As an accounting firm, you make one key assumption every time you review a client’s financial statements: the business is still operating and will continue operating for at least the next 12 months. That means it can meet its obligations, generate income, and continue using its assets in the normal course of business.

This assumption is called the going concern principle, and it’s one of the foundations of financial reporting. It affects how you value assets, classify liabilities, and prepare statements. Without it, you’re not preparing financials for an ongoing business; you’re preparing them for liquidation.

In this guide, we’ll explore everything you need to know about the going principle: what it means, when it applies, what red flags to watch out for, and what to do when that assumption no longer holds. This will help you assess financial risk accurately and support clients through difficult decisions when needed.

What is the Principle of Going Concern?

The going concern principle is the assumption that a business will continue to operate for the foreseeable future, typically for at least the next 12 months. When your firm prepares or reviews a client’s financial statements, you apply this assumption by default. That means you assume the business is not planning to shut down, liquidate its assets, or cease operations in the near term.

This principle shapes how you prepare and interpret financial statements. It allows you to:

- Recognize revenue and expenses on an accrual basis.

- Depreciate fixed assets over their useful lives.

- Classify liabilities as current or non-current based on expected payment timelines.

- Avoid writing assets down to liquidation value unless there’s clear evidence that the business won’t continue.

Without this assumption, financial statements must be prepared using the liquidation basis of accounting, which changes how you value assets, present liabilities, and disclose financial risks.

Both Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) embed the going concern principle in their frameworks, although the specific requirements differ slightly.

In both frameworks, the going concern assumption is the default. It only changes when there is strong, documented evidence that the business may not survive the next 12 months.

When Does the Going Concern Principle Apply?

The going concern principle applies by default. When your firm prepares or reviews financial statements, you assume the business will continue operating for the foreseeable future unless you identify clear evidence that suggests otherwise. You don’t have to prove the business will survive; you only need to question that assumption when financial or operational warning signs emerge.

Period of Assessment

The timeframe for evaluating going concern status differs slightly between GAAP and IFRS, so it’s important to apply the correct standard based on your client’s reporting framework.

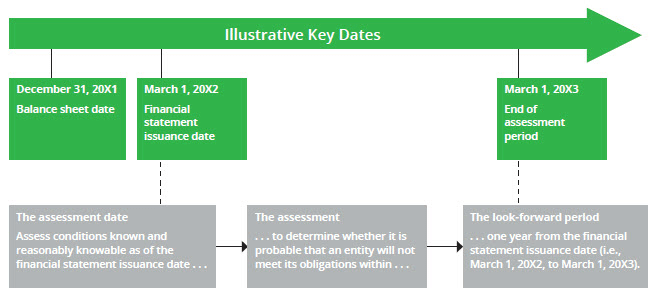

Under U.S. GAAP (ASC 205‑40):

- The look‑forward period is 12 months after the date the financial statements are issued (or available to be issued).

- The evaluation must include information that is known or reasonably knowable as of the issuance date—not just as of the balance sheet date.

- This means that events occurring after the reporting date but before issuance can and should affect the going concern conclusion.

For example, if financial statements are issued on March 1, 2022, management must assess whether the business can meet its obligations through March 1, 2023. Any material developments between the balance sheet date and the issuance date must be considered.

Under IFRS (IAS 1 and related guidance)

- The period of assessment must cover at least 12 months from the reporting date (i.e., the end of the accounting period).

- This 12‑month period is a minimum requirement, not a cap. If relevant, management must look further ahead based on facts and risks specific to the business.

- IFRS also requires management to consider subsequent events—developments that occur after the reporting date but before the financial statements are authorized for issue—if those events provide additional evidence that affects the going concern assessment.

For example, if the company’s reporting date is December 31, 2021, management must assess whether the business can meet its obligations through at least December 31, 2022. Under IFRS, the period of assessment is flexible and may extend beyond 12 months when warranted by the circumstances.

Required Evaluations

When doubt exists, here are a few factors to evaluate to determine if the going concern assumption still holds:

i. Financial health:

- Past and projected profitability.

- Recurring net losses or margin decline.

- Working capital deficiencies.

- Negative financial ratios (e.g., current ratio, interest coverage).

ii. Liquidity position:

- Cash on hand.

- Access to credit lines or borrowing capacity.

- Timing of expected inflows vs. upcoming obligations.

