Businesses need your help recording, classifying, organizing, and indexing their transactions to communicate their financial position and performance to investors, creditors, and regulators.

The general ledger links raw transaction data with high-level financial statements and analysis by organizing and summarizing the transactions.

This article will show you how to improve your client’s financial compliance, performance, and transparency with the general ledger.

What Is a General Ledger?

A general ledger is a document that organizes and summarizes your client’s financial activities and transactions by accounts – assets, liabilities, equity, revenue, and expenses.

Financial records are taken from the journals and classified in the general ledger for preparing a trial balance and financial statements (such as the balance sheet, income statement, and cash flow statement.

The Difference Between the General Ledger and General Journal

The general ledger is the permanent home for your client’s financial transactions, which enables the preparation of financial statements.

Transactions are recorded in the general journal before they get to the general ledger.

As a result, the general journal captures more granular information, such as transaction dates and descriptions. While the general journal documents transaction-level activities, the general ledger organizes financial records at the account level, making information in the GL more concise.

Key Components of a General Ledger

1. Types of Accounts in A General Ledger

The five accounts in the general ledger represent the pillars upon which every company’s financial position is established.

They are:

- Assets: resources that the company owns and has future economic value, such as cash, inventory, equipment, and debts owed. More details covered here: Assets in Accounting.

- Liabilities: payment obligations or debts owed by the business, such as loans, accrued expenses, and accounts payable. Read more: Liabilities in accounting.

- Equity: a company’s value after deducting its liabilities from its assets. More in-depth coverage here Equity in accounting.

- Revenue (Income): money or other economic benefits that flow into the company from its business operations. Learn more about Revenue in Accounting here.

- Expenses: the monetary value of the resources used to run the business. Further reading: Expenses in accounting.

2. Chart of Accounts: The chart of accounts is a predefined system for categorizing various financial transactions in the general ledger using account identifiers.

Your chart of accounts could look like this:

Assets (1000–1999)

Liabilities (2000–2999)

Equity (3000–3999)

Revenue (4000–4999)

Expenses (5000–6999)

3. Debits and credits: The general ledger employs the double-entry accounting system, where each transaction affects both the debit and credit sides of the ledger. Debit is on the left side of the ledger, while credit is on the right.

4. Journal Entries VS Ledger Entries: The first recording of each transaction is done in the journal (journal entry). Because it is the first instance of record-keeping, transactions here are more detailed and recorded as they occur, making them more chronological.

In the general ledger, these transactions are taken from the journal and summarized into their corresponding account columns.

5. Ledger Accounts and Balances: Every account on the general ledger has a debit and credit side. These accounts’ balances are obtained by deducting the debit side from the credit side.

You can prepare a trial balance (at the end of each accounting period) by calculating the total debits and credits. If they are equal, your books are accurate, and you can proceed to prepare the financial statement. Otherwise, you’ll investigate the entries to find and resolve the discrepancies.

How does the General Ledger Work?

Understanding the following concepts will show you how the general ledger works.

a. The Double-Entry Accounting System

The general ledger uses the double-entry accounting system, which ensures every financial transaction affects the debit and credit accounts, to balance out the accounting equation (Assets = Liabilities + Equity) in a company.

For example, if a business pays for office stationery, the expense account is debited while the cash account is credited with the same amount.

That way, the debits will equal the credits in the company’s general ledger.

Recommended Read:

b. How Transactions Flow from Journals to the GL

Every transaction in a company undergoes two stages of recording:

→ Entry into the Journal: Journals are also called the book of original entries because all transactions are initially entered here by date (together with amounts, affected accounts, and descriptions).

→ Posting into the General Ledger: After entering transactions as journal entries, they will be posted to the corresponding account in the general ledger.

The general ledger presents information in a single, central location, making it easy to track, summarize, and analyze a company’s financial health.

c. Relating the General Ledger with Sub-ledgers and the Trial Balance

Sub-ledgers: Sub-ledgers break down accounts into their constituent parts when transaction volume is high and difficult to track.

For example, you can divide your client’s accounts payable into sub-ledgers for individual vendors, enabling you to track the financial activities between the company and individual vendors. In the end, the sum of all accounts payable sub-ledger balances must tally with the controlling accounts balance in the general ledger. Learn about the difference between sub-ledgers and general ledger here.

Trial Balance: At the end of the year, you can use the information in the general ledger to prepare the trial balance, which is a list of all the account balances in the general ledger.

