A Comprehensive Guide for Building Your Accounting Firm’s Tech Stack

Author: Financial Cents

In this article

Spreadsheets can only sustain your accounting firm for so long. As you start to grow and increase the amount of client information and projects you have to manage, your accounting firm will need to move away from manual methods like spreadsheets to an upgraded tech stack that helps you run your business smoothly and efficiently.

Creating a seamless workflow is the biggest challenge accounting firms face. According to our 2023 State of Accounting Workflow Automation Report, nearly 67% of accountants cite workflow issues as the biggest challenge they faced in 2022. But after implementing workflow automation, their time spent on manual work significantly decreased from an average of 1-10 hours to an average of 0-5 hours.

If you’re ready to say goodbye to spreadsheets and mundane administrative tasks, and hello to workflow automation and efficiency, let’s go over how to build your accounting firm’s tech stack so you can optimize and scale.

5 Things to Consider When Building Your Accounting Firm Tech Stack

Not sure where to get started? Here are a few things to consider as you set out to build your firm’s tech stack.

-

Your goals

Before you start building your accounting firm’s tech stack, establish your goals. There’s a reason you’re looking for new tools. If you’re like a majority of small firms, then creating a solid accounting workflow is the biggest challenge that you want to solve.

Get clear on exactly what you want to achieve with your workflow: Do you want to increase efficiency to meet deadlines faster? Are you expanding your team and need a better solution for collaborating and communicating across the firm? Or perhaps you’re bringing in more clients and looking for a better way to organize and track client information.

Consider what your firm’s top priorities are and use those to determine which tools and features are most essential for your tech stack.

-

Platform

When you’re exploring different tools, consider whether the software is specifically built for accounting firms or if it’s more general purpose.

Accounting firms have specific needs, from managing client information to tracking different documents and managing deadlines. While general workflow tools may work for some of your goals, accounting workflow software will be more tailored to your various needs.

-

Scalability

The best tools for your accounting firm’s tech stack are tools that will grow with your firm. As you expand your team, bring in more clients, and have more expenses to manage you’ll need a tech stack that can support you through every stage.

Look for tools that have different levels and packages. See if they offer features that fit your current stage of business as well as the level you anticipate growing to. It’s better to stick with one tool and upgrade as you grow than to transfer everything over to a new platform.

-

Pricing

As an accountant, numbers and budgeting are in your DNA, so it only makes sense that pricing is a major consideration when selecting the right tools for your tech stack.

There are plenty of free tools available for accounting firms as well as relatively inexpensive tools that have an accessible starting rate. As we mentioned in the last point, it’s important to consider how your tech stack will scale as you grow your firm.

Check out the different pricing levels for the tools you’re considering. What features or capabilities are provided at each price point? Does the software offer a free trial so you can try it out before committing?

-

Reviews and recommendations

As you grow your small firm, it’s critical to be strategic about which resources you invest in. You don’t have the time or budget to try out new tools without any assurance that it’s going to work for your firm. This is why it’s important to use reviews and recommendations to help inform your decision.

No one understands your firm’s needs like another accounting firm owner. Ask your peers for recommendations for new tools based on what you’re looking for or hoping to achieve. If there’s a specific tool you’re considering, try to find out what other firms’ experience has been with it. The more information you can gather from the accounting community, the more prepared you’ll be.

What Should be in Your Accounting Firm Tech Stack?

Ready to build your accounting firm’s tech stack? To find out what accountants like you rely on, we asked the customers in our accounting community what their must-have tools are based on different needs — from expense management, to accounting practice management to CRMs to time tracking.

QuickBooks is one of the most popular accounting software in the world, with an estimated market share of about 80%. If you are reading this, there’s a high probability that you use QuickBooks for general ledger and some other accounting functions.

The QuickBooks general ledger report provides you with a detailed overview of transactions from all accounts within the specified date range.

- Pricing: QuickBooks pricing starts from $15 per month if you opt for a quarterly plan (3 months), which gives you a 50% discount, or from $30 per month if you choose to pay monthly.

