A Step-by-Step Guide for Performing a Bookkeeping Clean up (+Free Checklist template)

Author: Financial Cents

Reviewed for accuracy by: Kellie Parks, CPB

In this article

There are many reasons why a business might need a bookkeeping cleanup. Perhaps they’re preparing for tax season, undergoing an external audit, planning to sell or merge the business, migrating to new accounting software, or seeking funding. Whatever the reason, one thing is certain: they need to tidy up their books or risk wrong decision-making, compliance issues, and missed opportunities.

That’s where accountants and bookkeepers come in. Many businesses lack the time, expertise, or resources to handle this task independently, so they turn to firms like yours to bring order to their financial chaos. A thorough bookkeeping cleanup ensures that their records are accurate and up to date and allows them to make informed decisions.

In this article, we’ll walk you through a step-by-step guide to performing a bookkeeping cleanup for your clients. We’ll also share a free checklist template to streamline the process so you can do a great job for clients.

What is a Bookkeeping Cleanup?

A bookkeeping cleanup is the process of reviewing, correcting, and organizing a business’s financial records to ensure they are accurate, complete, and up-to-date. It is necessary to fix past mistakes, catch up on missed entries, and get everything in order for a fresh start.

For example, let’s say a client hasn’t recorded their expenses for the last six months, leaving their profit-and-loss statement completely off. Or maybe they’ve been categorizing personal expenses as business expenses, creating messy records that don’t reflect reality. In both cases, a bookkeeping cleanup is essential to untangle the chaos, identify errors, and get the books back on track.

This process might include correcting miscategorized transactions, adjusting or posting journal entries, reconciling bank statements, and ensuring compliance with tax regulations. By the end of the cleanup, your client’s books will be accurate, balanced, and ready for any upcoming audits, tax filings, or business decisions.

Step-by-Step Checklist Guide to Perform a Bookkeeping Cleanup

Now that we’ve covered the basics let’s look at the step-by-step process for performing a bookkeeping cleanup. Following this clear and structured process will save time, reduce errors, and ensure the best outcome.

Step 1: Gather all Necessary Financial Documents

Before you can start cleaning up the books, you need to collect all the financial records related to the business. This includes bank and credit card statements, bills and invoices, receipts, payroll reports, loan and financing documents, and other relevant financial data.

Ensure you cover all the client’s accounts (business checking, savings, credit cards, loans) and financial activity. Otherwise, you’ll miss some documents, resulting in incomplete or inaccurate records, which defeats the purpose of the cleanup.

Step 2: Review and Categorize Transactions Accurately

The next step is to review and categorize all transactions carefully. Proper categorization ensures the client’s financial statements are accurate and provide meaningful insights into their business performance.

If your client uses an accounting ledger software such as QuickBooks, Xero or FreshBooks, your client can grant you access to their account, enabling you to review their financial transactions and match and post from their connected bank feeds.

Or manually create spreadsheets of your client’s transactions, audit them for inconsistencies, and then categorize them to align with tax filing requirements and the client’s specific reporting needs.

Expert Tip: Use a tool like Financial Cents ReCats, which enables you to automatically pull uncategorized transactions from your client’s QuickBooks Online account, saving time and ensuring you always have the most up-to-date data.

Step 3: Address Discrepancies or Missing Transactions

During a bookkeeping cleanup, it’s common to encounter discrepancies or missing transactions. These issues can arise from forgotten entries, incomplete records, duplicate records, or miscommunications about business expenses.

Find these contradictions by comparing transaction records across bank statements, receipts, and the accounting system. Look for mismatches in amounts, duplicate entries, or transactions that appear in one record but not the others. Also, cross-check with other supporting documents like invoices, receipts, or client-provided notes to locate missing transactions.

Once you’ve identified them, ask the client for clarification, supporting documents, or context to fill in the gaps. Then, correct the errors and document your findings for future reference.

Step 4: Review Accounts Receivable and Accounts Payable

Accounts receivable (AR) and accounts payable (AP) directly impact your client’s cash flow and financial health. Hence, it’s essential to review them to ensure they’re accurate and up-to-date.

For AR, verify all outstanding invoices and follow up on past-due ones. Collaborate with your client to decide whether to write off invoices that are unlikely to be paid as bad debt.

