All You Need to Know About IRS Form 8886 Reportable Transactions

Author: Financial Cents

In this article

It’s not uncommon to see many entrepreneurs leave their accounting and tax matters to professionals while they focus on other revenue-generating activities.

As such, besides handling financial tasks for clients, it’s also your responsibility to inform them about some typically overlooked tax obligations.

One of such obligations is filing IRS Form 8886 – Reportable Transaction Disclosure Statement.

Failure to file this form could lead to fines by the IRS. Hence, accounting firms must understand IRS Form 8886 to ensure their clients remain tax-compliant and avoid legal or tax issues.

This is what this guide seeks to discuss. Here’s all you need to know about IRS Form 8886.

What is IRS Form 8886?

Form 8886 is a document taxpayers are required to file to disclose certain transactions to the IRS. These transactions are known as “reportable transactions” (more on this as we progress).

In other words, Filing Form 8886 is a way of saying, “Hey IRS, I was involved in so-so transactions and I don’t want to evade tax. Here are all the details.”

Disclosing these reportable transactions to the IRS helps to:

- Promote transparency

- Ensure tax compliance

- Monitor potentially abusive tax shelter schemes

- Prevent tax avoidance strategies

Who Needs to File Form 8886?

Taxpayers such as individuals, partnerships, trusts, estates, and S corporations that participated in a reportable transaction and are required to file an income tax return or information return must file Form 8886.

Material advisors are not left out. These are individuals or entities that provide material aid, assist, or advise in organizing, managing, promoting, or executing these reportable transactions. However, they are required to report their role in these transactions by filing Form 8918.

IRS Form 8886 Reportable Transactions

We’ve mentioned reportable transactions a lot in this article. So what exactly are they?

Reportable transactions are transactions with a potential for tax avoidance or evasion. They must be reported to the IRS for review and monitored for compliance with tax laws.

These reportable transactions are classified into five different types:

- Listed transactions

- Confidential transactions

- Transactions with contractual protection

- Loss transactions

- Transactions of interest

Now, let’s look at each type in detail.

Listed Transactions

These transactions are the same or substantially similar to the ones the IRS has deemed as tax avoidance transactions. They are identified by notice, regulation, or other form of published guidance.

If your clients participate in such transactions, they must disclose them by filing Form 8886 with their tax return.

The published listed transactions list is dynamic and can change over time as the IRS identifies new schemes.

Here are examples of listed transactions on the current IRS list:

- “Son of Boss” Transactions: transactions generating losses resulting from artificially inflating the basis of partnership interests (identified as “listed transactions” on August 11, 2000).

- Lease Strips: transactions in which one participant claims to realize rental or other income from property or service contracts and another participant claims the deductions related to that income (identified as “listed transactions” on February 28, 2000).

- BOSS Transactions: Transactions involving the distributions of encumbered property in which losses claimed for capital outlays have been recovered (identified as “listed transactions” on February 28, 2000).

- Intermediary Transactions: Transactions involving the use of an intermediary to sell the assets of a corporation (identified as “listed transactions” on January 18, 2001).

You can find a full list of listed transactions in Notice 2009-59, 2009-31 I.R.B. 170, on this existing IRS guidance page. For updates to the list, check this IRS web page.

Confidential Transactions

A transaction is considered confidential when taxpayers enter a confidentiality agreement with an advisor and have paid a minimum fee.

For example, a tax advisor proposes a specific tax-saving strategy to a client, in return for a significant fee. Then he requires the client to sign an agreement. Such a client has entered into a transaction under conditions of confidentiality preventing him from disclosing the tax-saving strategy to anyone.

If your clients take part in this kind of transaction, they must disclose this information to the IRS by filing Form 8886.

It’s usually not worth investing in such tax strategies because the IRS negates any beneficial tax treatment once it identifies the strategy as a potentially abusive scheme and demands full disclosure of the confidential arrangement.

Not only would the individual or corporation be required to pay the full taxes, but severe penalties could also apply in such cases.

Transactions with Contractual Protection

This refers to specific transactions where taxpayers seek to secure the right to a partial or full refund of fees if the expected tax benefits of the transaction are not upheld.

If your clients have this kind of agreement in place, they must disclose it to the IRS by filing Form 8886.

Doing so allows the IRS to analyze these transactions which prevents potential abusive tax evasion schemes.

