Running an accounting firm (or any business, for that matter) can feel like going from one challenge to another.

Thankfully, the technology landscape has grown so big that there is an accounting application for any challenge you’ll face now or in the future.

This article spotlights some of the best applications helping accounting and bookkeeping firms like yours solve their biggest challenges.

We hope it helps you choose your tech stack more intentionally rather than getting distracted by shiny new tools.

Key App Categories for Accounting & Bookkeeping Professionals

1. Accounting & Bookkeeping Software

This foundational software tracks your client’s financial transactions to ensure accurate reporting and decision-making.

Without these software solutions, you’ll have to record and track transactions manually, which breeds human error and incorrect tax returns.

2. Practice Management Tools

This software centralizes your work, client, and team information to keep your processes efficient, your team productive, and your clients satisfied.

While most of these solutions integrate with other relevant tools, few, like Financial Cents, provide all-in-one features so that you can use as few third-party integrations as possible. Skip to the Financial Cents features reviewed below to get an idea.

With the right practice management solution, your team can find information faster, make decisions quicker, and do the work that grows the firm more confidently.

You should read this: Integrating Accounting Applications with Your Practice Management Software.

3. Time Tracking & Billing Software

Time can neither be hastened nor revised. It can only be maximized. That is what time tracking helps you achieve by monitoring the time your team members spend on client projects.

Naturally, this should help you eliminate time-wasting activities and adjust your workflow to get the most out of your firm.

Similarly, the ability to bill clients gets you paid adequately and on time. This helps you compensate your staff enough to boost morale and work/life balance.

4. Communication & Collaboration Apps

At the bottom of all ineffective teams and client communication are challenges that a cloud application can solve by centralizing work and client information in one place.

With communication and collaboration apps, you can exchange files and information and discuss projects with your team and clients in real time.

This puts everyone involved in a project on the same page and helps projects move faster and turn out more accurately.

5. Client Management

As your firm grows, storing client information and staying on top of client communication will be hard.

The client management solution organizes client information, documents, projects, and everything needed to serve them satisfactorily in one place.

In Financial Cents, all information (big and small) is stored in the Client Profile. When done well, your team will always find the files and information they need to complete client work on time, enhancing your team’s efficiency.

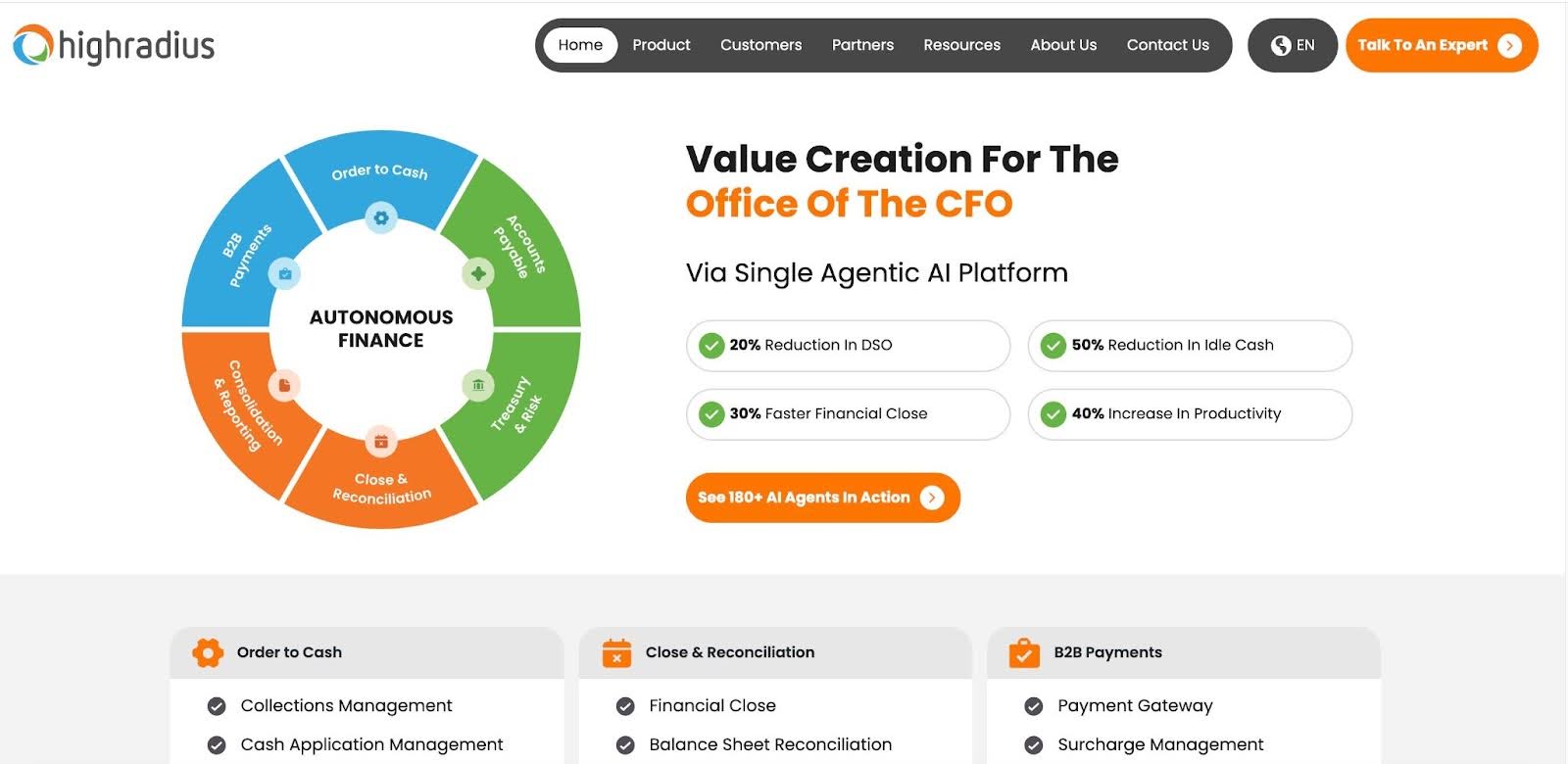

6. Accounts Payable & Receivable

AP/AR software tracks the money coming in and going out of your firm. As for AP, your team is better equipped to pay only the invoice (and amount) that needs paying through a strict invoice approval workflow.

With AR, this software streamlines your receivable collection process to ensure you’re paid the amount you’re owed on time. They improve cash flow and liquidity by shortening the order-to-cash cycle and reducing your day sales outstanding (DSO).

7. Payroll

The Payroll software ensures that full-time and part-time employees are paid accurately, on time, and through the right channel.

A solid payroll system automatically calculates salaries and employee benefits while withholding taxes and pensions.

This makes it easier and quicker to run payrolls according to the relevant tax and regulatory requirements.

What are the Best Apps for Accountants & Bookkeepers?

