Most taxpayers don’t take part in reportable transactions, i.e. transactions with a potential for tax avoidance or evasion out of the blue.

They are often influenced by certain individuals or entities known as material advisors.

To monitor such transactions and avoid potential tax abuse, the IRS introduced Form 8918. It’s a tax form these material advisors are required to file after aiding or advising in any reportable transaction.

However, Form 8918 reporting requirements can differ based on various factors, making it a tricky document to handle. Also, specifics about who qualifies as a material advisor and what makes a transaction reportable can be complex.

So it’s important to understand when, and how to file Form 8918 to mitigate any unforeseen consequences.

That’s why we created this guide. In it, you’ll learn more about Form 8918, material advisors, reportable transactions, and how to file the form. We’ll also discuss penalties, extensions, and deadlines associated with Form 8918.

So whether you’re an accountant, tax professional, or material advisor, read on to discover all you need to know about Form 8918.

What is Form 8918?

IRS Form 8918, known as the Material Advisor Disclosure Statement, is a form material advisors file to disclose their participation in reportable transactions.

It’s similar to Form 8886, Reportable Transaction Disclosure Statement, which taxpayers involved in reportable transactions must file.

The purpose of filing Form 8918 is twofold.

First, tax laws are complex, and certain transactions can be structured in ways that may lead to significant tax benefits. This becomes a concern when there’s a potential to avoid or evade tax.

However, making advisors disclose their involvement in such transactions by filing Form 8918 helps the IRS maintain transparency and ensures these transactions comply with tax laws.

Secondly, the form acts as a deterrent against abusive tax strategies. Advisors are less likely to contribute to such schemes if they are to disclose their involvement to the IRS. Failure to do so will lead to severe penalties.

Who Needs to File Form 8918?

Material advisors involved in any reportable transaction must file Form 8918.

This can be any individual, trust, estate, partnership, or corporation that provides advice or assistance on a reportable transaction and receives a minimum income for it must file Form 8918.

Who is a Material Advisor?

A material advisor refers to any individual or entity who provides advice, aid, or assistance in promoting, organizing, promoting, implementing, or participating in any reportable transaction.

These material advisors are typically professionals, such as accountants, lawyers, tax specialists, or financial consultants.

By their profession and the advice they provide, material advisors could significantly affect their clients’ tax statements.

Advisors who receive direct or indirect income above a specified threshold amount for their advice are required to disclose this to the IRS by filing Form 8918.

The threshold amounts are:

- For listed transactions, $10,000 for a natural person and $25,000 for all other entities.

- For non-listed transactions, $50,000 for a natural person and $250,000 for all other entities.

In addition, the IRS also expects material advisors to maintain a list identifying each individual or entity they advised on a reportable transaction.

Failure to provide this list on request will lead to severe penalties, as we’ll see shortly.

Reportable Transactions

These are transactions with a potential for tax evasion or avoidance. The IRS classifies them into five categories:

1. Listed Transactions

Transactions that the IRS has explicitly identified as tax avoidance transactions in this existing guidance page are called listed transactions.

Material advisors who aid or advise in transactions that are the same or substantially similar to the ones identified in the list must file Form 8918.

For example, creating artificial tax losses to offset income by transferring assets with significant contingent liabilities to a partnership is a tax avoidance transaction and must be reported to the IRS.

For updates on the list, check this IRS web page.

2. Confidential Transactions

These are certain transactions where advisors enter a confidentiality agreement with their clients and get paid a minimum fee. This is called a confidential transaction and requires disclosure to the IRS.

For a corporation (excluding S corporations), or a partnership or trust in which all the owners or beneficiaries are corporations (excluding S corporations), the minimum fee is $250,000. For all others, the minimum fee is $50,000.

It’s important to note that the conditions of confidentiality do not imply that the transaction is abusive or unlawful. Rather, the advisor seeks to keep their tax strategies a secret which the IRS frowns at.

Therefore, disclosing this information ensures transparency and compliance with IRS regulations.

3. Transactions with Contractual Protection

This involves transactions where the taxpayers enter an agreement to get a partial or full fee return if all or part of the intended tax benefits don’t materialize.

For instance, let’s assume you structure a deal that allows your client to claim a large tax deduction. If the IRS disallows the tax deduction, you will return your client’s fees.

These types of transactions need to be disclosed to the IRS by both the taxpayer and any material advisors involved by filing IRS Form 8918.

