Dawn Brolin, CPA, CFE: The Accounting Apps Behind One of the Most Powerful Women in Accounting

Author: Financial Cents

In this article

Dawn Brolin is an accounting thought leader and firm owner. She has been named in CPA Practice Advisor’s 25 Most Powerful Women in Accounting for six consecutive years.

Thanks to her years of experience in the industry, Dawn has learned to blend technology with a human touch to drive client satisfaction.

Her firm, Powerful Accounting, has successfully filed 1,585 tax returns, resolved 116 IRS cases, and kept 589 clients happy by leveraging tech solutions like Financial Cents.

Financial Cents is a practice management tool that absolutely rocks. All of my client information is in one place. It automates my workflows and creates transparency across the firm. The benefits of using Financial Cents are tremendous."

In this article, Dawn references her softball career to break down the accounting apps that have enabled her to build a system that allows her team to work only six hours a day—even during tax season.

Why Dawn Brolin’s Starting Lineup Matters to Every Firm Owner

Dawn’s choice of accounting apps is an invaluable source of guidance for firm owners who want:

a. Access to Up-to-Date Work and Client Information for Their Team

The right accounting apps help teams access accurate information from anywhere in the world at any time of the day.

The wrong tool will make accessing client information another source of endless admin tasks that reduce productivity and could impact the clients’ data security.

b. To Use Great Accounting Apps that Complement One Another

Many accounting apps are not as effective as they claim to be.

Since you do not have the time to try them all (to know the right fit for you), Dawn’s starting line-up will guide you through some of the best tools on the market and how you can combine them to manage your firm’s different moving parts.

c. To Avoid the Costly Mistakes Dawn Made in the Past

During her time running Powerful Accounting, Dawn faced numerous challenges and tested various software, some of which failed. She is determined to save you from the pain of these headaches.

I've been in business since 1999. I have done it all wrong and all right. I now feel like I've got my thumb on the pulse of running a firm efficiently, productively, and profitably."

Dawn Brolin, , Owner of Powerful Accountingd. To Understand How to Turn Clunky Processes Around (Like Dawn Did with Client Onboarding)

Client information management was Dawn’s biggest workflow challenge before Financial Cents, and it affected her client onboarding.

Since implementing Financial Cents, she has established a secure and user-friendly process that has made the client onboarding experience consistent and memorable.

