Zapier and Financial Cents: Automate Accounting Client Document Management

Author: Financial Cents

Reviewed by: Alexis Sadler

In this article

Nobody wants to spend hours on work that could be automated. That is why Financial Cents seeks to help accountants realize the time-saving benefits of automation by helping them automate the tasks they’ve been spending a lot of time on (and what they could be doing with that time instead).

However, there’s just so much you can do in one app. Currently, most accounting tools focus on one aspect of accounting operations. This leads accounting teams to use a lot of productivity apps to manage different aspects of their workflows, such as client document management.

Thankfully, Financial Cents’ integration with Zapier gives accounting firms access to over 5,000 apps that help them manage their workflows (like accounting client document management) from one central place—Financial Cents.

As a critical part of your accounting workflow, client document management determines how fast you can get work done. Any bottleneck in collecting and organizing client documents threatens the timely completion of client projects, which can incur penalties, especially during tax season.

Accounting firm owners rely on document management system (DMS) solutions because they help their teams to:

- Access and Share Client Documents from Anywhere (and at Any Time). Beyond being more convenient for your staff, it also increases response rates.

- Improve Accuracy of Client Information (And Projects). Working with accurate and up-to-date client information reduces your chances of errors and improves customer satisfaction, which enhances brand trust.

- Collaborate More Effortlessly (Internally and Externally). Document management systems have version control and document-sharing features that enable employees to collaborate on client projects effortlessly.

Come along as we explore the opportunities to automate your accounting client document management with software solutions like Dropbox, Box, Google Drive, Sharefile, and OneDrive.

First, the Drawbacks of a Poor Client Document Management Process

1. Increased Risk of Errors

When your document management process is poor, there’s a greater likelihood of error in your accounting records, which can result in inaccurate financial reporting and costly compliance violations.

For example, an ineffective document management client system produces outdated document versions. And any work done with such incorrect information will be inaccurate.

2. Delayed Decision-Making

The quality of your decisions depends on the timeliness of those decisions. And you can’t make right decisions when you don’t have the relevant information to guide you.

A disorganized client document management process makes it difficult to access your client’s financial information and help them make informed decisions, especially if those decisions are time-sensitive.

3. Compliance Risks:

Failure to comply with relevant financial regulations is a natural result of ineffective document management.

If you don’t have enough control over (or the knowledge of) how your client documents are transferred and stored, you can easily fall short of data privacy laws, which may put your accounting firm at legal and regulatory risk.

For example, the Safeguards Rule of the Federal Trade Commission (FTC) requires the information security program (ISP) of accounting firms to:

- Protect client information by encryption technology during transfer and storage in your document management system.

- Regularly conduct and report regular risk assessments to detect foreseeable risks and threats to the security, confidentiality, and integrity of documents.

- Require at least two authentication factors from anyone accessing customer information.

4. Inefficient Workflow

Manual document management systems do not streamline the document process enough for the level of efficiency accounting teams require.

As a result, most accounting professionals waste time trying to track or find the documents they need to complete client work.

This affects team productivity and efficiency. Meanwhile, document management software solutions make it easy for team members to manage work from a shared platform—usually a client portal.

In addition to that, most document management software simplifies the process with:

- Automatic reminders: to notify team members of shared and overdue documents.

- Mobile versions: to enable clients to share documents on their mobile devices.

- Automated requests: to help accountants automatically request the documents they frequently need.

5. Loss of Client Trust

A disorganized document management system means client documents can slip through the cracks at any time. This implies that you might need to request the same documents several times.

It won’t be long before your clients get frustrated with your stressful document-handling process, which breeds mistrust for your firm’s processes.

6. Data Security Concerns

Poorly managed documents are a source of security risks. When you have less control (because emails are no longer secure), there’s a greater likelihood of unauthorized access, data breaches, and sensitive information exposure.

But most, if not all, document management software solutions offer a robust set of security features that protect confidential client information. They use security features (such as user authentication, data encryption, and access control) that keep client documents out of the reach of unauthorized persons.

How to Automate Client Document Management Process Using Zapier and Financial Cents

Thanks to the integration with Zapier, Financial Cents users can now automate their client document collection, processing, and storage in their preferred DMS tools (DropBox, Google Drive, ShareFile, etc).

After setting it up (in a few clicks), client folders will be automatically created in your DMS once a client profile is created in Financial Cents.

You need a Zapier account to enjoy this integration. Here’s a link to create one.

