How to Choose The Right Accounting Tech Stack For Your Growing Accounting Firm (+ a Free Checklist )

Author: Financial Cents

In this article

When starting your accounting firm, it is easy to have shiny object syndrome as you build your tech stack. You hear about a cool new software and think it sounds like something useful for your firm.

As you scale, you’ll quickly see that not every software is relevant to your firm’s needs and budget. With direct insights into how you spend your time, you’ll learn which tools you actually need to get your job done efficiently.

The best accounting tech stack is one that fits your firm’s needs. These tools should make it easier for you to schedule your time, store files, manage project deadlines, collaborate with your team, and communicate with clients.

Every firm is different, and choosing the wrong software to add to your tech stack can slow you down or impact your processes.

Below, let’s go over some of the must-have tools that should be in your accounting tech stack as you grow your firm at every level.

How to Choose the Right Tech Stack for Your Accounting Firm

There are a few things to consider when building your accounting firm’s tech stack.

Does it fit your current needs? Is the price point reasonable? How well will it scale as your firm grows?

Consider your firm’s current needs

Before you can build the ultimate accounting tech stack, you have to identify what your current challenges and needs are so you can prioritize certain tools over others.

Are you currently struggling with client communication and searching for a way to streamline messages and emails? Look for a tool that helps you take control of your inbox and keeps all of your client communication in one place.

Or perhaps you want to improve your firm’s workflow automation so you can stay on top of project deadlines and save time so everyone on your team can focus less on administrative tasks or more on the work they’re good at. Add an accounting workflow automation tool to your tech stack so you can better manage projects, communication, and deadlines across your firm. You can also use ChatGPT for accounting in your firm’s day to day tasks.

Consider your expenses

As an accountant, you know that numbers are a critical consideration behind every business decision. Review your current expenses and tools so you can determine what’s necessary for your tech stack and how much more you can afford to add.

If there’s a tool you really want to add to your stack but you don’t have the budget for, you can always drop another expense that may not be worth it for your firm anymore. Regularly review your expenses and tools so you can ensure you’re only investing in a tech stack that benefits your accounting firm’s current goals and priorities.

Consider the tool’s scalability

If your goal is to grow your accounting firm, then keep scalability in mind. The last thing you want is to build your ideal tech stack and then have to start from scratch once your firm levels up. To prevent this, look for tools that offer tiered subscription plans. These are designed to fit your needs at different levels, from small business to growing enterprise.

Below, let’s go over these considerations in more detail so you can prepare to choose the right accounting tech stack for your growing firm.

The Best Accounting Tech Stack For Your Growing Firm

While every firm may have slightly different needs, we’ve put together the ideal tech stack to get started with.

These tools will help you save time and resources.

Here are our recommendations for the tools to include in your accounting tech stack.

Client Management

There’s a lot that goes into client management. As an accounting firm, you’re constantly collecting your client’s data, requesting documents, and even sending over documents or proposals for signature. Without a tool or platform to manage these tasks, you’ll end up spending countless hours going back and forth over email.

