A Guide for Selecting Accounting Workflow Software for Canadian Firms

Author: Financial Cents

Reviewed by: Kellie Parks, CPB

In this article

Realizing your need for accounting workflow software is easy.

When you can’t tell where client work stands, who is assigned which task or organize client information in one easily accessible place, you know you need reliable workflow software.

Finding the right tool for your firm is where the problem lies. Choosing a workflow tool for your firm is so challenging because; (1) the number of workflow tools on the market is overwhelming and (2) it’s hard to tell exactly what each tool does, or how they will meet your specific workflow needs, until you’ve subscribed.

This is even more challenging for Canadian accounting firms who need a good workflow tool and one that:

- Is compliant with the Canadian data privacy and residency laws, which regulate how Canadian firms collect, process, and manage client information.

- Enables them to pay more conveniently in their national currency– Canadian Dollars. Many accounting workflow solutions bill in United States Dollars.

This article will save Canadian accounting firm owners the blood, sweat, and tears of figuring this all out for themselves.

Benefits of Accounting Workflow Software for Canadian Firms

Your firm will reap the benefits of using an accounting workflow software designed with Canadian firms in mind in terms of:

-

Increased Efficiency and Productivity

The amount of work your team does increases when they no longer have to spend hours on manual work like data entry, updating the status of client work, managing recurring work, and sending email follow-ups to remind your clients of the documents you need for their work.

Workflow tools automate most of these day-to-day tasks, freeing your team up to do meaningful work at scale.

-

Reduced Errors and Improved Accuracy

Humans are more prone to error than software programs. The more manual tasks your team handles, the higher their likelihood of getting tired or distracted and mixing things up, which results in the incorrect client data .

Using workflow automation for your manual processes equips your team with reliable information that improves the accuracy of your work.

-

Improved Collaboration and Communication

Workflow automation empowers accounting teams with the features to communicate and collaborate seamlessly.

In Financial Cents, for example, your employees wouldn’t need to send reminders when they complete tasks or when the information or documents they need for work are ready. Everything is clear for all to see on the workflow dashboard and client profile.

You can also use the @mention feature to tag your colleagues in time-sensitive comments. This prompts the system to notify the colleague about your comment.

Similarly, there’s the dependency feature, by which Financial Cents’ accounting workflow tool notifies your team members when their tasks in a project are due for their action.

-

Scalability and adaptability to firm growth

A reliable accounting workflow software for Canadian firms will take your firm from a start-up mentality to a firm you can scale to any degree.

But scaling your firm is nearly impossible without systems to rely on. Accounting workflow software enables you to build systems that keep things from falling through the cracks.

That way, you wouldn’t have to deal with the dreaded situation where accountants forget to do what they promised their clients.

-

Enhanced client satisfaction and service

Automating relevant aspects of your client-facing processes helps you streamline your client engagements and gives you a clearer mind to build reliable client relationships.

-

Cloud Access

Since accounting workflow software solutions host their data in the cloud, they allow your team members to access work and client information anytime and from anywhere.

This allows them to work from places where they are happy and comfortable boosting your success in meeting client deliverables.

Key Features to Consider When Selecting a Workflow Software for Your Canadian Firm

-

Workflow Automation

In an average Canadian firm, task management takes up too many hours of billable work. It competes for time with the actual accounting work.

By outsourcing administrative duties to accounting software (thanks to the workflow automation feature), you’re better able to track tasks and request additional files from clients with little to no human input.

Workflow automation in Financial Cents could be as simple as using tags to automate the status of client work. If, for example, a client’s project can’t continue until the client sends a particular document, a tag showing “waiting on client info” will be automatically added to the client’s project.

It enables you to see what’s delaying that project so that you can take any necessary steps to move it forward.

-

Recurring Projects

70.5% of accounting firm owners said the recurring projects feature is the most important in their accounting workflow software.

The recurring project feature comes in handy for those projects that you do for your clients regularly. It recreates the copy of the work for their future dates.

In Financial Cents, this feature takes effect either when you have completed the current copy of the project or when the current copy of the project has passed its due date.

The recurring feature works for the work you need to do on a regular (weekly, monthly, quarterly, etc.) and custom schedule (the last Monday of the month, the third Wednesday of the month, etc.).

In all, this feature will save you the time of recreating repetitive projects each time you need to do the work and the embarrassment of forgetting to do the client’s work altogether.

-

Compliance with Canadian Data Residency Laws

The risk of violating Canadian residency laws is key when considering an accounting workflow tool. What’s the point of an automated workflow system if it’ll cause you to violate relevant government regulations?

For any workflow software to get your attention, it has to enable you to manage your client’s data without worrying about violating Canadian data privacy laws.

Financial Cents, for example, has servers in Canada that ensure that your client’s data never leaves the country during collection, processing, or storage.

Without this feature, you will need complex workarounds to stay compliant with these laws.

Bonus!

