6 Compelling Reasons Your Firm Should Implement Accounting Workflow Automation

Author: Financial Cents

In this article

Quick one: what is the biggest challenge accounting and bookkeeping firms face?

Getting new clients? Managing clients? Delivering great service? Overseeing staff?

While these are all valid challenges, they are not the most pressing. According to our 2023 State of Accounting Workflow Automation Report, the top challenge is workflow.

The reason is simple. Workflow is the foundation of every business’ operations, and the whole business suffers if it isn’t optimized.

The ideal optimized workflow eliminates tedious manual processes, promotes efficiency, and supports the smooth operation of the firm. This gives you room to focus on the value-added activities to grow your practice.

For instance, you can use an automated system instead of spreadsheets to track workflow tasks. Such systems are more efficient as they show you details like the status of work and due dates from a single dashboard. This will save you from being overwhelmed with administrative work, letting you divert your focus to some other profitable activity.

As Shahram Zarshenas, CEO and Co-Founder of Financial Cents said,

The #1 way to build a high growth firm is by improving work quality, while simultaneously increasing productivity. You do this through workflow documentation & automation."

Accounting Firm Workflow Automation: What is it?

Simply put, workflow automation is using technology to streamline certain tasks and processes. In the context of accounting firms, it involves automating recurring, time-consuming activities. It serves multiple functions across the board, like…

- Eliminating manual data entry.

- Getting necessary documents from clients faster and with less stress.

- Onboarding new clients by automating the collection of necessary client information, setting up new client accounts, and establishing communication channels.

- Assigning work in an organized manner and according to capacity

- Streamlining communication with clients and among staff

Overall, workflow automation helps firms increase productivity, save time, avoid missing deadlines, and scale faster.

Use-Case: Manual vs Workflow Automation for Requesting Client Documents

In our aforementioned survey, “clients sending documents late” is the second top workflow issue (53.8%) firms face. But if you automate the document collection process, this wouldn’t be an issue. You’ll receive records faster without having to chase anyone down.

Here’s an illustration to drive home this point.

Picture two accounting firms: firm A (StellarPro Financial Services) and firm B (Prime Book Advisory). The former still does a lot of manual work, while the latter has upgraded to automated processes.

If StellarPro Financial Services wants to request documents from their client, the process looks like this.

Step 1: At the beginning of the week or month, an accountant or bookkeeper lists all the clients from which the firm wants to collect documents. They may track this list in a spreadsheet or on paper.

Step 2: They send individual emails or messages to each client requesting the necessary documents to perform the tasks. They include instructions and deadlines in the email and wait for the clients to respond.

Step 3: Some clients respond and deliver on the first ask, but others need more pressure. So, after a few days, the accountant manually sends them a follow-up message to remind them.

Step 4: At this point, many clients oblige. However, a few still forget or get caught up doing things. This means more reminder emails. Sometimes, client’s non-responsiveness gets so bad it forces the accountant to go to their office physically to get what they need.

Imagine doing this with over 50 clients while racing against deadlines. It’s a recipe for disaster.

For one, this manual process is time-consuming, stressful, and leads to burnout. As if that’s not all, you’re faced with other issues like:

- The high potential to mix up client documents.

- Being pressured by the client to meet the deadline, even though the delay came from them.

- Getting blamed if you miss the deadline for submitting documents to resolve time-sensitive problems like tax-related ones.

- Lacking the time to take on new business because the ones you currently have are a handful.

- Running at a loss because of all these complications.

It’s certainly not a pleasant situation and is usually an aftereffect of manual processes.

On the other hand, if Prime Book Advisory is in the same situation, i.e., they need records from their clients, the gathering process is much more straightforward because they use a workflow automation system.

With software like Financial Cents, all they need to do is:

- Create a request list of all the documents needed in the client’s project.

- Add a due date, description, and automated reminders in case they ignore the first notification.

- Voila! your client will receive a notification of your request. And you’ll also get notified when they complete your request.

Interestingly, because Financial Cents offers such an organized and simple document-sharing process, we find clients often respond to such requests the same day. Multiple follows are not usually needed. That’s the experience of Martha Yasso. In a chat with her, she says this (automation) has made her life easier. It allows her to get more done, resulting in more money.