1. Accounting & Bookkeeping Software

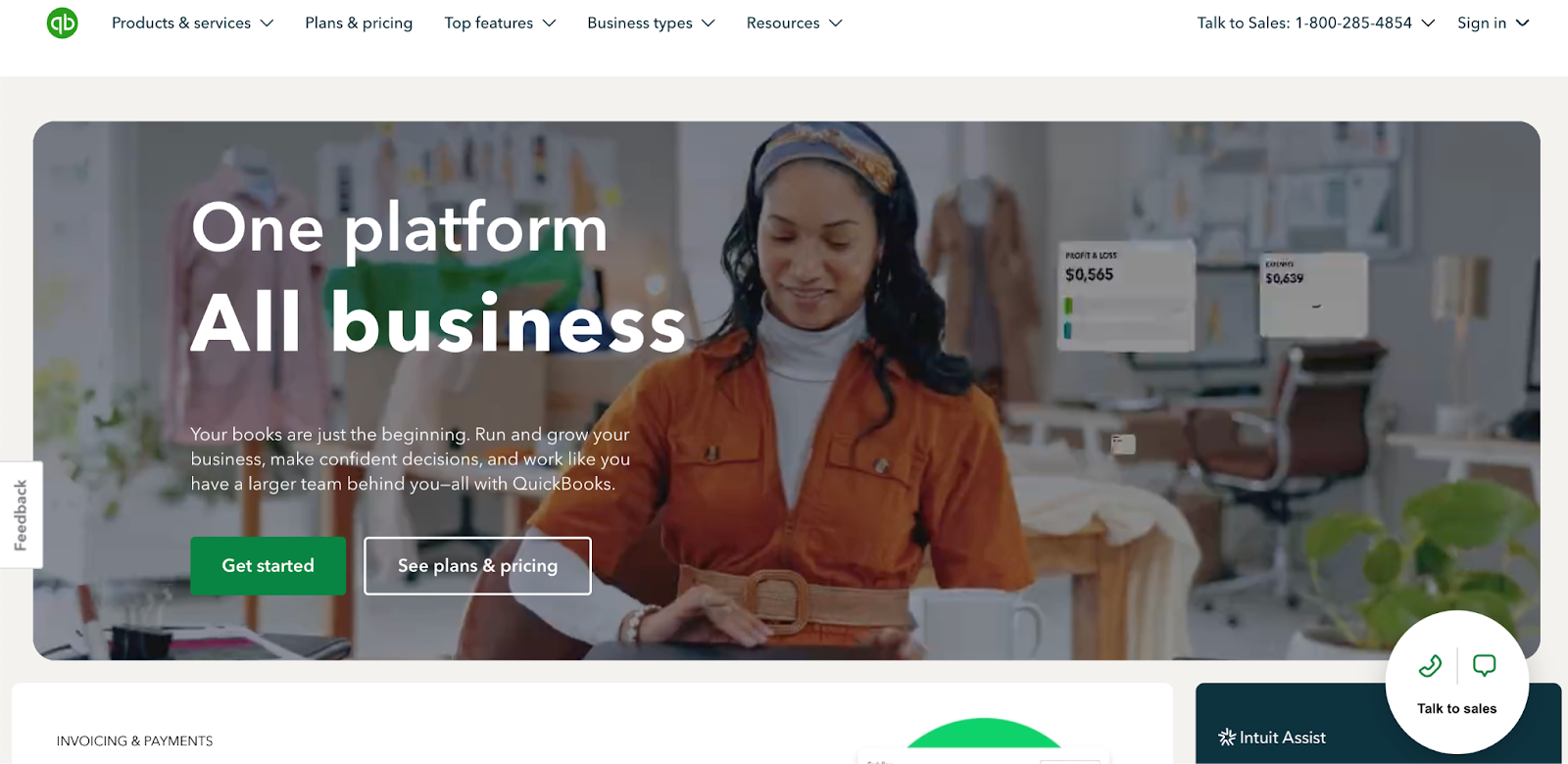

QuickBooks

QuickBooks simplifies financial management by tracking income and expenses, enabling businesses to understand their finances and stay ready for tax regulatory compliance.

It also equips accounting professionals with real-time insights, secure data management, and scalable solutions to meet diverse client needs.

Here are QuickBooks’ key features and their benefits:

Invoicing

- Payment Processing: You can send bills and track invoice statuses in real-time to ensure timely payments.

- Invoice Templates: Use customizable invoices and estimates to speed up your invoicing workflow.

- Invoice Tracking: QuickBooks Online Accountant provides visibility into your clients’ invoicing activities.

Expense Tracking

- Income Tracking: Track clients’ income and expenses to help them make the right decisions.

- Picture Upload: Clients can snap and upload receipts using the mobile app.

- Cash Flow Insights: Provide data-backed advice to help clients understand their spending habits.

Cloud Accounting

- QBO Accountant: Access and manage all your clients from one place.

- Bank Feeds: Connect your client’s bank account to QuickBooks for a free flow of transactions into QuickBooks.

Reporting

- Custom Reports: Generate custom financial reports to understand your client’s performance and the opportunities to save money and make their business more profitable.

Pricing

- Simple Start: $30/month

- Essentials: $60/month

- Plus: $90/month

- Advanced: $200/month

Ratings

QuickBooks has a

Pros

|

Cons

|

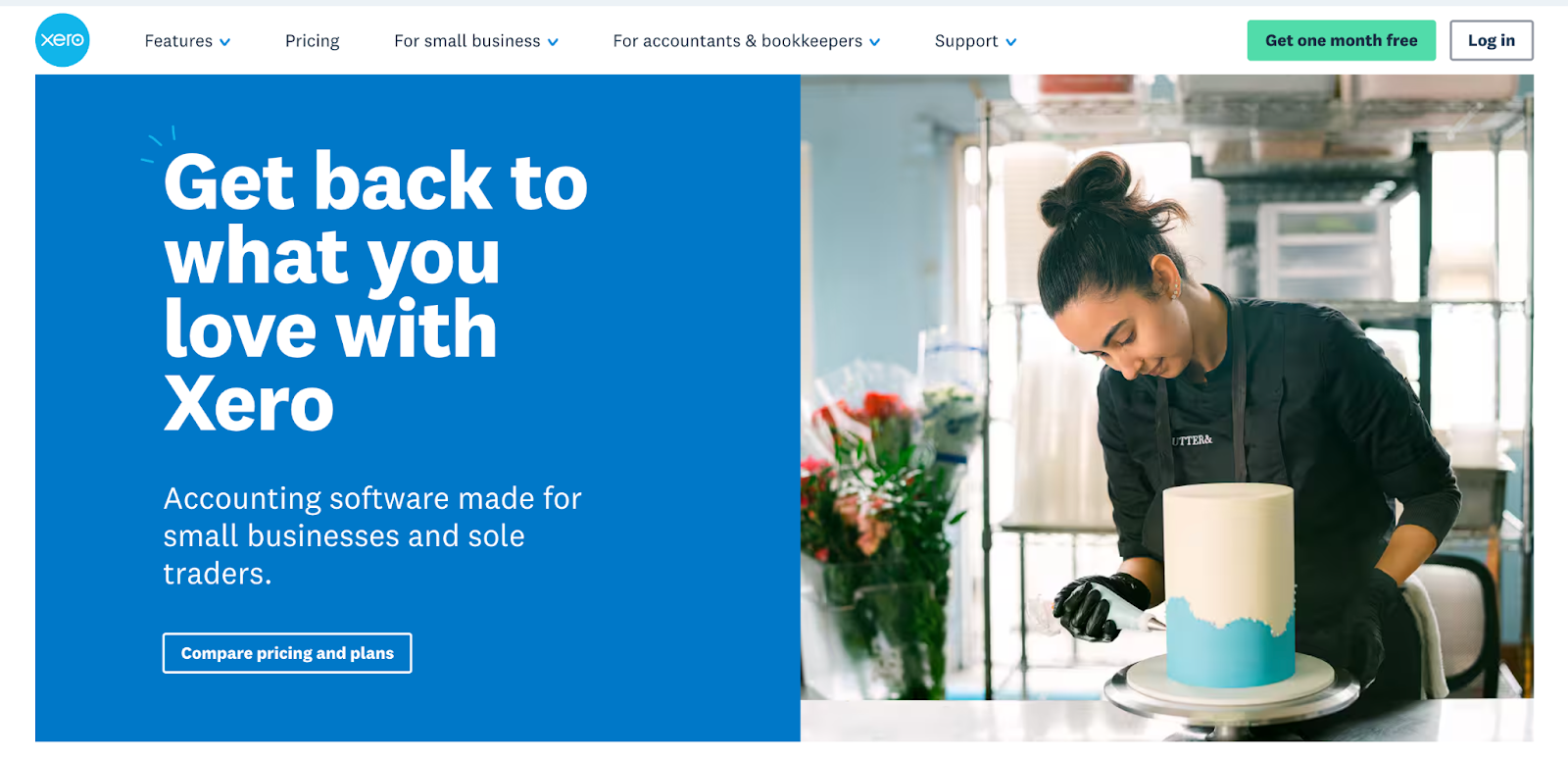

Xero

Xero is designed to help small businesses and sole proprietors organize their finances to minimize errors and enhance financial reporting.

