Most people will scrunch up their faces at the thought of filing taxes but not you. That’s because your clients depend on you to make their lives easier and in some cases proffer solutions that help them reduce tax liability or qualify for certain tax benefits.

This rings true, especially in estate planning where your job is to ensure regulatory compliance and provide guidance on strategic decisions that can impact your client’s legacy especially when it relates to planning and recovering estates.

It might seem unusual for an accountant or CPA to be involved in matters of estates, but accountants and CPAs are essential partners in estate planning, and this is why Form 8855 is of utmost importance for tax benefits.

We want you to be better equipped at handling your client’s business that’s why we’re breaking down everything you need to know about Form 8855 in this article.

At the end of this article, you will understand what IRS Form 8855 is all about, how to file it, the information needed to file as well as the benefits that your clients can enjoy from filing it.

What is IRS Form 8855?

IRS Form 8855 is an election form that allows a Qualified Revocable Trust (QRT) to be treated as part of the decedent’s estate for federal tax purposes.

It is essentially a choice that the trustees and executors of an estate can make to treat an electing trust as part of the estate of a deceased for income tax purposes – essentially to make section 645 election.

This election can be beneficial in several situations, such as when the QRT holds assets that would otherwise be subject to estate tax or when the executor wants to simplify the estate administration process.

This election allows a QRT to be treated and taxed as part of its related estate for income tax purposes during the election period. Once the election is made, it is irrevocable.

Section 645 Election: What Are The Tax Implications?

Choosing to make a Section 645 election presents several advantages, simplifying the complexities of estate and trust administration. The process of filing tax returns becomes more manageable, requiring only one combined return instead of separate filings for the trust and the estate.

This reduced paperwork translates into less time and effort dedicated to tax preparation, freeing up resources for other essential tasks.

While this is laudable, a Section 645 election can have several tax implications, both positive and negative.

Let’s start with the positives:

- Simplified estate administration: Combining the QRT with the estate for tax purposes can simplify the administration of the estate and reduce the administrative burden on the executor and trustees.

- Tax deductions and credits: The QRT may be able to take advantage of certain tax deductions and credits that would not be available if it were treated as a separate entity. For example, the QRT may be able to deduct charitable contributions that are made from its assets.

- Reduced tax liability: The election may result in a reduced tax liability for the estate and its beneficiaries. This is because the QRT’s income and deductions are combined with the estate’s income and deductions, which can result in a lower overall tax rate. For example, a married couple with a QRT can use Form 8855 to elect to have the QRT treated as part of the estate of the first spouse to die. This can allow the surviving spouse to take advantage of the estate tax exemption.

- Avoid probate: The election can help to avoid probate for the assets in the QRT. This is because the assets in the QRT are treated as part of the estate for tax purposes, which means that they are not subject to probate when the grantor of the trust dies. A client with a disabled child can use Form 8855 to elect to have the QRT treated as part of their estate. This can help to ensure that the child’s needs are met after the client’s death.

Now to the negative impact:

- Limited asset sales: The election can make it more difficult to sell assets from the QRT. This is because the assets in the QRT are treated as part of the estate for tax purposes, which means that they are subject to the same capital gains tax rules as the assets in the estate.

- Limited asset distributions: The election can limit the ability to distribute assets to the beneficiaries of the QRT. This is because the assets in the QRT are treated as part of the estate for tax purposes, which means that they are subject to the same income tax rules as the assets in the estate.

Now that you’re aware of the benefits and drawbacks, you’re possibly wondering if it’s worth pitching to your client. Before you make the call or send the email, there are considerations you should look at to determine if this is the best course of action for your client.

Form 8855: Considerations for Making a Section 645 Election

The decision of whether or not to make a section 645 election is a complex one, and it should be made on a case-by-case basis after careful consideration of all of the relevant factors. Here are some factors to consider:

The size and complexity of the estate

The election may be more beneficial for larger estates with significant income as they can benefit from the increased deductions and reduced tax burden.

Consider two estates: Estate A, with a moderate income of $250,000 per year, and Estate B, with a substantial income of $1 million per year. Both estates have qualified revocable trusts (QRTs) established for estate planning purposes.

Estate A, with its relatively modest income, may not find the Section 645 election as advantageous. The potential tax savings from combining the income and deductions of the QRT and the estate may be relatively small. Additionally, the reduced flexibility in asset sales and the increased complexity of tax return filing may outweigh the potential benefits.

In contrast, Estate B, with its significantly higher income, is more likely to reap the benefits of the Section 645 election. The potential tax savings from combining the income and deductions of the QRT and the estate can be substantial. Additionally, the administrative efficiencies gained from streamlined tax management and recordkeeping can be more noticeable for a larger estate.