-

Dropbox

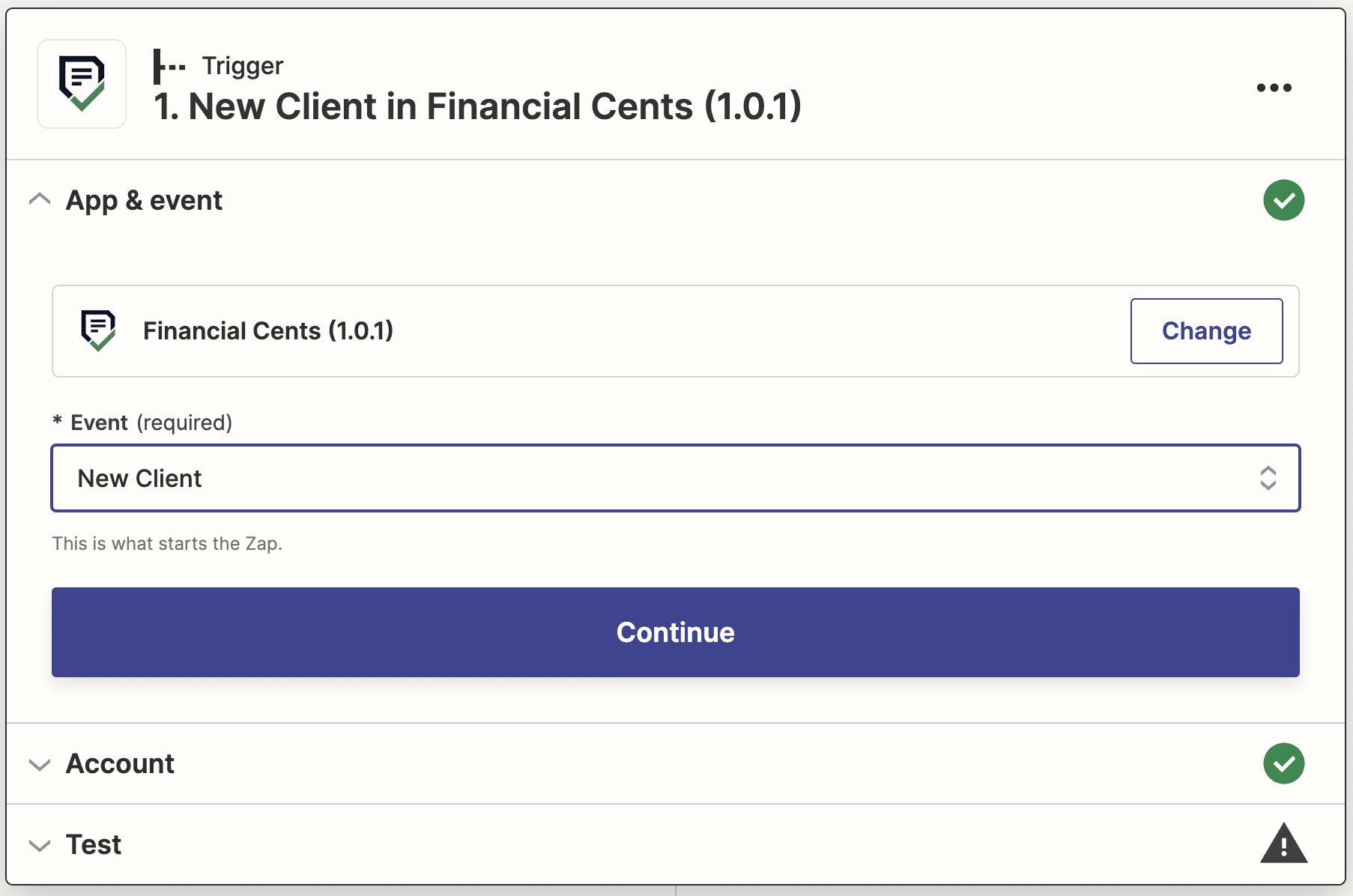

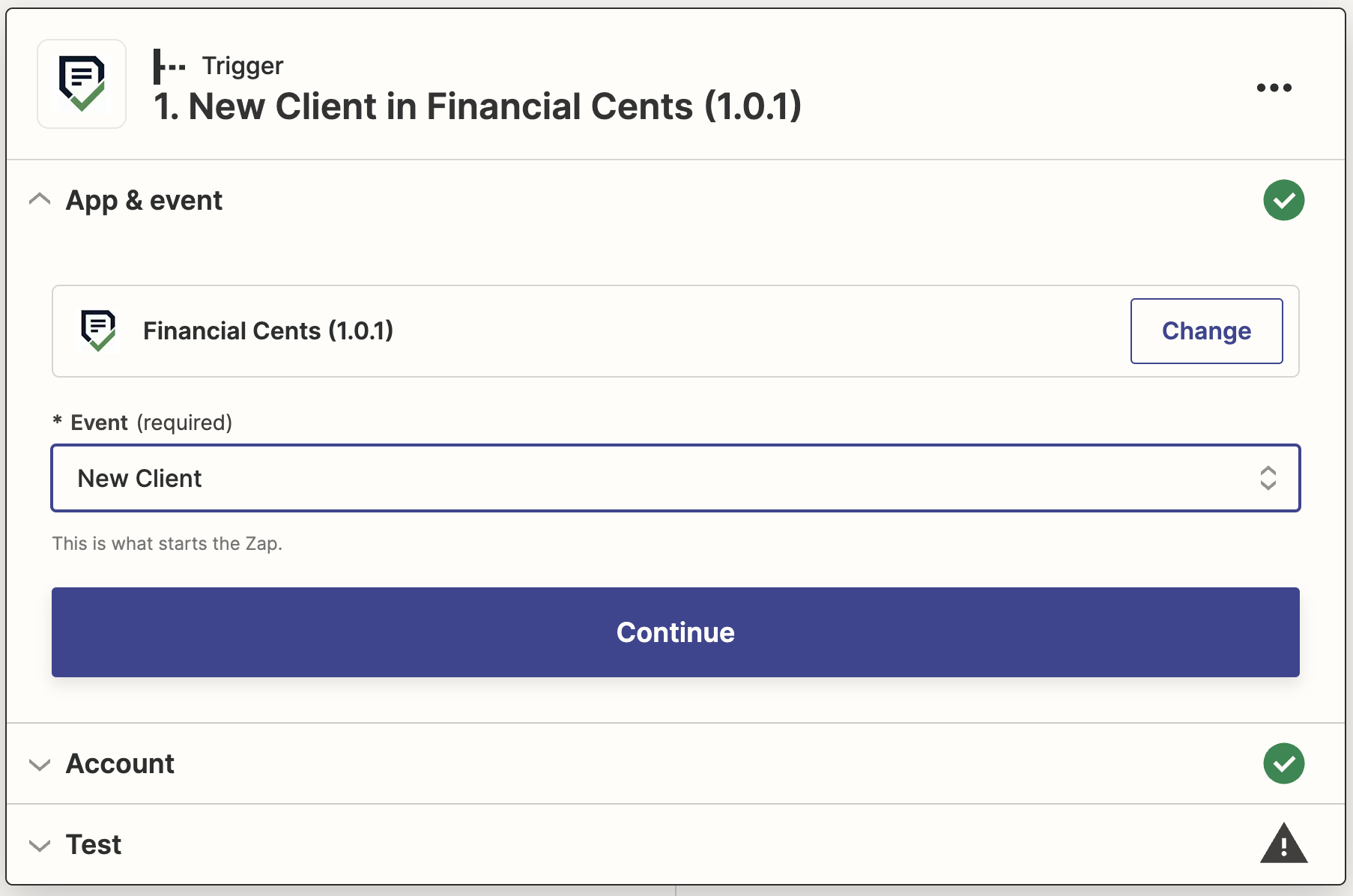

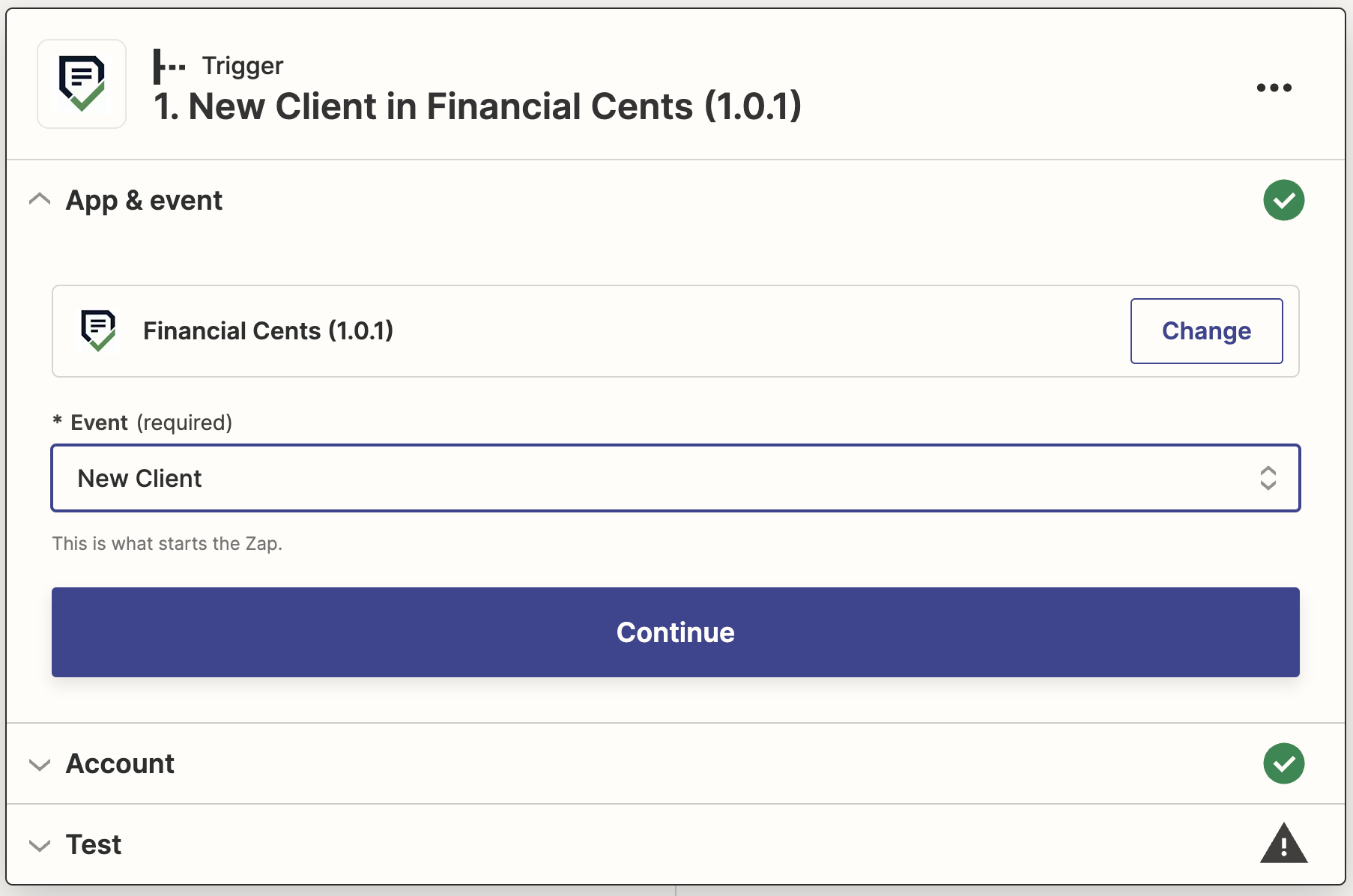

Here’s how to automatically create a client folder in Dropbox after creating the client profile in Financial Cents:

- Select Financial Cents as the trigger app and New Client as the trigger event.

- Select Dropbox as the action app and Create Folder as the action event.

- Select the Space and Parent Folder for the new client folder.

- Select the information from Financial Cents for the client’s folder name in Dropbox.

