What Are Assets in Accounting?

Assets are things a business owns or controls that hold value and are expected to help the business financially over time. It includes obvious things like cash and company vehicles, but it also includes less visible items like unpaid invoices (accounts receivable), equipment, inventory, and even trademarks. Essentially, if the business can sell it, rent it, use it to generate revenue, or has a future economic benefit, it’s likely an asset.

Assets play a big role in how you advise clients and interpret their financials.

- Need to assess cash flow or short-term stability?

- You’ll need accurate current asset data.

- Looking at growth trends? Changes in fixed assets often reveal whether the business is expanding or stagnant.

- Helping clients prepare for funding or valuation? Incomplete or inaccurate asset data can make the business look riskier than it really is.

In essence, proper knowledge of asset classification can help you guide and support clients effectively.

In this guide, we’ll break down the different types that should be tracked, how they show up on the balance sheet, and how to manage them efficiently across multiple clients.

What Are the Types of Assets in Accounting?

Assets are grouped into different categories based on how quickly they can be converted to cash, how they’re used in the business, and whether they’re physical or not.

Current Assets

Current assets are short-term resources a business expects to convert into cash, sell, or use up within one year (or one operating cycle, whichever is longer). These are essential for covering day-to-day operations and short-term liabilities. Examples are:

- Cash and cash equivalents: This includes physical cash, checking account balances, and highly liquid investments, such as money market funds.

- Accounts receivable asset: Money owed by customers for goods or services sold in the normal course of business.

- Inventory: These are goods held for sale. For product-based businesses, this is a major current asset that needs regular valuation and tracking.

- Prepaid expenses: Payments made in advance for services or goods, like rent, insurance, or subscriptions. They’re considered assets because the benefit will be realized at a future date.

- Marketable securities: Short-term investments (like stocks or bonds) that can be quickly sold and converted to cash, usually within a year.

Non-Current (Fixed) Assets

Non-current assets (or fixed assets) are long-term resources that a business expects to use for more than one year. These assets help generate revenue over time and are often depreciated or amortized over time. They can include:

- Property, plant, and equipment (PP&E): Tangible assets like office buildings, machinery, or computers. These typically depreciate over the asset’s useful life

- Long-term investments: Assets such as stocks, bonds, or real estate held for more than a year. These aren’t used in day-to-day operations but can impact overall value.

- Intangible assets: Non-physical assets like patents, copyrights, trademarks, and goodwill (often recorded after acquisitions). Some intangible assets are amortized over the asset’s useful life.

Tangible vs Intangible Assets

Tangible assets are physical items you can touch, like buildings, laptops, furniture, or vehicles. These are often depreciated over time because they wear out or lose value with use.

Intangible assets, on the other hand, don’t exist in physical form but still hold value. Think of things like software, trademarks, domain names, copyrights, or goodwill acquired through a business purchase. These are typically amortized instead of depreciated.

While tangible assets are easier to track and value, intangible assets can carry just as much financial weight, especially for tech startups, SaaS companies, or IP-heavy businesses.

Operating vs Non-Operating Assets

Operating assets are assets a business uses regularly to deliver its core services or products. This includes things like inventory, accounts receivable, office equipment, and prepaid expenses.

Non-operating assets don’t directly contribute to daily business activities, but they still hold value. These might include long-term investments, a piece of property the company isn’t using, or old equipment sitting in storage.

This distinction paints a clearer picture of how efficiently a business is using its resources and where there is room to optimize.

How are Assets Listed on the Balance Sheet?

