Optimize your team’s workload with capacity management

Managing workload distribution across your firm can be challenging—especially as your team grows. With Financial Cents’ Capacity Management feature, you get real-time visibility into your team’s availability, ensuring work is assigned efficiently while preventing burnout.

Michael McMullin

Managing Partner, Jack Trent & Co

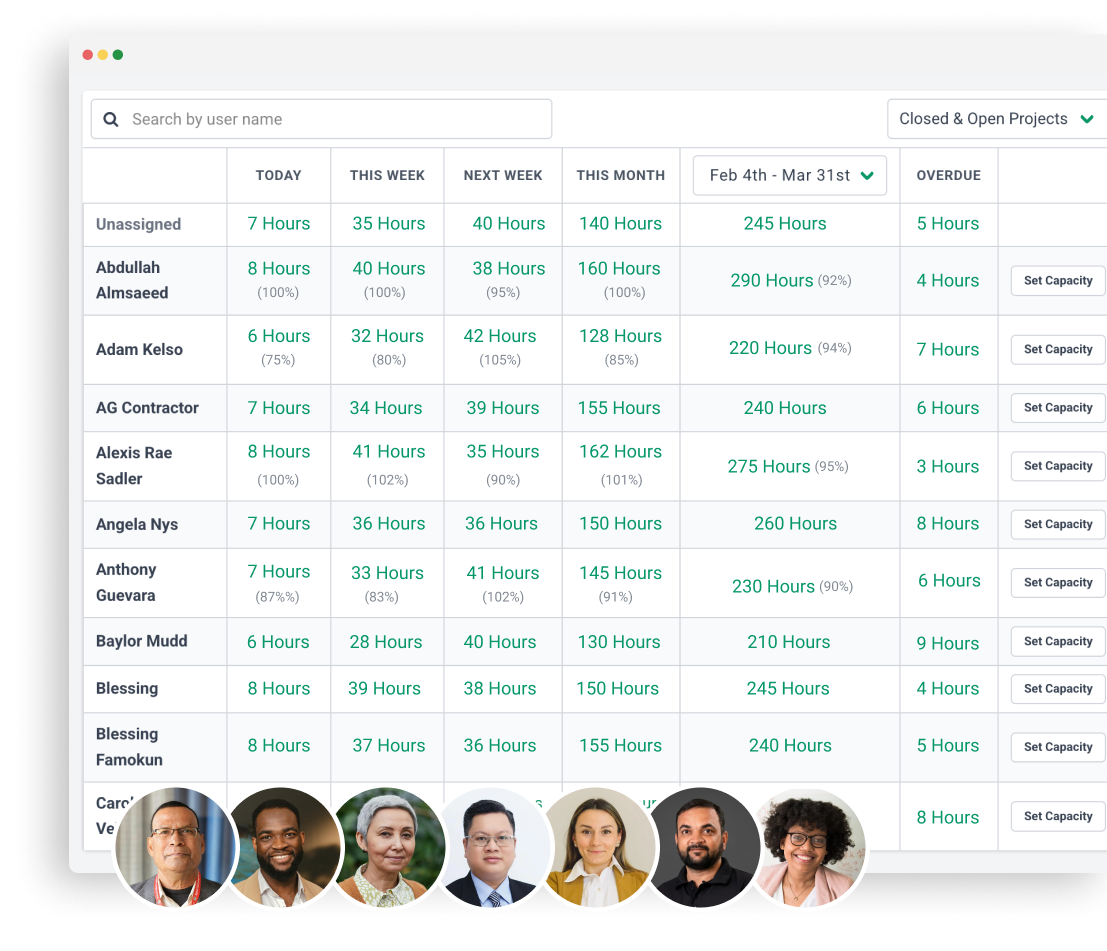

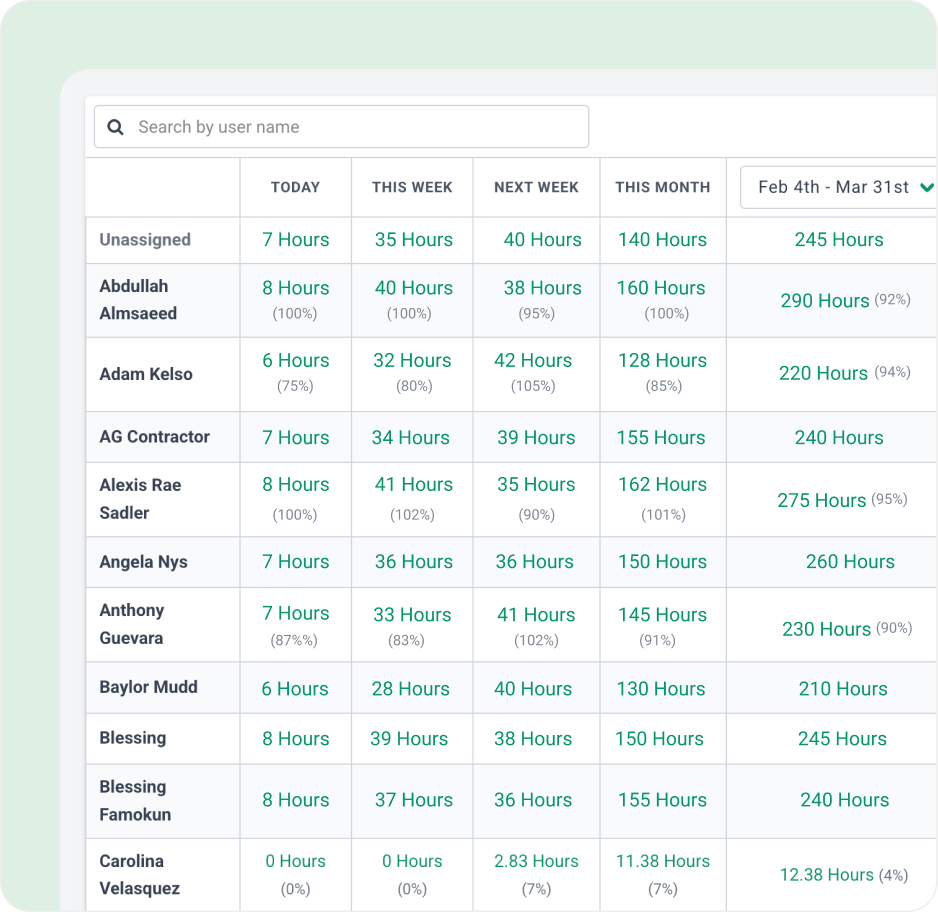

Gain full visibility into team capacity & workload distribution

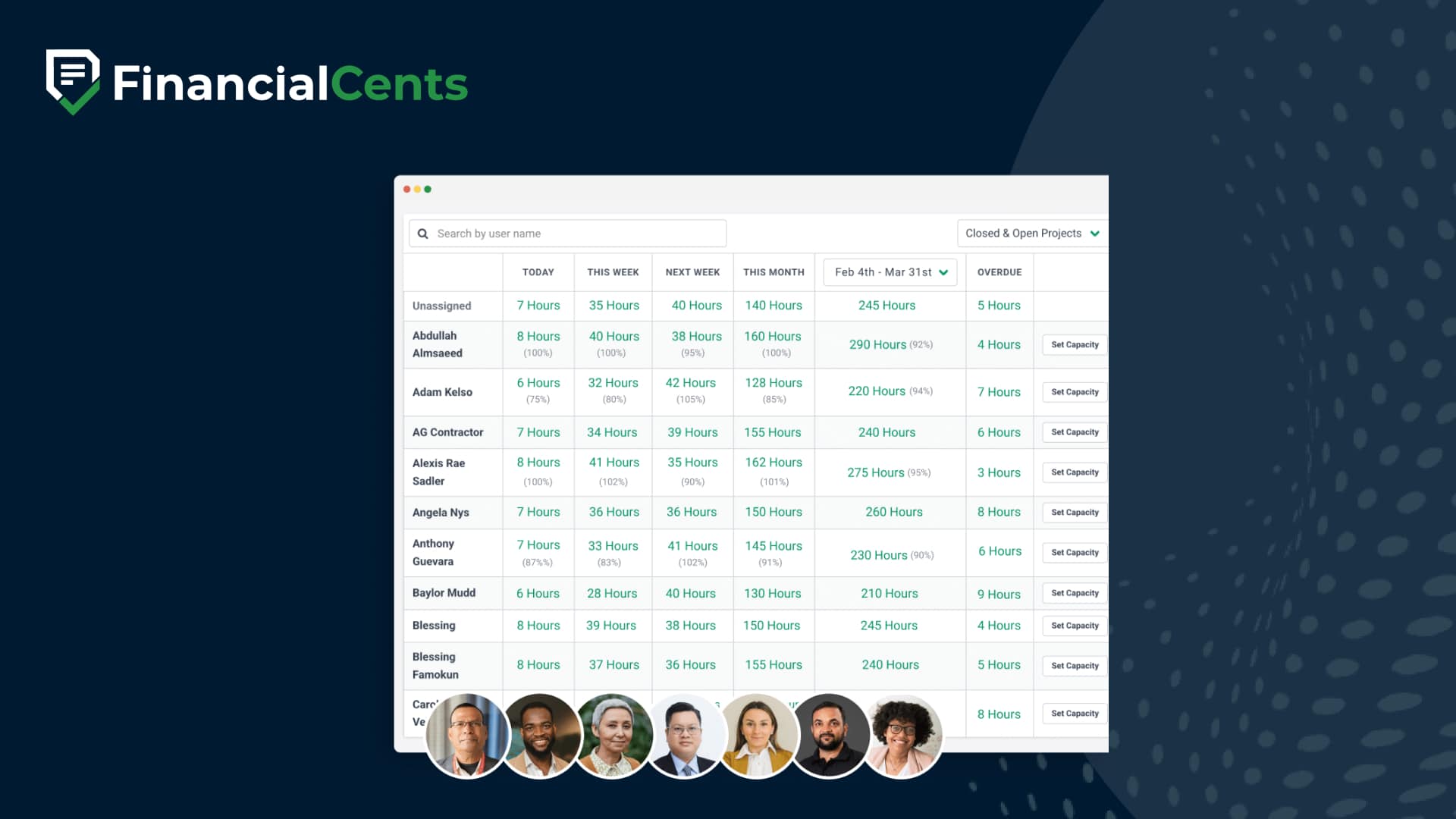

Stop guessing who has time for more work. With a centralized workload dashboard, you can see every team member’s assignments and capacity in real-time. Easily identify who is at full capacity, who has availability, and where bottlenecks may occur – so you can make informed decisions when assigning new work.

Whether you’re managing a small team or a growing firm, this visibility helps you keep projects on track and ensure no one is underutilized or overwhelmed.

