E-signature has reduced the time it takes accounting professionals to collect client signatures by cutting through the innate challenges associated with wet signatures.

Accounting professionals who request signatures manually spend an average of five (5) days waiting on client signatures. Those who request through E-signatures wait only 37 minutes to receive client signatures.

Here’s why:

Wet Signature Requests Will Make You Chase Down Clients

When you’re so close to sealing a new deal, filing a tax return, or getting approval for documents – and all you need is to receive your client’s signature – it is frustrating to wait for clients who may not know how important it is that the signature process be completed.

The more onerous the process, the less likely it will be done quickly, if at all.

With E-signature, you upload the document into the client portal and drag and drop the fields you need your client to sign. There’s no need for anyone to waste minutes on tedious paperwork.

Your client won’t have to print, sign, and scan the document before sending it back to you.

Traditional Signature is Too Rigorous for Clients in the Current Virtual Accounting Landscape

Signature collection is one of the most repetitive and demanding tasks in accounting. It can take a toll on your firm’s productivity and more if you still rely on traditional methods.

But E-signature helps you move away from that manual process and edges your firm closer to building a system that respects your client’s time and work schedule.

Wet Signature* Eats into Execution Time – Which is Bad for Client Relationships

Most accounting firms switch to E-signature because it is easier for their employees to collaborate with clients on document signatures.

Every extra minute your team has to spend preparing and emailing or snail mailing out documents is extra minutes they don’t have for your clients and the client work. The minutes add up and reflect in lower work quality, straining your client relationships.

What is Wet Signature?

Wet signature is the traditional signature that requires clients to sign a piece of paper with a physical pen.

How Wet Signatures Work

Each time a client approves your document with wet ink, they must have taken the following steps:

- Download the document (or receive by post)

- Print it

- Sign it with a pen

- Scan it into their computer

- Send it back to you

Why E-Signature is the Solution

E-signature streamlines your document workflows and paperwork into a central platform where your clients can go for document signing.

No more printing and scanning each document for your clients. And with E-signatures you can implement auto-reminders, which also creates visibility into the process.

The Common Use Cases for E-signature in Accounting

-

Engagement Letters

Accounting tasks are as complex as the number of steps or apps they take to complete.

Enabling your new clients to sign electronically simplifies the signing process for them. It explains why sales teams buy back 41% of their time, allowing them to get more deals done.

Neither you nor the client needs several steps to do their part and get the new working relationship going.

Once you have drafted your accounting engagement letter, upload it to the signature platform with a click of a button and wait for your client to sign it.

On the client’s part, they no longer need to print the document before signing it and then sending it back to you by email or fax.

If your new client has to go through the wet signature cycle each time they need to sign an engagement letter, they will soon realize that your process is too outdated for their productivity, efficiency, and growth. Especially when there’s the option of going into a platform to review and sign them.

Each unnecessary minute they spend on admin tasks can add up to hours they could have used to grow their business.

They’ll leave as quickly as they came. After all, many other accounting firms will give them the same, if not better, quality of work but more streamlined processes.

Even better, the Financial Cents’ E-signature feature organizes the documents your clients sign in your client file tab, where your team can access them for relevant work.

-

Tax Forms and Filings

In the height of tax season, your ability to file tax returns ultimately boils down to getting them signed by clients.

This is the worst time to put your clients through a strenuous administrative cycle of printing, signing, and scanning tax forms. Not to mention that they have to be in the office or have the relevant devices to do these in their homes.

All these factors are more discouraging for your clients than you imagine. Remember, they don’t necessarily understand the implications of missed deadlines as much as you do and can leave it for a time that is too late.

However, reducing the burden of signing tax forms with E-signature encourages them to sign and saves you time waiting on clients for signatures at a critical time.

That said, you can’t guarantee that your clients won’t forget to sign the tax forms so you can file them. E-signatures allow for auto-reminding of the signature request you have sent to them.

Without it, your staff would need to set other work aside to send a follow-up email or place a call. That is time the staff could have used for more critical tax work. So, E-signature also saves you redundant work and possible overhead costs.

If used well, the E-signature feature does not just make your team more productive; it also makes your clients’ experience and perception of your firm more pleasant. It’s one less process removed from being that tax accountant that takes out the stress of the busy season on their clients.

This improves trust and the desire to stay with your firm long-term.

-

Document Approvals

E-signature also streamlines the process of getting approval for any document by making it easier and faster for your clients to sign any document for which client approval is required.

It gives you more visibility into the status of the signature request. The activity log and audit report features show you what your clients have done to the document (from your dashboard).

This will not only keep you from constantly asking for updates on your documents but also help you know what you might need to do to speed up the approval process.

E-signatures also make it possible to get approvals outside clients work hours by eliminating the need to return to the office to use their printers, scanners, and other physical logistics. This gives your client a more flexible way of working with you.

The automatic reminder feature also helps your team save the time they would have used to ask for updates, giving them the room to take on other work or take a rest from the hustle and bustle of accounting work, which will make them more efficient at work.

How to Use Financial Cents Adobe E-signature to Turn Around Client Engagement in Minutes

Here’s how the Financial Cents and Adobe E-signature integration help you achieve all the electronic signature possibilities we discussed above.