- Free Trial: Yes

- Platform: Desktop and Cloud-based (QuickBooks Online)

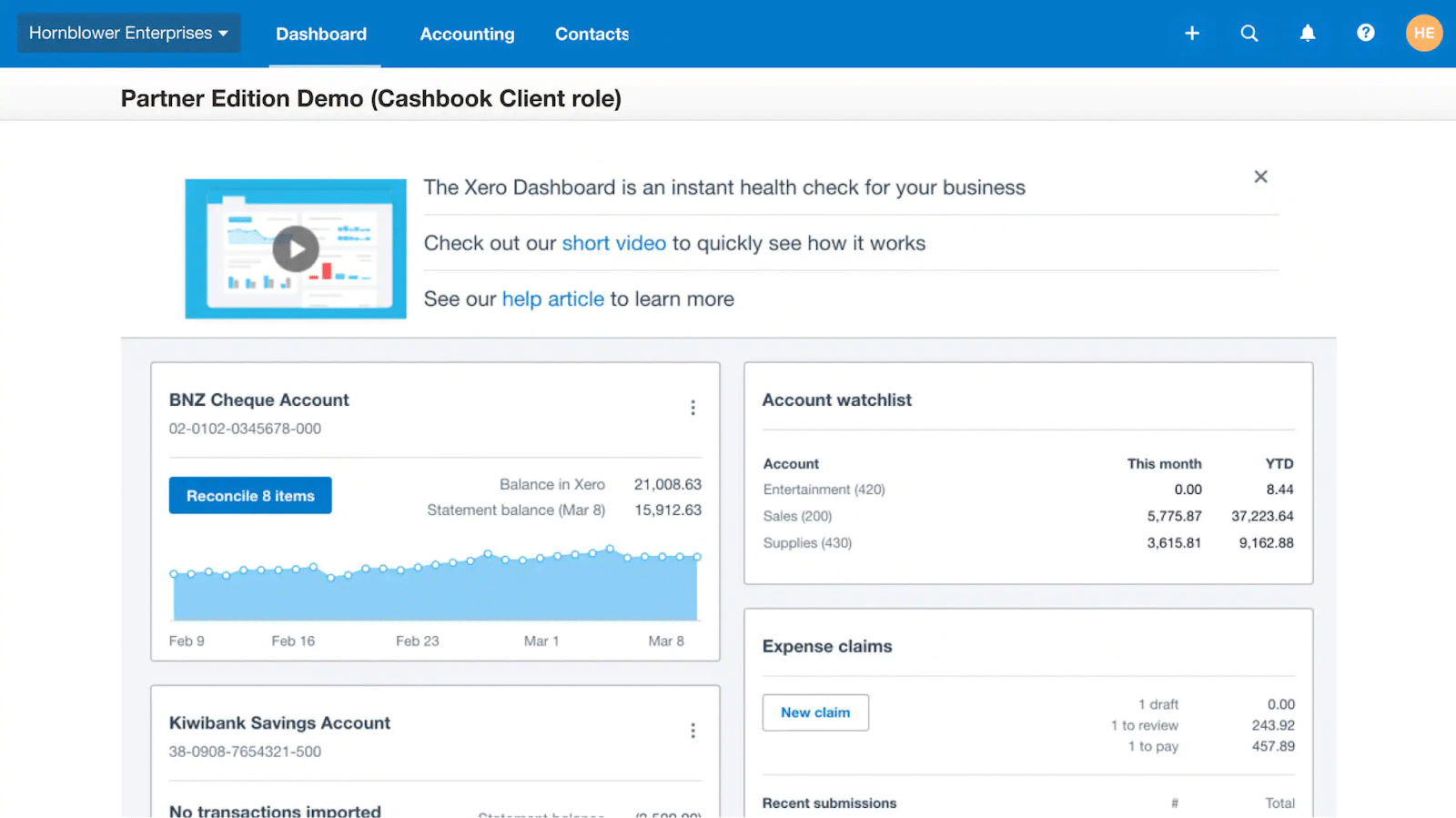

Xero

Xero is an accounting software for small businesses, self-employed people, accountants, and bookkeepers. For accountants and bookkeepers who are part of Xero’s partner program, Xero offers specialized plans including Xero Ledger and Xero Cashbook. These plans are tailored to the needs of accountants who need to manage multiple client accounts.