- Click Continue

- Test and publish

-

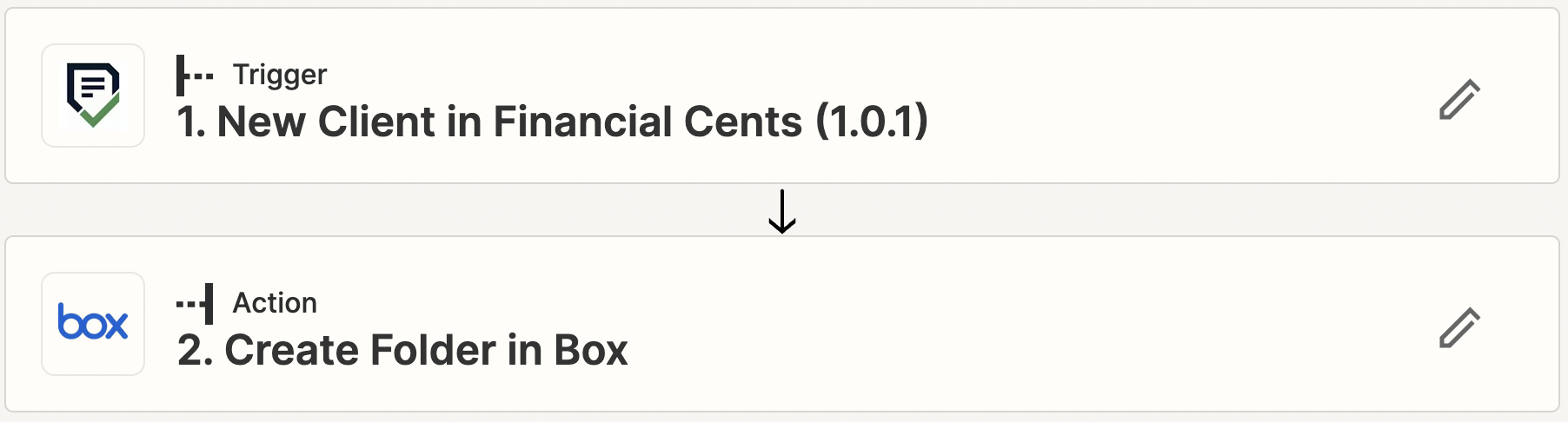

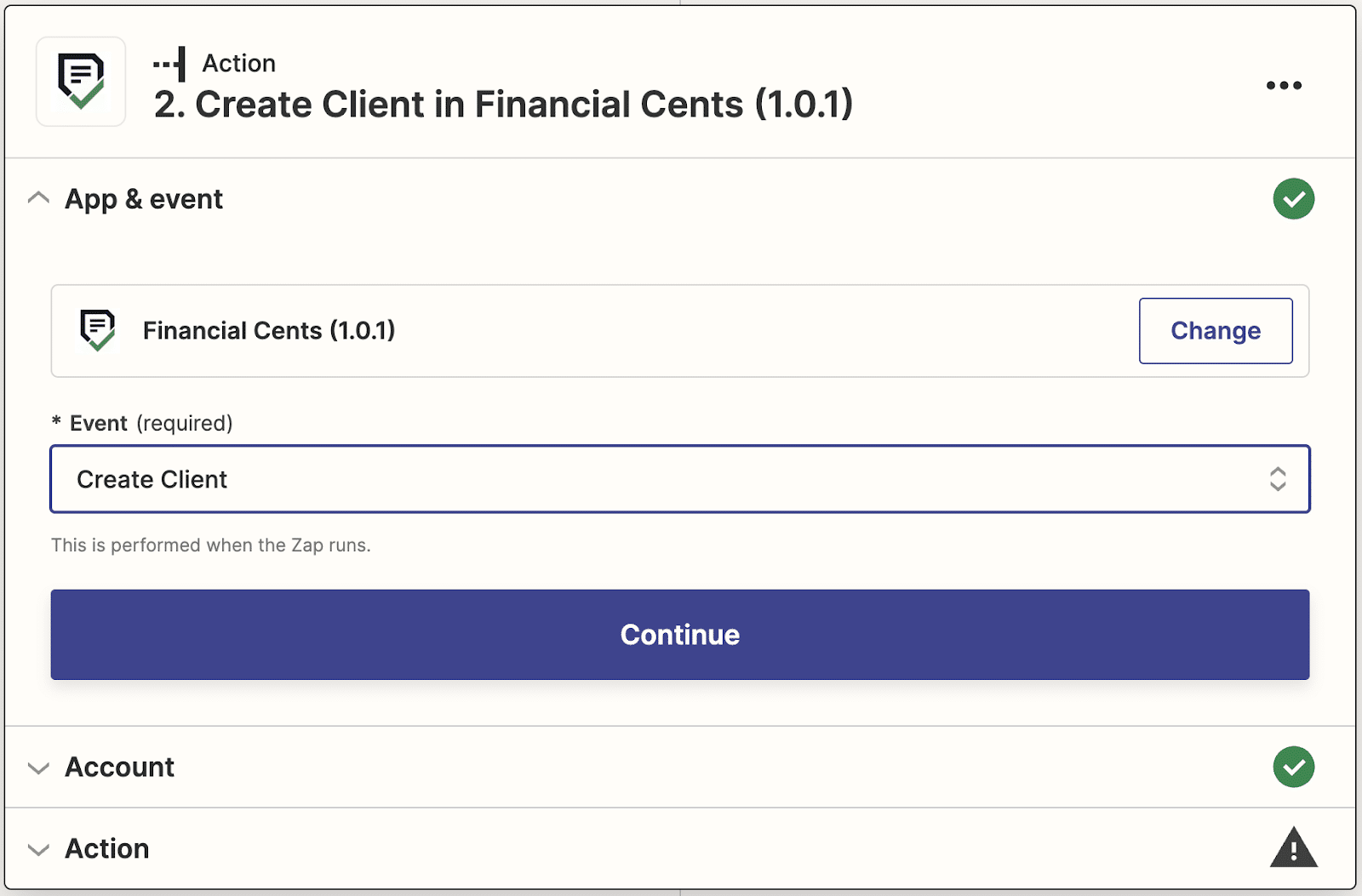

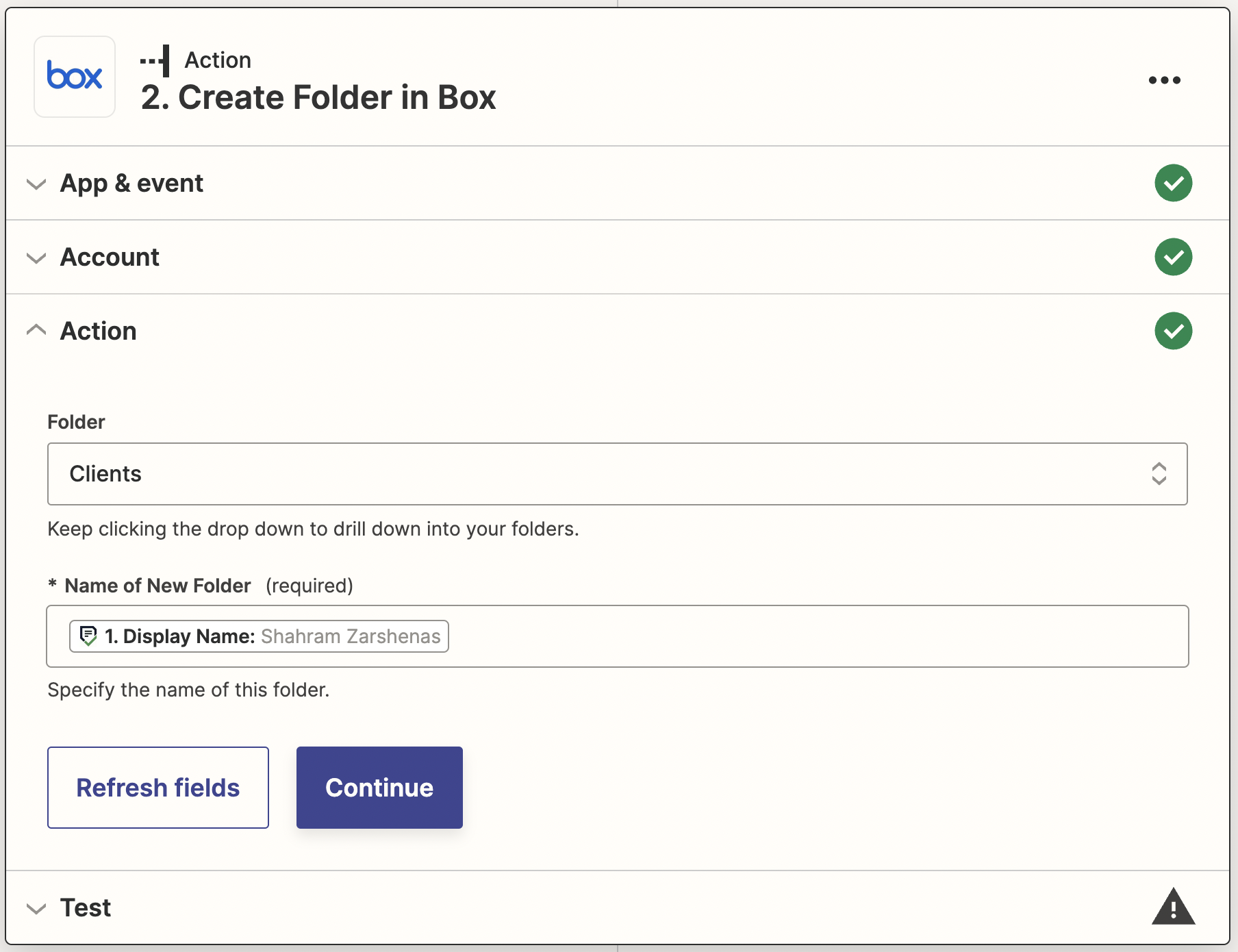

Box

Here’s how to automatically create a client folder in Box after creating the client profile in Financial Cents;

- Select Financial Cents as the trigger app and New Client as the trigger event.

- Select Box as the action app and Create Folder as the action event.

- Select the Parent Folder for the new client folder.

- Use the client’s information from Financial Cents to create the new client Folder’s Name.