Loss Transactions

A loss transaction refers to when taxpayers claim a loss under section 165 of the IRS Code.

This section allows taxpayers to deduct losses incurred during the tax year that are not compensated by insurance or other means.

However, not all losses are subject to disclosure.

For any loss to be considered a reportable transaction, the amount of the claimed section 165 loss must meet certain conditions. These conditions specify threshold amounts that determine whether the loss transaction must be reported:

Here are the reporting thresholds for loss transactions according to the IRS:

- At least $2 million in any single tax year or $4 million in cumulative tax years for individuals.

- At least $2 million in any single tax year or $4 million in cumulative tax years for all other partnerships and S corporations whether or not any losses flow through to one or more partners or shareholders.

- At least $2 million in any single tax year or $4 million in any cumulative tax year for trusts whether or not any losses flow through to one or more beneficiaries.

- At least $10 million in any single tax year or $20 million in cumulative tax years for corporations (excluding S corporations)

- At least $10 million in any single tax year or $20 million in cumulative tax years. This is for partnerships with only corporations (excluding S corporations) as partners, whether or not any losses flow through to one or more partners.

The IRS requires taxpayers to look at the year they conducted the transaction and the next five years when considering whether a loss transaction meets the threshold amount.

This means if your client engages in a transaction this year, and it results in losses for this year and the next five years, you need to sum up these losses. If the combined amount crosses the IRS threshold for a loss transaction during these six years (the year of the transaction and the next five years), then it must be reported on Form 8886.

This helps the IRS monitor potentially abusive tax transactions that result in large losses over multiple years.

Transactions of Interest

There are certain transactions the IRS believes have the potential for tax avoidance or evasion.

But unlike listed transactions, there’s insufficient evidence to determine whether these transactions are tax avoidance transactions.

The IRS calls them ‘transactions of interest’ and identifies them on this IRS guidance page.

So if your clients participate in transactions that are the same or substantially similar to the ones identified in the published guidance, they must report them by filing Form 8886.

Note: The IRS regularly updates its notices and regulations to reveal new transactions of interest on this web page.

Recommended Reading

IRS Form 8886 Instructions for Filing Reportable Transactions

Knowing when and what reportable transactions to file for your clients ensures they are on the right side of the law.

But if you’re unsure whether or not your client’s transaction is reportable, simply request a ruling from the IRS.