- Pricing: Xero Ledger is $3 per month, and Xero Cashbook is $8 per month, per client

- Free Trial: Xero’s partner program is free to join

- Platform: Cloud-based

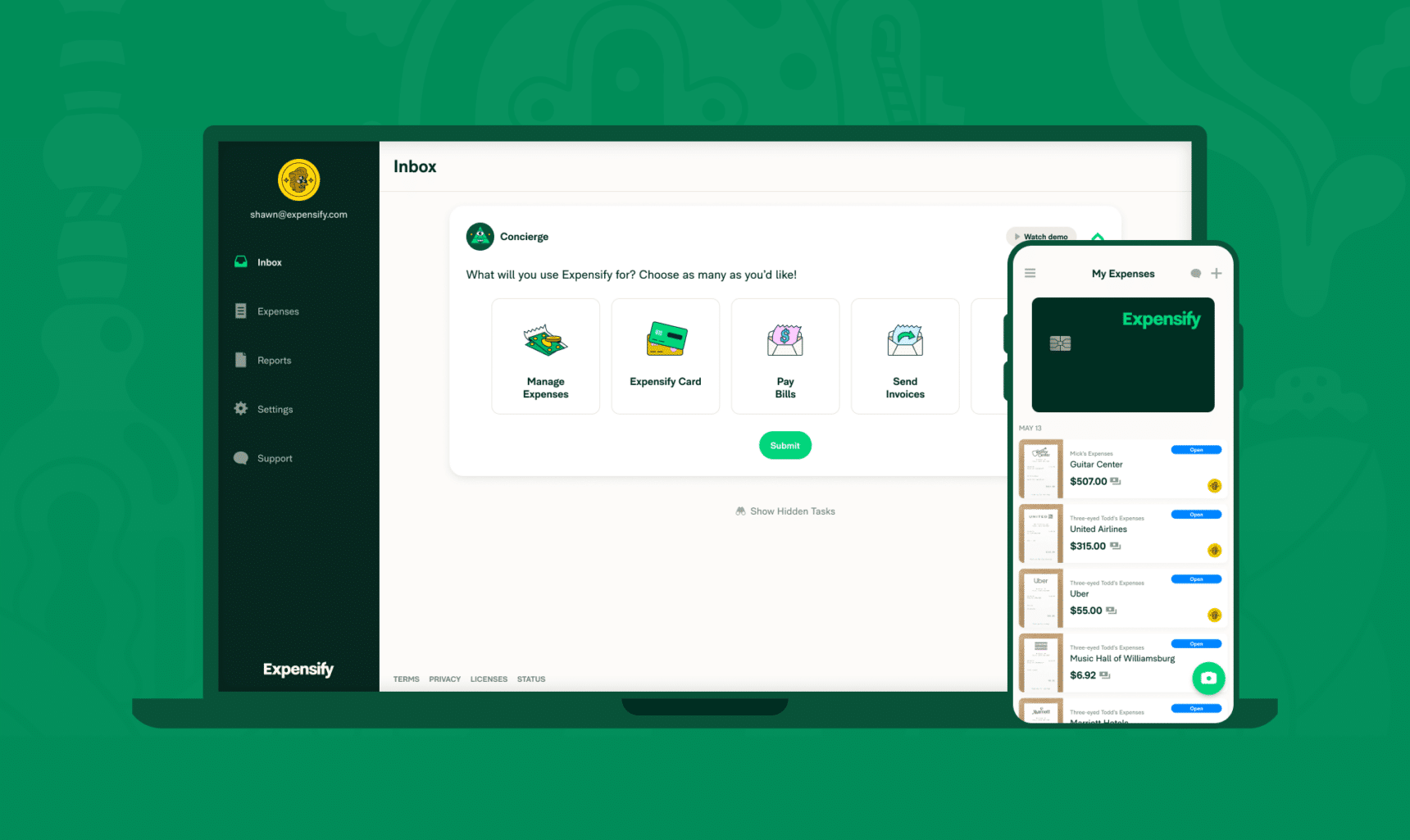

Expensify is an expense management system. With Expensify, you can manage your clients’ expenses and transactions in real-time. Expensify enables you and/or your clients to scan and upload unlimited receipts, pay bills, send invoices, chat, and more. Expensify is also accessible via the Expensify mobile app on Android and Apple OS.