- Click Continue

- Test and publish

-

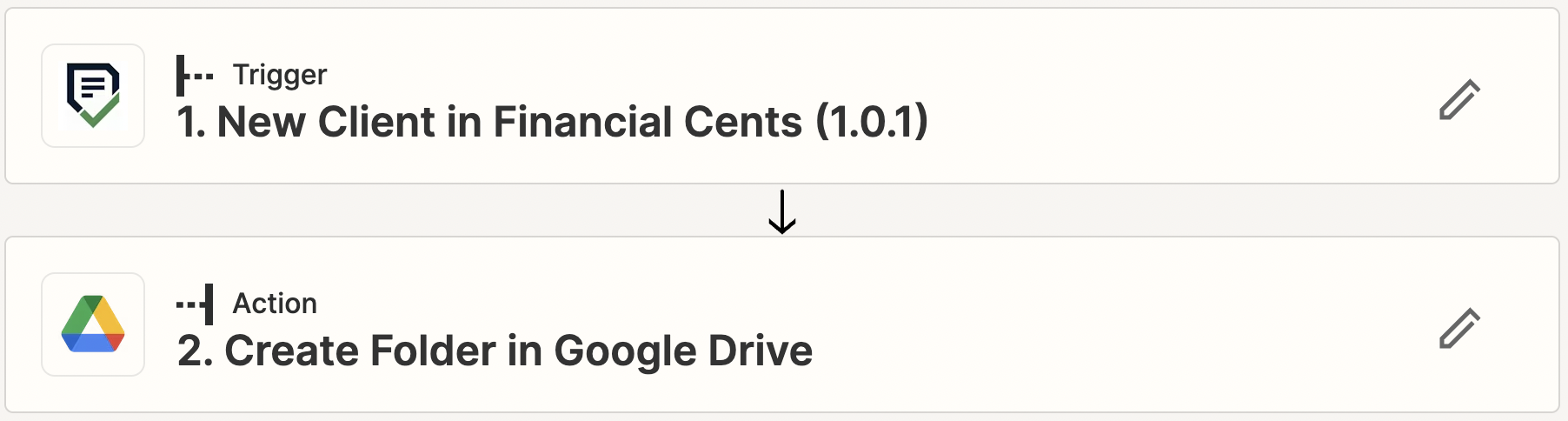

Google Drive

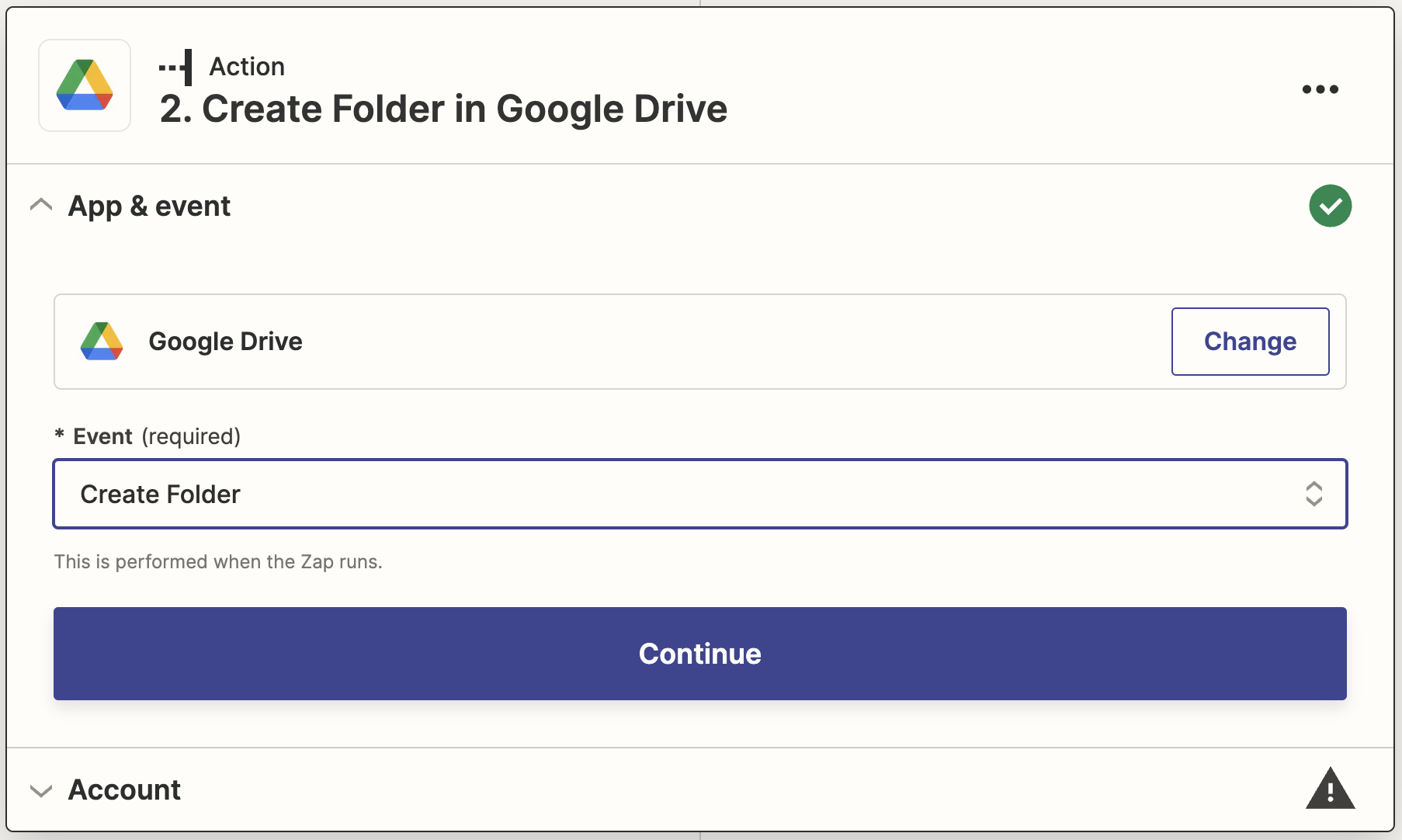

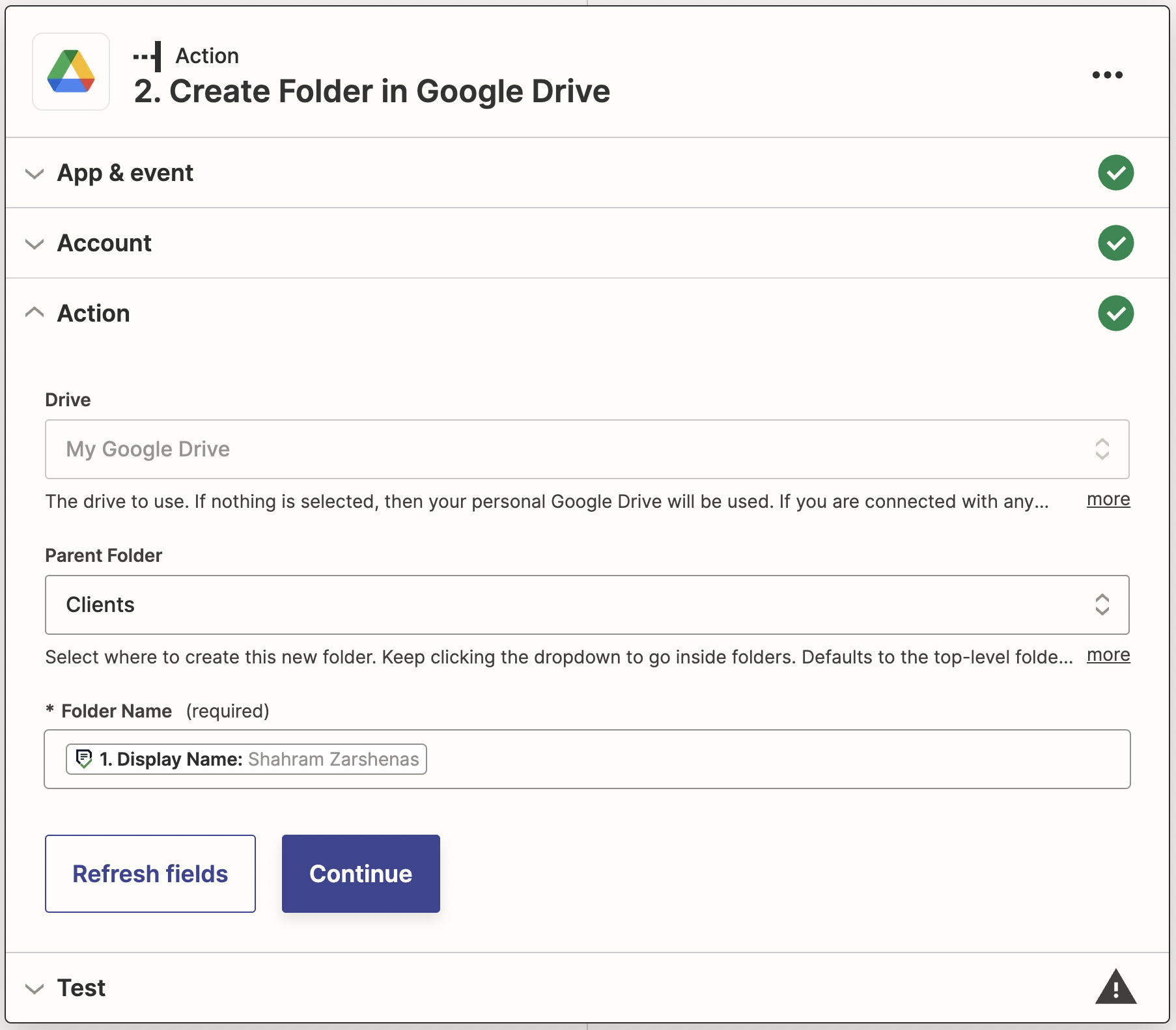

Here’s how to automatically create a client folder in Google Drive after creating the client profile in Financial Cents;

- Select Financial Cents as the trigger app and New Client as the trigger event.

- Select Google Drive as the action app and Create Folder as the action event.

- Select the Drive and Parent Folder for the new client folder.

- Use information from Financial Cents to create the new client Folder’s Name.

