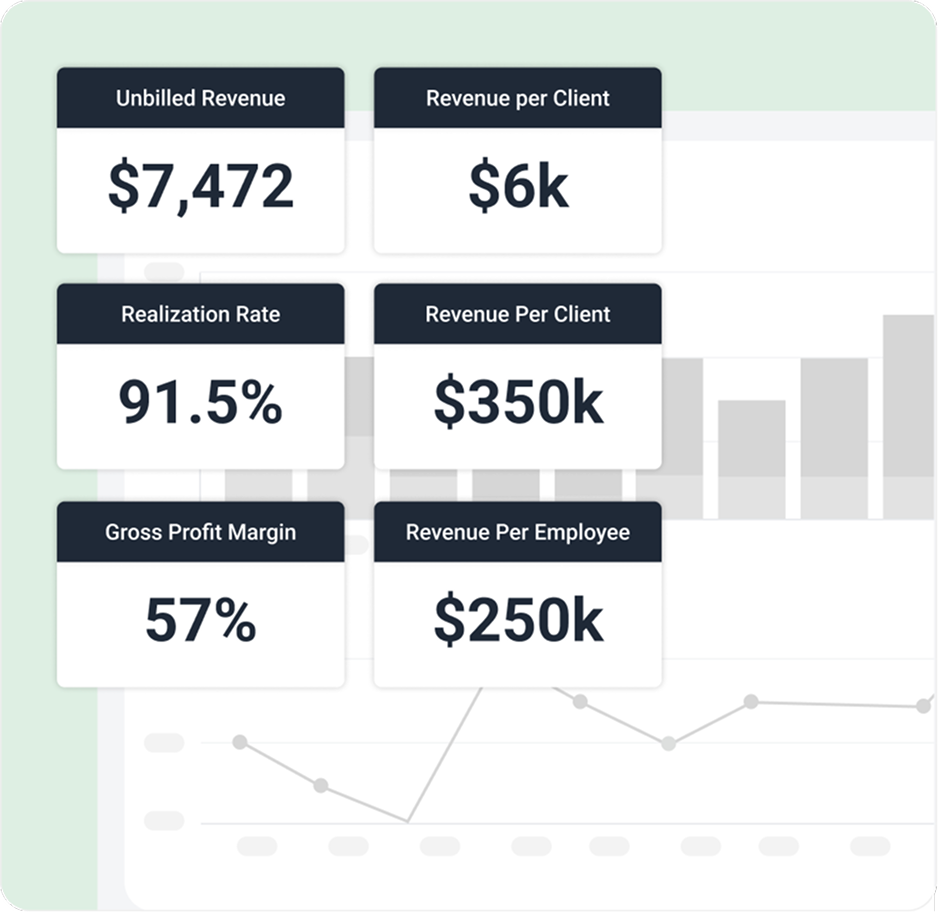

| Robust reporting | ||

| Workflow Templates | ||

| Community template library | ||

| Workflow templates AI | ||

| Email templates AI | ||

| Team Chats | ||

| Comments and @mentions on tasks and projects | ||

| CRM | ||

| Secure file storage | ||

| Time Tracking |

Why users love us ❤️

For all firms

Canopy is built specifically for tax firms. Their system enables tax professionals to manage tax preparation, tax resolution and their practice in one place. It’s a good fit if your firm focuses on taxes alone.

Financial Cents on the other hand is a comprehensive practice management software built to meet the needs of accounting, bookkeeping and tax firms. Our solution equips you with tools to streamline work, improve productivity and grow their business, regardless of your niche!

“Streamlining Bookkeeping to leave room for more Advisory

I don’t have to chase clients nearly as much with their to-do lists and client portals set up. They can ask questions, and I can add accountability tasks for clients for them to be reminded automatically, and everything is pretty customizable – including the reminder emails.”