- Pricing: Expensify pricing starts at $5/seat/month when you pay annually and from $10/seat/month when you opt to pay monthly. There’s also a special ExpensifyApproved! Accountants partner program at $9/seat/month for your firm and clients, with no annual commitment.

- Free Trial: Yes, 7 days free.

- Platform: Cloud-based

3. Practice Management

Financial Cents

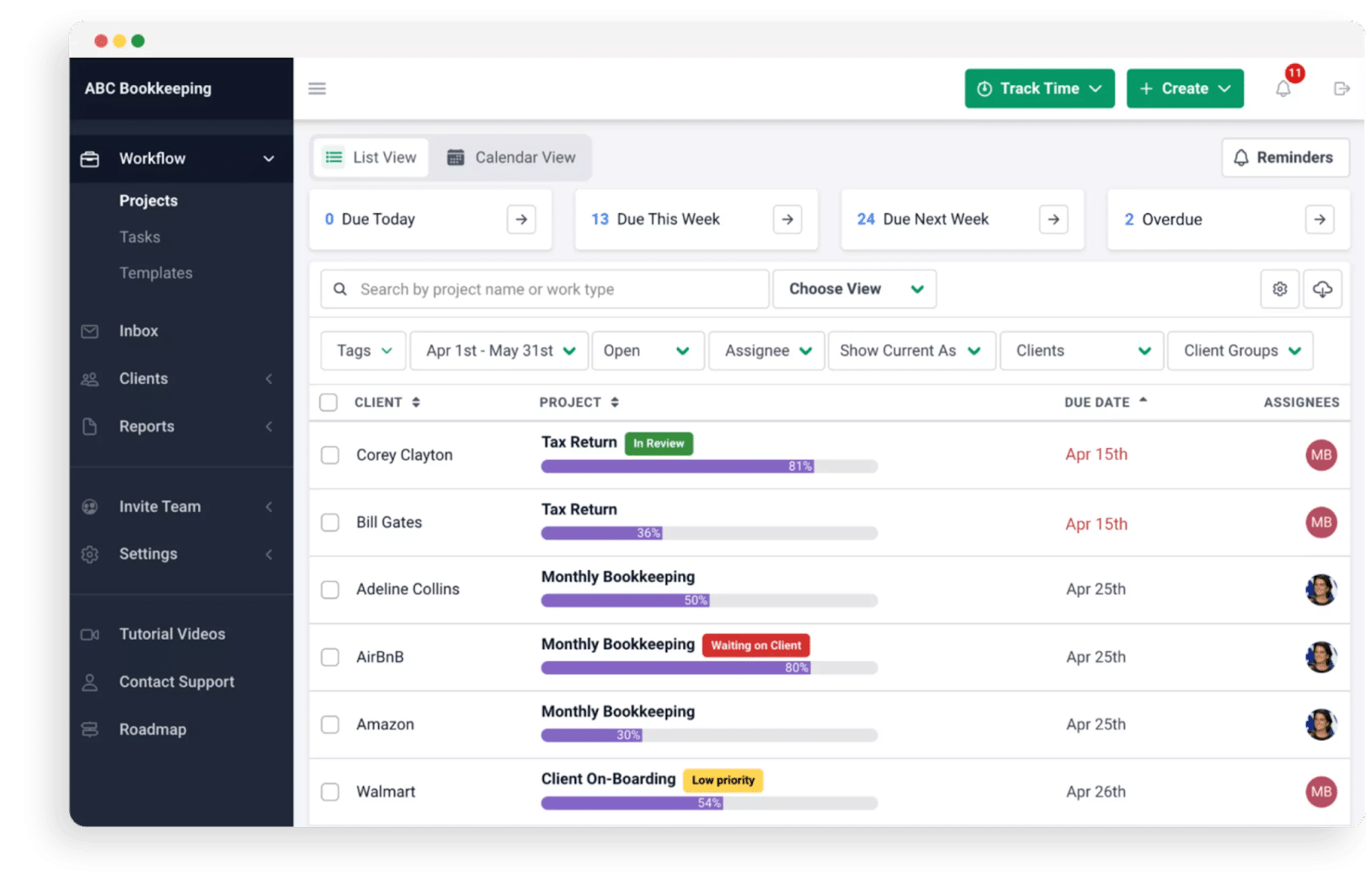

If you’re looking for an all-in-one solution for your firm, accountants in our community recommend Financial Cents’ practice management software.