6 Benefits of Using Accounting Workflow Automation in Your Firm

Below are some of the reasons to consider workflow automation.

a. Improved Accuracy and Reduced Errors

Manual work comes with a myriad of challenges, with one of the most prominent being an increased chance of errors. That’s because humans are fallible and are prone to mistakes.

By enforcing standardized processes, you ensure the execution of accounting projects is consistent and error-free.

Standardization involves using templates for routine tasks such as financial statements, weekly to monthly bookkeeping, quarterly to yearly reviews, data entry, and automating it to recur.

Automate your accounting workflow to do the best work for clients, i.e., free from human errors.

b. Enhanced Efficiency and Productivity

Automation streamlines your overall workflow by allowing you to eliminate repetitive tasks, reducing time-consuming manual efforts. This results in a smooth running process, promoting synergy among employees. Like a well-oiled engine, they are in sync and work in a more efficient manner.

Essentially, you’re achieving more in the same (or even less) time, boosting productivity.

c. Cost Savings and Resource Allocation

Think about it. If you automate certain activities, you’ll reduce the hours spent. This reduces labor or operational costs, as you’ll require fewer employees to perform these tasks.

You can then redirect your time and resources into higher-value activities requiring human judgment and expertise, like Client Accounting Advisory Services (CAAS).

It also helps you distribute work evenly among staff. In the Workflow Automation Report, 38.6% of respondents said poor work distribution was the biggest impact of their workflow issue.

But with a capacity management feature, you can track the workload and availability of each employee and redistribute work when needed.

d. Increased Client Satisfaction

An automated workflow contributes to customer happiness with faster response times, better organization, and improved client experiences.

- Faster response time: A good accounting workflow software will have a robust CRM that promotes client communication and collaboration with automated notifications and reminders.

These systems send notifications of messages to both the accountants and clients, ensuring timely communication. They also keep all client communication in one place, so you can respond to any client question or inquiry quickly without having to hunt down hundreds of emails.

- Efficient document management: With document management features integrated into workflow automation systems, clients can securely upload and access their documents through online portals. This eliminates needing a physical document exchange or searching through cluttered email threads.

By centralizing document storage and providing easy access, automation helps your firm become better organized.

- Tracking and transparency: Clients have real-time visibility into the status of their projects. They can track the progress and see the communication history. This transparency builds their trust and confidence in the accounting firm’s ability to manage their work effectively.

e. More Flexible Working Styles

Remote or hybrid work conditions are all the rage today. To attract top talents, consider optimizing your firm for these working styles.

Without workflow automation, it’ll be hard for you to achieve this transition. Technological advancements like cloud storage (for remote data accessibility), project management capabilities, task tracking skills, and document management abilities make remote or hybrid work possible. A good accounting workflow software will have these features.

f. Successful Firm Scalability

Manual workflows limit the amount of work you can do while maintaining your standards. But by saving time on manual tasks and creating standardized processes, you have increased capacity to take on more clients without compromising quality or timeliness. This lets you successfully scale your operations.

Struggling with manual tasks? Download our Accounting Firm Automation Playbook as PDF.

Selecting an Accounting Workflow Software

Let’s look at the factors to consider when choosing workflow software.

Functionality

First, assess the software’s features to ensure they align with your accounting workflow needs. Consider whether it supports essential tasks such as data entry, document management, task assignment, communication, collaboration, document upload, and reporting. Additionally, evaluate whether the software offers customization options to accommodate your unique business processes.

Scalability

It’s not only about the present. Aside from the tool being able to cater to your current needs, you have to look to the future. Ensure it can accommodate your firm’s growth and increasing workload demands.

Ease of use

Look for a software solution that is intuitive and user-friendly. Both clients and team members should be able to navigate the interface easily. Else, its rate of adoption would be low.

Reviews

Check sites like G2, Capterra, etc, for what real users say about the software. Filter by ratings, and go for those with at least 4-star ratings. If you also know colleagues who have used the tool, ask them about their experience.