In a trial balance, the balance on the debit side must equal that on the credit side. Equality shows that the books are accurate, and financial statements can be prepared. Otherwise, the books should be investigated for errors. We cover trial balance in detail here.

d. The Process of Posting and Summarizing Financial Data

The Posting Process: to post transactions from the journal to the general ledger, review and enter the transaction date, account number, amount, and running balance in the relevant general ledger accounts.

Summarizing Financial Data: summarizing financial data involves calculating the ending balance of each account after all debit and credit transactions have been posted.

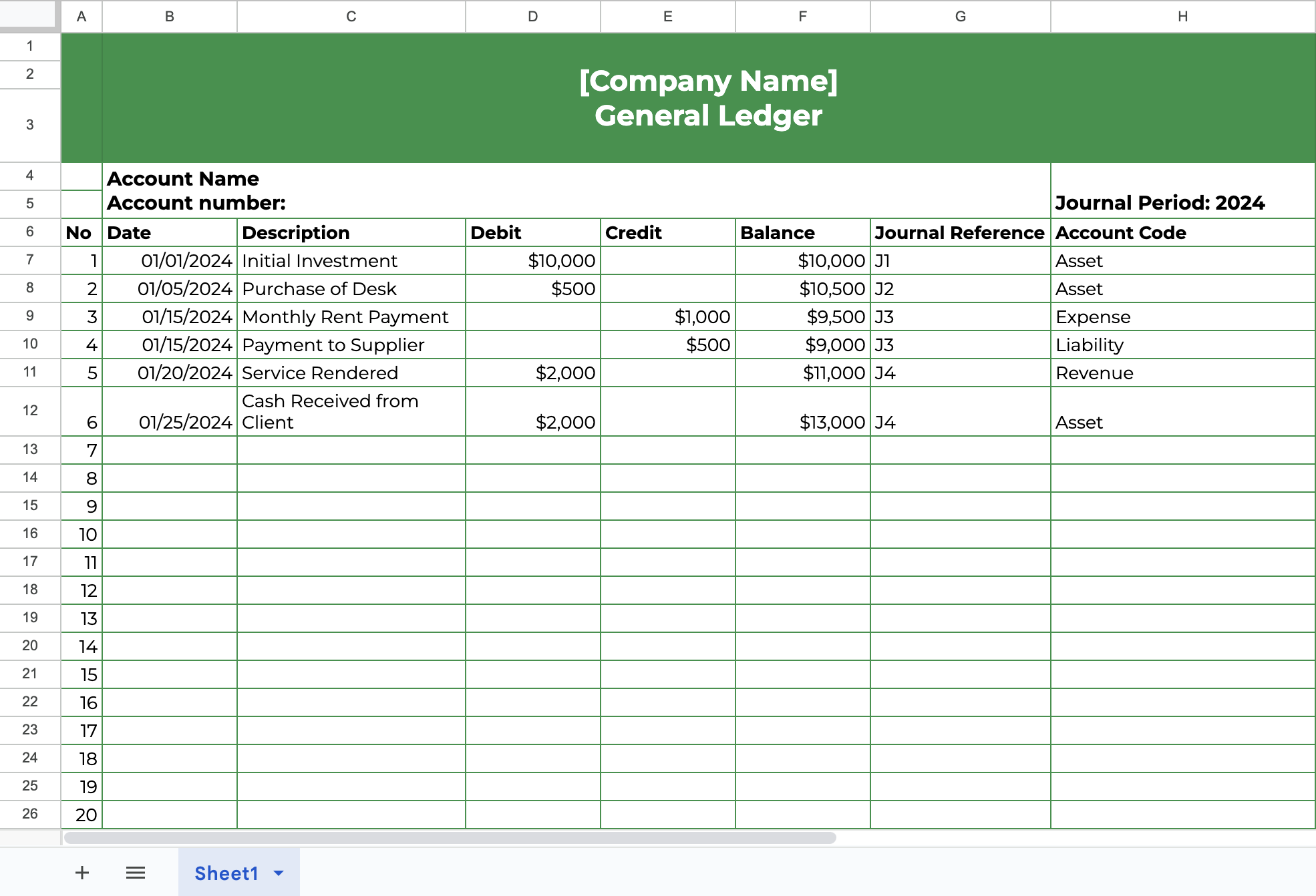

Ledger Format and Example

General ledger accounts are presented in tabular formats to ease the tracking and summarization of account activities.