It is more suitable for small businesses and solopreneurs with low transaction volumes (around 1,000 sales invoices and purchase bills per month).

Here are Xero’s key features and their benefits:

- Payment Processing: Supports credit cards, debit cards, and direct debit, which speeds up payment cycles.

- Online Invoicing: Create, send, and track invoices from any device.

- Automated Reminders: Helps clients remember to make payments on time.

- Bank Connections: Xero integrates with other global financial institutions for real-time bank feeds and automated reconciliation.

- Expense Management: Streamlines expense tracking, submissions, and reimbursements with intuitive tools.

- Bank Reconciliation: Keeps records accurate and up-to-date with automated matching of transactions.

- Reporting: Delivers accurate, real-time financial reports, with advisor collaboration built in for strategic insights.

Pricing

- Starter: $2.90/month per user.

- Standard: $4.60/month per user.

- Premium: $6.90/month per user.

Ratings

Xero has a

Pros:

|

Cons:

|

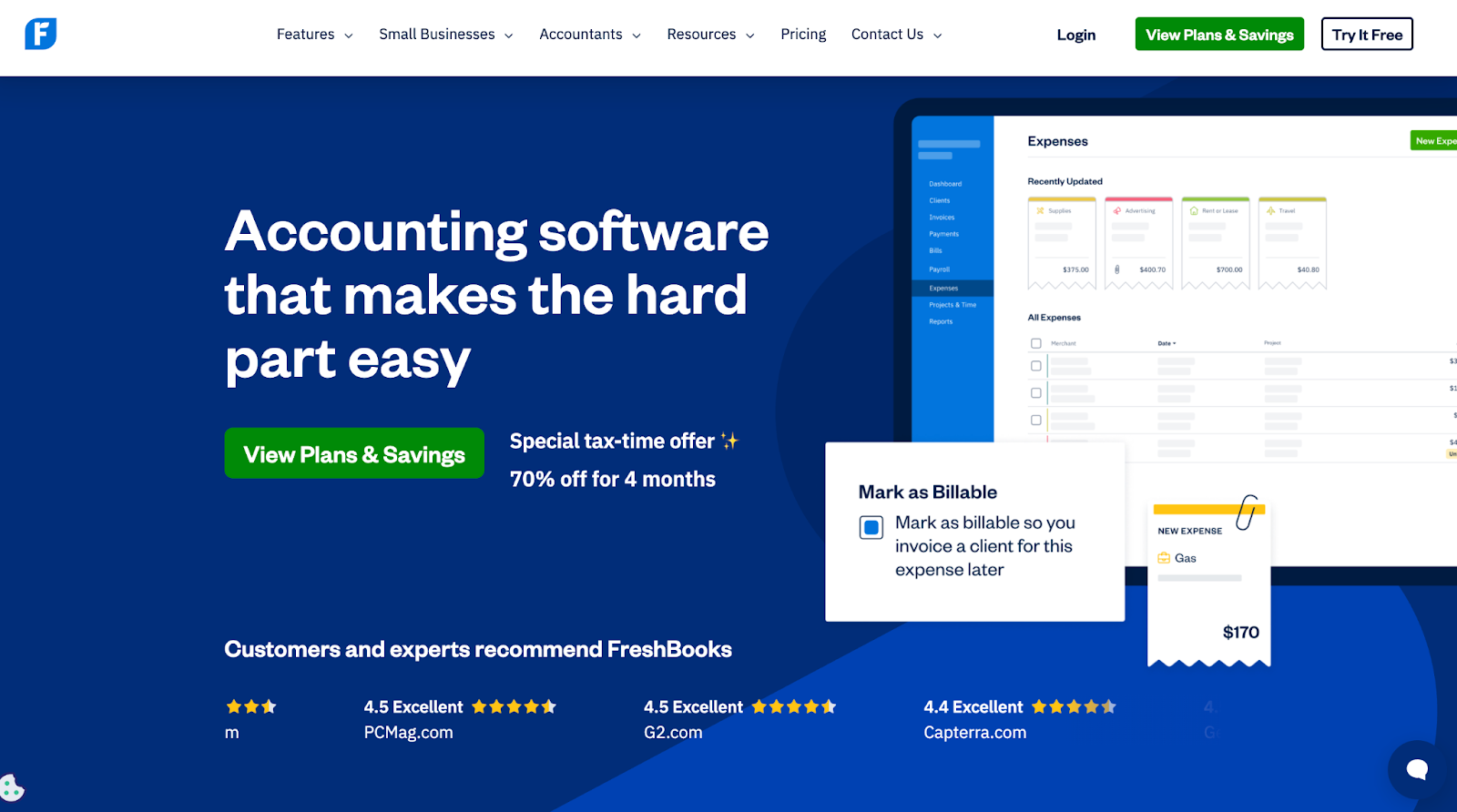

FreshBooks

FreshBooks is designed for freelancers and solopreneurs looking for an intuitive software solution to simplify and automate their accounting tasks while they focus on growing their businesses.

Here are FreshBooks’ key features and their benefits:

Invoicing

- Multiple Payment Methods: FreshBooks accepts credit cards, Apple Pay, and bank transfers, enabling clients to pay invoices faster.

- Recurring Invoices: Save time by automating invoices for repeat clients.

- Customizable Invoices: Create professional invoices with your logo, custom colors, and fonts to impress clients and reinforce your brand.

- Automatic Late Fees: Encourage timely payments by setting FreshBooks to apply late fees when overdue invoices.

- Payment Reminders: Automatically follow up with clients who forget to pay.

Expenses

- Receipt Attachments: All your receipts are stored in FreshBooks.

- Tax-Friendly Categories: Organize expenses into pre-set categories, making tax prep easier for your team.

- Easy-to-Read Summary: Monitor spending by category with a clear summary to keep your budget on track.

- Remembered Vendors: Frequently used vendors are saved for quick expense logging.

Estimates and Proposals

- Modern Proposals: FreshBooks enables you to build detailed proposals with project scope, timelines, and deliverables.

- E-Signatures: Enable clients to approve and sign proposals online, making your engagement more convenient for clients.

- Review and Accept Estimates Online: Clients can approve estimates with one click, and you can respond to feedback on the platform.

Time Tracking

- Time Tracking: FreshBooks allows team members to track while working.

- Bill for Tracked Hours: This lets you convert logged hours into invoices to bill clients accurately.

Pricing

- Lite: $6.30/month.