4. Loss Transactions

According to Section 165 of the IRS code, any loss incurred during a taxable year that isn’t compensated by insurance or other forms can be deducted. When taxpayers claim a loss under this code, it is referred to as a ‘loss transaction.’

Material advisors that provide aid or advice in such loss transactions must disclose it to the IRS.

However, for a loss to be considered a reportable transaction by the IRS, it must meet certain threshold amounts:

- For individuals, the amount is at least $2 million in any single tax year or $4 million in combined tax years.

- For partnerships and S corporations, at least $2 million in a single tax year or $4 million in combined tax years.

- For trusts, at least $2 million in any single tax year or $4 million in combined tax years.

- For corporations (excluding S corporations), at least $10 million in any single tax year or $20 million in combined tax years.

- For partnerships with only corporations (excluding S corporations) as partners, at least $10 million in any single tax year or $20 million in combined tax years cumulatively over many years.

If taxpayers meet these thresholds, the material advisors involved in the transaction must disclose their involvement to the IRS.

These large loss thresholds ensure the IRS can track and analyze high-value transactions that may potentially be used for tax evasion or avoidance schemes.

5. Transactions Of Interest

These are potential tax avoidance transactions that require further scrutiny by the IRS to determine if they should be ‘listed.’

Similar to listed transactions, the IRS has a published guidance page for transactions of interest.

Material advisors involved in the same or substantially similar transactions to the ones identified on the guidance page must disclose them to the IRS.

You may be interested in:

Penalties for Non-Compliance

Material advisors have two main tasks:

- Disclose the reportable transaction on or before its due date.

- Maintain a list that identifies each entity or individual to whom they provided material aid or advice about a reportable transaction and make it available upon request.

The penalty for failing to file Form 8918 on or before its due date or submitting inaccurate information could lead to a $50,000 fine for all reportable transactions except listed transactions.

For listed transactions, the penalty is anyone that’s higher between $200,000, or 50% of the gross income gotten from participating in the listed transaction. 75% if failure to file the form was intentional.

Also, for material advisors who fail to provide the list of advisees to the IRS within 20 business days of a written request, a $10,000 penalty per day will be imposed for each day of non-compliance after the 20th business day.

What’s more, failure to maintain the list in a format that allows the IRS to ascertain the required information without delay could also lead to penalties. As such, material advisors are encouraged to maintain the list in an organized and accessible manner to ensure compliance with this requirement.

Can material advisors request a recession of penalties imposed on them? Yes, they can.

According to the IRS, material advisors may request a cancellation of the penalty imposed for failure to disclose reportable transactions or for providing inaccurate information.

However, they must make this request within 30 days from the date the IRS sends a notice and demand for payment of the penalty.

Alternatively, if the advisor pays the penalty promptly, the rescission request deadline is within 30 days from the payment date.

Keep in mind that a request for rescission doesn’t extend the time to pay the penalty. Therefore, material advisors must pay all penalties by their due date, even if they’ve requested a rescission. And if the IRS rescinds the penalty, they’ll get a full refund.

Note: The IRS’s decision regarding rescission is not open to review by Appeals or any court. This makes their decision final.

Filing Deadlines and Extensions

Adhering to filing deadlines for Form 8918 is crucial for several reasons:

- Avoiding Penalties: As mentioned earlier, material advisors can face significant penalties for untimely filing Form 8918.

- Maintaining Compliance: Timely filing of Form 8918 ensures that material advisors comply with IRS regulations. This is not only a legal necessity but also helps to maintain a good standing with the IRS.

- Preserving Professional Reputation: Constant compliance with tax laws, including Form 8918 filing deadlines, helps maintain a material advisor’s credibility.

As per the IRS guidelines, Form 8918 must be filed with the Office of Tax Shelter Analysis (OTSA) by the last day of the month following the end of the calendar quarter in which the advisor became a material advisor for the reportable transaction.

Regarding extensions, the IRS doesn’t grant extensions for filing Form 8918. It’s expected to be filed by the prescribed due date.

However, if there are reasonable grounds for being unable to meet the deadline on time and in the manner required, it may be possible to apply for an extension.