- Click Continue

- Test and publish

-

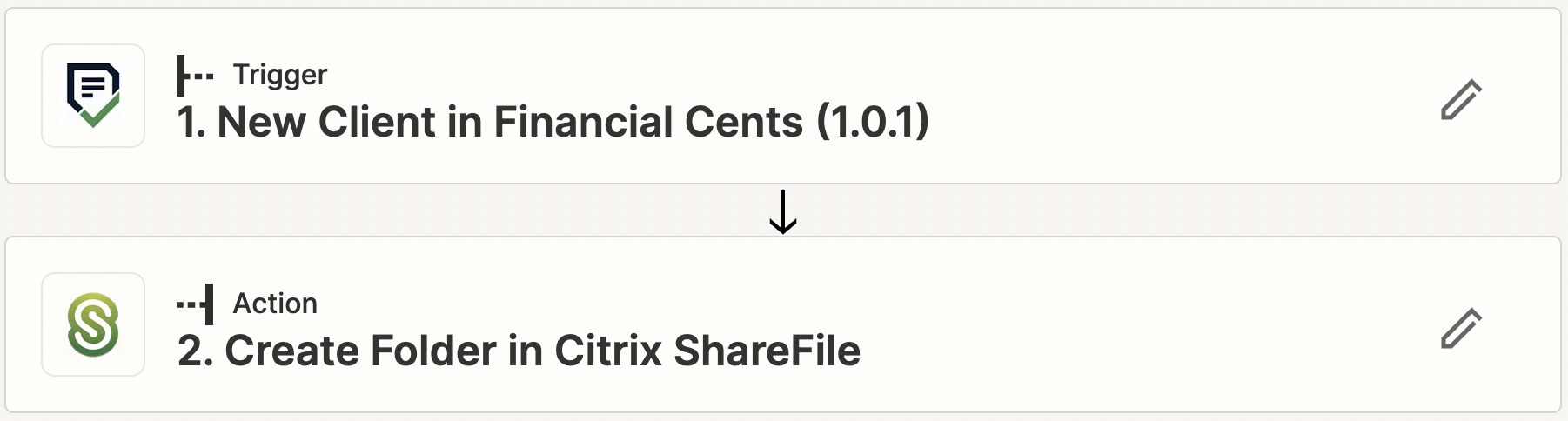

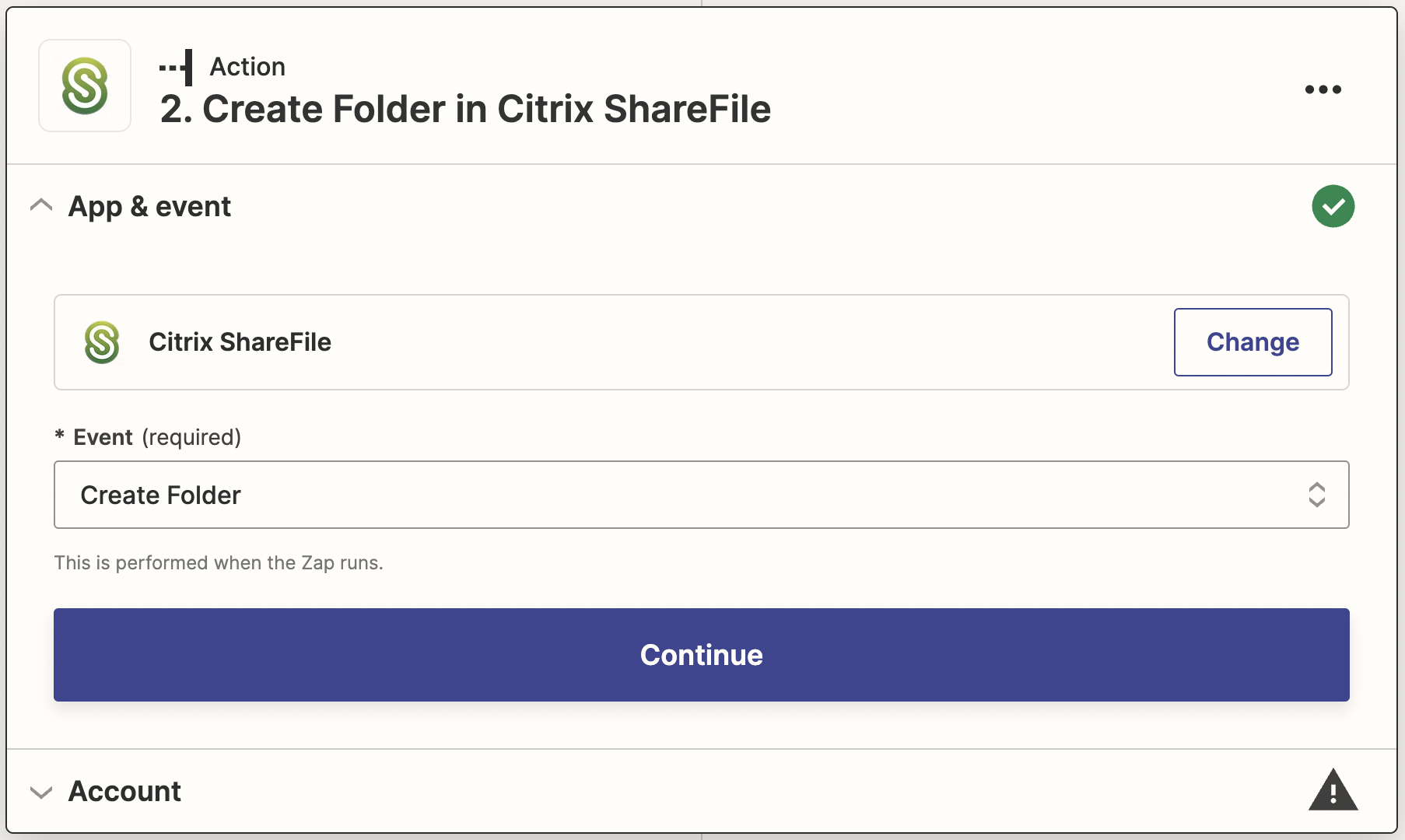

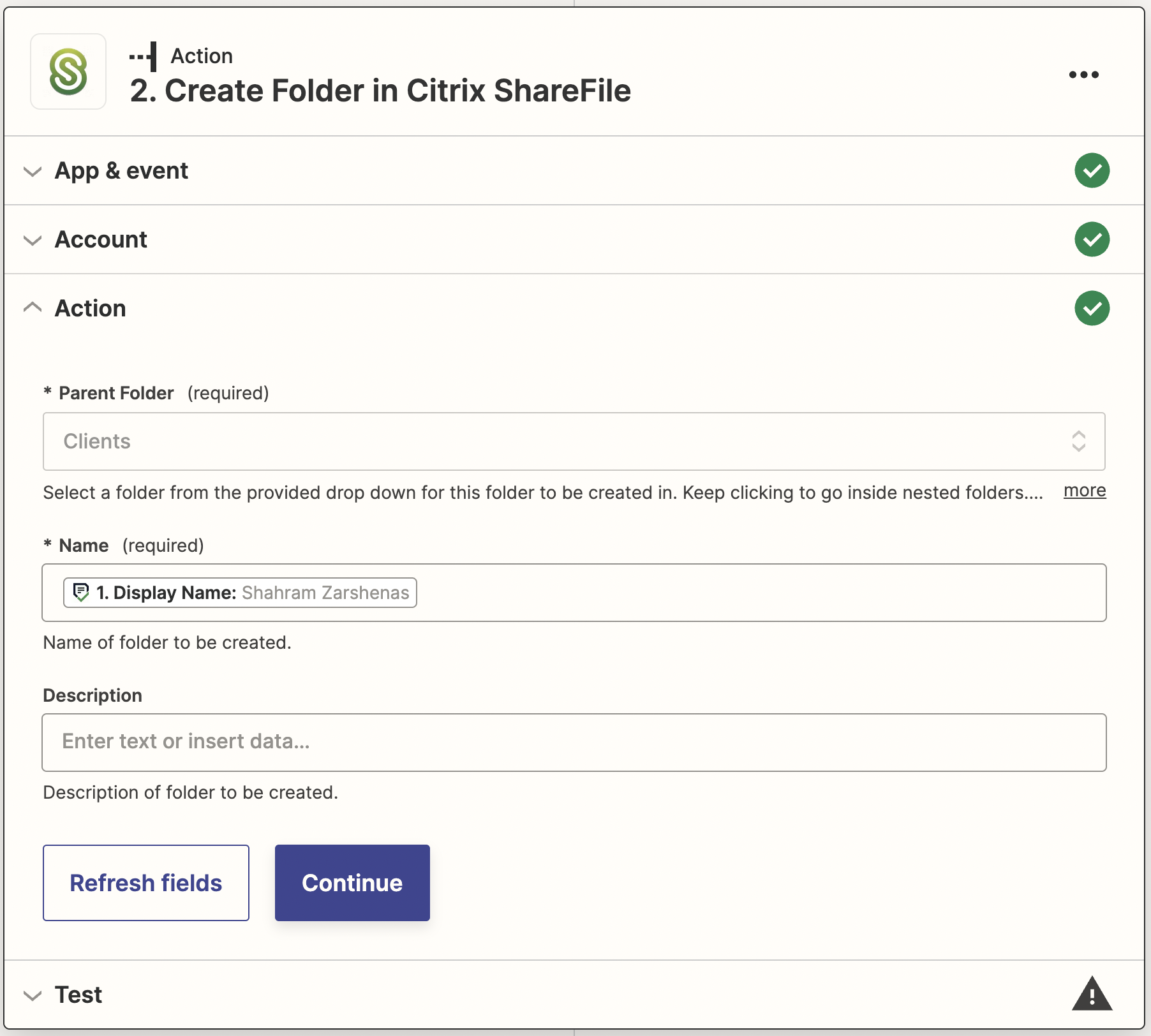

Sharefile

Here’s how to automatically create a client folder in Sharefile after creating the client profile in Financial Cents;

- Select Financial Cents as the trigger app and New Client as the trigger event.

- Select Sharefile as the action app and Create Folder as the action event.

- Select the Parent Folder for the new client folder.

- Use information from Financial Cents to create the new client folder’s name.

