25 Practice Management Tips for Accountants by Accountants

Author: Financial Cents

In this article

You’d think you know so much about accounting practice management until you have to own one with three staff or above.

- How do you get clients?

- How do you meet their (client) deliverables consistently?

- How do you find the right talents to enable you to serve more clients (to grow)?

- Which software do you use in a sea of other productivity and efficiency tools?

- How do you keep in step with evolving IRS laws, which is one major challenge for accountants according to the 2022 PCPS CPA firm top issues survey?

No one has it all figured out, but whatever your challenge might be, several other firm owners have been there. Your solution is most likely in the words of the right accounting professional.

The following accounting practice management insights (from other accountants) should help you strike the right balance between overworking and underworking your staff, overcharging your clients (and chasing them away) and underselling your services, and knowing the status of each client’s work and drowning in too many details.

Accounting Practice Management Tips by Accountants

-

Practice Management

Running your accounting practice boils down to getting clients, providing the services they need, and getting paid, but within each of these events are decisions that can stunt or even ruin your firm’s growth if gotten wrong.

For example

1. Don’t Fixate Over the Decision to Niche Down

Niching down is critical, but if you’re not sure which industry or client attributes to focus on, analysis paralysis can get you stuck at one point. You can serve any client that comes your way (until you understand what you want to do). This will help you get the lay of the land before finding what interests you the most.

I have seen quite a few of my friends that started as generalists, and then as their firms grew, they realized that they loved working with their retail clients, and not so much with the construction folks or vice versa. I think it's okay to be a generalist, and within that generalist journey, you can find what you love and lean into that."

Tonya Shulte, Founder, The Profit Constructors2. How Do You Package Your Services?

It is good to specialize in one aspect of accounting—and do it well but bundling related services into one package is better for your accounting practice.

It gives you a better chance of providing more extensive services for your clients, which helps you earn more. Plus, it is more difficult for your clients to leave.

My mentor only wanted to do tax work. He referred his clients to bookkeepers. Later, he set up QBO and Gusto for their bookkeeping and payroll. However, the clients never ran their payroll or bookkeeping in these apps.

So, I decided I wouldn't do their tax returns alone. I decided to take care of it all, which saved me from the stress of selling the bookkeeping and payroll services separately. I just put it all in a bundle, and because I've taken care of the accounting, I just rolled all that data into the tax return, which is basically a reconciliation of everything we did all year long."

3. How Far Should You Go for Your Client?

Accountants need to help business owners make more informed business decisions by meeting with their clients frequently to help them make sense of their financial reports.

This amplifies your value to your clients. You don’t want clients to leave your firm because they no longer see the value of their services.

I’ve had a challenge where we would do high-quality bookkeeping work and hand it off to the client's tax preparers (without interacting much with the client). Over time, the clients began to forget all the things we were doing and were only seeing our monthly fee. Some began to question the value they were getting and left"

Blake Oliver, Founder, Earmark CPE-

How to Know Your Ideal Client

As a service-based business, you can’t work with every kind of client. The rule of thumb is to create an ideal client persona, and the questions above can guide you into knowing your ideal clients, and create a list of questions to guide you into knowing your ideal clients.

For example, Hall CPA PLLC is a boutique accounting and consulting firm with the sole focus of serving the needs of real estate investors and real estate business owners.

When anyone is looking up real estate CPA’s across the country, they are going to find our firm and contact us. We're not going to win every time but we're always going to be a part of the conversation. We have a sales process that helps us stay focused on our ideal clients. It goes thus - after prospects find us during their search and contact us, we have a whole process to qualify them. This qualification process determines if we will connect them with a sales rep. We have a scoring system where if they fill out our webform, they indicate certain things that help us determine if we want to talk to them.

If they're not qualified, meaning they're either not ready nor a good fit for our services, or we believe that based on how they filled out the form, they can't afford our services, we send them a different email sequence. The goal is to show them why we aren’t a good fit today while still highlighting other ways we can help (such as our membership groups or courses).

A strong qualification process will prevent you from wasting valuable time. You do not have to hold a call with every person who fills out your intake forms."

5. How to Find Solutions to Your Firm’s Challenges

Take note of whatever may be frustrating your team now so that when you are less busy, you can find a lasting solution, like Nayo Carter-Gray.