Financial Cents subscription can be paid in Canadian Dollars. This saves you the stress of factoring currency conversion costs when paying for one of the most important tools in your tech stack.

Only a few of the top workflow applications bill in Canadian Dollars (CAD).

-

Task Dependencies

You will need the task dependencies feature for projects that require several team members to complete because those team members might be assigned tasks in several other projects.

The feature helps you to coordinate assignees so that none of them is confused about the timing or urgency of their tasks in a project.

In Financial Cents, this feature helps to:

- Keep assignees focused on what needs their attention by removing all tasks that are not urgent from their dashboards.

- Notify assignees when they need to start a task (so they don’t forget to do the work).

This feature will help your team focus, improving productivity and efficiency.

-

Client Tasks and Reminders

This feature was ranked the third important feature accounting firm owners sought after in workflow software in 2023. It reduces the time you spend chasing clients.

The client task feature enables you to create a checklist of the files you want from your clients so that you don’t forget that you will need it to complete the work when you sit down to do it.

If you don’t collect the documents early enough (by setting up client tasks when you create the work), you might look inexperienced if you start asking for them when you realize you don’t have all you need later.

Then again, no business owner ever has free time on their hands. They could easily forget to attend to your document request. That’s where the reminder aspect of this feature comes in handy.

The reminders enable you to auto-remind your client to attend to your requests. This frees you from the stress of drafting and sending several email follow-ups.

Workflow software that gives you templates to customize for your firm easily will improve the consistency of your work quality.

Workflow templates enable you to guide your new and seasoned staff to execute client work according to your exact procedures. They take the guesswork out of your processes so your team members can complete their tasks confidently.

Standardizing your firm (with workflow templates) also enables you to get your firm to operate independently of you; your staff members will not need to run to you every time for clarity.

-

Team (and Client) Collaboration and Chat

This feature helps keep team members and clients on the same page.

The team chat and collaboration feature helps everyone know where each work stands, what to expect, and what they might need to do.

In Financial Cents, this feature enables your staff members to discuss a project with comments and tags. There is a team chat feature on the workflow dashboard that shows your team members relevant updates about each of the projects.

-

Integration with Other Apps

Your workflow software should be able to help you do as many of your accounting and bookkeeping processes as possible. However, there’s just so much a single software can do without losing its core strength.

So, it’s either a workflow tool that integrates with other software to provide its users with the features it doesn’t have, or it integrates with other tools that implement a particular picture slightly differently. This gives its users more options.

For example, Financial Cents has a sufficient file management system, but it also has a native integration with SmartVault that gives Financial Cents users the option of accessing SmartVault’s document management features from Financial Cents.

Integrations keep you from going in and out of several other tools when working inside your workflow tool.

Selecting the Right Fit

These seven steps should help you find the best accounting workflow software for your firm,

1. Define Your Firm’s Needs and Goals

Why do you need workflow software? Your workflow needs are likely different from those of every other firm, depending on your area of procedures, specialization, or clientele.

If workflow automation is your priority, your choice of a tool might differ slightly from the firm that prioritizes client portals or time and billing above all else.

Moreover, how a workflow software implements the workflow functionality you need counts also the. Two workflow tools can have the same set of features but implement them differently.

Do you want your workflow tool to have recurrences? How would you want these to work for your accounting practice?

Rank your workflow needs in their order of importance. Out of the best tools, choose the one whose user interface most appeals to you.

Overall, you want the platform with the most meaningful implementation of the functionality that matters to you.

2. Set A Budget

Defining how much you can spend on your workflow tool will guide your search. Some workflow tools are as expensive as they are simply because they are designed for the needs of larger firms.

There’s no need to spend thousands of dollars on a tool that was built for larger firms (which might overwhelm your small or mid-sized firm) when you can get a less expensive one built with your specific needs in mind.

Generally, the higher you can go, the higher your options. But don’t make your final decision based on how expensive or reasonable a tool is.

The most expensive accounting workflow software solutions are not necessarily the best. Some workflow tools are in a race to have the most features, and this may shoot up their price structure.

3. Research and identify potential software options

In researching available workflow tools, speaking with the product providers and the actual users of the product has proven to be very reliable.

The providers are best positioned to give you information you can’t get elsewhere. But remember that they have every incentive to spin information to sell their product.

Also, contact people in your professional network to learn about their experience with the tools. Product users are most likely to give you unfiltered stories about the product. They’ll tell you where the workflow tools are good and where they are lacking.

These conversations could save you the time and stress of buying a tool you will have to abandon shortly after. You can also check our detailed review of the best accounting workflow software solutions.

4. Evaluate shortlisted software based on key features

Most workflow software solutions try to compete on features. Knowing the exact features you need to move your firm forward is best.

So, you must be clear about what you are looking for in a workflow. Else, every tool will look like the best for you.

You want to be able to recreate re-occurring work; how exactly do you want your recurrences to function?

Financial Cents, for example, allows you to use regular and custom recurrences. Together, they let you set recurrences on work you do with regular intervals (like weekly and monthly) and those you do on a custom schedule (like a particular day of the work or month).