- Click Continue

- Test and publish

-

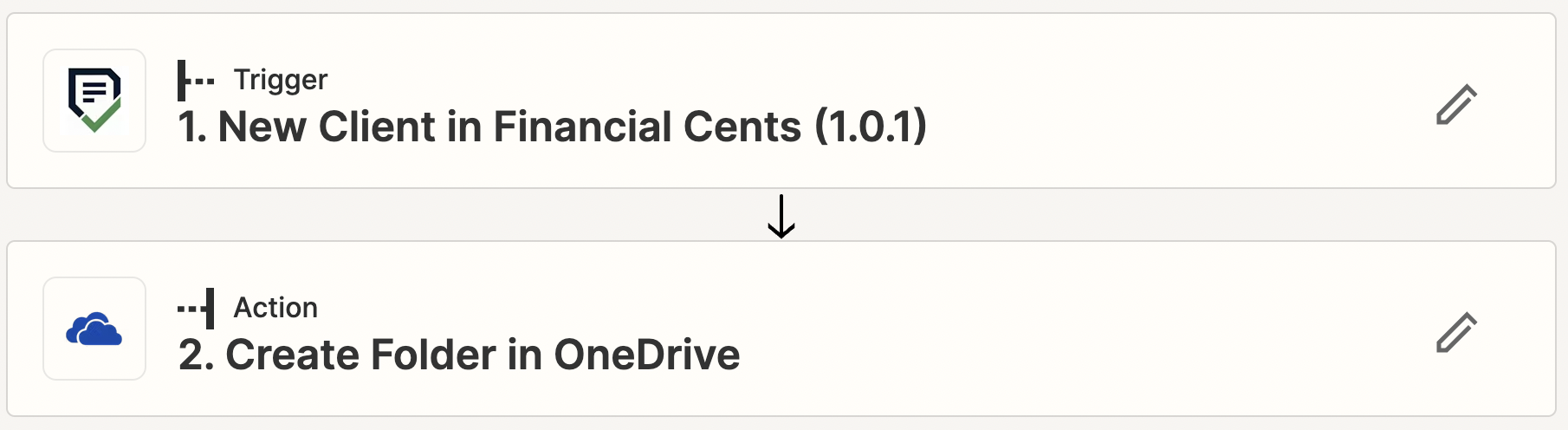

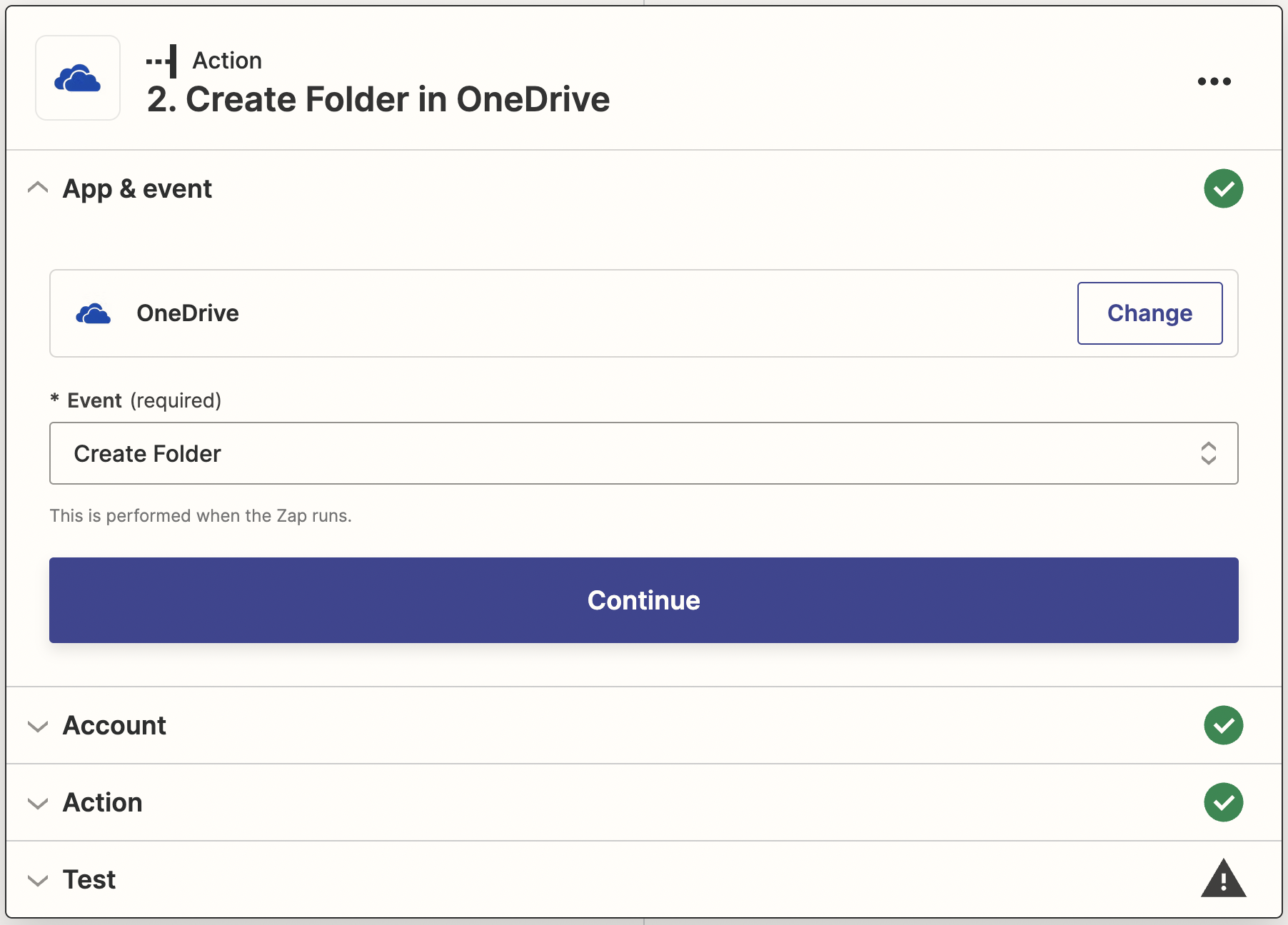

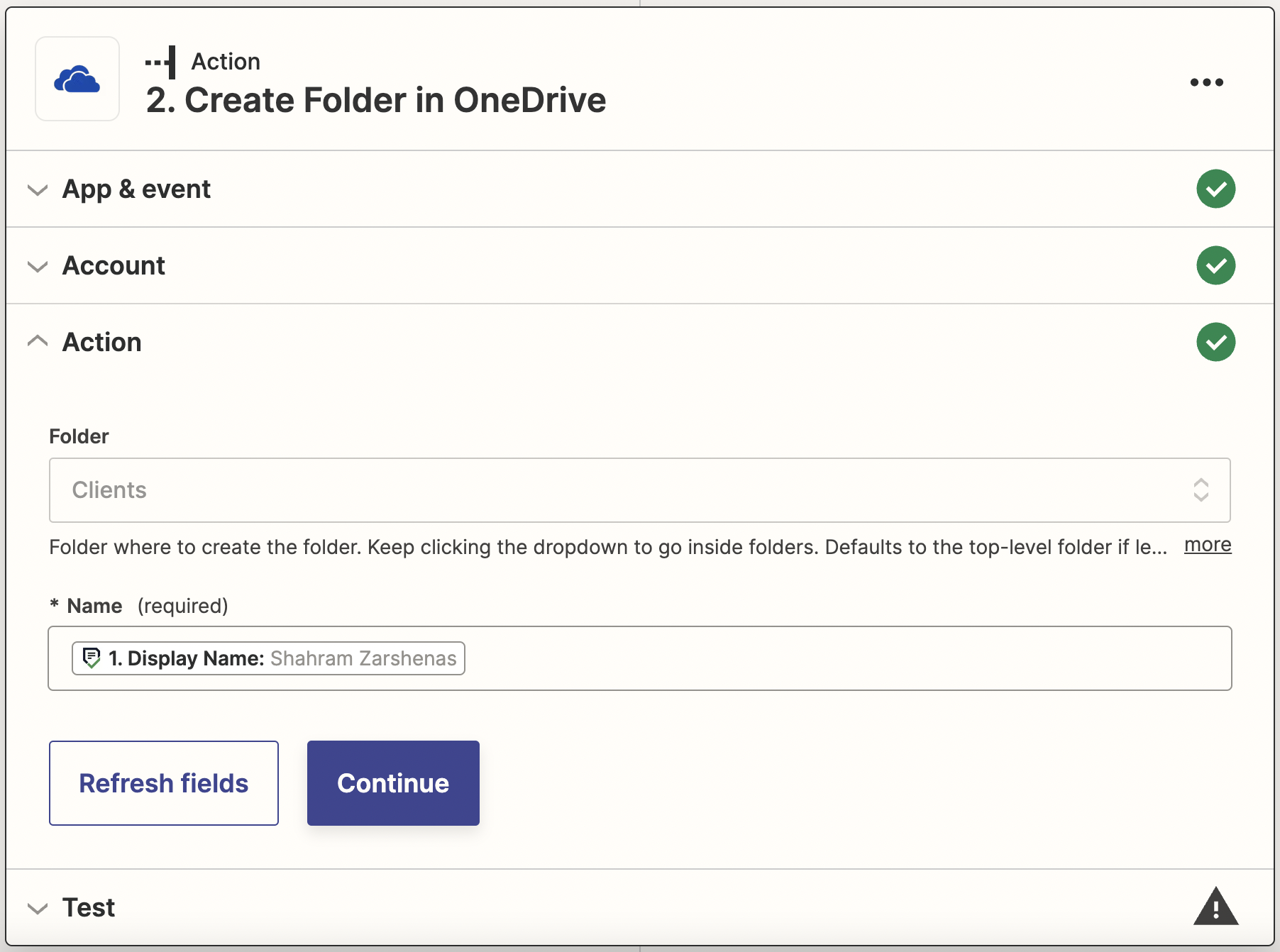

OneDrive

Here’s how to automatically create a client folder in Box after creating the client profile in Financial Cents;

- Select Financial Cents as the trigger app and New Client as the trigger event.

- Select OneDrive as the action app and Create Folder as the action event.

- Select the parent folder for the new client folder.

- Use information from Financial Cents to create the new client folder’s name.

- Click Continue

- Test and publish

BONUS POINT: SmartVault Direct Integration

If SmartVault is your preferred document management software, Financial Cents has a direct integration with SmartVault which will help you access SmartVault’s document management features from inside Financial Cents.

Follow this link to begin fetching and processing client documents in SmartVault from inside Financial Cents (so that you can focus on finding new ways to meet evolving client needs).

Automate Your Firm with Financial Cents Zapier Integration

The best accounting professionals use tools like Zapier to build systems that take manual work off their team’s plate by streamlining processes and automating manual tasks. They reinvest the hours of work they buy back to improve service quality, take on more clients, and grow their revenues.

Zapier enables you to automate accounting processes so that each step triggers the next until the process is complete—with little to no human input.

For example, if you use Zapier for client onboarding, Zapier will communicate with every relevant software in your workflow to coordinate each client onboarding. Once a client signs your contract, it triggers the next line of action in the workflow, and the cycle goes on until the client is set up in your firm’s tech stack.

Other use cases of the Zapier and Financial Cents integration includes the creation of clients in Financial Cents when:

- A Google Form has been signed (so you wouldn’t have to manually enter the client information in Financial Cents, which could lead to errors).

- An Anchor proposal is approved (to save you the time of creating their profile in Financial Cents.

- And many more

Start Using Financial Cents to Automate Your Client Document Management Process.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features Your Accounting Client Portal Must Have

By utilizing a client portal, you can eliminate the inefficiencies of manual methods and create a smoother workflow for both you and…

May 15, 2024

The 5 Best Avii Workspace Alternatives for Modern Firms

If, for whatever reason, Avii does not meet your long-term workflow needs, this review of the best Avii workspace alternatives should help…

May 08, 2024