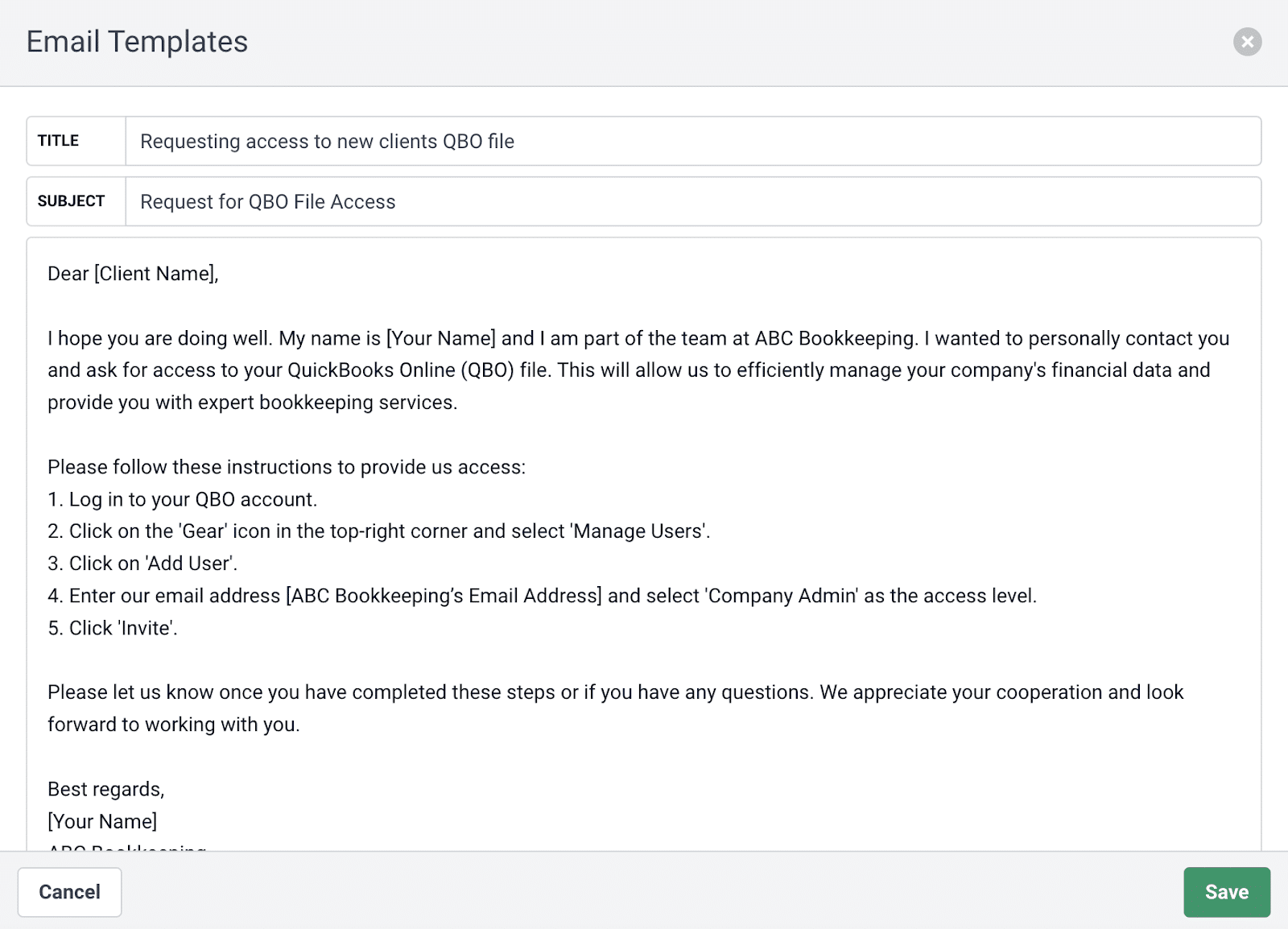

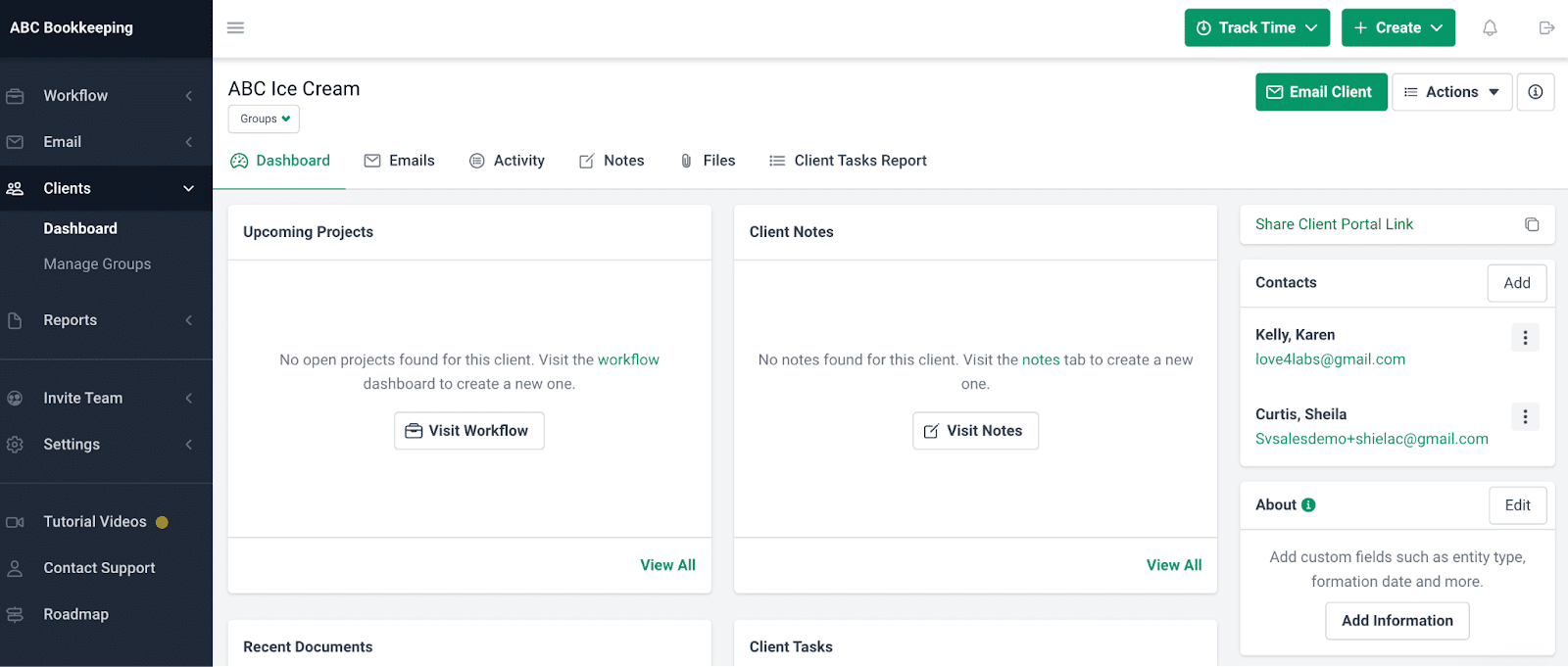

The time-saving approach to client management is to use a platform like Financial Cents to help you better manage your client tasks all in one place. With Financial Cents, you can securely retrieve client documents faster by setting up automated requests and using text or email reminders. Sending automated reminders to your clients to upload their latest statements eliminates one of the many tasks on your plate and makes it easier for both parties to stay on top of data collection.

You can also use Financial Cents as a comprehensive client database. Not only can you store sensitive client information in a secure vault — like pins and passwords — but you can also create notes for each client profile so you can stay on top of the latest conversations, meetings, and updates.

