The practice management hub for accountants and bookkeepers

Where to get actionable insights and frameworks to scale your firm.

“Financial Cents is like having a trusty sidekick in your accounting adventures! And with the Practice Management Hub, they’re a dynamic duo that’ll make running your firm feel like your superpower!”

Alexis Sadler | Accounting Therapy, Inc

Browse the topics or categories below to find what you are looking for.

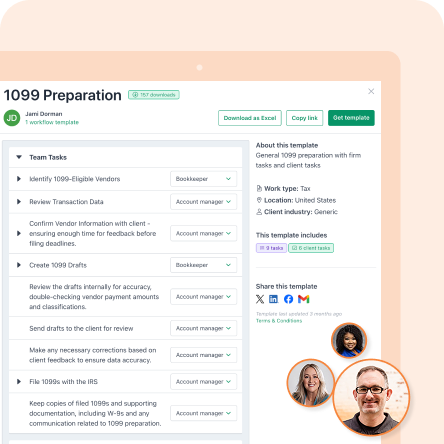

Accounting templates

Use these frameworks to optimize your templates and standardize your process.

Accounting workflow

Use these frameworks to optimize your templates and standardize your process.

Virtual accounting

Learn how to start, build and scale a successful virtual accounting or bookkeeping firm.

Marketing

Access up-to-date marketing tactics and strategies to scale your firm.

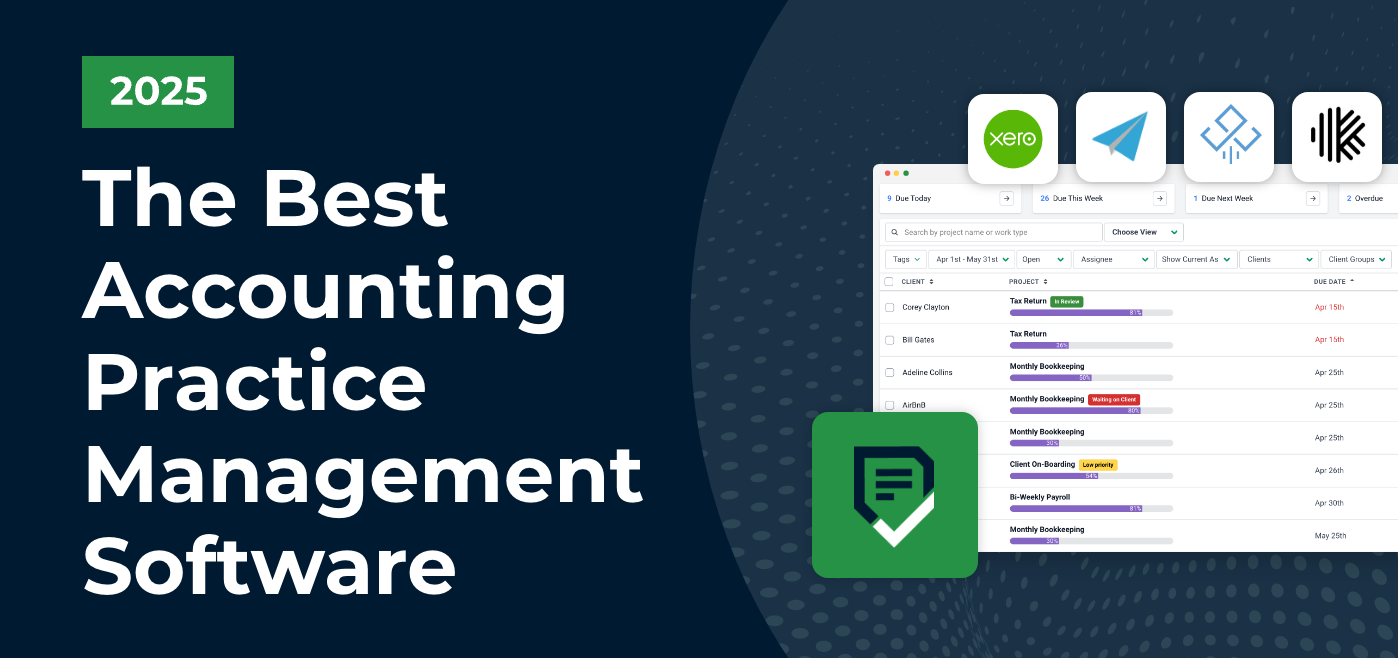

Practice Management

Build a successful firm through unique practice management insights and advice from firm owners like you.