You may be interested in:

How to Complete IRS Form 8918

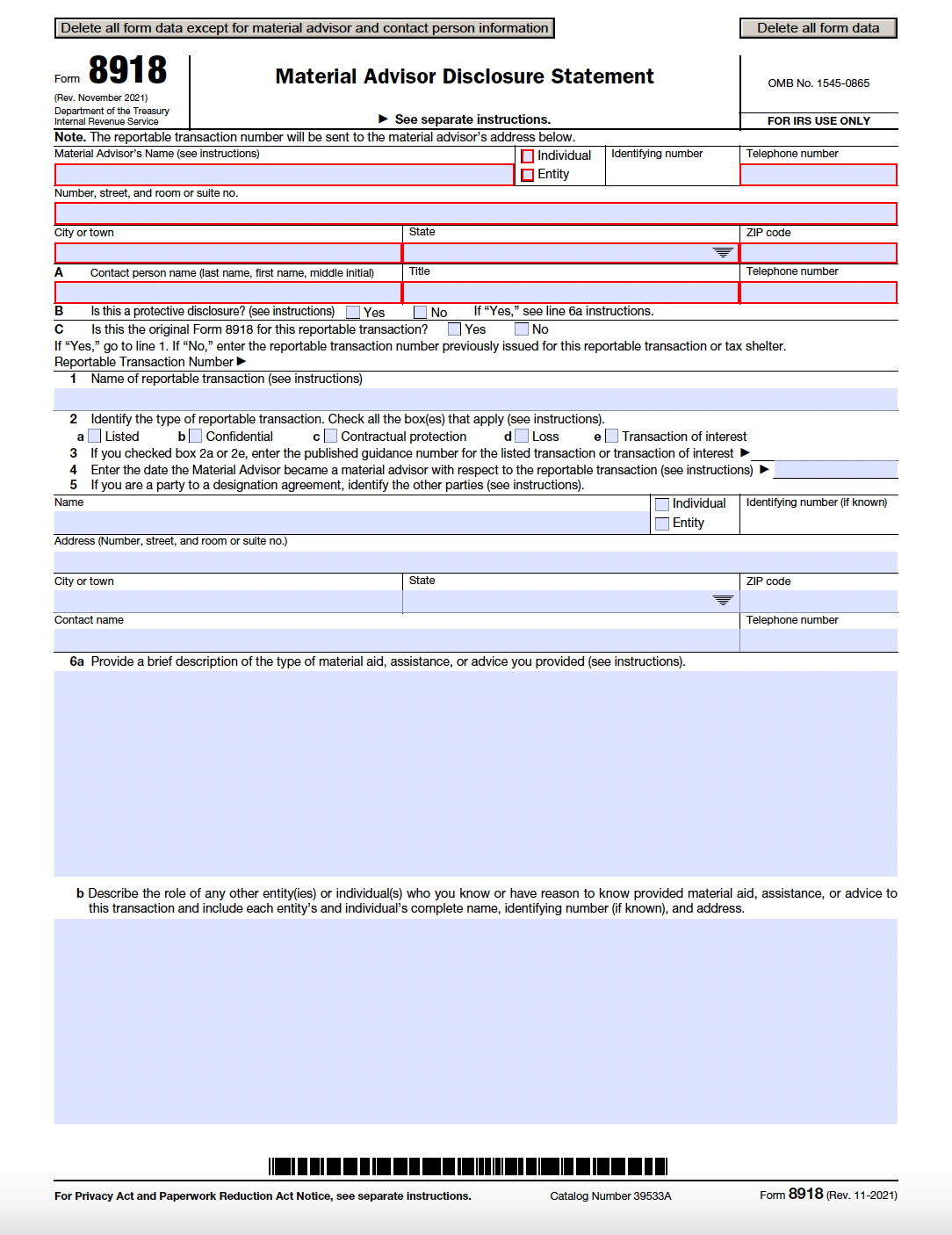

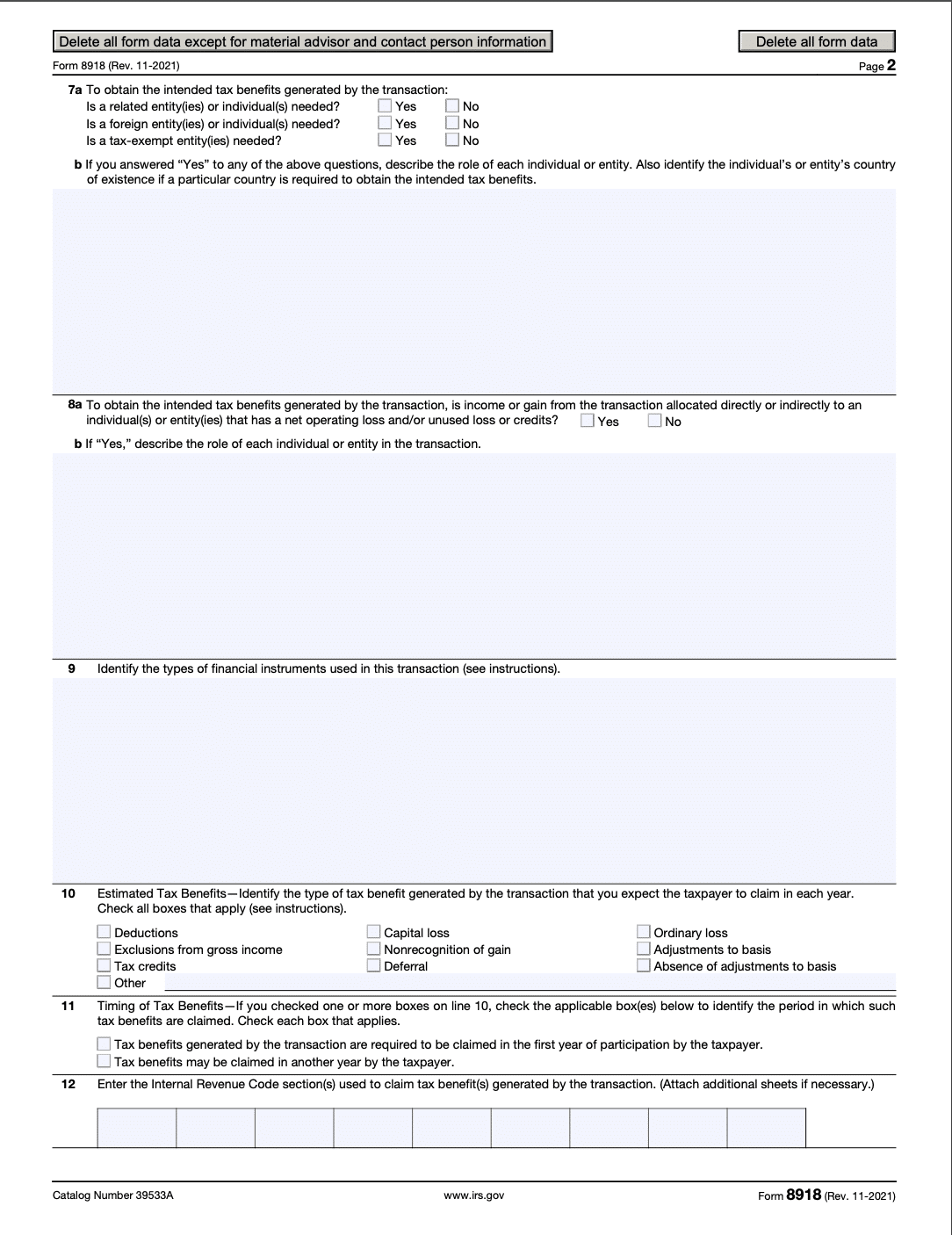

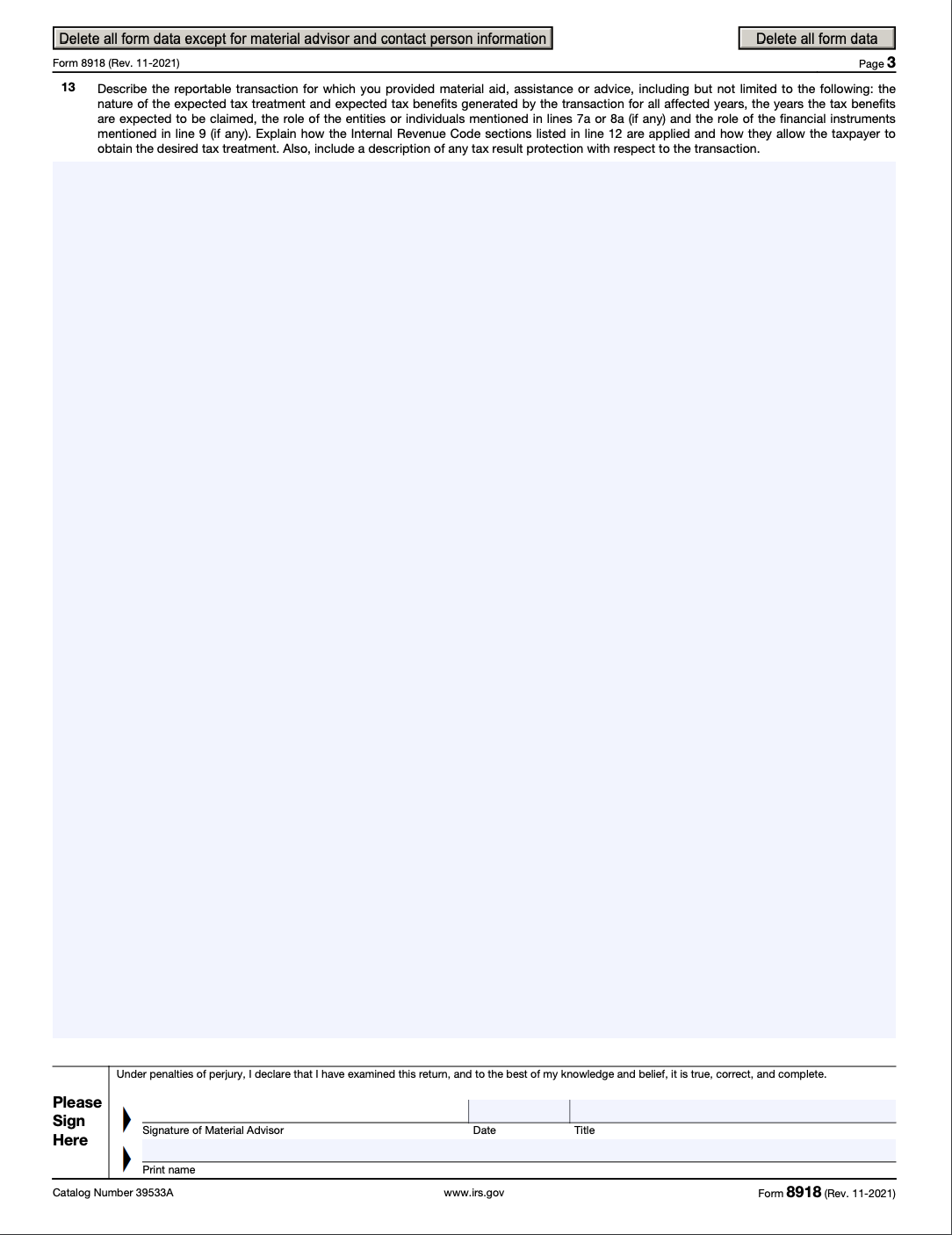

Form 8918 has 4 pages. The IRS requires material advisors to provide accurate information on the form so they can process it on time.

Also, material advisors must describe in detail all tax statements and potential benefits from reported transactions so the IRS can understand the structure.

Here’s how to complete IRS Form 8918:

The first page is where material advisors including individuals and entities enter their details such as full name, address, SSN, and phone number.

Also, they are to identify the type of transaction being reported, describe their role in the transaction, and the role of any other individual or entity involved.