To resolve my tax season challenges, I always take the week of Christmas off to brainstorm ideas for my firm because things are slow. Find a week that's slow for you. It could be the summer months when people are on vacation or dealing with graduation. Look at your firm’s process that needs improvement and check on Google for apps that do (whatever the challenge is).

Review the list of apps that come up. Personally, the way I review apps is to go to their pricing page because they usually have the features listed out. That makes it easy to understand how much it will cost me and what I'm getting for my money."

With all the technical expertise in your team, not establishing how client projects flow from one stage to another and one team member to another can cause things to slip through the cracks constantly.

Here’s how you can prevent that:

1. Document Your Processes for Better Work Quality

You can’t succeed at building your firm if you’re drowning in the day-to-day client work. Jeremy Wells recommends documenting your processes so that your team members can complete client work with your level of accuracy to give you more time to build the firm.

Michael Gerber’s book, the E-Myth, talks about the three types of workers you need in your firm. The technician does the work, the manager oversees the work and the entrepreneur focuses on building the business.

Growing your firm requires you to spend less time as the technician and the manager and more time as the entrepreneur. Because I knew this, I knew I needed to build a firm that could run without me. And to do that, I immediately started documenting and building out processes so that someday, I wouldn’t be the one doing all these."

2. Never Stop Revising Your Workflows

Your team’s ability to maximize time by completing work on time will determine your firm’s success. The following questions can help you test your processes.

- Does it work for you?

- Are you happy with how it works?

- If not, how can you make it better?

Which kind of work are you not looking forward to doing each morning? Where is the friction coming from? How can you resolve it? Maybe you need to reverse some steps in the process in the workflow."

Jeremy Wells, CPA, The HVAC CPA3. Reduce Redundancy with Software

Redundancy in workflow is the enemy of efficiency and productivity. You can’t do much about it until you find the right workflow tool to centralize your work and client information in one place.

The high level of redundancy in our system caused lots of frustration for our accountants and clients. We were doing double work and it was just a waste of time. Client communication and collaboration were a hassle, but now, we have eradicated such repetitive work by utilizing Financial Cents.

If our client intends to file their taxes, I'll create a project for them and request that the client upload their documents in Financial Cents.

From there, we can all view the project and monitor the progress.

"