Pricing

Evaluate its pricing structure and compare it with the features and benefits it offers. The value of the software has to be commensurate with the pricing. Ascertain that the pricing is transparent with no hidden fees, and it fits your budget.

Cloud Computing

Select a cloud-based option if your firm is remote or hybrid. This virtual accounting solution allows users to access their data anywhere, promoting seamless collaboration regardless of physical location.

Integration Capabilities

Another factor to consider is whether the software integrates with your current accounting tech stack. Seamless integration allows for smooth data flow between different platforms. Most accounting software integrates with email platforms and tools like QuickBooks (for invoicing), Zapier (for workflow automation), SmartVault (for document management and secure file sharing), Adobe Sign (for e-signatures).

Automate Your Workflow With Financial Cents

You’ve seen why it’s important to implement workflow automation in your firm. The benefits are numerous, and it’s the key to growing your practice.

If you’re looking for a tool that ticks all the criteria of good workflow automation software, check out Financial Cents. We built this tool for accounting, CPA, and bookkeeping firms, so we’ve tailored all features to solve your challenges.

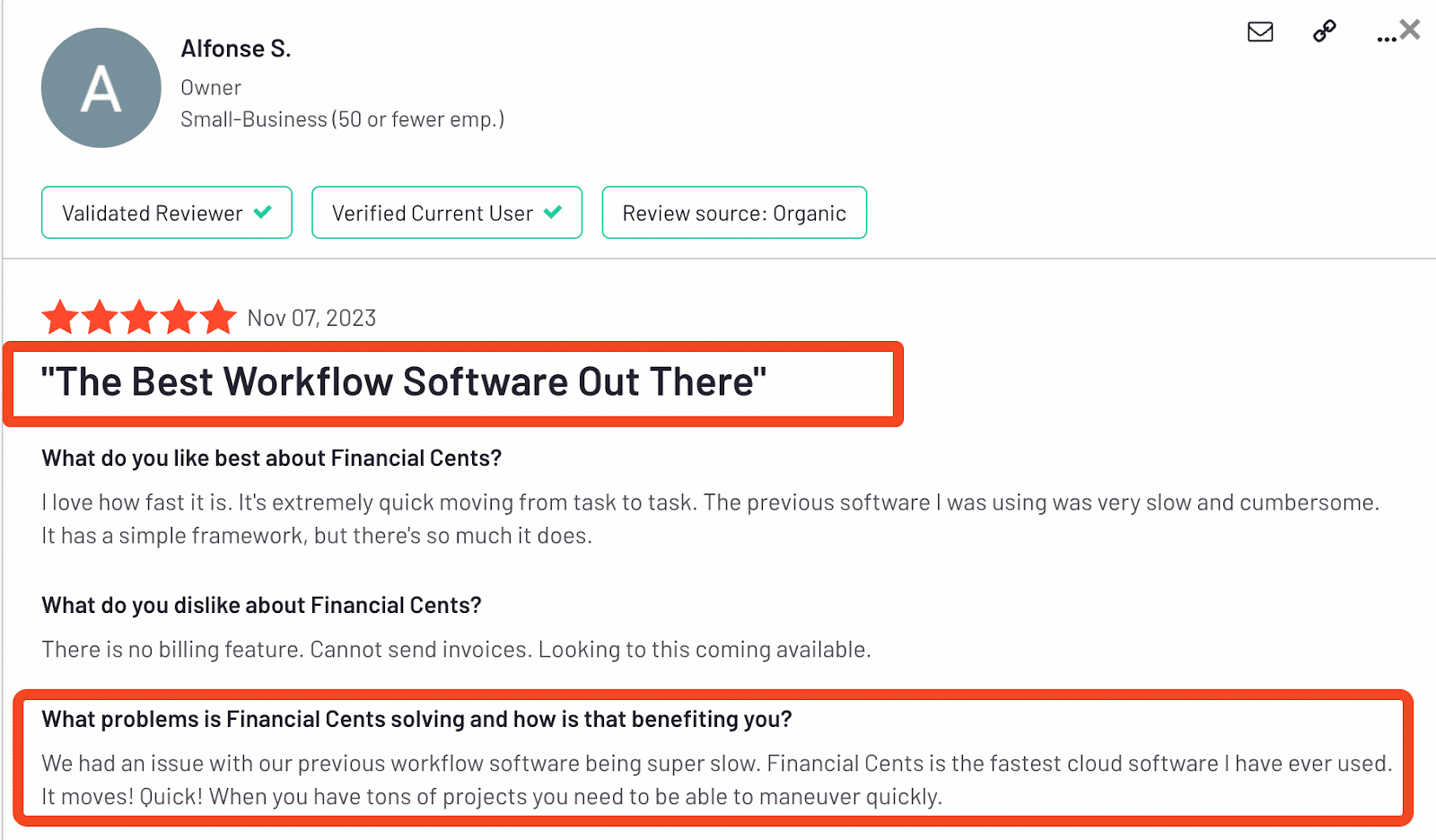

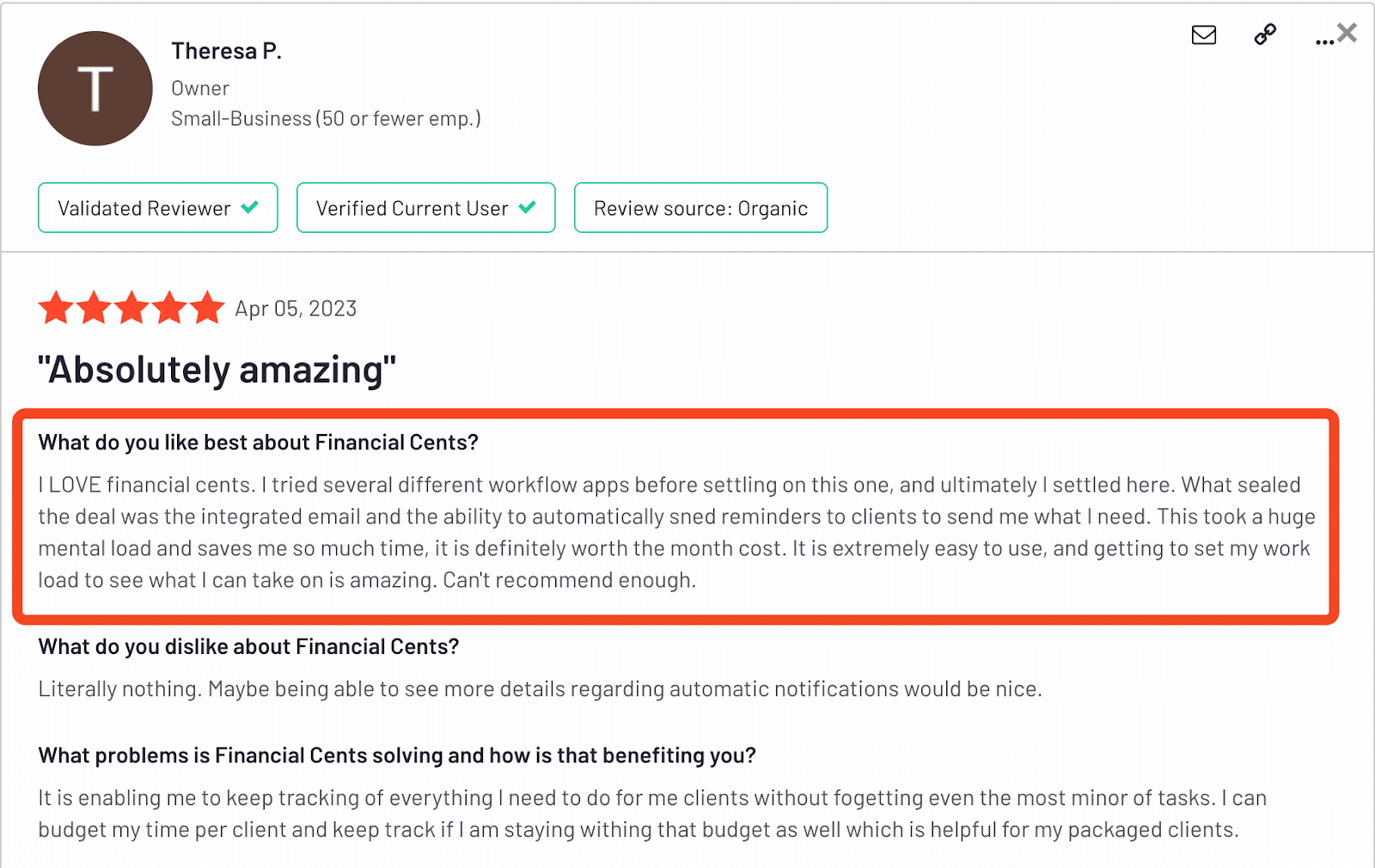