Financial Cents makes it easy to create a seamless workflow across your accounting team. You can seamlessly track client work, assign work to team staff and collaborate, manage capacity, and stay on top of deadlines, all in one place.

I’ve been a Financial Cents user since its inception,” says accountant Phil McTaggart. “[It] would be very difficult to run my business without it."

Phil McTaggart, Accountant- Pricing: $39 per team member, per month

- Free Trial: 14-day free trial

- Platform: Cloud-based

4. Client Relationship Management (CRM)

Financial Cents

Financial Cents

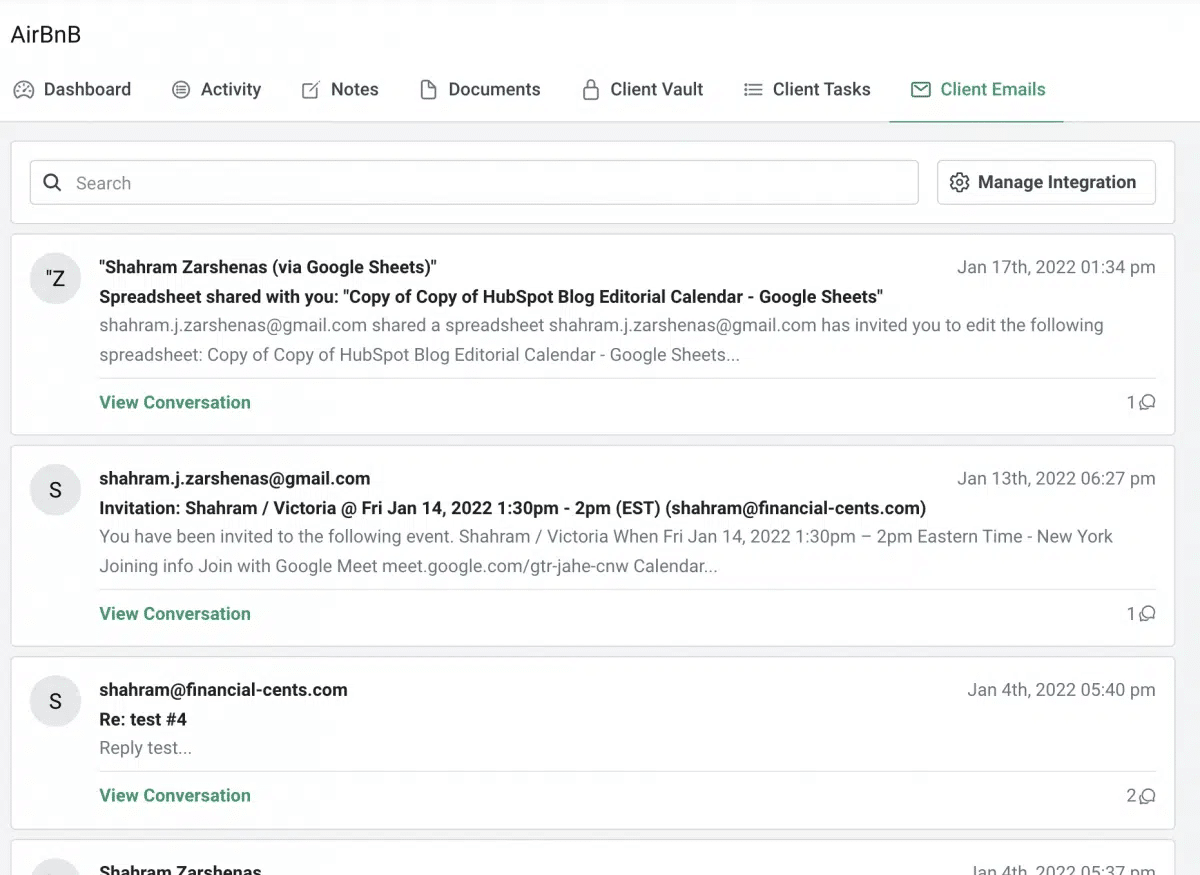

In addition to practice management, Financial Cents offers a comprehensive accounting CRM. With this CRM, you can better track and manage your client information and ongoing communication. Plus, it’s easy to find your client’s information when it’s stored in one place.