Download our Free IRS Form 8886 Checklist Template

How to Complete IRS Form 8886

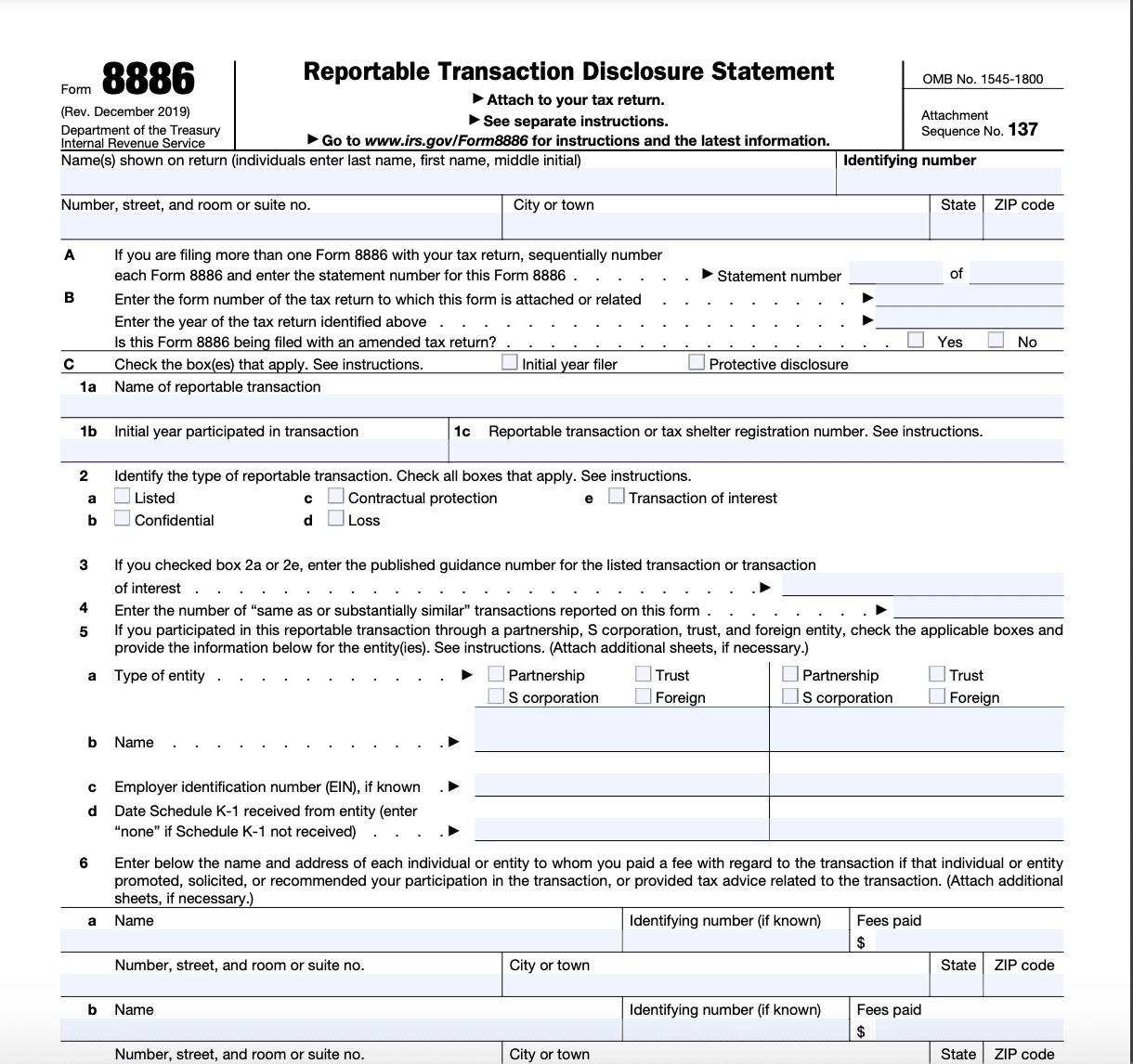

Form 8882 contains one part and two pages. Here’s a sample of what the form looks like:

[Source]

It’s important to note that the IRS is strict about rejecting incomplete forms. As such, ensure the information on the form is accurate and complete before submitting it. We cover in detail a step-by-step guide instructions for filing form 8886 here.

Now, let’s look at how to complete Form 8882 for your clients:

Step 1: Basic client information

In this section, clients are to enter their details including name, identifying number, and address.

Step 2: Tax form details

A. Participating in more than one reportable transaction requires filing a separate form and labeling each form sequentially. For example, if there were three transactions for the tax year, then three Form 8886s would need to be filed and each labeled as “statement 1 of 3,” “2 of 3,” and “3 of 3.”

B. In this line, clients enter their tax return form number and year of tax return attached. Then check the appropriate box to confirm if Form 8886 is filed with an amended tax return.

C. In this line, clients disclose whether it’s the first year of filing this Form or it’s a protective disclosure by checking the appropriate box.

1a: Enter the name of the reportable transaction commonly known as. For example, Son of Boss or Lease strips. If no name exists, provide a short description of this transaction that differentiates it from other transactions on the form.

1b: If this is the first year a client participates in a reportable transaction, enter it in year format (YYYY).

1c. This line requires entering the reportable transaction or number provided by their Material advisors.

Step 3: Reportable transaction information

- In this line, check the appropriate reportable transaction being reported.

- Choosing listed transactions or transactions of interest in line 2 requires you to provide its corresponding published guidance number.

- If your client is reporting the same or substantially similar transactions, enter the number on this line. Otherwise, file a separate form.

- Participating in reportable transactions through other entities requires indicating the type of entity it is in this line: whether it’s a partnership, S corporation, foreign, or trust.

Also, provide the entity’s full name, EIN (use hyphens when entering the EIN), and date when the k-1 schedule was received.

- In this line, clients are to provide the name, address, SSN/EIN, and approximate fees paid for each material advisor.

