The government, investors, and other stakeholders rely on your audit opinion for their regulatory and investment decisions.

However, achieving accurate audit opinions is becoming increasingly challenging. In 2023, the PCAOB found deficiencies in 46% of the financial audits. That’s a 6% increase from the previous year.

With increasing complexity of financial instruments, this trend may continue if audit professionals effectively utilize project management tools, such as checklists, to organize their work.

The following financial audit checklist will give you the mental clarity to consistently present a true and fair view of financial statements and help businesses comply with all relevant regulations.

What Is a Financial Audit and Why Is It Essential?

A Financial Audit is the independent examination of a company’s financial statements to determine the accuracy and completeness of the financial records. In the United States, financial statements are typically reviewed under Generally Accepted Accounting Principles (GAAP).

Financial audits assist clients in:

- Detecting Fraud: Financial audits expose business practices that might lead to mismanagement of resources.

- Improving Decision-making: Financial audits provide businesses with data to address financial risks and misconduct.

- Attracting Investors: Companies looking to raise funds want to assure investors of their profit potential. Financial audits allow them to present the data that communicates these potentials.

- Meeting Regulatory Requirements: Ultimately, audits help publicly traded companies provide financial statements that comply with GAAP.

The success of your audit engagements is critical to the entity’s understanding of its financial health and compliance with state and federal regulations. Therefore, the audit process must be efficient.

Challenges in Conducting Financial Audits Without a Checklist

As a list of the steps your team needs to complete a financial audit, the absence of a financial audit checklist creates several problems for the average team member, including:

a. Risk of Missing Critical Steps

The audit process can last anywhere from a few weeks to several months. Naturally, your team members can forget where they left things off (in a particular project), especially considering they have other projects to work on.

Financial audit checklists structure your audit projects, allowing your team members to check off tasks upon completion.

b. Inefficiencies Due to Lack of Organization

When there isn’t a central place to collect and organize client documents and information, your team members will waste precious time trying to access the resources they need to complete tasks.

This can affect your judgment of the client’s financial reporting.

c. Increased Likelihood of Errors or Non-Compliance

You may remember everything you need to complete each audit engagement, but your team members won’t. If you remember all the recent amendments to audit regulations and frameworks, your team members may not.

Checklists are created to reflect your client’s compliance needs. It will show your staff what to do, get, and test at every stage, improving the accuracy of your audit process.

A Detailed Financial Audit Checklist

The steps of a typical financial audit are:

1. Planning Phase

- Initial Client Meeting

The audit engagement begins with a meeting with your new client, where you define the objectives, scope, methodology, and timeline.

When done well, this meeting will set the tone, expectations, and timelines for the engagement and allow you and your client to make adequate arrangements for a smooth audit engagement.

- Engagement Letter Preparation & Signing

The engagement letter allows you to define (in writing) the objectives, scope, and other terms of the engagement, such as the client’s and auditor’s expectations and responsibilities.

Most accounting practice management software solutions will have an engagement letter feature that quickens and standardizes your engagement letters, making it easier to customize and tailor them to each client as you see fit.

- Draft and Share a Document Request List Detailing All Required Financial and Operational Documents

Following the signing of an engagement letter, you should request all the documents and information (previous audit reports, receipts, meeting minutes, bank statements, ledgers, etc.) for the work.

With practice management software, you should be able to send a list of the files and information you need from your client in advance.

Combined with the automated reminders feature, you will not need to call or email an entity to follow up on your requests manually.

2. Risk Assessment

- Review of Prior Year Audit Work Papers

Reviewing your client’s prior year working papers gives more context to an entity’s financial statements.

The working papers will also help you understand the recurring compliance risks and the level, scope, and procedure of previous audits in the company, which will guide your approach.

- Preliminary Analytical Procedures

This is where you analyze the entity’s prior year report and the company’s operating environment to understand the likelihood of misstatement, especially when auditing a client in specialized industries (like banking and insurance, agriculture, etc.).

3. Fieldwork Preparation

- Schedule Fieldwork

Usually, financial audits are done following the preparation of the entity’s financial statements.

The earlier the audit is done, the better because the financial data is fresh in your auditee’s mind.

- Assign Team Roles and Responsibilities

This is where you assemble your audit team for the engagement. You’ll determine the staff in charge of testing procedures, audit review, and other aspects of the engagement.

Some firms will use staff auditors, senior staff auditors, audit management, and engagement partners for these respective roles.