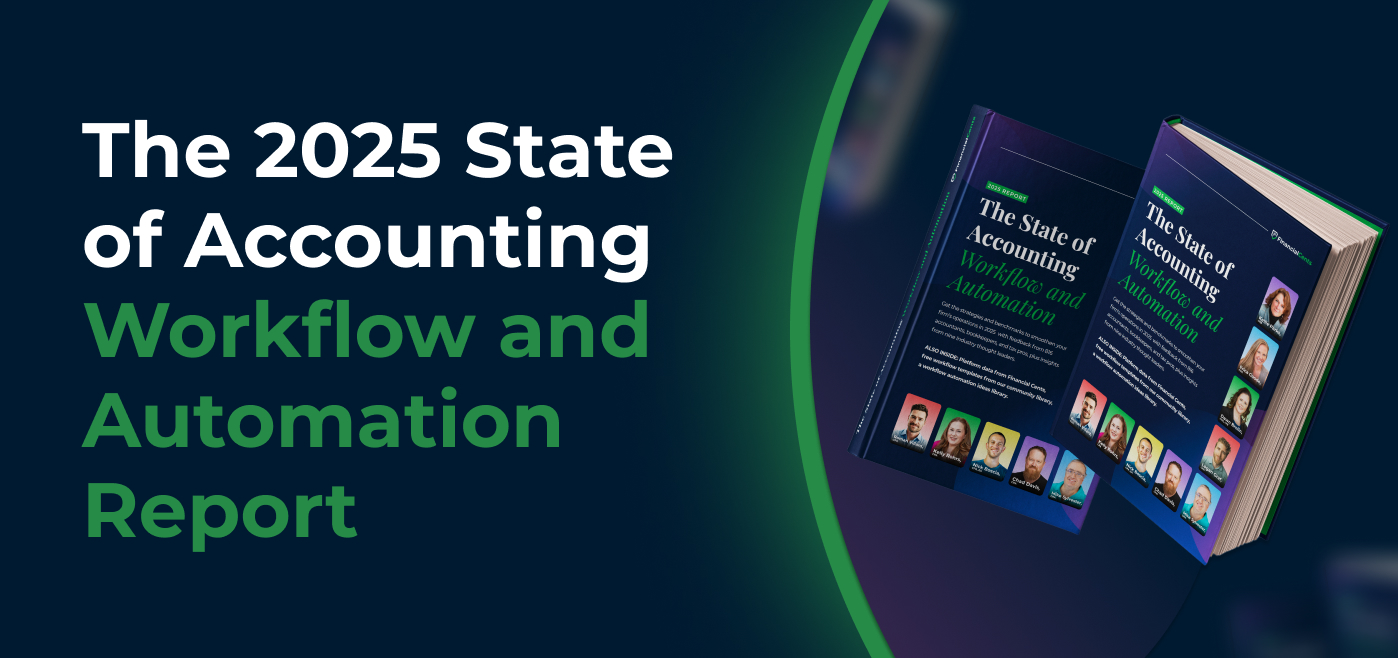

Financial Cents news

Read up on the latest updates, feature releases, and news from the Financial Cents team.

Top picks

Dive deeper

Get templates

Get for free

Find out more

Enroll now

Find out more

Sign up now

Enroll now

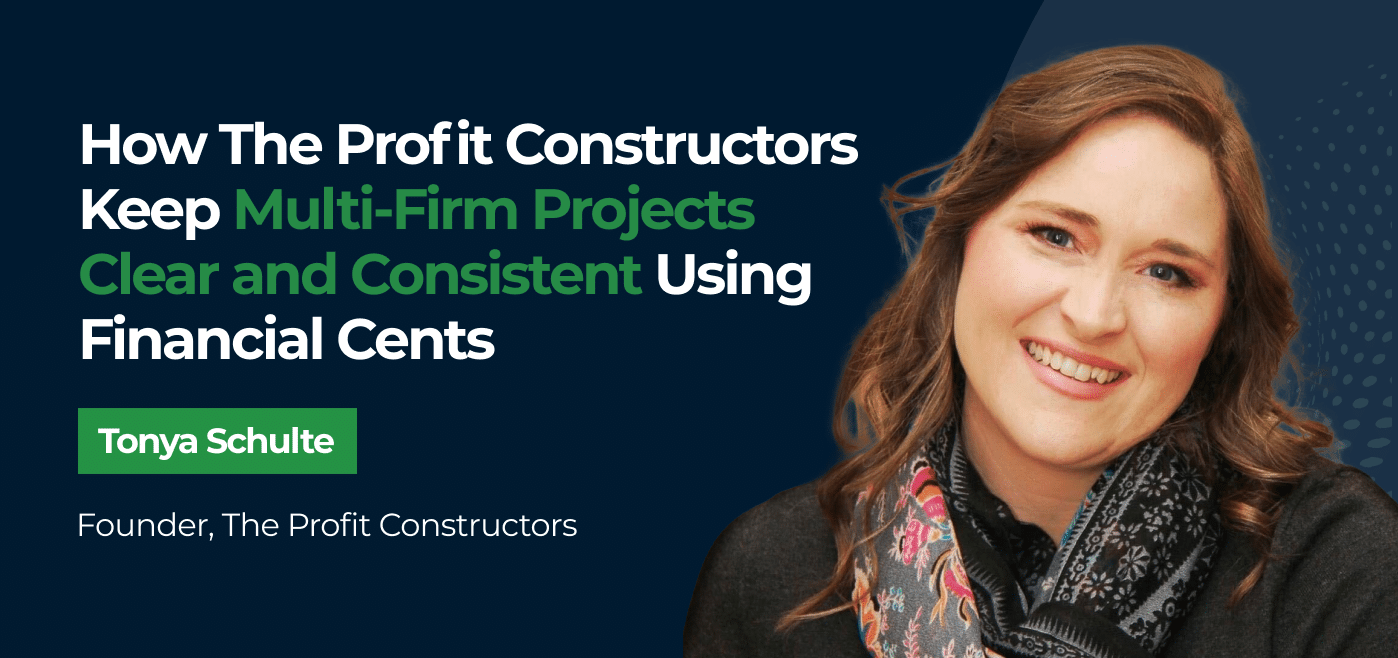

Customer stories

View all customer storiesSubscribe to our newsletter for an awesome dose of firm growth tips

High-value articles, expert interviews, actionable guides, and events.