- Future capital expenditures or loan repayments.

- Sensitivity analysis based on downside scenarios.

iii. Future cash flow projections:

- Base case and stress-tested forecasts.

- Assumptions around revenue, expenses, and collections.

- Plan for raising new financing or executing cost cuts.

iv. External risks:

- Economic conditions, industry downturns, or regulatory changes.

- Technological disruption.

- Legal disputes or unresolved litigation.

- Customer or supplier concentration risk.

Red Flags That Challenge the Going Concern Assumption

While the going concern principle assumes a business will continue operating, there are times when that assumption becomes questionable. Your job is to recognize early warning signs that a client’s ability to survive the next year is at risk.

Here are some of the most common red flags that may challenge the going concern assumption:

Repeated Net Losses or Negative Cash Flows

Persistent losses or ongoing negative cash flows are strong indicators of financial distress. A single bad quarter may not be significant, but when these trends persist, they suggest that the business may struggle to generate enough cash to sustain its operations. Persistent losses or ongoing negative cash flows are strong indicators of financial distress.

Loan Defaults

Failing to make loan payments, breaching debt covenants, or failing to meet minimum financial ratios (e.g., debt service coverage) can restrict access to capital. These events may trigger accelerated repayment terms, higher interest rates, or loss of access to capital, all of which strain the company’s ability to stay operational.

Lawsuits or Regulatory Investigations

Ongoing litigation or government investigations (e.g., tax disputes, compliance violations) is a red flag because it can expose a company to financial penalties or reputational damage that affects its ability to continue operations.

Inability to Raise Capital

If a business is actively seeking funding and fails to secure it—or faces unfavorable terms—it signals a lack of investor or lender confidence. For companies that depend on external financing to meet payroll, service debt, or fund working capital, this raises immediate concerns about short-term survival.

Mass Layoffs or Key Personnel Exits

Large-scale layoffs or the departure of senior leadership, founders, or essential staff can signal deeper operational or financial problems. These events may disrupt recovery plans, delay growth initiatives, or raise concerns among investors and clients, especially if there’s no clear succession or restructuring strategy in place.

Bankruptcy Filings or Restructuring Plans

Filing for bankruptcy protection or initiating a formal restructuring process typically marks the end of going concern status. At that point, financial statements should shift to the liquidation basis of accounting, where assets and liabilities are remeasured based on expected recovery and settlement values.

Dependence on One Major Client

Client concentration can be a red flag especially for small and mid-sized businesses that rely heavily on a single customer or revenue stream. However, it doesn’t automatically indicate a going concern issue. You need to evaluate the likelihood of losing that client, the financial impact if it happens, and whether management has a plan to replace or diversify the revenue.

If the loss of that client would materially affect the business’s ability to meet obligations within the next one year, and there’s no mitigation strategy, then it may affect the going concern assumption.

What Happens if a Business Is Not a Going Concern?

When a business no longer qualifies as a going concern, its financial reporting must change, with the focus shifting to how much of its assets it can recover and how it will settle obligations.

Here’s what that means in practice:

Management’s Disclosure

Once management assesses that going concern is no longer appropriate (or that there is substantial doubt that it is), the company must disclose this conclusion in its financial statement footnotes. These disclosures typically include:

- The conditions or events that triggered the going concern assessment.

- Management’s evaluation of those conditions.

- Any plans to mitigate risk (and whether they are likely to succeed).

- A statement that the going concern basis is no longer appropriate, if applicable.

- An explanation that the company has applied (or will apply) the liquidation basis of accounting.

Auditor’s/Accounting Firm’s Report Modification

If your firm provides assurance services, you must evaluate management’s conclusion and determine whether to modify your report.

- If substantial doubt remains, include an emphasis-of-matter (or explanatory) paragraph to highlight the going concern risk.

- If disclosures are incomplete or inconsistent with the risk, issue a qualified or disclaimed opinion.

- Document the conditions that triggered the assessment, management’s plans, evidence supporting or contradicting those plans, and whether doubt remains or is alleviated.

Shift to Liquidation Basis of Accounting

Under U.S. GAAP (ASC 205-30), once liquidation becomes imminent, the company must stop using the going concern basis and adopt the liquidation basis of accounting.

Under liquidation basis:

- Assets are measured at their expected net realizable values (i.e., what they are likely to fetch upon forced sale).