Here’s an example of a general ledger:

Download your free Accounting General Ledger Template

Here’s what each column means:

- Date: indicates the day a debitor credit transaction was posted from the journal. This helps to catch errors related to the wrong timing of transaction entries during audits or financial close.

- Description: short explanations that give context to transactions for financial reviews and audit purposes.

- Journal Reference: links entries in the general ledger to the original entry in the journal to provide an audit trail for the information in the general ledger.

- Account Code (and Account Type): classifies entries by the account identifier (often a numerical code) assigned to the account type. This provides structure and helps with consistency.

- Credit: transactions that increase revenues and liabilities are recorded on the right side.

- Debit: transactions that increase assets and expenses as recorded on the left-hand side of the ledger.

- Balance: the running (current) balance of each account after every transaction posted to the ledger. This is useful for monitoring cash flow and evaluating ending balances.

Why Is the GL Important?

The general ledger provides several benefits for businesses and their accounting firms.

They include:

A. Serving as a central source of financial truth: as the central repository of a company’s financial records, the general ledger organizes and makes all account and transaction information accessible to interested parties.

This provides everyone with a single source for accurate and up-to-date information to understand business performance.

B. Supports the preparation of financial statements: information in the general ledger forms the basis of the information in the trial balance, which leads to accurate financial records and financial statements.

C. Ensures accuracy and compliance: Regular review and reconciliation of the general ledger make error detection (and correction) easier and faster.

This ensures the records are accurate and compliant with relevant regulatory requirements.

D. Helps detect and prevent fraud: With features like journal reference, you can trace suspicious transactions to their original entries and analyze account activities in the ledger to catch and prevent fraudulent transactions in the company’s financial operations.

E. Facilitates tax preparation: Tax planning and preparation rely on the accuracy and organization of financial records (revenue, expenses, assets, liabilities, and equities) in the general ledger. This information is necessary for calculating a company’s tax liability.

Best Practices for Managing a General Ledger (GL)

Your clients’ general ledger (GL) will be easier to manage if you:

-

Keep it updated

When you delay posting entries to the general ledger, you risk accumulating data, which can make information unclear and increase the likelihood of errors, such as skipping, duplicating, or misclassifying entries.

Promptly posting transactions into the general ledger helps you to send financial data where it belongs on an ongoing basis, keeping the records more accurate and reviews much easier.

-

Reconcile accounts

Regular reconciliation of the general ledger with supporting data (sub-ledgers, bank statements, etc.) helps you detect missing transactions, duplicate entries, and other errors in your client’s financial records on time.

This helps you to maintain the integrity of the general ledger (GL) and, by extension, the financial decisions.

-

Use audit trails and track version history

Thanks to general ledger software, you can keep audit trails and view version histories to see what has happened to the information in a journal entry over time.

You can see when a change is made to accounting information, what is changed, and who is responsible for it. This enables you to maintain financial transparency, which might be necessary for regulatory compliance.

-

Maintain a clear chart of accounts

A clear chart of accounts (which shows your team how to categorize and represent financial information in a company’s records) ensures your data is properly classified.

This helps the uniformity and consistency of your clients’ data while simplifying reporting, analysis, and decision-making.

Common Mistakes and How to Avoid Them

-

Misclassifying accounts

When you record transactions under the wrong account, they can be overstated or understated, which can result in a company paying more or less taxes than it should, as well as inaccurate financial data.

You can avoid misclassifying accounts by reviewing existing records to detect unusual balances. But before then, train your staff to classify transactions in the general ledger.

It also helps to implement validation rules in your general ledger software. Validation rules allow you to set boundaries around the transaction or account information you can provide in the different sections of the general ledger.

This allows the software to flag transactions entered on the wrong side of the general ledger for your review and correction.

-

Forgetting to record adjustments

When you forget to record adjustments such as accruals, depreciation, prepayments, bad debts, and asset write-downs, expenses and revenues won’t match, creating an inaccurate financial picture of the business.

To prevent this, create a closing checklist to ensure no step is forgotten in your standard adjusting entries workflow. Secondly, automate your adjustments to recur on a regular basis. A depreciation schedule will also help you track your assets and report every change in asset value.

-

Skipping reconciliations

Errors go undetected when you fail to compare the general ledger with the sub-ledgers, bank statements, and other relevant documents often enough.