PS: You can only use Adobe Reader DC or Adobe Acrobat DC to open Form 8918. You’ll receiver a warning if you try opening it on a web browser and possibly other applications.

The second page is where material advisors provide information about the intended tax benefits and financial instruments used in the reportable transactions.

On the third page, material advisors are to describe in detail all relevant information about the reportable transaction, such as tax benefits, years affected, and the nature of the transaction.

Line 13 has sufficient space to accommodate more information within the form. This helps to reduce the need for adding attachments, ensuring the IRS processes Form 8918 faster. As such, material advisors are advised to utilize the space to great effect.

Never Miss a Deadline With Financial Cents

As you may have noticed, completing and filing Form 8918 isn’t a walk in the park.

That’s why it’s vital for accountants and tax professionals to fully understand Form 8918 and how it works. This way, you can help material advisors:

- Complete the form accurately

- Submit it on time

- Ensure compliance

- Avoid penalties

However, with so many tasks to handle, you need accounting software like Financial Cents to work faster and more efficiently. It’s designed to help accounting professionals organize their firms, manage clients, and meet deadlines.

With features such as project management, time tracking, document management, and client portal, you can finally stay on top of your accounting tasks without breaking a sweat.

Ready to see how it works?

Use Financial Cents Accounting Practice Management Software to manage your firm.