Whatever your unique process looks like, the idea is to create a team to manage individual aspects of the engagement.

4. Fieldwork Execution

- Perform Substantive Testing

Now that all pre-fieldwork processes are done, you can begin reviewing everything that makes up the entity’s financial statements—transactions, balances, assets, liabilities, etc.—to prove their accuracy and completeness.

This includes:

-

- Revenue Testing: assess revenue transactions (like date, amount, etc.) for revenue manipulation according to the relevant compliance framework.

- Expense Testing: observe the purchase transactions to see if there are improper authorizations or abnormal transactions and balances.

- Payroll Testing: evaluate various aspects of the payroll processing and operation to ensure employees are promptly and adequately compensated.

- Fixed Asset Verification: verify the costs, conditions, and depreciation of the assets the entity claims to have.

- Inventory Testing (if applicable): if your client holds inventory, this is where you determine whether their financial records and inventory match.

- Accounts Payable and Accruals Testing: Track accounts payable and accrual transactions to ensure all purchase orders, invoices, and payments are recorded.

- Cash and Bank Balance Reconciliation: compare your client’s cash on hand with their bank statement to account for cash items, resolve discrepancies, and ensure accurate financial records.

- Equity Testing: verify share issuance, dividends, treasury stock transactions, and other equity-related transactions. Learn more about equity in accounting.

- Detailed Analytical Procedures: carefully analyze all abnormal areas or events in the company, such as all high-risk areas, unusual transactions, and complex accounting.

- Subsequent Event Review: analyze the events (from internal or external sources) that occurred after the balance sheet and before the financial statements and make disclosures where necessary.

- Related Party Transactions: this is where you disclose the nature, amounts, and terms of financial activities between the company and the companies associated with it.

- Verify Internal Controls

How well are the financial procedures and policies preventing or detecting financial misconduct in the company?

This is where you test them to verify their effectiveness through observation, reperformance, inspection of evidence, computer-assisted audit techniques, etc.

- Prepare Audit Documentation

The audit documentation should clearly state the nature, purpose, timing, the accounting records reviewed, the approach, and conclusions (with evidence backing it up).

The audit documentation provides the basis for the audit report that follows. It should be detailed enough for an experienced auditor to understand.

5. Review Phase

- Initial Review by Audit Manager

This should focus on the connection between the documentation and conclusion and how these align with the audit report.

- Senior Review

The senior review will likely focus on the audit work papers to ensure they comply with generally accepted audit standards.

6. Reporting Phase

- Draft Audit Report

This is where you write the report by stating the accuracy and completeness of the financial information, the basis for your conclusions and room for improvement, and any issue worthy of note.

- Management Response Collection

The auditee should comment on the audit process and provide more context to the findings. Management should also state whether the findings and recommendations are relevant to their business.

- Finalize Audit Report

Add the management’s response to your audit report for issuance to the management and stakeholders.

7. Closing Phase

- Conduct Closing Meeting

The closing meeting allows you to explain the audit findings while they’re still fresh.

This should cover the auditee’s strengths, weaknesses, and areas for improvement.

- Archive Work Papers

Store the audit documentation in a safe, secure, and accessible location.

The auditee’s management may need to access the work papers in the future.

- Post-Audit Review

This is where you help the auditee understand how they can use the audit conclusions to improve their financial and compliance goals.