To prevent this, assign reconciliation work to specific team members and ensure they reconcile the high-volume accounts more frequently (monthly, for example).

Some accounting software solutions also provide the bank feed feature, which helps to match bank information with GL data.

-

Not closing out temporary accounts

When revenue and expense accounts remain open at year-end (and net income is not transferred to retained earnings), the revenue and expenses of the previous year are carried over to the new year, which affects the balance sheet and financial statements.

Use the automated closing entry feature in your accounting software to generate and post the closing entries at the end of an accounting period without manual input. This not only prevents your team from forgetting, but their time can also be used elsewhere for other important tasks.

Tips for Maintaining Ledgers for Multiple Clients

1. Use a General Ledger Software

Managing your clients’ finances with a physical ledger will require every member of your team to be present with the document to post entries and manage clients’ finances. This is time-consuming and difficult to update.

There’s only so much your team can do to prevent skipping a reconciliation, misclassifying transactions, or forgetting to make necessary adjusting entries, which is why every business should use a general ledger software solution (like QuickBooks and Xero).

These tools allow you to switch between clients on demand, enabling you to serve all your clients in one place.

Built with bank feed integration, version history, and other automation, general ledger software provides real-time access to client information while reducing the manual work involved in managing your clients’ books.

2. Train Staff and Implement Access Control

Omissions, misclassification, and other errors are common when you’re the only one with the patterns and procedures for adding transactions to a client’s charts of accounts.

This is where SOPs and staff training come in. They allow you to teach your team how to structure each client’s chart of accounts and post (and reconcile) transactions using templates.

While at it, use the access control feature in your general ledger software to control who can see and edit what information in a client’s general ledger. This strengthens the security of your client’s data and helps to maintain the integrity and accuracy of the resulting financial statements.

3. Centralize Your Workflow with Practice Management Software

As tools that help accounting firms manage their projects, clients, and teams, practice management software provides the features you need to deliver general ledger services at scale.

These features include:

Workflow Management & Automation

That enables you to create, execute, and monitor projects and automate manual tasks using:

- Accounting workflow templates to standardize work across multiple general ledger (GL) clients

Workflow templates standardize general ledger services by documenting the step-by-step procedure for performing tasks (like adjusting journal entries, bank reconciliation, and month-end close).

This ensures that any team member assigned to your general ledger client completes their tasks to standard, making your team’s output consistent across all clients.

- A Workflow dashboard to track the status of work

The workflow dashboard shows all your general ledger projects on one screen. This makes it easy to see where each client project stands, what has been completed, and what is overdue, without having to open multiple tabs or drill through rows and columns in a spreadsheet.

With this visibility, you can plan your resources, follow up with lagging tasks, and eliminate bottlenecks in your process to ensure timely and accurate financial records for all your clients.

- Automating Tasks to Recur

Financial Cents’ Recurring Project feature automatically schedules your general ledger work to appear in your workflow dashboard. This makes it easy for whoever is responsible to find it in their weekly and monthly tasks and complete it.

If you wait till it’s time for monthly reviews, reconciliations, and adjustments before creating and assigning these projects, your chances of forgetting them will be high.

Even if you remember to create every project as and when due, you’ll be wasting precious time on manual tasks that do not generate direct profit.

- Deadline tracking and reminders

Apart from tracking your deadlines with the Financial Cents Due Date feature, your team members can also set up reminders for Financial Cents to automatically remind them when their general ledger-related tasks come within a few days of their deadlines.

For example, if an employee sets their due date reminder for five days before their tasks are due, Financial Cents will automatically remind them whenever any task is five days before their deadline. This prevents deadlines from taking your team members by surprise.

Team Collaboration

Financial Cents enhances team collaboration in several ways. The most common are:

- Task assignment: this allows you to make specific team members responsible for tasks in a client’s general ledger work to team members.

Combined with the Financial Cents dependency feature, your team members will not only know the tasks they are responsible for, but they will also know when they can work on them.

- Comments: Financial Cents allows you to ask questions and share your thoughts with your team members inside the general ledger work to ensure all project-related conversations are held in context.

- Tag (@Metnion): you can also mention specific team members to bring your comments to their attention more quickly.

- Client Notes: this enables your team to share client-related updates in the client profile, guiding assignees to present the true picture of your client’s general ledger.