Dawn’s Line Up of Accounting Apps and Their Roles

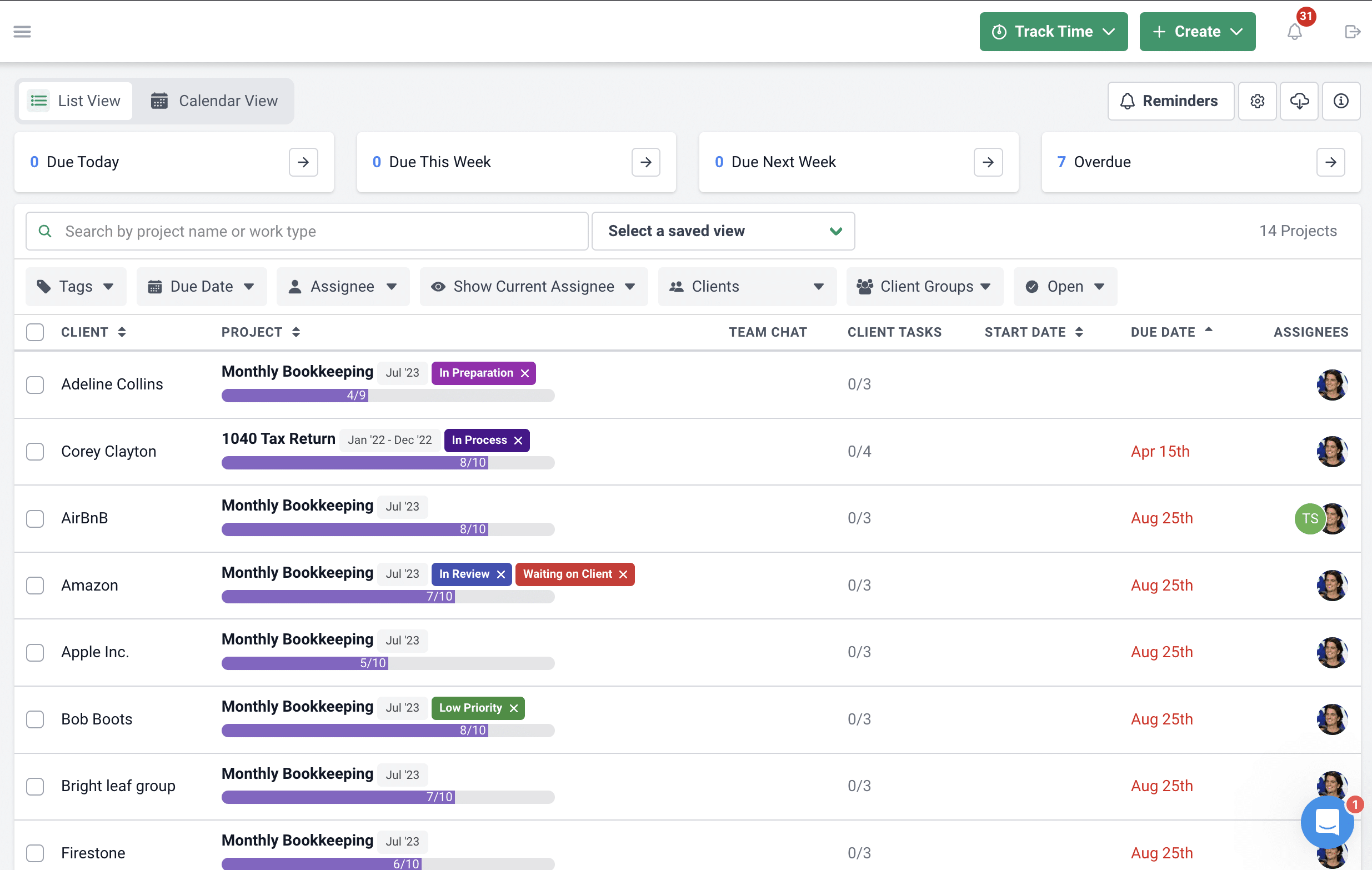

1. Practice Management — Financial Cents (First Base)

Practice Management software is at the core of every accounting tech stack, and Financial Cents is Dawn’s software of choice.

In softball, Dawn uses Financial Cents as her First Base. The First Base is usually a good hitter and handles the ball more than any other infield player. They also coordinate with the pitcher on bunts.

Similarly, building an accounting tech stack starts with the practice management software to coordinate all the other tools.

Financial Cents provides firms with the following:

- Workflow Management with automation to handle routine tasks and client requests with minimal human input.

- Client Tasks and Automated reminders to automatically create a checklist of the information you need from clients and auto-remind them until they complete the requests.

- Document Management gives accountants one place to manage and organize client documents into folders.

- Manage Uncategorized Transactions with the ReCats feature that leverages Financial Cents’ QBO integration to categorize uncategorized transactions without leaving Financial Cents.

- Team Collaboration saves you context-switching that kills productivity. Financial Cents allows you to share files, get up-to-date client information, and assign tasks on the project dashboard.

- Integrations:

-

- AI integration (like ChatGPT) generates workflow checklists and email templates that you can customize to your firm’s standard.

- Adobe Sign Integration to request client signatures on proposals, tax returns, and other important documents inside Financial Cents.

- Gmail and Outlook Integration to stay on top of client communication with a focused folder in Financial Cents. Also enables you to pin client emails to relevant projects, turn ad-hoc requests into projects, etc.

- QBO Integration allows you to import and auto-sync all your clients (in seconds), sync the time you tracked in Financial Cents with QBO (for invoicing), etc.

- SmartVault Integration allows Dawn to receive client documents in Financial Cents and route them to SmartVault. This integration also enables you to import clients from SmartVault to Financial Cents, create clients in SmartVault when a client is created in Financial Cents (automatically, and access SmartVault from projects or client profiles in Financial Cents.

- Zapier Integration enables you to connect with thousands of apps (like Ignition, 17hats, and Xero) from Financial Cents.