As we learned in our State of Accounting Workflow Automation Report, tracking down client documents is one of the biggest issues accountants and bookkeepers face. However, 68.2% of accountants say the process became faster after implementing an accounting workflow.

- Pricing: $39 per team member, per month

- Free Trial: 14-day free trial

- Platform: Cloud-based

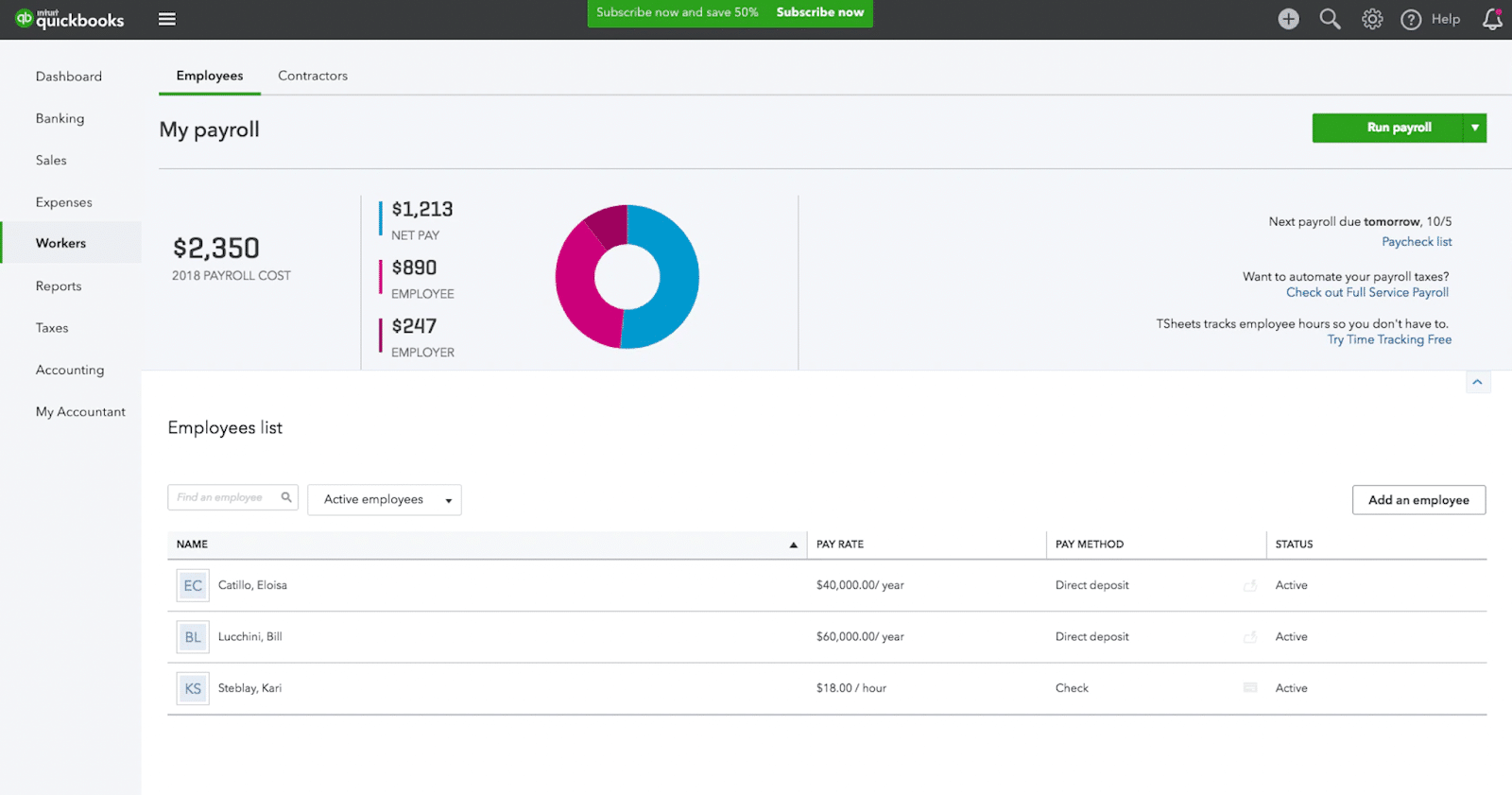

Another recommendation for your accounting tech stack is QuickBooks, specifically for payroll purposes. QuickBooks Payroll integrates with the rest of QuickBooks tools so you can manage each of these functions for your clients in one place.

- Pricing: Starts at $31.50 per month

- Free Trial: 30-day free trial

- Platform: Offers cloud and desktop-based

Drake Software is a professional tax preparation software. Drake enables you to manage tax returns for multiple clients on a centralized system and is programmed to compare and evaluate taxes for different states.

It has features such as electronic signatures, calculation error messages, return archiving, joint filing, amortization schedules, automated data flows and more.

- Pricing: Its pay-per-return pricing starts at $355 for 10 individual tax returns plus $34.99 and $49.99 for additional per individual and business tax return respectively. There’s a 1040 plan at $1,620 for unlimited individual tax return but an additional $49.99 per business tax return. Unlimited individual and business tax return plan goes for $1,970.

- Free Trial: Yes

- Platform: Desktop based.