Start free trial

Prevent overwork & keep your team happy and productive

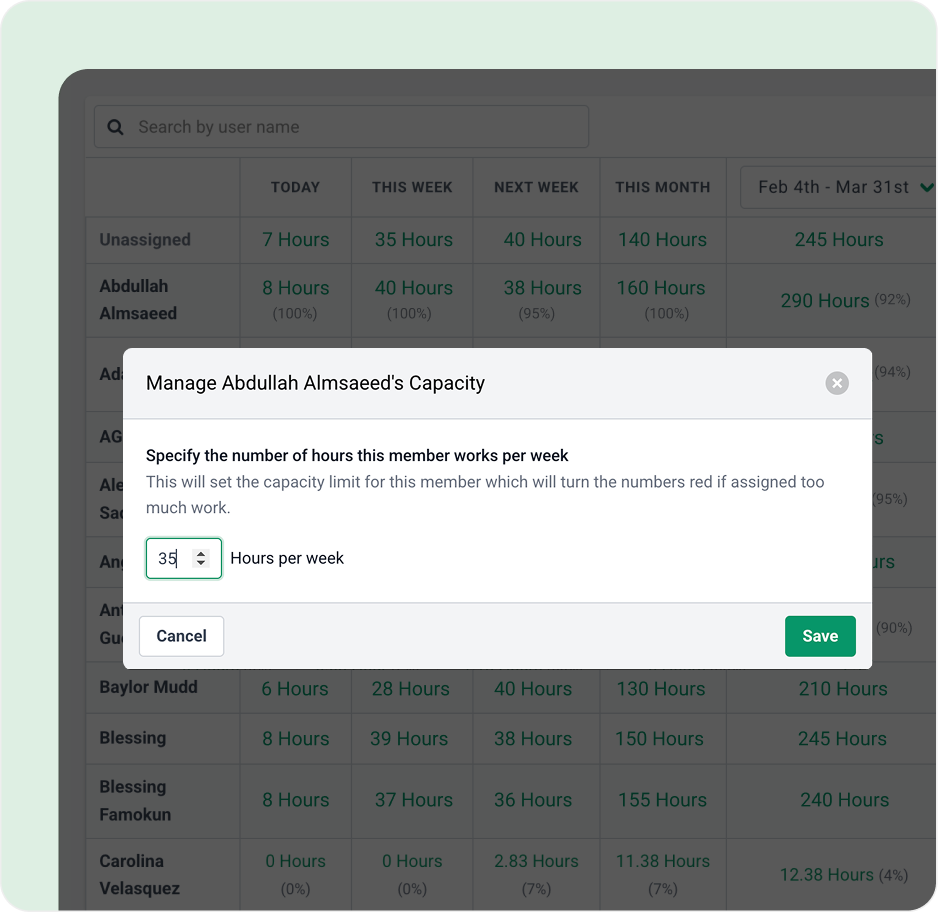

Overloading team members leads to stress, mistakes, and eventually burnout. With real-time capacity tracking, you can prevent work from piling up on certain employees while others have availability.

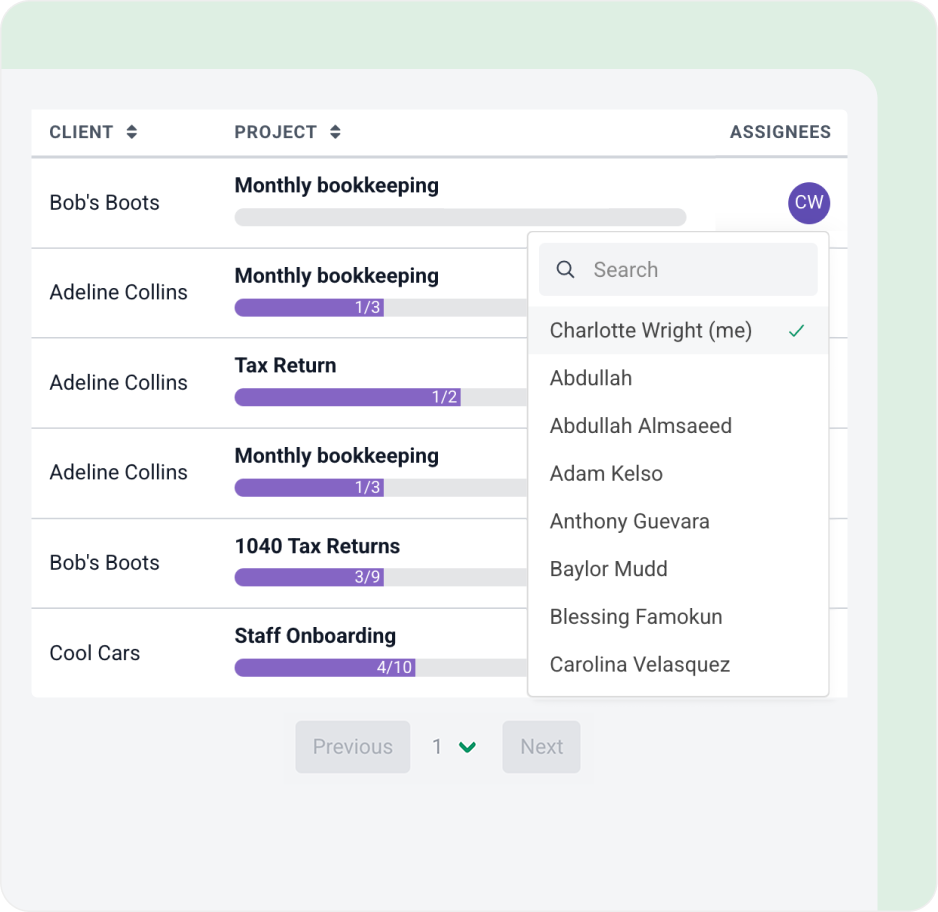

If someone is at risk of being overburdened, you can reassign work with just a few clicks, balancing the workload across your team. Keeping your team at a healthy workload doesn’t just improve morale. This also ensures higher-quality work and better client service.