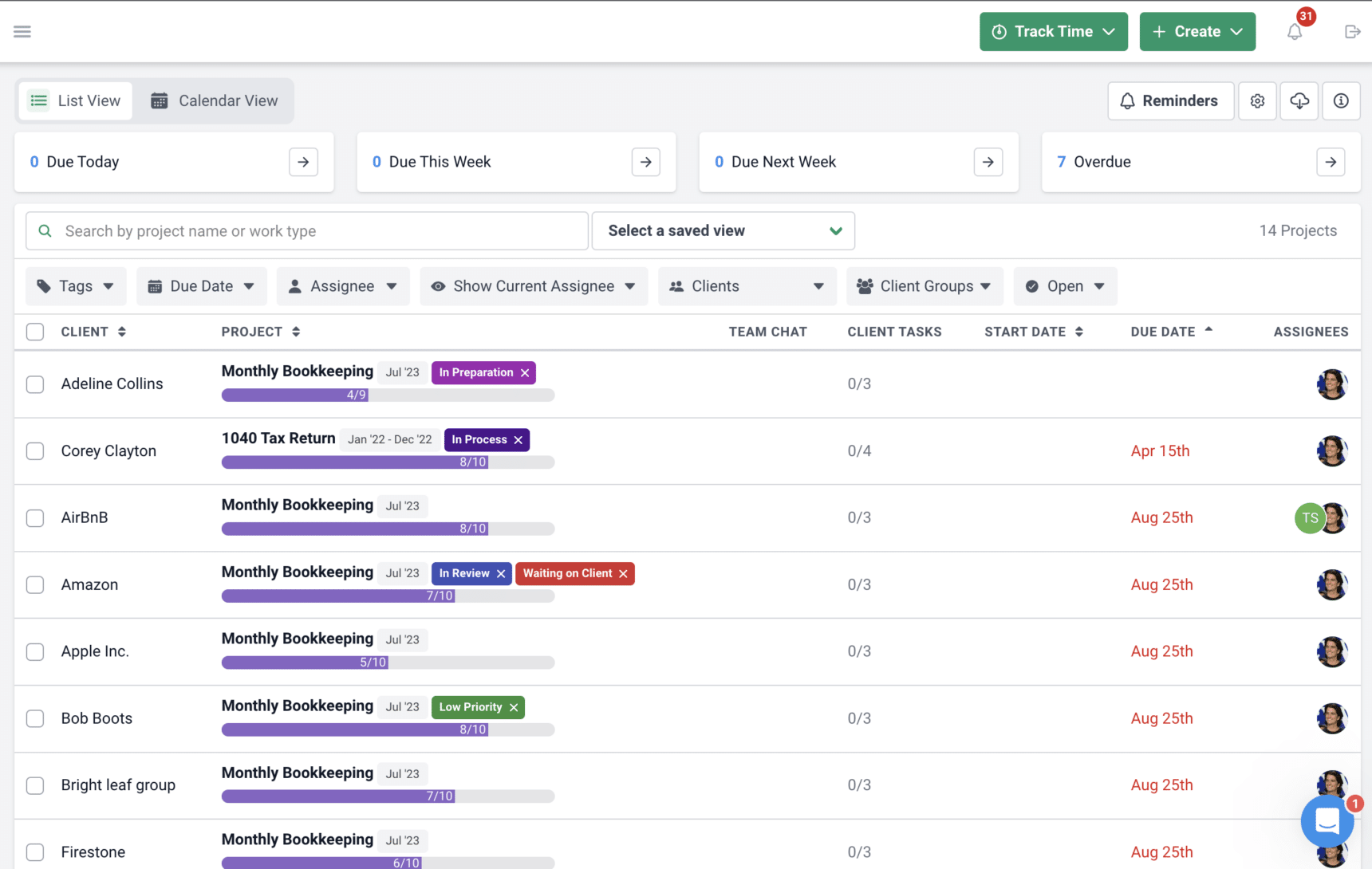

4. Leverage Due Dates to Track Deadlines

The ability to filter your workflow dashboard to see only relevant information at a time will help you focus your team’s efforts on the most urgent tasks so nothing slips through the cracks.

We use the due date feature to meet deadlines consistently.

With the due date filter, we can easily declutter our dashboard to show what we need to do at a time."

5. Centralize Work and Client Information

More work gets done if your team can collaborate and find the information and workflow checklists to complete work in one of your accounting practice management tools.

Financial Cents held not just my brain, not just my to-do lists, but everybody on my team, and I had everything I needed at my fingertips. I have staff working remotely. We are all on Financial Cents. It's all online. It'll hold your brain. Hold your staff's brain. It'll build in the workflows so you never forget that one little thing that gets forgotten."

ChristiSoftware

The accounting software industry is huge and more software solutions are coming up. Making up your mind on which one to use and how to best deploy them can be overwhelming.

These ideas can help you reduce that burden of decision.

-

Technology will Not Take Your Job

While some accountants are worried about whether AI will take their jobs, Jason Staats believes that software and AI are positively changing the game and will make accountants more valuable, efficient, and profitable.

I see it through two lenses, there's an element of AI that our tech partners will enable for us, like what Financial Cents does. But there's also a whole other side of that - a personal productivity angle where every day, honestly, we're stumbling into cool new use cases. For example, from looking up a whole bunch of ambiguous bookkeeping transactions, you start to figure out how you can use AI to solve those problems. You also start seeing how you can use it in writing and rewriting emails (and I think that's probably the most common use case). It's interesting. There's also a subset of folks who cover their eyes and say, ‘well, I'll make use of it a bit when my tech people implement it’. I think if you do that, you miss out on some elements that can help you get stuff done."

Jason Staats CPA2. Workflow Documentation Is Easier with Walkthrough Videos

Video is worth—probably—a million words. Since your new hires might not know how you do things in your firm, using video to show as many details as possible will improve the specificity of your standard operating procedures.

Loom has become valuable in my firm because it enables me to record my screen. With the audio setup, you can also be talking while you're doing the tasks. It’s like you're recording the story of how you're preparing tax returns for the future generation of people working in your firm.

