What Is Client Collaboration in Accounting?

Client collaboration refers to the strategic process of working closely with clients to exchange information, communicate effectively, and achieve shared financial goals. In accounting, it involves maintaining open lines of communication, sharing documents securely, and providing real-time updates on projects and deliverables to enhance transparency and trust. This goes beyond simply providing accounting services; it’s about building a partnership where both you and your client are actively involved in financial decision-making.

Why Collaboration with Clients Is Essential for Accounting Firms

Strong collaboration with clients is vital for several reasons:

- Enhanced Communication: Clear, consistent communication ensures clients are informed and engaged, reducing misunderstandings and fostering better decision-making. This includes not only communicating financial data but also explaining its implications and providing strategic advice. Think of it like client accounting services.

- Increased Trust and Retention: Clients who feel involved in the process are more likely to remain loyal and recommend your firm to others, creating a foundation for long-term relationships. Collaboration builds a sense of partnership, where clients feel that their accountant is truly invested in their success.

- Efficient Problem Solving: Direct collaboration helps resolve issues quickly, preventing minor errors from escalating into costly mistakes. By working closely with clients, accountants can identify potential problems early on and take corrective action.

- Better Financial Outcomes: With timely access to accurate data, clients can make informed financial decisions that lead to improved profitability and optimized resource management. Collaboration ensures that clients have the information they need, when they need it, to make sound financial decisions.

- Competitive Advantage: In today’s competitive landscape, client collaboration can set you apart. By offering a collaborative approach, your firm can attract and retain clients who value a close working relationship.

Components of Effective Collaboration

- Secure Document Sharing: A reliable system to upload, access, and review financial documents safely, ensuring data privacy and regulatory compliance. This includes features such as encryption, password protection, and access controls. An accounting firm client portal provides you with this.