- Plus: $11.40/month

- Premium: $19.50/month

- Select: Custom pricing

Ratings

FreshBooks has:

Pros

|

Cons

|

2. Accounting Practice Management Tool

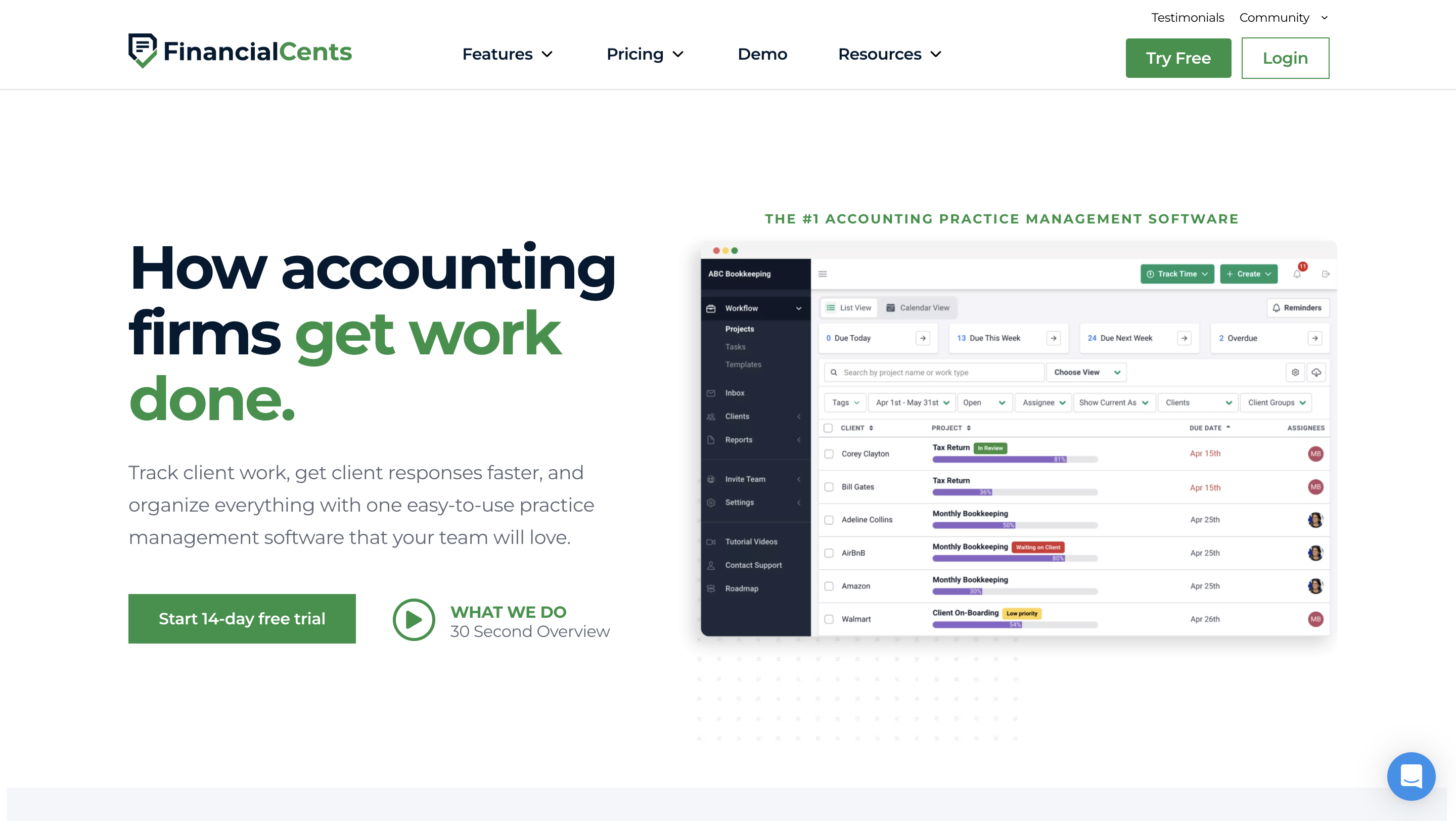

Financial Cents

Financial Cents was built to address the need for organization and collaboration in accounting teams.

Its all-in-one practice management solution enables its users to complete most of the functions of the app categories covered in this article from one place.

Here are Financial Cents’ key features and their benefits:

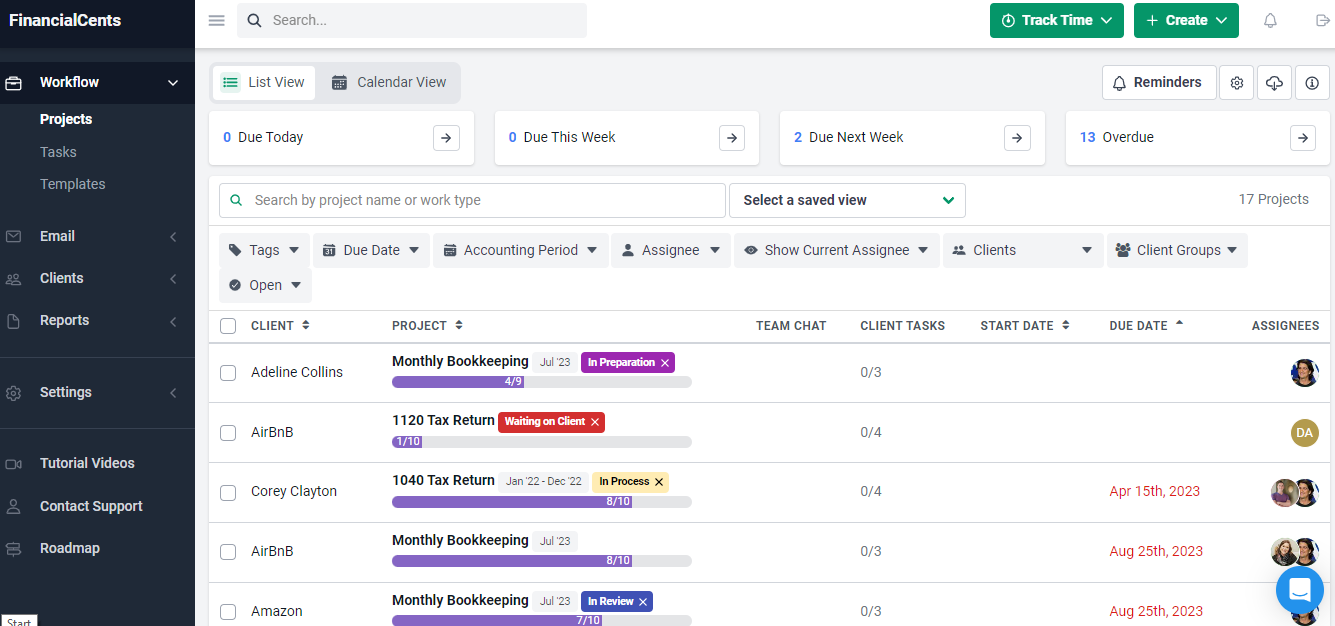

Workflow Management and Automation

- Workflow Dashboard: This displays all your projects with their assigned team members, due date, and status, helping you find the information you need to make decisions at a glance.

- Document Storage: Work-related files are stored inside the relevant projects and client profiles to make retrieval easier.

- Dependencies: automatically notify your staff when their assigned tasks are ready for them to work on.

- Workflow Filters: This lets you find work or client information in your dashboard faster.

- Workflow Templates: Make creating projects easier using prebuilt workflow checklists.

- Recurring Projects: Automatically create projects for their scheduled dates when the current copy is completed or past the due date.