- Liabilities, including those that may have been off-balance-sheet under going concern, are recognized to reflect likely settlement amounts.

- Statements shift focus to a statement of net assets in liquidation and a statement of changes in net assets in liquidation rather than continuity of operations.

- This change takes effect prospectively from the date liquidation becomes imminent, rather than retrospectively.

Changes to Financial Statements

When a company adopts the liquidation basis of accounting, its financial statements must reflect the plan to wind down operations:

- Asset valuation: Assets (such as property, equipment, or inventory) are no longer depreciated. Instead, they are written down to their estimated net realizable value, the amount expected to be collected upon sale, less disposal costs.

- Liability reclassification: Liabilities that were previously classified as long-term are often reclassified as current, as they are likely to be settled during the liquidation process. Off-balance-sheet obligations may also need to be recognized.

- Disclosures: The notes must include details about the liquidation plan, expected timeline, and how management will prioritize creditor claims. These disclosures help users understand the assumptions behind the reported values.

Impact on Stakeholders

When a company is no longer a going concern, every stakeholder is affected:

- Creditors and claimants will compete for proceeds in the liquidation cascade, creating uncertainty about recoveries.

- Customers may lose key services or product support.

- Employees may lose jobs or have uncertain severance and benefits.

- Investors and equity holders face the risk of losing their entire investment, and equity may have little to no residual value.

- Lenders may accelerate maturity, call in loans, or demand collateral.

- Suppliers and vendors may require cash payments or suspend credit terms.

Real-World Example Scenarios

To understand how the going concern principle applies in practice, below are three practical scenarios that often trigger a going concern review. Each one highlights different risk factors and how your team should approach them.

Scenario 1: A Startup With 6 Months of Runway and No Committed Funding

A startup has just enough cash to cover six months of operations. It’s in early fundraising conversations for a Series A, but there are no signed term sheets, no bridge financing, and no board-approved plan to extend runway. The current forecast shows the business running out of cash before the 12-month look-forward period ends.

Under U.S. GAAP (ASC 205-40), management must assess whether this shortfall creates substantial doubt about the company’s ability to meet its obligations. They must also evaluate whether their plans to raise funding are likely to succeed—and back those plans with evidence, such as signed Letters of Intent (LOIs) or committed capital.

If the startup cannot support its assumptions with credible documentation, management must disclose the risk in the financial statements. The auditor will likely include an emphasis-of-matter paragraph in the audit opinion.

How your firm should approach it:

- Review the 12-month cash forecast and assumptions.

- Determine whether any new financing is legally committed or still under negotiation.

- Evaluate whether management’s cost-cutting or fundraising plans are feasible and documented.

Scenario 2: A Retail Business Hit by the Pandemic Shutdown

A multi-location retailer lost a significant portion of its revenue due to COVID-related closures. It furloughed staff, delayed rent, and extended payables. While the business has reopened, sales remain 40% below pre-pandemic levels. It’s also behind on loan payments and struggling to meet upcoming obligations.

This business shows clear signs of liquidity stress and operating losses, both of which raise potential going concern concerns. Management must project whether the business can generate or access enough cash to cover obligations over the next 1 year.

If management plans to renegotiate leases or restructure debt, those plans must be realistic and supported by evidence such as lender letters or signed agreements. If there’s no clear path to recovery, going concern disclosure is required.

How your firm should approach it:

- Analyze cash reserves, loan terms, and upcoming payment obligations.

- Confirm whether lenders have granted covenant waivers or loan modifications.

- Review any restructuring plans or revenue recovery strategies.

Scenario 3: A Company Under Acquisition, but Still Reporting Independently

A mid-sized manufacturer has signed an acquisition agreement with a larger competitor. The deal is expected to close in five months. In the meantime, the company continues to operate independently, relying on interim support from the buyer to meet payroll and supplier obligations.

The going concern assumption may still apply if the buyer is contractually obligated to fund operations through closing, and the closing is highly probable with few contingencies remaining.

However, if the deal depends on external approvals and the company cannot operate without buyer support, management must assess the risk of the deal falling through. If that risk is material, it should be disclosed, even if liquidation is unlikely.

How your firm should approach it:

- Review the acquisition agreement to confirm funding obligations.

- Assess the likelihood of deal completion and any outstanding conditions.

- Determine whether the company has a viable fallback plan if the deal collapses.

