The more we advance in technology, the more it breaches our privacy, and the more we value said privacy. That’s why people are turning to certain measures to regain their privacy. E.g. cell phones over smartphones, burner phone numbers, anonymous social media accounts, Virtual Private Networks (VPNs), and privacy-focused web browsers.

In the finance world, departments like the Internal Revenue Service (IRS) also respect and protect taxpayers’ privacy. They keep tax information secret and ensure only the owners can access them. Any unauthorized release of this information is a crime and is punishable by the law.

But there are some exceptions to this rule. According to the IRS, the following entities may receive tax information:

- Certain State agencies responsible for tax information

- Law enforcement agencies for investigation and prosecution of non-tax criminal laws.

- Official tax administration investigations to third parties if necessary to obtain information that is not otherwise reasonably available

- SSA about Social Security and Medicare tax liability if necessary to establish the taxpayer’s liability.

- Powers of attorney and other designees.

The last group — powers of attorney and other designees — is what we’re addressing in this article. It gives professionals like you access to your client’s records for different purposes. For instance, filing tax returns, bookkeeping, tax advice, or financial planning.

Now, the IRS can release this information to you in two ways: either by filing form 2848 or form 8821.

Let’s see what each form is about and which to go for in certain situations.

What is IRS Form 8821?

Form 8821, Tax Information Authorization, is the form that individuals, corporations, firms, etc., — taxpayers in general — use to grant third parties access to their otherwise confidential tax records.

The taxpayer can also decide to grant access only to certain information, like type of tax info and years, with this form. So, if your client doesn’t want you to access their income tax of 5 years ago, they can specify that on the form.

On the other hand, Form 2848, Power of Attorney and Declaration of Representative, is a legal document that an individual or business uses to grant authority to a tax professional to act on their behalf in dealings with the IRS.

While this form also grants the third party access to restricted records, the key difference from form 8821 is that it permits a designated individual to represent (and make decisions for) the taxpayer.

This makes the scope of form 8821 more limited. But it still has its uses and is the preferred form in certain circumstances.

If form 2848 is more ideal for for your engagement with your client, we discuss in detail all you need to know about IRS Form 2848 – Power of Attorney in this guide. If you need a detailed step by step form 8821 instructions for filing check here.

Reasons to File IRS Form 8821 Instead of Form 2848

There are times when your client’s requirements don’t warrant filing form 2848, just form 8821. Such requirements include if…

1. The client only wants you to access tax information without acting on their behalf. Sometimes, your client only needs tax advice from you. They don’t want you to sign and file documents, respond to IRS notices, or appear before the IRS on their behalf. In this case, you only need to file form 8821. It’ll provide you with the information you need to give them tax advice.

2. You and your client can agree on a validity period. Form 8821 allows your client to establish a validity period i.e. an agreed upon time frame for you to access their information. Beyond that time limit, the system revokes your access.

Some individuals and businesses prefer this option, as it gives them control over their tax information. It also ensures your access (plus the services you provide) aligns with their needs.

However, if you and your client didn’t have a previously agreed-upon date before filing, not to worry, the form has an expiration date of 7 years. This means it automatically expires after 7 years, unlike form 2848, which requires you or the client to cancel it manually.

The client only wants you to receive the IRS notice sent to them. With this form, you can get copies of current notices the IRS sends to your clients within the validity period. It could even come a few days before theirs, so you have more time to review beforehand and help them with any issue they might have.

3. You want to list your firm as an appointee. Unlike form 2848, you can allow your entire firm, rather than a specific individual in your firm, access the client’s tax information. This comes in handy if multiple professionals will work on the client’s project, and they all need to access the information. Or if one employee is busy and you need to assign someone else to the case. With form 8821, you can list your firm as an appointee, meaning any of your employees can access the tax records.

4. If your client is hesitant to sign a complicated form. Since the aim of form 8821 is to give access to information, the overall process of filling it out is more straightforward than form 2848. It doesn’t require as much detailed information and is a one-page form.