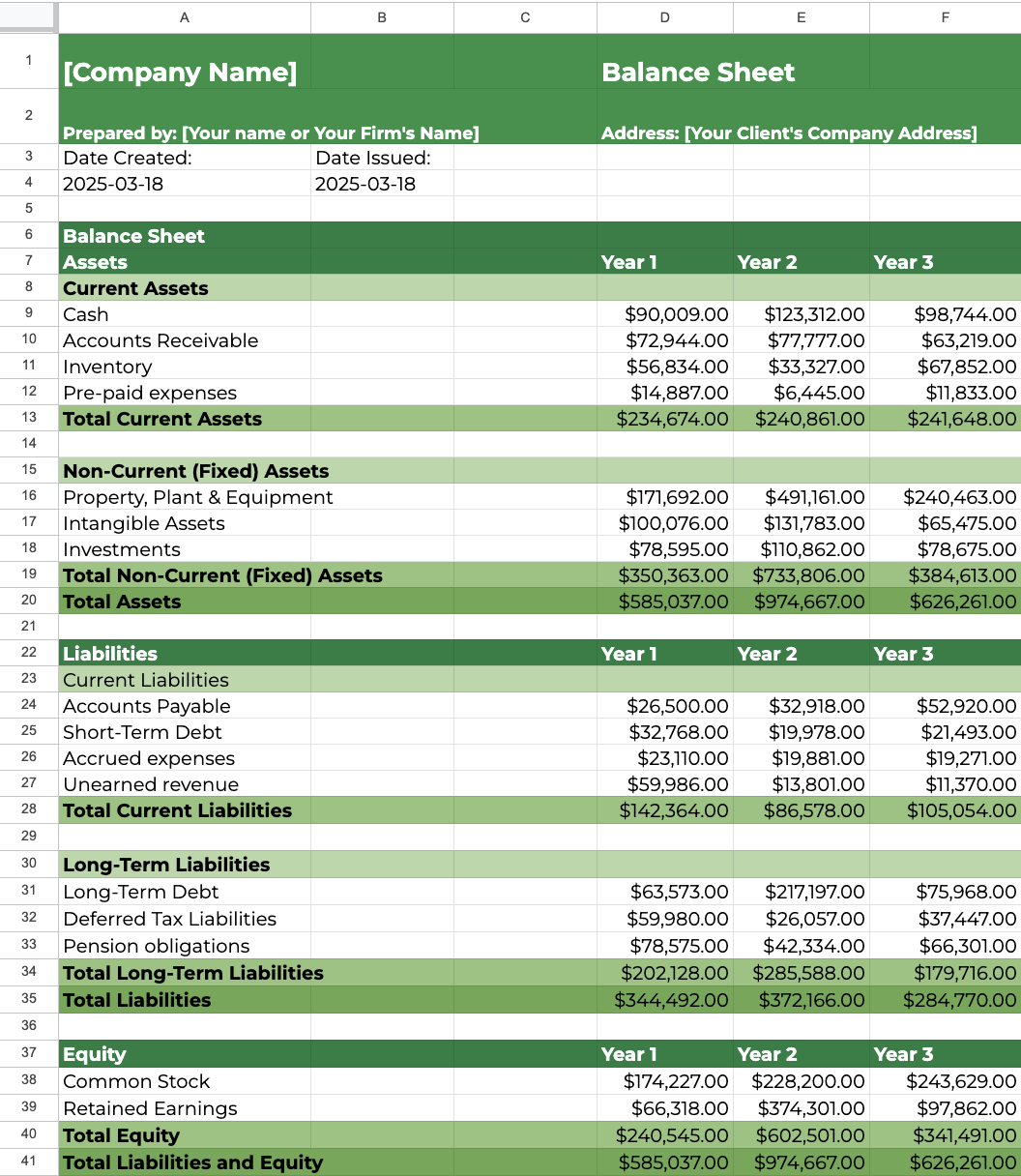

On a balance sheet, assets appear at the top and are grouped by how quickly they can be turned into cash. The standard order is:

- Current assets: Cash and anything expected to become cash or be used up within 12 months (cash, accounts receivable, inventory, prepaid expenses, marketable securities).

- Non-current assets: Long-term resources that stay in the business for more than a year (property, plant, equipment, long-term investments, and intangible assets).

Within each category, items are usually listed from most liquid to least liquid. For example, cash first, then receivables, then inventory.

In double-entry accounting (where every financial transaction affects at least two accounts), assets are impacted alongside either a liability, equity, or another asset.

For example:

- If a client buys new office equipment with cash, one asset (equipment) increases while another (cash) decreases.

- If they invoice a customer, accounts receivable (an asset) increase while revenue (equity) also increases.

- If they get a bank loan, cash (an asset) increases while loans payable (a liability) increase too.

Every entry keeps the books balanced, thanks to the accounting equation:

Assets = Liabilities + Equity

This equation is the foundation of every balance sheet. It ensures that for every asset a business holds, there’s either a claim from a creditor (liability) or ownership from the business owner(s) (equity).

That’s why keeping asset records clean, consistent, and correctly categorized is so essential for reporting, compliance, and strategic planning.

Examples of Assets in Different Businesses

Every business has assets, but what counts as an asset varies depending on the industry. Here’s how that plays out in different types of businesses your firm might work with:

Retail Store

Retail businesses typically have a large portion of their assets tied up in physical goods, and examples of their assets include:

- Cash and cash equivalents from daily sales (POS systems, online payments, etc.)