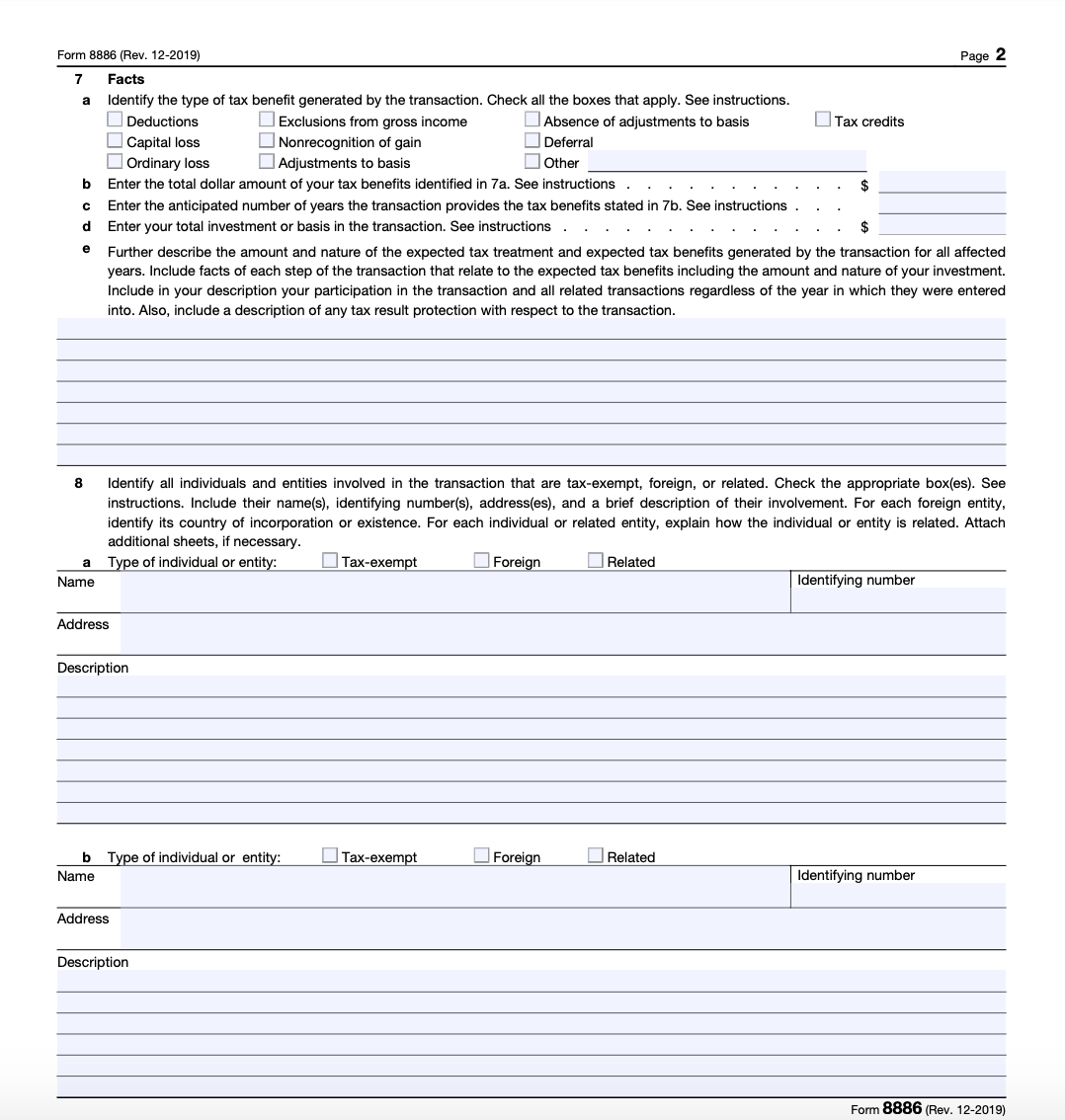

Step 4: Facts

- In this line, clients are required to check the appropriate box to identify the type of tax benefit the reportable transaction generated. If the tax benefit isn’t identified, check the “other” box and list it in the space provided.

Also, provide information such as:

-

- The anticipated total amount of all tax benefits checked in line 7a (in dollars).

- Expected number of years it will take to claim all tax benefits

- Total investment or basis in the transaction i.e. According to the IRS, this is the total amount your client paid including cash, fair market value of property or services transferred or acquired, adjustments to basis, valuation of notes, obligations, shares, or other securities.