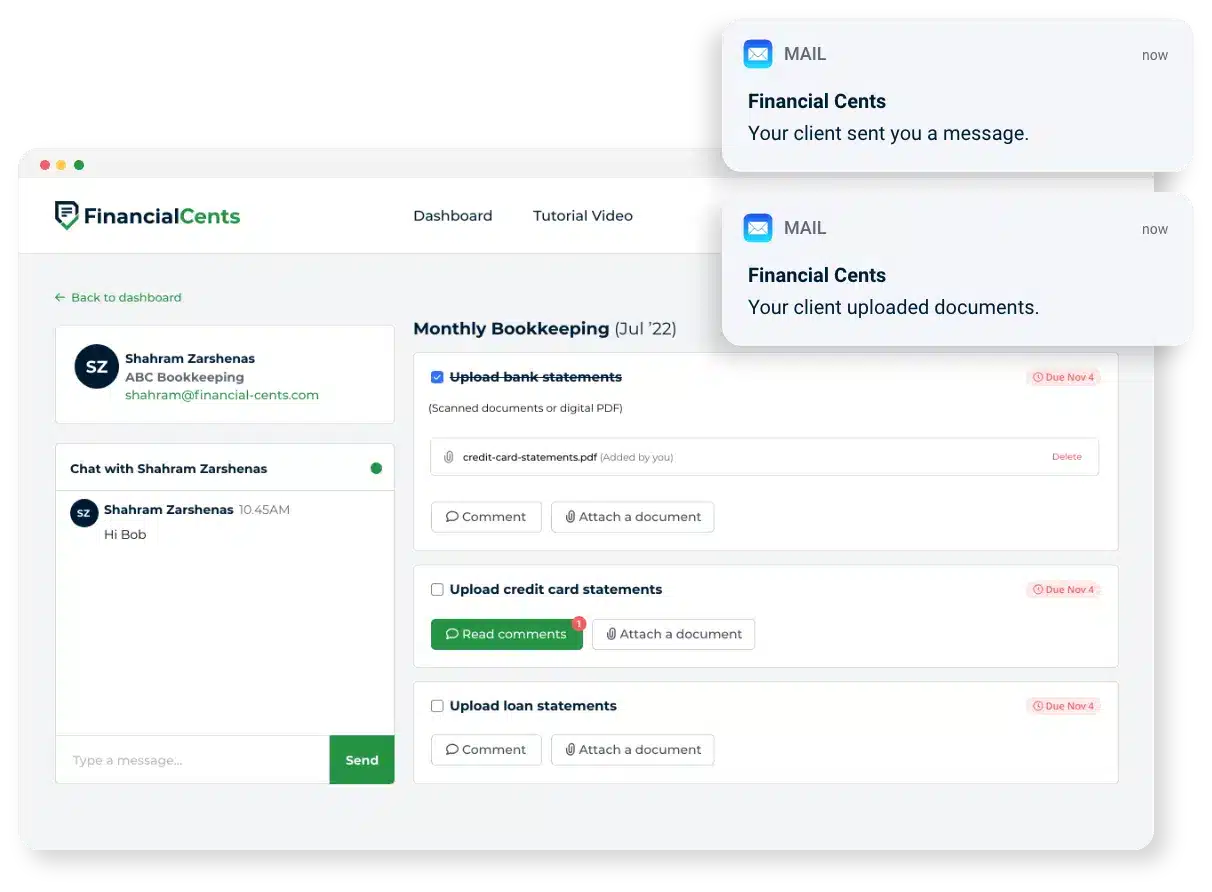

- Real-Time Communication Tools: Platforms that facilitate instant messaging (client chats), video conferencing, and quick status updates to maintain seamless interactions. This allows for quick and easy communication, regardless of location or time zone.

- Shared Task Management: Allowing clients to view and track progress on key deliverables enhances transparency and mutual accountability. This can include features such as task lists, deadlines, and progress reports. Financial Cents’ client facing work statuses feature gives your client access to view these through the client portal.

- Role-Based Permissions: Ensuring only authorized individuals access sensitive information protects data integrity and client confidentiality. This includes assigning different levels of access based on user roles and responsibilities.

- Client Education: Providing clients with the knowledge and resources they need to understand financial data and make informed decisions. This can include workshops, webinars, and educational materials.

- Proactive Advice: Going beyond reactive responses to financial data and offering proactive advice and strategic guidance. This demonstrates a commitment to the client’s success and can help them achieve their financial goals.

Types of Tools That Facilitate Collaboration with Clients and Their Functions

- Client Portals: Designed for secure file sharing and centralized communication, allowing easy document uploads and approvals. These accounting client portals provide a secure and convenient way for clients to access their financial information and communicate with their accountant.

- Project Management Systems: Tools such as Financial Cents, that allow firms and clients to collaborate on task progress, deadlines, and responsibilities in real-time. These systems help keep projects on track and ensure that everyone is on the same page.

- Digital Signatures: E-signature platforms that streamline contract and document approvals, cutting down response times. This eliminates the need for printing, signing, and scanning documents, saving time and improving efficiency.

- Cloud Accounting Software: Cloud-based accounting platforms that allow for real-time collaboration and data sharing between accountants and clients. These platforms provide a centralized location for financial data and enable seamless collaboration.

- Video Conferencing Tools: Tools such as Zoom or Skype that enable face-to-face communication and collaboration, regardless of location. This can be particularly useful for building relationships and providing personalized advice.

Common Collaboration Challenges

Despite its importance, collaboration presents unique challenges:

- Data Security Risks: Sharing sensitive financial information increases vulnerability to cyber threats and requires robust security measures. This includes using encryption, firewalls, and other security protocols to protect client data.

- Communication Overload: Frequent updates can overwhelm clients and obscure important messages. It’s important to strike a balance between keeping clients informed and overwhelming them with information.

- Time Zone and Availability Issues: Coordinating schedules across different time zones can complicate timely responses and slow down workflows. This requires flexibility and the use of tools that enable asynchronous communication.

- Technophobia: Some clients may be hesitant to adopt new technologies or may not have the skills needed to use them effectively. This requires providing training and support to help clients get comfortable with collaboration tools.