Financial Cents client management features:

- Automated text and email reminders to collect information and request documents faster

- Securely store sensitive client information like passwords and pins

- Communicate with your clients from inside your workflow

- Create notes for each client to stay on top of important updates and information

Financial Cents pricing:

Pricing:

$39 per team member, per month on an annual plan

$49 per team member, per month on a monthly plan

Free trial: 14-day free trial

Client Communication

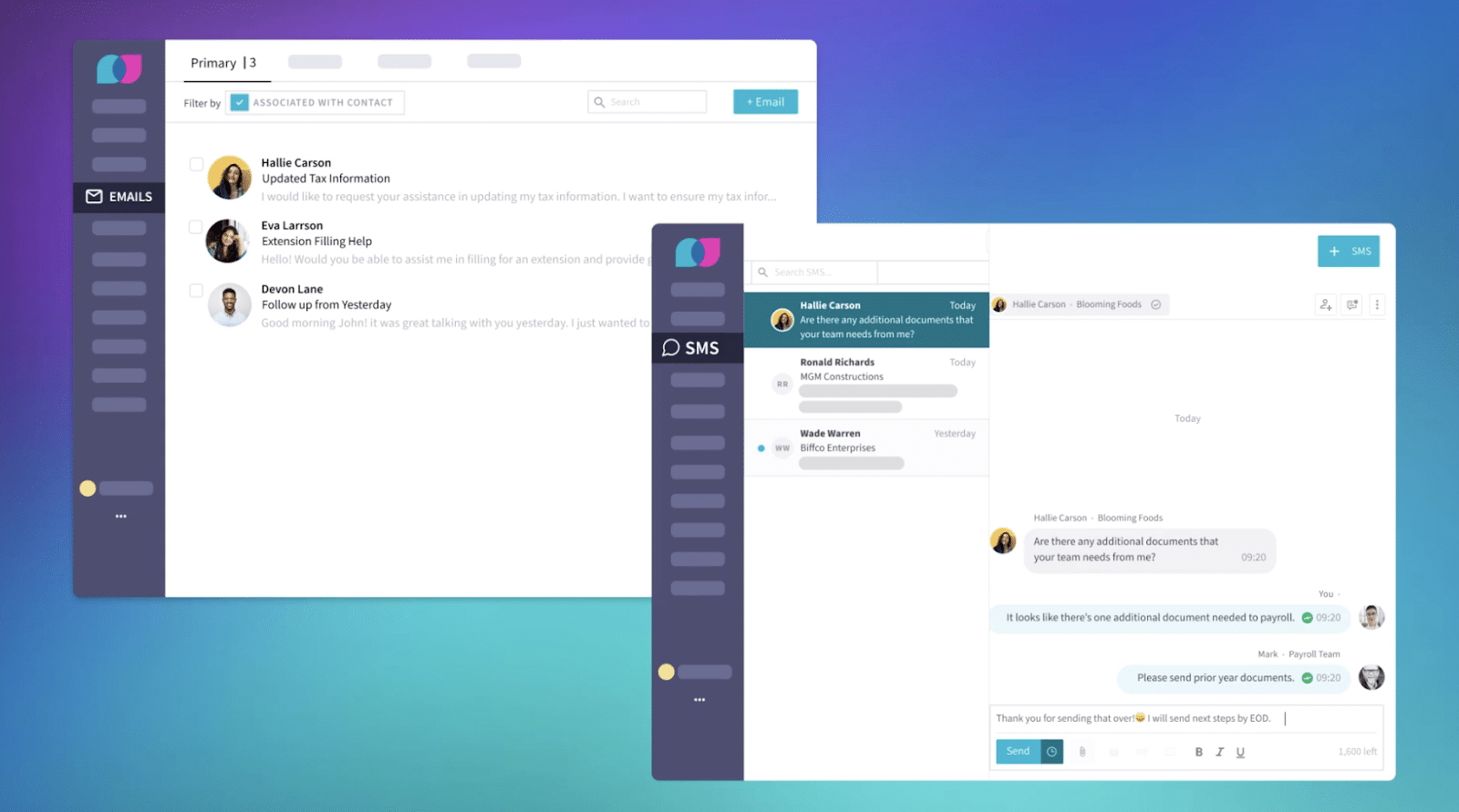

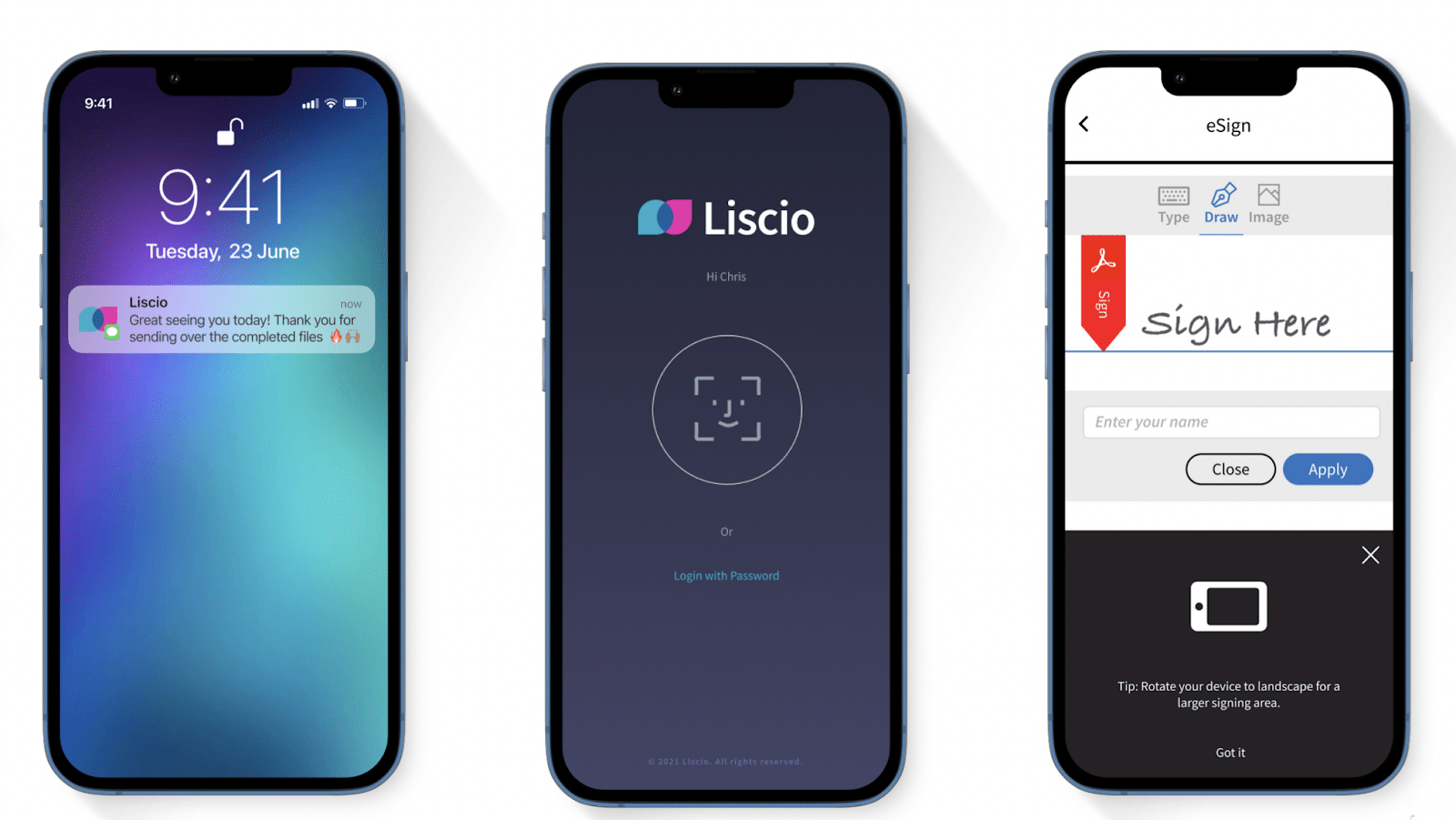

When you’re making frequent requests from your clients, your messages can get lost across channels — from texts to emails to messaging platforms. To streamline your client communication, we recommend adding a tool like Liscio to your accounting tech stack.

Liscio is a communication portal for accountants and their clients. With Liscio, you and your clients can set up a secure account so you both can share and access all of your messages, signatures, and business communications in one place.

If you’re looking for seamless client communication and management features in one place, take advantage of both Liscio and Financial Cents. Financial Cents will be integrating with Liscio in the coming months and you’ll soon be able to communicate with your clients within your workflow.

Liscio client communication features:

- Send secure texts, emails, and messages to clients from one platform

- Set up automated reminders through email and text notifications

- Offer clients multiple log-in options including through Microsoft, Google, or Face ID

- Securely share documents and files up to 5GB in size; clients can also scan documents to send directly to you

- Request signatures in an instant

Liscio pricing:

Pricing: Starts at $40 per user, per month

Free trial: Liscio offers a free demo

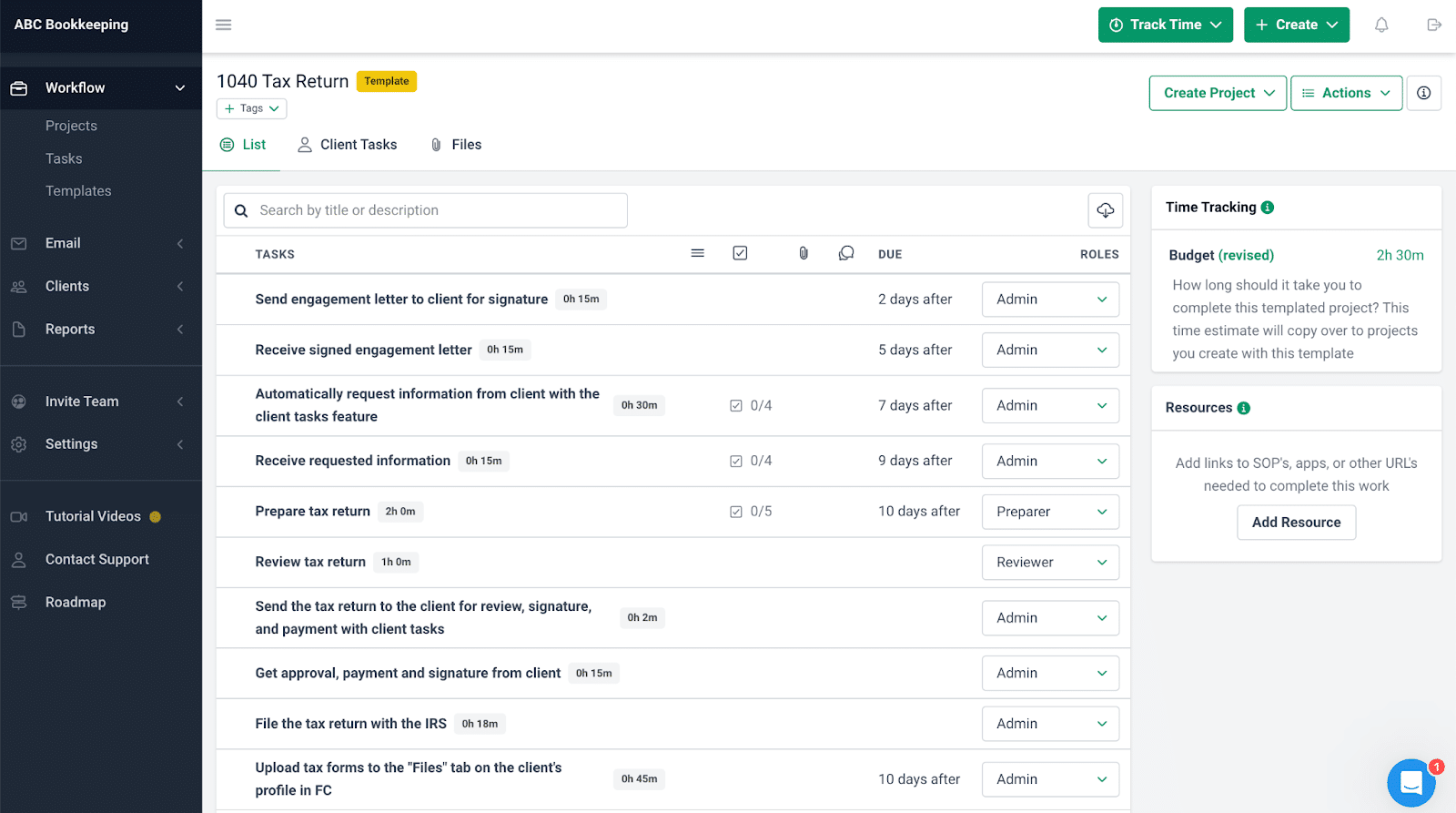

Accounting Workflow Management

You’re always juggling multiple deadlines across many clients at your firm. Even if you have a team to manage your client accounts, it’s easy for tasks to slip through the cracks if you don’t have a solid workflow management tool or process.

That’s why an accounting workflow management software like Financial Cents must be part of your tech stack. With Financial Cents, you can assign and track tasks across your firm. Your workflow dashboard provides increased visibility into who is working on what and when it needs to be completed — so you’ll never miss a client deadline again.

When you have a streamlined workflow, not only will your firm be more organized and on top of everything, but it’ll also save you time that’s typically spent going back and forth checking on who’s working on what. According to our 2023 State of Accounting Workflow Automation Report, accountants who implemented workflow automation software significantly decreased their time spent on manual work from 10 hours to less than five hours.

Financial Cents account workflow management features:

- Easily track the status of tasks or assignments and project deadlines across your firm in one simple view

- Collaborate with your team by discussing tasks, asking questions, sharing files, and setting up notifications within your workflow

- Integrate Financial Cents with your email so you can streamline tasks and communication in one place

- Automate your workflow and reduce manual work by setting up recurring tasks

Financial Cents pricing:

Pricing:

$39 per team member, per month on an annual plan

$49 per team member, per month on a monthly plan

Free trial: 14-day free trial

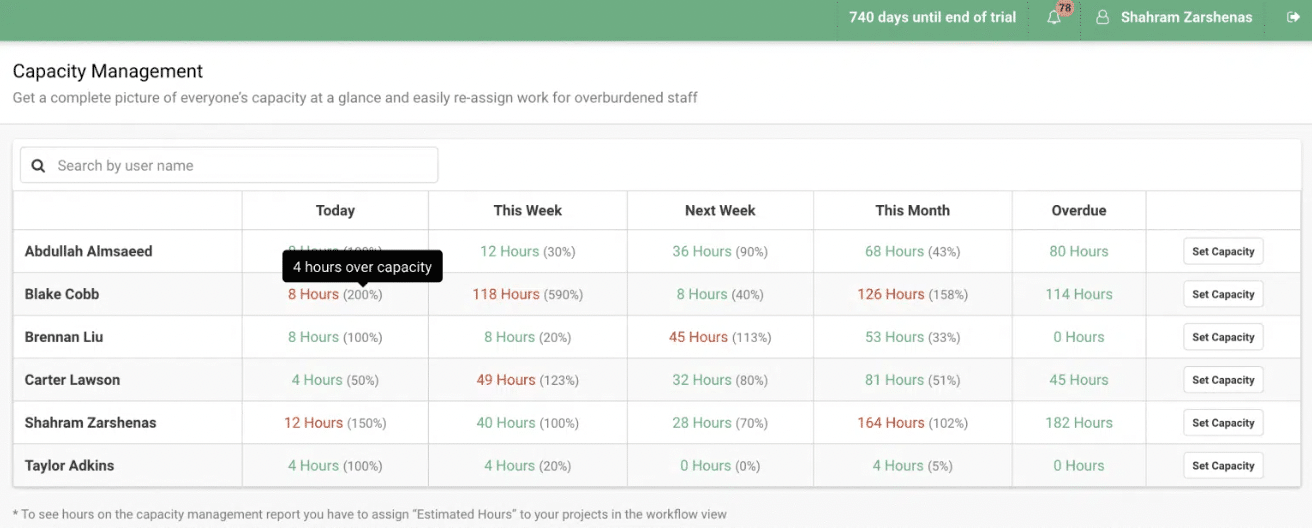

Accounting Practice Management

If you have a team of accountants at your firm, Financial Cents can also help improve your overall practice management. Our software helps you manage each team member’s capacity to ensure no one has too much on their plate.

If you identify a team member who’s working overtime, you can reassign their tasks to another team member. Having this insight helps avoid missed deadlines, inefficiencies, and even employee burnout.

Financial Cents accounting practice management features:

- Track task progress and collaborate with your team within your workflow

- Manage each team member’s capacity and reassign tasks as needed

- Track your time spent on projects and individual tasks so you can see how and where you’re spending the most time and adjust as necessary

- Create recurring tasks so you never miss a deadline

Financial Cents pricing:

Pricing:

$39 per team member, per month on an annual plan

$49 per team member, per month on a monthly plan

Free trial: 14-day free trial

Payroll

Whether you’re looking for a tool to manage your client’s payroll or for your own practice, a payroll tool is essential.