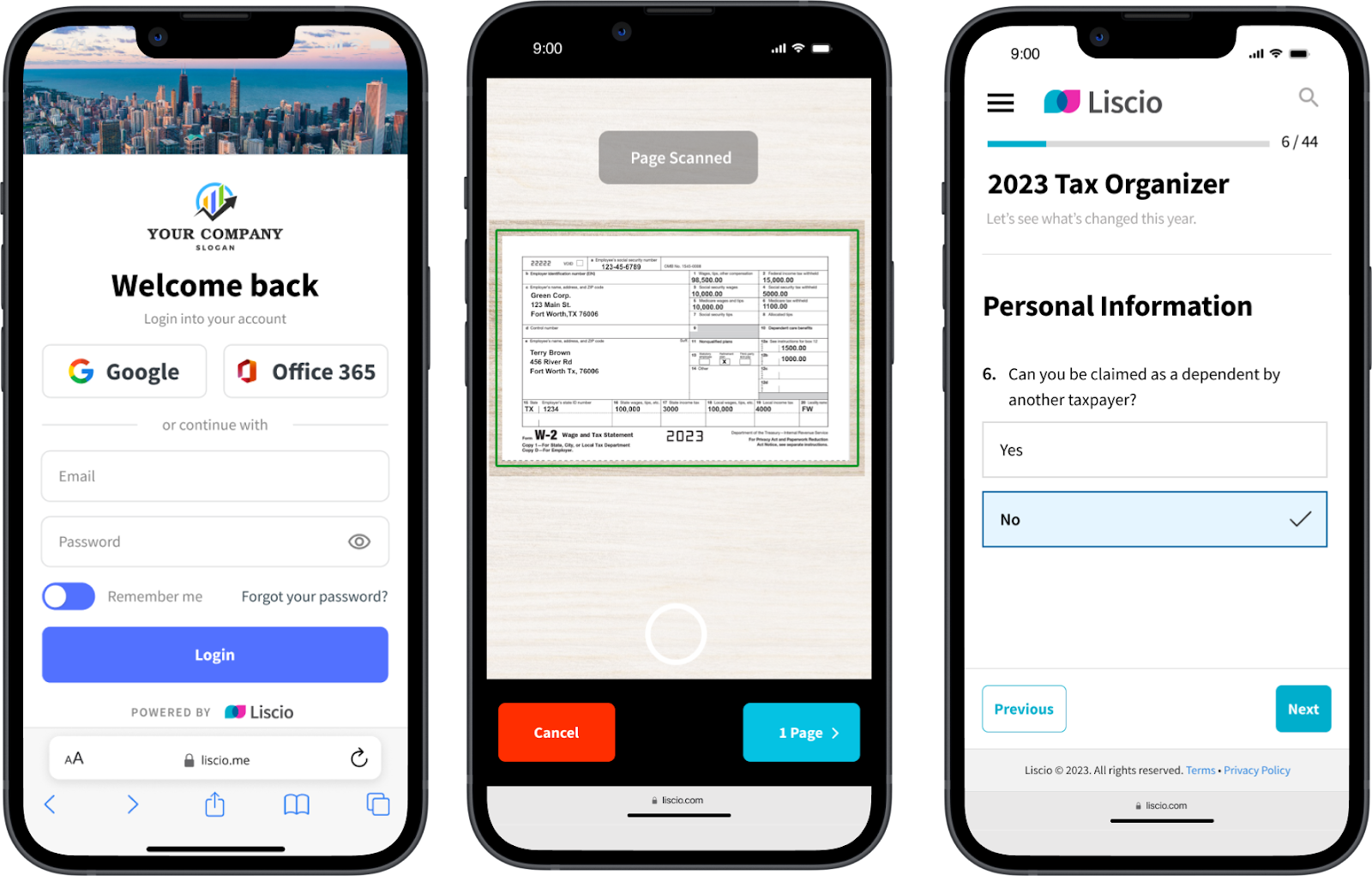

2. Client Management – Liscio (Pitcher)

Liscio is a client experience software that provides accountants with everything they need to manage client relationships.

You can only win a game of softball with great pitching as much as you can satisfy your clients with a good client management solution.

Liscio helps accounting firms collect and store client information to meet client deliverables.

Liscio’s key features include:

- Client Request Lists allow you to create and save your common request as templates you can reuse.

- Electronic Signatures enable firms to receive legally binding client signatures conveniently.

- Personalized Tax Organizers enable you to create bespoke checklists for your tax clients, drawing from Liscio’s knowledge of your previous tax returns.

- Secure Messaging Platform that encrypts data to protect your client communication from unauthorized access.

- Task Lists with Automatic Reminders draw your client’s attention to your requests by email and on the mobile app.