The types of assets in the QRT

The election may be less advantageous for estates with a high proportion of illiquid assets, as the restrictions on asset sales can limit flexibility.

Consider an estate with a significant portion of its assets invested in real estate and closely held businesses. These assets are considered illiquid, meaning they cannot be easily converted into cash. The Section 645 election may not be beneficial for this estate because it could restrict the ability to sell these illiquid assets.

The Section 645 election could make it more difficult to sell these assets without incurring substantial capital gains taxes. This could limit the estate’s ability to raise cash for unforeseen expenses or investment opportunities.

The expected tax liability of the estate

If the estate has substantial deductions or credits, the election can potentially lower the overall tax liability by allowing the estate to utilize these benefits.

The needs of the beneficiaries

If the beneficiaries have immediate financial needs, the election may not be suitable as it can restrict distributions.

You may be interested in

Form 8855: Why You Should File

Form 8855 can be a valuable tool for your clients, offering flexibility and potential tax savings and as an accountant or bookkeeper, you play a vital role in helping your clients achieve their financial goals.

Here are some reasons why you should advise your clients to file based on their unique needs:

Tailoring Distribution to Beneficiary Needs

The flexibility offered by Form 8855 allows individuals to customize the distribution of assets based on the unique needs and circumstances of their beneficiaries. For example, if there are minor beneficiaries, the election can facilitate the establishment of trust structures to manage and control the distribution of assets until the beneficiaries reach a certain age or milestone.

Strategic Use of Credits and Deductions

Form 8855 enables individuals to strategically use available tax credits and deductions (e.g. unified credit, credit for charitable deductions, deduction for marital transfer, etc) to minimize the overall tax burden on the estate. This might involve coordinating the timing of asset transfers and leveraging the benefits of various tax provisions to achieve the most favorable outcomes.

Avoidance of Probate

Form 8855 can contribute to the avoidance of probate for the trust assets included in the estate. This can lead to faster and more private distribution of assets to beneficiaries, bypassing the often time-consuming and public probate process.

Preservation of Family Wealth

For high-net-worth individuals, Form 8855 can play a key role in preserving family wealth by optimizing the tax implications and ensuring a more strategic and tax-efficient transfer of assets to the next generation.

Long-Term Legacy Planning

Clients can engage in comprehensive, long-term legacy planning by leveraging the benefits associated with Form 8855. This includes considerations for the financial well-being of heirs and the establishment of a lasting legacy under the client’s wishes.

Recommended Resource:

IRS Form 8855 Instructions: Information and Documents Required

When making preparations to file IRS Form 8855, you will need to gather all necessary information to make the process seamless.

Luckily, we’ve prepared a customizable and Free IRS Form 8855 Checklist Template to help you avoid any potential hitches.

Let’s look at all the information you’ll need.

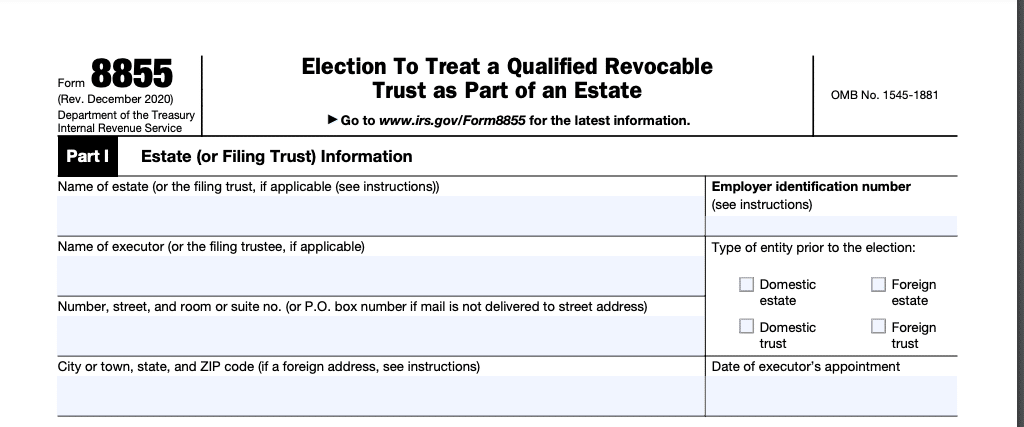

Information about the estate: For the first part of the form, you’ll need to include the details of the filing estate.