Start free trialPlan for growth with data-driven hiring & resource allocation

Are you constantly pushing your team to their limits? Or do you have underutilized capacity? With historical workload trends and forecasting, you can confidently decide when it’s time to hire more staff or redistribute work to improve efficiency.

By tracking your team’s capacity over time, you can ensure your firm has the right people in the right roles—maximizing billable hours and optimizing profitability. No more scrambling during busy seasons or struggling with last-minute hiring decisions.

Start free trial

Capacity management features

Capacity dashboard

See your entire team’s workload at a glance to quickly identify who is at full capacity and who has availability.

Workload forecasting

Plan ahead by analyzing historical workload trends and predicting when additional resources or hires may be needed.

Task reassignment

Easily redistribute work when someone is overloaded or unavailable to meet deadlines without overwhelming the team.

Automated task assignments

Automatically assign tasks based on team capacity, reducing manual workload distribution and keeping projects on track.

Task dependencies

Ensure work flows smoothly by setting task dependencies that trigger the next step only when the previous task is completed.

Time & utilization reports

Monitor team efficiency and billable hours to ensure optimal productivity and resource allocation.

Custom workload views

Filter workloads by team members, projects, or deadlines to get a clear, customized view of resource allocation.

Task & workflow automation

Eliminate manual tracking by automating task creation, updates, and follow-ups based on workload capacity.

Loved by over 10,000 accountants, bookkeepers and CPAs

Capacity Management FAQs

Capacity management refers to tracking and balancing your team’s workload to ensure no one is overburdened or underutilized. With Financial Cents, you can easily view staff availability, assign tasks efficiently, and forecast resource needs, helping your firm stay productive and avoid burnout.

Financial Cents provides a centralized dashboard showing each team member’s current and upcoming workload in real-time. It allows you to assign work based on availability, set task dependencies, automate task creation, and access historical workload trends to make informed hiring and scheduling decisions.

Yes. With workload forecasting and historical data insights, you can identify peak periods, underutilization, and trends, enabling you to hire or allocate resources proactively instead of reactively.

Yes. Financial Cents offers time and utilization reports so you can monitor how team members are spending their time and how effectively resources are being used to drive profitability.

With full visibility into each team member’s workload, managers can make quicker, data-informed decisions, preventing bottlenecks, meeting deadlines, and keeping clients happy. It reduces guesswork and manual tracking.

If someone is at full capacity or goes on leave, you can quickly reassign tasks to available teammates. This flexibility helps keep your projects on track without overwhelming others.

Capacity management helps accounting firms prevent overwork, reduce burnout, and ensure work is evenly distributed. It also improves planning, efficiency, and profitability, especially during busy seasons like tax time or year-end reporting.

Yes. Financial Cents allows you to set individual capacity thresholds (e.g., 35 or 40 hours/week) for each team member, so task assignments and availability reflect their actual workload limits.

Yes. The capacity dashboard updates automatically as tasks are assigned, completed, or reassigned, so you always have up-to-date visibility into team workload and availability.

Yes. Whether you’re a large team, small team or a fast-growing accounting firm, capacity management scales with you. As your team grows, Financial Cents helps you maintain visibility, streamline workload distribution, and improve operational efficiency.

Get Started Today

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

Many of the other tools are poor at managing updates and bugs. Some use subcontracted developers, providing real client data samples. Others have suffered breaches without proper notifications.

Of the pre-built systems out there, I do think Financial Cents has a solid offering.

One of my top goals is to make the process easier for clients. Glad I made the switch!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!

If you’re not using this feature, I highly recommend it! Remembering to follow up with clients can be a serious bottleneck and I love how this solved that problem!