We (in Canada) are required to store our documents in Canada. Using an accounting workflow management software solution in the United States means that our client data will be stored in its servers in the United States unless there's a way to link our Canadian-based documents in the client portal to keep our documents on our side of the border."

Peter Piluk, Owner of Pathway, an accounting and bookkeeping firm in Canada.Complying with data residency laws is critical because each country must establish guidelines for how businesses collect, process, and manage citizens’ data.

Non-compliance carries various levels of sanctions. Some Canadian accounting firm owners have gone to great lengths to ensure compliance with applicable laws.

For instance, the Personal Information Protection and Electronic Documents Act (PIPEDA) mandates that Canadian accounting firms bear the responsibility of protecting personal client information. Failure to fulfill these obligations can result in fines amounting to millions of dollars.

This consideration influenced our decision to prioritize the rollout of the Canadian File Storage in our September 2023 feature update. We are excited to announce that CANADIAN USERS CAN NOW STORE CLIENT DOCUMENTS IN FINANCIAL CENTS SERVERS LOCATED IN CANADA.

With this file storage solution, Financial Cents users in Canada no longer need to resort to complex workarounds to collect and store client documents.

It’s now possible to do it all inside Financial Cents, eliminating the need to shuffle between Financial Cents and third-party apps. Users can proceed with confidence, knowing they are in compliance with the pertinent data residency laws.

Key Features of Financial Cents Canadian File Storage

-

100% Canadian Data Residency

This file storage system is 100% hosted in Canada, satisfying a significant portion of the Canadian data residency law requirements.

Storing clients data outside of Canada exposes it to the legislation of foreign governments, potentially violating Canadian privacy laws.

For example, File Storage systems in the United States are subject to the US Patriot Act, granting the US government access to data retained by companies in the US without customer consent.

In contrast, Canadian Privacy laws require businesses to obtain customer consent before disclosing client data.

-

Full Compliance with Canadian Laws

The Canadian file storage solution is meticulously designed to adhere to the complex federal and provincial privacy laws governing various business sectors in Canada.

The PIPEDA, for example, mandates ensuring the technical and physical security of client data against public access.

PIPEDA also requires notifying the office of the Privacy Commissioner of Canada (OPC) and affected individuals in the event of a data security breach that compromises client data.

These considerations are integrated into the design of our storage solution, alleviating one concern as you grow your business.

-

Seamless Integration

Canadian users no longer need complex workarounds to store client files in third-party applications. The Financial Cents Canadian File Storage integrates seamlessly with your firm’s workflows, enabling access to all information from within the Financial Cents workflow dashboard.

Changing the file storage location is a simple process within Financial Cents, making it easier for new Financial Cents users. This option is automatically activated during the sign up process.

Benefits of Financial Cents Canadian File Storage

-

Data Security

Financial Cents implements robust data security measures to safeguard client data from potential breaches, both during transfer and storage.

To secure the transfer of client files from their computer to our Canadian servers, we utilize secure sockets layer (SSL) protocol. This ensures that the data remains unreadable and unmodifiable by unauthorized users.

During storage, Financial Cents’ CRM feature uses a client vault designed to store sensitive client information, including passwords, usernames, and credit card information.

The client vault uses OpenSSL encryption technology to provide advanced encryption standard (AES) 256, which converts the plain texts in client files into a cipher.

All records within the client vault are signed and concealed using a message authentication code (MAC), ensuring that access is restricted until the access code is shared.

These comprehensive measures, among others, eliminate the security risk of client data during transfer or storage.

-

Data Compliance

Our Canadian file storage complies with Canada’s data residency laws, like the PIPEDA.

But these laws are ever evolving. Compliance today doesn’t necessarily mean compliance tomorrow. Staying compliant requires ongoing efforts to review each requirement.

Using the Financial Cents Canadian File Storage allows firm owners to leverage our ongoing initiatives to review and keep our storage mechanisms compliant with Canadian data privacy and residency regulations.

This eliminates the need for you to stay ahead of the latest developments, as these laws can be complex. It will free up time to focus on meeting client deliverables and growing your firm.

-

Data Sovereignty

Information is power and unauthorized access to it can be damaging to your clients, firm, and the government.

Cloud service providers can move a firm’s client data from one part of the world to another, which increases the possibility of sensitive information getting into the wrong hands and threatens your ability to keep your clients out of (cyber) harm’s way.

This is why governments require businesses to ensure their client’s data are kept in the local jurisdiction, keeping client data out of the reach of foreign governments.

The Financial Cents file storage solution enables you to use passwords to control access to the client information in your care. To prevent unwanted access to the client portal, Financial Cents client portal uses secure magic links (sent to your clients’ emails) each time they want to access their client portal. These measures give you better control of your clients’ data.