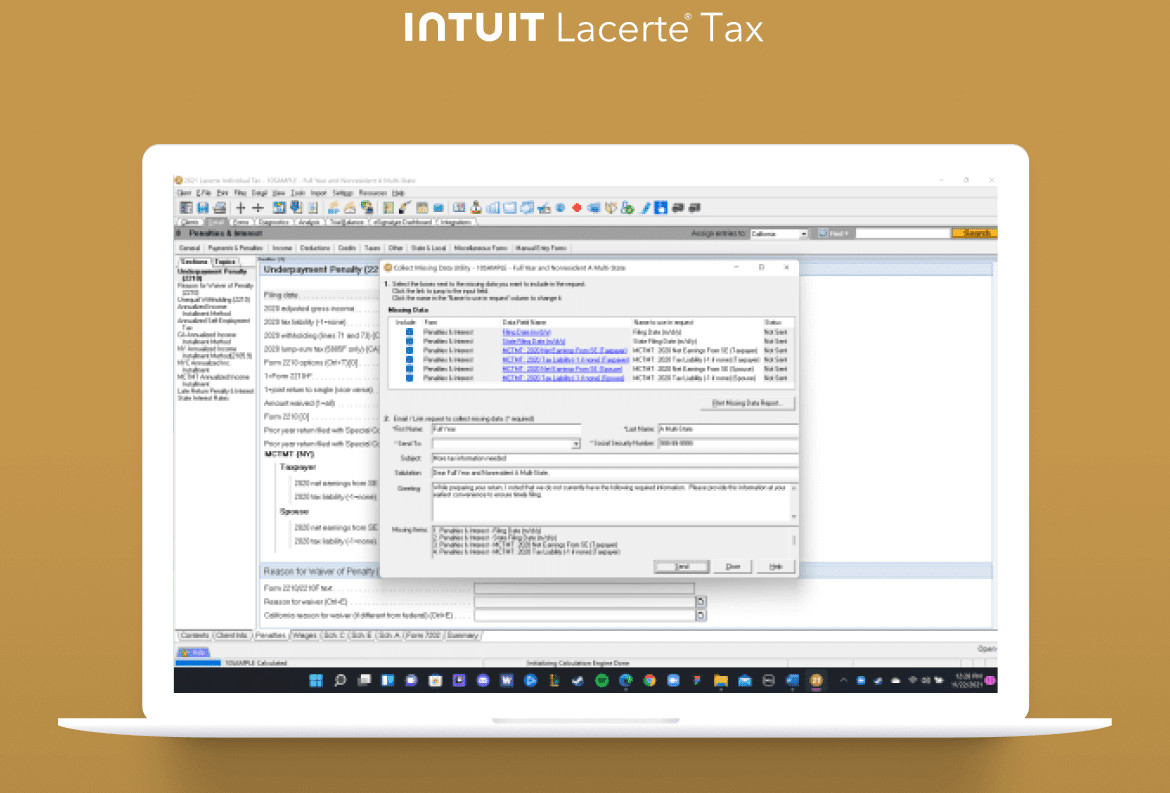

Lacerte

This is another accounting software developed by Intuit, the software company responsible for the popular QuickBooks. If you like to stay on-brand, then you should consider adding it to your accounting tech stack.

Lacerte Tax software enables you to execute and manage simple and complex tax returns with robust diagnostic and reporting tools. Like Drake, it is also configured to prepare taxes for different states. It has a seamless integration with QuickBooks, allowing you to easily import accounting data from QuickBooks to Lacerte.

- Pricing: Starts at $449 Pay-Per-Return license pricing for new users.

- Free Trial: Yes

- Platform: Desktop and Cloud-based

Financial Cents can also be used to support project management at your firm. There are a ton of moving parts when managing client projects, and it becomes even harder to stay organized as you grow your team. With Financial Cents, you can easily delegate and track work between different team members, monitor recurring work, and make sure you’re hitting your deadlines in an all-in-one dashboard instead of having to navigate a clunky spreadsheet.

- Pricing: $39 per team member, per month

- Free Trial: 14-day free trial

- Platform: Cloud-based

Accountants and bookkeepers need to be able to track both their billable time and non billable time in order to accurately invoice clients and see how your team is spending its time. With Financial Cents, time tracking is seamlessly integrated with Quickbooks Online so you can manage your time without disruption.

- Pricing: $39 per team member, per month

- Free Trial: 14-day free trial

- Platform: Cloud-based

For internal communication across your firm, consider a messaging platform such as Microsoft Teams or Slack.

“Slack [is a] simple and effective communication tool for internal and external communication with team and clients,” said Steven Mulligan. “We use the Huddle feature on Slack for an urgent or impromptu idea call.”

- Pricing: Pro plans start at $7.25 per month

- Free Trial: Slack offers a free plan

- Platform: Desktop-based

Zoom