Danielle M

A more complete workflow

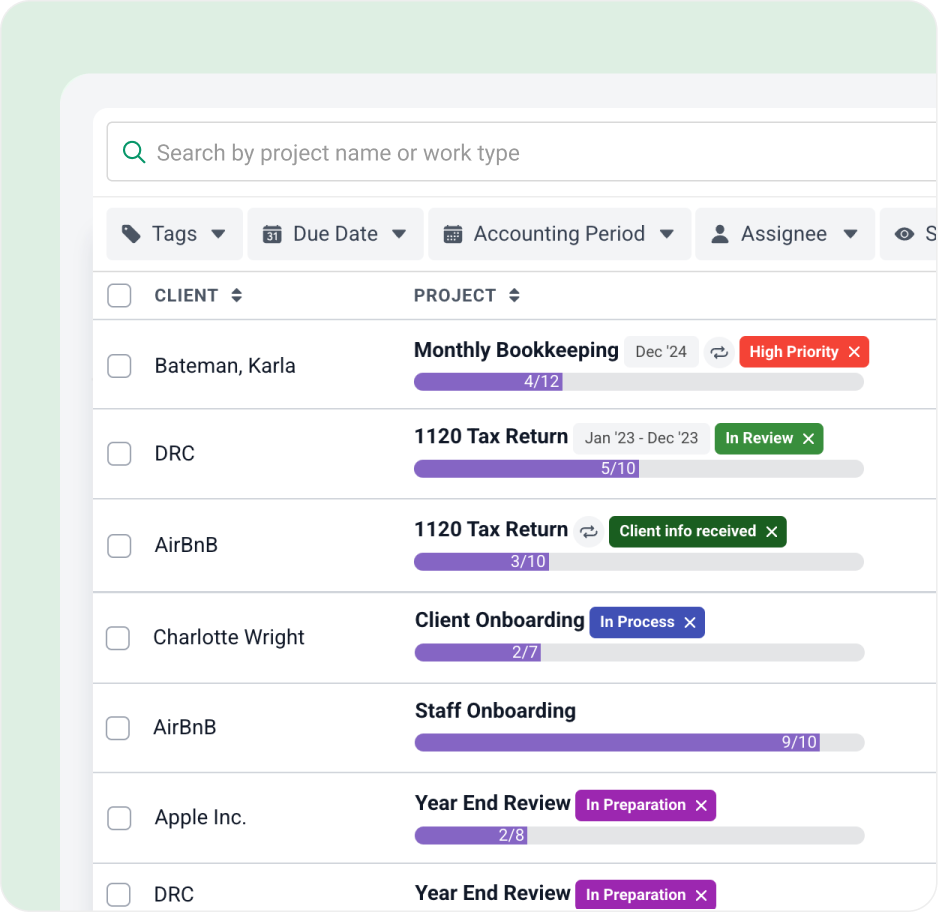

Financial Cents provides you with powerful workflow management and automation features to help you get work done.