-

Enhanced Performance

We’ve had to use a workaround that syncs with OneDrive (OneDrive stores its documents in Canada). If a client uploads something in our US practice management software, we download it, throw it in our Canadian Server, and then delete it from the practice management software."

Peter Piluk, Owner of Pathway, an accounting and bookkeeping firm in Canada.Going through the above process once may not mean so much, but if you must do it for each client document you receive, it will take a toll on your firm’s productivity.

Now that our Canadian users can receive their client documents directly into a Canadian file storage system, you can reinvest those hours into work that drives better client results and improves your firm.

Moreover, this solution allows you to keep client documents in your workflow dashboard (where they are getting client work done) instead of going into other apps to search for the files you need for work.

All of these make your firm’s workflow simpler and your team more efficient.

-

Simplified Client Data Organization

Organization is at the heart of Financial Cents design. We believe that an organized system takes your team one step closer to doing your best work. We simplify your client data organization by adding files to the client profiles, saving you the time you would have needed to organize client documents manually.

With this storage solution, Canadian users do not need to manually receive and organize their client files into different file storage systems. All client data is saved in the client database and on the project (so that your team members can see work-related files inside the project) inside Financial Cents.

This solution also helps Canadian firms get the most out of our client task feature. After setting up client tasks and automating the reminders (which saves your team hours of billable work each week), the files are organized inside Financial Cents’ secure files storage system.

How to Use the Canadian File Storage to Store Clients Data

While new and existing Financial Cents users can implement the Canadian File Storage to send their client documents to Canadian-hosted servers, it works slightly differently for both groups of users.

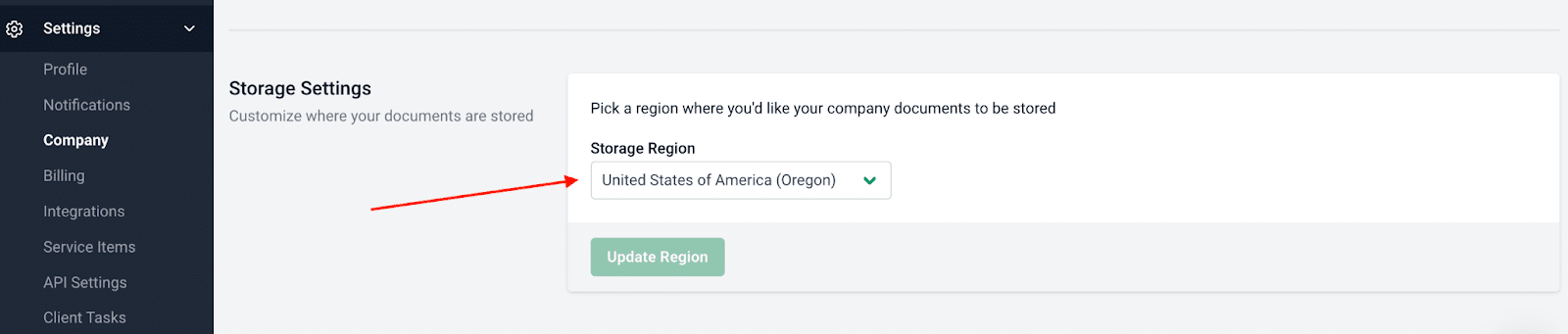

As a new user, your Storage location is set to Canada already. However, existing users must manually switch their storage location to Canada and start receiving subsequent documents in storage servers within the Canadian border.

Here are the steps to make the switch:

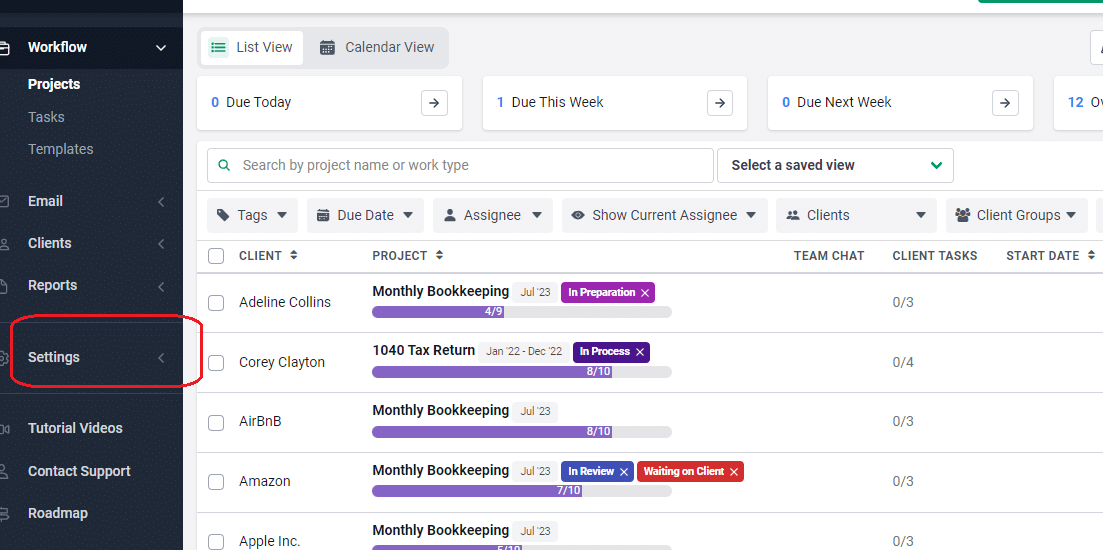

- Go to Settings

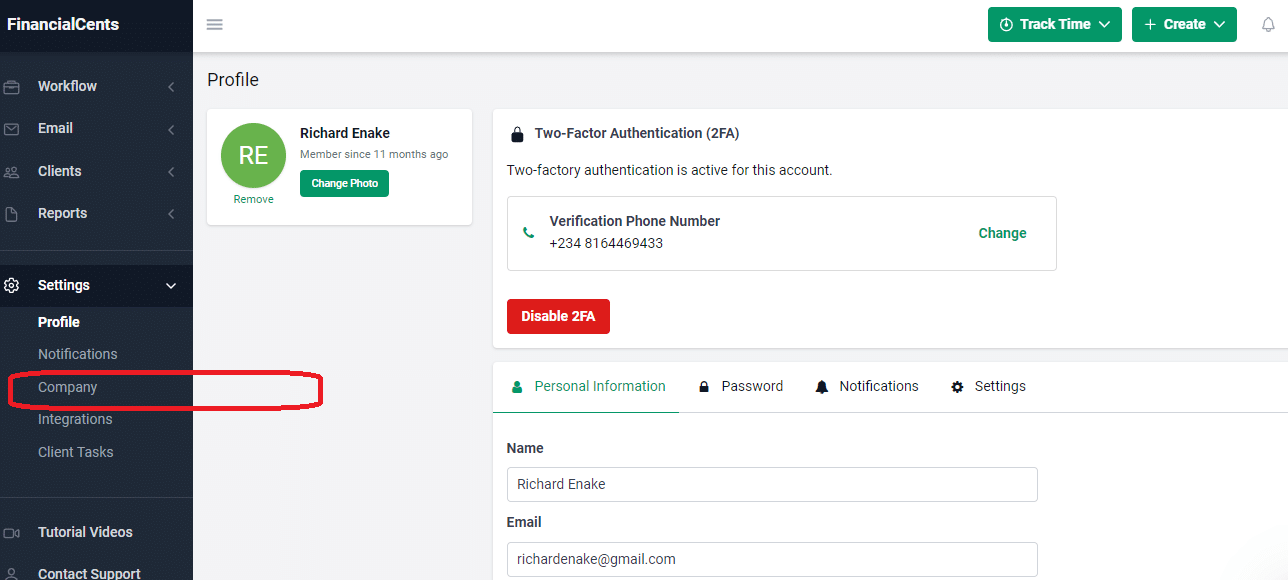

- Click Company

- Scroll down to Storage Settings

- Select Canada instead of the United States of America

Frequently Asked Questions about Financial Cents Canadian File Storage

Q: When will it be available?

A: The Canadian file storage solution launched in September 2023.

Q: Does it come at an extra cost?

A: No. It is part of the Team and Scale plans.

Q. Can I migrate existing clients?

A: Documents that clients upload after the switch will be hosted in Canada. The documents clients uploaded before the switch to the Canadian file storage will remain in US servers.

Q: Is client data securely stored within data centers in Canada?

Yes. The storage solution locates client data 100% within the Canadian border.

Start Using Financial Cents Canadian File Storage

Every nation has unique privacy regulations, and the lack of Canadian file storage has been a pain point for Financial Cents users who have found the software particularly beneficial for accounting project management.

This file storage solution empowers our Canadian users to comply intuitively with data privacy and residency demands in Canada.

We achieve this by seamlessly integrating with your existing workflows, facilitating a streamlined use of Financial Cents.

When team members do not have to access a separate tool to obtain client information during their work, they can maintain greater focus and accuracy in their output.

Start Using Canadian Data-Compliant Accounting Practice Management Software for Your Firm.