When you’re busy with client work every day, it can be easy to forget that you’re running a business, too. As a small business owner, you’re in charge of handling everything involved with your business finances. Staying on top of your own finances is critical, and it only gets more challenging as you start bringing on employees.

As your team grows, you’ll need to ensure your payroll processes can scale with you. Add a payroll tool like Wagepoint to your accounting tech stack to make sure everyone gets paid and your firm and client’s payroll taxes are taken care of, too.

Wagepoint payroll features:

- Easily enter your payroll data once and Wagepoint will handle it from there

- Set up an online portal for employees to access themselves

- Set up automated payroll

- Integrates with other tools in your accounting tech stack such as QuickBooks or Xero

Wagepoint pricing:

Pricing: Wagepoint pricing is based on the number of employees you have and how often you pay them. You can calculate your estimated costs here.

Free trial: Free to sign up; you won’t be charged until you run your first payroll

Expense Management

Manual data entry often leads to costly errors, which is the last thing you want to happen when you’re handling your client’s expenses, taxes, and more.

Use a tool like Dext to eliminate errors and reduce the time spent on data entry and processing. Dext extracts data from any document you upload, including receipts, invoices, or bank statements. The digital data is then uploaded directly into your accounting system for seamless access for both you and your clients.

Dext expense management features:

- Manage multiple client and business account logins and easily switch between businesses and practices using one login

- Integrate with accounting software such as QuickBooks and Xero so you can instantly sync your existing data

- Set up supplier rules such as tax rates, currencies, and categories

Dext pricing:

Pricing: Dext Prepare starts at $189.99 per month for accounting and bookkeeping firms

Free trial: Free 14-day trial

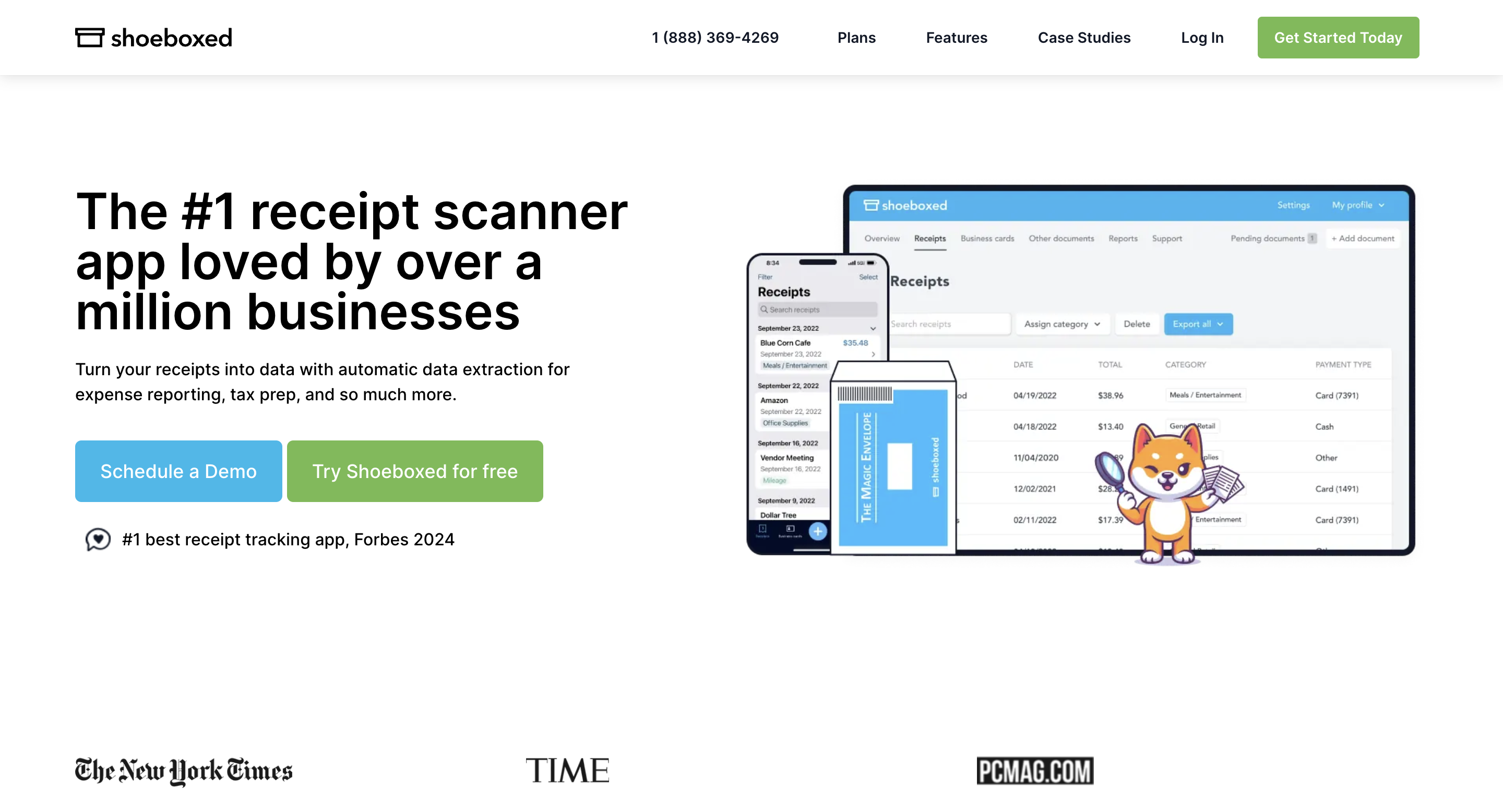

Receipt Management

As you build a robust accounting tech stack for your growing firm, the ability to efficiently manage expense and tax receipts should not be overlooked.