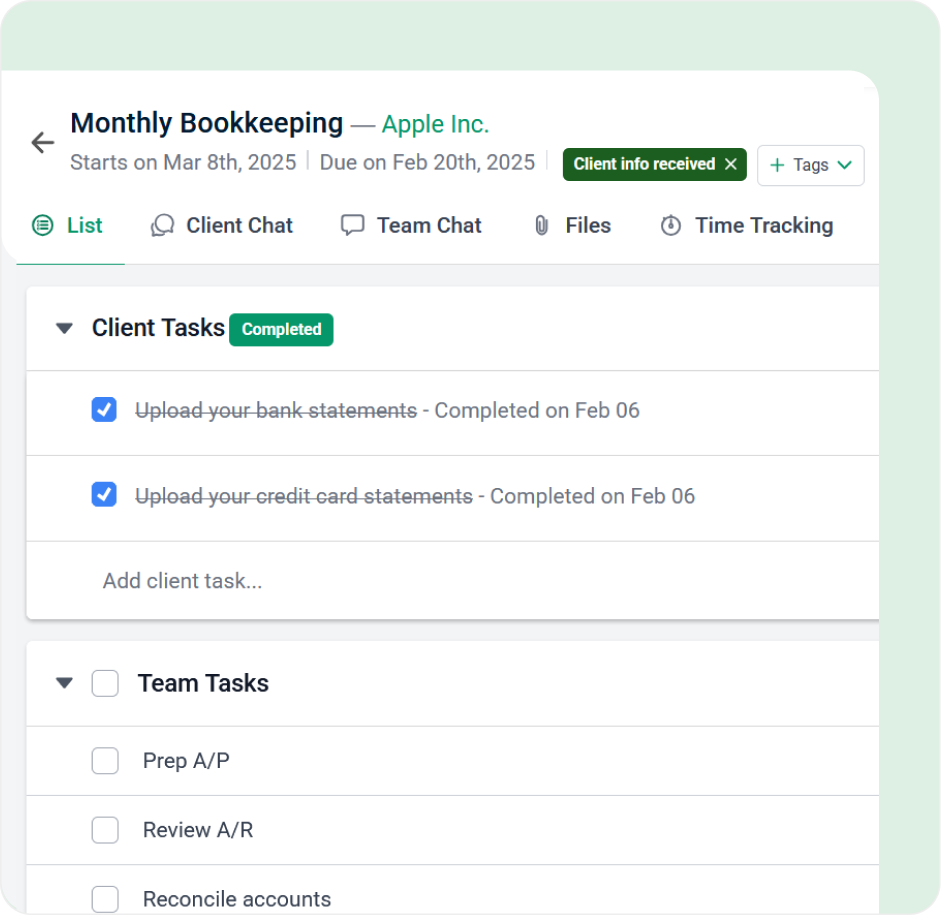

Our workflow management features include a workflow dashboard that gives you visibility to track work in your firm and ensure you never lose sight of anything; workflow automation to help you automate repetitive and manual tasks to free up your time for more billable tasks; automated client requests to help you get information from clients quickly, saving you time and effort; an easy-to-use client portal and more.

A major part of Canopy’s focus is tax, which makes its workflow management and automation system limited.

“Overall, I can’t praise it [Financial Cents] enough. And I’m very picky about software. I’ve tried about 5 different client management software and this one is the best. It is pricier than others. However, if you take into account the 25 hours a month it saves me. Overall, it’s saving me money. IMO .. the features don’t compare with other CRMs for accountants.”

Stephanie W

Simple pricing. More value for money

Financial Cents pricing plans are straightforward. We have two pricing plans, the Team plan and the Scale plan, each plan gives you access to powerful practice management features that suit your firm’s needs, regardless of the number of clients you serve. The team plan which is priced at $49/month per user (billed annually) provides you with access to workflow automation, workflow and to-do lists, client portal, document management, client CRM & database, e-signature, time tracking, billing & invoicing, email integration, quickbooks integration and more. The Scale plan priced at $69/month per user (billed annually) has more automation features, integrations and customizations.

This means you won’t have to worry about hidden fees or constantly upgrading your plan as your business grows.

Canopy’s pricing is complex and to access certain features such as workflow management, document management and time and billing, you have to pay an additional fee for each feature per user/per month.

“I love that it took little to no effort to understand, all of the intro videos were so helpful. They got me started on the right path. I love that it is like taking my brain and putting it into order. It helps me get/stay organized.”

Jill B

Financial Cents vs Canopy Pricing

Financial Cents has four plans – Solo plan, Team plan, Scale plan and the Enterprise plan.

The Solo Plan is perfect for solo accountants and bookkeepers who want a simple way to stay organized, manage client work, and never miss a deadline. It includes features like workflow management, time tracking, invoicing & billing, client portal & client tasks. It costs $19/month – billed annually.