For AP, confirm that all unpaid vendor bills are accurate. Identify and correct duplicate invoices or vendor overpayments, ensuring expenses aren’t inflated. Help the client prioritize payments to avoid late fees and maintain strong vendor relationships.

Ensure that AR and AP balances match the amounts in the general ledger. Address and resolve any discrepancies to keep financial records accurate and reliable.

Step 5: Ensure Payroll Records Are Accurate and Up-To-Date

Payroll errors can lead to tax penalties, compliance issues, and unhappy employees, making reviewing payroll records during a cleanup crucial.

Start by examining payroll summaries, timesheets, and pay stubs to confirm whoever is in charge accurately recorded all employee and contractor payments, including wages, bonuses, overtime, and deductions.

Then, the payroll expenses in the accounting system are matched with bank statements and payroll provider reports, ensuring that tax withholdings and benefit payments align. Record and address any unpaid payroll liabilities, such as taxes or contributions.

If you notice missing records, collaborate with your client to gather and document them. Taking these steps ensures payroll records are complete and accurate.

Step 6: Reconcile Bank and Credit Card Accounts.

Once you’ve gathered all the necessary financial documents, reconcile the business’s bank and credit card accounts. Reconciliation involves comparing the transactions recorded in the accounting software to the actual statements from the bank or credit card provider to ensure they match.

To do this, first confirm that the opening balances in the accounting software align with the beginning balances on the bank or credit card statements. Then, go through each transaction in the statements and ensure they are recorded correctly in the books. Look for missing entries, duplicate transactions, or errors in categorization. If there are any mismatched amounts, investigate and resolve the differences.

Common issues include unrecorded bank fees and expenses, or payments that cleared later than expected. Once you’ve addressed all issues, reconcile each account to ensure the ending balances in the software match the statement balances.

Step 7: Verify Tax Compliance

Ensure your client meets all tax obligations, including sales tax, income tax, and payroll tax, to help them avoid penalties and maintain compliance with tax authorities.

Start by reviewing sales tax records. Confirm that all sales transactions reflect the correct tax rates and that the sales tax collected matches what was reported to tax authorities. Address any unpaid or overdue sales tax filings promptly.

Next, income tax accuracy is verified by cross-checking the business’s income and expense records with what has been or will be reported. Identify any missed or misclassified deductible expenses and make the necessary adjustments.

Audit payroll tax filings to ensure all payments and filings are completed on time and accurately reflect wages paid. Resolve any penalties resulting from late or incorrect filings.

Reconcile tax liabilities in the accounting software with amounts paid and any outstanding balances. Resolve these inaccuracies with the client and update the records accordingly.

Finally, confirm all tax forms, such as W-2s, 1099s, and sales tax reports, are accurate, filed, and properly documented for future reference.

Step 8: Generate Financial Reports To Check Accuracy

You’re almost done with the cleanup at this point. The next step is to generate and review the financial reports to confirm that everything is accurate and balanced. These reports offer a clear view of your client’s financial health and validate that the cleanup has resolved all discrepancies and gaps.

Run key reports like the Profit and Loss (P&L) Statement, Balance Sheet, and Cash Flow Statement to ensure you’ve correctly recorded income, expenses, assets, liabilities, and cash movements. Look for trends or inconsistencies, such as unusual expenses or negative balances, and correct any errors you uncover. Use this step as a final quality check. If anything seems off, revisit earlier cleanup steps to resolve overlooked issues.

Step 9: Share Reports With Client

After completing the bookkeeping cleanup and generating the reports in step 8 above, share them with your client for transparency and to help them understand their financial standing.

Include a summary of the cleanup, highlighting major issues resolved, key insights from the reports, and areas needing attention moving forward. Offer practical recommendations for maintaining clean books, such as regular reconciliations, better documentation practices, or adopting automation tools.

Also, offer to schedule a follow-up meeting to review the reports together. This helps address any questions, strengthens trust, and reinforces your value.

Download: Free cleanup Checklist Templates

Here are some free templates created by other bookkeeping and accounting professionals that will assist you in your bookkeeping cleanup. Download them via the link below and start using it immediately.

1. Bookkeeping Clean up

This is a clean up checklist template created by a bookkeeping firm owner, Jenny Rost, owner of Construct Bookkeeping. It includes the step-by-step process of performing clean ups, from the prep up and set up to the chart of accounts and all other necessary steps involved.