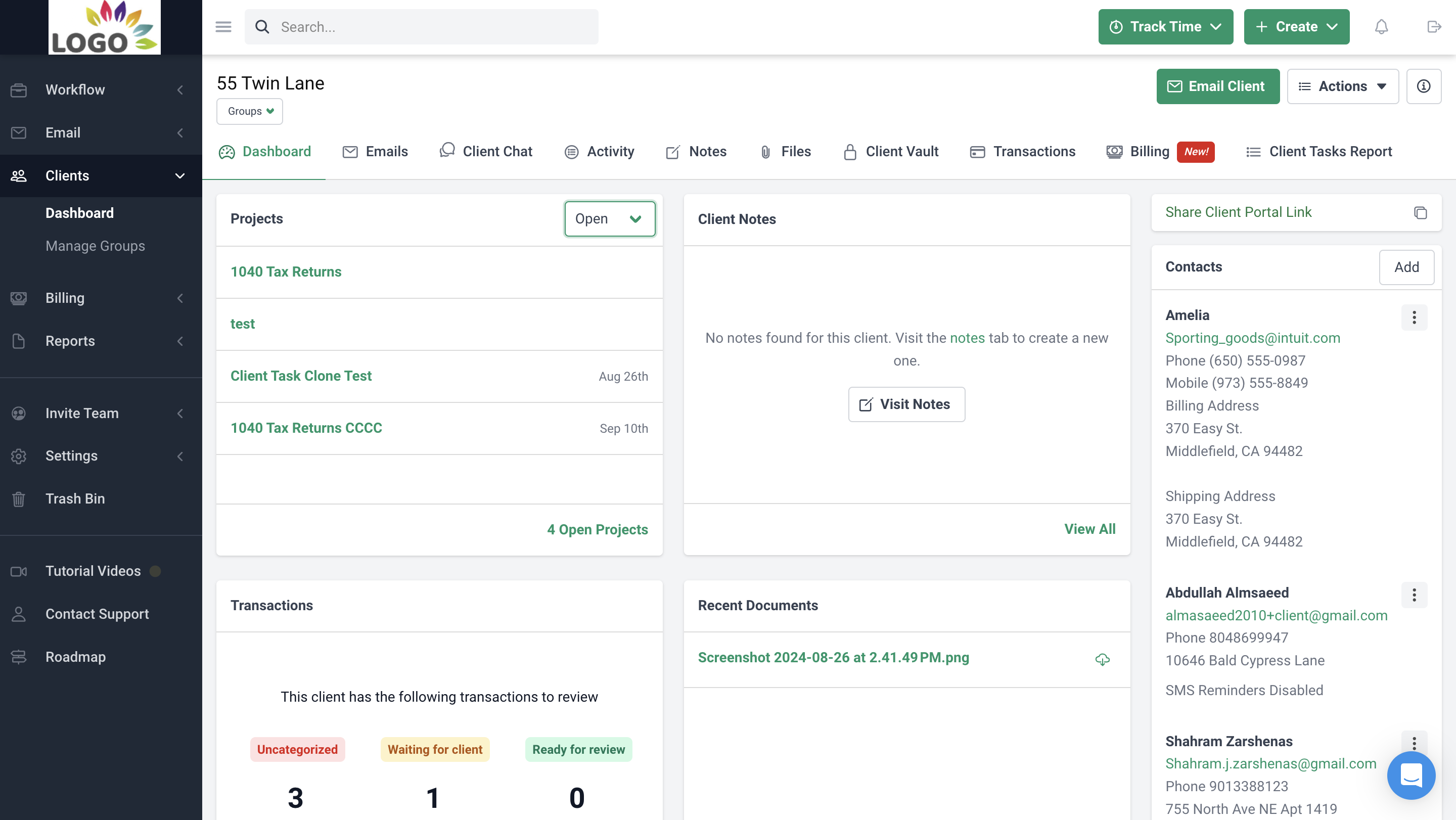

Client Management

- Client Profiles: Stores and organizes your client information in their profile, making it faster for your team members to find them.

- Client Tasks: These checklists enable you to request client information in advance.

- Auto Reminders: Financial Cents follows up with your clients on your behalf.

- Passwordless Client Portal: One secure place for clients to collaborate with you without creating usernames and passwords.

- Activity Feed: This shows when each client was last interacted with and about what.

- Client Vault: securely stores your most sensitive client data using encryption technology and other security protocols.

- Client Notes: Allow your team to share the most recent client information or updates.

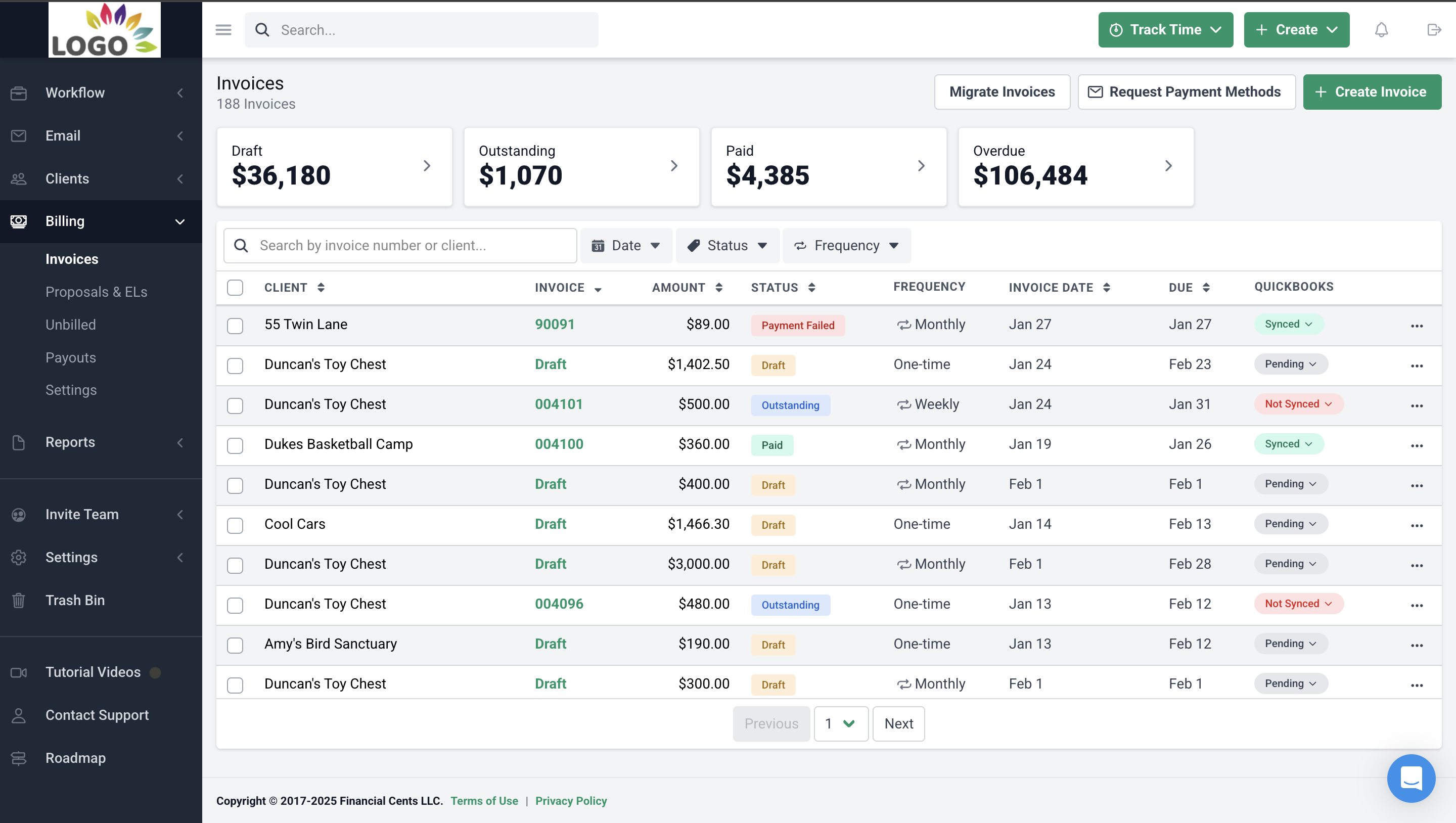

Billing

- One-Off & Recurring Invoicing: Get paid for your one-time projects or automate recurring invoices to get paid on time consistently.

- Flexible Payment Options: This gives your clients more options to pay (by ACH or credit card)

- QBO Sync: This keeps the information in your Financial Cents accounts uniform with that in your accounting software without manually entering data.

- Automated Client Reminders: Reminders will consistently go out to your clients to remind them about outstanding payments.

- Client Portal: This helps your clients track open invoices and payment history in one place.

- Advanced Permission: This enables you to determine which employees can see your client billing information.

Time Tracking

- Inbuilt Timer: enables your team to start and stop recording time for clients’ work.

- Manual Entries: This allows you to record time manually.

- Time Budgets: You can estimate the time projects will take and help your team plan their Time Better.

- Billable Rates: This lets you understand how much you are getting from serving clients.

- Billable VS Non-Billable: Monitor your time to understand how many resources are going into projects you get paid for.

- Effective Hourly Rate: See how much revenue each client is generating for your firm.