- Accounts receivable (if they offer invoicing to customers or wholesalers)

- Inventory (products on shelves or in storage)

- Point-of-sale equipment (registers, barcode scanners)

- Store fixtures (shelves, lighting, signage)

- Building or leasehold improvements (if they own or heavily customize the space)

Service-Based Business

Service businesses usually hold fewer physical assets, but they still have a mix of current and non-current items like:

- Cash and bank balances from client payments

- Accounts receivable (for services already rendered)

- Prepaid insurance or subscriptions

- Office equipment (laptops, furniture, phones)

- Company vehicle (if they travel to clients or job sites)

- Software subscriptions or licenses

SaaS Company

Software companies tend to have fewer tangible and more intangible assets. Examples include:

- Cash reserves, especially after fundraising rounds

- Accounts receivable (for unpaid subscriptions or usage fees)

- Cloud server subscriptions (as prepaid expenses)

- Intellectual property (like proprietary code or trademarks)

- Capitalized software development costs (if applicable)

- Office equipment or remote work stipends for staff

- Domain names or licensing agreements

How Assets Are Recorded and Tracked in Accounting

Here’s what to keep in mind when recording and tracking assets.

Journal Entries

Every time a business acquires or disposes of an asset, record the transaction using double-entry accounting. This means one account is debited and another is credited, keeping the books balanced.

Example:

A client buys a $5,000 computer with cash.

- Debit: Equipment (asset account) $5,000

- Credit: Cash (asset account) $5,000

If the same computer was purchased on credit:

- Debit: Equipment $5,000

- Credit: Accounts Payable (liability account) $5,000

Proper classification at this stage is critical, as it affects depreciation, financial reporting, and even tax treatment down the line.

Depreciation and Amortization (for Non-Current Assets)

Long-term assets (like machinery or software) don’t just show up on the books once; their cost needs to be spread out over the useful life using:

- Depreciation for tangible assets (e.g., equipment, vehicles)

- Amortization for intangible assets (e.g., software licenses, patents)

This helps match the asset’s cost with the revenue it helps generate, and gives a more accurate picture of profitability over time.

Some accounting software lets you automate this process. Once you input the asset cost, useful life, and method (straight-line, declining balance, etc.), the software calculates and posts periodic entries for you.

Asset Valuation: Historical Cost vs Fair Market Value

Assets are usually recorded at historical cost, making valuations easy to verify with receipts or invoices.

But in some cases, you may need to report fair market value instead, especially for investments or financial instruments that fluctuate in value. This approach reflects what the asset could reasonably sell for in the current market.

Make sure you’re clear on your client’s applicable reporting standards (e.g., GAAP, IFRS) and when revaluation is required.

Accounting Software To Manage and Track Assets

Trying to manage assets manually across multiple clients? That’s a recipe for errors and missed depreciation entries. Instead, use modern accounting software to help you:

- Create and manage a detailed asset register

- Track purchases, disposals, and transfers

- Schedule automatic depreciation or amortization

- Record prepaid expenses and deferred assets

- Maintain audit trails and history for each entry

Why Understanding Assets Matters in Accounting

Knowing what qualifies as an asset and how to track it properly directly has many benefits, including:

Financial Analysis and Decision-Making

When assets are tracked correctly, you can:

- Assess liquidity (how quickly a business can cover short-term obligations)

- Calculate asset turnover ratios (how efficiently resources are used)

- Identify when it’s time to invest in or scale back certain areas

With this information, your firm can give clients better advice around spending, budgeting, and operational planning.

Asset Management and Optimization

It’s not just about what a business owns; it’s about how well those assets are being used. Effective asset management helps clients:

- Maintain an up-to-date asset register

- Avoid duplicate purchases or unnecessary costs

- Plan for replacements or upgrades

- Reallocate underused assets to areas with higher returns

Essentially, it helps clients get more value from every dollar spent.

Valuation of a Business

Whether your client is applying for a loan, attracting investors, or preparing to sell, their asset base is a big part of how their business is valued.

Buyers and lenders want to know:

- What the business owns

- How much those assets are worth

- How they contribute to future earnings

Clean, well-documented asset records speed up due diligence and strengthen your client’s credibility.

Compliance and Reporting

Regulations and tax rules often require specific asset documentation, especially for depreciation, amortization, and capital gains. Misclassified or unrecorded assets can lead to missed tax deductions, inaccurate financial statements, and red flags during audits.

Keeping asset records compliant helps protect your client’s business and saves your team a lot of last-minute stress.

Understanding Assets is Just the Beginning

Assets are important to every business, and as an accounting or bookkeeping firm owner, having a clear grasp of how to classify, value, and track assets puts you in a better position to deliver accurate financials and guide smarter business decisions.

But when you’re juggling multiple clients, each with their own asset mix and reporting quirks, staying organized becomes a real challenge.

That’s where Financial Cents comes in.

With built-in task management, recurring workflows, and client communication tools, Financial Cents helps you stay on top of asset-related work across your entire firm. It lets your team create standardized asset-tracking workflows, assign recurring depreciation tasks, and store supporting documents in one place, so nothing slips through the cracks.

Start your free trial today and see how much easier it is to manage your firm with the tool.