Best Practices for Accounting Firms When Assessing Going Concern

Here are three best practices to improve the quality and reliability of your going concern assessments.

1. Regularly Review Financial Health Indicators

Don’t wait until year-end to assess going concern status. Monitor high-risk clients—like startups, seasonal businesses, or companies with tight margins—throughout the year. Set up a monthly or quarterly review process that assesses:

- Cash flow forecasts and downside scenarios.

- Profitability and cash flow trends.

- Upcoming debt maturities and covenant compliance.

- Working capital position and current ratio.

By reviewing these indicators quarterly or even monthly, you can catch red flags early and help clients take corrective action before they face a going concern warning.

2. Communicate With Clients About Risks Early

If you see signs of trouble, such as negative cash flow, missed loan payments, or staff layoffs, raise the issue with clients immediately. Don’t wait for year-end close or the audit cycle.

Early conversations help clients plan realistically, whether that means cutting costs, renegotiating debt, or securing new financing. It also gives them time to gather supporting documents (such as term sheets, waivers, or board-approved budgets) that can help alleviate substantial doubt in their financials.

3. Document Assumptions Clearly

If you conclude that the going concern assumption still holds—even when there are warning signs—you’ll need to show why. In your documentation, include:

- Cash flow forecasts and key assumptions.

- Management’s mitigation plans and why they are feasible.

- Risks identified and their financial impact.

- Supporting documents, such as loan agreements, covenant waive.

Auditors, stakeholders, or regulators may revisit your assessment later, so thorough documentation protects your firm and ensures your work holds up under audit or regulatory review.

Conclusion

The going concern principle is central to how your firm prepares and interprets financial statements. Assuming a business will continue operating for at least the next 12 months allows you to apply standard accounting treatments like depreciating assets, recognizing revenue, and classifying liabilities appropriately.

But when that assumption no longer holds, financial reporting changes significantly. You may need to switch to liquidation-based valuation, reclassify liabilities, and disclose risks that impact how stakeholders view the business.

That’s why your firm should assess going concern status regularly, not just at year-end or during audit prep. This helps you identify and address risks before they escalate.

Financial Cents helps accounting and bookkeeping firms organize their work, track progress across teams and clients, and always meet deadlines.

Here’s how:

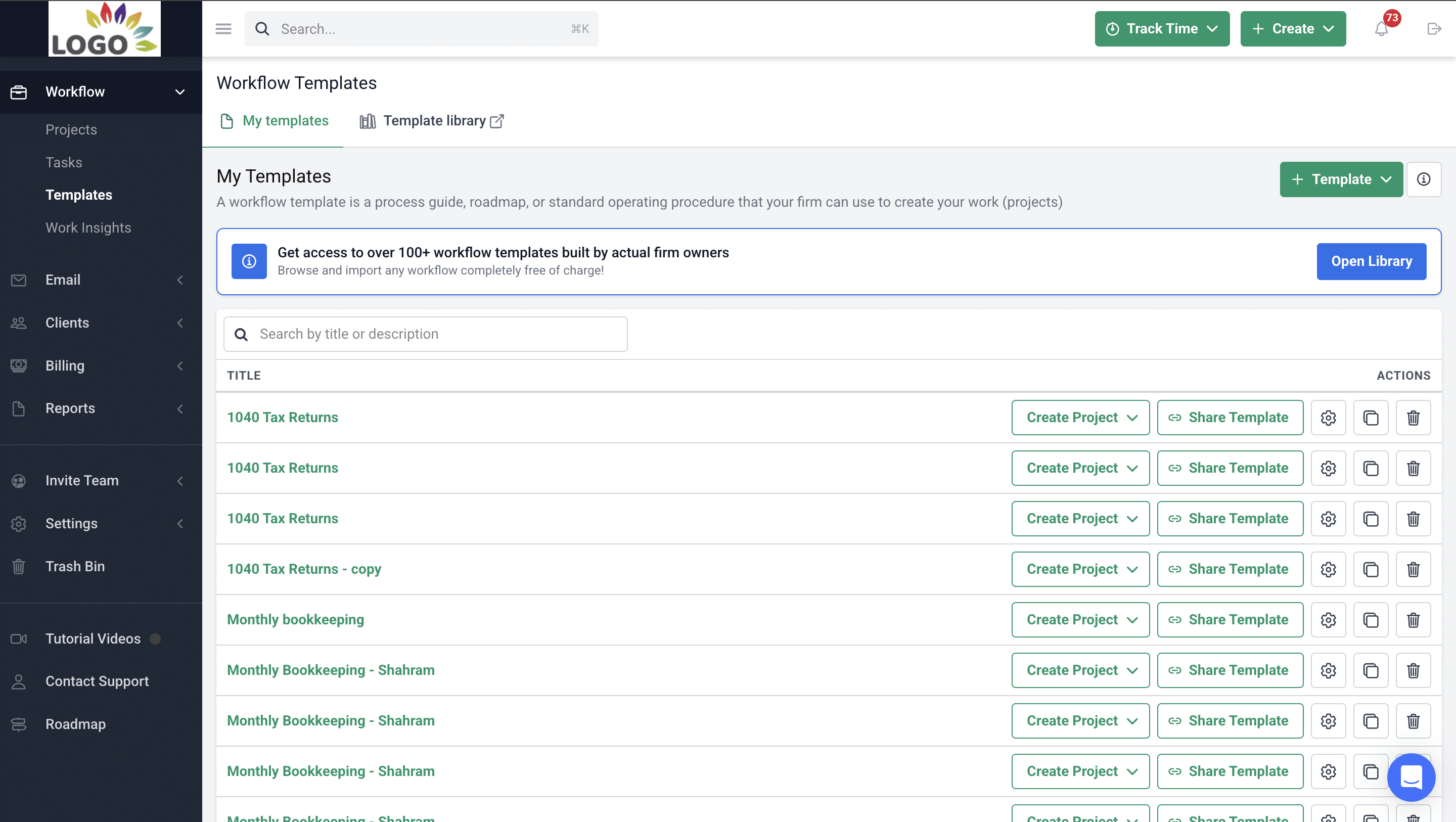

- Standardized workflows across clients

Financial Cents makes it easy to build standardized workflows across your entire client base. You can choose from more than 250 prebuilt templates for common accounting processes, such as monthly bookkeeping, payroll, and year-end reviews. You can also document your own processes from scratch or generate them using the built-in AI feature, then save them as a template for company-wide use. This ensures every team member follows the same steps and deliverables, providing consistent service quality across all clients.