- Reporting: Provides real-time insights into how your team members spend their time.

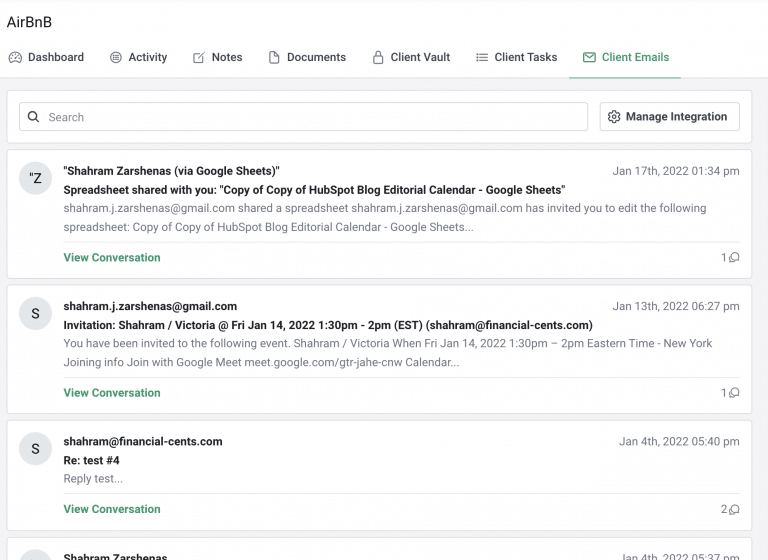

Email Integration

- Focused Client Folder: This folder pulls all client emails shared between your team and clients in Gmail or Outlook into the client’s profiles, giving you visibility into client communication.

- Pinned Emails: Financial Cents allows you to pin important emails to their respective projects, giving your team the context to work.

- Turn Emails to Projects: You can turn ad hoc client requests (by email) into projects in your dashboard, keeping requests from clients from slipping through the cracks.

- Two-way sync with Gmail and Outlook: All read, sent, or archived emails are read, sent, and archived in your Gmail and Outlook accounts.

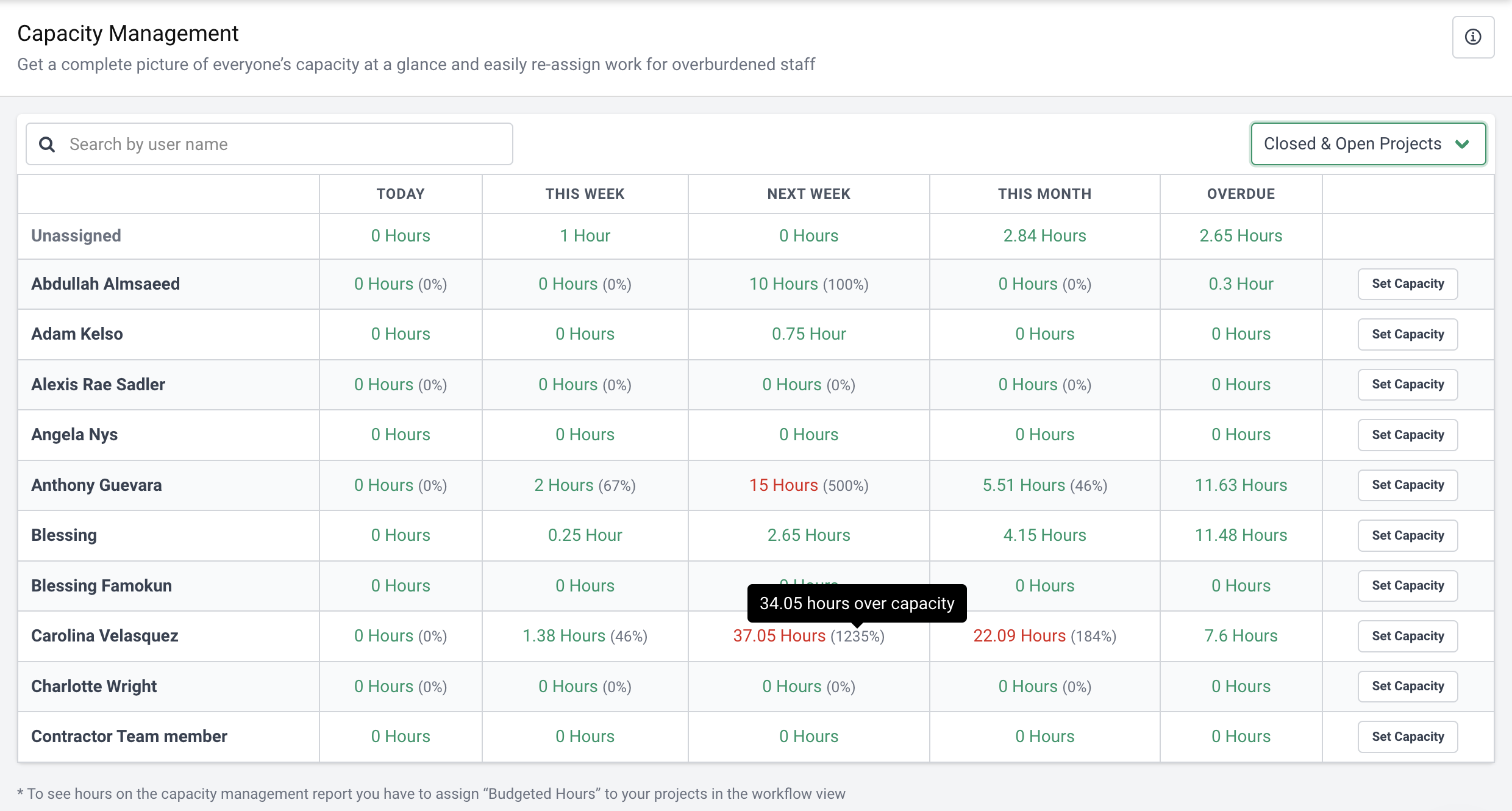

Capacity Management

- Workload Dashboard: View your team’s responsibilities to see who is over- and underworking.

- Capacity Limits: Set the number of hours each team member can work to keep them from burning out.

- Overcapacity: Financial Cents will flag any work that exceeds the number of hours a team member has been assigned to work in a day, week, month, etc.

- Task Reassignment: This lets you reallocate tasks from an overworked team member.