Time Tracking & Billing

Financial Cents ‘ integrated time and billing features make it easy to get paid (and adequately) for the general ledger work you’ve done.

The features include:

- Automated Timer and Manual Entries: track time in the background and add time entries manually.

- Time Budgets: estimate the time your general ledger work will take to keep your firm profitable.

- Billable Vs Non-Billable: this shows the time your team spends on non-billable general ledger work versus billable work.

- Multiple Payment Methods: Financial Cents accepts ACH and Credit Card payments.

- Recurring invoices: create recurring invoices for your monthly general ledger work.

- Saved Payment Methods: add your client’s payment method to their file to enable automatic payments.

- Automatic Payments: charges your client’s card when their payments are due.

- Automated Client Reminders: follow up with clients until they make payment.

4. Schedule Periodic Reviews and Reconciliations

Regular reconciliation of the general ledger with sub-ledgers and bank accounts enables you to detect and correct errors to keep your client’s general ledger accurate and up-to-date.

But when you have many other projects in a short period (and clients delay sending the information you need to perform these tasks), you can easily forget this critical function.

That’s where the Financial Cents client task and auto-reminder feature helps.

It allows you to send a checklist of the information and documents you need to review and reconcile GL entries tasks in advance. Its auto-reminder feature helps you follow up with clients, eliminating the need to chase them manually.

5. Securely Share and Store Client Documents

A secure document management system keeps client information from the prying eyes of cybercriminals and helps you comply with relevant data regulations.

Secondly, the best document management software solutions centralize client documents for easy retrieval, which enables your team to review and reconcile your client’s general ledgers more quickly.

Financial Cents’ document management features enable you to exchange documents securely with your clients through a dedicated client portal. Client documents are automatically saved to the client’s profile and projects, providing your team with a single location to access each client’s documents, such as bank statements, for completing their general ledger work.

Financial Cents integration with other document management tools (like SmartVault, OneDrive, Dropbox, Sharefile, etc) allows you to route your client documents to any third-party document management software you prefer, if you don’t want to store them inside Financial Cents.

6. Communicate Clearly with Clients

Effective client communication is crucial to the timeliness, accuracy, and consistency of general ledger data, and effective communication is both clear and proactive.

You can’t afford to wait till your month-end close projects to ask questions about transactions. Once you catch an error in the financial records, bring it to the client’s attention.

For example, when you detect an inconsistency in the financial records, contact the client to verify it. This helps to reduce the workload while making it easier for clients to remember the details of transitions since they will still be fresh in their minds.

PRO TIP: Use Financial Cents’ ReCat Feature

The ReCats feature in Financial Cents helps you to categorize your client’s uncategorized transactions from inside Financial Cents.

Instead of exporting the QuickBooks transactions to a spreadsheet and chasing clients to clarify them, ReCats pulls the transactions into the client’s profile in Financial Cents, where you can share them with the client with a click.

To quicken their response, the auto-reminder feature follows up with the client on your behalf until they provide the information you need to put them where they belong in the general ledger.

Once the client sends the information, you can publish it (together with their description and related files) to QBO right from Financial Cents.

Other Financial Cents Client Communication Features include:

- Client Chat: the client chat feature allows you to discuss unclear transactions with your clients inside its secure client portal. This saves you the back-and-forth, insecurity, and information silos that are common with email threads.

- AI Emails: when you have to communicate with your client via email, Financial Cents integration with OpenAI allows you to compose emails in seconds (which you can use for subsequent emails), saving you the time and effort of thinking about what to say in the middle of your workday.

Combine Your General Ledger Expertise with the Right Software to Improve Client Service at Scale

A well-maintained general ledger is critical to fraud detection (and prevention), decision-making, and compliance with tax and other regulatory requirements.

Establishing robust ledger practices and procedures is crucial for accurately posting entries and utilizing the general ledger efficiently.

However, no number of best practices will suffice without implementing accounting practice management software to manage your ledger projects, client collaboration, and team capacity.

Using Financial Cents all-in-one practice management software, you will be able to automate and make your ledger maintenance (and other) services more efficient using:

- Task Management

- Workflow Automation

- Due Date Tracking

- Client communication

- Secure Document-sharing

- Time-tracking and billing

- Client Tasks and Auto-reminders

- AI email assistance

By combining your accounting expertise with tools like practice management software, you unburden your team to provide more value to clients through general ledger services.

Start managing your GL accounting services with Financial Cents today.