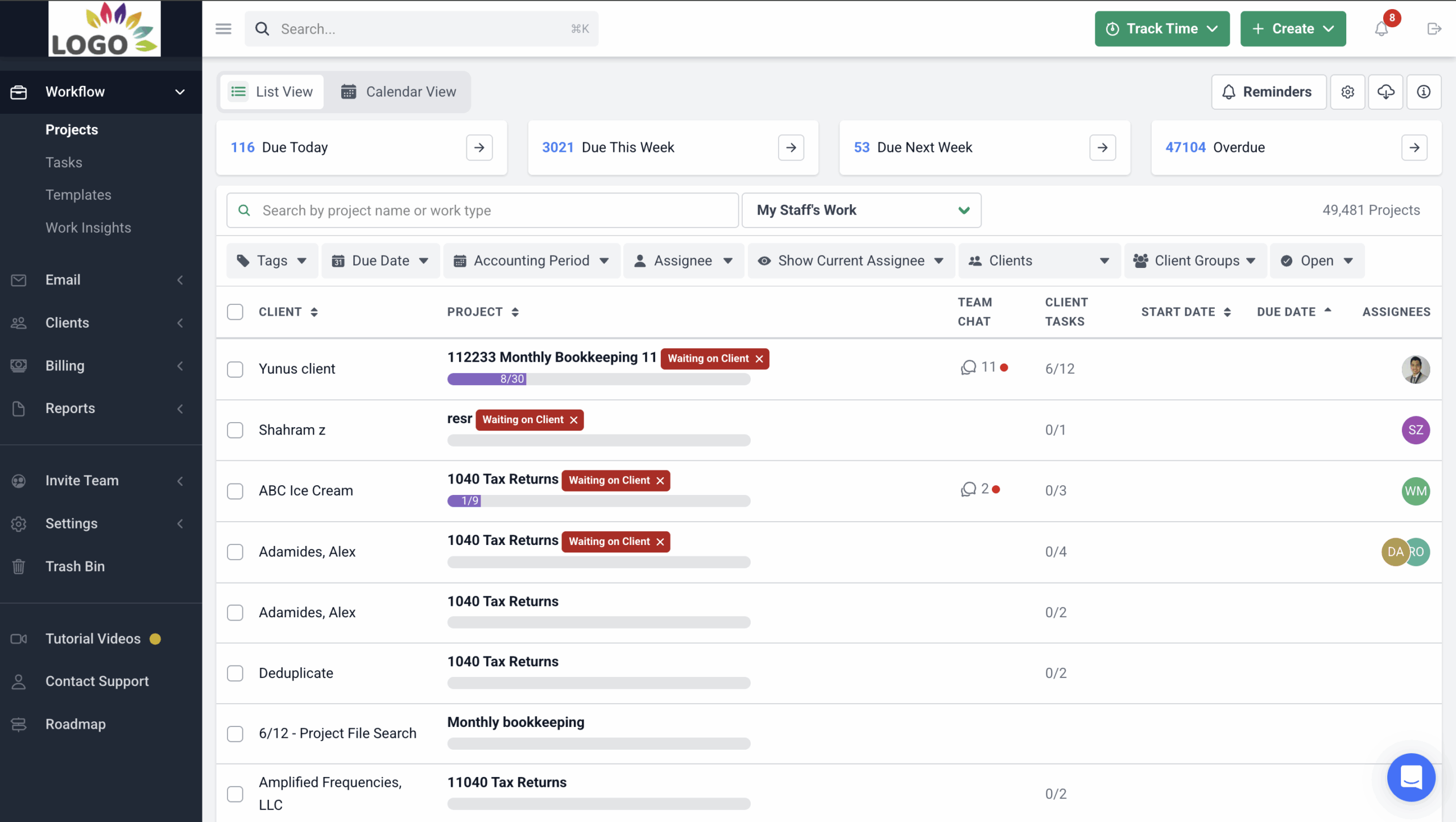

- Centralized task and deadline tracking

Instead of managing work through scattered spreadsheets, emails, and manual to-do lists, Financial Cents gives your team a single dashboard to track tasks and projects. Each client engagement is treated as a separate project, complete with task lists, due dates, assignees, and progress status.

You can use this data to assess capacity, prioritize urgent work, and keep all client deliverables on track. If you need more context, you can customize your dashboard to show additional info like internal due dates, team chat, or budget versus actual hour.