Clients usually feel more comfortable signing this form. This is because it’s easier to fill and speaks to their need for privacy. They don’t have to worry about giving you too much access to their personal information.

When Should You File IRS Form 8821?

You should file form 8821 for your client in the following cases.

Filing a tax return

While people can file their tax returns themselves, sometimes, they have issues with it. So, they opt for an expert like you to guide them. In such a case, you might need to view their past tax records for reference or clarification on specific items leading you to file form 8821.

Amending tax return

Another time to file this form is when making changes to a previously filed tax return because of an error or changes in tax situation. Access to relevant tax information will assist in completing the amended return. And also ensuring it’s accurate and compliant with the IRS requirements.

Tax planning and advisory services

In general, you should file form 8821 for all your clients. This is because every client’s case is unique, and so when consulting for them or helping with their taxes, generic advice won’t do. Accessing their tax history, income records, deductions, credits, and other relevant details helps you tailor tax strategies, provide sound advice, and make informed decisions for the client.

Resolving tax issues

Tax issues come up all the time and for various reasons. Poring over tax records is necessary as it could help you identify any potential error that could have contributed to their tax issues. This will help you develop a strategic approach to resolve said issues.

Onboarding new tax clients

As said earlier, filing form 8821 should be a part of your client onboarding process. It provides you with a comprehensive understanding of the client’s tax situation from the onset. Hence, you have a solid foundation for providing ongoing tax services for them.

Now that we’ve gotten that out of the way, let’s look at the actual filing for the form.

You may be interested in:

What You Need to File IRS Form 8821

There are two parts to what you need. The first is your information since you’re who the client is granting access to. The second is the client’s information.

If you’re the one completing and filing the form, here’s what you need:

1. Taxpayer information: This is your client’s name, address, Taxpayer Identification Number(s) (TIN), and telephone number. To make getting this information easier, you can consider sending a tax preparer checklist to clients.

2. Designee Information: This includes your name, address, Centralized Authorization File (CAF) number, Preparer Tax Identification Number (PTIN), Telephone number and Fax number. If you don’t have a CAF number, just write “none” in the field, and the IRS will issue one within weeks. Read this guide for how to get the IRS to issue you a CAF number.

Note: The client can have more than one designee. Although the form only has two slots for this, if you want to add multiple designees, attach a separate sheet of their information to the form. Ensure you tick the box at the top confirming you attached a list.

3. Tax information: You also need to fill in the type of tax information access your client agreed to provide i.e. Income, Employment, Payroll, Excise, Estate, Gift, Civil Penalty, Sec. 4980H Payments, etc. Then, the tax form number, validity period, and specific tax matters you’re handling (if applicable).

4. Client Consent: Finally, your client’s signature, acknowledging and granting the authorization. As well as the date of signing.

If your client is completing the form themselves, the process is similar. The only difference is that you’ll need to send your details — name, address, Centralized Authorization File (CAF) number, Preparer Tax Identification Number (PTIN), Telephone number and Fax number — to them.

Then, they fill out the remaining fields following your guidance and sign.