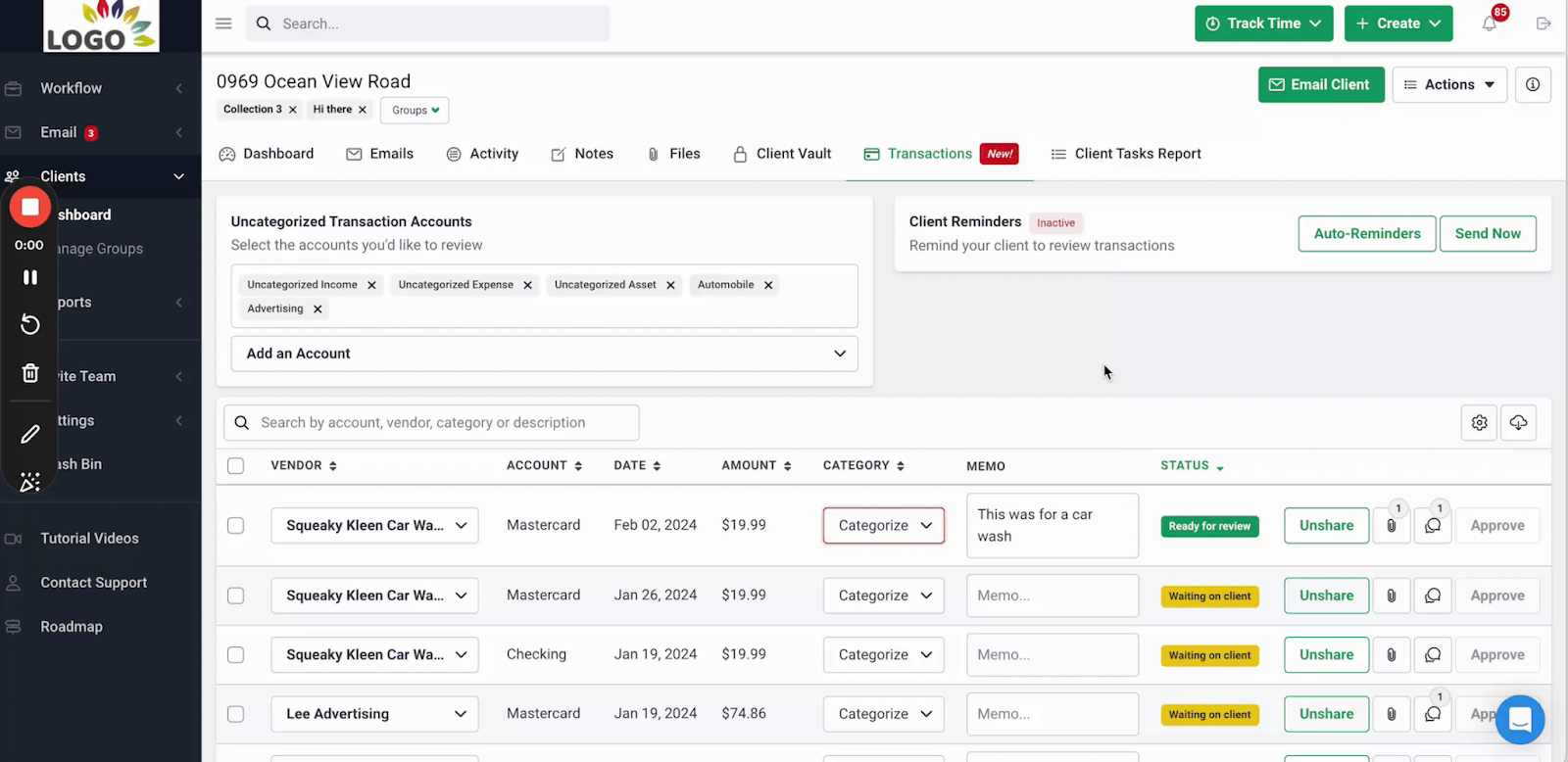

ReCats

- Auto-pull Functionality: View your clients’ uncategorized transactions inside their client profile in Financial Cents instead of exporting spreadsheets.

- Client Communication: Ask your client questions about uncategorized transactions.

- Automatic Reminders: This helps your clients remember to review the uncategorized transactions.

- Transaction Notes, Descriptions, and Documents: Your client can respond to requests for transaction information by providing necessary notes to describe and verify the transactions.

- QuickBooks Recategorization: You can send the updated transaction information (with the notes and descriptions) to QuickBooks.

- Client Portal: Your client can also discuss uncategorized transactions with you in the client portal.

Pricing

- Solo Plan: $19/month (Billed annually)

- Team Plan: $49/month per user (Billed annually)

- Scale Plan: $69/month per user (Billed annually)

- Enterprise: Custom Pricing

Ratings

Financial Cents has a 4.8 (out of 5) stars on Capterra and G2

Pros

|

Cons

|

3. Time Tracking & Billing Software

Big Time

BigTime helps professional services firms track time and monitor team performance to understand workflows that work and identify (and address) the ones that don’t.

It also enables you to get better value for your resources by matching your human resources to projects and automating invoices for faster payments.

Here are BigTime’s key features and their benefits

Time Tracking

- Time and Expense Tracking: Captures time and expenses accurately and on time.

- Mobile Availability: Track and submit timesheets from your mobile device.

- Required Fields: Make some fields compulsory for your staff before they can submit their timesheets.

Billing

- Multiple Payment Options: This lets clients pay easily via credit card or ACH from their inbox.

- Branded Invoice Templates: Impress your clients with a professional invoice that looks and feels like your firm.

- Client Portal: This shows your clients their invoices, payment schedules, and saved payment methods to give them visibility into their payment history.

- Reporting & A/R Dashboard: Provides actionable insights with a customizable accounts receivable dashboard.

Pricing

- Essentials: $20/month per user

- Advanced: $35/month per user

- Premier: $45/month per user

Ratings

BigTime has:

Pros

|

Cons

|

Harvest

Harvest makes it easy for the team to track time in the accounting apps they already use while giving you real-time insights into firm operations.

It allows you to “turn your hours into money” by billing clients from their timesheets in a few clicks.

Here are Harvest’s key features and their benefits:

Time Tracking

- Timesheets: Enable your team to record their work hours.

- Custom Reminders: Notify your team to remember to submit their timesheets.

- Timesheet Approvals: an approval system that ensures your timesheets are accurate, preventing invoicing disputes and late payments.

Reporting and Analysis

- Project Reporting: Monitor budgets and costs to measure project profitability.

- Team Reporting: View and manage your team’s workload and ensure no one is overworking.

Invoicing and Payments

- Accept Online Payments: Integrate with PayPal and Stripe for fast, secure, one-click payments.

- Automated Invoicing: Save time and energy with recurring invoices for your repeat clients and help them pay faster.

Pricing:

- Pro: $11/month per seat (billed annually,

or $12/month per seat (billed monthly).

- Premium: $14/month per seat (billed annually)

Or $15/month per seat (billed monthly).

Rating:

Harvest has:

Pros

|

Cons

|

4. Communication & Collaboration Apps

Slack

Slack is a team communication and collaboration platform that organizes team files and information into different categories (channels).

While it’s primarily text-based, Slack also allows teams to communicate audibly.

Here are Slack’s key features and their benefits:

- Channels: Channels allow teams to create topics to streamline conversations.

- Slack Connect: Allows teams to collaborate with external partners, customers, and agencies without compromising security.

- AI Recaps: Slack’s AI-powered summaries deliver daily recaps and intelligent insights to keep members up-to-date with relevant events.

- Huddles: Enables remote team members to work side-by-side from different parts of the world using a virtual audio-visual collaboration system.

- Clips: Share information efficiently with audio or video recordings, helping you bypass meetings.

Pricing

- Free: Free forever.

- Pro: $4.38/month per user (billed monthly).

- Business+: $15/month per user (billed monthly).

- Enterprise Grid: Custom pricing.

Ratings

Slack has:

Pros

|

Cons

|

Microsoft Teams

A part of the Microsoft 365 suite of apps, Microsoft Teams centralizes workplace communication with chat and video conferencing features.

Here are Teams’ key features and their benefits:

Messaging

- Chat: Discuss projects with an individual or group from the profile card.

- File Management: Store all your files in a centralized location in OneDrive, making it easier for your team to access them.

Meeting

- Multiple Calls: This allows you to place a call on hold while you make or receive a new call. This allows you to keep multiple conversations going simultaneously.

- Teams Rooms: provide HD video, audio, and content sharing to bring an in-office experience to remote work settings and meetings.

- Multiple Cameras: enables teams to use multiple cameras to stream meetings. It allows you to switch between the views to make meetings more engaging.

Pricing

- Microsoft Teams Essentials: $4.00/month per user (billed annually

- Microsoft 365 Business Basic: $6.00/month per user (billed annually)

- Microsoft 365 Business Standard: $12.50/month per user (billed annually)

Ratings

Microsoft Teams has:

Pros

|

Cons

|

5. Client Management

Liscio

Liscio’s CRM unifies client information and communication in one central place to help you focus on service quality.

Its user-friendly portal makes it easy for clients to provide the information they need to complete their work on time.

Here are Lisco’s key features and their benefits:

- Client Requests: Collect necessary client information in advance.

- Automatic Reminders: automatically alerts your clients to grant pending file or information requests.

- Tax Organizers: Liscio uses historical data to help you deliver personalized tax organizers to clients.