The Team plan includes all you need to hit your client deadlines with more visibility, collaboration and organization. It costs $49/month per user – billed annually and $69/month per user month – billed monthly.

The Scale plan has more advanced features such as the branded client portal, auto-follow ups for client tasks and more. It costs $69/month per user – billed annually and $89/month per user month – billed monthly.

The Enterprise Plan provides advanced support, security, and customization for large firms. It includes everything in the Scale Plan, plus enhanced security, custom permissions, webhooks, priority support, premium training, and a dedicated success manager. Contact sales for custom pricing.

Learn more about our pricing plans

Dependant on the features and number of clients.

Standart Plan

- Workflow – $35/month per user

- Document management – $40/month per user

- Time and billing – $25/month per user

- You get 250 clients for free. Additional costs once your clients list is more than 250.

Pro Plan

- Workflow – $45/month per user

- Document management – $40/month per user

- Time and billing – $35/month per user

- You get 250 clients for free. Additional costs once your clients list is more than 250.

*There are add-ons that you may have to pay for depending on your firm’s choice.

Loved by over 10,000 accountants, bookkeepers and CPAs

Financial Cents vs Canopy FAQs

Canopy is designed primarily for tax firms, with tools tailored to tax preparation and resolution. Financial Cents, on the other hand, is built for all types of accounting, bookkeeping, and tax firms. It provides a full suite of practice management features, workflow automation, client portal, billing, accounting CRM, document management, reporting, and integrations that help firms of any niche streamline work and scale efficiently.

Financial Cents offers simple, all-inclusive pricing starting at $19/month for solo users and $49/month per user for teams. All core features: workflow management, billing, client portal, email integration, and more are included. Canopy’s pricing is more complex: features like client engagement, workflow, document management, and time & billing are billed separately per user. This means firms often pay significantly more with Canopy, especially as they grow.

Canopy offers limited workflow automation. Financial Cents provides robust workflow automation, including recurring tasks, auto-reminders for clients, bulk actions, and workflow templates (including an open community template library). These features save firms hours each week and ensure deadlines are never missed.

Both platforms offer secure client portals. Financial Cents’ portal is fully firm-branded (custom URL, branding, and messaging), supports passwordless login, and includes automated reminders to clients so firms don’t have to chase them for documents. Canopy’s portal is solid for tax-related client exchanges but doesn’t have the same automation flexibility for general accounting workflows.

Financial Cents is known for its ease of use (with a 4.9/5.0 ease of use rating on Capterra), firms often get up and running without extensive training. Canopy, with its tax-heavy features and add-ons, can take longer to set up and navigate.

Firms that manage bookkeeping, accounting, and tax work (not just tax resolution) often prefer Financial Cents because it offers broader features, easy automation, and affordable pricing. Canopy is best suited for firms focused primarily on tax resolution.

Many firms move to Financial Cents because it’s easier to use, more affordable, and not limited to tax. Users often cite saving 20+ hours a month through automation, faster client responses via the portal, and firm-wide visibility that helps prevent missed deadlines.

Both offer reporting, but Financial Cents includes robust workload and client reporting out of the box helping firms track profitability, productivity, deadlines, billable hours, and client deliverables. Canopy reporting is centered more around tax workflows.

Yes. Financial Cents Month-End close tool feature helps accounting and bookkeeping firms manage uncategorized transactions. This allows you to assign, track, and resolve unclassified entries so they don’t slip through the cracks keeping books accurate and reconciliations smooth.

Canopy, on the other hand, does not currently offer functionality for managing uncategorized transactions. Since its focus is more tax-centric, firms often need to rely on separate bookkeeping software or manual processes to handle this task.

Both platforms offer document storage and sharing. Financial Cents allows you to organize documents within client records, attach them to projects, and share them directly through the client portal at no additional cost. Canopy also offers document management, but it is sold as a separate module and requires an additional fee per user. This means firms often end up paying more for the same core functionality that comes standard with Financial Cents.

Get Started Today

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!