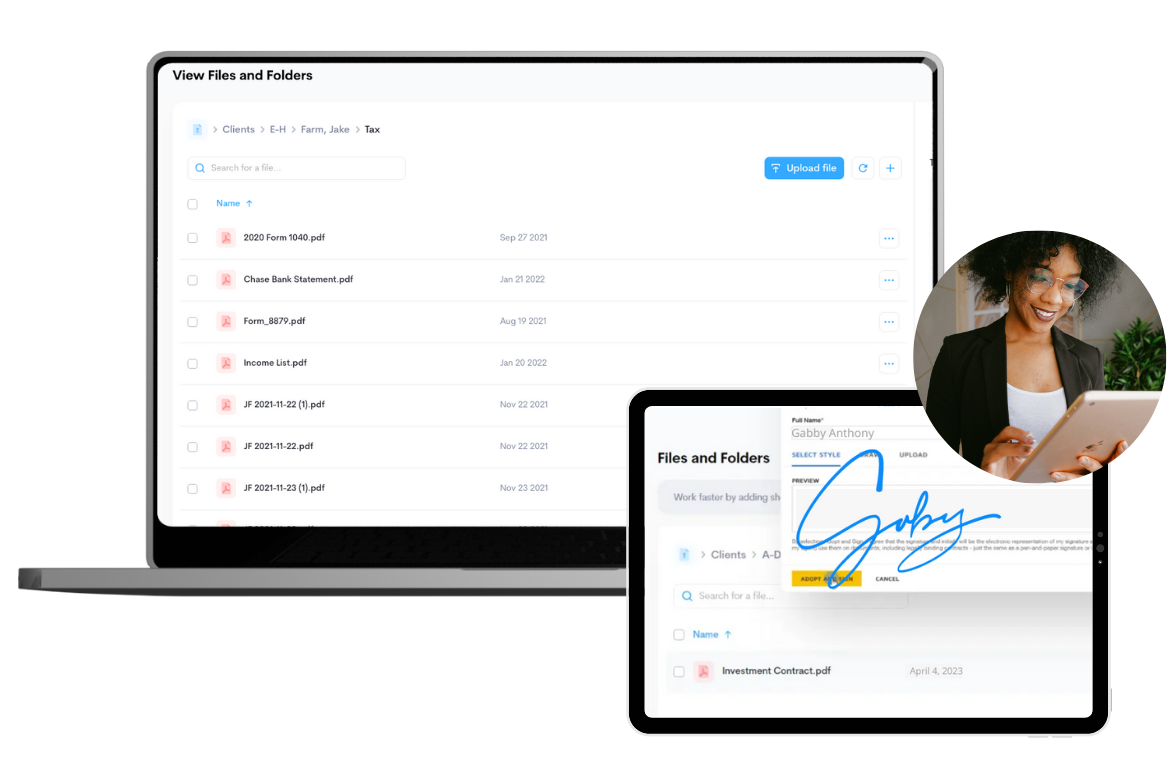

3. Document Storage – SmartVault (Catcher)

SmartVault is a document management software. It was built to address the real-world challenges of accounting professionals by centralizing their documents to unlock their productive potential.

Like a Catcher in softball receives and blocks the ball to keep someone from getting into the wrong hands, SmartVault receives all of Dawn’s documents to keep documents from getting into the wrong hands.

SmartVault’s features include:

- Document Workflows streamline document requests, collections, and storage.

- Secure File Sharing, which makes it easy to exchange files with clients.

- Secure Remote Access to a cloud-based platform that gives users access anytime and from anywhere.

- Unlimited Document Storage to organize documents through an app or a website and reduce paper handling.

Thanks to Financial Cents’ direct integration with SmartVault, Dawn requests client information with Financial Cents and chooses SmartVault as the destination.

4. Automated E-commerce and Retail Accounting & Reconciliation Bookkeep (Second Base)

Bookkeep helps accounting firms manage their multi-channel e-commerce and retail clients by automatically posting accrual-based sales and payment summaries to QBO, Xero, Zoho Books, etc.

The Second Base position (in softball) is known for quickly throwing the balls to teammates. Bookkeep identifies the revenue, sales tax, fees, and deposits from e-commerce platforms like PayPal, Square, Shopify, and Amazon.

Its features include:

- Daily Reconciliation of sales with bank deposits, expenses, etc.

- Multi-Channel Consolidation automatically pulls reports from multiple points of sales systems.

- Neat Financial Summaries sum up thousands of individual orders.

- Sales Tax Automation, which completes, files, and pays sales taxes for you across all 50 states in the USA.

- Seamless Integration with Shopify, Amazon, Big Commerce, blaze, eBay, PayPal, etc.

5. Financial Planning & Analysis – Jirav (Third Base)

Jirav’s Financial Planning and Analysis solution offers firms an all-in-one solution to increase their advisory revenues by integrating general ledger and workforce data.