Some other workflow tools may not let you do this — in this way. You need to know how well the features you see in a particular tool will work for your firm’s processes.

5. Request Demos and Trials

Product demos present a unique opportunity to see how a workflow tool functions in real-time. Everything you know about a product before a demo is all talk and theory. Demos give you a practical feel of the product.

You can ask questions, express your concerns about the product, and gain clarity during the demonstration.

In Financial Cents, for example, the product demo presents a chance for prospective users to ask for the Canadian Dollar billing feature instead of the USD billing that United States users prefer.

Every once in a while, Financial Cents organizes a demo day to show its users how its features work. Here’s a link to request a personal demonstration of Financial Cents workflow tool.

6. Consider User Reviews and Testimonials

Sites like Capterra, G2, and GetApp have grown popular because they give past users the chance to leave unfiltered opinions for other prospective users to find guidance.

These opinions are a reliable source of software information because the reviewers are not connected to the product providers and have little or no reason to distort facts.

7. Make the final decision and implement the software

When you have researched available workflow tools and seen the best possible fit for your firm, you need to go all in to implement the one you choose.

If you did your research well, the tool you choose will be easier to implement and use. This is important because many businesses buy software products they never fully implement, which ends up being a frustrating waste of time and money.

Financial Cents is the Perfect Workflow Software for Canadian Firms

With some of Canada’s top accounting professionals like Kellie Parks and Elizabeth Birch in our user base, Financial Cents has become an accounting workflow software of choice for small and mid-sized Canadian accounting and bookkeeping firms.

Upon signing up for a free trial, you can start enjoying all Financial Cents’ features including:

- A Workflow Dashboard: that gives you firm-wide visibility over projects, staff, and client information. Financial Cents’ workflow tool enables you to automate manual, repetitive tasks and buy back time for the work that brings the most value to your firm.

Financial Cents’ Canadian file storage solution that enables you to collect, process, and store your clients’ data within Canadian borders. This helps you intuitively comply with Canadian data privacy and residency regulations.

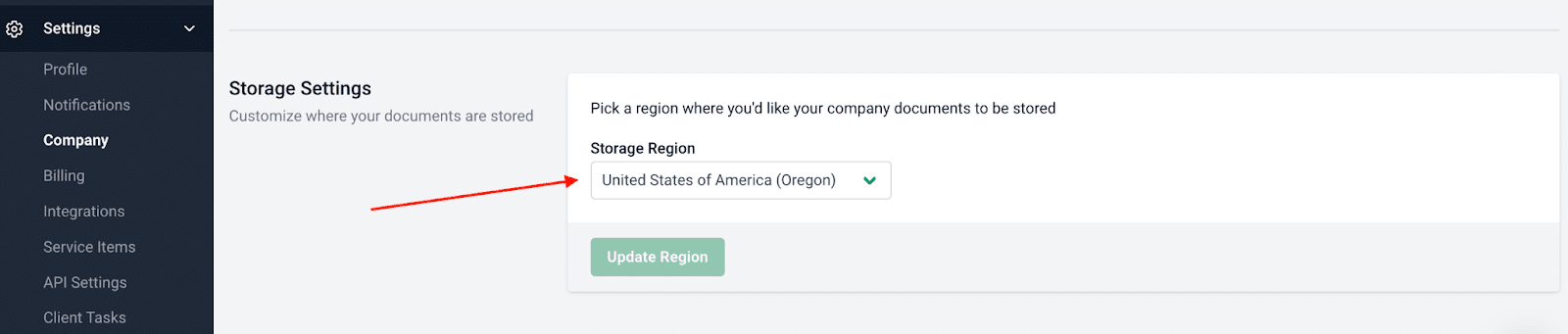

Here’s how you can switch to the Canadian file storage today:

- Go to Settings

- Go to Company

- Scroll to the bottom

Sharing information and ideas with staff and clients about client projects is easy in Financial Cents. Your team can discuss client work with more context right inside the project.

They can share updates about a client’s project with the Client Notes feature on the client’s profile.

While discussing the client’s projects, they can use:

- Comments to ask questions or share ideas about the client’s work.

- Mentions to @tag your team members to your comment to pull them into the conversation.

-

Canadian Dollar Billing

Financial Cents enables you to pay for your workflow management tool in Canadian Dollars, saving you the hassle associated with foreign exchange payments.

You can request to switch to the Canadian Dollar billing option when you book a demo with our team or start a free trial today.

Start Using Financial Cents to manage your firm.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

How to Perform a Comprehensive QuickBooks Cleanup (+ Free Checklist Template)

QuickBooks cleanup drove the most profits for accounting and bookkeeping firms in 2023. Knowing how to bring order and clarity to the…

May 02, 2024

Key Features of a Great Accounting Document Management System

Here’s all you need to know about an accounting document management system and how it can make you more organized and save…

Apr 26, 2024