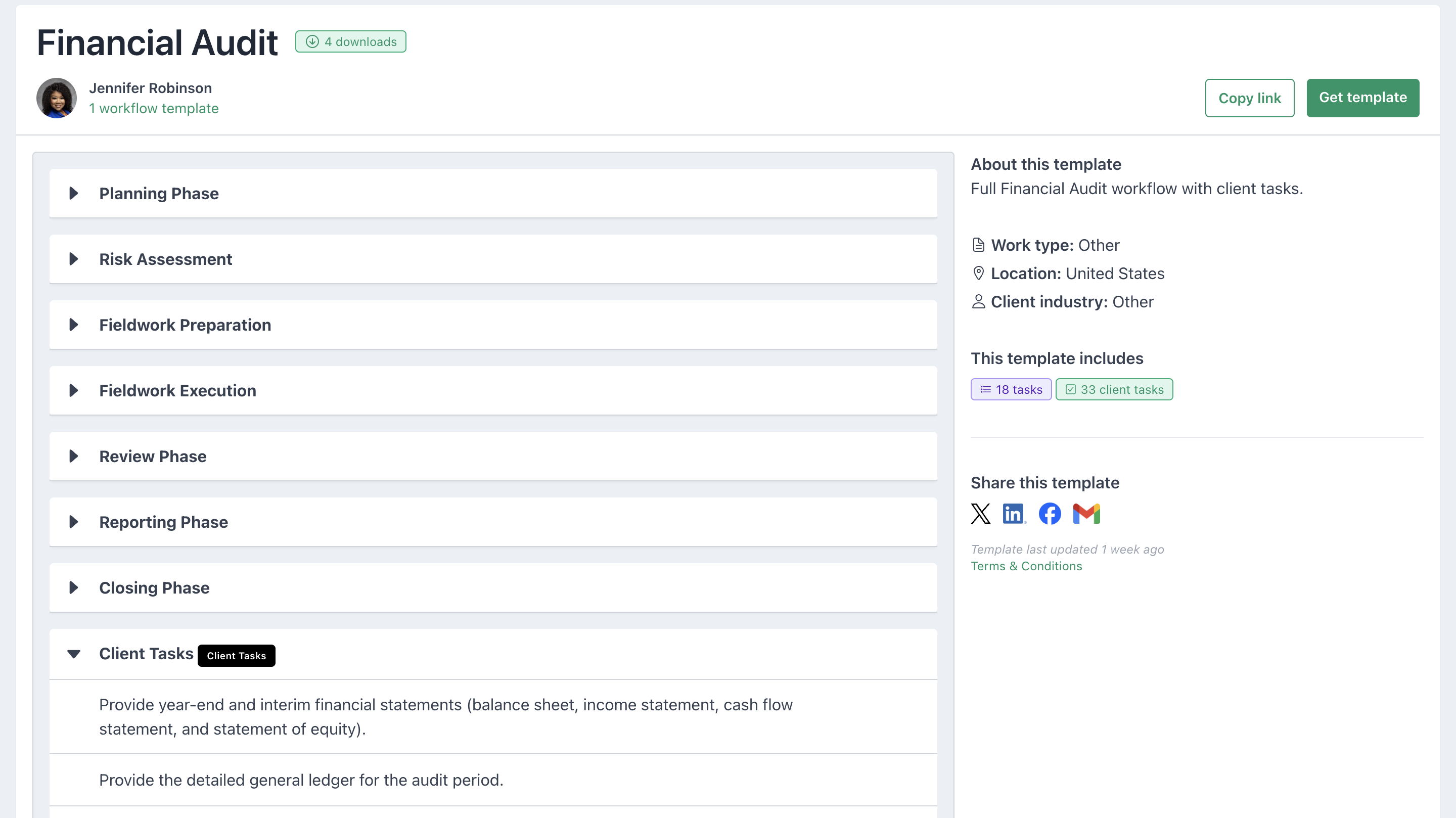

Your Free Financial Audit Checklist Template.

Best Practices for Managing the Audit Process

a) Plan and Organize Effectively

Effective planning prevents unforeseen surprises that might delay your audit work and organization makes it easy for your team to access what they need to get work done.

When you work with a checklist, you can see what to expect in each stage of the process just as having practice management software makes it easier to manage the project, client information, and your audit team’s workload in one place.

The client management feature in audit practice management tools will centralize your client information and documents, enabling your team members to access everything they need in one place.

This frees them to focus on getting to the roots of all financial data to determine their correctness.

b) Maintain Clear Communication

Being the subject of an audit is not particularly exciting. Your audit clients (or some of their staff) have a measure of dread for your work, but with clear communication, you can help them relate with you more comfortably.

This can make them more forthcoming with the files, information, and resources you need to do a thorough job.

Reduce the technical jargon when communicating your audit findings. Most business owners may not understand them, and that can prevent them from understanding your findings and recommendations.

c) Leverage Technology

Like every industry, opportunities abound in financial audits to leverage technology for improved productivity and efficiency.

For example, audit management software can help extract, clean, and analyze your client’s data, so your team can focus on providing the much-needed human judgment to contextualize financial data.

Similarly, the client task feature in accounting practice management software automates client data collection. Its automated reminders help with following up with clients to save you the hours you’ll need to call and email your clients for additional files and information.

d) Focus on Risk Areas

Areas like revenue recognition, going concern, related transactions, and journal entries are more prone to error and misstatements, prioritizing them is not just more efficient, but it also produces more accurate audit results.

e) Ensure Compliance and Updates

Staying up to date with all relevant regulations is easier when you:

- Use Compliance Management Software: these applications keep track of regulatory changes and industry best practices automatically.