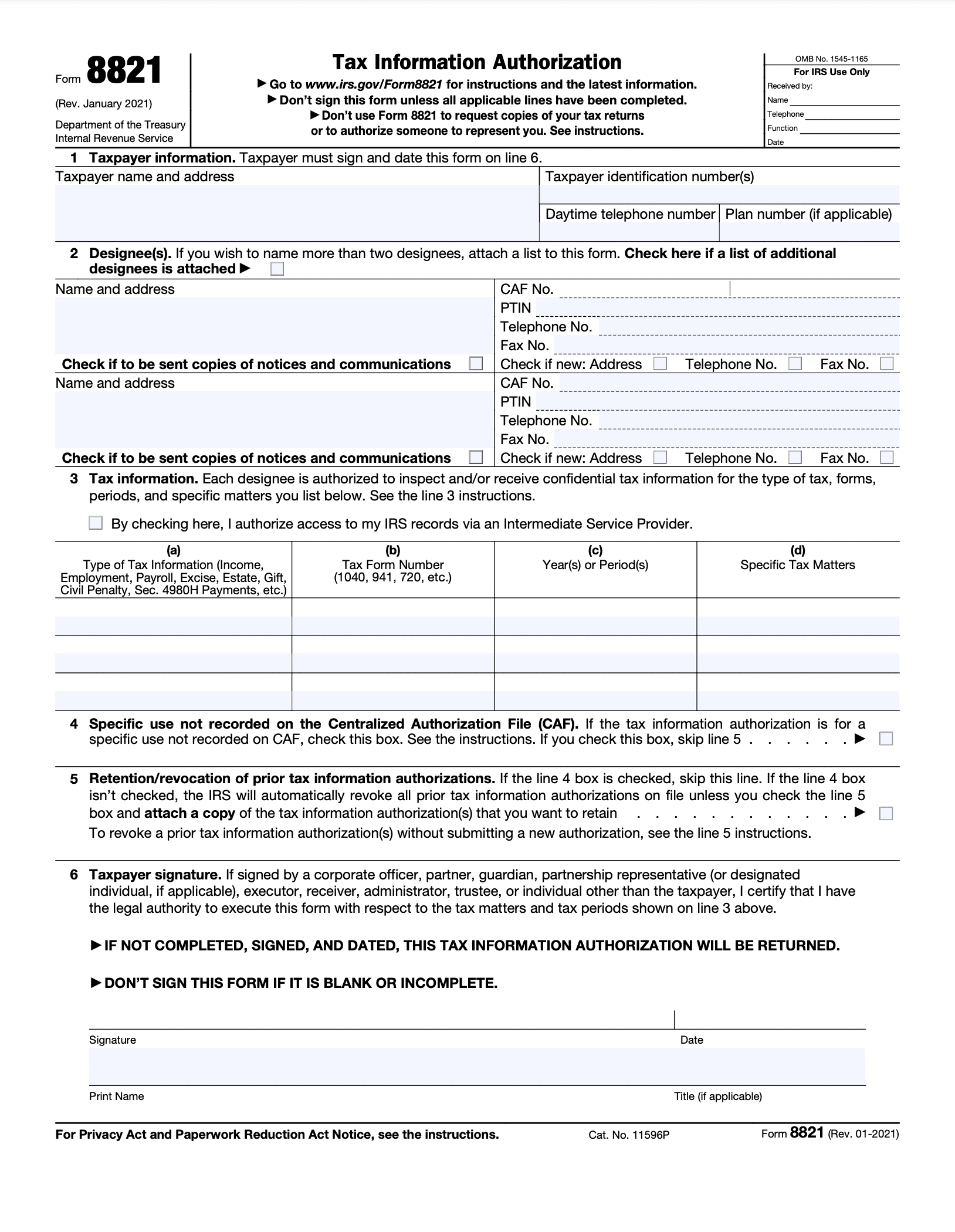

Here’s what the form looks like:

P.S. The same way you can use this form to grant access, you can also use it to revoke access. Any new form 8821 you’re submitting supersedes previously filed ones and revokes their access. So, if you still want previous appointees to have access, tick the “line 5” box, and attach a copy of their information to the form.

After completing form 8821, ensure you submit it to the IRS within five weeks. It’ll take them about 5 weeks to review and authorize it.

Final Thoughts

Filing IRS form 8821 is straightforward and is something you should do for all your clients. It ensures you provide the best and most personalized service for them.

However, don’t take advantage of the opportunity. Respect their privacy and protect their sensitive information. If you list your firm as an appointee, ensure no one in your firm is abusing this power.

Remember, the law protects this information for a good reason. Violating this protection can carry legal consequences.

If you need help organizing your work and tracking clients, turn to Financial Cents. Accountants and bookkeepers love us because of how easy we make their lives.