Shoeboxed revolutionizes the way accounting firms handle their receipts by providing a 2-for-1 service—a receipt scanner app and a receipt scanning service.

Individuals can use its mobile app to snap pictures of receipts while on the go, or they can simply stuff receipts into Shoeboxed’s postage-prepaid Magic Envelopes and outsource receipt scanning and data entry to Shoeboxed’s scanning facility.

Shoeboxed then automatically extracts key data from these receipts, such as vendor, total amount, and date, and assigns extracted expenses relevant tax categories.

This is the ideal choice for accounting firms that want to outsource the manual data entry portion of their accounting tasks.

Shoeboxed Receipt Management Features:

- Outsourced, automated data extraction

- Human verification of scanned data

- Receipt management dashboard

- Postage-prepaid Magic Envelopes

- IRS-accepted receipt scans

- Unlimited document returns

- Unlimited file storage

- Unlimited users

- Unlimited mileage recording

- IOS App included

- Quickbooks Online integration

- Integration with other popular accounting software

Shoeboxed Pricing:

- Shoeboxed’s receipt scanning service starts from $18 per month.

- All plans come with a 30-day free trial

General Ledger Accounting

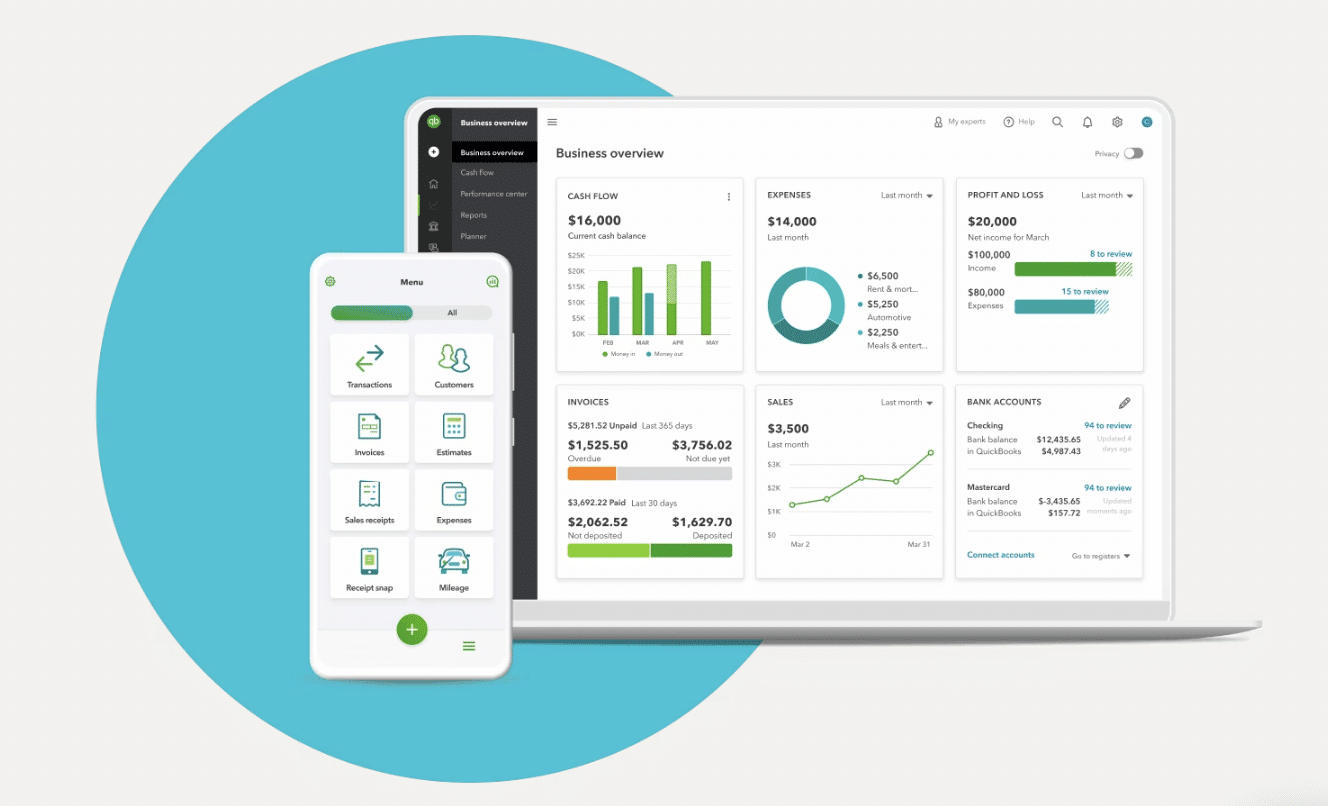

QuickBooks is a go-to for small businesses and their accountants, so there’s a good chance you likely already use the software for your firm’s accounting practices. If you don’t, consider adding QuickBooks to your tech stack for general ledger accounting.

The software provides detailed insights and reports to track everything that goes in and out of your client’s business accounts. Plus, it’s user-friendly and familiar to most businesses which makes it easy to integrate into your current processes.