Note: you need an Adobe Sign account to use this integration. You can sign up easily here.

Start using the integration to streamline your document workflow in the following steps:

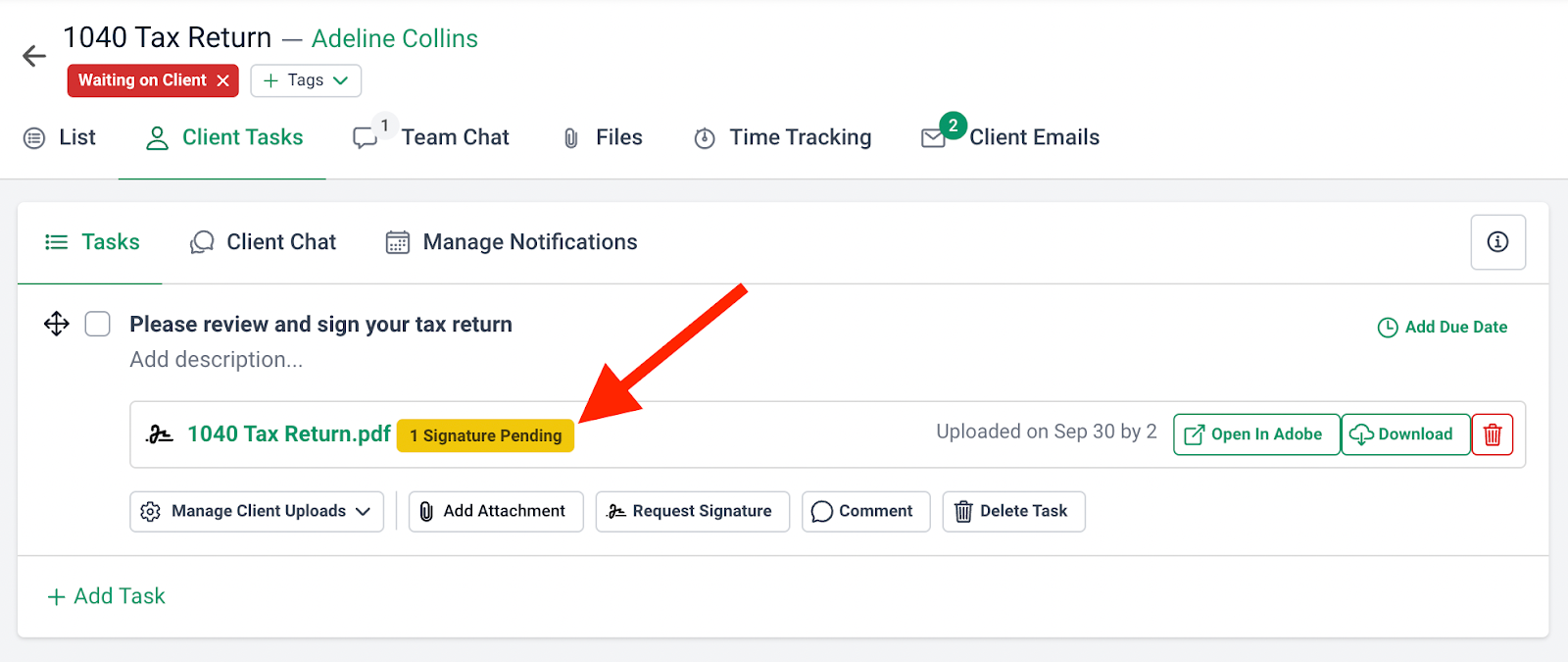

- Click on the client’s project in Financial Cents

- Click Client Tasks

- Click Request Signature

- Click Browse Files to upload the relevant document

- Select the person(s) you want to sign the document

- Click Upload to Adobe

- Add the Signature Fields (by dragging and dropping it in the part of the document you want it to be)

- Click Send

That’s not all; you get complete visibility over your signature requests in your Financial Cents dashboard.

Each document you send to the clients is tagged “pending” until the client signs.

When the document is signed, the system will notify you by email and within the app, and the signed copy will be organized automatically in the client task files tab (in the client’s profile), where your team can use it when necessary.

Start Using Financial Cents E-signature Feature to Turn Client Engagement Around in Minutes

If the signature signing process were a journey, wet signatures would be a car, and E-signature would be a helicopter.

When the car is slower (mainly because it needs to obey the traffic laws, and has longer driveways (to navigate the streets), the helicopter has fewer restrictions (without streets to drive through) and cuts directly to the chase on air.

With the Financial Cents and Adobe integration, Financial Cents users are empowered to send their clients to a place where they can review and add their signatures to documents directly.

Request signatures for key documents and track the status of those documents to see which have been signed.

When they sign the document, you get an in-app and email notification showing that the document is ready for use. Then, you go ahead to use it for the client’s work in the workflow dashboard, which is a click away.

With automated reminders, you get the ability to remind clients of the documents they may have forgotten to sign. The E-signature feature enables you to turn accounting documents around faster while meeting the needs of your clients and the accountants together.

Use Financial Cents to turn around client engagement in minutes.