- Name of the estate (or the filing trust, if applicable)

- Names of the Executor

- Employer Identification Number

- Entity type prior to the election (Domestic estate, domestic trust, Foreign estate, foreign trust)

- Executor’s date of appointment

- Mailing Address

- Dated signature of executor or filing trustee (s)

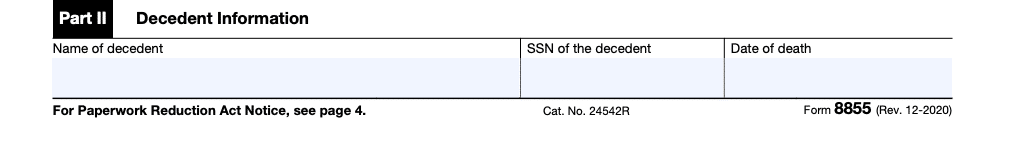

Information about the decedent: For the second part of the form, you’ll need to include information about the deceased owner who created the revocable (now irrevocable) trust.

- Name of decedent

- Social Security Number (SSN) of decedent

- Date of death

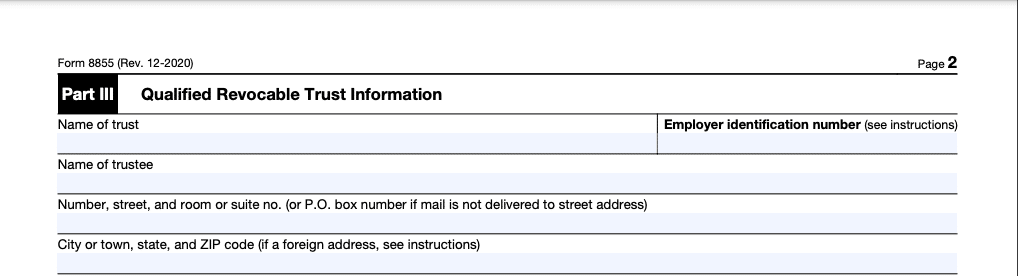

- Name of trust

- Name of trustee

- Employer identification number

- Address

- Dated signature of trustee (s)

If the QRT has multiple grantors or trustees, you may need to gather the information and signatures of all of them but note that only one executor or trustee must sign Form 8855 on behalf of the entity, unless otherwise required by applicable local law or the governing document.

Once you have gathered all of the necessary information and documents from your clients, you can begin preparing and filing Form 8855.

Instructions to Complete Form 8855

Your role as your client’s accountant or bookkeeper may require you to assist your clients in completing Form 8855.

Firstly, get the form and fill out the required information for your respective client.

Get the form here: https://www.irs.gov/pub/irs-pdf/f8855.pdf

Next, confirm the appropriate place where it will be filed depending on the state.

The following states file at the Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999:

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin

These other states file at the Department of the Treasury, Internal Revenue Service Center, Ogden, UT, 84201:

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming, a foreign country or a U.S. possession.

Lastly, file the form by the due date of Form 1041 for the first tax year of the related estate (or the filing trust).

Walk Through These Steps Once You’re Ready to File

- Understand Eligibility Criteria: Before initiating the form, ensure that the client’s trust meets the eligibility criteria outlined in the instructions for Form 8855.

- Gather all relevant information: Collect all the necessary financial information from your client, including income, expenses, assets, and tax transactions related to the QRT and the related estate.

- Review the instructions carefully: Thoroughly examine the instructions provided with Form 8855 to fully understand the requirements and guidelines for completing the form accurately.

- Complete the form with precision: Fill out the form with accurate and complete information, utilizing the gathered financial data. Ensure that all details are entered correctly and no required fields are left blank.

- Review the completed form: Before submitting the form to the IRS, carefully review the entire document to check for any errors or omissions. Double-check the accuracy of all information and ensure consistency throughout the form.

- Sign and date the form: Once you are satisfied with the accuracy and completeness of the form, sign and date it appropriately. The signature should be from the trustee(s) of the QRT and the executor of the related estate, if applicable.

- Submit the form to the IRS: File the completed and signed Form 8855 with the IRS by the due date. The form can be submitted electronically or through mail.

- Provide Supporting Documentation: Include any required supporting documentation or additional forms, to substantiate the information provided on Form 8855.

- Double-Check for Accuracy: Conduct a meticulous review of the completed form to catch any errors or omissions. Accuracy is crucial to avoid potential issues with the IRS.

- Retain Copies of filed Documents: Make copies of the filed forms for your records and possibly the trustee or executor of the related estate.

Wrapping up

Navigating the complexities of estate planning and tax implications requires expertise and attention to detail.

Our accounting practice management software can make the processes easier with a centralized platform that streamlines your firm’s operations, enhances efficiency, and delivers exceptional service to your clients.

Use Financial Cents Accounting Practice Management Software to manage your firm.