- Lastly, clients are to describe in detail the transactions they participated in and state all the amounts, facts, and tax benefits that made it a reportable transaction.

- In this line, clients are to identify all individuals and entities involved in the transaction. Check the appropriate box to indicate if they are tax-exempt, foreign, or related. Include their names, EIN/SSN, addresses, and a brief description of their involvement in the transaction.

Also, taxpayers are to explain their relationship with each individual or entity. For each foreign entity, identify its country of incorporation.

Penalties and Consequences For Not Filing Form 8886

Taxpayers required to file a Form 8886 will face penalties if they fail to:

- Attach the form to the appropriate tax return, amended return, or application for tentative refund.

- File the form with the Office of Tax Shelter Analysis (OTSA) if required

- Include all the necessary information required or provide inaccurate information.

So what are the penalties for failing to file or incorrectly filing Form 8886?

The penalty for not reporting a reportable transaction is 75% of the amount by which the taxpayers reduced their income tax return.

However, no matter how small the 75% may be, the penalty cannot be less than $5,000 for individuals and $10,000 for other cases such as trusts or corporations.

Also note that the maximum annual penalty for not disclosing a reportable transaction, except a listed transaction, cannot exceed $10,000 for individuals and $50,000 in any other case. For listed transactions, it’s $100,000 for individuals and $200,000 in any other case.

As an accounting professional, always ensure that your clients understand the gravity of failing to file Form 8886 and its potential consequences.

Penalties for Material Advisors

Material advisors who fail to file Form 8918 on or before its deadline or if they provide inaccurate information will also face penalties.

In cases where multiple advisors are associated with the same reportable transactions, each one could receive a separate penalty if they fail to correctly file Form 8918.

So what’s the penalty?

Failure to share a list of advisees involved in a reportable transaction upon request amounts to a $10,000 penalty for each day of non-compliance, starting from the 21st business day after the IRS has requested the list.

Material advisors who disagree with the penalty can pay a portion of the penalty for a single day ($10,000) and then sue for a refund. It is known as a “divisible penalty” and can be contested in court before the full amount is paid.

Importance of Avoiding Abusive Transactions

Abusive transactions often involve complex structures designed primarily to evade tax laws and regulations.

As such, accountants and material advisors must maintain the highest level of professionalism and ethical standards, particularly when dealing with reportable transactions.

The immediate financial benefits might seem appealing, but there could be severe consequences for engaging in such transactions for both you and your clients such as:

- Heavy Penalties: The IRS can impose severe financial penalties on the taxpayer and the advisor for failing to disclose reportable transactions or for incorrectly filing the forms.

- Legal Consequences: Involvement in abusive transactions may lead to legal action and potential criminal charges. It can result in severe fines and even imprisonment.

- Reputational Damage: Any association with potentially abusive transactions can harm your accounting firm’s reputation. It will impact future business opportunities and client relationships. It may also lead to losing your professional license.

- Scrutiny from the IRS: You and your clients could come under increased scrutiny from the IRS in the future, leading to extensive audits and investigations.

Given these potential consequences, you must exercise due diligence and caution when advising on or participating in any reportable transaction.

Streamline your accounting firm with Financial cents

Handling finances for your clients goes beyond mere number crunching. It involves mastering current financial regulations, ensuring compliance with local and international tax laws, and providing advisory services on ethical issues.

It makes you more valuable and puts you in a better position to land more clients for your accounting firm.

But relying on traditional methods to file tax forms as well as manage accounting tasks is stressful and time-consuming.

To save time, work more efficiently and increase productivity, use accounting software like Financial Cents. It’s designed to help you streamline operations, manage clients, and collaborate with your staff.

Ready to see how it works?

Instantly download this blog article as a PDF

Download free workflow templates

Get all the checklist templates you need to streamline and scale your accounting firm!

Subscribe to Newsletter

We're talking high-value articles, expert interviews, actionable guides, and events.

Key Features Your Accounting Client Portal Must Have

By utilizing a client portal, you can eliminate the inefficiencies of manual methods and create a smoother workflow for both you and…

May 15, 2024

The 5 Best Avii Workspace Alternatives for Modern Firms

If, for whatever reason, Avii does not meet your long-term workflow needs, this review of the best Avii workspace alternatives should help…

May 08, 2024