The Third Base in softball does a lot of planning (of next moves), so it’s easy to see why Jirav’s planning and analysis features occupy Dawn’s Third Base position.

These features include:

- Automated Reports to standardize client deliverables, giving your staff more time to analyze and offer actionable insights.

- Budget VS Actuals gives variance reports that are beneficial for comparing budgets versus actual costs.

- Dashboard Visualization that simplifies financial statements by providing an overview of your client’s business.

- Industry Templates that streamline financial workflows.

- Three-way Financials enable firm owners to easily access a client’s income statement, balance sheet, and cash flow statement.

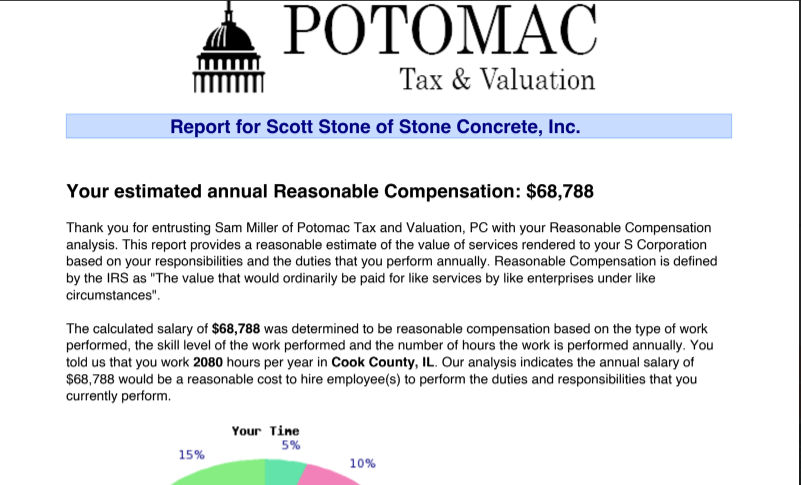

6. Reasonable Compensation – RCReports (Left Field)

RCReports is a reasonable compensation solution built on the same methodologies as the IRS to ensure its reports comply with IRS requirements.

In softball, left-fielders seek to catch fly balls, line drives, and field ground balls to keep balls from going further behind.

As Dawn’s Left Field, RCReports helps the Powerful Accounting team with immediate, accurate, and independent figures that minimize risks and maximize payroll tax savings.

It provides:

- A Resource Library with whitepapers, templates, eBooks, and court cases that get you up to speed with Reasonable Compensation.

- Advisor Network allows you to market your firm to potential clients.

- Custom Branding allows you to use your logo and color scheme in your client reports.

- Warp Speed Wages enable you to look up wage data points of up to 6000 occupations in seconds.

7. Hosting and Cyber Security – Visory (Pitch Hitter)

Visory handles Dawn’s hosting and cybersecurity concerns with cybersecurity features that safeguard accounting firms against internet fraud and unauthorized access.

Visory understands the safety requirements of accounting data, so it uses the latest security protocols and procedures to protect your client data across all devices.

Visory’s features include:

- Employee Security Awareness Training that empowers your employees to recognize and address security threats adequately.

- QuickBooks Expertise that secures access to QuickBooks and protects the movement of accounting data between local systems and the cloud.

- Secure Filter that blocks spam and malicious emails to protect your clients’ communication.

- Secure Gateway (SSO) with encryption technology and streamlined user authentication across multiple systems.

- Secure SASE that ensures the verification of all access to client data through a secure private network wherever your employees may be.

How Financial Cents Helps Dawn’s Powerful Accounting

-

Client Information Management

Dawn found the answer to her firm’s client information management challenges in Financial Cents.

One of my keys to success is consistency. I want to be consistent and have all the data at my fingertips, so we store all our data in Financial Cents, and we absolutely love it."

Other benefits Dawn gets from Financial Cents include:

-

Team Communication

Financial Cents enables Dawn’s team to communicate inside each client’s project. This has helped them to keep discussions about each project in the proper context.

-

Client Collaboration

Dawn uses Financial Cents’ client task feature to request additional client information through the client portal.

Allow Financial Cents to hold your firm together today.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Emerging Accounting Technology Trends to Look Out For in 2024

Years back, many accounting firm owners deemed technology too expensive, complex, or unnecessary. But that’s no longer the case in today’s rapidly…

Oct 30, 2023

Accounting Automation Explained: Meaning, Benefits, Tips for Getting it Right in 2024

Accounting automation, also known as automated accounting, offers a comprehensive solution for firms looking to improve their internal process and focus on…

Oct 03, 2023