- Timeline: All your team’s interactions with clients in one central location.

- Email Integration: Get visibility into client emails by centralizing them in the Contact and Client tabs.

Pricing

- Pro: $60/month per user (billed annually)

- Enterprise: Custom pricing

Rating

Pros

|

Cons

|

Method CRM

Method CRM helps businesses organize their client information to make their client engagements more productive and efficient.

Here are Method’s key features and benefits:

- Automatic Lead Collection: Imports prospects into your CRM without manually entering their information.

- Email Integrations: Gmail and Outlook data capture that saves you stress and manual labor.

- Web-to-Lead Forms: Capture leads from your website with customizable forms.

- Activity Tracking: Monitor interactions to personalize communication with your clients and leads.

- Custom Fields: Store information unique to each client to build better relationships.

Pricing

- Contact Management: $25/month per user (billed annually)

or $28/month per user (billed monthly)

- CRM Pro: $44/month per user (billed annually)

or $49/month per user (billed monthly)

- CRM Enterprise: $74/month per user (billed annually)

or $85/month per user (billed monthly)

Ratings

Method CRM has:

Pros

|

Cons

|

6. Accounts Payable & Receivable

Invoicera

Invoicera is an invoicing and accounts payable/receivable (AR/AP) automation tool that helps businesses bill clients quickly, receive payments faster, and improve their cash flow.

Here are Invoicera’s key features and their benefits:

- Centralized Payment Dashboard: Get visibility into client payments in one place, helping you understand a client’s payment history.

- Automatic Payment Reminders: Invoicera helps you to follow up with your clients on outstanding payments.

- Scheduled Invoicing: This helps to avoid delayed invoicing (and late payments) on your recurring billing.

- Customizable Templates: Bypass the process of creating invoices from scratch by leveraging prebuilt invoice templates.

- Credit Note Management: Generate credit notes automatically to prevent and minimize AR disputes.

- Quick Purchase Orders (POs): Create professional POs complete with automated approval workflows, within minutes.

- PO-to-Invoice Conversion: Turn purchase orders into invoices in seconds without manual entry.

- Recurring Billing: Send out invoices for recurring out to the client as and when due.

Pricing

- Starter: $15/month (billed annually)

or $19/month (billed monthly)

- Business: $39/month (billed annually)

or $49/month (billed monthly)

- Enterprise: $79/month (billed annually)

- Infinite: $119/month (billed annually)

Ratings

Pros

|

Cons

|

HighRadius

HighRadius’s versatile financial technology platform helps businesses streamline their AP/AR systems to improve cash flow and vendor relationships.

It uses Artificial Intelligence and Machine Learning to serve enterprise businesses with multiple business units while remaining relevant to mid-sized firms.

Here are HighRadius’s key features and their benefits:

- Collections Worklist Prioritization: This creates worklists that suggest the best strategy to collect payments.

- Delinquency Prediction: forecast invoice payment date up to 30 days in advance.

- Payment Invoice Matching: automatically matches payments to open invoices to enhance cash application.

- Fraud Detection: Flags duplicate transactions and suspicious payment patterns to prevent fraud.

- Credit Risk Scoring: Use AI to evaluate your clients and determine their credit risk level.

- AP Portal Bots: automate the upload of AR invoices to 600 client portals using Robotic Process Automation (RPA).

Pricing

HighRadius operates a subscription-based model. Its prices are tailored to your size and needs.

Ratings

Highradius has:

Pros

|

Cons

|

7. Payroll

Gusto

Gusto’s all-in-one HR solution handles the complex processes of hiring, paying, and managing for small and large accounting firms with a few clicks.

When used well, Gusto will automatically file your payroll taxes while helping you identify and maximize your tax credits.

Here are Gusto’s key features and their benefits:

- Payroll Taxes: Gusto calculates and files federal, state, and local payroll taxes at no additional cost.

- Workers’ Compensation: Create and administer your workers’ compensation policy online.

- Gusto Global: helps you pay your local and international employees in their local currencies while keeping you compliant.

- Employee Benefits: This manages your employees’ medical, dental, vision, and life insurance, plus 401(k) retirement plans.

- Time Tracking: Your employees can clock in and out or submit hours via any web browser.

Pricing

- Simple: $49/month base + $6/month per person

- Plus: $60/month base + $9/month per person

- Premium: $135/month base + $16.50/month per person

Ratings

Gusto has:

Pros

|

Cons

|

Wagepoint

Wagepoint’s payroll software provides small businesses with an intuitive platform to manage payroll across Canada and the U.S.

It helps you to automatically calculate direct deposits, tax remittances, and year-end reporting, saving you time, reducing errors, and keeping your clients compliant.

Here are Wagepoint’s key features and their benefits:

- Direct Deposit: Bank transfers allow you to pay your employees and contractors quickly.

- Automated Payroll Taxes: Wagepoint calculates all levels of taxes and remits them accordingly.

- Online Paystub Access: Employees can access their payment details in the portal.

- Compliance Made Easy: Automate withholdings, contributions, and reporting for T4s, W2s, and other year-end requirements.

- Automatic Calculations: Save time with built-in tools that handle incomes, deductions, benefits, paid time off, and workers’ compensation—no manual math required.

Pricing

- Solo: $20/month base + $4 per employee/contractor

- Unlimited: $40/month base + $5 per employee/contractor

Ratings

Wagepoint has:

Pros

|

Cons

|

How to Choose the Right Accounting Apps for Your Firm

-

Ease of Use

The usability score of a potential product will tell you whether your team will be able to navigate it for their tasks or set aside hours of billable time to learn it.

But how do you know a product’s usability when you’ve not used it before? That’s where asking for walkthroughs, live demos, and free trials will come in handy.

-

Features

The more RELEVANT features an app has, the more work your team will get done without jumping between several other tools.

For example, Financial Cents’s all-in-one accounting solution enables you to perform the functions in most of the app categories we’ve discussed above.

This enables you to manage the entire project lifecycle (from client onboarding to client management, project delivery, and billing) in one place.

This makes it easy to meet client deliverables at scale, especially during busy periods like tax season.

-

Integrations

Software integration is necessary for two main reasons:

- Data Centralization: Your team would no longer need to log into separate tools to retrieve the information they need to get work done.

- Automation: Most integrated apps have a two-way sync that automatically migrates data between both apps. This eliminates the need for manual data entry.

-

Security and Compliance

This requirement ensures your client data is protected from external individuals and unauthorized employees.

For example, Financial Cents protects client information using magic link technology and two-factor authentication.

Furthermore, it keeps sensitive client information safe using encryption technology and other security protocols and certifications.

-

Cost vs. ROI

For every specialized app accounting firms buy, there are likely several apps that can address their pain point in the same, if not better, ways and at the same, if not more, affordable cost.

All-in-one software solutions have proven to bring better returns on investments than specialized tools, and that’s where industry-specific apps shine the brightest.

For example, while many apps may handle your communication and collaboration needs alone, Financial Cents provides a single platform to:

➔ Communicate with your team and clients

➔ Manage your client’s work

➔ Store and organize client information

➔ Track time and bill clients

➔ Categorize uncategorized transactions.

➔ ERC.

Consolidate Your Tech Stack to Reduce Costs and Increase Operational Efficiency

The flip side of having so many apps to choose from is the likelihood of letting technology take the driver’s seat instead of using it to free up time to do more meaningful work, build quality client relationships, and grow your firm.

That’s why firms like Benchmarks Financial Group prefer an all-in-one solution like Financial Cents that allows them to manage:

- Clients by storing, organizing, and retrieving client information on the go.

- Workflows by tracking the status of client work to ensure you meet all deadlines.

- Manage your team’s workload to prevent burnout and underutilized resources.

When you can do with one application what you need several software solutions for, you set up your team to focus on improving service quality (instead of coordinating information across multiple tools).

You need to see how these features work in real-time. Click here to book a demo or Start Your Free Trial Now.