QuickBook’s general ledger accounting features:

- Automatically sync your bank transactions to QuickBooks so you can seamlessly track client’s income and expenses

- Easily track receipts, mileage, and other deductions so you can quickly access it for taxes

- Create custom reports with detailed insights for your clients

QuickBooks pricing:

Pricing: Starts at $15 per month

Free trial: Free 30-day trial

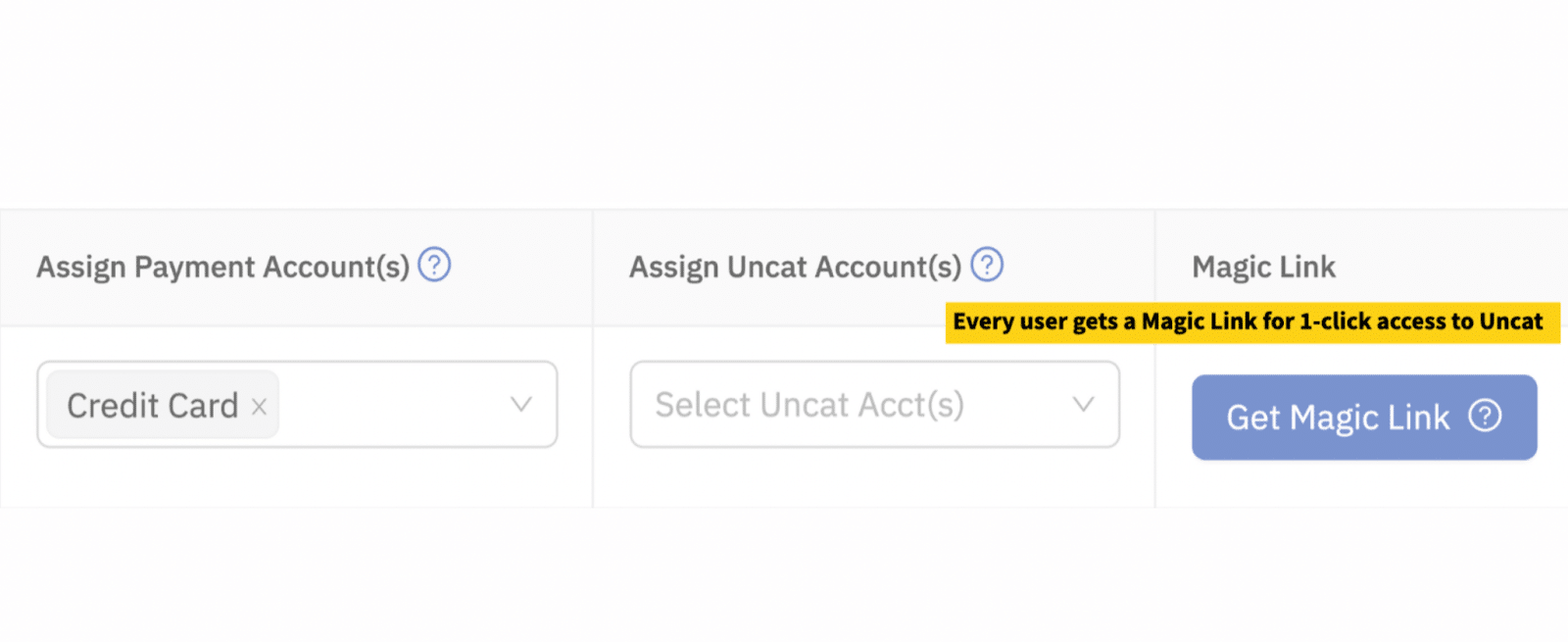

Uncategorized Transactions

Sifting through your client’s uncategorized transactions is always a challenge. For starters, you have to manually review and identify these types of transactions which can be easily missed. Then, once you spot it, you have to reach out to your client for clarification which can become a lengthy or complicated process if your client is prompt with their response.

If you want to make this process easier for everyone involved, add Uncat to your tech stack. The software helps you clean up uncategorized transactions in minutes by quickly reviewing your client’s expense data. One of the best parts about this tool is that it makes the review process much easier and seamless on the client side, too. Clients can quickly review the transactions and add their notes instead of dealing with lengthy spreadsheets or going back and forth over email with you.

Unact’s uncatergorized transactions features:

- Automatically sync data from your accounting software like QuickBooks or Xero

- Seamlessly send email or SMS text notifications to clients when there’s a transaction that needs their response

- Clients can easily access their Uncat dashboard without setting up an account; instead, they’ll receive 1-click access through a Magic Link

Uncat pricing:

Pricing: $5 per month

Free trial: Free 14-day trial

E-Signature

In addition to client communication, Liscio also enables you to collect signatures. You can send any type of document to your client, whether that’s a tax form or engagement letter, and your client can sign it and send it right back. This is an especially useful tool to have in your accounting tech stack when you work with clients remotely.

Liscio e-signature features:

- Easily request e-signatures from your clients using KBAs (knowledge-based authentication)

- See all client communications, including signatures, emails, and texts in one dashboard

Liscio pricing:

Pricing: Starts at $40 per user, per month

Free trial: Liscio offers a free demo

Looking for more recommendations for your accounting tech stack?

As we mentioned earlier, every accounting firm is different. While there are a few tools that your firm will benefit from no matter what, such as workflow automation and general ledger accounting, the rest of the tools in your tech stack will depend on where you’re at in business. If you’re just getting your firm started, start with the basics. As you grow, you can add tools to your tech stack that will help your firm scale even more.

Use Financial Cents Accounting Practice Management software to scale your accounting firm.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

The 5 Best Avii Workspace Alternatives for Modern Firms

If, for whatever reason, Avii does not meet your long-term workflow needs, this review of the best Avii workspace alternatives should help…

May 08, 2024

The 6 Best Canopy Alternatives to Consider in 2024

Wondering if Canopy is the right fit for your accounting firm? Discover 6 canopy alternatives to streamline your workflow and boost efficiency.

May 08, 2024