If you were asked about the process of doing a tax return, you can mindlessly say things like:

- I would get the information

- Put the stuff in the software

- I will print out the return

But then, what does it mean to get the information? The information doesn't just magically show up. Then you'll realize that there are sub-steps and then each of those sub-steps have sub-steps.

However, if you record each step on video by showing what you did, what you clicked on, and what you typed in, then your team has a better chance of doing that."

3. Get Your Time Back with Automation

Some firms have dedicated staff to chase clients for documents, others need their staff to pause on each project until they get the documents they need from clients to complete their assigned work. Either way, your team’s time is being wasted when you can have software do the chasing for you.

Apart from giving us a good base for managing projects and jobs, our workflow software also helps us to stay efficient and consolidate the way we communicate with our customers.

My favorite feature is the automated request. We know who is scheduled on a project and each team member’s capacity. The automated request saves us from wasting time waiting around, which helps to automate and gain visibility in your practice."

-

Streamline Your Firm with Practice Management Software

Excel is a good place to manage your firm when you’re just starting, but after a short time, things begin to get bulky and unwieldy.

Creating several columns to manage different aspects of your firm is one documentation and admin task too many to allow you to attend to your firm’s strategic goals—that’s if you’re able to meet your client deadlines quickly enough.

Standardizing processes by documenting them and creating checklists was the single most important thing I did as a firm owner because it allowed me to hand off the work. That's why it blows my mind that so many firms don't have practice management software.

They're using Excel to maybe manage clients. They've got columns for different areas. There's so much documentation and if you don't systematically document your processes, you have no hope of scaling your business."

5. Ease Your Client’s Stress with Digital Signature

Digital signature will help make your client’s life easier. Instead of sending them documents (attachments) to sign and send back to you, you can simply put it in DocuSign, where they can sign it and you take it up from there.

To this day, I see many tax accountants who would send attachments for you to sign. But I’ll tell them to put it in DocuSign and make everyone's life a little easier like just put it in DocuSign or Panda doc or whatever digital signature tool you prefer."

Casey Haynes, Owner of The Compass CPA-

Staff Management

Accounting talents are jumping ships so quickly. Here are some ideas to boost your ability to hire and retain talents.

1. Effective SOPs Equal Effective Delegation

Jeremy Wells of The HVAC CPA believes that delegation begins with building out the processes and workflows for yourself first by imagining how you’d complete a task if you hadn’t done that task before. He recommends getting this in place before making your first hire.

Delegation is not hiring someone and saying ‘do this now’. It gives more detail to things and builds out the processes and the workflows your team needs to complete work.

I've got my workflows built out in templates in my practice manager, and I'm constantly revising them. Almost every time we go through a monthly close or prepare a tax return, we say, wait a minute, this step is not clear enough. What needs to happen here?

This step is actually two steps. These two steps need to be in the reverse order because they don't work in that order."

2. Flexible Working Hours Help to Keep Talents

Once you can get them to put the client first and satisfy the client, it’s better to let your team work as flexibly. It gives them better work-life balance and job satisfaction.

Trust and flexibility have played a huge role in our staff retention in my firm—Compass. We've been focusing on giving people flexible remote working relationships. I have hired talents geographically, where I wanted somebody in the Eastern Time Zone or somebody in the Central Time Zone, but I haven't been super strict on where that is necessary.

And also I don't say that you'd have to be at your home to work. We have VPNs to keep our data secure and enable our staff to travel, feel free to work remotely or set their schedule that works for them.

"

4. Delegate Work and Trust Your Staff

Nicole Davis CPA, believes that firm owners may find it difficult to give up control, but you need it if you’ll ever find time to focus on strategic work and take time off work for some much needed vacation.

It’s really hard to give up control because we're technicians through and through. And also, there's something called delayed delegation, I think a lot of us also suffer from that. That is, there's a task that you shouldn't be doing or that you can delegate to someone else to do.

Even if you didn't hire someone, you can hire a VA to handle this task, but you don't actually delegate it until it's at the deadline, or it's too late. One of the things you can do to get over that fear of letting go and trusting others to handle those important tasks Is to start small and build trust for you.