For internal and external communication such as virtual video or audio meetings with clients and your staff members, you should consider adding Zoom to your accounting tech stack. Zoom has become very popular for virtual meetings during the start of the Covid19 pandemic. You can also use Zoom to generate leads by holding virtual conferences or webinars.

- Pricing: Pro Plan at $149/year per user. Business at $199/year per user.

- Free Trial: Zoom offers a free plan for up to 100 attendees per 40-minute meeting.

- Platform: Desktop and Cloud-based.

Accountants can also use Financial Cents for its communication capabilities. Financial Cents offers seamless email integration that automatically categorizes client-only emails so you can easily track client communication across the firm, increasing visibility within the team. You can also discuss tasks, ask questions, and share files with teammates directly in the platform without disrupting your workflow.

- Pricing: $39 per team member, per month

- Free Trial: 14-day free trial

- Platform: Cloud-based

A recommendation from our accounting community is Ignition. Ignition is a client engagement platform that makes it easy for accountants and bookkeepers to create and send proposals. You can also manage client billing and payment collection.

- Pricing: Starts at $69 per month

- Free Trial: 14-day free trial

- Platform: Cloud-based

Wrapping it up

Your accounting firm’s tech stack will be unique to your firm’s day-to-day needs. But a great starting point is a platform that addresses multiple needs you have when running your practice. “Accounting firms often use several tools to operate their practices,” says bookkeeper Crystal M. “Financial Cents speaks to that pain point with project management, email integration, client requests, time and capacity management, and password management.”

Use Financial Cents’ all-in-one Practice Management Solution for your Accounting Firm. Start a 14-day Free Trial

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to our newsletter for an awesome dose of firm growth tips.

Subscribe to our newsletter for an awesome dose of firm growth tips.