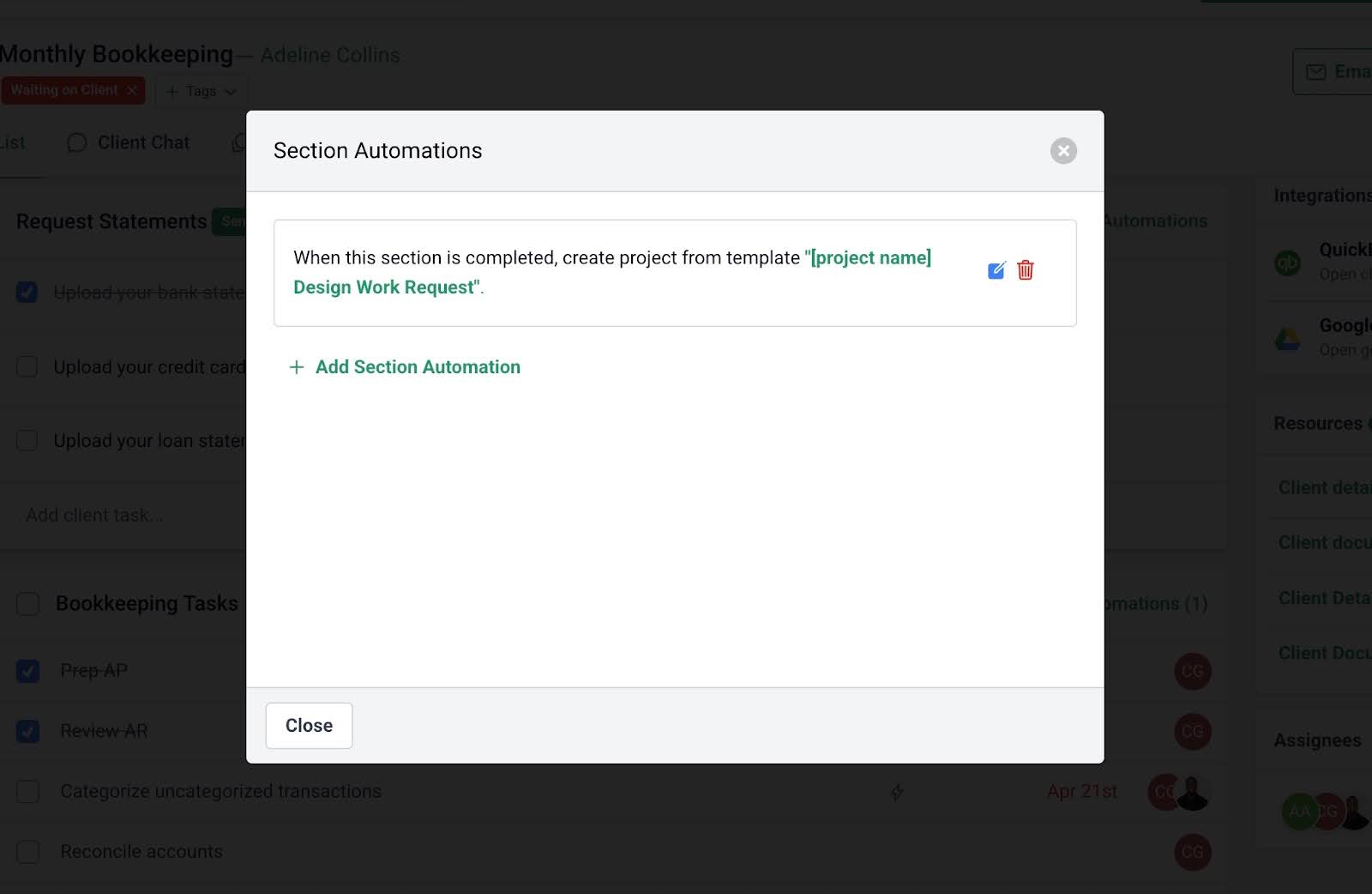

- Workflow Automation

Financial Cents automates routine workflow tasks so your team can spend less time managing admin and more time doing billable work. When a recurring project is completed, Financial Cents automatically creates the next instance and assigns the relevant team members. It also sends automated reminders for internal deadlines and client document requests. You can even notify clients automatically when work progresses or when they need to take action without sending emails manually.