See what some of our customers are saying about us:

Why not give Financial Cents a try?

Start Using Financial Cents to automate your firm.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

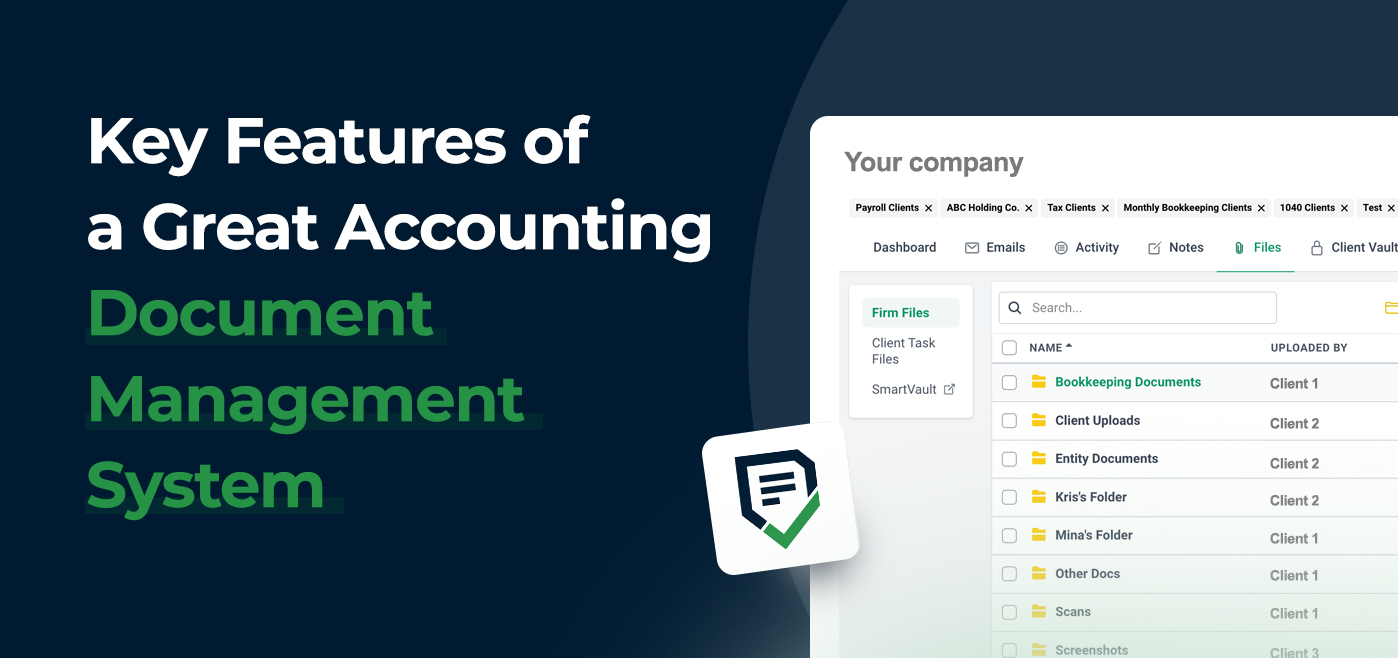

Key Features of a Great Accounting Document Management System

Here’s all you need to know about an accounting document management system and how it can make you more organized and save…

Apr 26, 2024

5 Simple Time-Saving Tips for Managing Uncategorized Transactions

Manually resolving multiple uncategorized transactions steals valuable time from accountants and bookkeepers. But there’s a solution. Here are five simple, time-saving tips…

Apr 24, 2024