- Invest in Professional Networks: joining professional communities helps with tracking audit developments. In the Financial Cents Template Library, for example, accounting professionals share insights that streamline their workflows and help one another deliver GAAP-compliant work quality.

- Share Ideas Social Media: it is common to see accounting and audit professionals sharing their thoughts about recent changes in financial reporting laws and regulations on LinkedIn, Twitter, etc.

f) Document Everything

Audit documentation provides support for your conclusions. It allows you to describe the source, purpose, procedure, results, and conclusion of your audit engagement.

When another auditor sees your audit report, they can understand the level of work done and the basis for your audit opinion.

Your audit documentation will also provide a historical basis for the entity’s subsequent audits.

g) Conduct Post-Audit Reviews

Apart from confirming that all regulatory standards were followed in the audit engagement, the post-audit review provides the opportunity to educate your client about the next steps while receiving feedback from the entity.

This will enable your team to address limitations in the scope of the review and documentation.

How Financial Cents Improves Your Audit Processes

Every successful audit requires a sufficient understanding of audit requirements and an effective project management solution, like Financial Cents, to establish workflows, assign work, and automate tasks.

Financial Cents improves financial audits with the following features:

1. Automation and Workflow Management

- Workflow Dashboard: Financial Cents workflow dashboard gives visibility into your audit engagements by showing what is due, who is assigned what, and where each project stands.

- Task Dependencies: automatically hand off tasks between your team members. It declutters your dashboard by removing the tasks that are not yet due so you can focus on priority items..

- Workflow Templates: Financial Cents workflow template feature allows you to document your financial audit process to standardize the performance and results of your audit projects.

2. Work Tracking

You can track work in Financial Cents with:

- Tags: labels that automatically monitor the progress of each audit engagement. It changes the status of your projects as your team completes the tasks within the audit work.

- Workflow Filters: these allow you to view the specific projects you want to see in your dashboard.

3. Team Collaboration

Financial Cents allows your team to discuss each audit engagement inside the audit project using:

- Comments: exchange ideas inside the audit work.

- @Mention: tag their team members in the comments.

Other collaboration features include:

- Project Files: add client files to the project and help your team access the documents they need for the audit engagement.

- Automated Notifications: Financial Cents’ automated notifications keep all your team members informed about the latest information and project-related comments.

4. Automate Client Requests and Client Portal

Financial Cents client request enables you to request all the documents you need from your clients. Its client portal built for accounting allows clients to send documents and collaborate with you in one place.

Its features include:

- Automated Reminders: help you remind your clients about all pending document requests.

- Client Chat: with Financial Cents’ client portal, clients can discuss the audit work or document request with you to keep everyone on the same page. In this place, you can

- Organize client chats by topics.

- Control the team members and client employees that can access chat topics.

- Search the chat topics using specific keywords.

5. Secure File Sharing and Storage

Financial Cents lets you send and receive engagement letters and other documents on demand.

Its security features include:

- Unlimited Data Storage: you can store your client’s audit work papers for as long as the laws allow without worrying about storage space.

- Data Encryption: renders your client’s financial information in Financial Cents inaccessible to unauthorized persons.

- Transport Layer Security: Financial Cents only grants access to your client data after establishing a secure connection, safeguarding file exchange with clients.

Its file-sharing features include:

- File Upload Tab: allows clients to share documents with you.

- Document Preview: allows clients to view documents they shared with you in the portal.

- Shared Folders: you can share folders with clients.

6. Deadline Tracking and Management

Financial Cents provides the due date feature to track and manage deadlines by adding a due date to each audit project when creating them.

Its due date features include:

- Due Date Reminders: remind your team members about upcoming deadlines at a pre-set time.

- Internal Due Dates: this feature allows you to use an earlier time when creating the project when you want to complete an audit engagement earlier than you gave the client.

Clarity and Focus: The Cornerstone of Every Successful Financial Audit

Accurate examination of business finances is impossible without clarity and focus.

When audit processes are too disorganized, you can hardly see what’s missing until it’s too late.

Financial Cents organizes your information to enable your team to deliver work that meets regulatory standards.

Click here to manage your audit engagements for free with Financial Cents’ 14-day Free Trial.