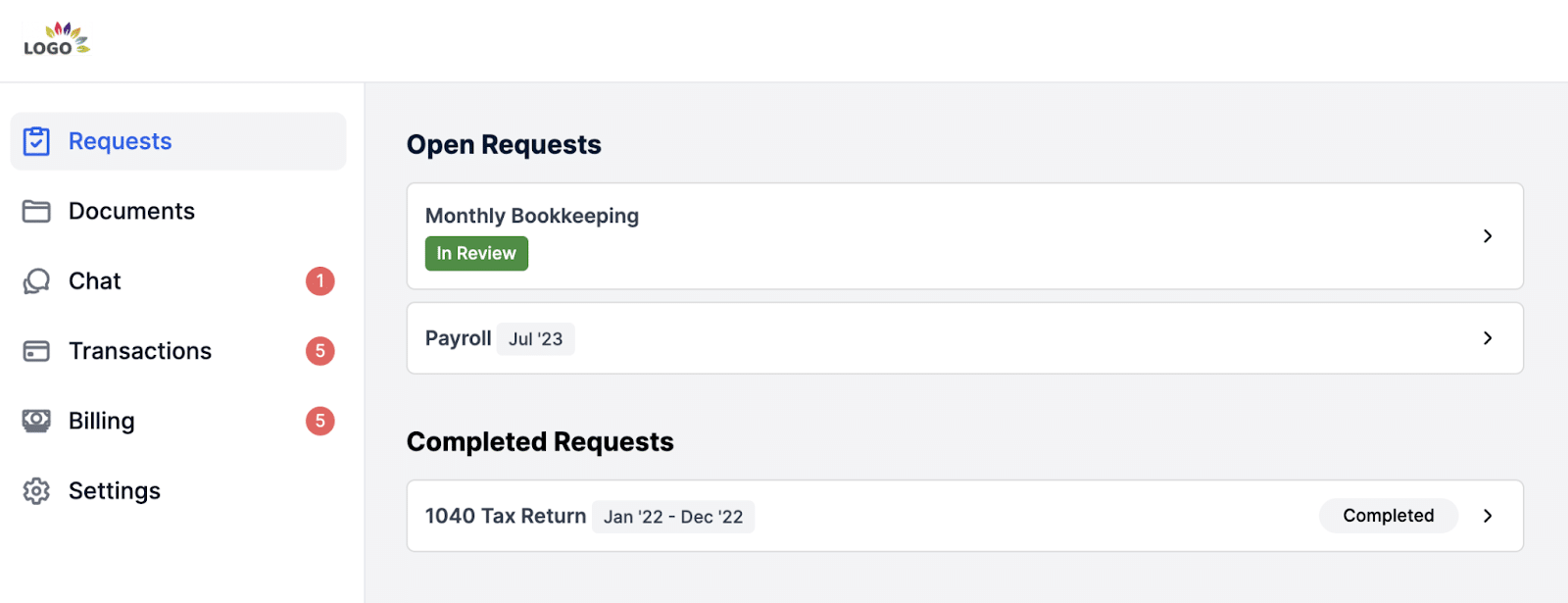

- Client portal

The client portal in Financial Cents makes it easy for your clients to communicate, send documents, and stay updated without needing a password to log in. The portal uses secure, auto-renewing magic links, which clients can use to log in instantly. Inside, clients can upload requested files, send messages, view shared folders, and access invoices.

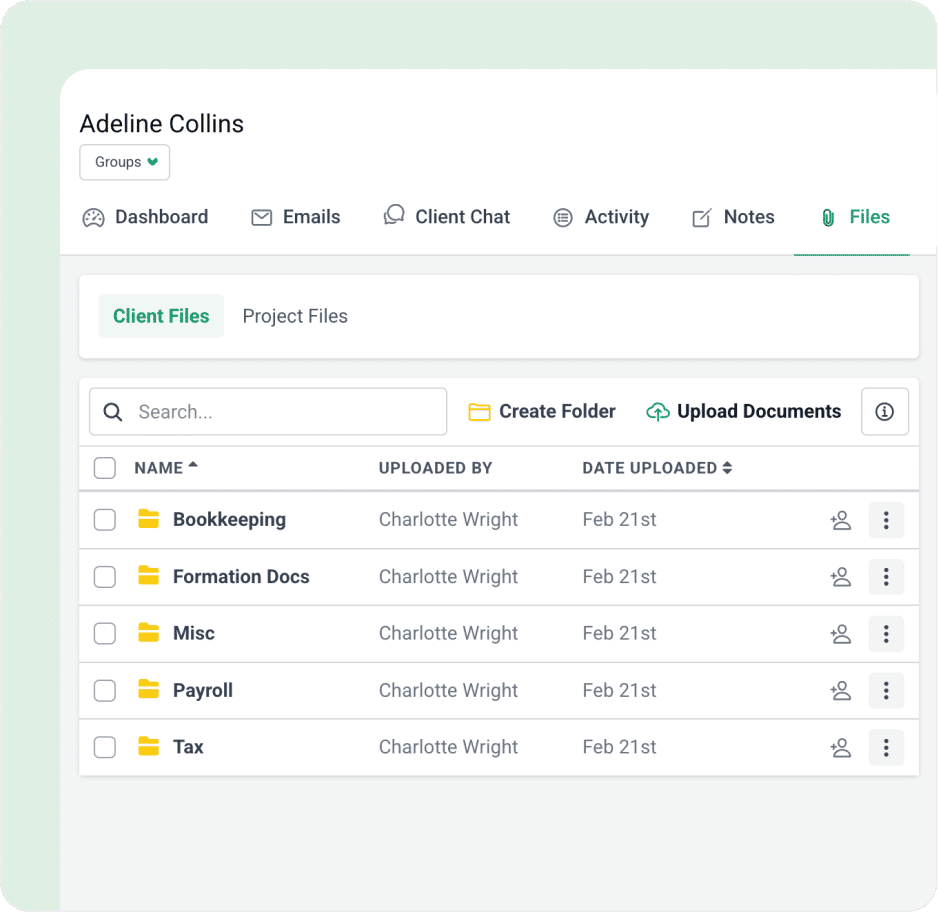

- Document management:

With Financial Cents, every document is stored within the client’s profile, so your team can find what they need without searching through emails or cloud drives. The platform supports secure, organized document storage that complies with SOC II, SOC III, and GDPR standards.

Ready to start your free 14-day trial?