Give them (employee, VA) a small task, delegate the outcome of what the task looks like when they complete it, and then give them autonomy to actually go out and do the task. When they are done, offer feedback, if it's not done correctly, or if there were some hiccups along the way."

4. Align Your Team Around a Common Goal

If you find yourself worried about why your team is not getting the alignment they need around the goals you set for your firm, you might not be giving them enough “whys.” It’s not enough to state the “what.” It’s the “why” that gets people to commit.

Knowing why a goal exists is almost as important as knowing what the goal is. It's not enough to say that I want those books closed between the fifth and the 10th. What's the reason that we want them done on time?

You should say, I want my client books to be closed early in the month. I want my team to do weekly meetings on Mondays because I want my client's books to be caught up and we don't have a month-end chaotic situation. Plus, the work is more evenly spaced.

That's one of the things you need to do when you are getting everybody on board with your goals."

5. Keep Your Virtual Team Connected

Keeping your team connected, communicating, and collaborating is a common concern for virtual accounting firms. But with a bit of intentionality, firm owners can get their remote staff to communicate and collaborate like Alisa McCabe of First Step Financials.

My team members live in different locations and different time zones which can make communication and collaboration difficult.

From the hiring process, we make our expectations about working remotely clear. We ask everybody to be available from 9-1 pm EST. That way, we have at least 4 hours to work together and in that 4 hours, we use Google Chat to communicate and collaborate and that helps our team bonding.

Each staff submits their favorite charity quarterly. We try to figure out how to support that charity together. A team member once submitted a blanket program for kids in the foster care system, and we got kits to hand-make blankets and sent them to the team some of us got on a Zoom call and made the blanket together, took pictures, and shared it, and supported the program of one of our team member.

"

-

Client Management

Extracting maximum value from your client relationships depends on how much attention you pay to your client relationships, which is reflected in:

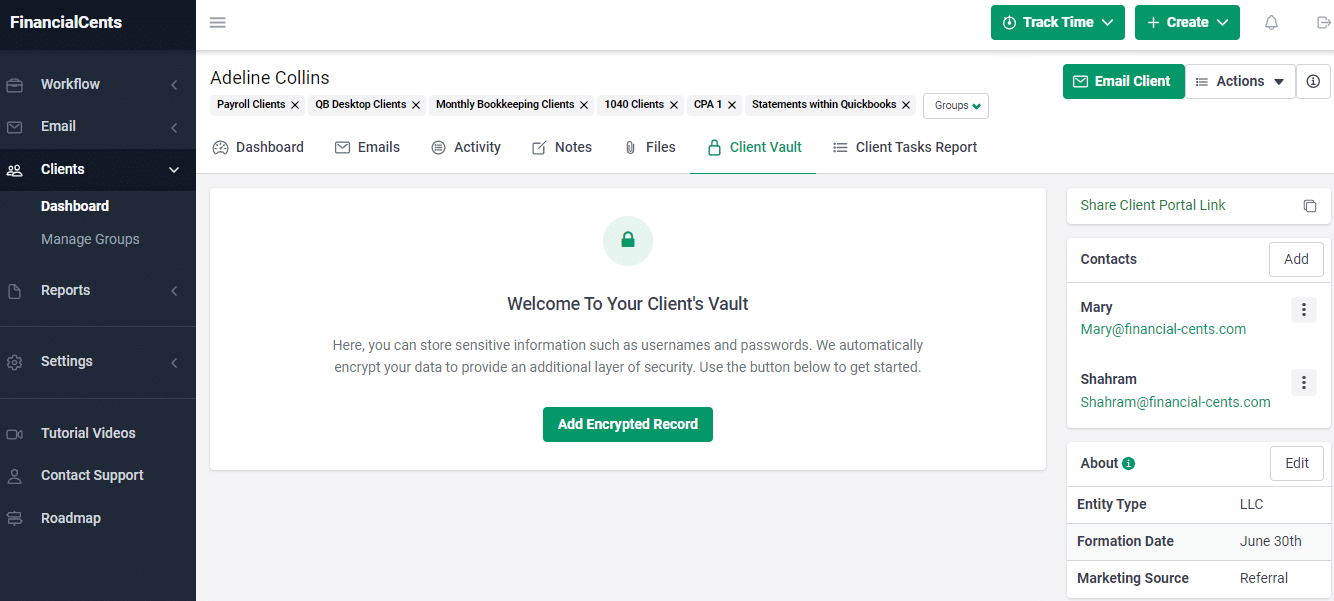

1. Making Your Clients’ Life Easier

Making it easy for your clients to work with you is a huge plus, because then, they can make better use of their time to focus on their core business activities, instead of worrying about keeping up with their accountants.