2. Multiple Month Bookkeeping Cleanup Project

This template is specifically for bookkeeping cleanup. Use it to systematically organize and clean up a client’s financial records over multiple months so they’re accurate and compliant.

This template is created by a professional bookkeeper, Chris Potter and can be accessed via our template library.

Best Practices for Performing Cleanups

Set Clear Goals for the Cleanup

You need to understand the specific reasons driving the project: tax preparation, securing funding, migrating to new software, or simply bringing the books up to date. This clarity ensures your efforts are targeted toward resolving the client’s pain points and meeting their expectations. They also provide a framework for measuring progress and determining when the cleanup is complete.

Organize All Financial Documents Before Starting

Gather and organize all relevant financial documents, such as bank statements, invoices, receipts, and tax filings, before starting the cleanup process. Having everything readily accessible ensures that you won’t waste time searching for missing information halfway through the cleanup.

Organized records also help you identify inconsistencies faster and make it easier to verify data as you categorize transactions, reconcile accounts, and address inaccuracies. This step lays the groundwork for a smooth cleanup process by giving you an accurate picture of your client’s financial history.

Fix Discrepancies and Errors Promptly

Discrepancies and errors are inevitable when cleaning up messy books, but you need to address them promptly to prevent them from compounding and creating further complications. Whenever possible, communicate with your client about inconsistencies that require clarification, such as unidentified transactions or incomplete records. This collaborative approach ensures you overlook nothing and builds trust in your process.

Use Automation For Requesting Client Information

Manually chasing down client documents and clarification can slow down the cleanup process and cause communication gaps. So, leverage automation tools to request and manage client information. This speeds up the process, improves organization by keeping all client-provided documents and responses in one place, reduces the risk of losing critical information and keeps the cleanup process on track.

Leverage Workflow Automation Tools

Workflow automation tools allow you to automate repetitive tasks, set reminders, and track progress across each cleanup stage, ensuring nothing falls through the cracks. They can also help you organize and manage your team’s tasks by creating checklists, assigning responsibilities, and tracking deadlines in real-time. This is especially useful when working on large or complex client files, as it keeps everyone aligned and ensures consistency.

By leveraging workflow automation tools, you can increase efficiency, reduce manual errors, and focus more on delivering valuable insights to your clients.

Have A Streamlined Process

A clear, well-defined process is essential for tackling bookkeeping cleanups efficiently. Without one, it’s easy to overlook important steps or waste time backtracking.

Start by breaking the cleanup into structured stages, such as gathering documents, addressing discrepancies, reconciling accounts, and generating reports. Follow the steps we shared to avoid confusion or duplication of effort. Also, use checklists or project management software to keep track of your progress and ensure nothing is missed.

A streamlined process also makes it easier to onboard team members if multiple people are involved in the cleanup. Everyone can follow the same framework, ensuring consistency in the final results.

Use Financial Cents for a Comprehensive Bookkeeping Cleanup

Financial Cents is a cloud-based accounting practice management solution that helps accountants and bookkeepers run their firms efficiently and manage projects. Here are some of its features:

1. Workflow Automation and Management

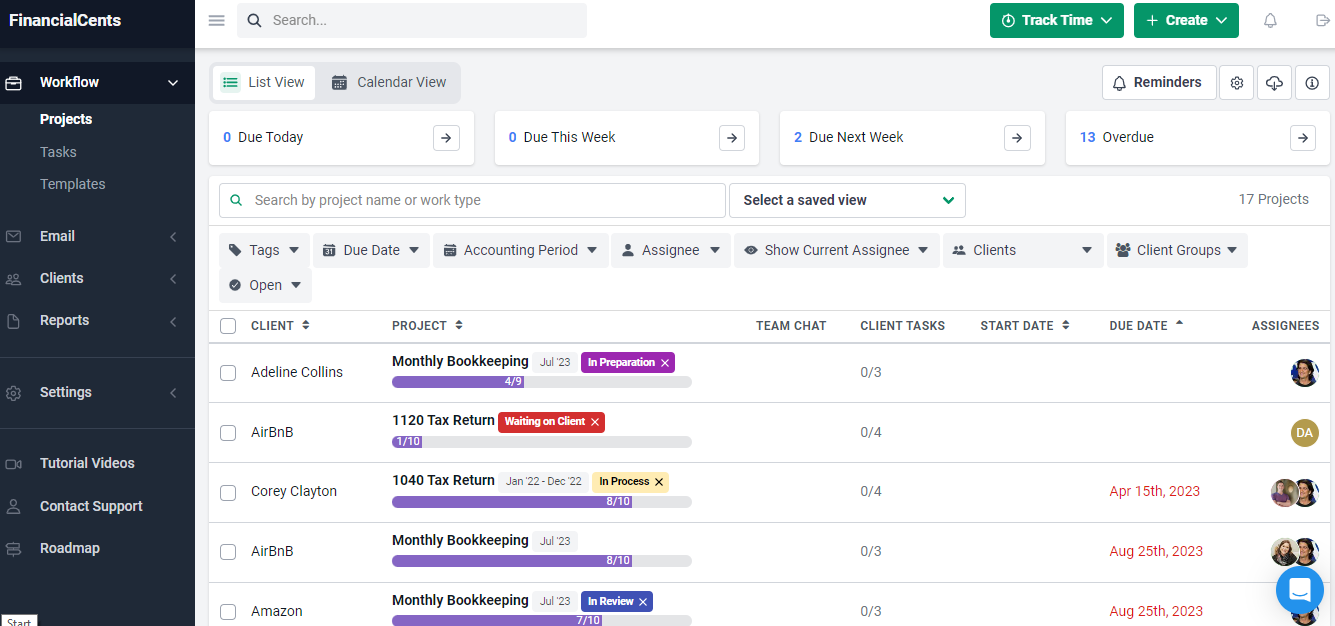

Financial Cents offers a workflow dashboard with a centralized hub for all work-related information. This allows you to monitor the status of each task at a glance and see who’s working on what so you can be sure your projects are on track.

2. Due Date and Deadline Tracking

With Financial Cents’ due date feature, you can see the deadlines for all your projects on the dashboard. This way, you know your most urgent projects and can see whether or not you’ll meet the deadline. You can also set reminders so team members can remain on course.

3. Manage Uncategorized Transactions (ReCats)

The ReCats feature allows you to efficiently categorize and reconcile transactions, reducing the time spent on manual data entry and minimizing errors. ReCats integrates seamlessly with your existing QuickBooks Online setup and automatically pulls uncategorized transactions from there without you having to manually do it. It then allows you to create and send automated reminders at intervals to clients to ensure they stay on top of outstanding requests to clarify the transactions.

4. Automated Client Requests

Instead of chasing clients for documents, Financial Cents automates client information requests, making it easy to send and manage document requests through a secure portal. There are also automated reminders to ensure clients provide the information you need without unnecessary delays.

5. Client Management

Our accounting CRM solution allows you to store all your information in one place so your team can easily find it (anywhere, anytime, as it’s cloud-based) and perform their work efficiently.

A built-in client portal also helps keep all client communication and documents in one place. You can easily manage client contact information and passwords, track responses, view important emails and turn some emails into tasks directly from your inbox.

6. Billing and Invoicing

Financial Cents has a billing feature that enables you to create (and send) one-off and recurring invoices, sends automated reminders to clients until they pay in full, automatically charges your client’s account using their stored payment information, syncs with your financial records in QBO to prevent duplicate information, and so much more.

Final thoughts

Performing a bookkeeping cleanup can seem overwhelming at first, especially when you’re doing it for multiple clients, but it becomes easier and faster with a structured approach and the right tools.

The checklist template we’ve provided will help you navigate this process efficiently and stay on track.

For an even more seamless experience, consider using Financial Cents to manage your bookkeeping cleanup projects and other firm operations. Features like workflow automation, deadline tracking, client management, and billing can save you time, boost team collaboration, and keep your clients happy.

With these tips, tools, and resources, you can handle any cleanup project and serve clients well.

Use Financial Cents to streamline bookkeeping cleanup for your clients and other projects in your firm.

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to our newsletter for an awesome dose of firm growth tips.

Subscribe to our newsletter for an awesome dose of firm growth tips.

Great checklist! Very helpful for organizing messy books and starting fresh with accurate records.