- Resistance to Change: Some clients may be resistant to changing their established ways of working. This requires clear communication and education about the benefits of collaboration.

Overcoming These Challenges

1. Use Secure Client Portals: Dedicated portals, like those offered by modern accounting practice management tools, provide a safe, centralized space for document sharing and messaging. These portals should use encryption and other security measures to protect client data.

Financial Cents client portal provides a secure client portal for you to collaborate securely with your clients. It’s also passwordless and your clients can login using magic links and OTP, meaning they don’t have less passwords to remember and you get smoother collaboration.

2. Set Clear Communication Guidelines: Define preferred communication channels, update frequencies, and response times to align expectations. This helps prevent communication overload and ensures that clients receive the information they need in a timely manner. You should do this when onboarding new clients.

3. Automate Routine Updates: Leverage automation to notify clients about key milestones and deadlines without manual effort, saving time and reducing repetitive tasks. This frees up accountants to focus on more strategic tasks and provides clients with timely updates.

4. Schedule Regular Check-Ins: Planned meetings keep clients engaged, provide status updates, and offer an opportunity for feedback and course corrections. These meetings can be conducted in person or via video conferencing.

5. Provide Training and Support: Offer training and support to help clients get comfortable with collaboration tools and technologies. This can include webinars, tutorials, and one-on-one support.

6. Be Flexible: Be willing to adapt your communication and collaboration style to meet the needs of individual clients. Some clients may prefer more frequent communication, while others may prefer a more hands-off approach.

Steps to Foster a Collaborative Client Culture

- Educate Clients on Collaboration Tools: Provide thorough onboarding and training to help clients use client portals, document-sharing platforms, and task management tools effectively.

- Create Personalized Client Plans: Tailor your approach based on each client’s business needs, communication preferences, and engagement style.

- Implement Feedback Mechanisms: Regularly solicit client feedback on collaboration processes and incorporate suggestions to enhance future interactions.

- Set Expectations Early: Clearly outline roles, responsibilities, and preferred communication protocols during onboarding to avoid confusion.

- Lead by Example: Demonstrate the value of collaboration by being proactive, responsive, and transparent in your communication.

- Celebrate Successes: Acknowledge and celebrate collaborative successes to reinforce the value of working together.

Collaborating with Clients: What are the Benefits?

- Higher Efficiency: Streamlined communication reduces the need for lengthy email chains and improves task management, enhancing overall workflow.

- Improved Client Satisfaction: Proactive, transparent collaboration shows commitment to client success, strengthening trust.

- Enhanced Compliance and Accuracy: Timely data sharing and well-structured collaboration processes minimize errors, support compliance with regulations, and improve financial accuracy.

- Stronger Relationships: Collaboration builds stronger relationships between accountants and clients, leading to increased loyalty and referrals.

- Better Business Insights: By working closely with clients, accountants can gain a deeper understanding of their business and provide more tailored advice.

Impact of a Collaborative Client Culture on Firm Growth

Mastering client collaboration contributes significantly to business success:

- Increased Referrals: Satisfied clients are more likely to refer your services, leading to organic business growth.

- Reduced Client Turnover: A strong collaborative relationship builds trust and loyalty, reducing the likelihood of losing valuable clients.

- Streamlined Operations: Efficient collaboration tools and practices enhance productivity, reduce administrative burdens, and improve the overall client experience.

- Higher Profitability: By providing value-added services and building stronger relationships, accounting firms can increase their profitability.

Final Thoughts

Mastering client collaboration is a continuous process that evolves alongside technology and changing client expectations. By investing in the right tools, setting clear communication strategies, and fostering a collaborative culture, accounting firms can strengthen client relationships, enhance service quality, and drive long-term success.

Collaborate with your clients effectively by using an all in one accounting practice management software such as Financial Cents with task and workflow management, client portal, secure document storage, automated reminders, e-signatures and lots more.