Business owners don't necessarily want to be buddy-buddy and best friends with their accountants. Most of them are perfectly open to a relationship where they don’t see you that much and they don't have to come to your office, but the communication is still there.

You just have to make their lives easy and efficient. With us Financial Cents allows us to set up reminders as part of our workflows to remind them to send their documents a particular day in the month and they upload it to the Financial Cents.

They can also drop sensitive tax documents with their social security and personal information on them. This has been crucial to our remote firm."

2. Implementing Tech Solutions that Your Clients Will Truly Use

Everything—including client relationships—revolves around technology these days. A huge part of knowing your clients is knowing how tech-savvy they are. That will keep you from making their lives more difficult with tools that are too complex for them.

I once helped a client Implement a timekeeping system that I felt we could slice and dice in different with many data points, but at the end of the day, the main users were the managers and the people clocking in and out of that system.

It confused them because they were in a low-tech industry and I realized that even though it made sense for me, it did not make sense for my user"

3. How You Handle Clients That Wouldn’t Follow Your Rules

Client demands can end up pulling your firm in different directions if you let them. and they will leave the moment you can’t operate at peak capacity.

A huge part of looking after your clients is knowing which ones to stop serving so that you can serve those you want to serve more satisfactorily.

This is your business. You have to set the terms and don't let your clients, especially family members, run over you by telling you how you're going to run your firm. If a family member wants to be my client, they have to abide by the rules of the firm.

They have to know that this is a business. It is not a little hobby. We have a team and we have to maintain profitability, so they have to pay regular fees and drop off their documents at the right time. They have to follow the rules.

"

4. How You Prevent Objections to Price Increase

Getting your pricing strategy right can keep you and your team from working your fingers to the bone. By understanding your client’s needs, you can tailor your offering to give them enough value to pay your rates without many objections.

Value pricing is about setting a price based on the value to the customer, not based on how many hours something takes. It sounds really simple but it is difficult to implement in the real world."

Mark Wickersham, Chartered Accountant and Profitability Improvement Expert5. Being Intentional about Client Communication

Everyone, including your clients, wants to be acknowledged. If you can make them feel valued in this way, you’re on your way to a beautiful client relationship.

One out of five new clients that come to me always say they're coming to me because their old accountant was not responsive enough.

So, I have made communication a pillar of our flat monthly fee contracts, where clients can email as much as they want. We can even set up calls or slacks.

One of the easiest things you can do is respond to people's emails within 24 hours, even if you can't complete their request. Acknowledge the email and set a new expectation with 'Hello, thank you. I've received your email. I'm looking and researching into this. Give me two to three days to get back to you.

And then follow up with that. Be true to your word. By the third day, if you don't have a response, check back in with them, and if you have it, give it to them."

Other Resources to Help You Build a More Profitable and Sustainable Accounting Practice

If you found these tips helpful, the following resources will give you more capacity to build a firm you’ll be proud of a few years from now.

- Use Accounting Software to Build Strong Relationships

- What to Look Out for in A Workflow Software

- How to Choose the Right Accounting Tech Stack for Your Growing Accounting Firm

- How to Build a Collaborative Culture in Your Virtual Accounting Firm

Financial Cents is an accounting practice management software that helps firms like yours manage work, client and staff from one place.

You can start using all of its practice management features for free today.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features of a Great Accounting Document Management System

Here’s all you need to know about an accounting document management system and how it can make you more organized and save…

Apr 26, 2024

5 Simple Time-Saving Tips for Managing Uncategorized Transactions

Manually resolving multiple uncategorized transactions steals valuable time from accountants and bookkeepers. But there’s a solution. Here are five simple, time-saving tips…

Apr 24, 2024